Maryland Taxes Forms

Maryland taxes are levied on individuals and businesses to generate revenue for the state to fund various public services and functions. These taxes help finance areas such as education, healthcare, transportation, public safety, infrastructure, and social welfare programs.

Documents:

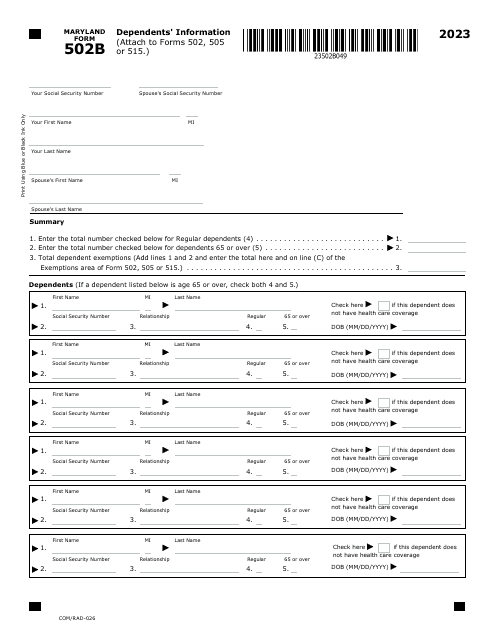

133

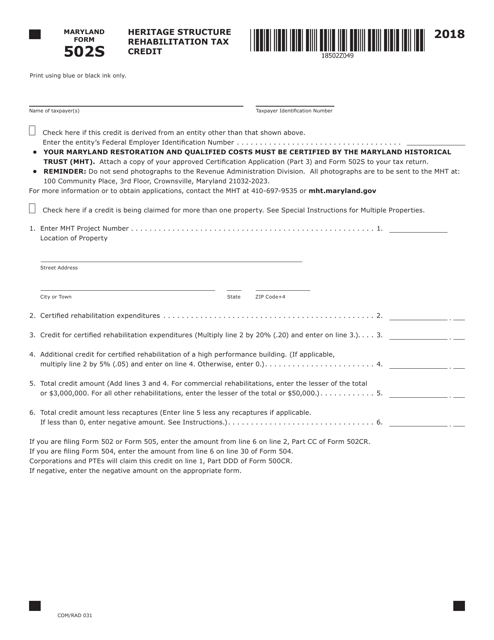

This form is used for applying for the Heritage Structure Rehabilitation Tax Credit in Maryland.

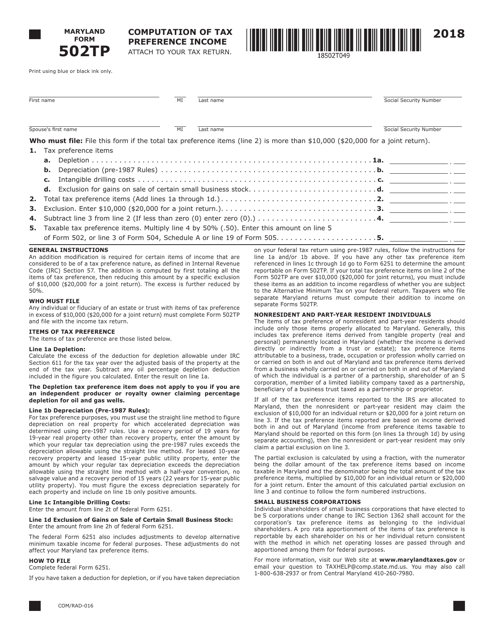

This Form is used for calculating tax preference income in the state of Maryland. It specifically applies to Maryland Form 502TP.

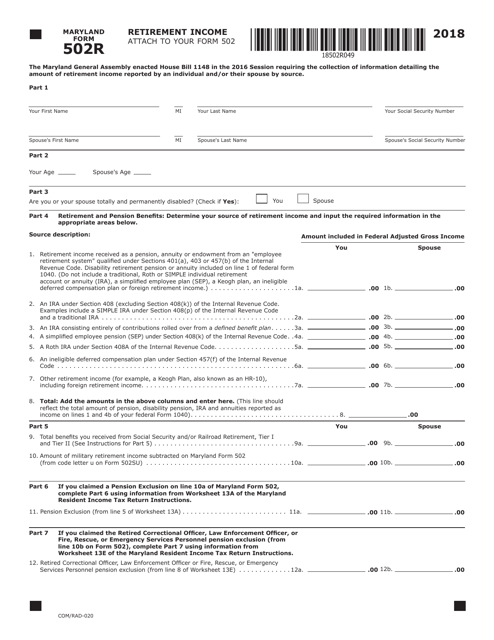

This Form is used for reporting retirement income in Maryland. It is known as Maryland Form 502R and is used for tax purposes.

