North Dakota Office of State Tax Commissioner Forms

Documents:

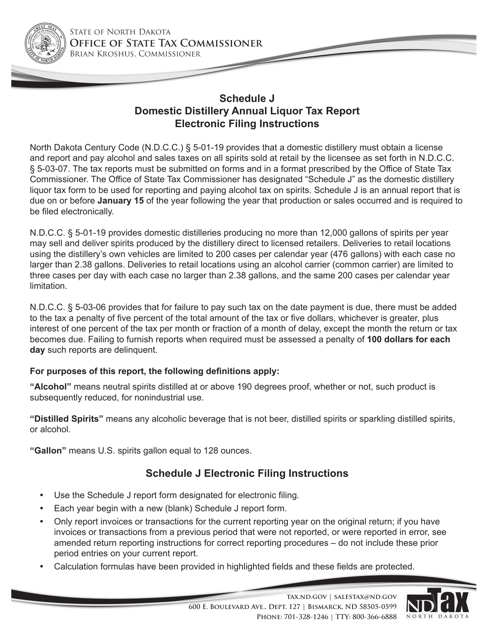

449

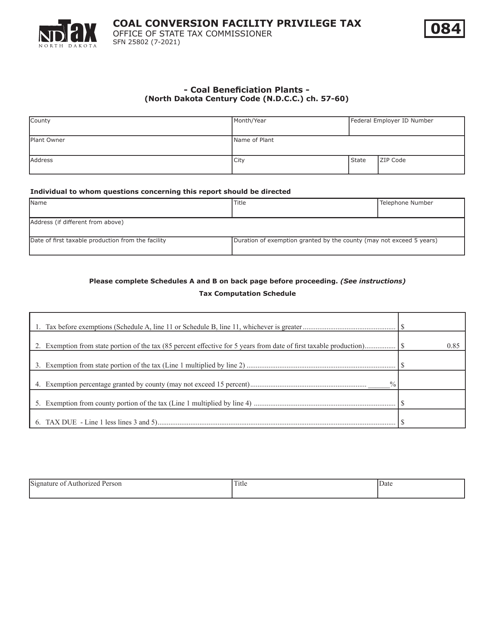

This form is used for the Coal Conversion Facility Privilege Tax specifically for Coal Beneficiation Plants in North Dakota.

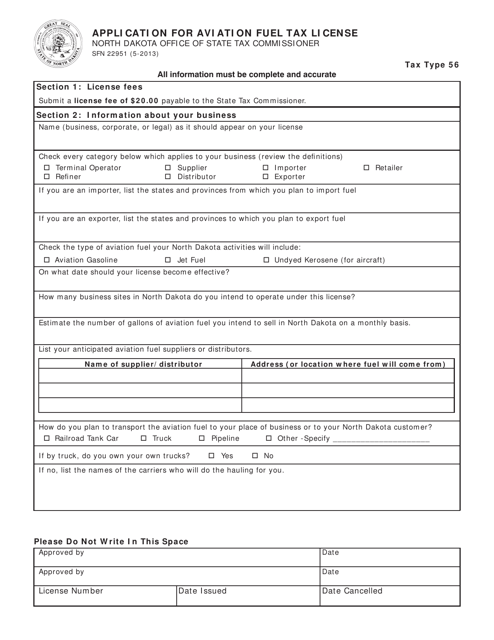

This Form is used for applying for an aviation fuel tax license in North Dakota.

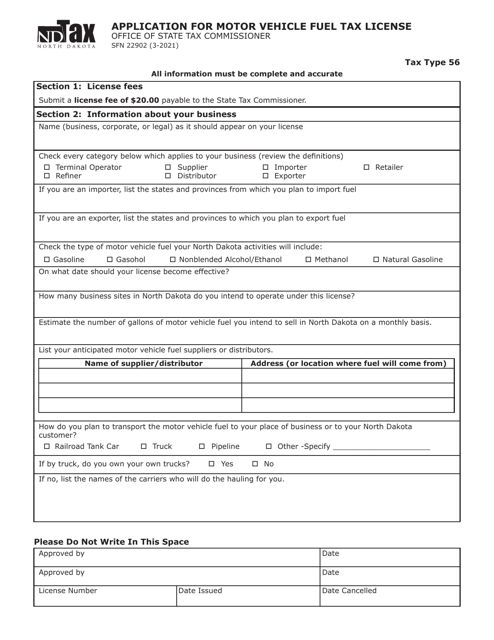

This form is used for applying for a motor vehicle fuel tax license in North Dakota. It is necessary for individuals or businesses that deal with motor vehicle fuel and need to be licensed to operate in the state.

