Indian Income Tax Department Forms

The Indian Income Tax Department is responsible for the administration of income tax laws in India. Its main purpose is to collect income tax from individuals, businesses, and other entities based on their income, and enforce compliance with tax laws. The department also undertakes initiatives to promote tax awareness and facilitate tax filing and payment processes.

Documents:

5

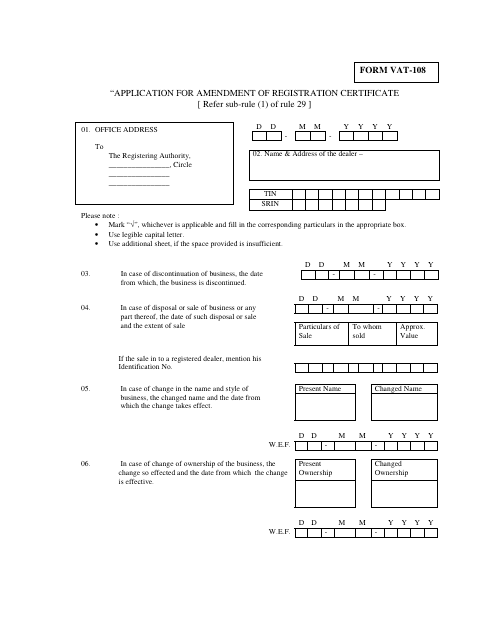

This form is used for applying to amend a registration certificate for Value Added Tax (VAT) in India. It is necessary to update or correct information on the registration certificate.

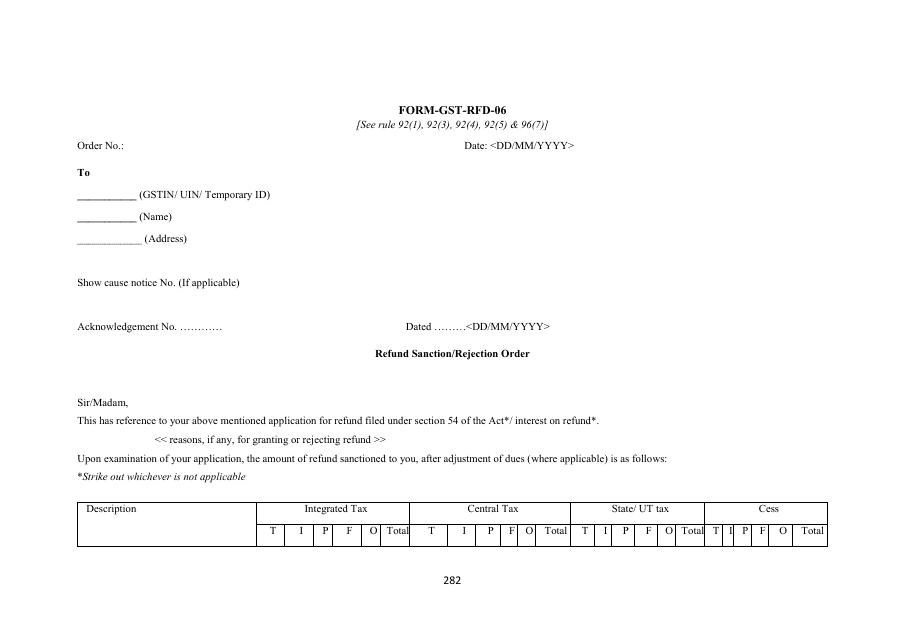

This form is used for issuing refund sanction or rejection orders for the Goods and Services Tax (GST) in India.

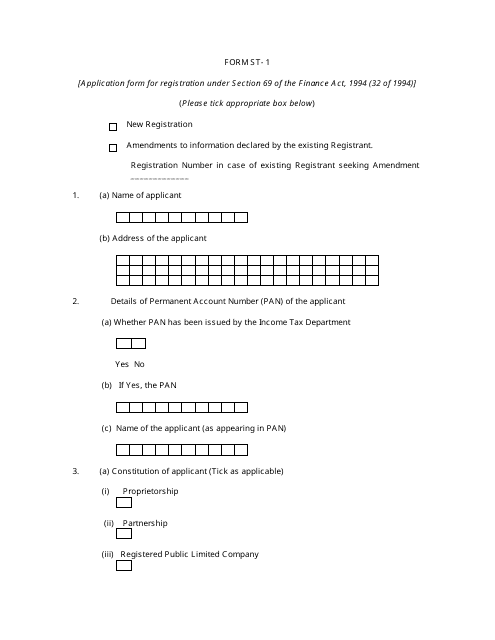

This form is used for applying for registration under Section 69 of the Finance Act, 1994 in India.

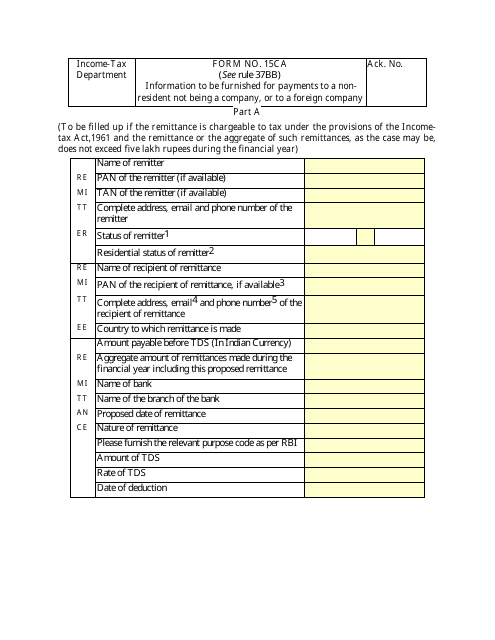

This form is used for providing information about payments made to non-residents or foreign companies in India. It is necessary for tax purposes and ensuring compliance with Indian regulations.

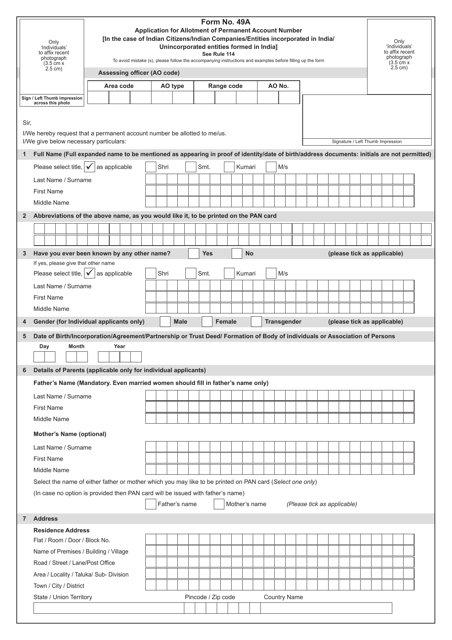

This Form is used for applying for a Permanent Account Number (PAN) in India. It is required for individuals and entities who are eligible for tax purposes.