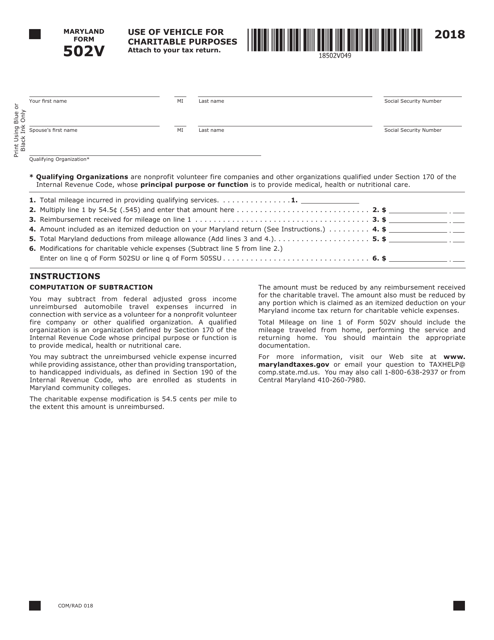

This form is used for reporting charitable purposes in the state of Maryland. It is specifically known as Maryland Form 502V.

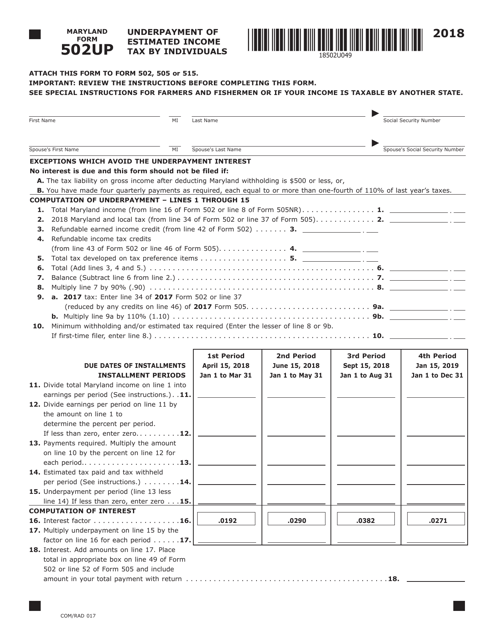

This form is used for reporting underpayment of estimated income tax by individuals in Maryland.

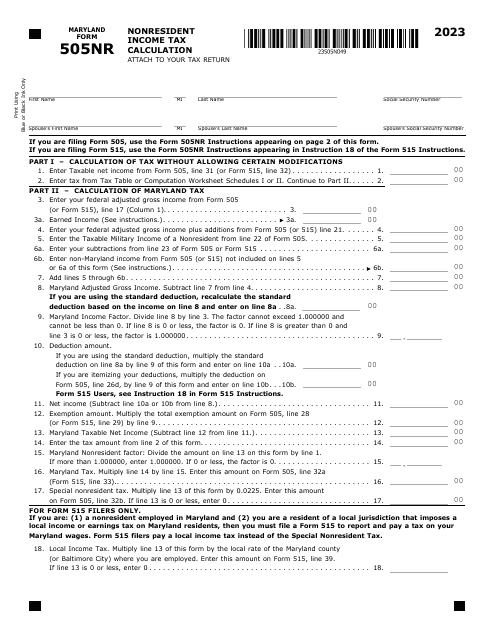

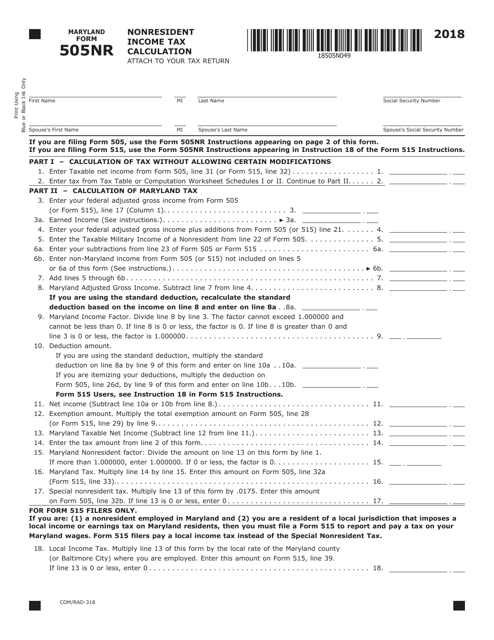

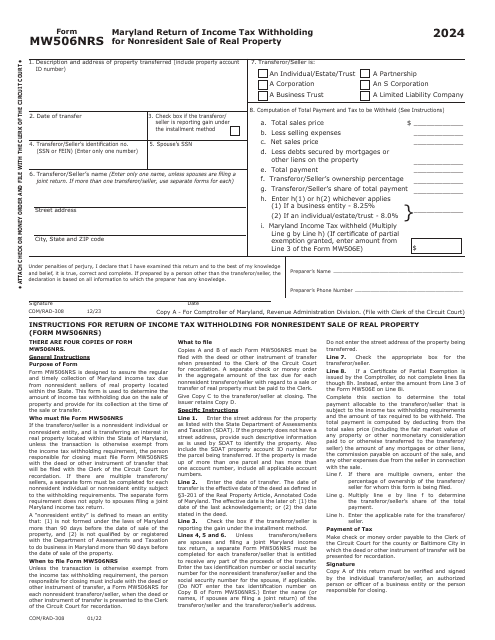

This form is used for calculating the income tax for nonresidents in Maryland.