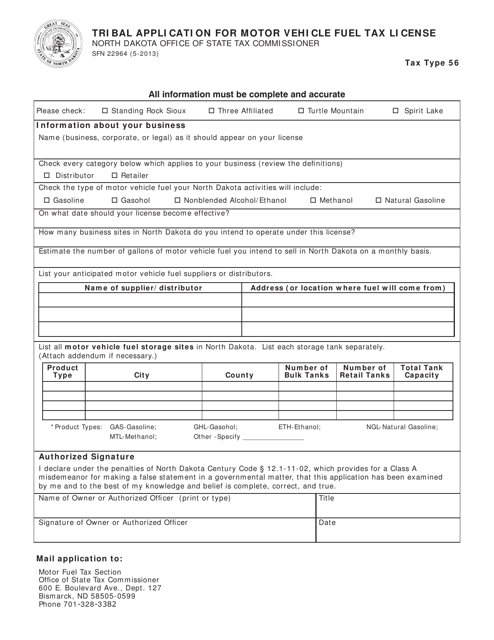

This form is used for applying for a motor vehicle fuel tax license in North Dakota specifically for tribal entities.

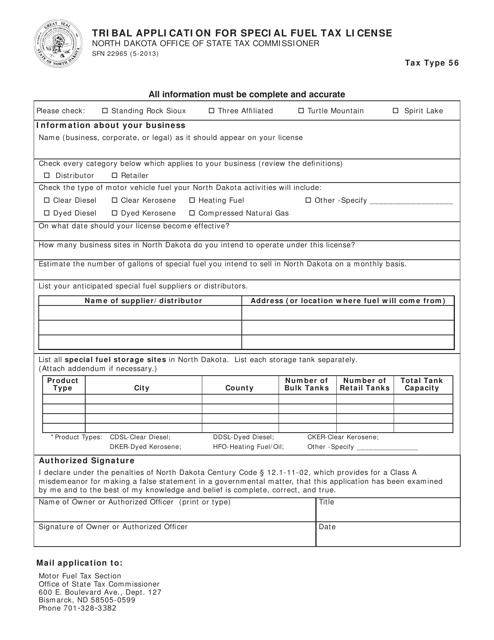

This form is used for applying for a special fuel tax license in North Dakota for tribal entities.

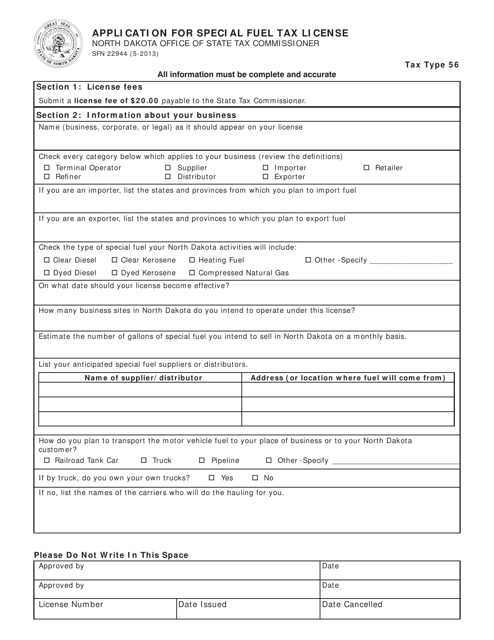

This form is used for applying for a special fuel tax license in North Dakota.

