Kansas Board of Tax Appeals Forms

The Kansas Board of Tax Appeals is responsible for resolving disputes related to tax assessments and appeals in the state of Kansas. They review and make decisions on various tax-related matters, including property tax assessments, exemptions, and valuation disputes. The board ensures fair and impartial resolutions for taxpayers and provides a platform for them to challenge tax assessments or exemptions they believe to be inaccurate or unfair.

Documents:

28

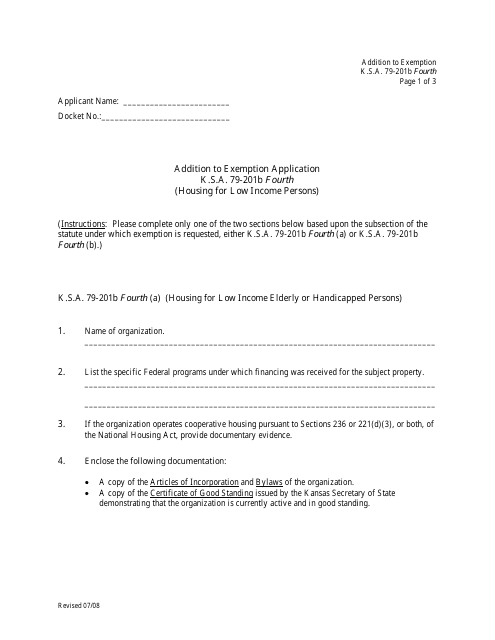

This document is an addition to the exemption application for housing for low-income persons in the state of Kansas. It provides additional information or updates to the original application.

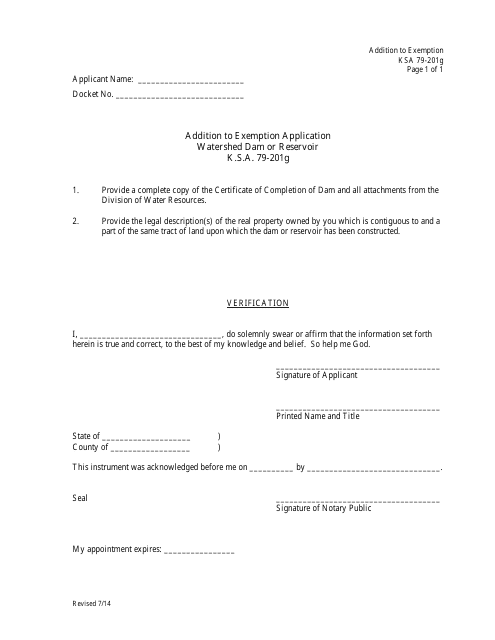

This Form is used for adding information to an application for exemption for a watershed dam or reservoir in Kansas.

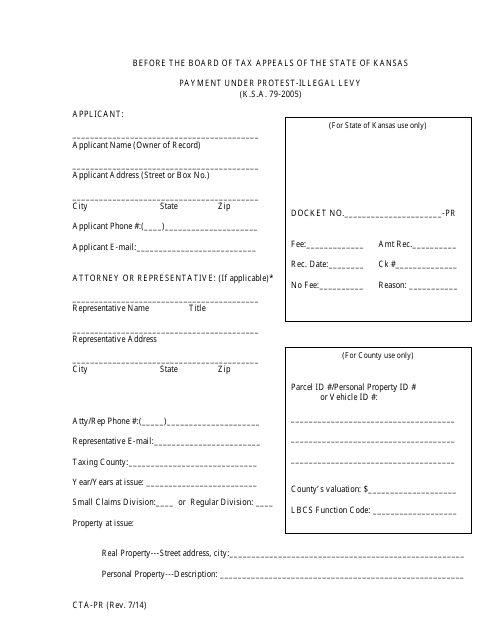

This Form is used for making a payment under protest in Kansas when a taxpayer believes that an illegal levy has been made.

