North Dakota Office of State Tax Commissioner Forms

Documents:

449

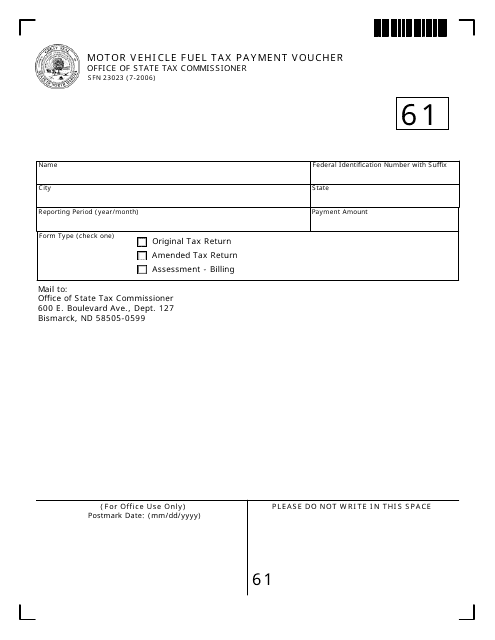

This form is used for submitting motor vehicle fuel tax payments in North Dakota.

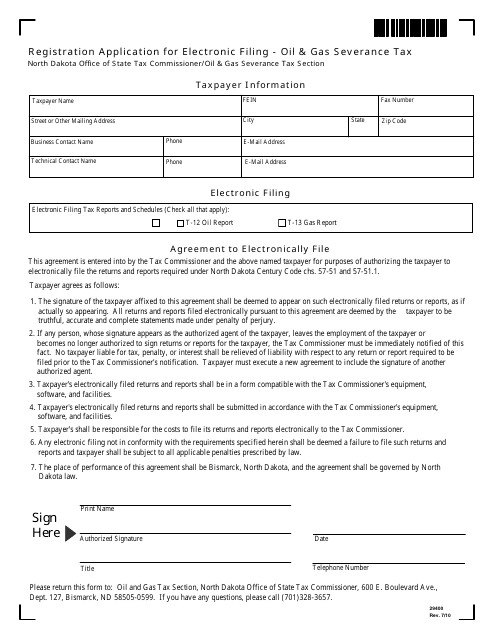

This Form is used for registering electronic filing of oil & gas severance tax in North Dakota.

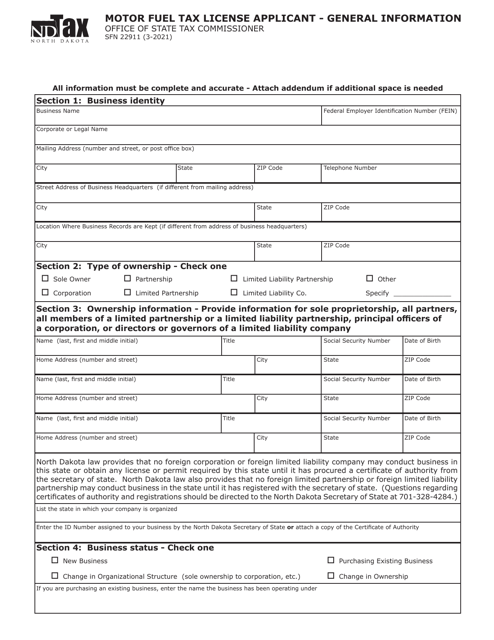

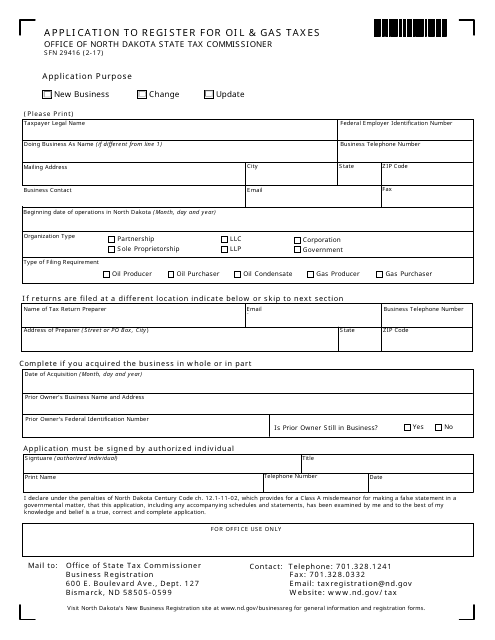

This form is used for registering for oil and gas taxes in North Dakota.

