Washington Dc Office of Tax and Revenue Forms

Documents:

76

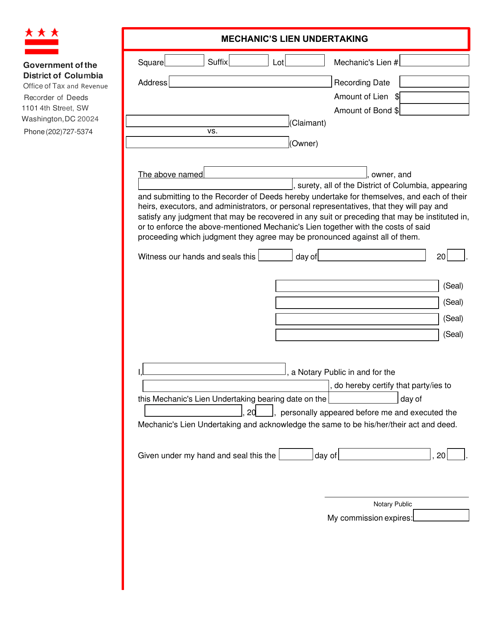

This form is used for submitting a mechanic's lien undertaking in Washington, D.C. to protect the rights of mechanics or contractors who have provided labor or materials for a construction project.

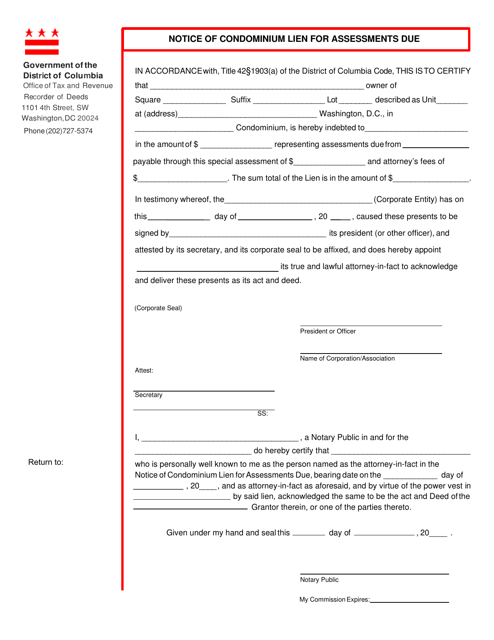

This form is used for notifying a condominium owner in Washington, D.C. of a lien that has been placed on their property for unpaid assessments.

