Indiana Department of Local Government Finance Forms

Documents:

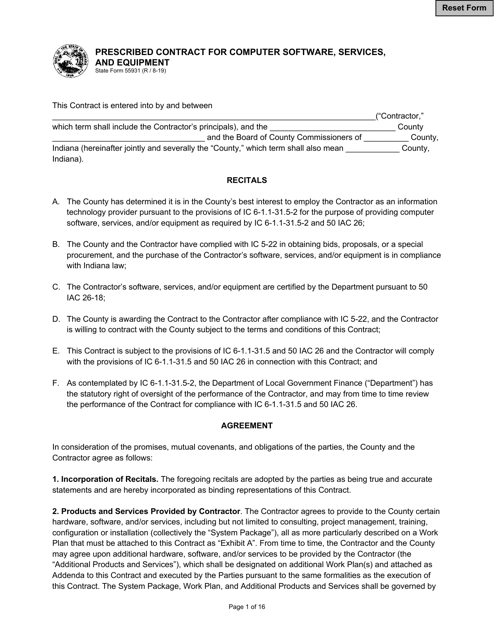

272

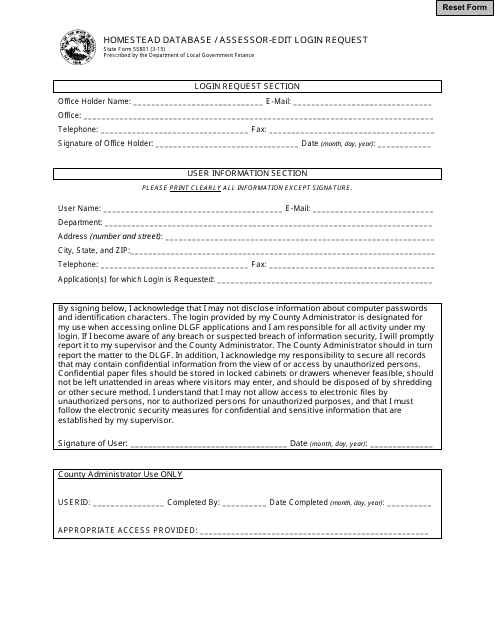

This document is used for requesting to edit login information in the Homestead Database for assessors in the state of Indiana.

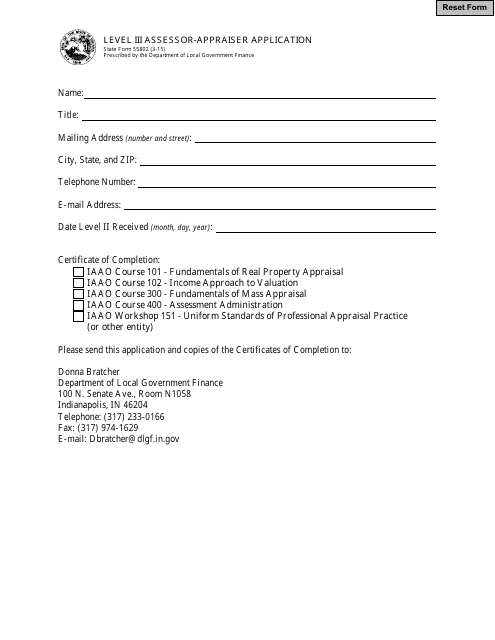

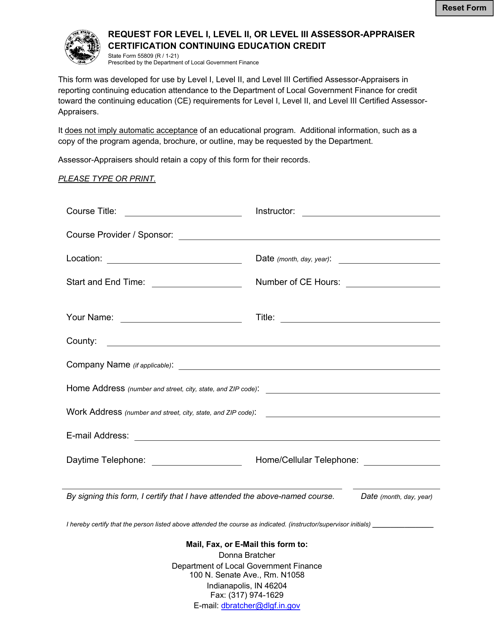

This form is used for applying to become a Level III Assessor-Appraiser in the state of Indiana.

