Indiana Board of Tax Review Forms

The Indiana Board of Tax Review is responsible for resolving disputes and making decisions related to property tax assessments. They review appeals filed by taxpayers who believe that their property has been overvalued or incorrectly assessed for tax purposes. The board serves as an independent administrative body that provides taxpayers with a fair and impartial forum to contest their property tax assessments.

Documents:

7

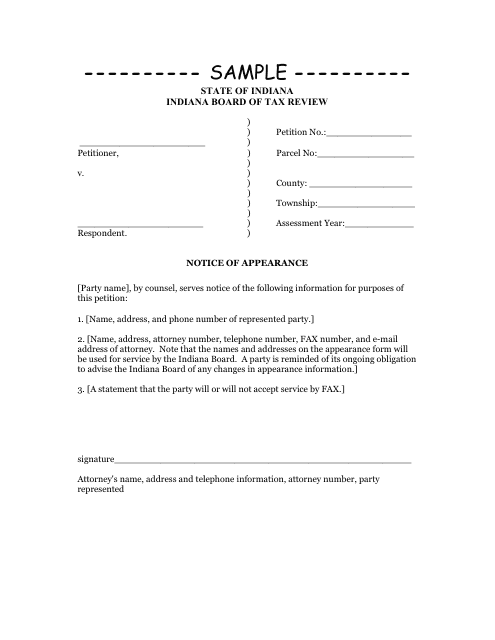

This document is used to notify the court and other parties involved that an attorney will be representing a client in a legal case in Indiana.

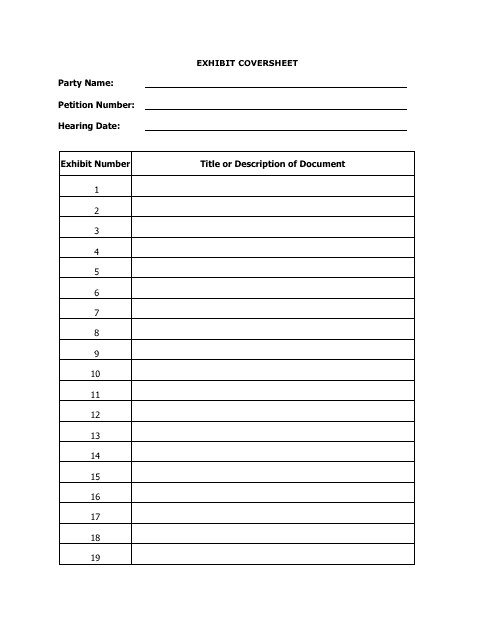

This document is used for submitting exhibits and providing a cover sheet for legal cases in the state of Indiana.