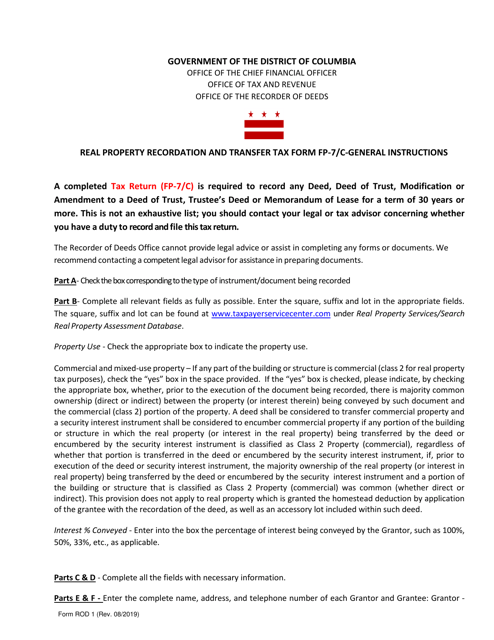

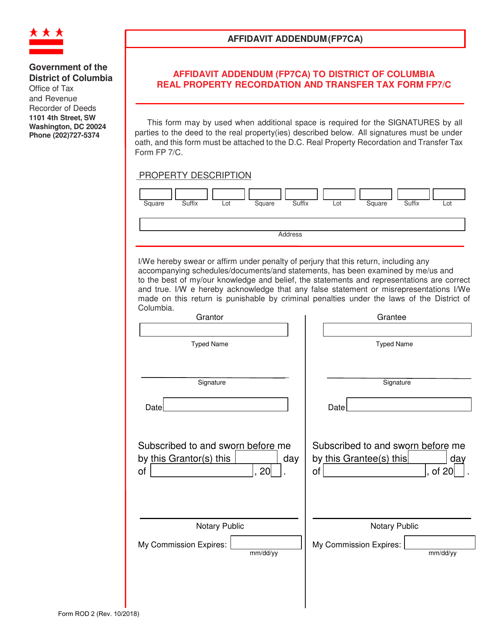

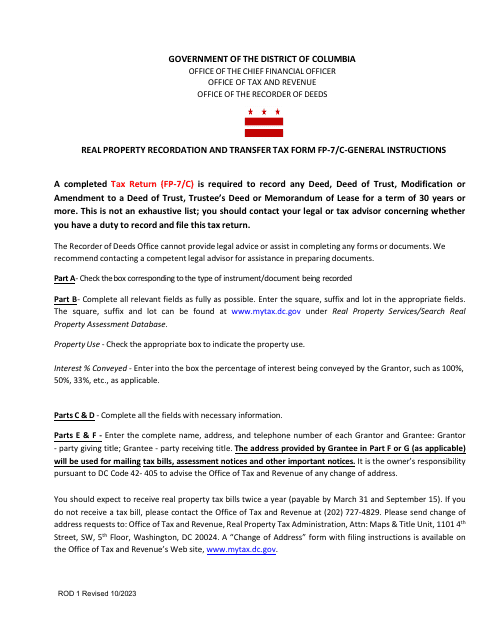

This form is used for recording and transferring the ownership of real property in Washington, D.C. It also serves as a tax form for collecting transfer taxes on the property.

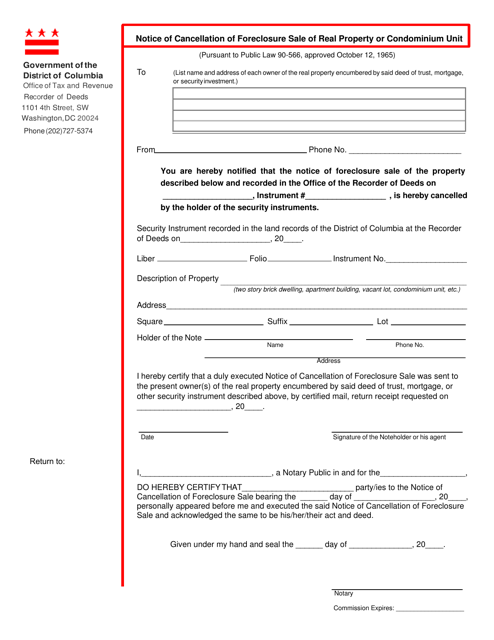

This form is used for notifying the cancellation of a foreclosure sale of real property or a condominium unit in Washington, D.C.

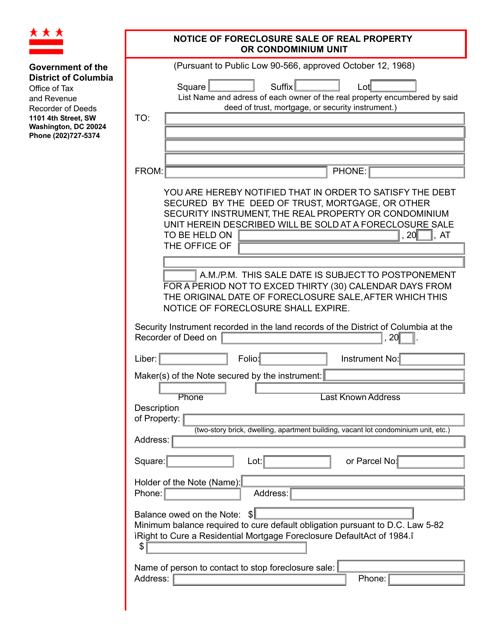

This Form is used for giving notice of the foreclosure sale of real property or condominium units in Washington, D.C.

