Delaware Office of the State Treasurer Forms

The Delaware Office of the State Treasurer is responsible for managing the financial resources of the state of Delaware. Their primary role is to maximize the returns on the state's investments, manage the state's cash flow, and ensure the proper disbursement of funds to various government entities. They also oversee the state's banking services, manage debt issuance and retirement funding, and provide financial education and resources to the public.

Documents:

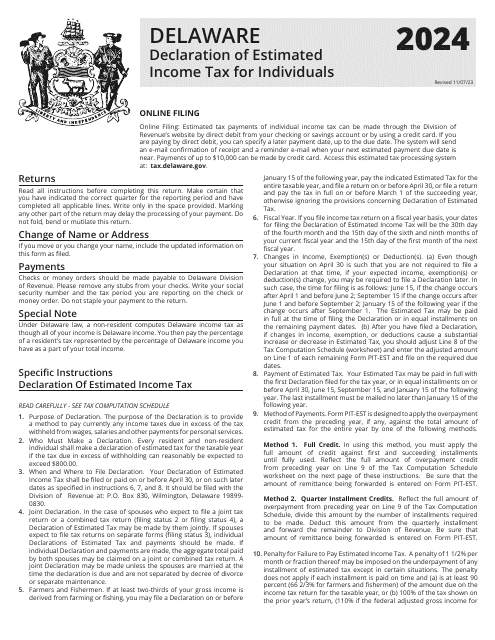

24

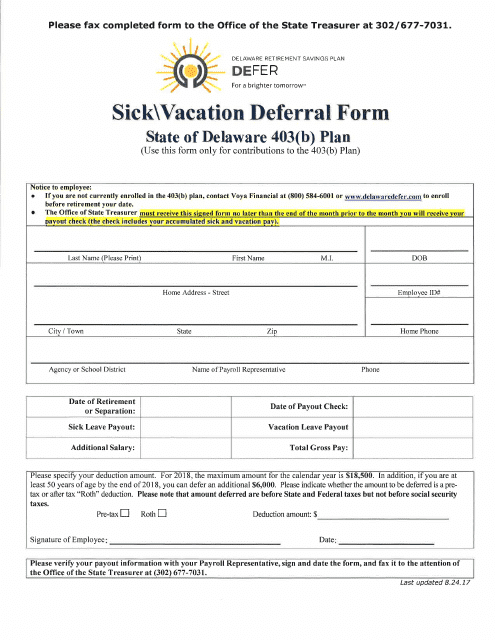

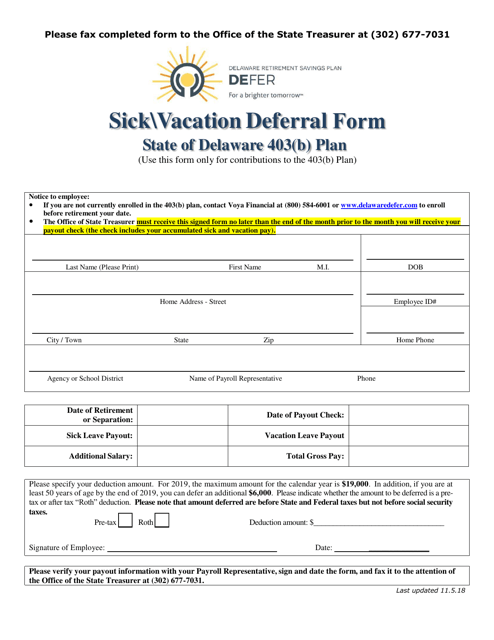

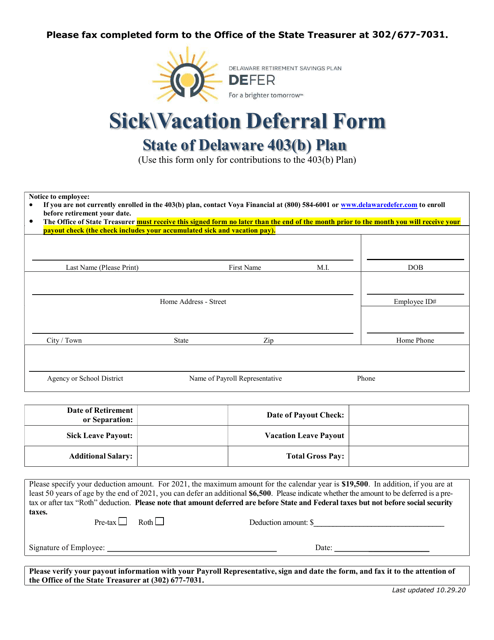

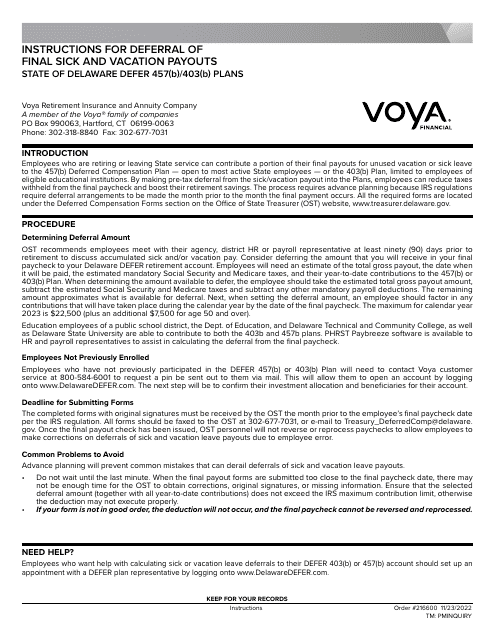

This document is a Sick Vacation Deferral Form specific to the State of Delaware 403(B) Plan. It is used for deferring sick vacation days as a part of retirement savings in Delaware.