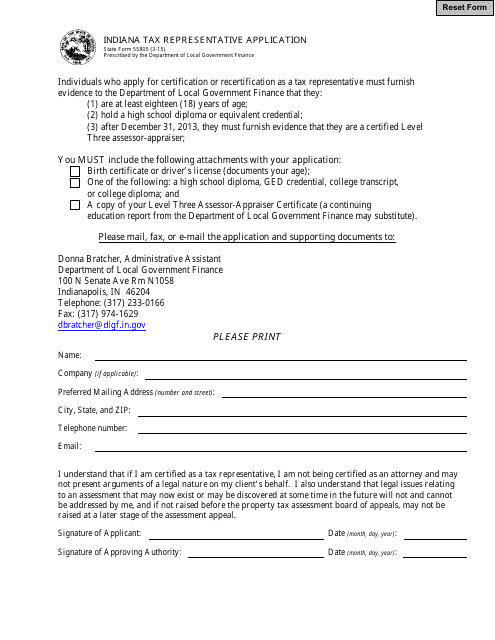

This Form is used for individuals who want to become a tax representative in the state of Indiana.

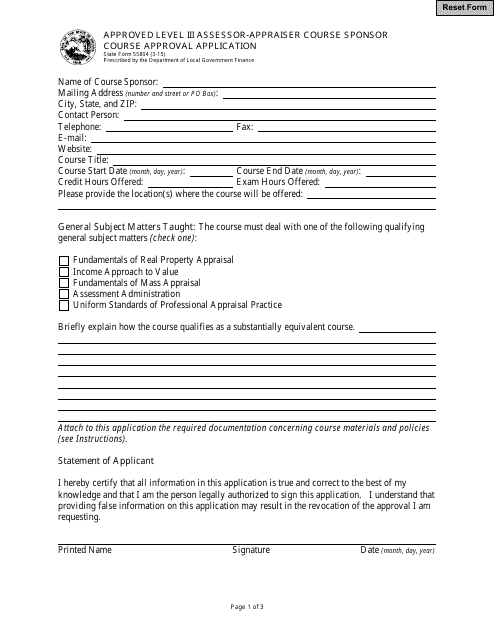

This Form is used for applying for course approval for the Level III Assessor-Appraiser Course in Indiana.

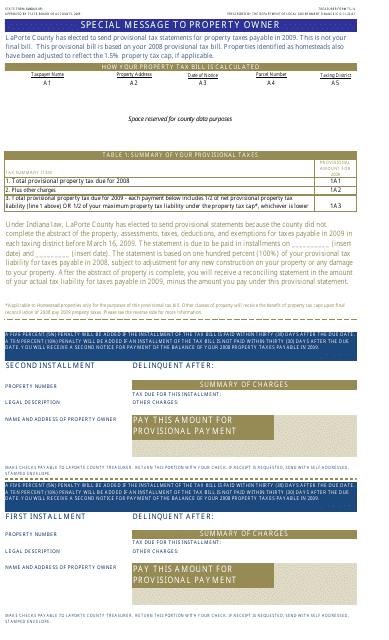

This form is used for filing your tax statement in the state of Indiana.

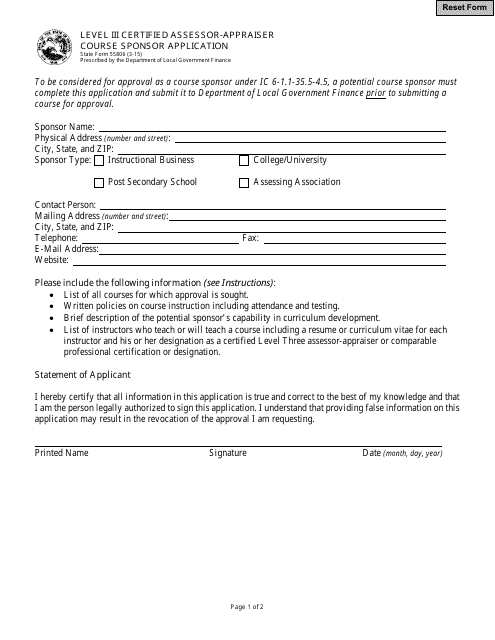

This form is used for applying to become a sponsor for the Level III Certified Assessor-Appraiser Course in Indiana.