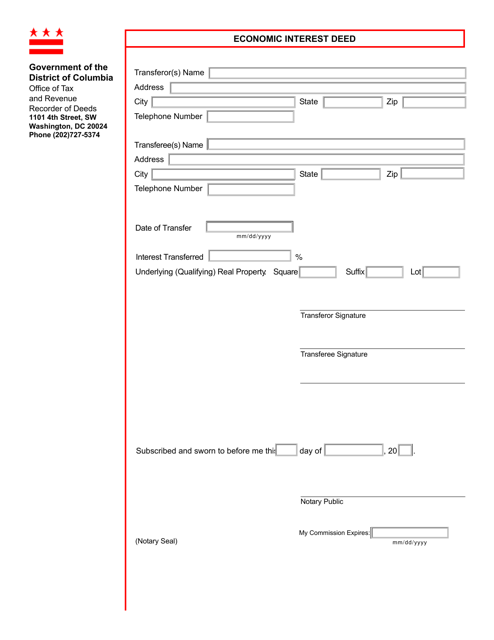

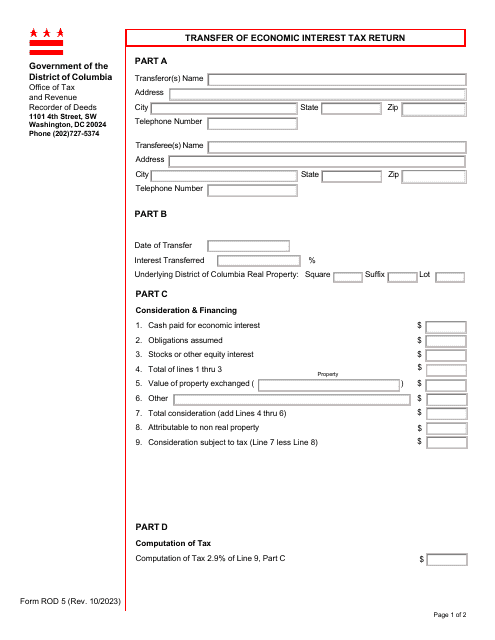

This Form is used for recording an Economic Interest Deed in Washington, D.C.

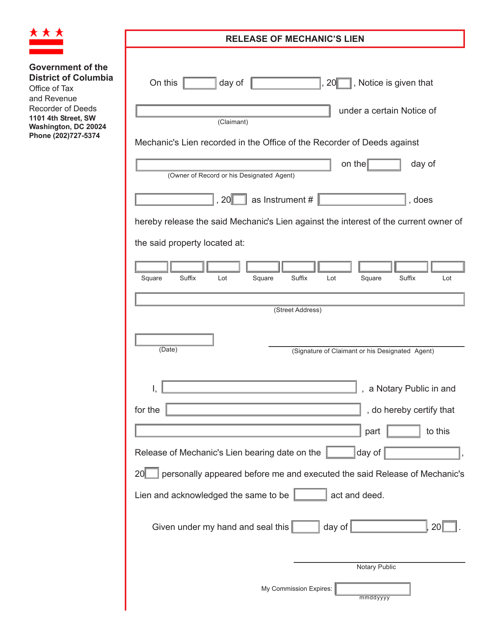

This form is used for releasing a mechanic's lien in Washington, D.C. It allows a property owner to officially remove the lien and clear the title of the property.

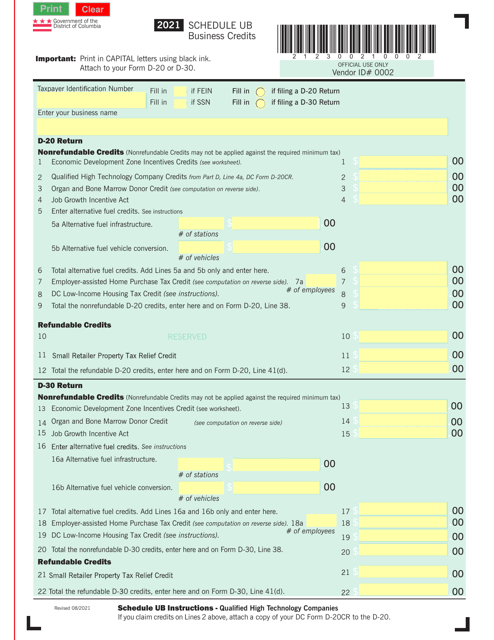

This Form is used for claiming business credits in Washington, D.C. It allows taxpayers to report and potentially reduce their tax liability by taking advantage of various business credits available in the city.