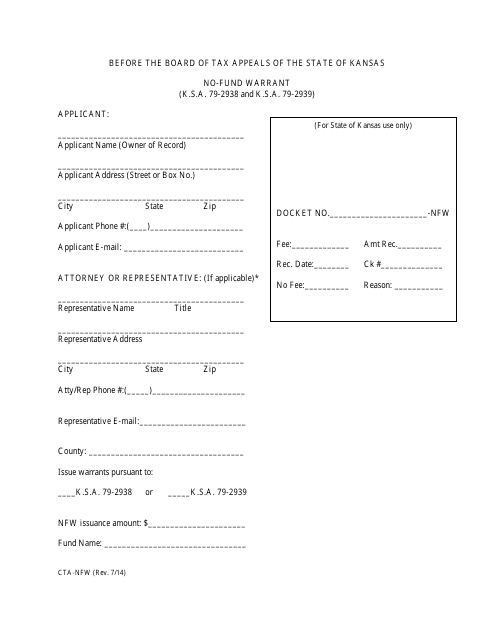

This form is used for applying for a No-Fund Warrant in Kansas.

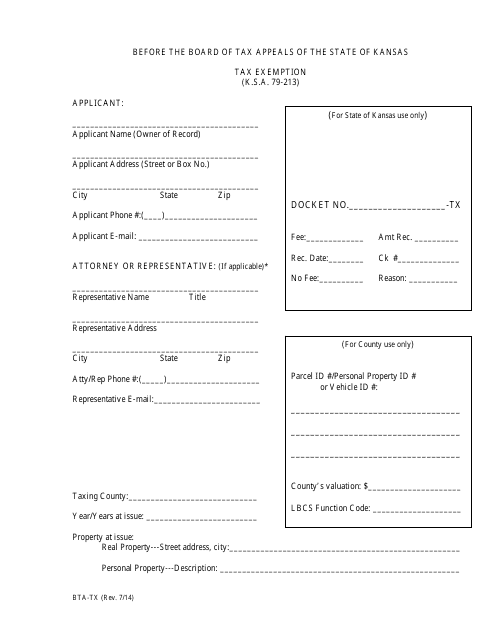

This Form is used for applying for a tax exemption in the state of Kansas.

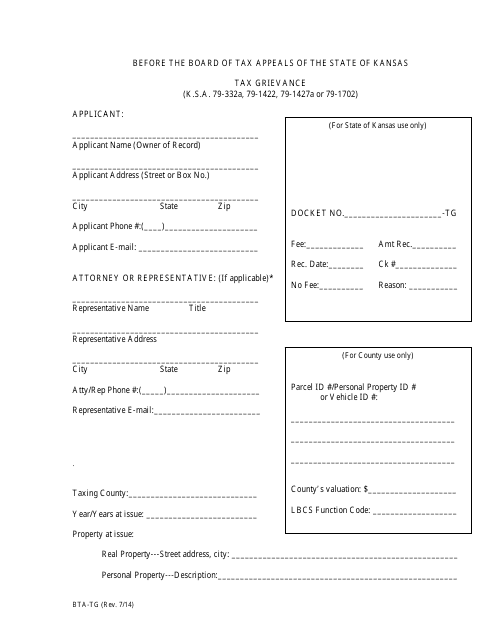

This document is used for filing a tax grievance in the state of Kansas.

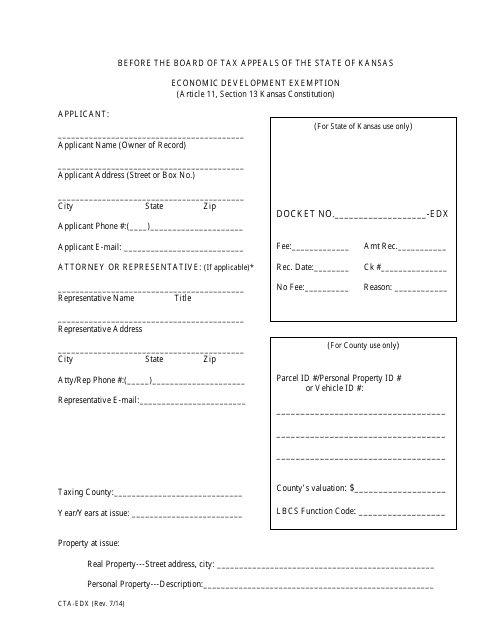

This type of document is used to apply for an economic development exemption in the state of Kansas. It allows businesses to potentially qualify for tax benefits and incentives in order to encourage job creation and investment in the local economy.