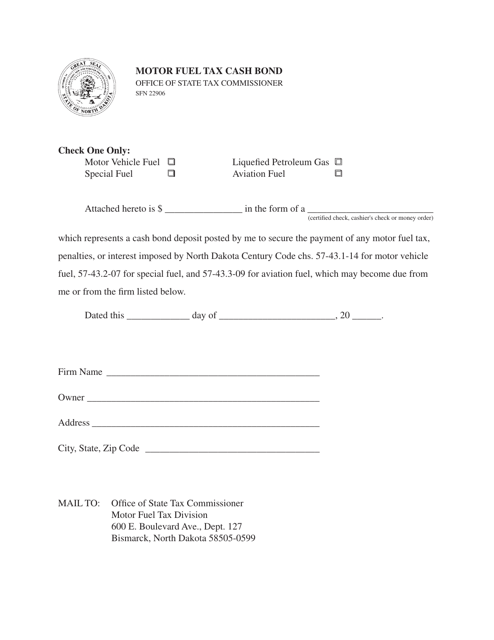

This form is used for submitting a cash bond for motor fuel tax in North Dakota. It is required for businesses in the state that need to post a bond as a guarantee for paying their motor fuel tax obligations.

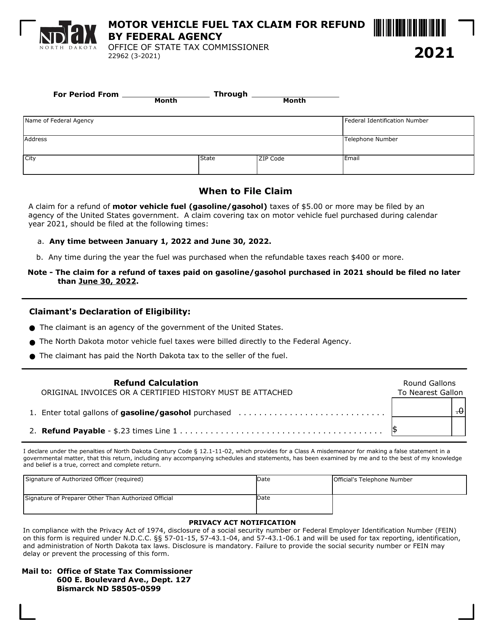

This form is used for federal agencies in North Dakota to claim a refund for motor vehicle fuel tax paid.

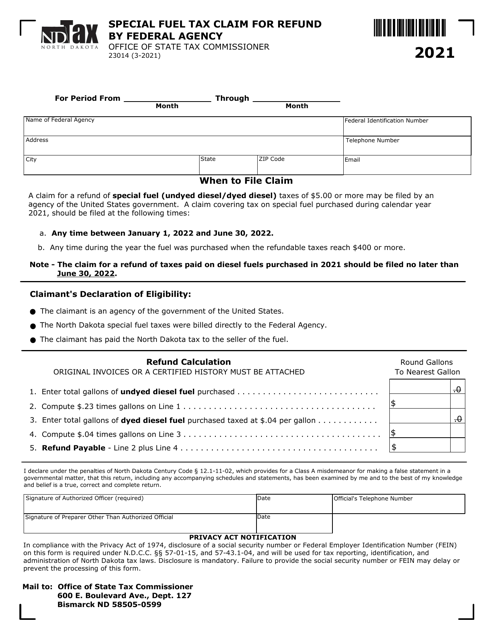

This Form is used for federal agencies in North Dakota to claim a refund for special fuel taxes paid.

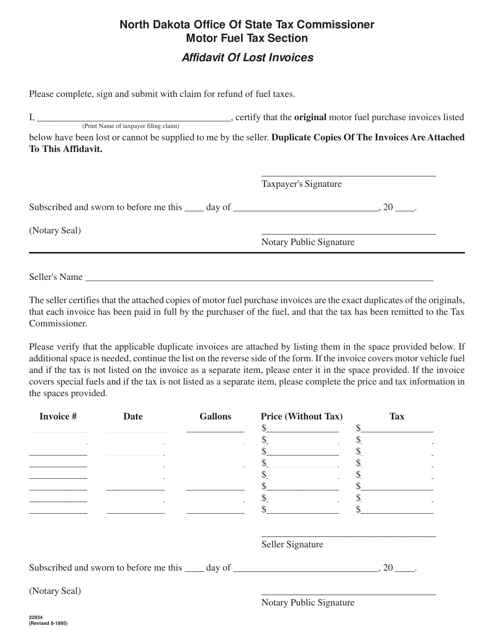

This form is used for reporting lost invoices in North Dakota. It allows individuals to provide an affidavit stating the loss of invoices and provides a legal document for documentation purposes.