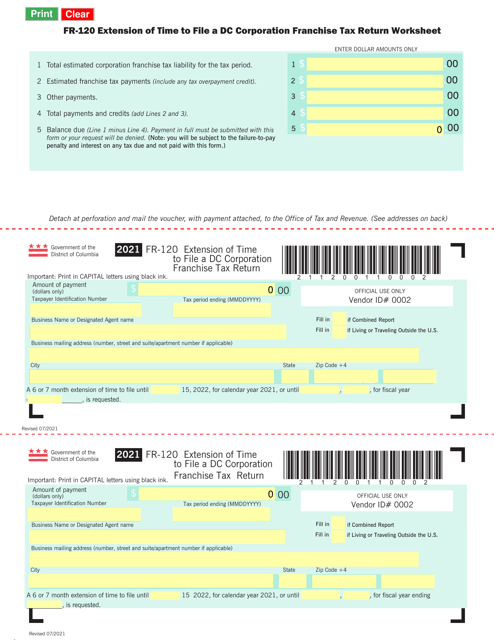

Form FR-120 Extension of Time to File a Dc Corporation Franchise Tax Return - Washington, D.C., 2021

This form is used for requesting an extension of time to file a corporate franchise tax return for Washington, D.C.

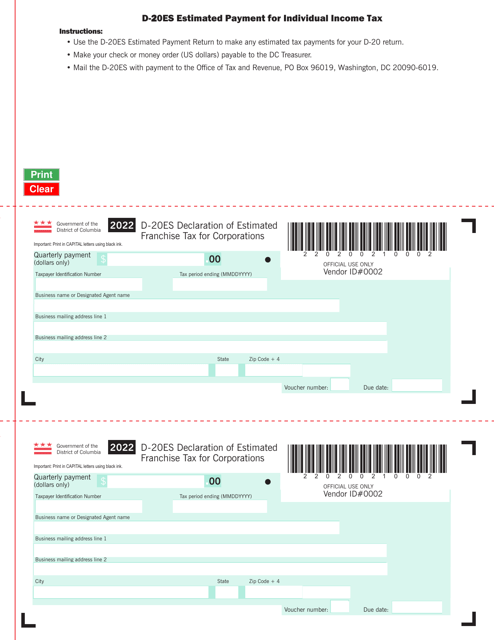

This form is used for corporations in Washington, D.C. to declare their estimated franchise tax.

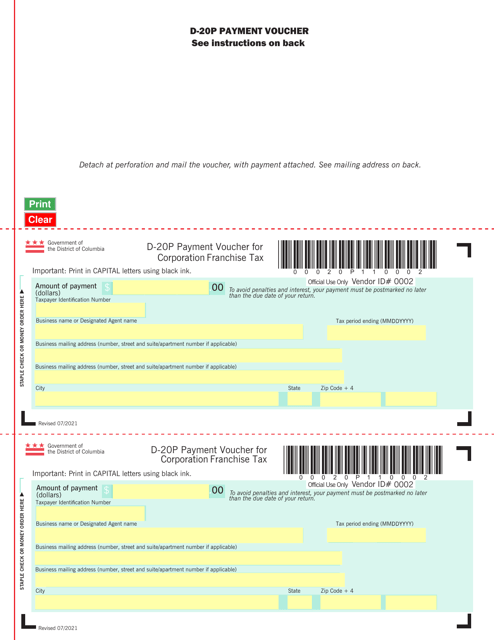

This form is used for making payment for Corporation Franchise Tax in Washington, D.C.

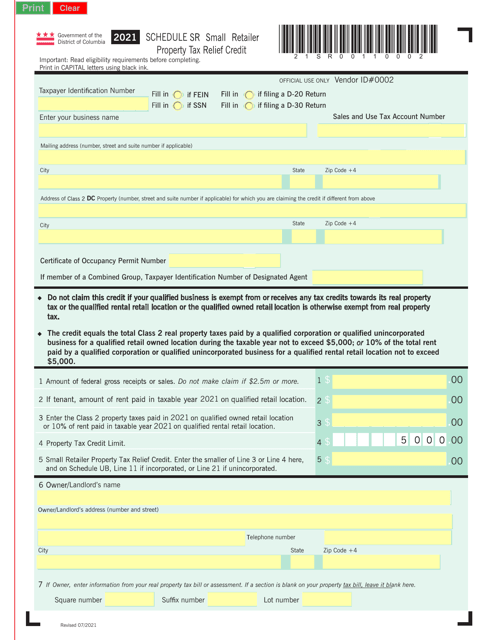

This document is used for claiming the Small Retailer Property Tax Relief Credit in Washington, D.C. It provides a schedule to report information related to the credit.