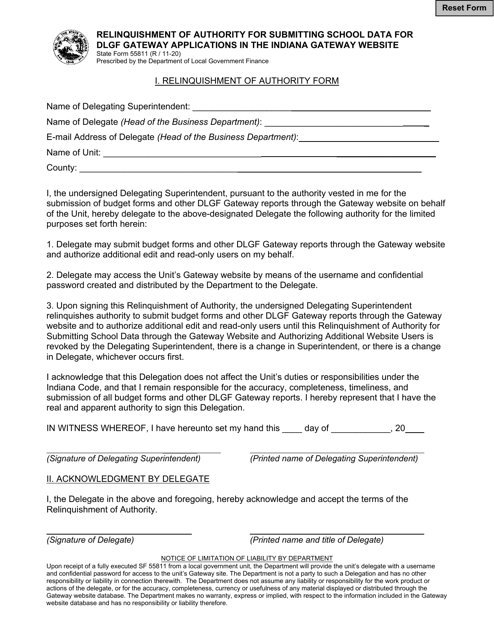

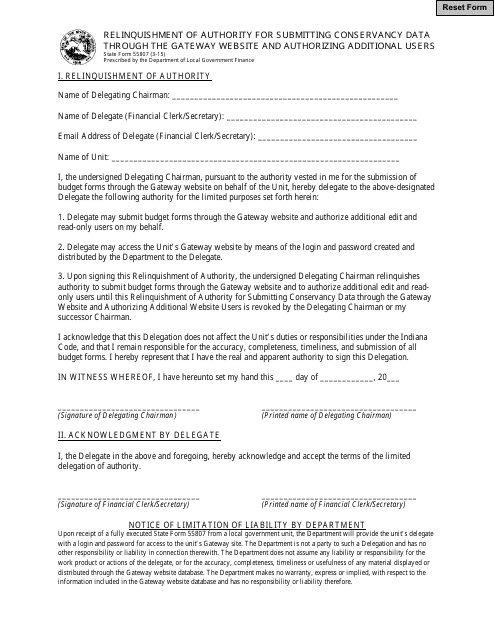

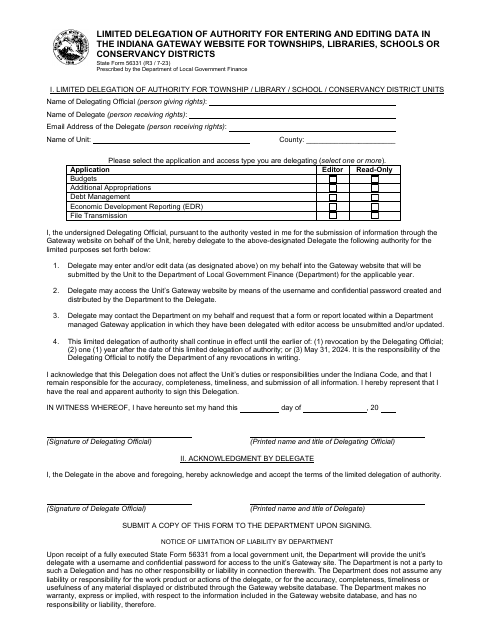

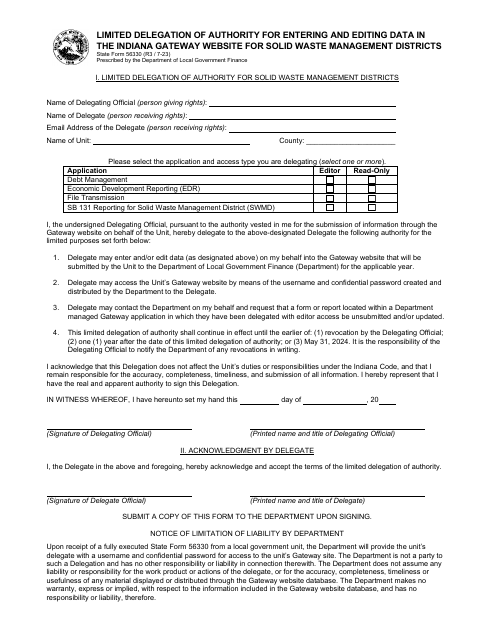

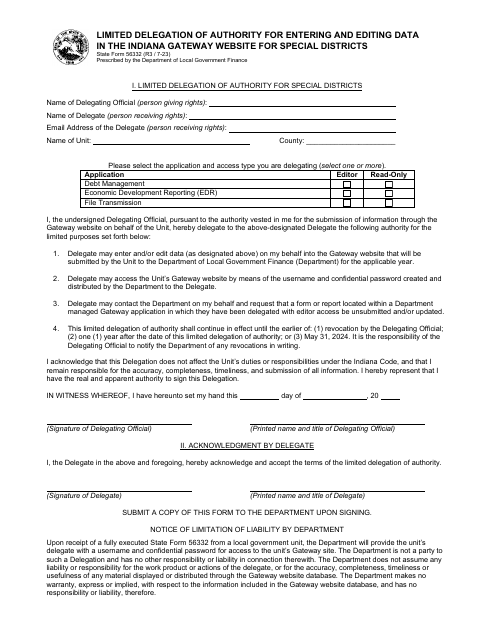

This form is used for relinquishing authority to submit conservancy data through the Gateway website and authorizing additional users in the state of Indiana.

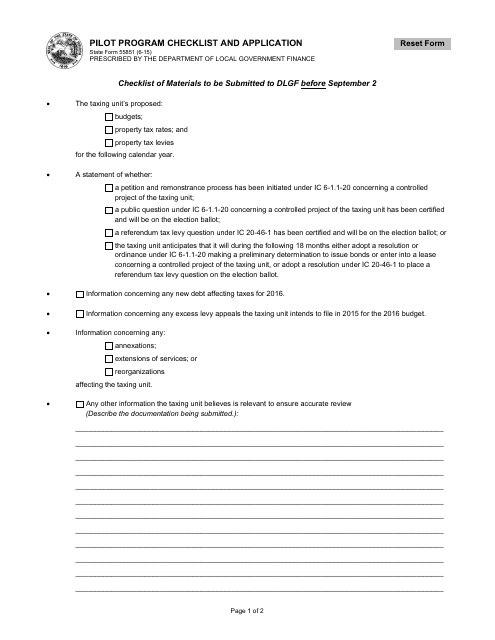