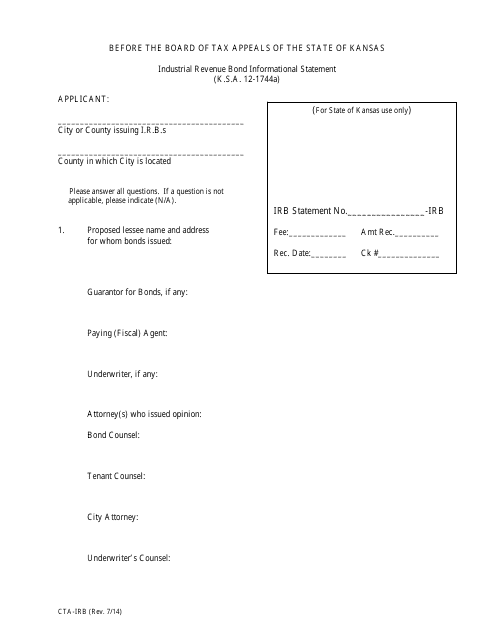

This Form is used in Kansas to provide information about Industrial Revenue Bonds.

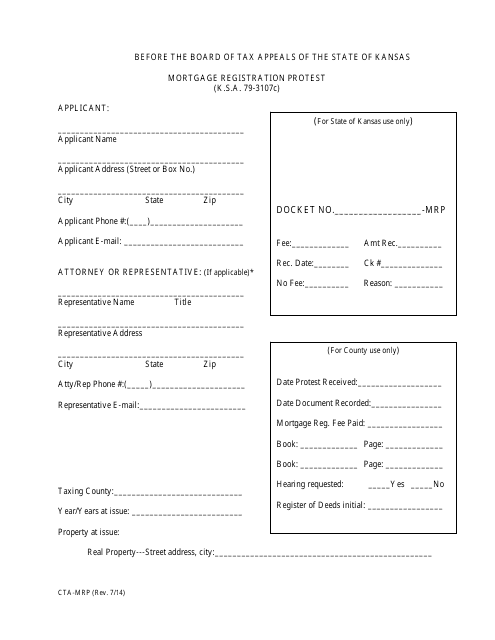

This document is used for registering a protest related to a mortgage in the state of Kansas. It is a way for individuals to challenge or question the legitimacy or legality of a mortgage registration.

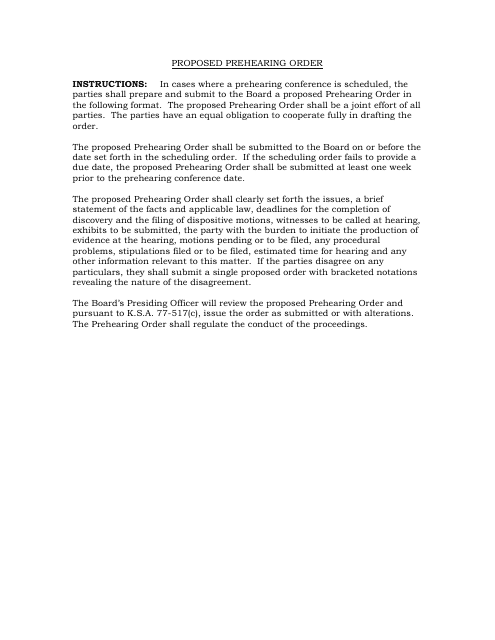

This document is a Prehearing Order used in the state of Kansas. It contains instructions and guidelines for a legal proceeding prior to the hearing.