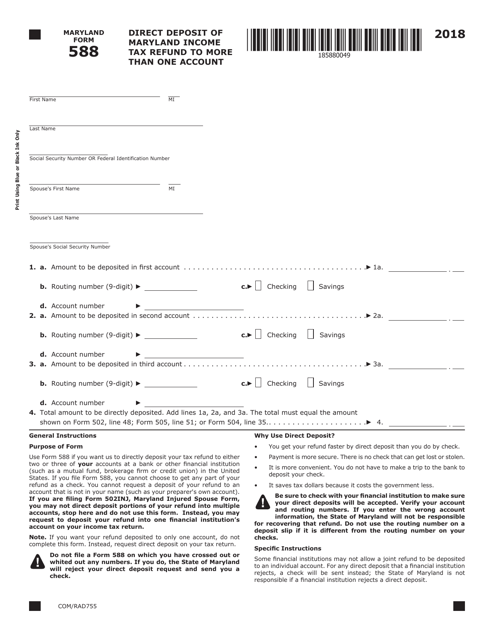

This document is used for requesting the direct deposit of Maryland income tax refunds into multiple bank accounts.

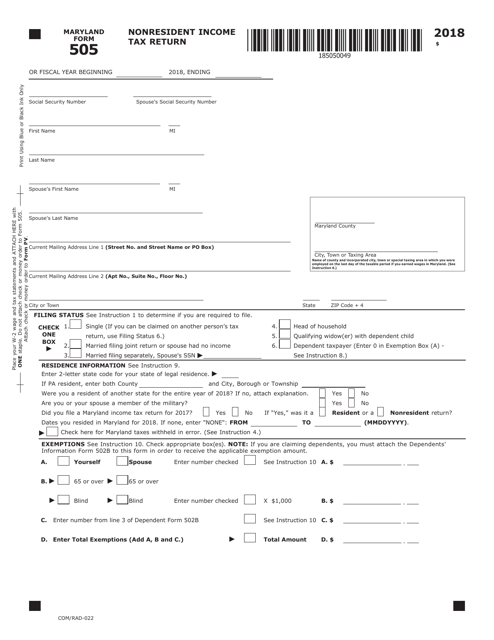

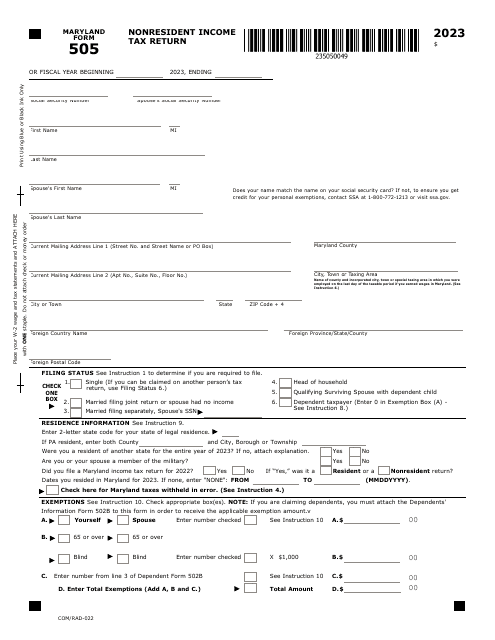

This form is used for reporting income tax for nonresidents in Maryland and is also known as Maryland Form 505.

