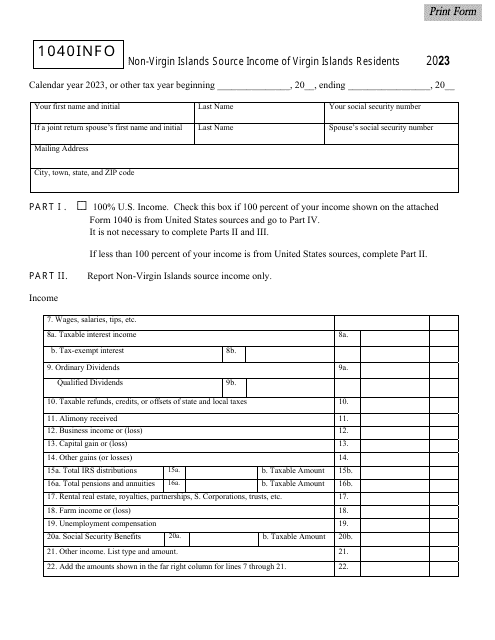

Virgin Islands Bureau of Internal Revenue Forms

The Virgin Islands Bureau of Internal Revenue is responsible for administering and enforcing tax laws in the United States Virgin Islands. Its main purpose is to collect taxes, including income tax and business taxes, from individuals and businesses operating within the jurisdiction of the US Virgin Islands. The bureau ensures compliance with tax regulations, processes tax returns, and manages tax-related inquiries and disputes. Its role is similar to that of the Internal Revenue Service (IRS) in the United States.

Documents:

27

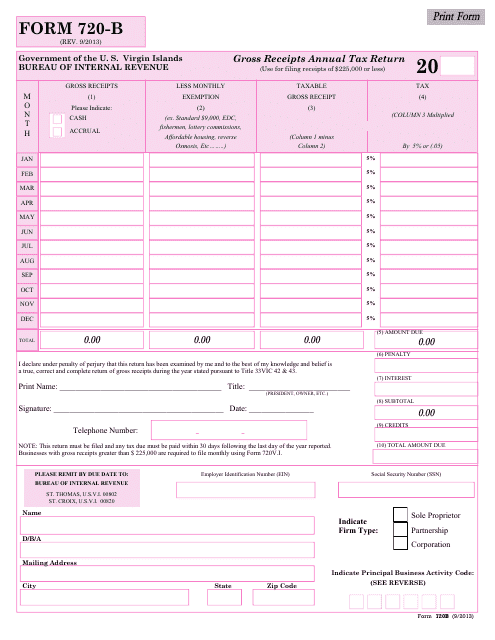

This Form is used for filing the Gross Receipts Annual Tax Return specifically for businesses operating in the Virgin Islands.

