Idaho State Tax Commission Forms

The Idaho State Tax Commission is responsible for administering and enforcing tax laws in the state of Idaho. It is a government agency that collects various taxes, including income tax, sales tax, property tax, and other related taxes. The commission is also responsible for providing taxpayer assistance, processing tax returns, conducting audits, and implementing tax policies and regulations.

Documents:

308

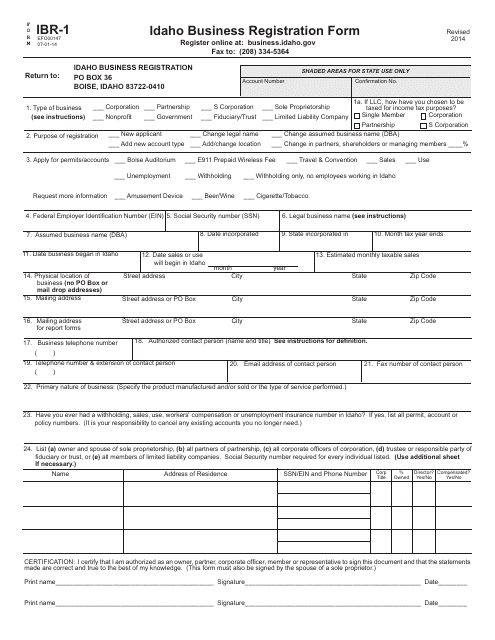

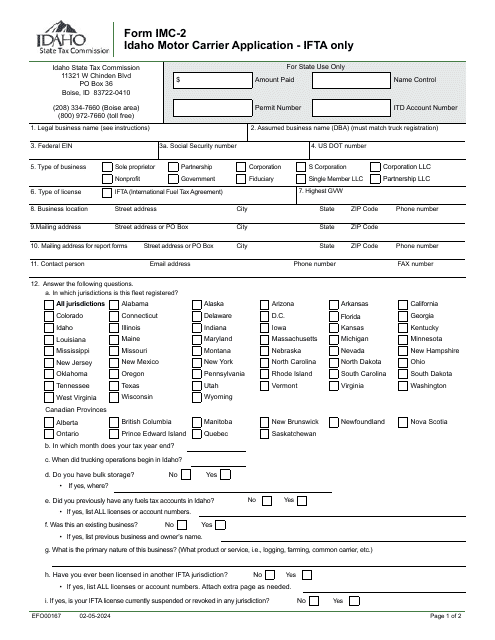

This type of document is used for registering a business in the state of Idaho.

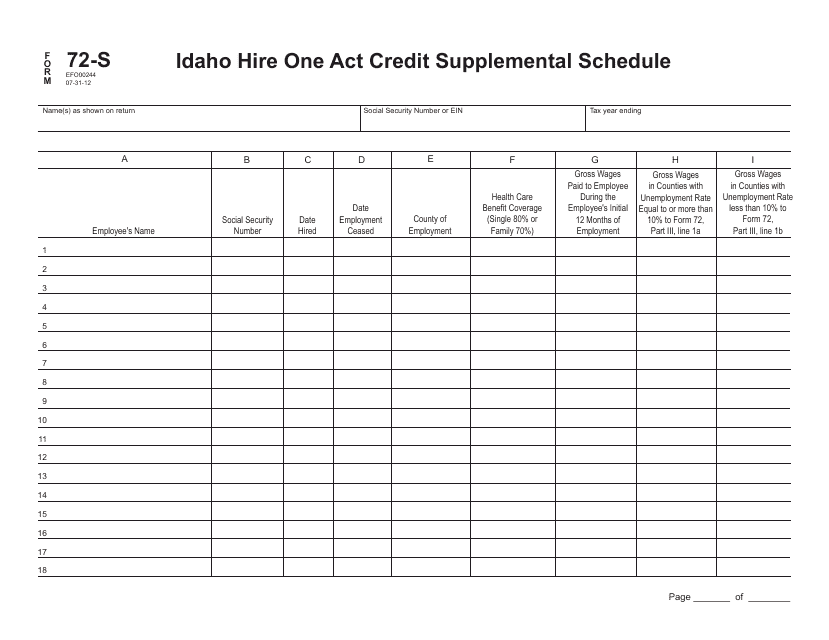

This form is used for filing a supplemental schedule for the Idaho Hire One Act Credit. It is specifically for businesses in Idaho.