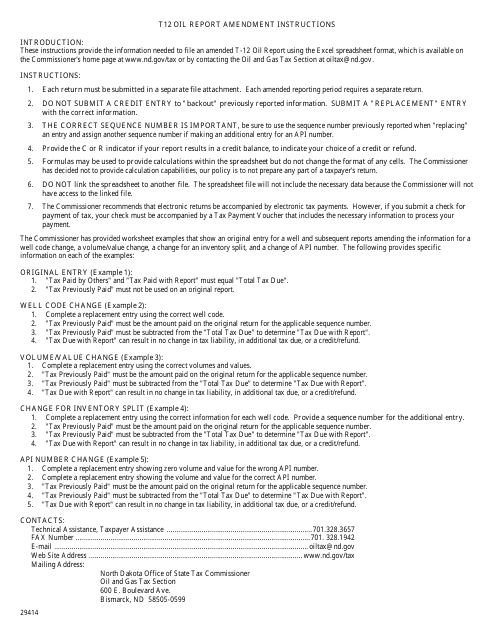

This Form is used for reporting amendments to oil reports in North Dakota. It provides instructions on how to correctly fill out and submit the Form T12 Oil Report Amendment.

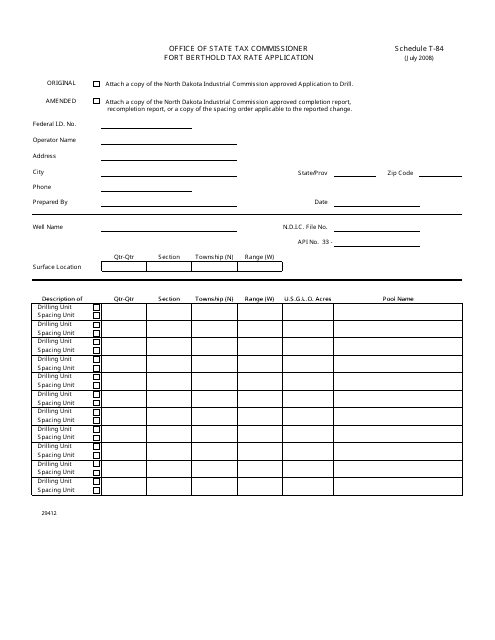

This document is used to apply for tax rates in Fort Berthold, North Dakota for Schedule T-84.

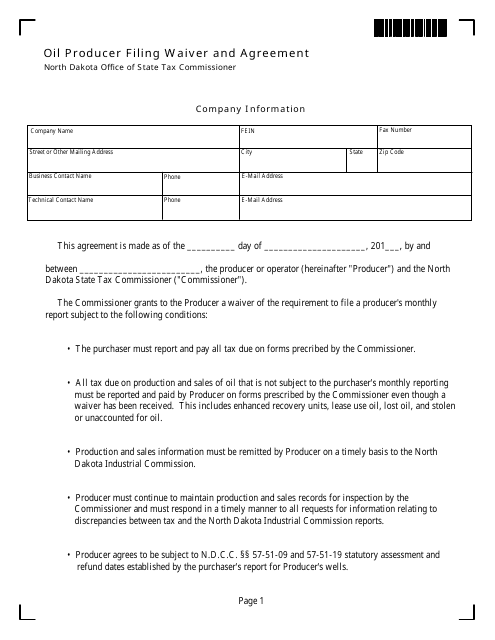

This Form is used for oil producers in North Dakota to file a waiver and agreement.