This Form is used for applying for the Pilot Program in Indiana.

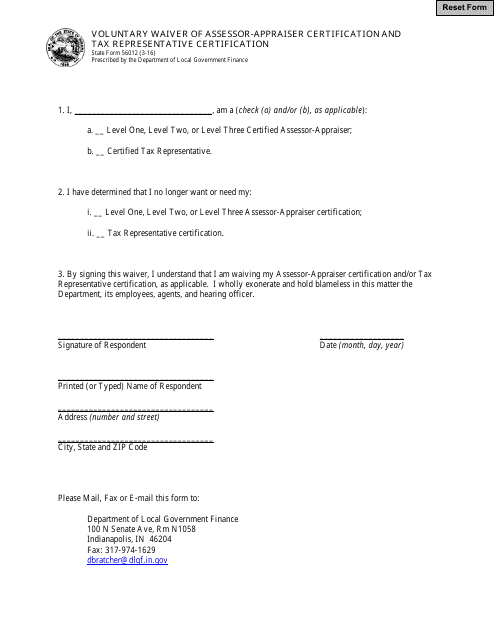

This form is used for voluntarily waiving the certification of assessor-appraiser and tax representative in the state of Indiana. It allows individuals to request the waiver of these certifications.

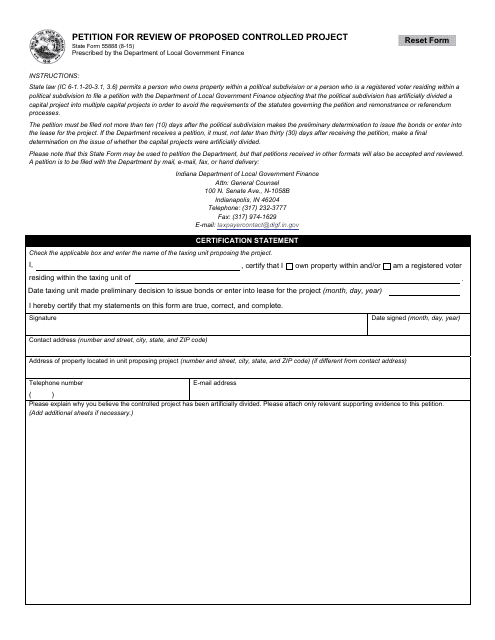

This form is used for filing a Petition for Review of a Proposed Controlled Project in the state of Indiana.