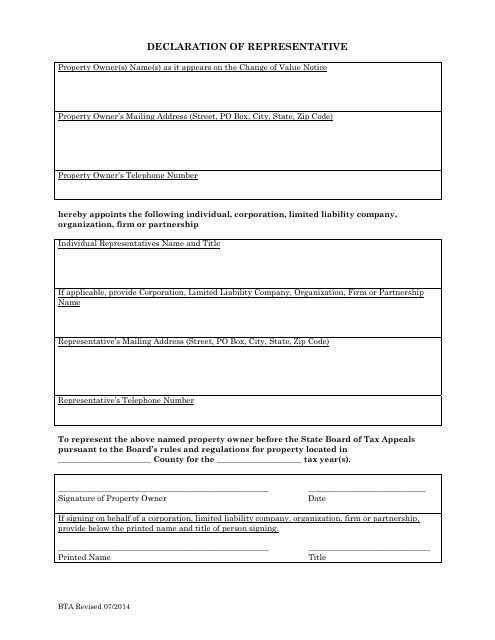

This Form is used for appointing a representative to act on your behalf in tax matters in the state of Kansas. It allows the representative to receive and respond to tax notices, represent you during tax audits, and communicate with the Kansas Department of Revenue.

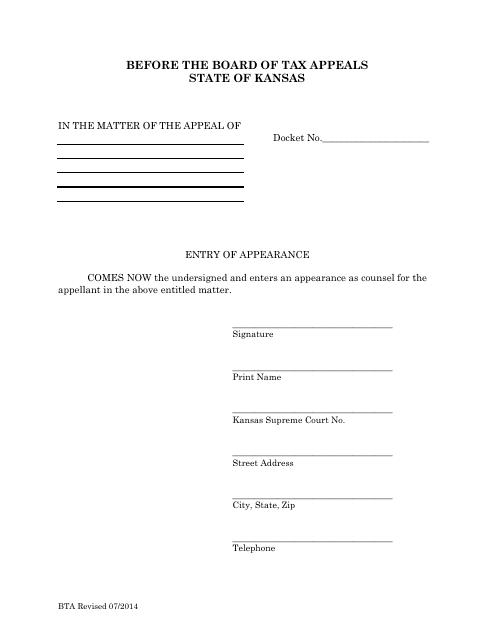

This document is used to notify the court that an attorney will be representing a party in a legal case in Kansas. It serves as a formal record of the attorney's appearance in the case.

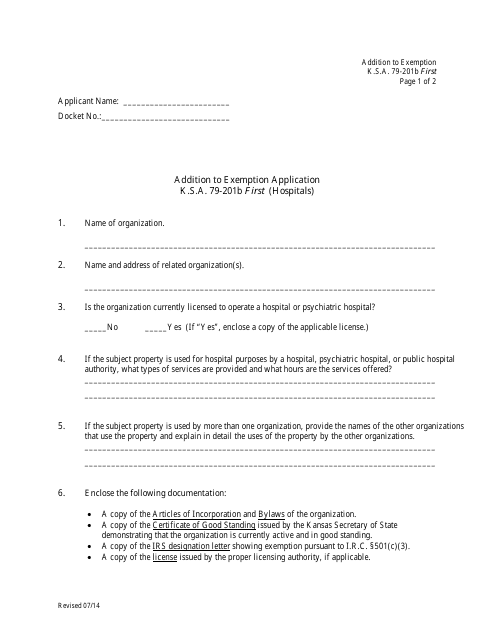

This Form is used for requesting an addition to a tax exemption application for hospitals in the state of Kansas.

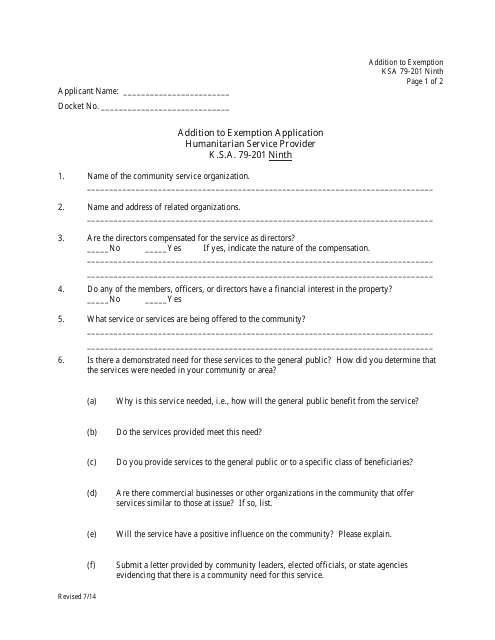

This document is an addition to the exemption application for Humanitarian Service Provider K.s.a. 79-201 Ninth in Kansas. It provides additional information or updates to the original application.