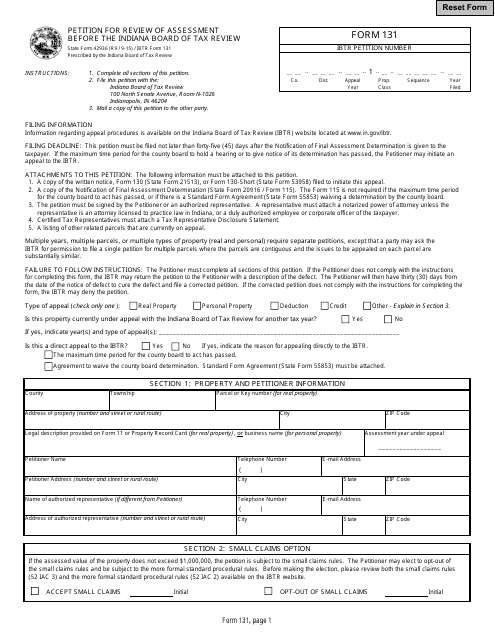

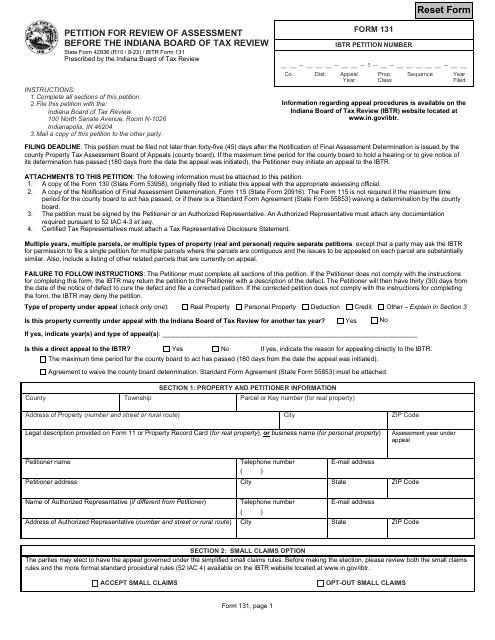

This form is used for filing a petition to review a tax assessment before the Indiana Board of Tax Review in the state of Indiana.

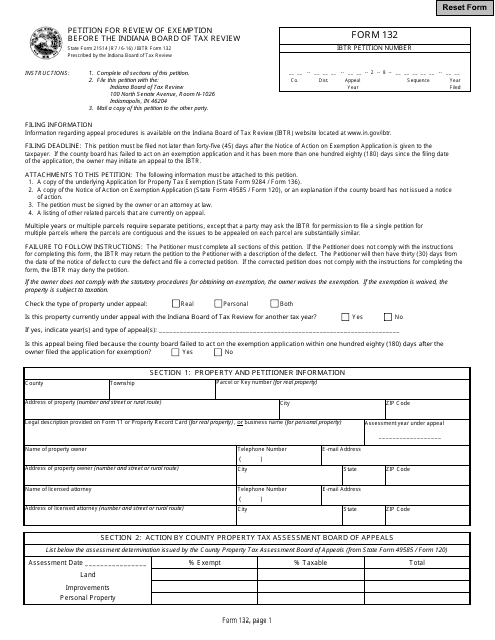

This form is used for filing a petition to review an exemption before the Indiana Board of Tax Review in Indiana.

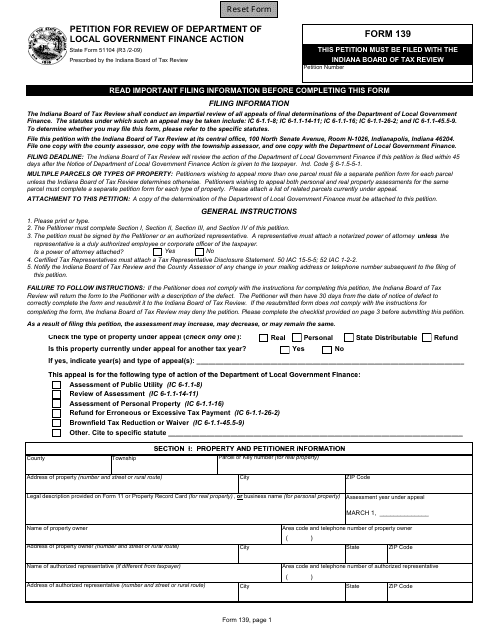

This form is used for filing a petition to review an action taken by the Department of Local Government Finance in the state of Indiana.

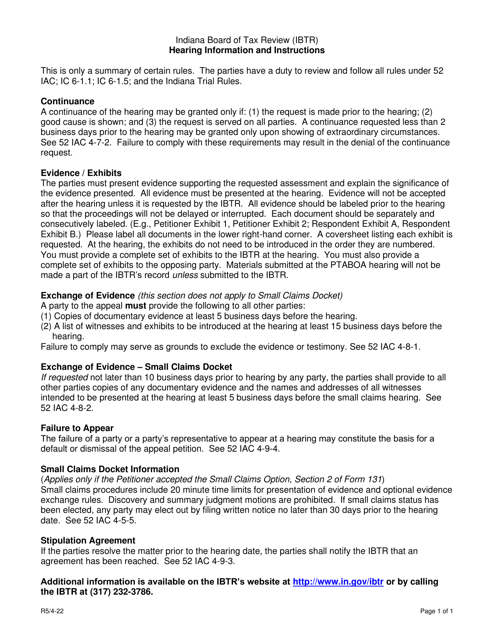

This form provides information and instructions for hearings in the state of Indiana.