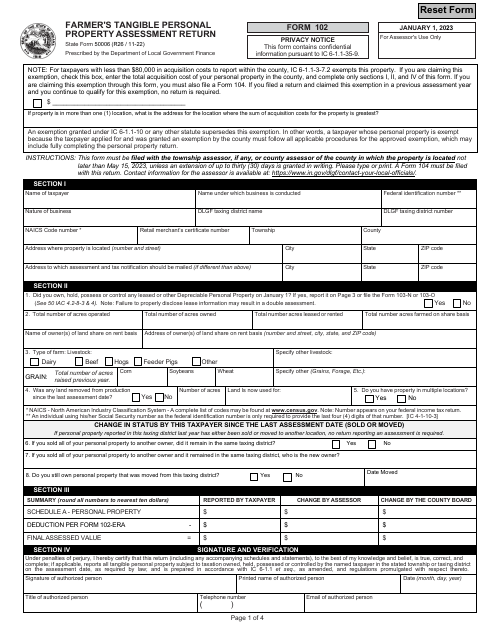

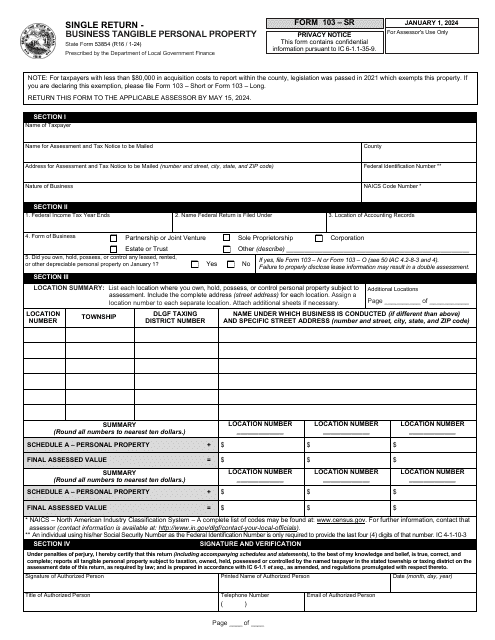

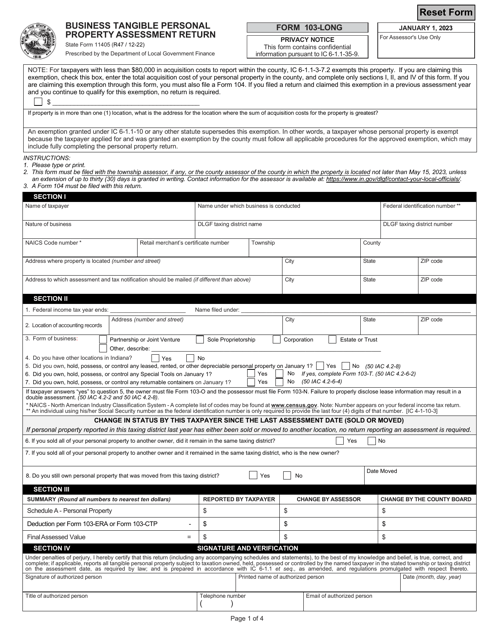

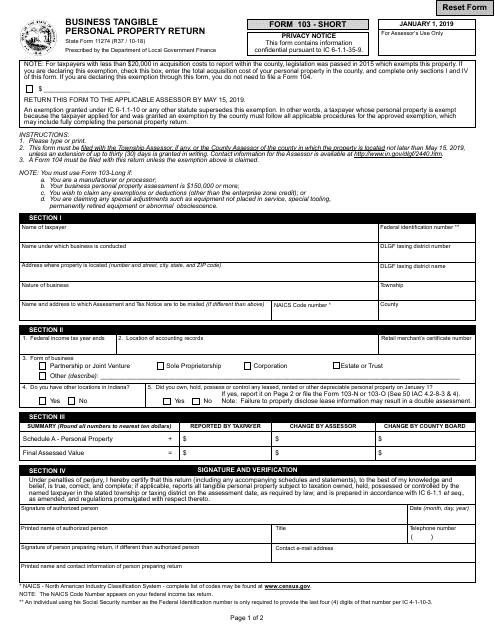

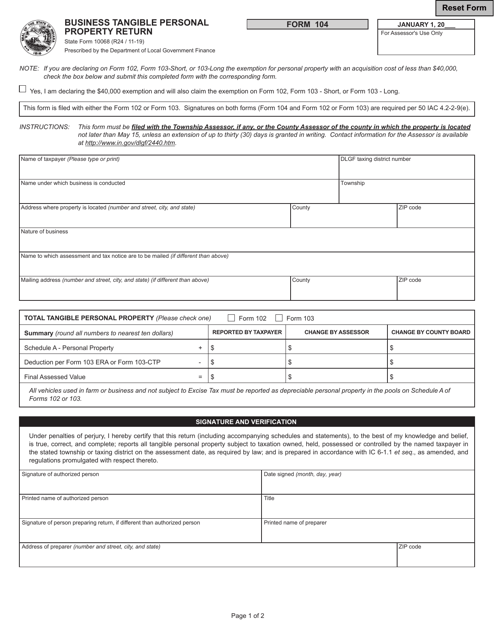

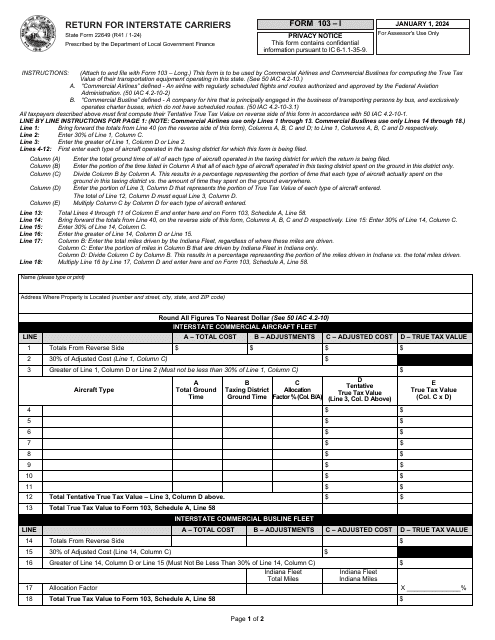

This form is used for reporting and assessing the value of tangible personal property owned by businesses in the state of Indiana.