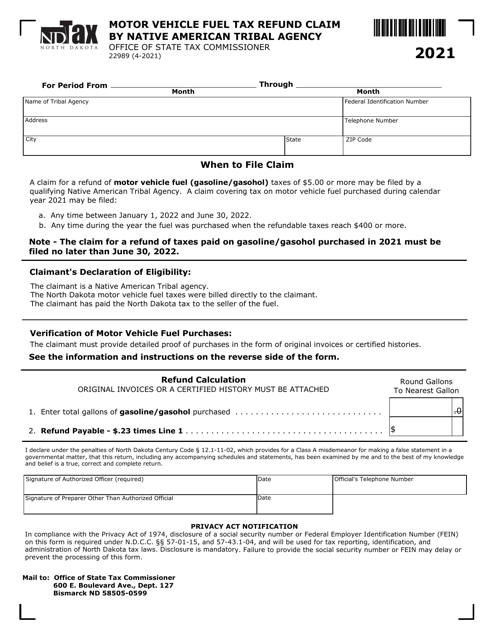

This Form is used for Native American Tribal Agencies in North Dakota to claim a refund for the Motor Vehicle Fuel Tax.

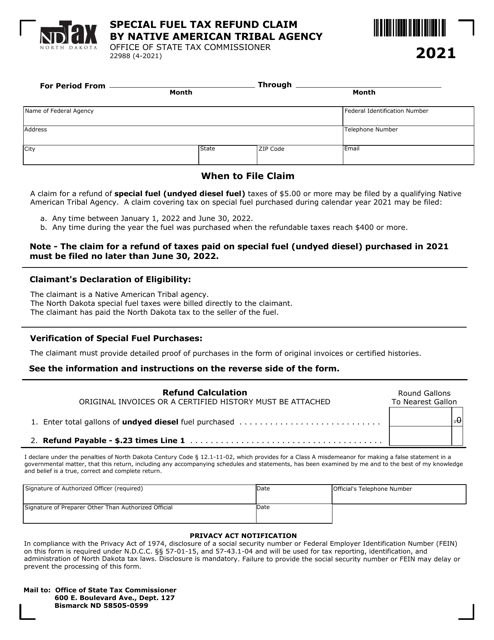

This form is used by Native American tribal agencies in North Dakota to claim a refund on special fuel taxes.

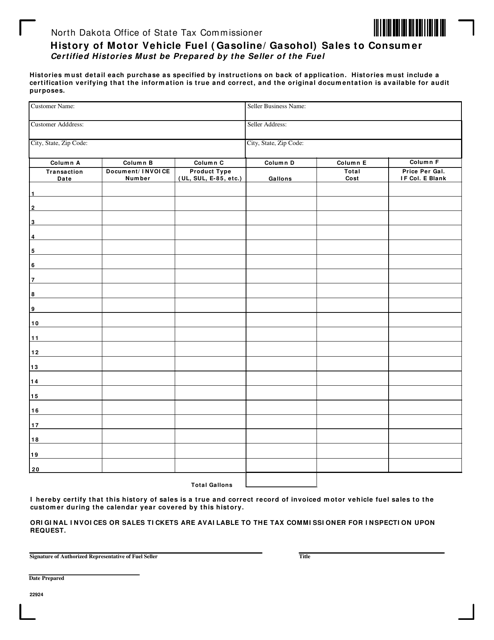

This document provides a history of motor vehicle fuel sales to consumers in North Dakota, specifically focusing on gasoline and gasohol.