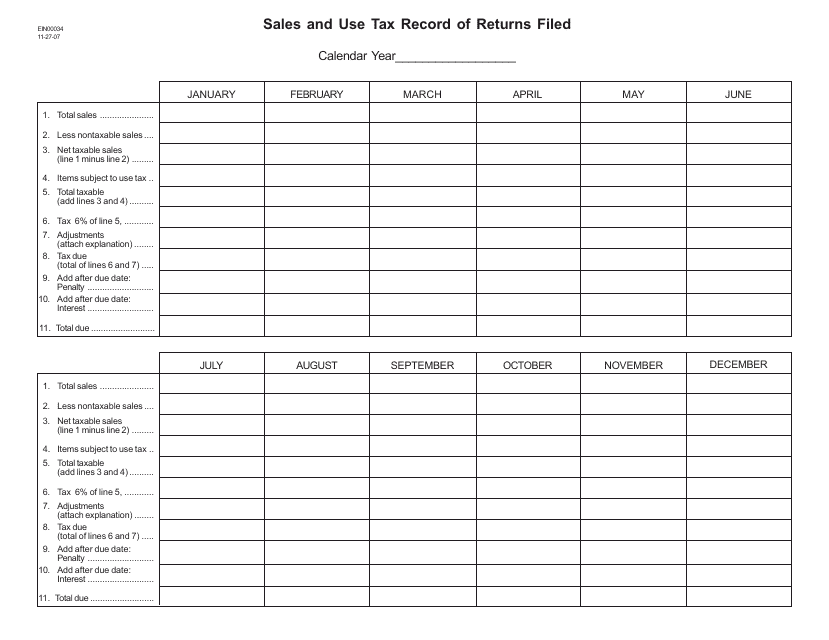

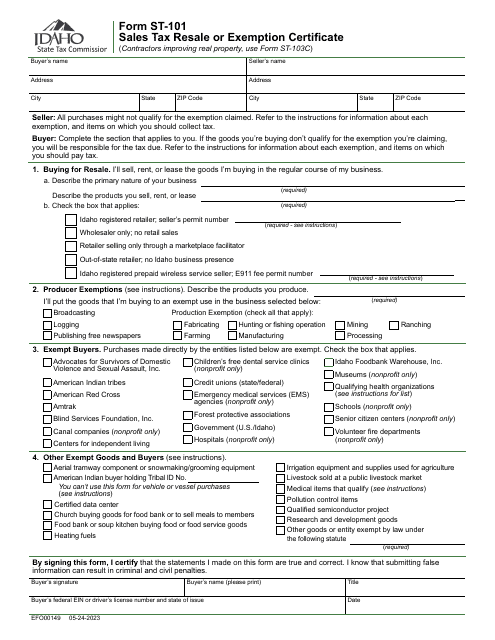

This form is used for recording sales and use tax returns filed in the state of Idaho.