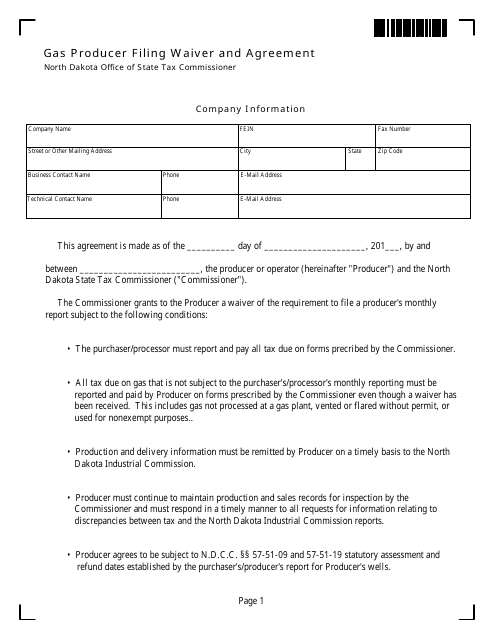

This Form is used for gas producers in North Dakota to file a waiver and agreement.

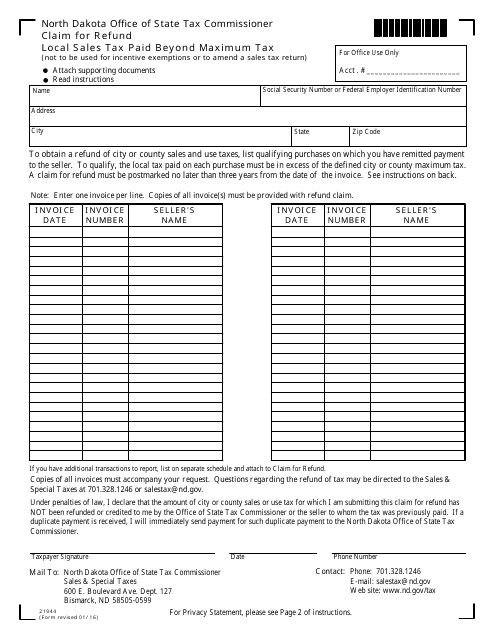

This Form is used for claiming a refund on local sales tax paid beyond the maximum tax amount in North Dakota.

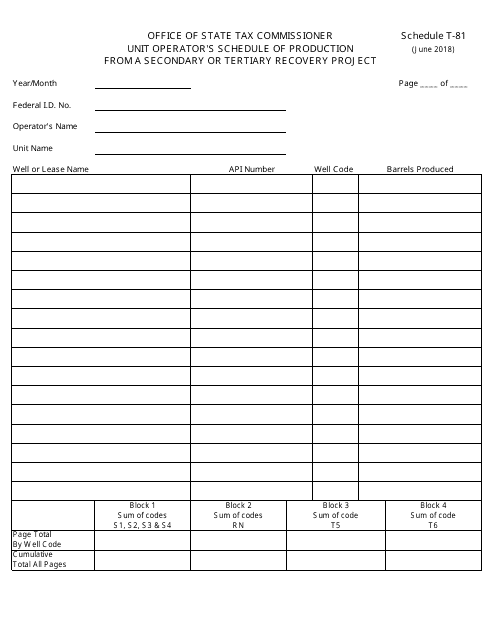

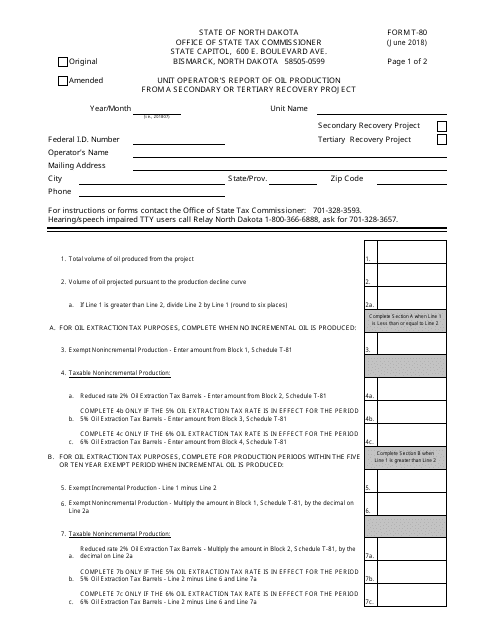

This form is used for reporting the production from a secondary or tertiary recovery project in North Dakota. It is specifically designed for unit operators to submit their schedule of production.

This document provides instructions for reporting oil and gas taxes specifically for the Fort Berthold Reservation in North Dakota. It guides individuals or businesses on how to properly report and pay taxes related to oil and gas operations on the reservation.