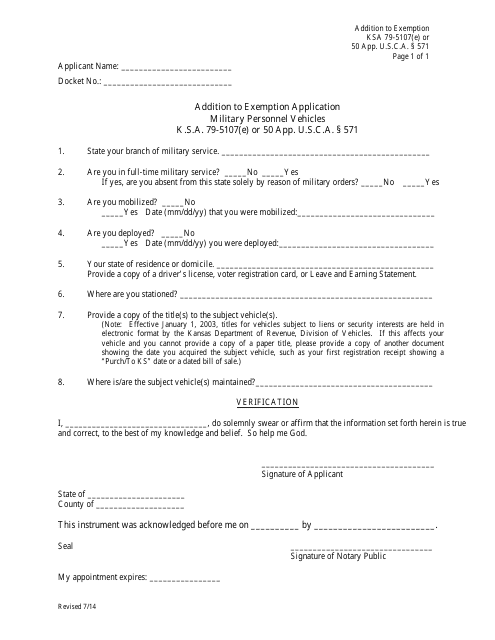

This form is used for requesting an exemption for military personnel vehicles in Kansas.

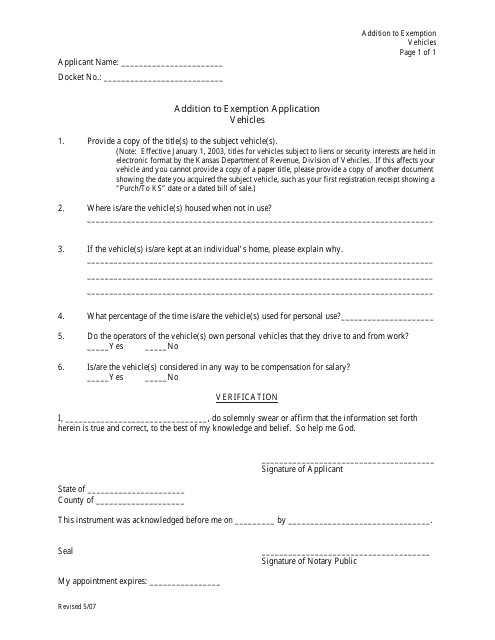

This form is used to add vehicles to an exemption application in the state of Kansas. It allows individuals to update their exemption status for additional vehicles they own.

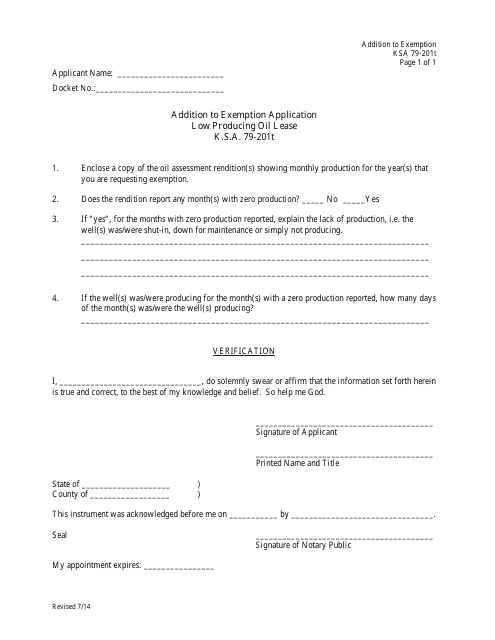

This document is an addition to an exemption application for a low producing oil lease in Kansas. It contains important information related to the exemption application process.