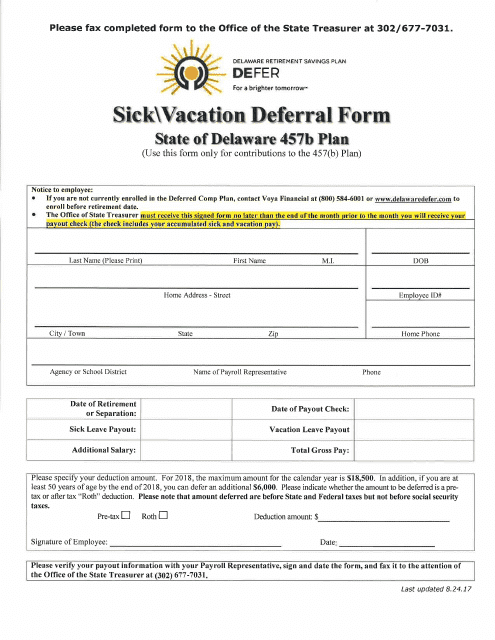

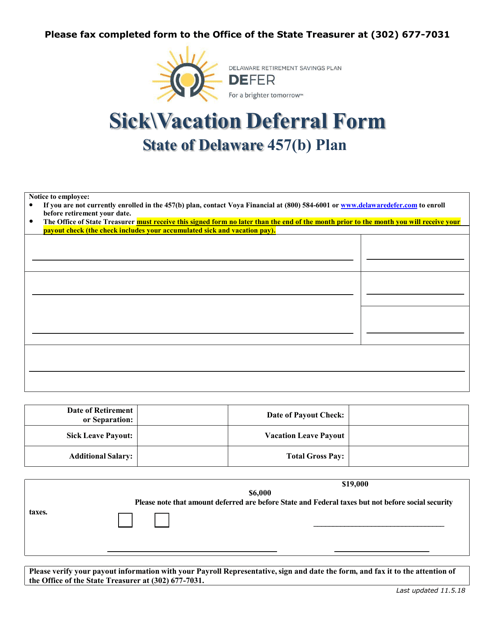

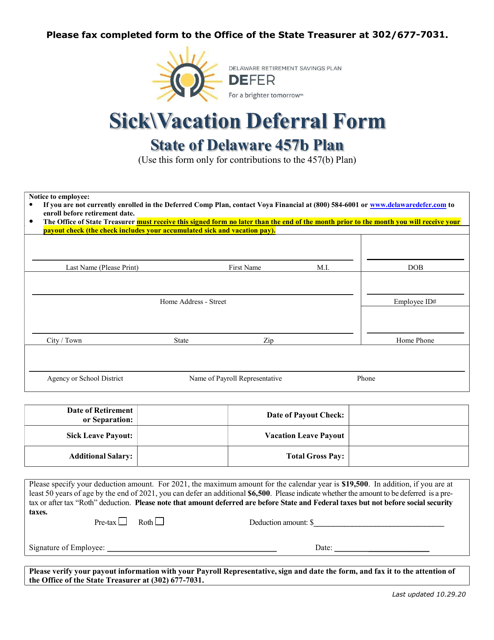

This form is used for deferring sick vacation days in the State of Delaware 457b Plan.

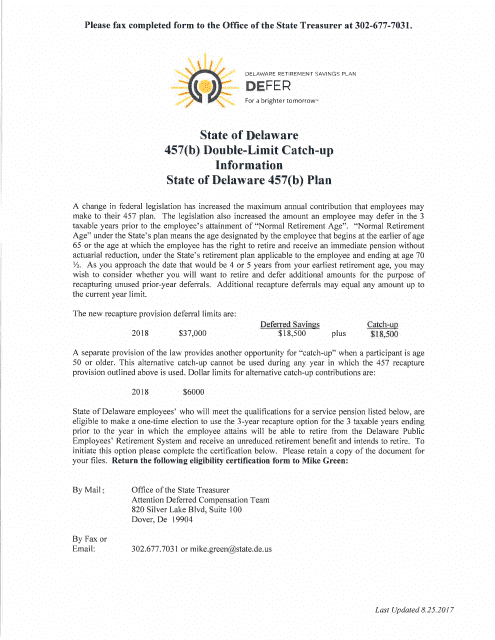

This Form is used for the certification of eligibility for the 457(B) double-limit catch-up contribution in Delaware.