This document provides instructions on how to file and pay oil and gas taxes in North Dakota. It includes information on reporting requirements, deadlines, and payment methods.

This form is used for reporting oil production from secondary or tertiary recovery projects in North Dakota.

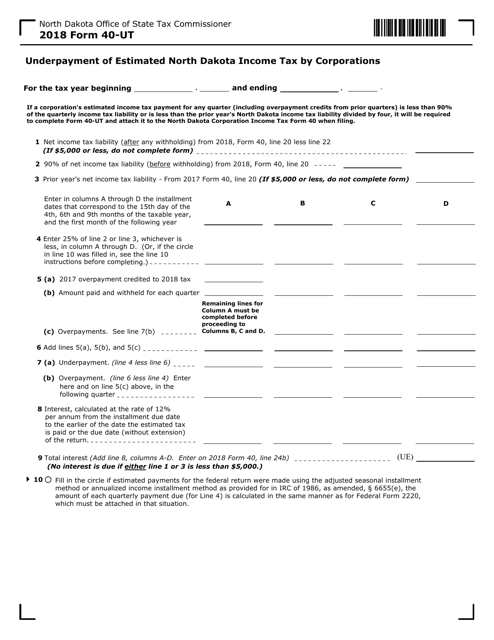

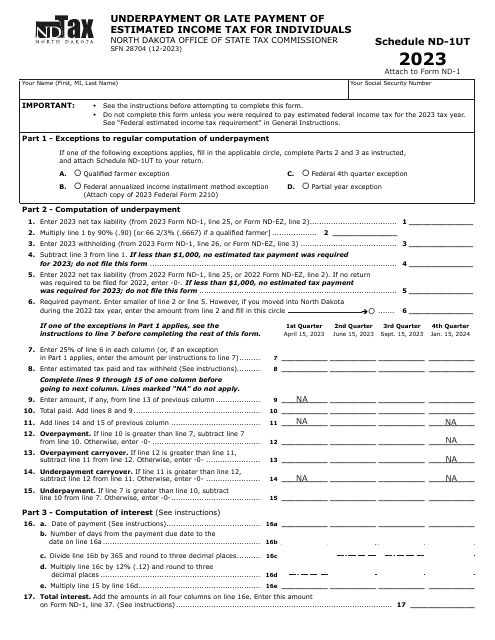

This form is used for corporations in North Dakota to report underpayment of estimated income tax.

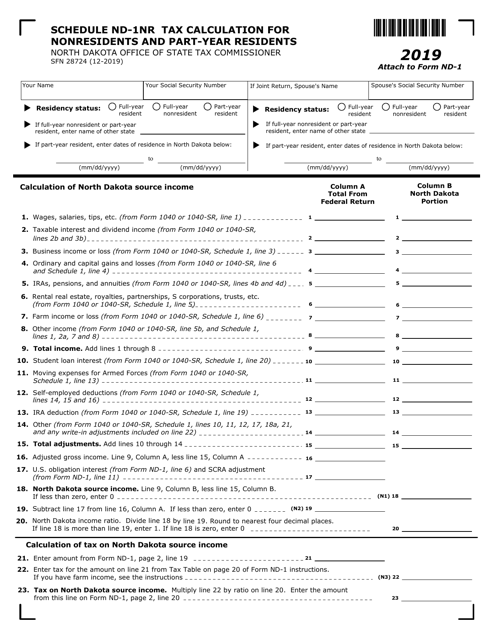

This form is used for calculating taxes for nonresidents and part-year residents in North Dakota.

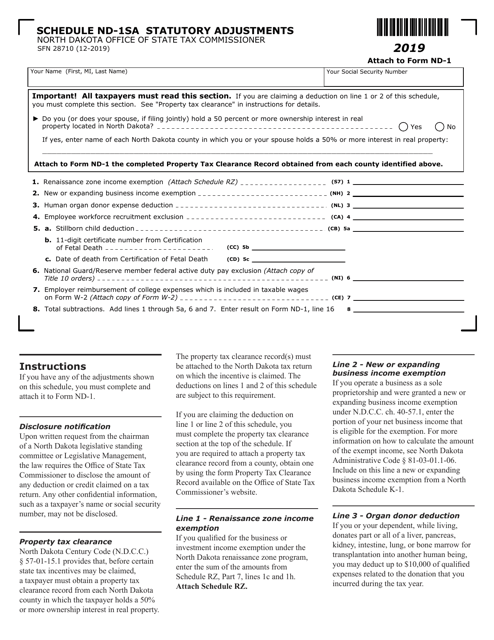

This document is used for reporting statutory adjustments on your North Dakota state tax return. It is an additional schedule that accompanies Form ND-1.