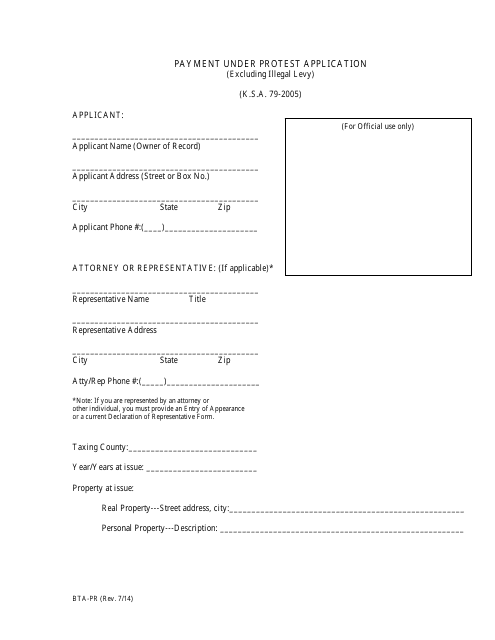

This Form is used for submitting a Payment Under Protest Application in the state of Kansas.

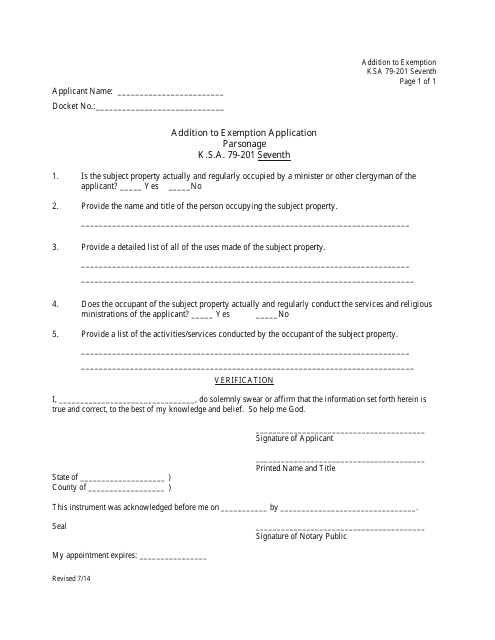

This document is an addition to the exemption application for parsonage in the state of Kansas. It is used to provide additional information or updates to an existing application.

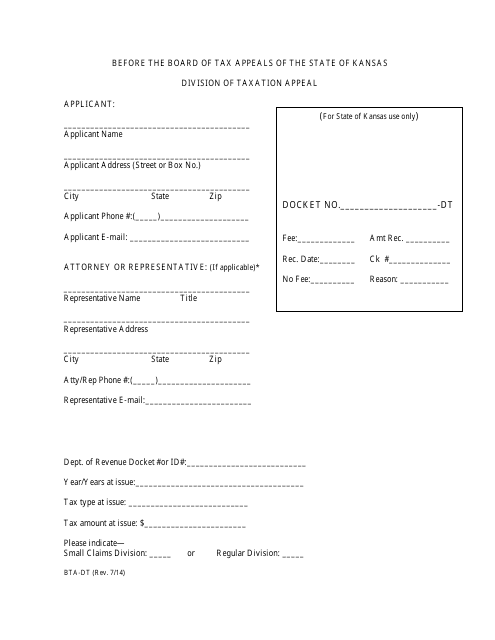

This form is used for filing an appeal with the Division of Taxation in Kansas.

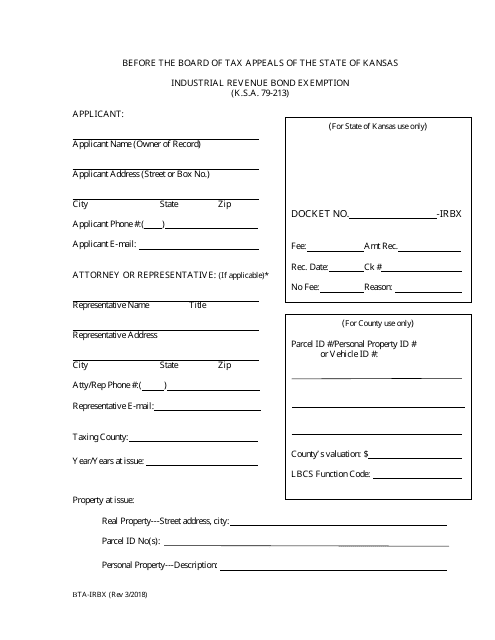

This form is used for applying for an exemption from industrial revenue bond taxes in the state of Kansas.

