National Credit Union Administration Forms

The National Credit Union Administration (NCUA) is a federal agency in the United States that is responsible for regulating and supervising the credit union industry. Its primary purpose is to ensure the safety and soundness of credit unions, protect the deposits of credit union members, and promote the stability and growth of the credit union system. The NCUA also administers the National Credit Union Share Insurance Fund (NCUSIF), which provides insurance coverage for deposits held by credit unions.

Documents:

42

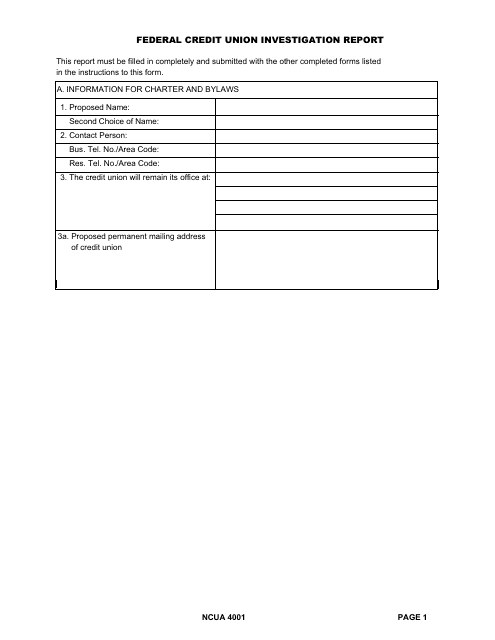

This form is used for reporting to the National Credit Union Administration (NCUA) regarding investigations conducted at federal credit unions.

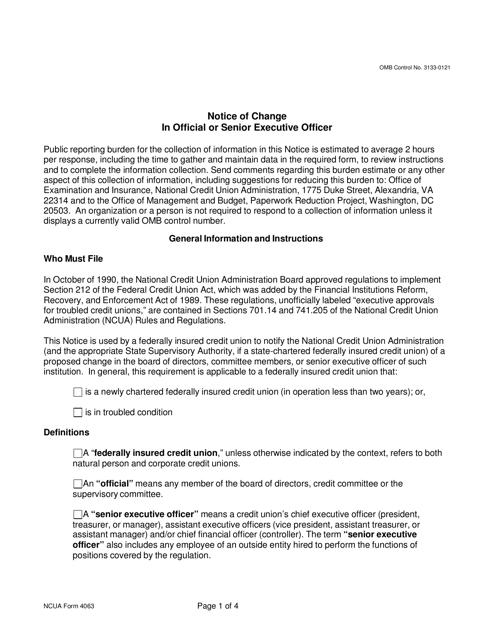

This Form is used for notifying the National Credit Union Administration (NCUA) about any changes in the official or senior executive officer of a credit union.

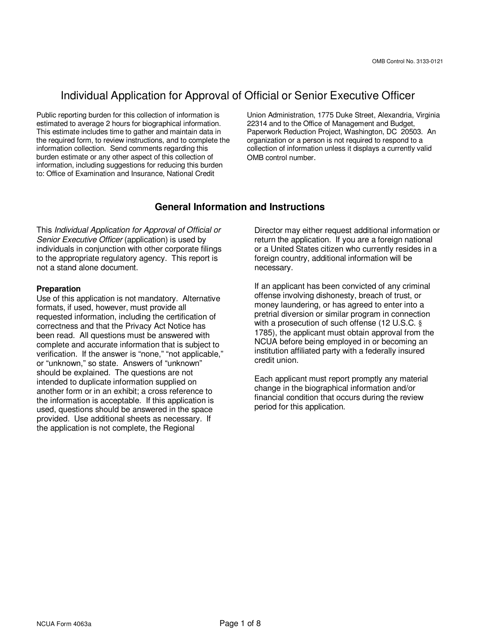

This Form is used for individuals to apply for approval as an official or senior executive officer in the National Credit Union Administration (NCUA).