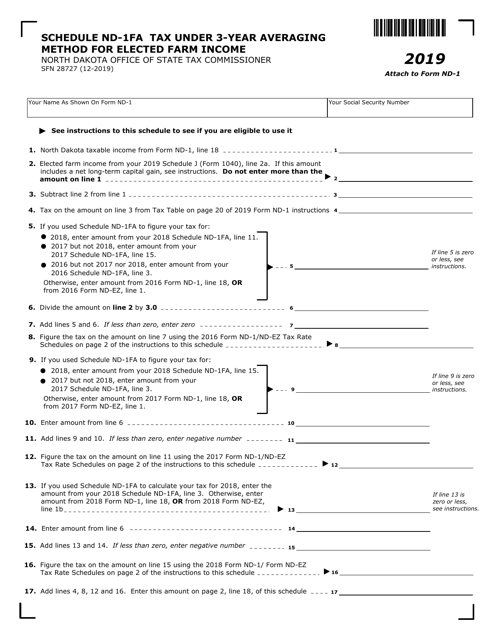

This form is used for calculating farm income using a 3-year averaging method in North Dakota.

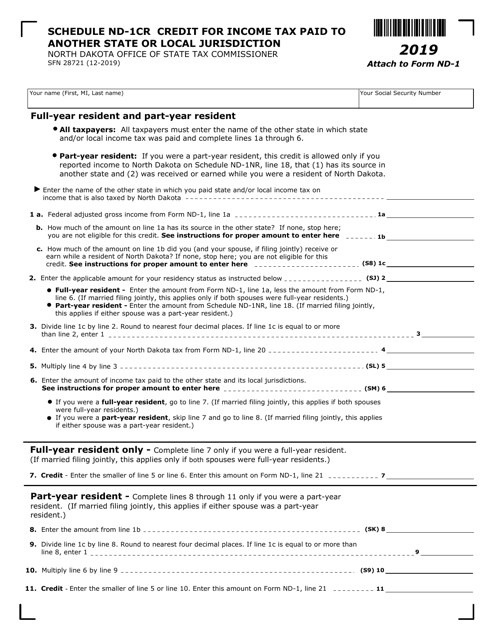

This Form is used for residents of North Dakota to claim a credit for income taxes paid to another state.

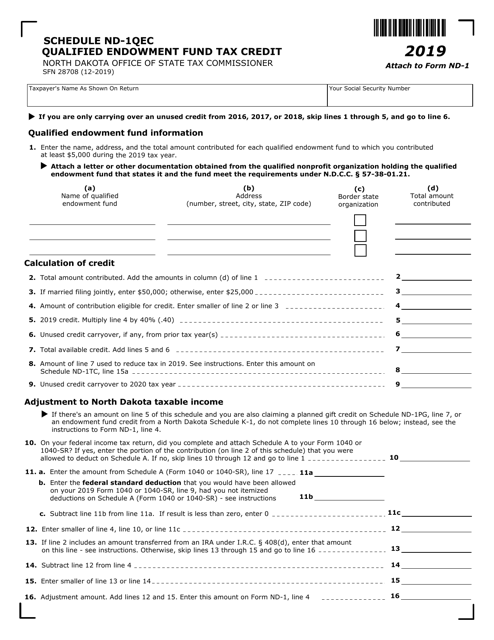

This form is used for claiming the qualified endowment fund tax credit in North Dakota.