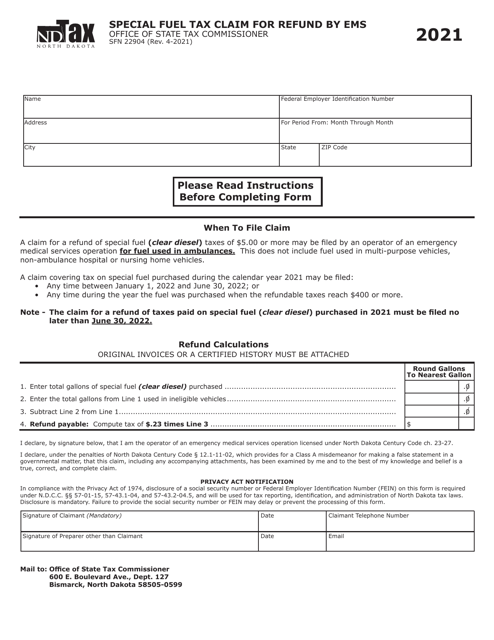

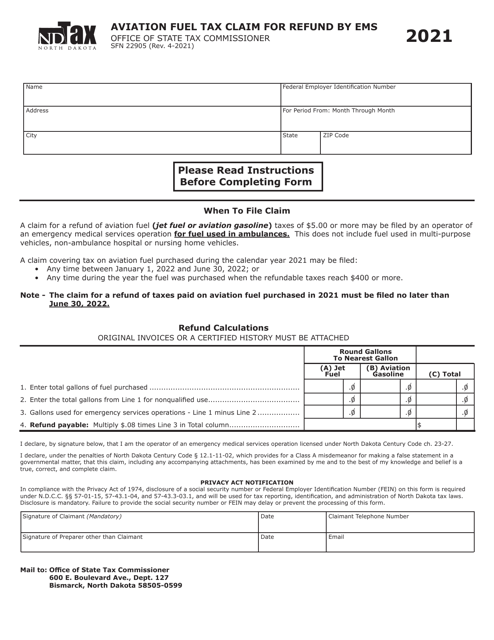

This form is used for claiming a refund of special fuel tax paid by EMS (Emergency Medical Services) in North Dakota.

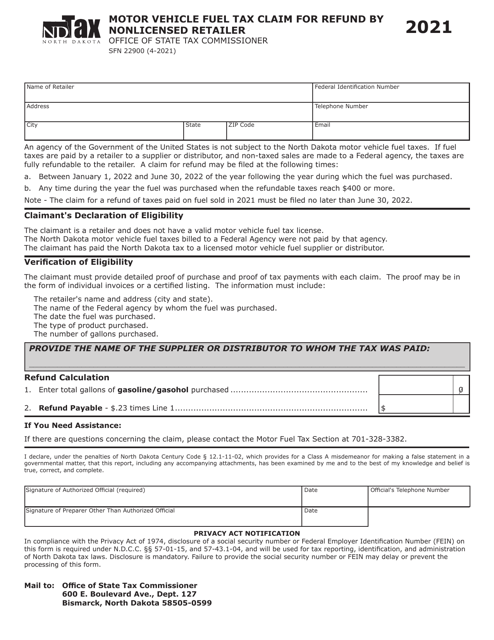

This form is used for nonlicensed retailers in North Dakota to claim a refund of motor vehicle fuel tax.

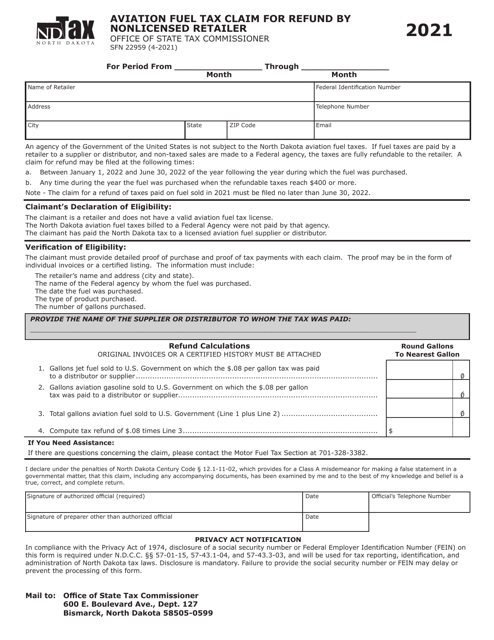

This form is used for nonlicensed retailers in North Dakota to claim a refund for aviation fuel tax paid.