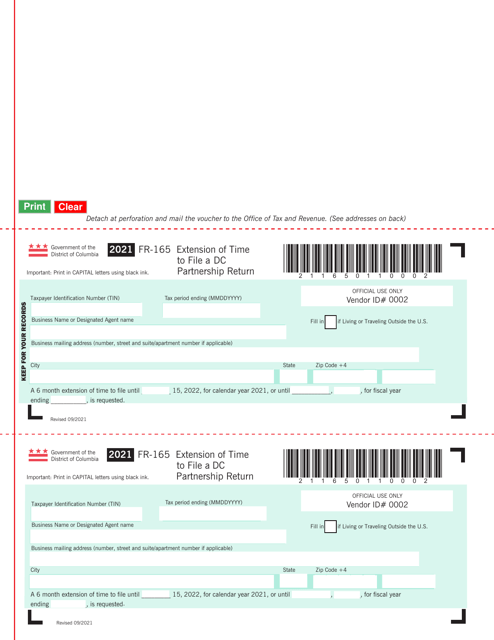

This form is used for requesting an extension of time to file a Washington, D.C. partnership tax return.

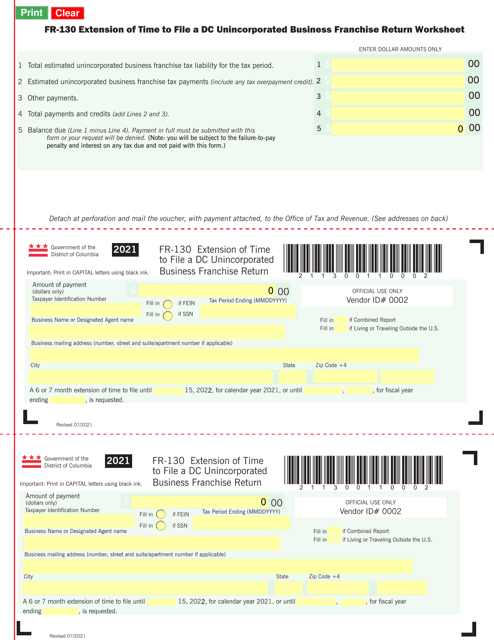

This document is used to request an extension of time to file a Washington, D.C. Unincorporated Business Franchise Return Worksheet for a DC unincorporated business.

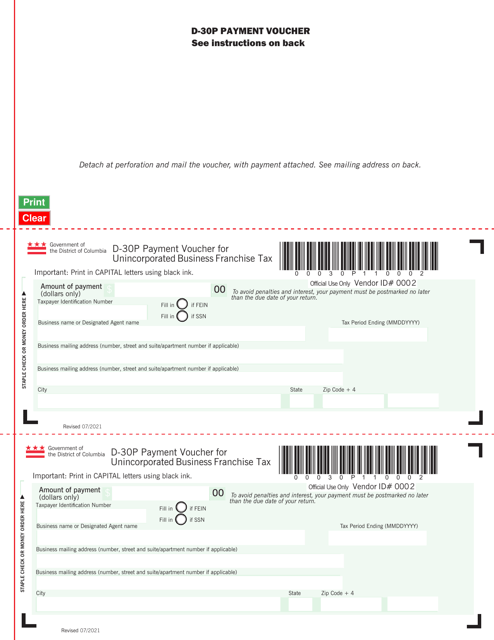

This form is used for making a payment for the Unincorporated Business Franchise Tax in Washington, D.C.