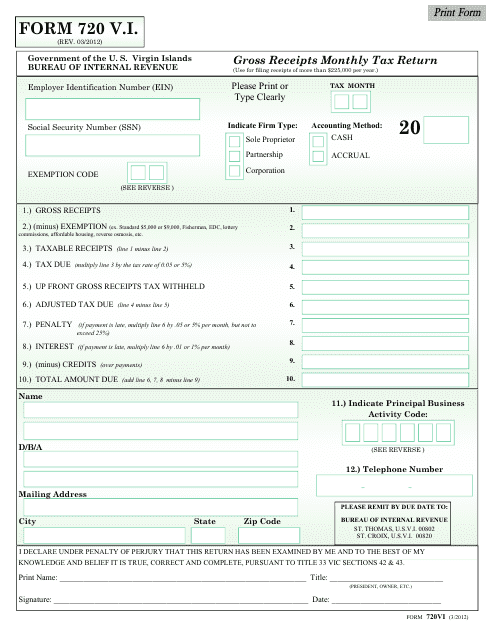

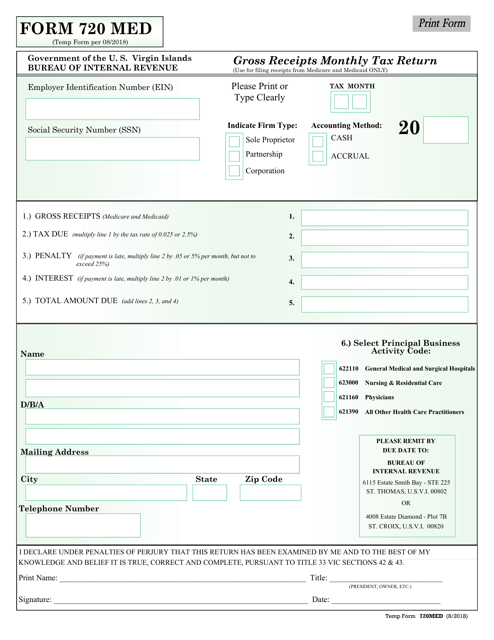

This form is used for reporting monthly gross receipts tax in the US Virgin Islands.

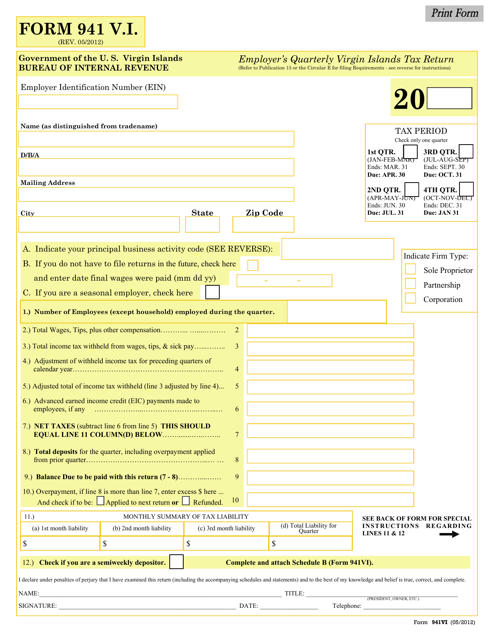

This form is used for employers in the Virgin Islands to report their quarterly taxes.

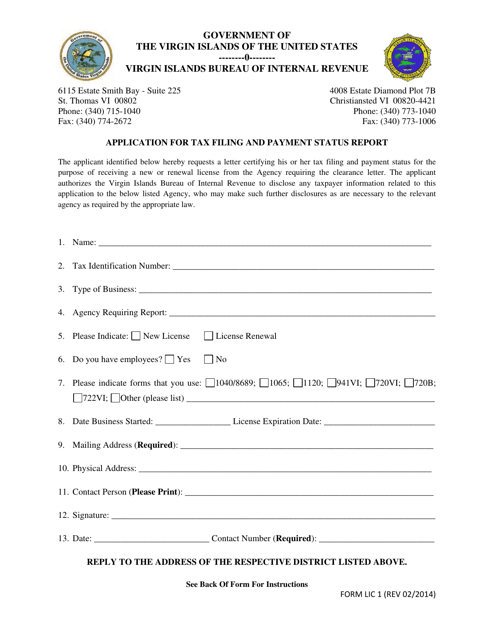

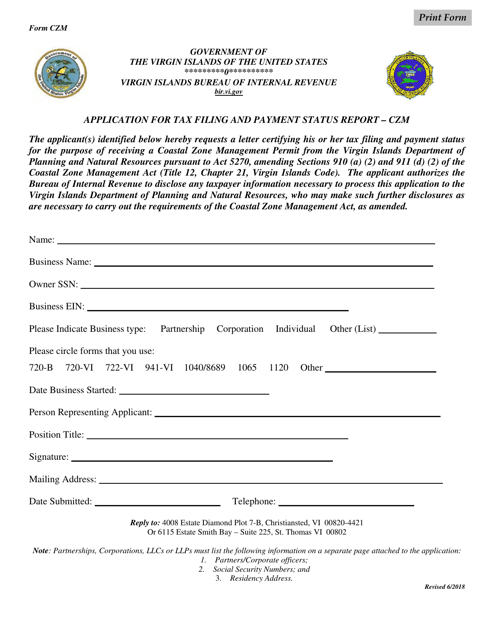

This form is used for applying for tax filing and payment status report in the Virgin Islands. It helps individuals and businesses to track their tax filing and payment history.