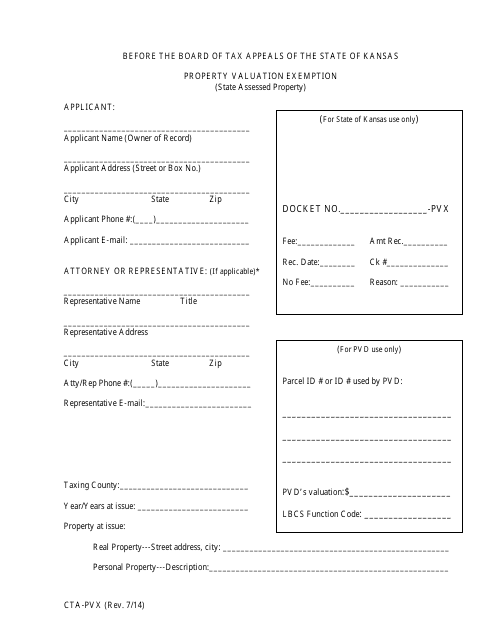

This form is used for applying for a property valuation exemption in Kansas. It is known as the CTA-PVX Form.

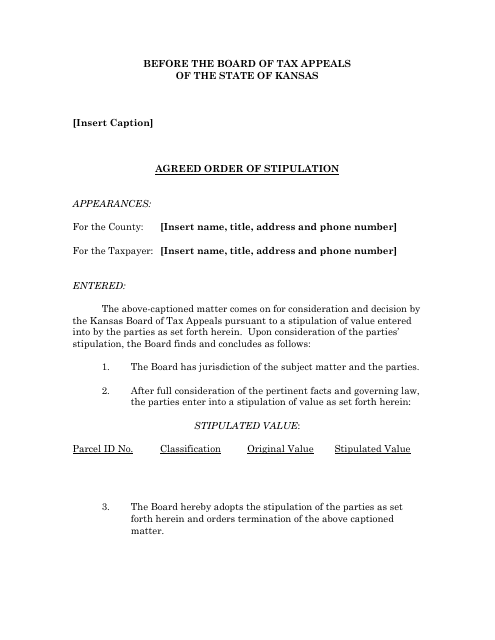

This document is used for reaching a mutual agreement between parties involved in a legal case in Kansas without going to trial.

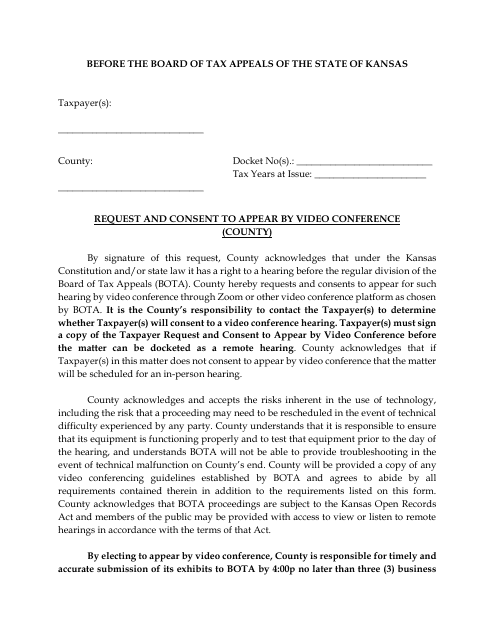

This document is used for requesting and giving consent to appear in court proceedings by video conference in Kansas county.