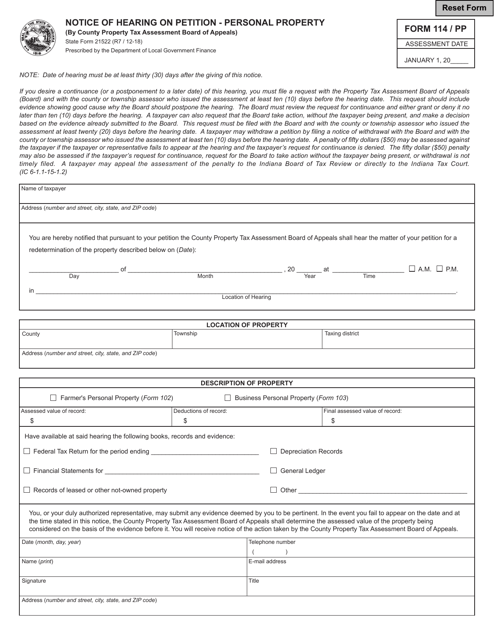

This form is used for notifying individuals about a scheduled hearing regarding a petition related to personal property in the state of Indiana.

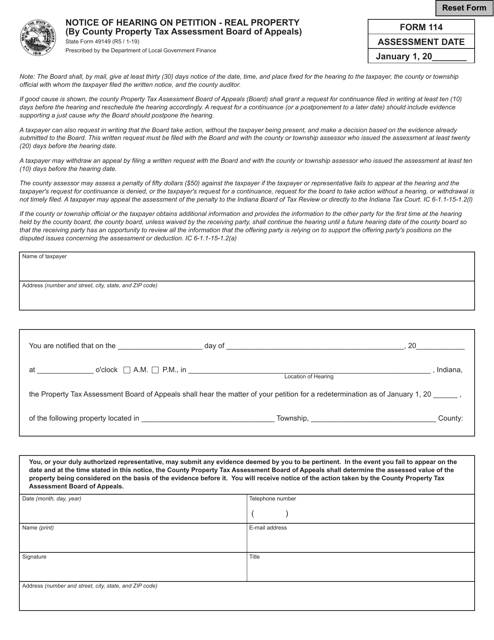

This document is used for notifying property owners in Indiana about a hearing on a petition related to their real property.