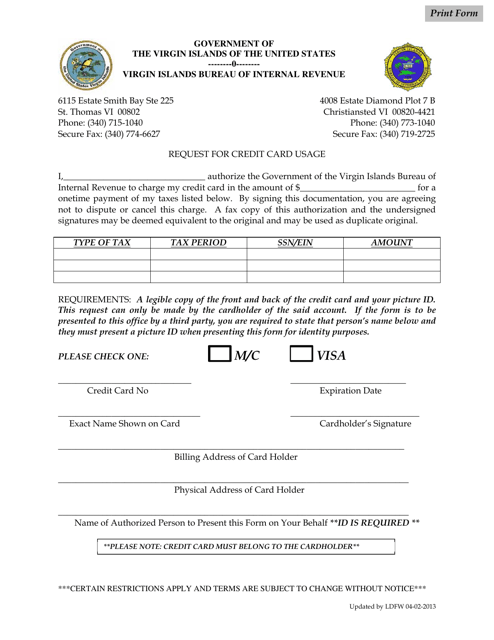

This document is a request form for credit card usage in the Virgin Islands. It is used to authorize the use of a credit card for transactions in this area.

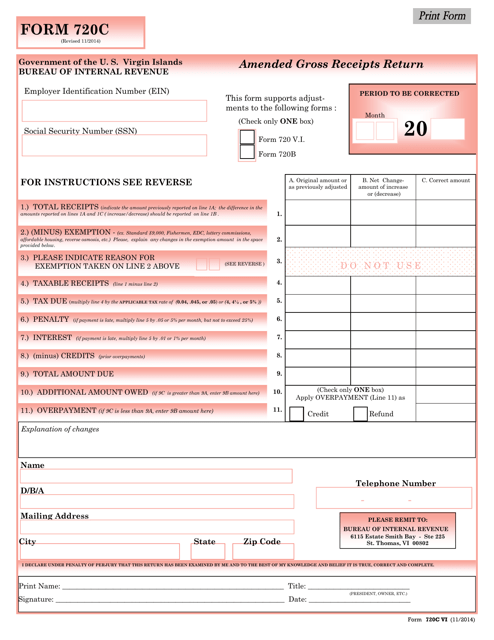

This Form is used for filing an amended gross receipts return for businesses operating in the Virgin Islands.

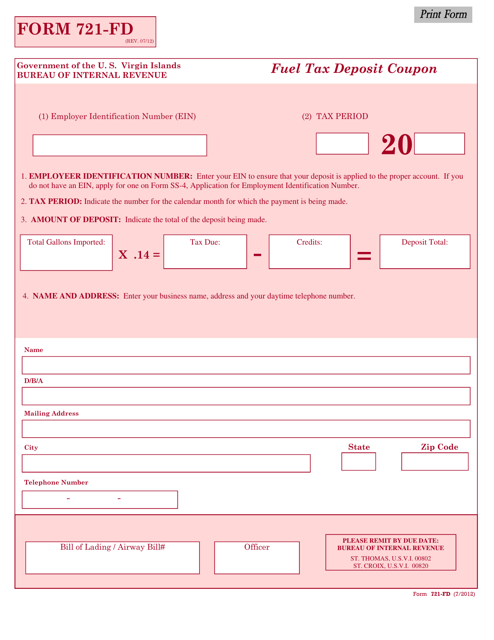

This form is used for making fuel tax deposits in the Virgin Islands.

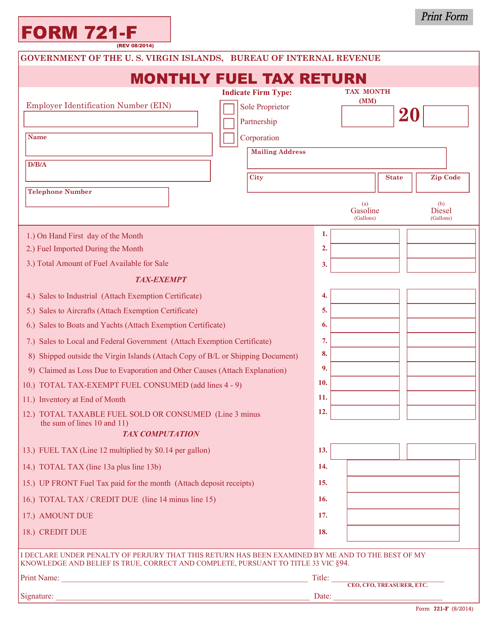

This form is used for filing the monthly fuel tax return in the Virgin Islands.