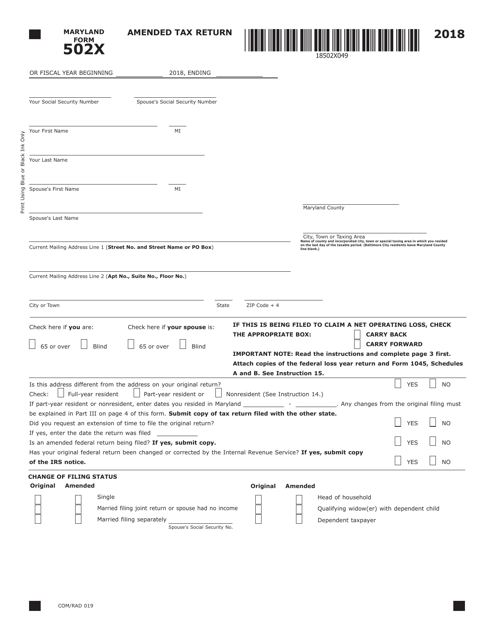

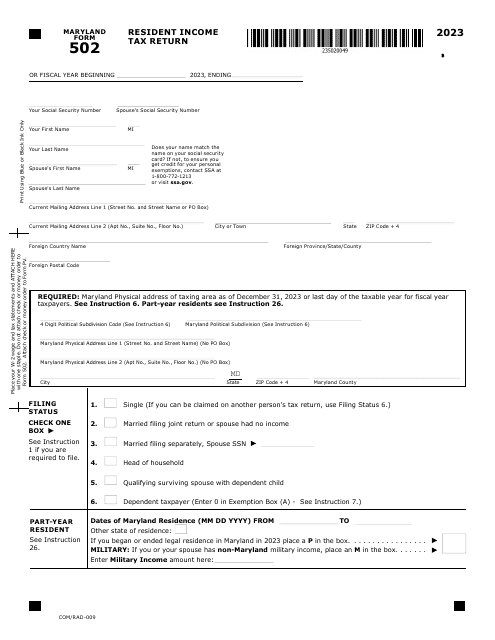

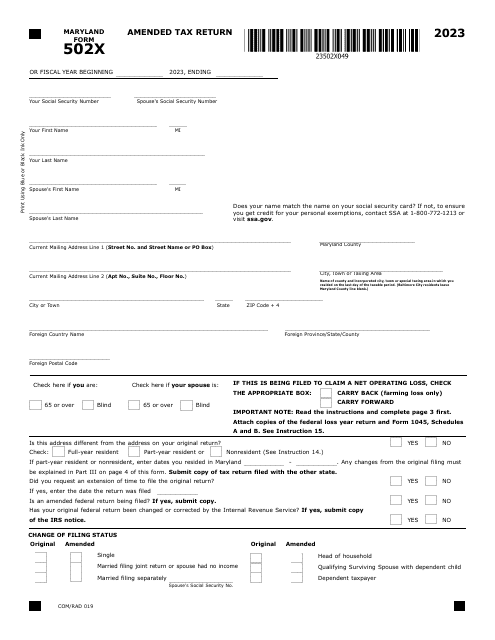

This form is used for filing an amended tax return in the state of Maryland. It is known as Form COM/RAD019 or Maryland Form 502X.

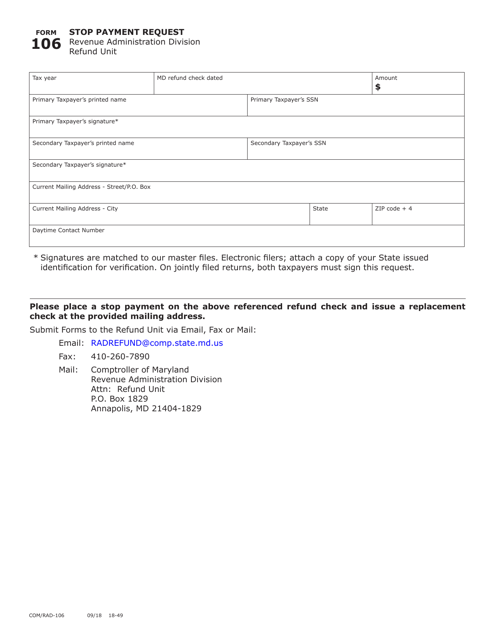

This form is used for submitting a stop payment request to the Maryland Department of Revenue.

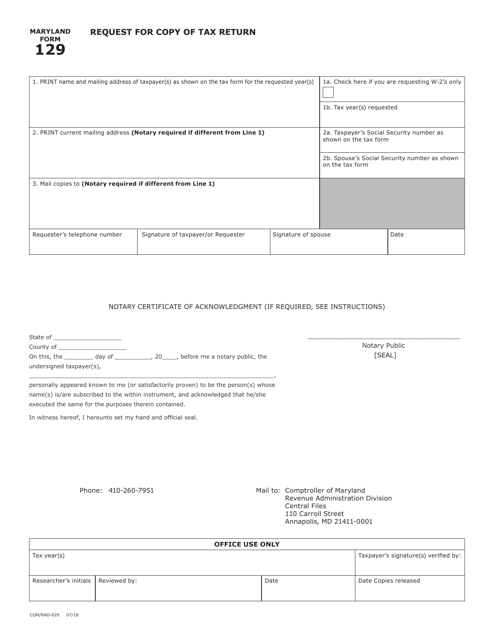

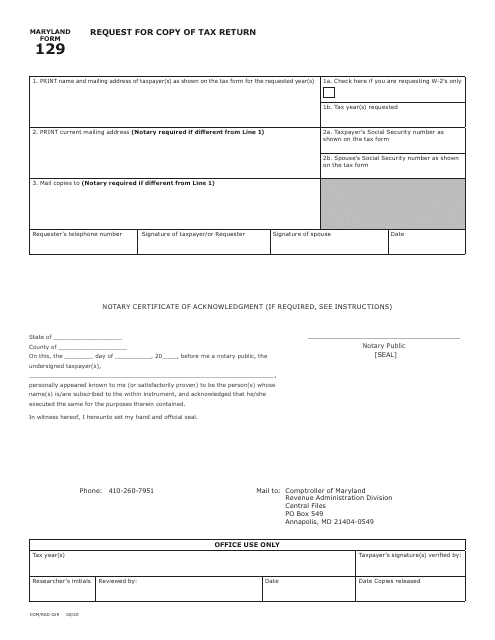

This form is used for requesting a copy of a tax return from the state of Maryland.