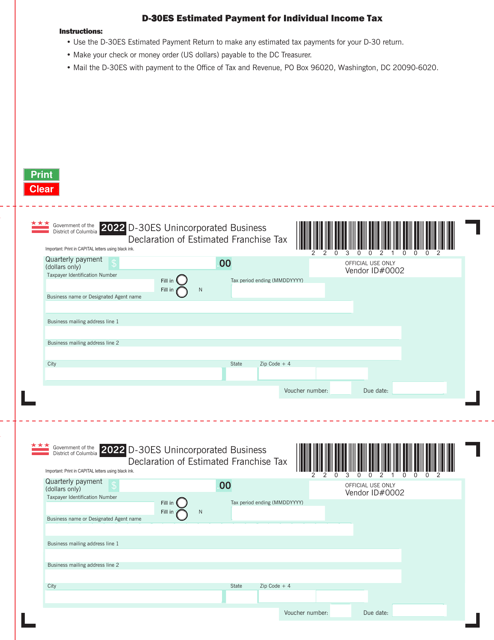

This form is used for unincorporated businesses in Washington, D.C. to declare their estimated franchise tax. It is used to calculate and pay the tax owed by the business.

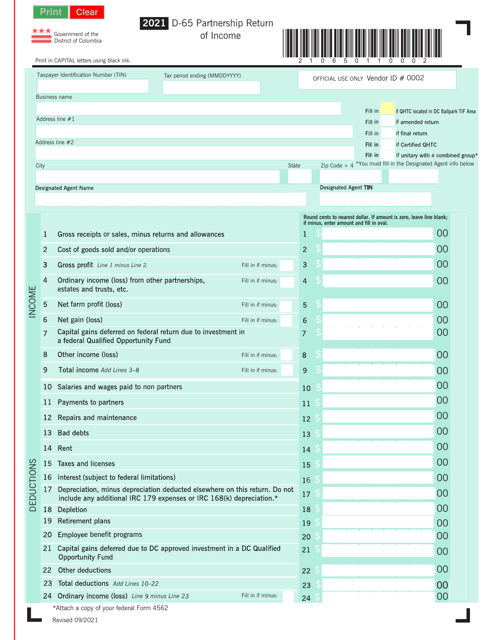

This form is used for reporting partnership income and deductions for taxpayers in Washington, D.C.

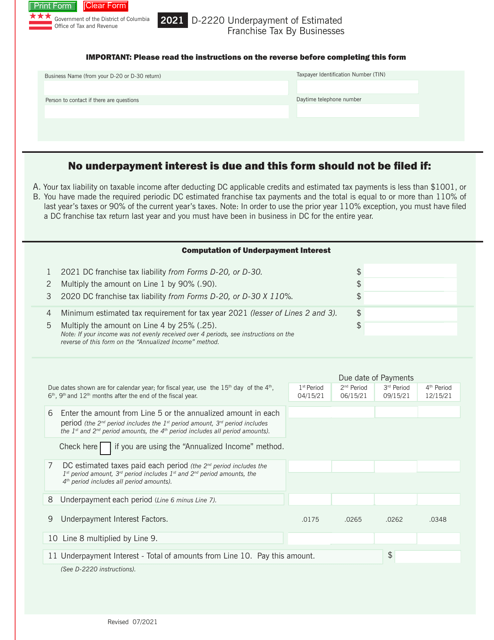

This form is used for reporting and paying any underpayment of estimated franchise tax by businesses in Washington, D.C.

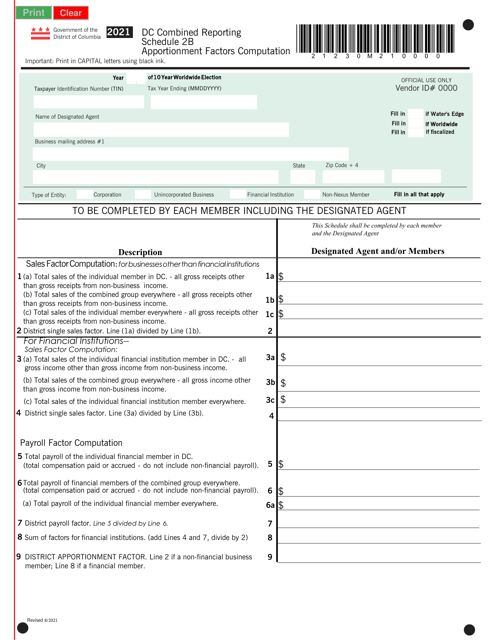

Schedule 2B Combined Reporting Schedule - Apportionment Factors Computation - Washington, D.C., 2021

This document is used for calculating the apportionment factors related to combined reporting in Washington, D.C.