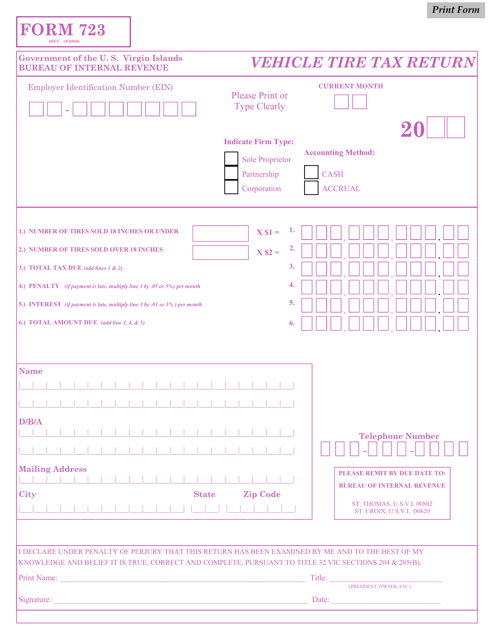

This form is used for filing vehicle tire tax returns in the Virgin Islands.

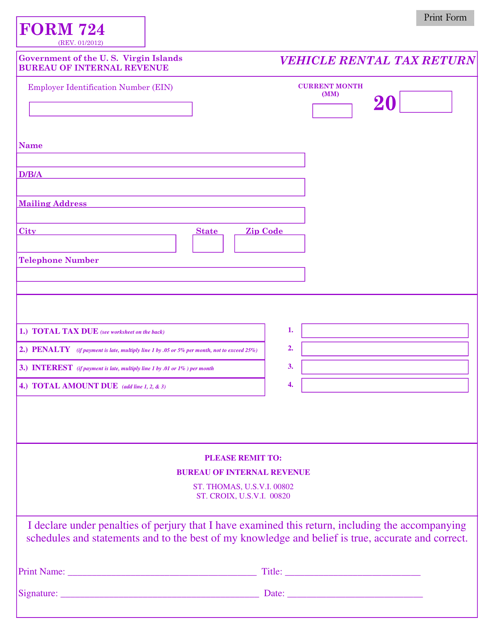

This form is used for reporting vehicle rental taxes in the US Virgin Islands.

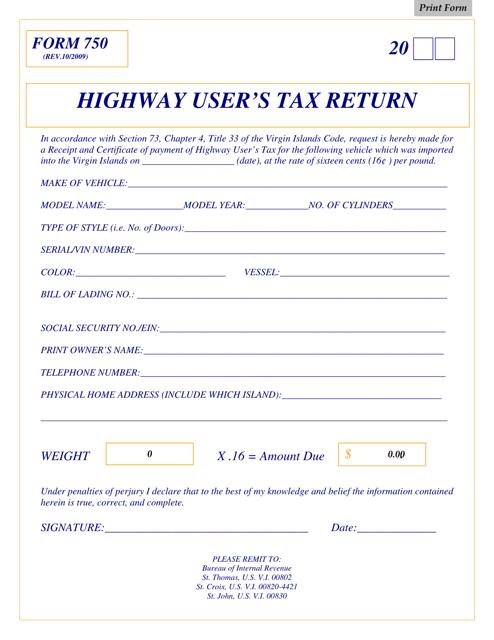

This form is used to report and pay the highway user tax in the Virgin Islands. It is a requirement for individuals and businesses that use licensed motor vehicles on public roads.