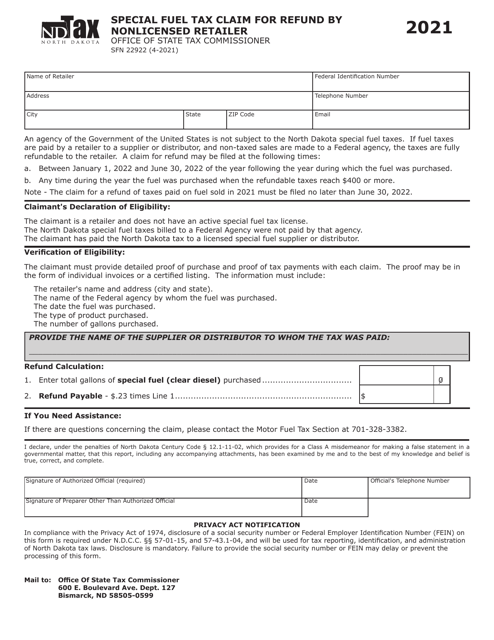

This form is used for nonlicensed retailers in North Dakota to claim a refund for special fuel taxes paid.

This form is used for claiming a refund on aviation fuel tax paid by an Emergency Medical Service (EMS) in North Dakota.

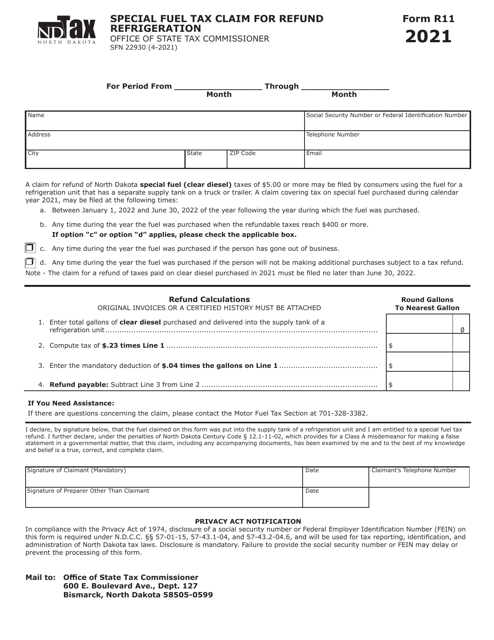

This form is used for claiming a refund on special fuel tax paid for refrigeration purposes in North Dakota.

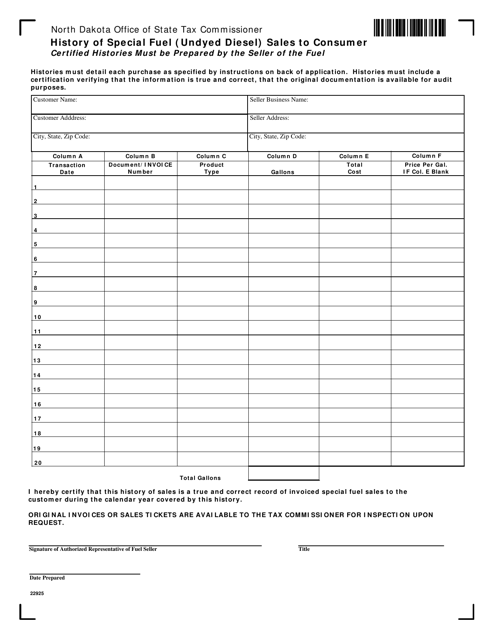

This Form is used for documenting the history of sales of undyed diesel fuel to consumers in North Dakota.