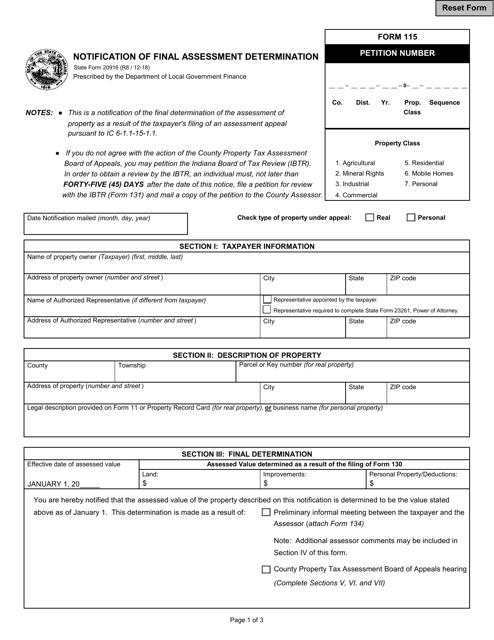

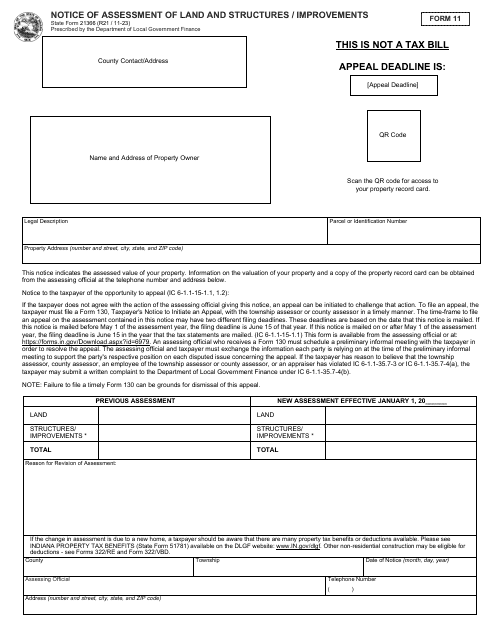

This form is used for notifying Indiana residents about the final assessment determination made by the state.

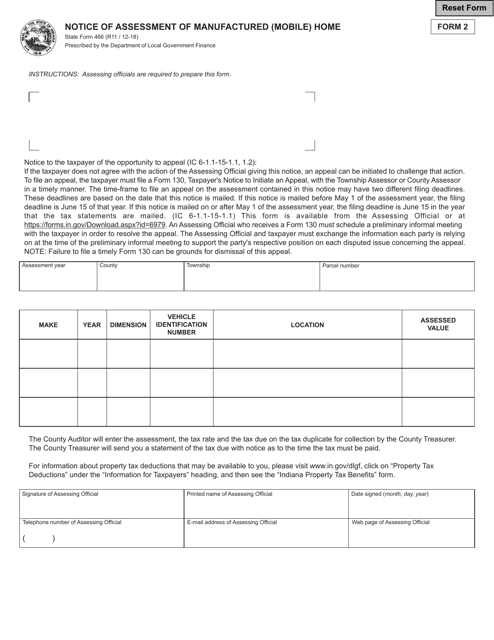

This Form is used for notifying the assessment of a manufactured (mobile) home in Indiana.

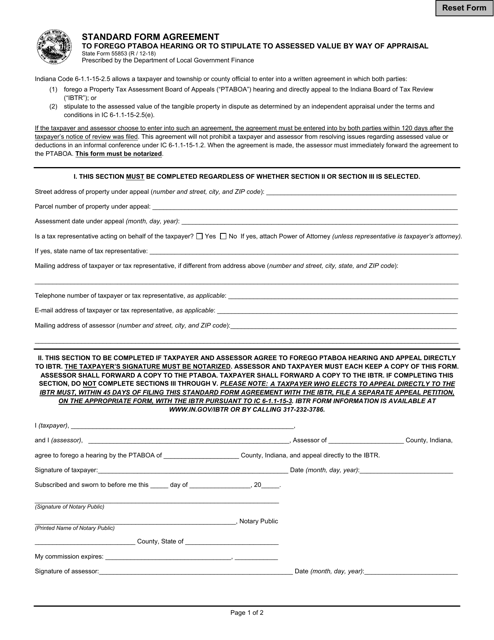

This document is a standard form agreement used in the state of Indiana. It allows parties to forgo a PTABOA hearing or agree to an assessed value by way of appraisal.