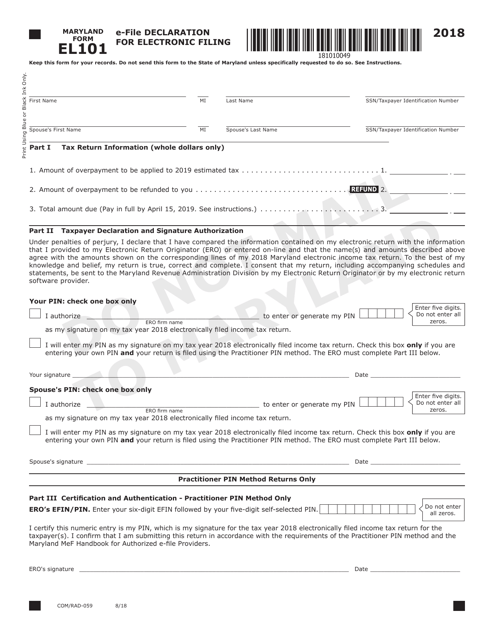

This form is used for declaring electronic filing in Maryland.

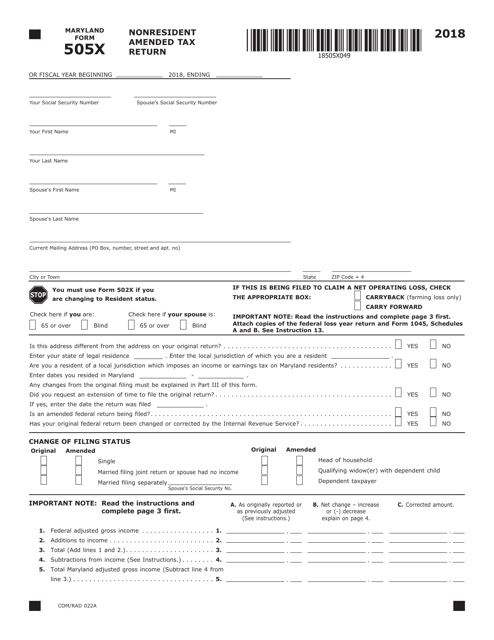

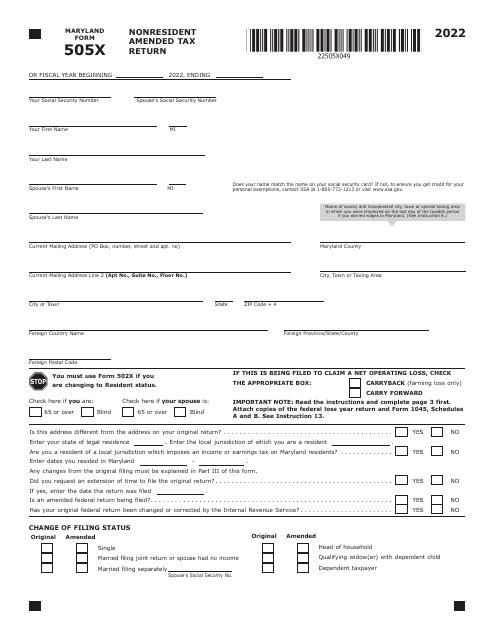

This form is used for filing an amended tax return if you are a nonresident of Maryland.

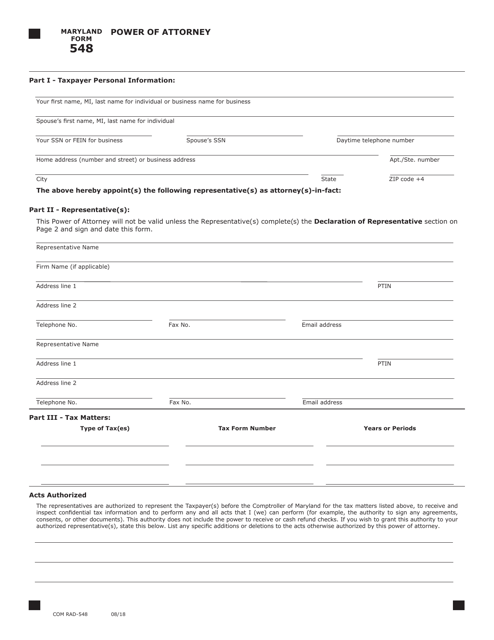

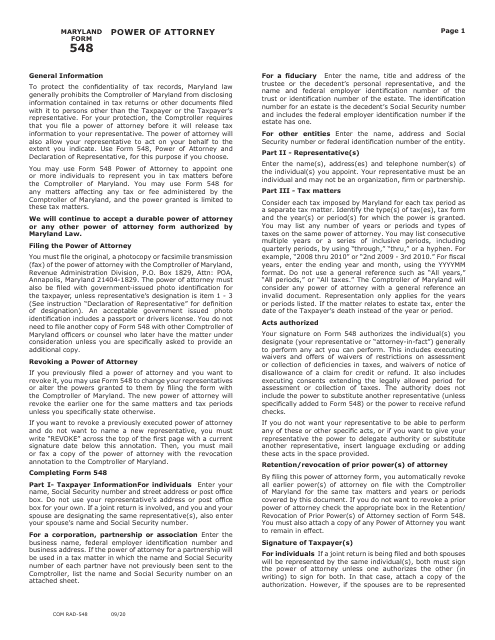

This form is used for creating a power of attorney in the state of Maryland. It allows an individual, known as the principal, to appoint someone else, known as the agent, to make legal and financial decisions on their behalf.