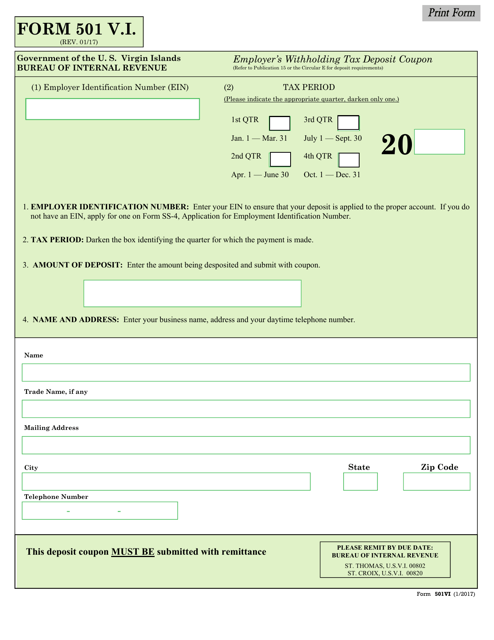

This form is used for employers in the Virgin Islands to make withholding tax deposit payments.

This form is used for reporting gross receipts tax in the Virgin Islands on a monthly basis.

This form is used for applying for tax filing and payment status report in the Virgin Islands.

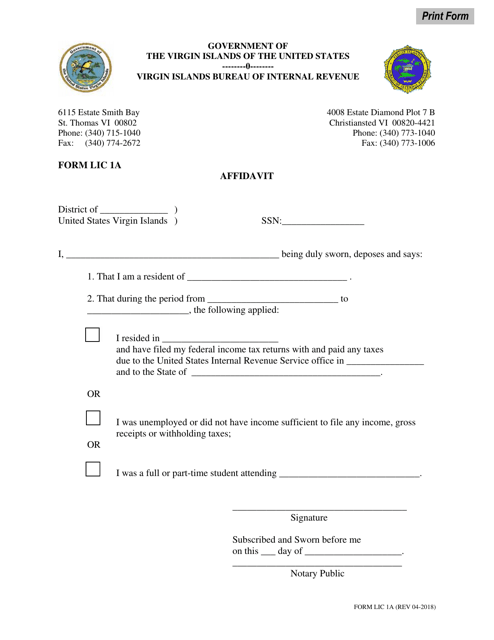

This form is used for filing an affidavit in the Virgin Islands.

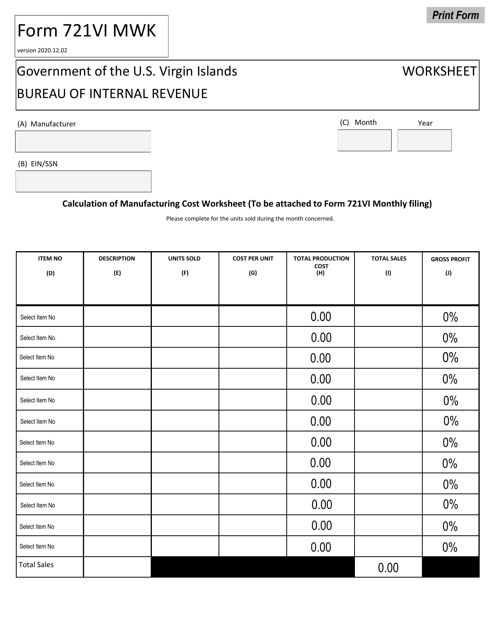

This form is used for excise manufacturers in the Virgin Islands to report their production and calculate the taxes owed.

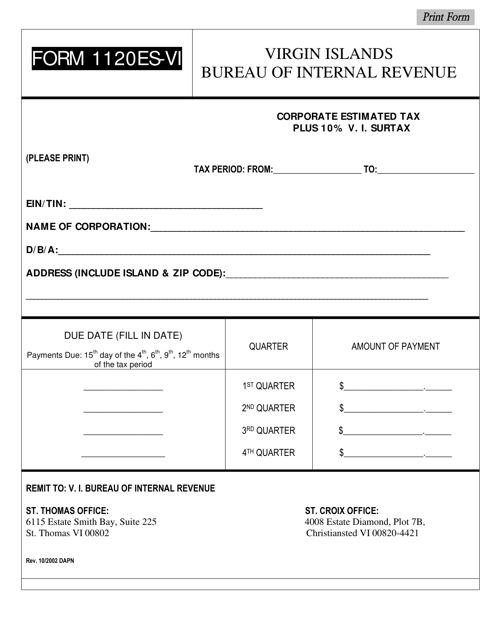

This Form is used for corporate estimated tax payments for businesses located in the Virgin Islands.