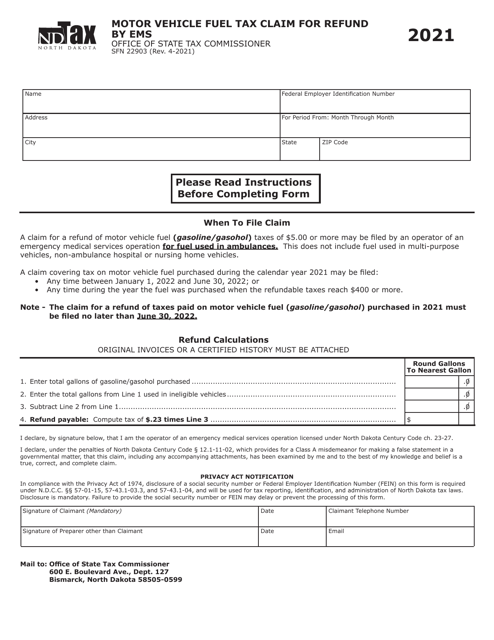

This Form is used for claiming a refund of motor vehicle fuel tax by EMS (Emergency Medical Services) in the state of North Dakota.

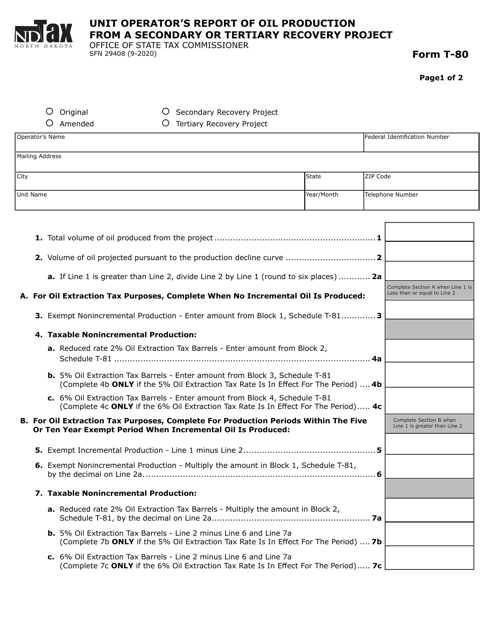

This form is used for reporting the oil production from a secondary or tertiary recovery project in North Dakota.

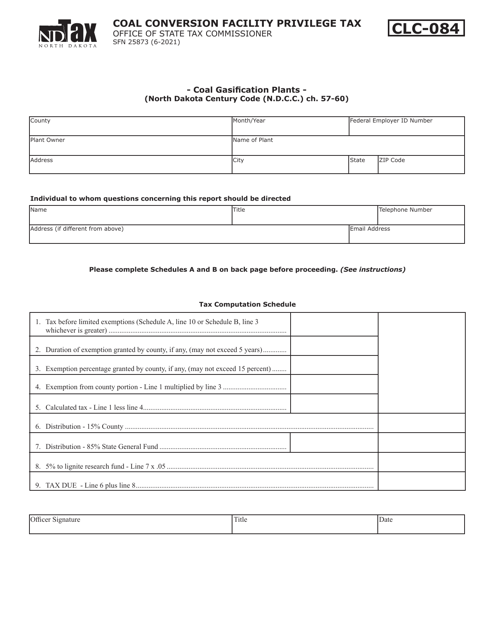

This form is used for reporting and paying the privilege tax for coal gasification plants in North Dakota.

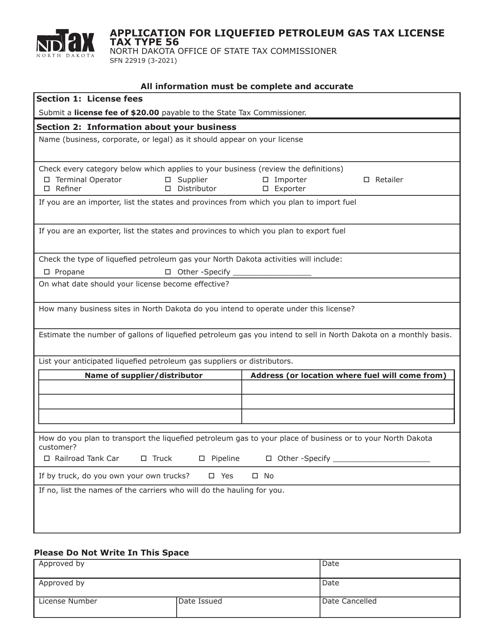

This form is used for applying for a tax license for the sale of Liquefied Petroleum Gas in North Dakota.