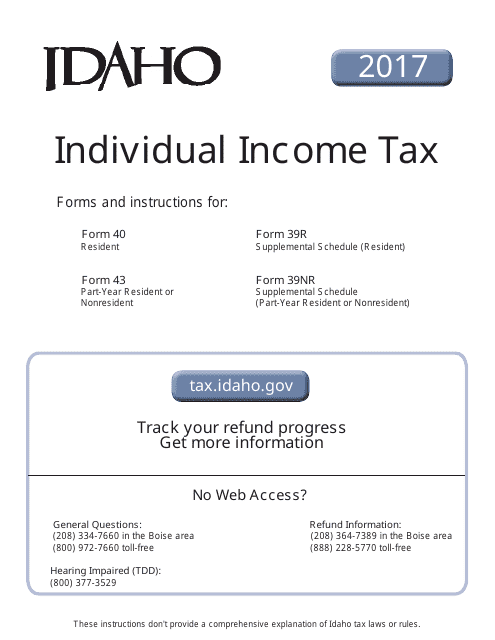

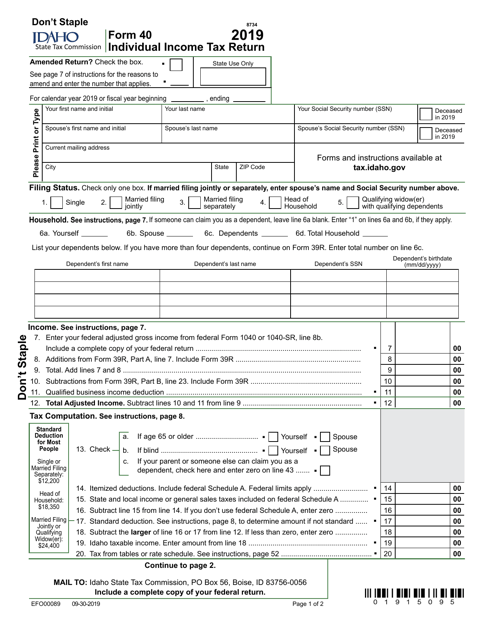

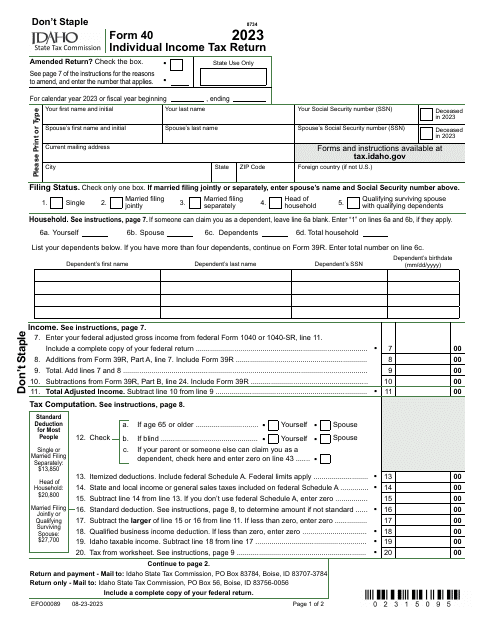

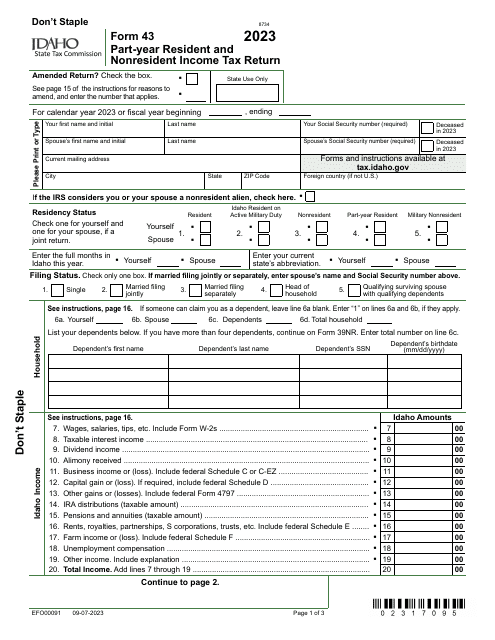

This Form is used for filing individual income tax returns in the state of Idaho. It includes instructions on how to fill out Form 40 for residents, Form 43 for part-year residents, and Form 39NR for nonresidents. The instructions provide guidance on what information to include, how to calculate taxable income, and how to claim deductions and credits.

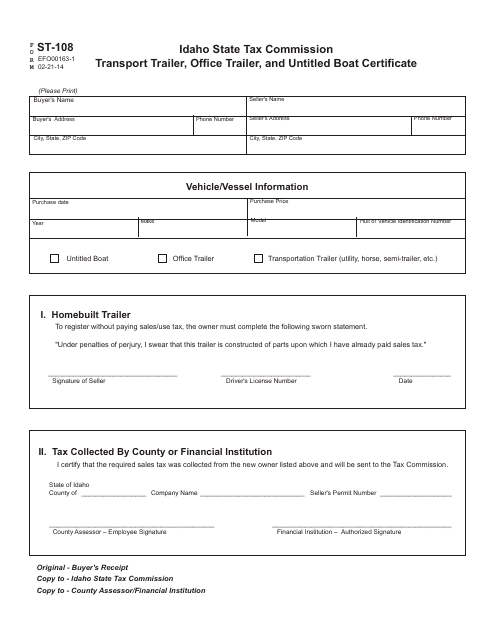

This form is used for obtaining a certificate for transporting trailers, office trailers, and untitled boats in the state of Idaho.