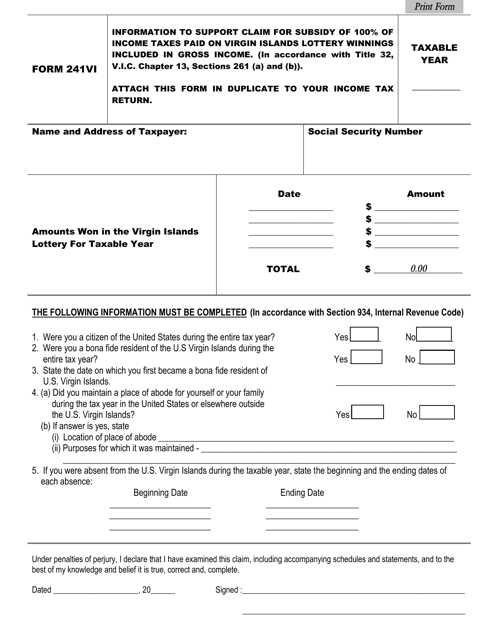

This Form is used for applying for a lottery subsidy in the Virgin Islands.

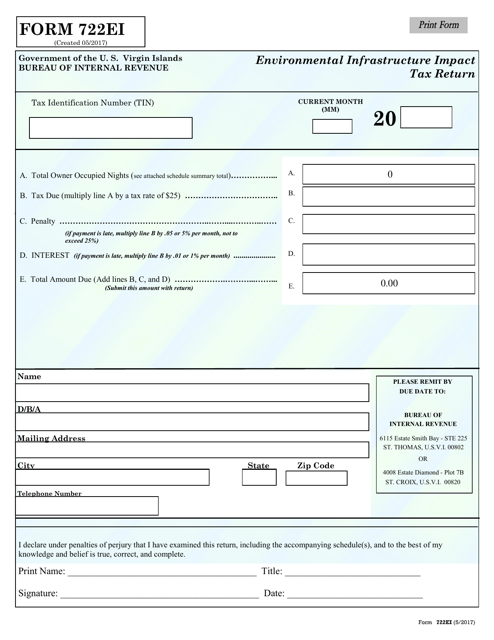

This Form is used for reporting and paying the Environmental Infrastructure Impact Tax in the Virgin Islands.

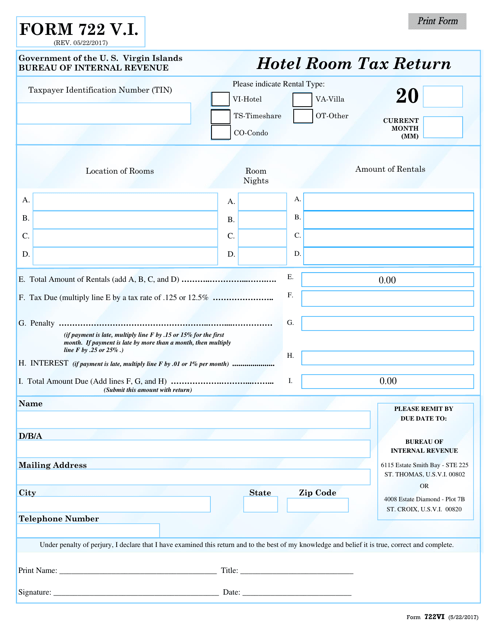

This Form is used for reporting hotel room tax in the Virgin Islands.