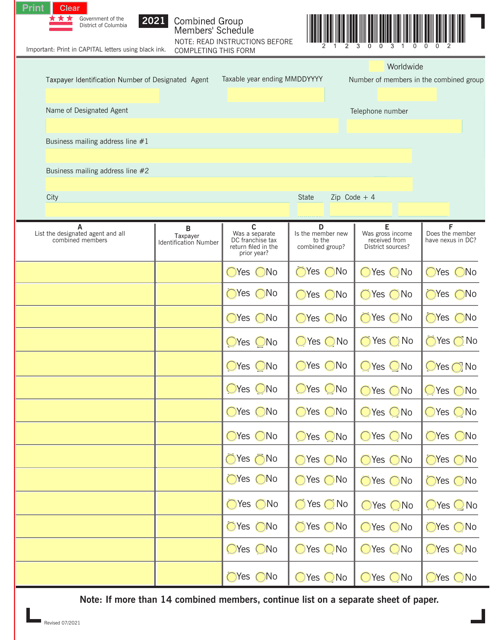

This document is a schedule for the members of a combined group in Washington, D.C. It outlines the activities and events planned for the group.

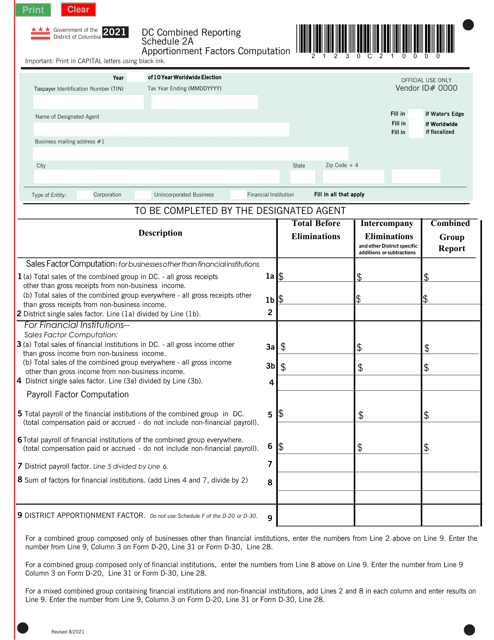

Schedule 2A Combined Reporting Schedule - Apportionment Factors Computation - Washington, D.C., 2021

This type of document is a schedule used to calculate the apportionment factors for combined reporting in Washington, D.C.