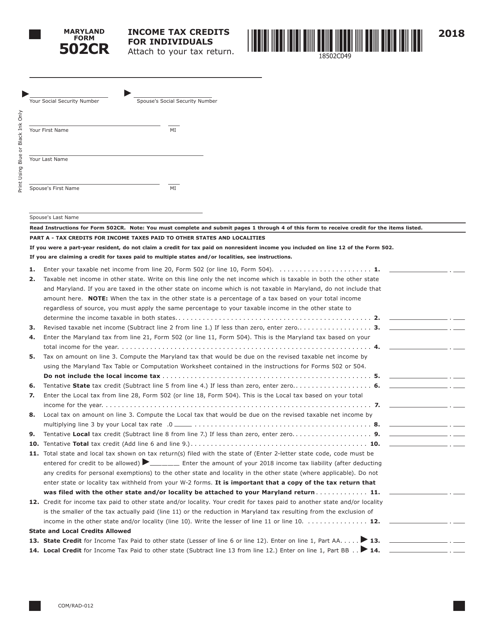

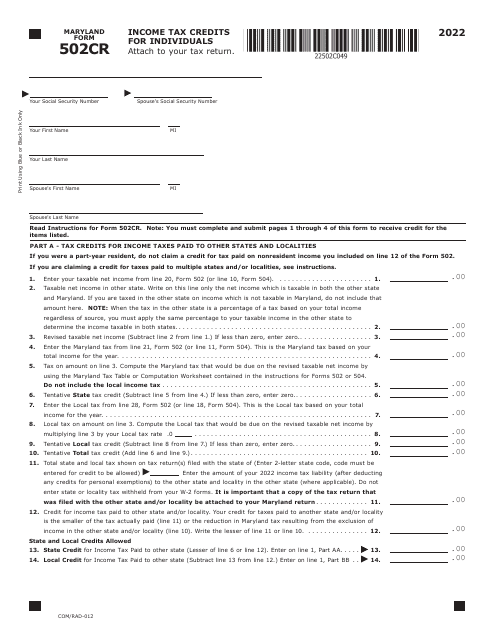

This form is used for claiming income tax credits for individuals in Maryland. It is designated as Form 502CR and is also referred to as COM/RAD-012.