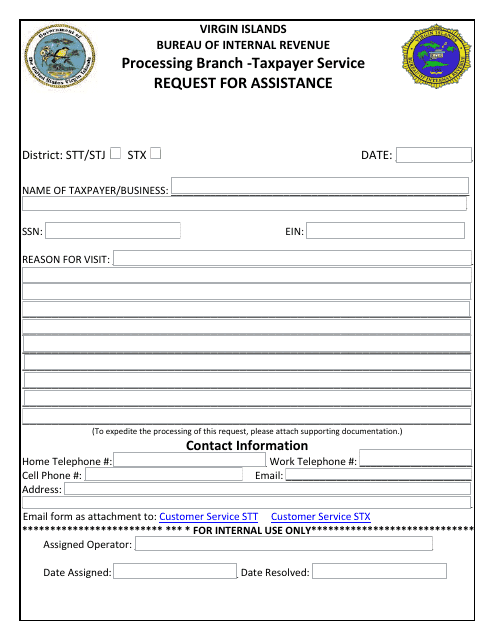

This form is used to request assistance from the taxpayer service in the Virgin Islands. It helps individuals to get guidance and support for their tax-related issues.

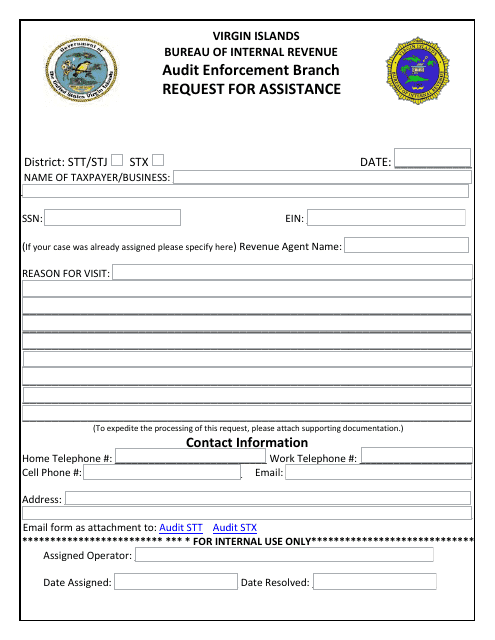

This document is used for requesting assistance from the Audit Enforcement Branch specifically for the Virgin Islands.

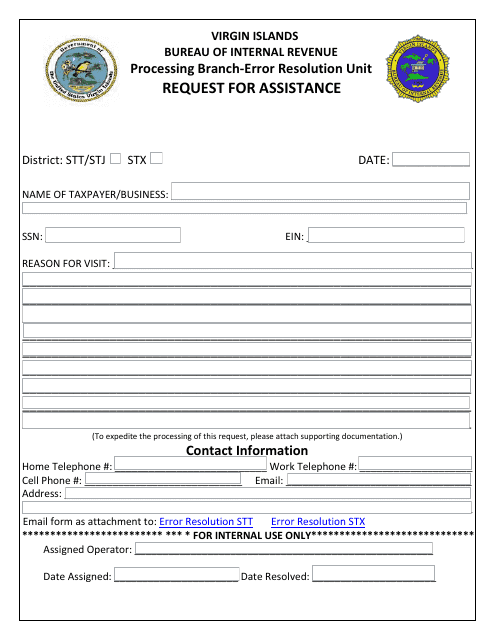

This document is used for requesting assistance from the Error Resolution Unit in the Virgin Islands regarding processing branch-related issues.

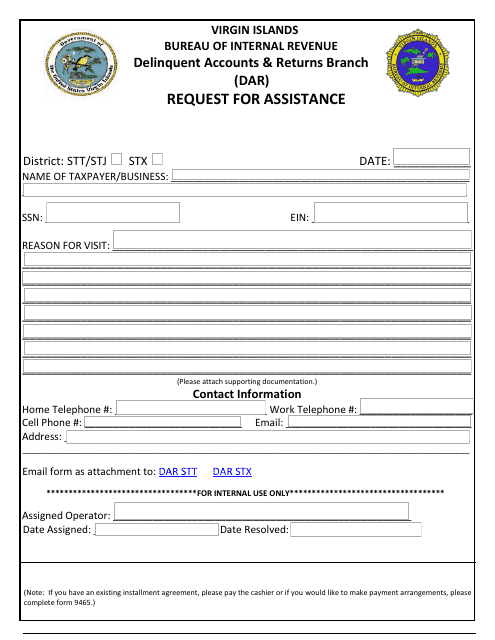

This document is a request for assistance from the Delinquent Accounts & Returns Branch (DAR) in the Virgin Islands.