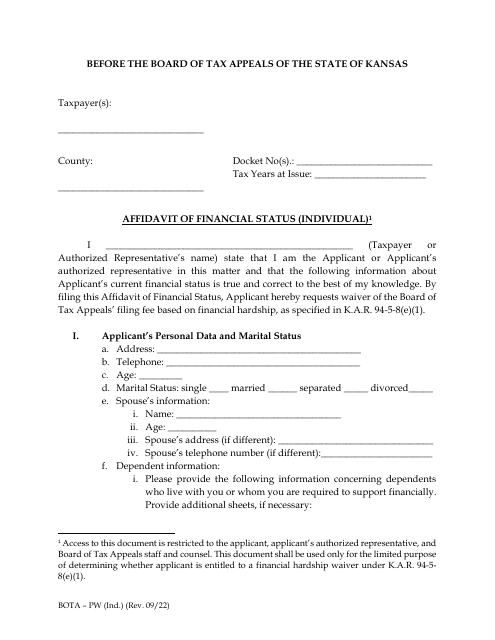

This Form is used for individuals in Kansas to provide an affidavit of their financial status. It is used to provide information on income, expenses, and assets for various legal proceedings or applications.

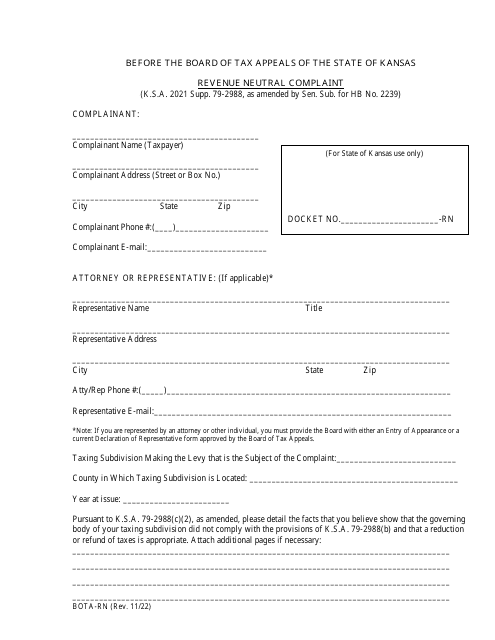

This form is used for filing a revenue neutral complaint in the state of Kansas. It is called Form BOTA-RN.

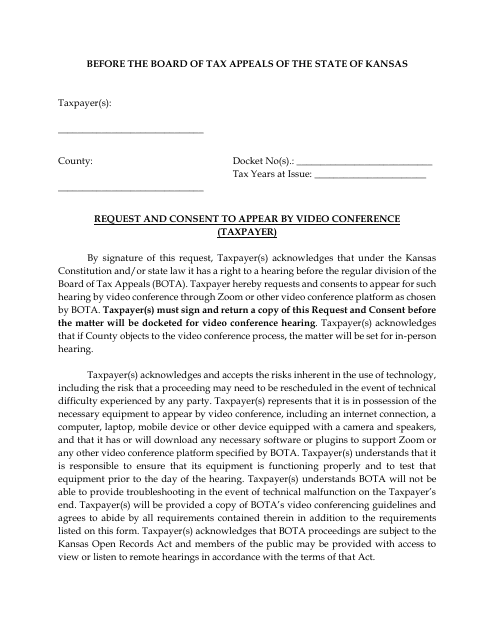

This document is used for taxpayers in Kansas to request and provide consent to appear for a meeting or hearing through video conference instead of appearing in person.

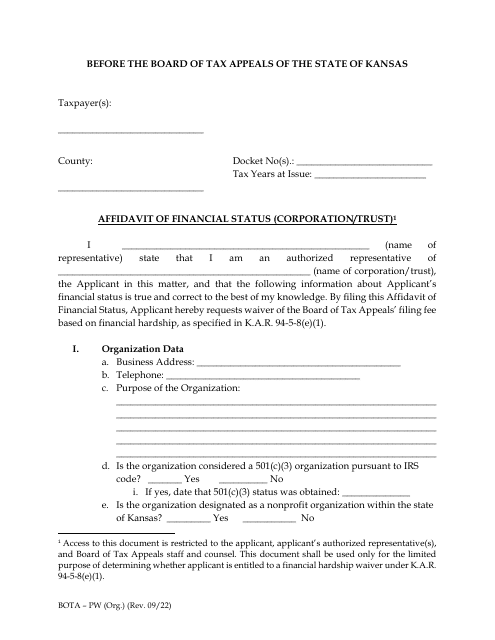

This document is used for corporations or trusts in Kansas to provide a sworn statement of their financial status.