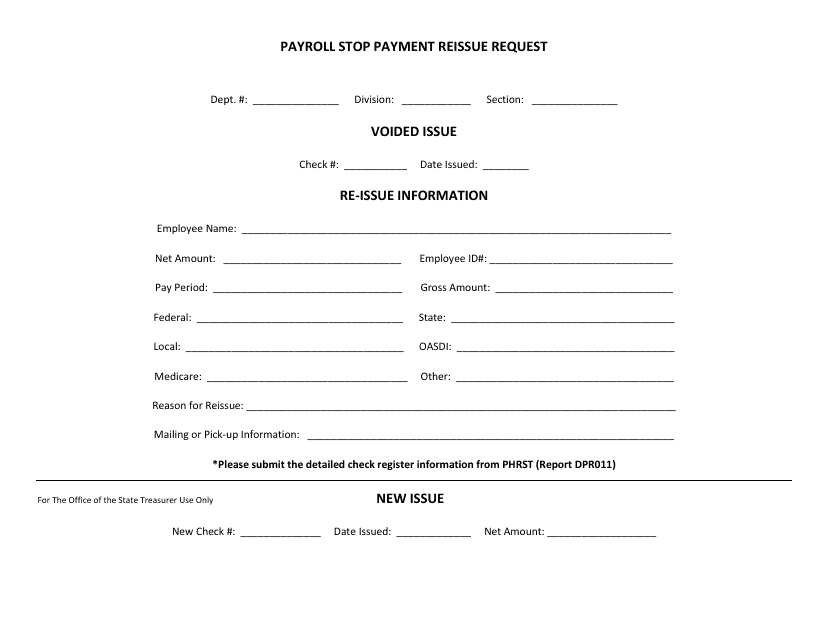

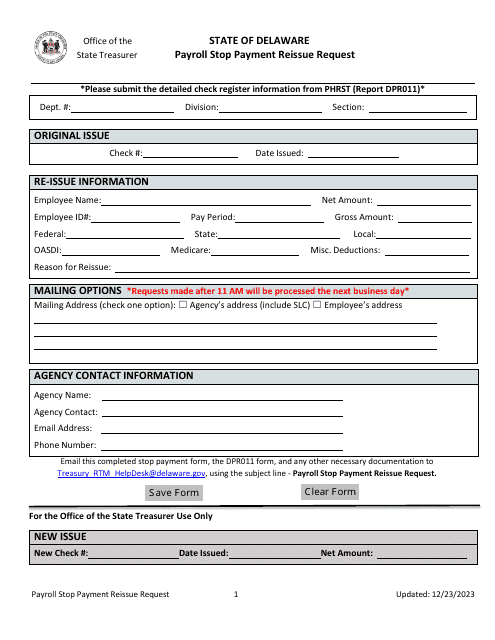

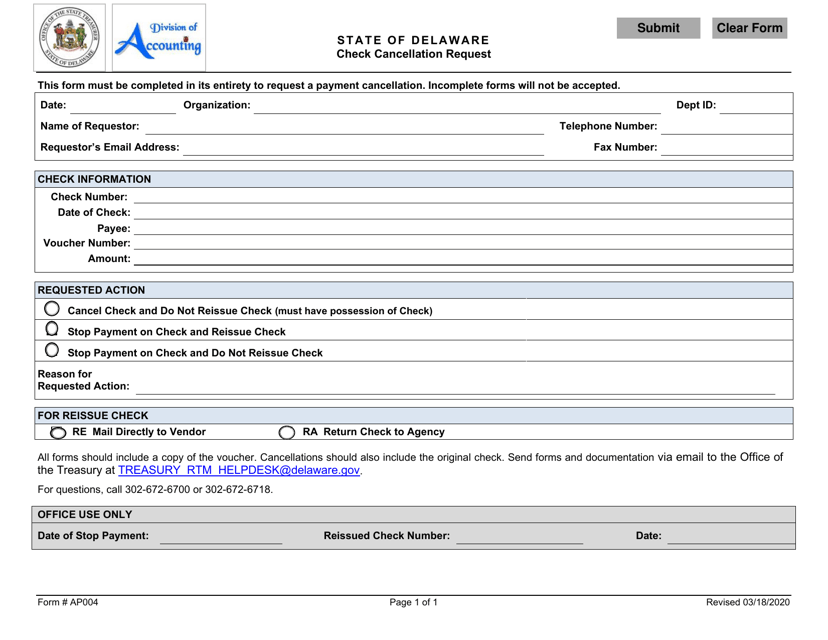

This Form is used for requesting a reissue of a stopped payroll payment in the state of Delaware.