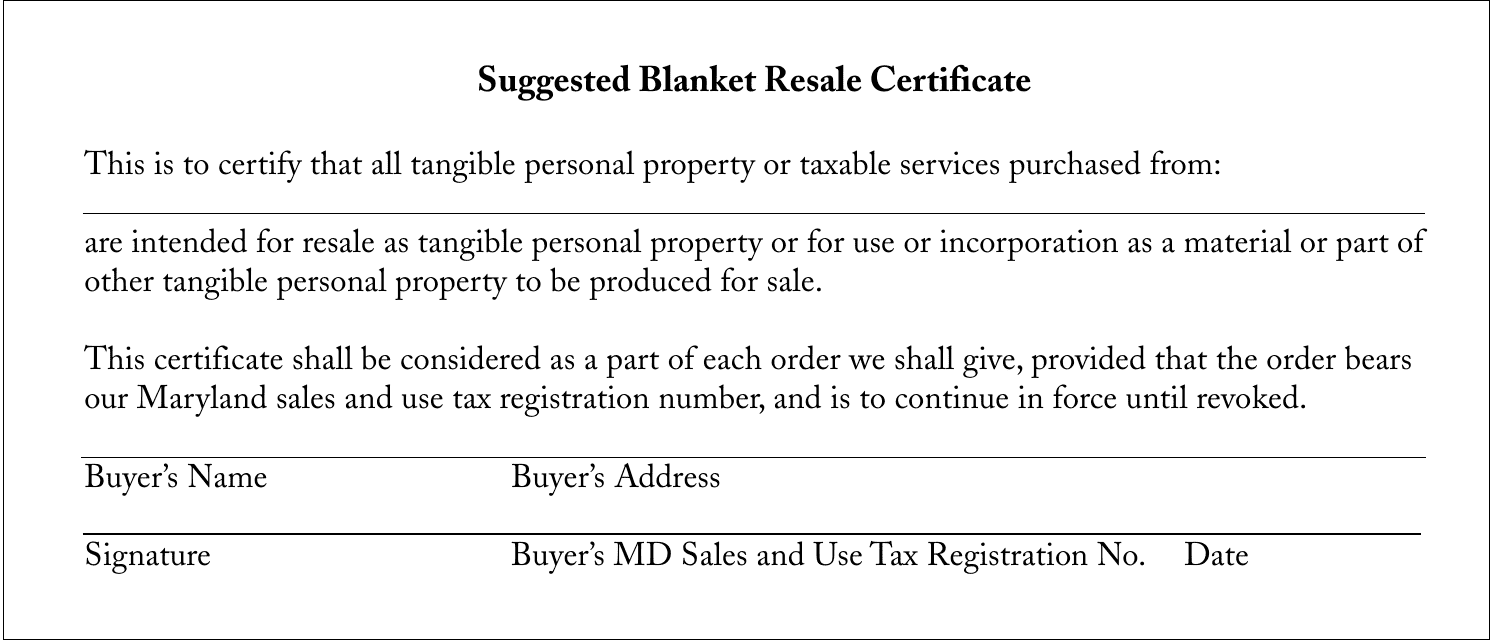

This form is used for reselling blankets in the state of Maryland. It ensures that the seller is exempt from paying sales tax on the blankets.

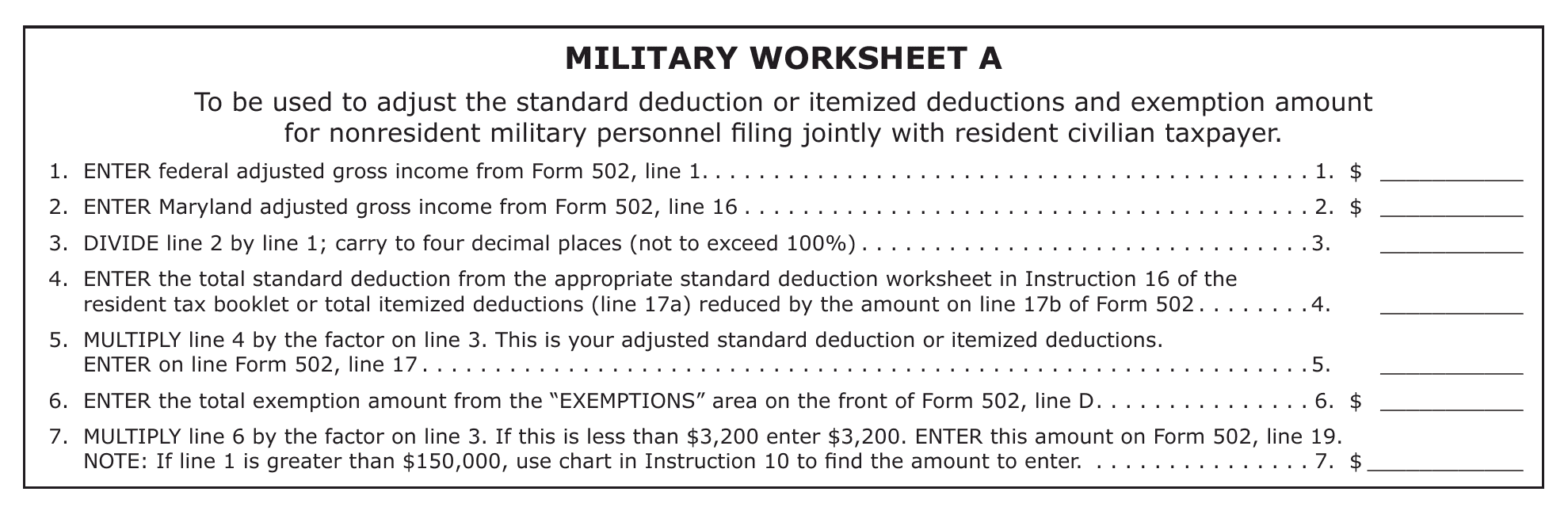

This document is used for military purposes in the state of Maryland. It may be a form or a template for organizing and planning military activities.

This form is used for requesting a copy of your tax return filed in Maryland.

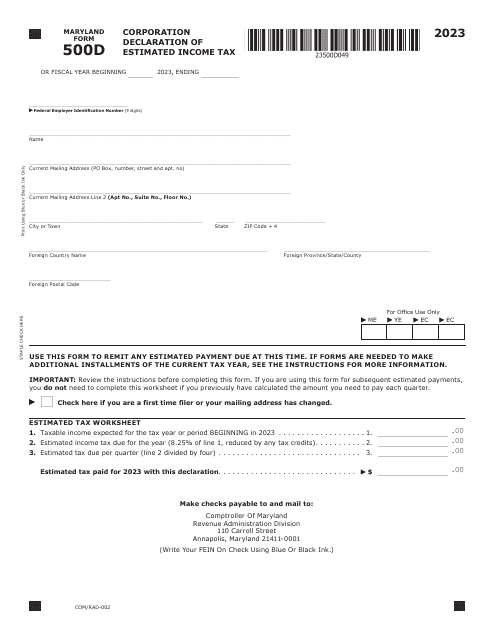

This form is used for corporations in Maryland to declare their estimated income tax.