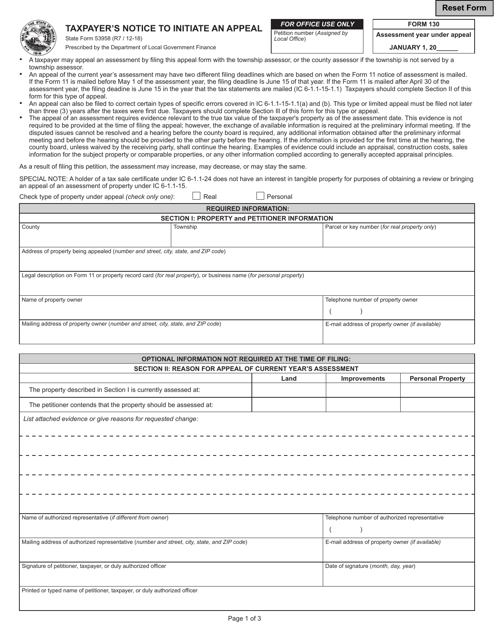

This form is used for Indiana residents who wish to initiate an appeal regarding their taxes.

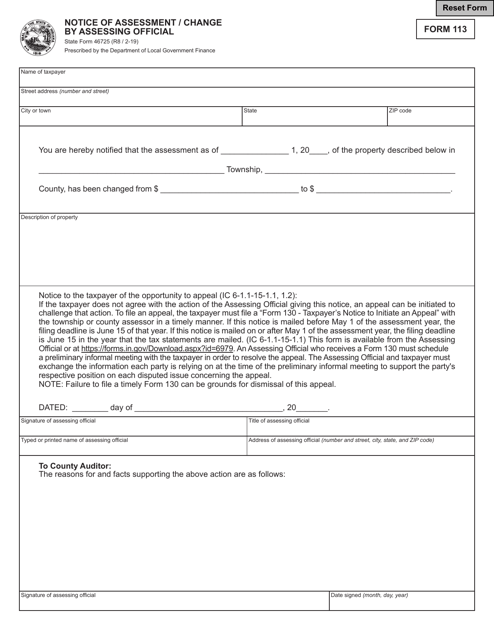

This Form is used for notifying residents in Indiana about assessments or changes made by the Assessing Official.

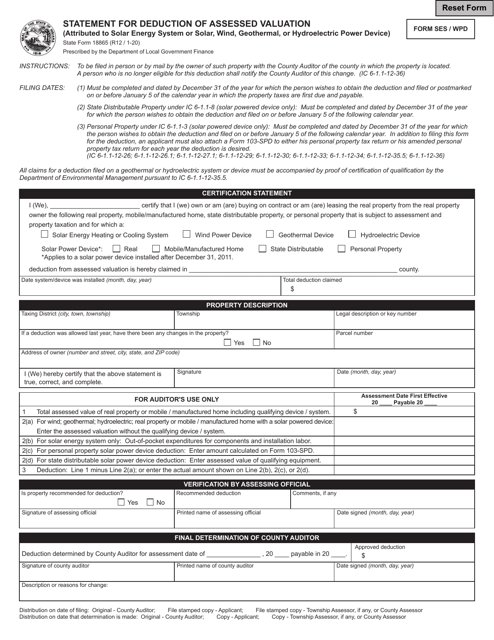

This form is used for deducting the assessed valuation of a solar energy system or other renewable power devices in the state of Indiana.

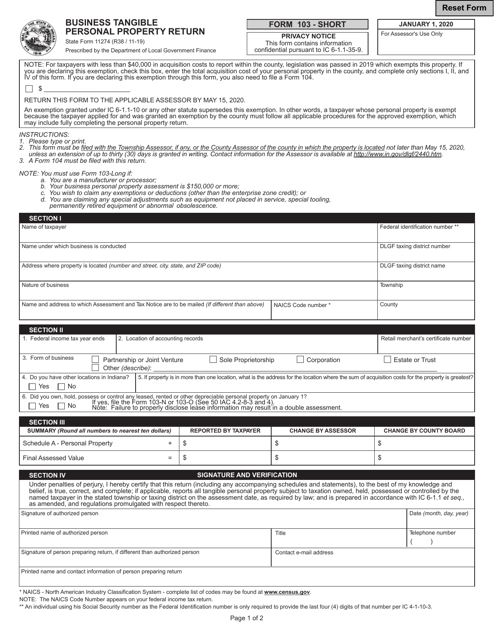

This Form is used for reporting tangible personal property owned by businesses in the state of Indiana. It is required for filing taxes and assessing property value.

This document is used for filing the Business Tangible Personal Property Return in the state of Indiana. It is a form that businesses must complete and submit to report their personal property holdings.