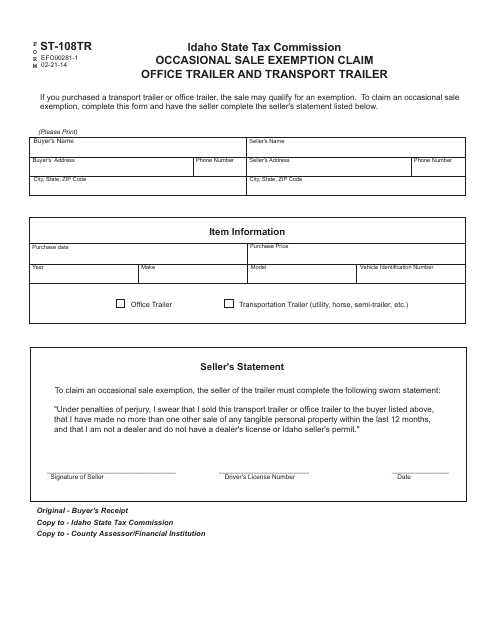

This form is used for claiming an exemption for occasional sales of office trailers and transport trailers in Idaho.

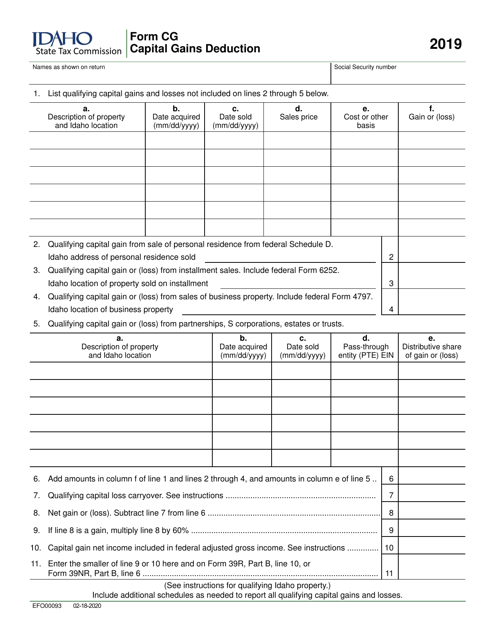

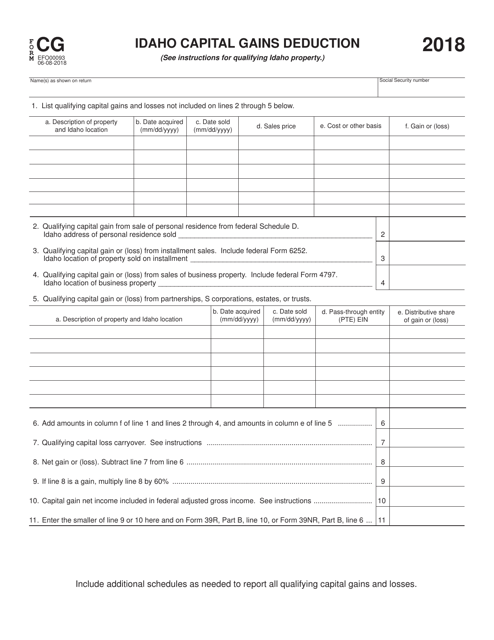

This document is used for claiming the Idaho Capital Gains Deduction in Idaho.