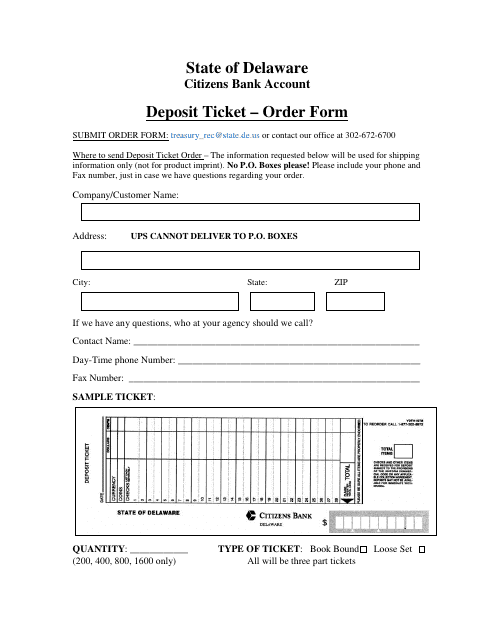

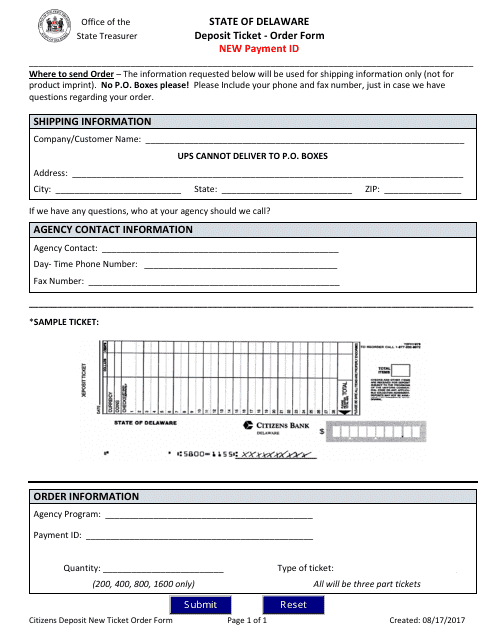

This Form is used for ordering deposit tickets in Delaware.

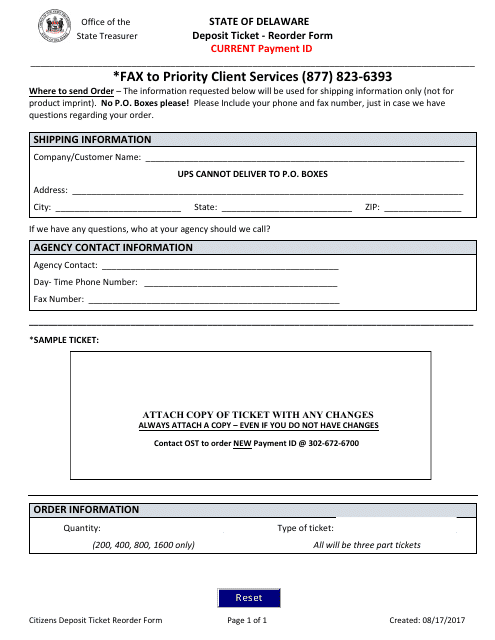

This Form is used for reordering deposit tickets for making payments in Delaware.

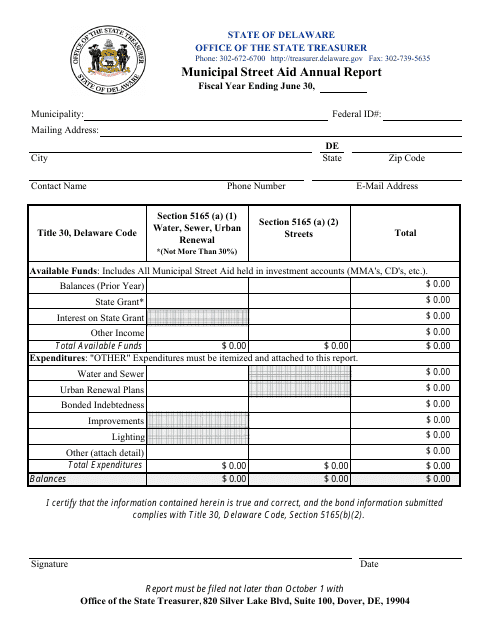

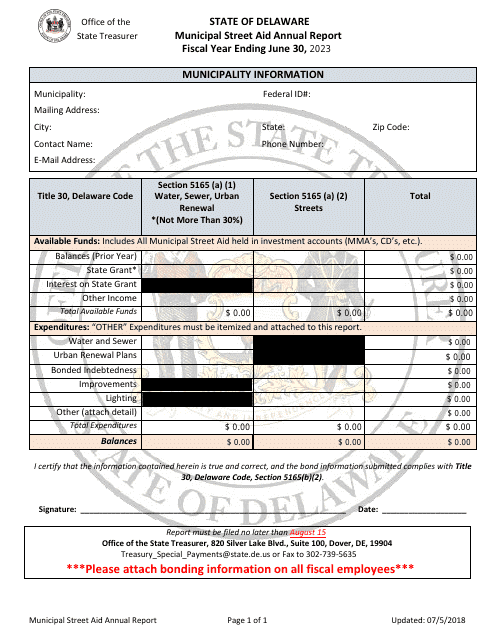

This form is used for reporting the annual usage of Municipal Street Aid funds in Delaware.