This document is for suppliers in North Dakota who need to report their monthly liquor sales to wholesalers. It provides instructions on how to fill out Schedule A of the report.

This document is used for reporting monthly liquor sales by wholesalers in North Dakota. It provides instructions on how to complete Schedule B, which includes details such as sales volume, product types, and prices.

This document is used for reporting monthly beer sales to wholesalers in North Dakota. It provides instructions on how to complete Schedule C for suppliers.

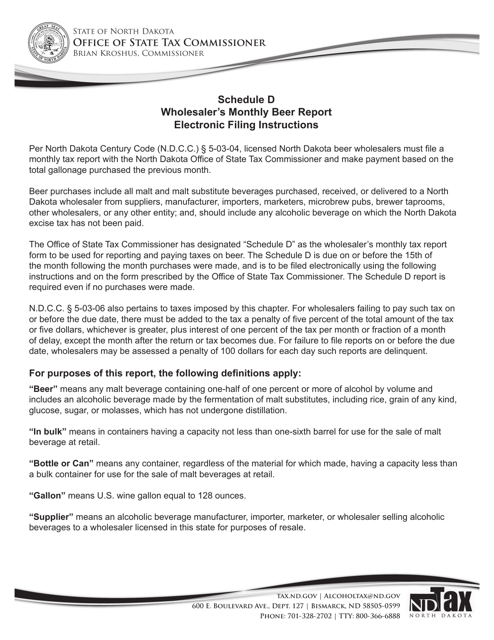

This document provides instructions for preparing the Schedule D Monthly Wholesaler Beer Report in North Dakota. It is used by wholesalers to report their monthly beer sales.

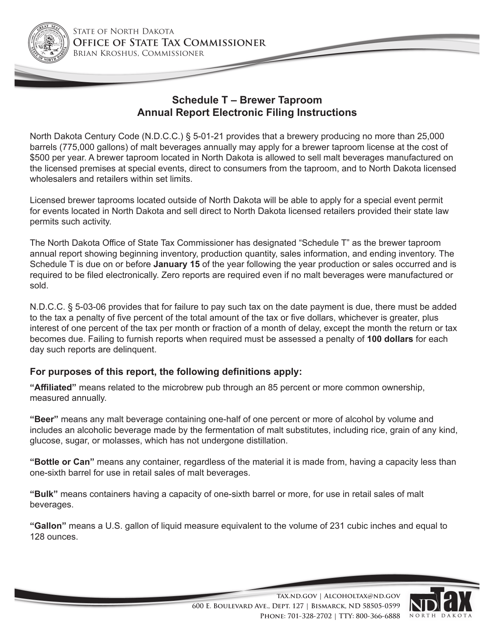

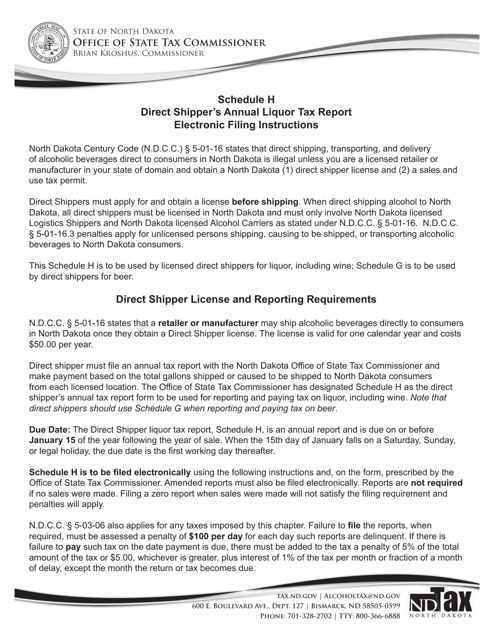

This document provides instructions for completing the Schedule H Direct Shipper's Annual Beer Tax Report in North Dakota. It guides individuals and businesses on reporting and paying their annual beer taxes when shipping beer directly to consumers in the state.