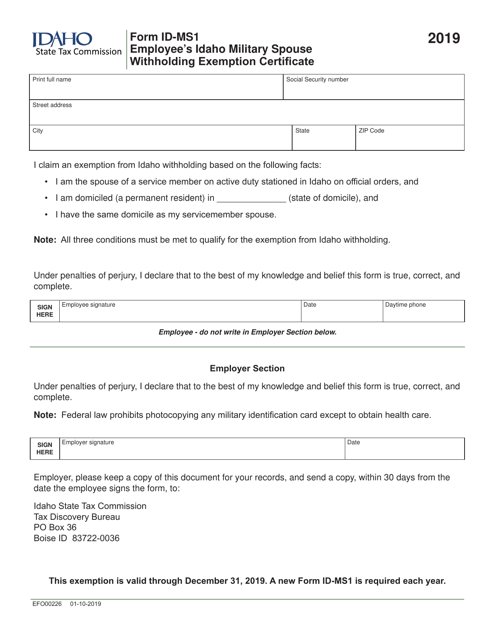

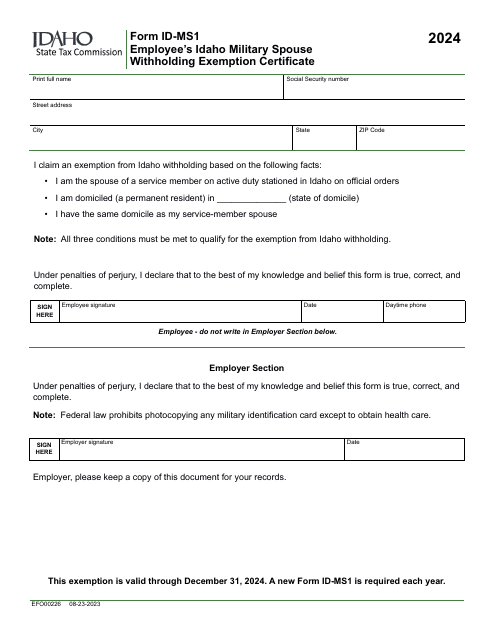

This form is used for employees who are military spouses in Idaho to claim withholding exemption from state income tax.

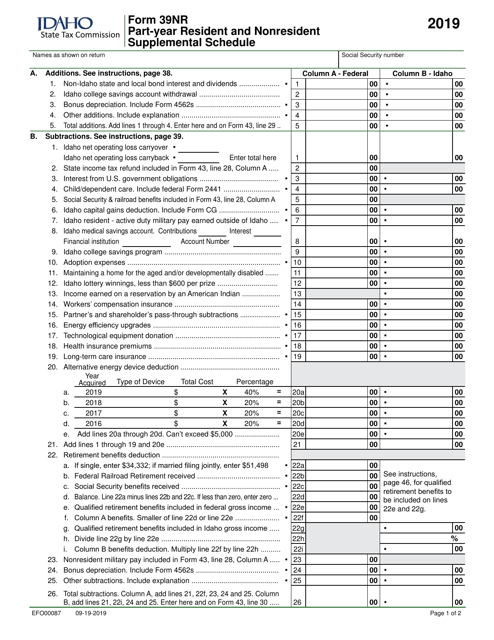

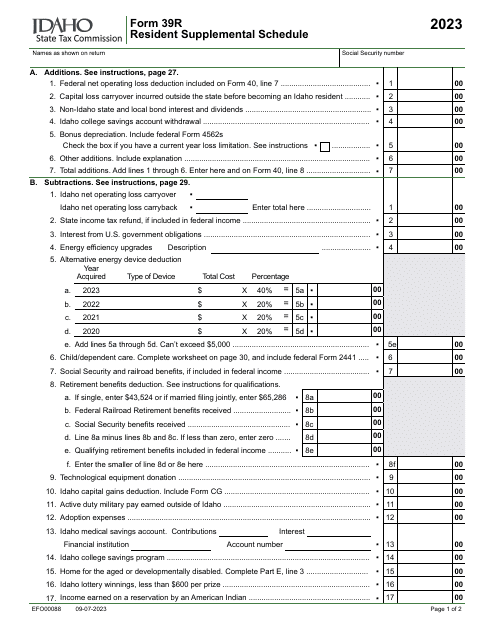

This document is used in Idaho for part-year residents and nonresidents to report additional income and deductions.

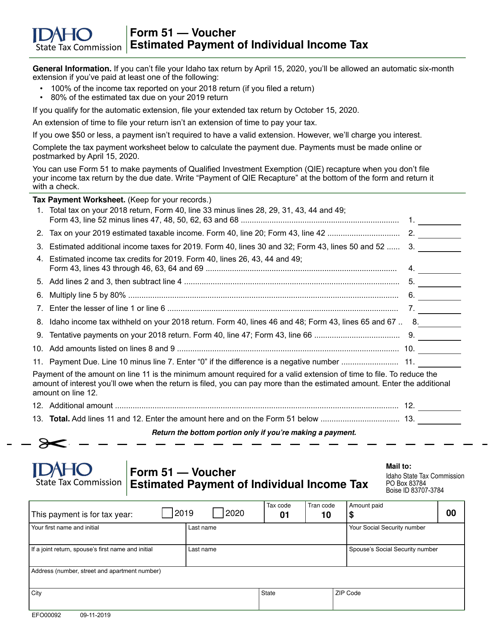

This form is used for making estimated payment of individual income tax in Idaho. It includes a voucher for submitting the payment.