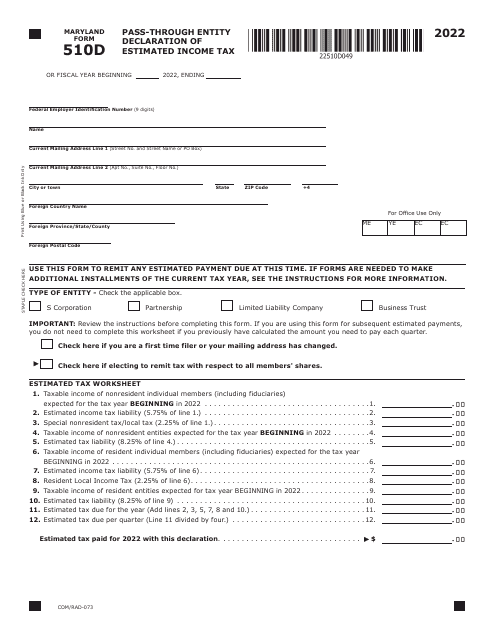

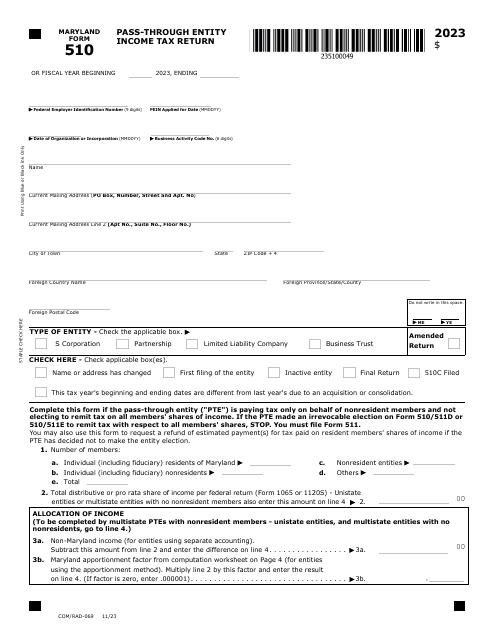

This Form is used for pass-through entities in Maryland to declare estimated income tax.

This Form is used for claiming income tax credits for individuals in the state of Maryland.

This Form is used for filing an amended tax return for nonresidents of Maryland.

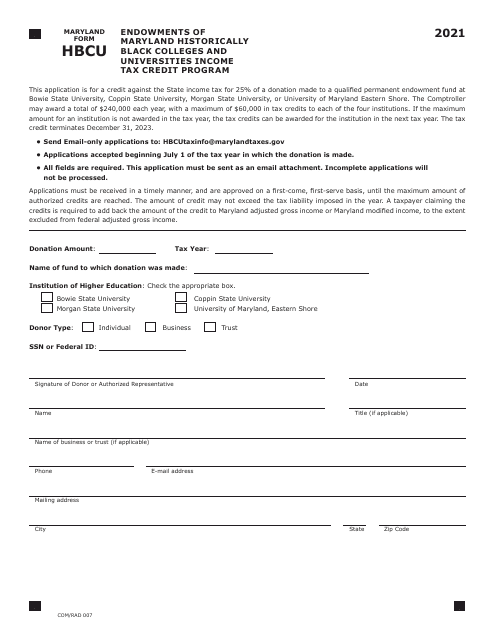

This document is used for the Endowments of Maryland Historically Black Colleges and Universities Income Tax Credit Program in Maryland. It is specifically for the HBCUs in the state and provides a tax credit for donations made to their endowments.

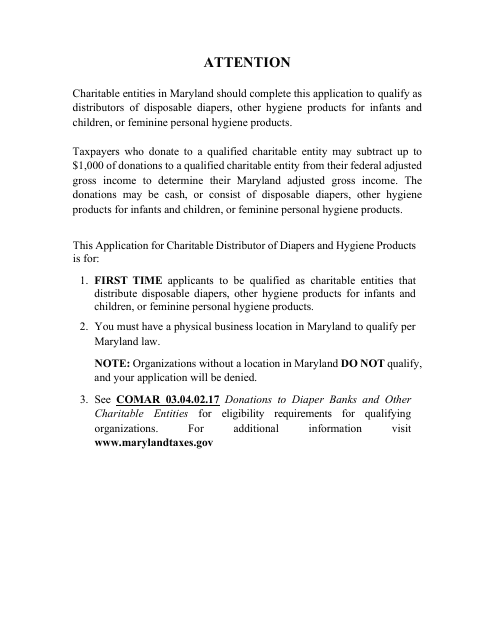

This form is used for applying to become a charitable distributor of diapers and hygiene products in Maryland.

This document is used for granting power of attorney in the state of Maryland. It provides instructions for completing the Maryland Form 548, COM/RAD-548 Power of Attorney.