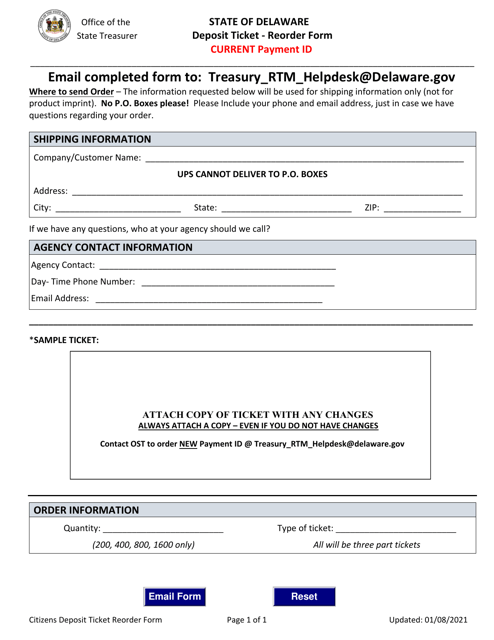

This form is used for ordering deposit tickets to make payments in Delaware. Get your new payment ID and easily order deposit tickets.

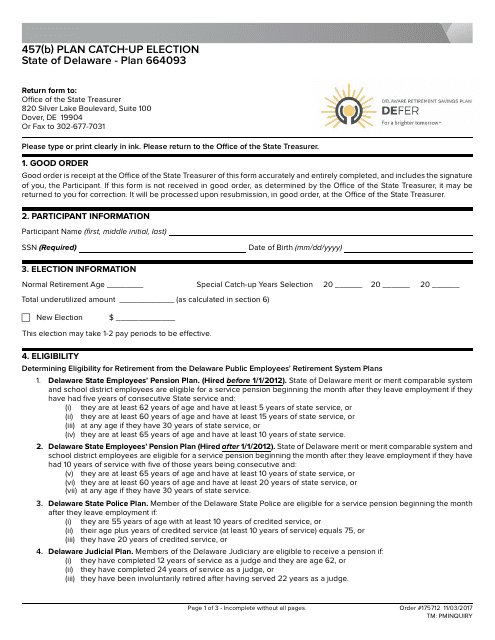

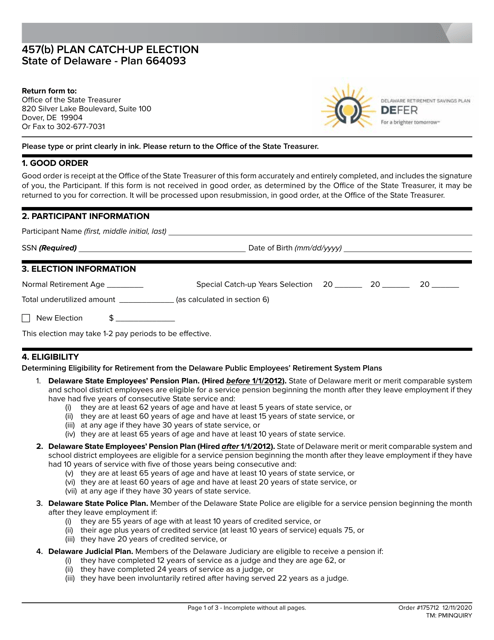

This type of document is a 457(b) Plan Catch-Up Election for the Delaware Plan 664093. It allows individuals to make additional contributions to their retirement plan in order to catch up on savings.

This type of document is used for deferring sick vacation time into a Delaware 403(b) plan.

This Form is used for deferring sick and vacation benefits in the Delaware 457(B) Plan.

This Form is used for deferring sick and vacation time for employees participating in the 457b retirement plan in Delaware.

This Form is used for deferring sick and vacation time for 403b retirement plans in the state of Delaware.

This document is for making catch-up contributions to a 457(b) retirement plan in the state of Delaware. It allows individuals to contribute additional funds to their retirement account to "catch up" on missed contributions.