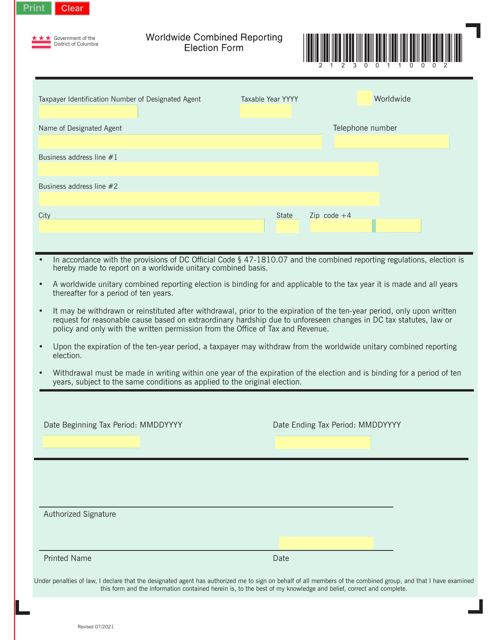

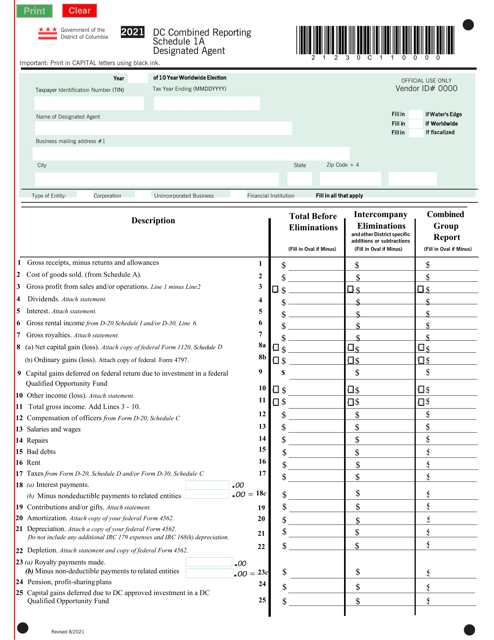

This document is used for reporting the designated agent for a business in Washington, D.C. for combined reporting purposes.

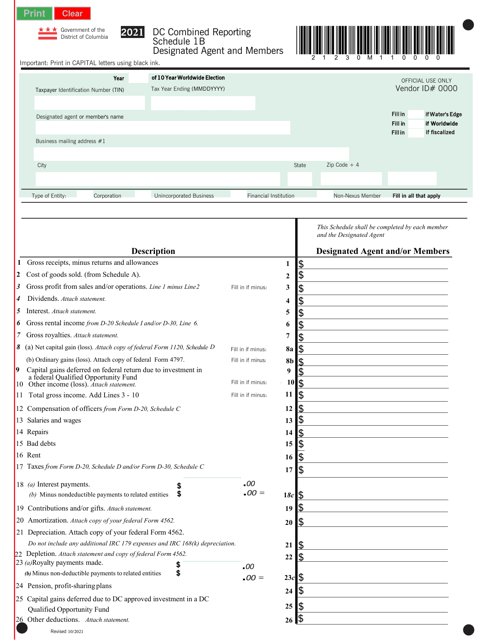

This Form is used for reporting designated agents and members for combined reporting in Washington, D.C.

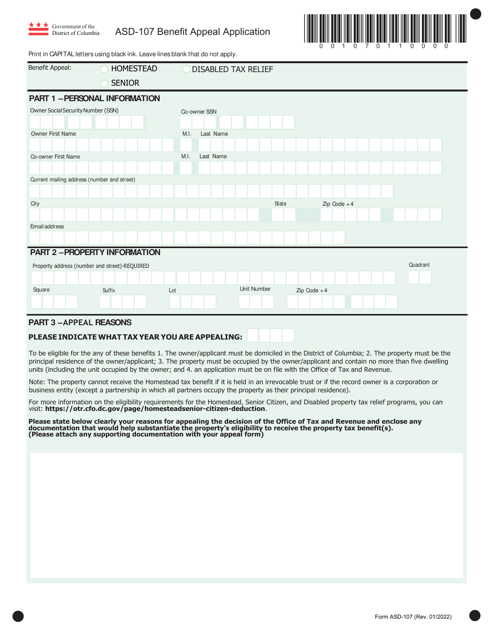

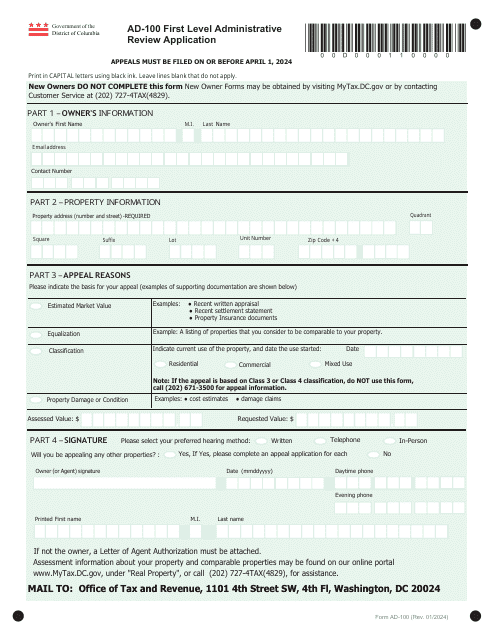

This form is used for filing a Benefit Appeal Application in Washington, D.C. It is used to appeal a decision related to benefits.