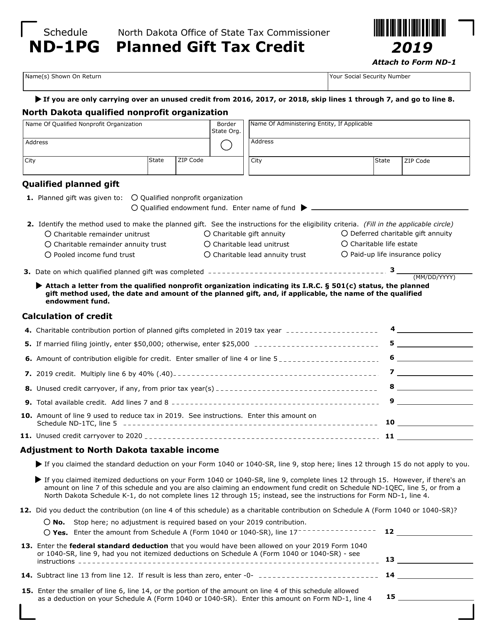

This form is used for claiming a tax credit for planned gifts in North Dakota.

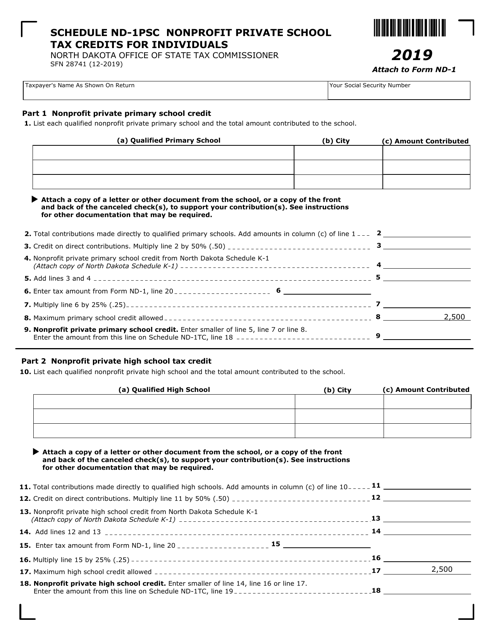

This form is used for claiming nonprofit private school tax credits for individuals in North Dakota.

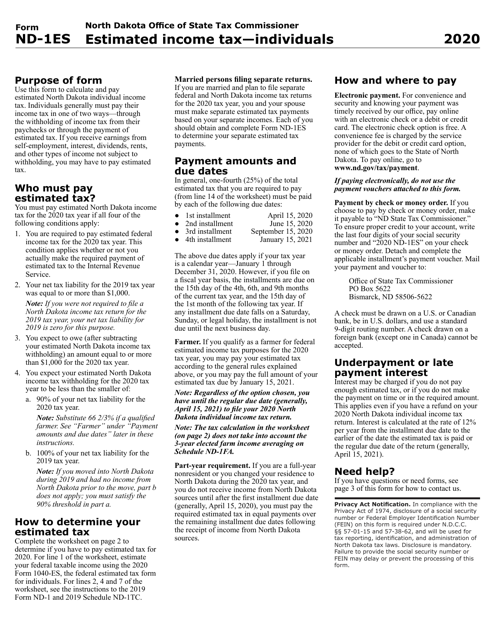

This Form is used for individuals in North Dakota to calculate and pay their estimated state income taxes.

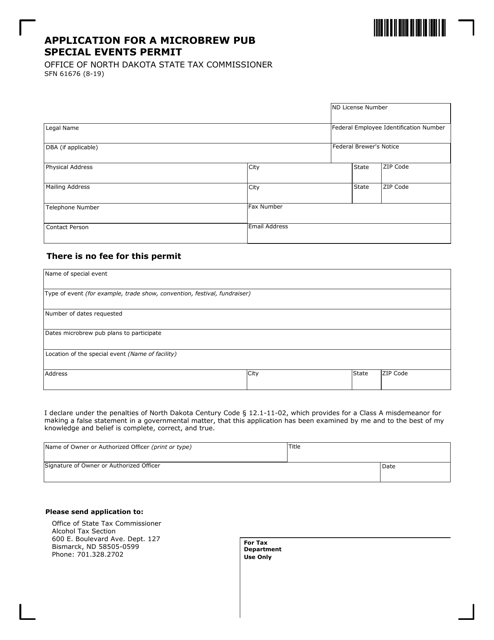

This form is used for applying for a special events permit for a microbrew pub in North Dakota.