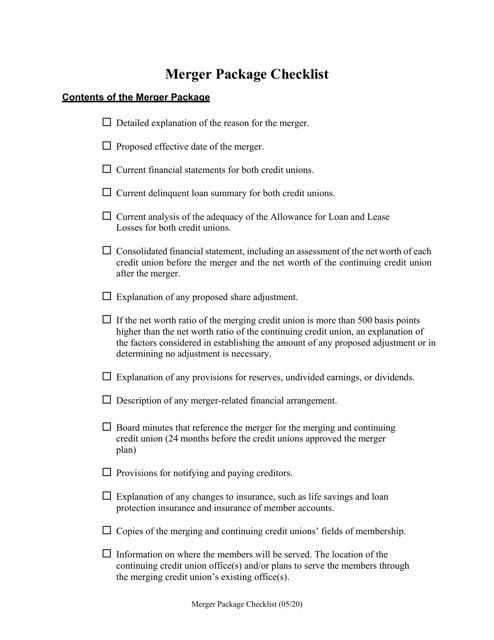

This document is a checklist used during a merger process to ensure that all necessary steps and documents are completed and in order.

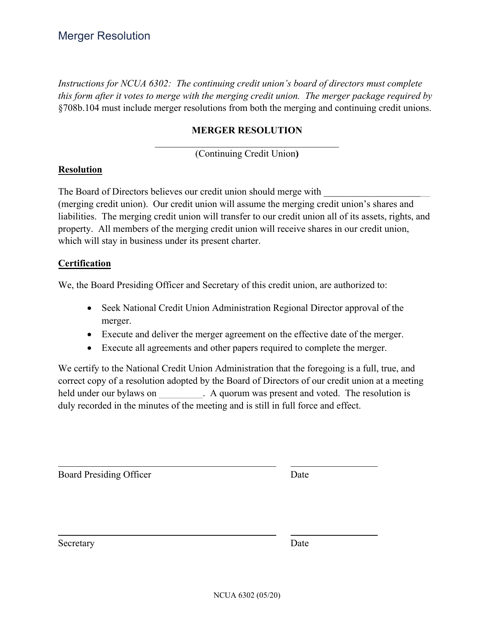

This document is used for resolving a merger involving a continuing credit union.

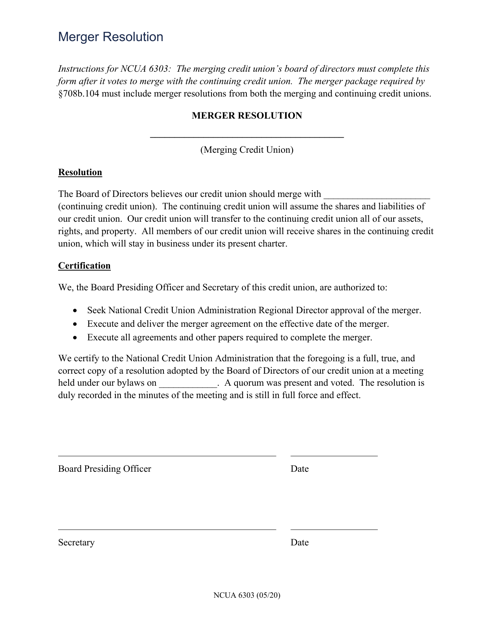

This document is used for resolving the merger of two credit unions.

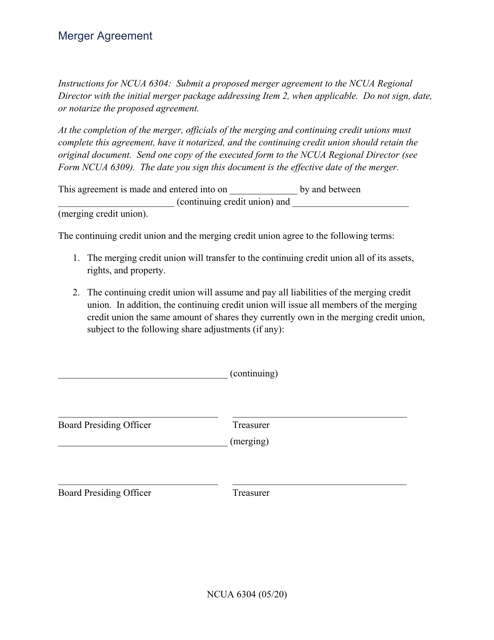

This form is used for filing a merger agreement with the National Credit Union Association (NCUA). It is necessary when credit unions decide to merge.

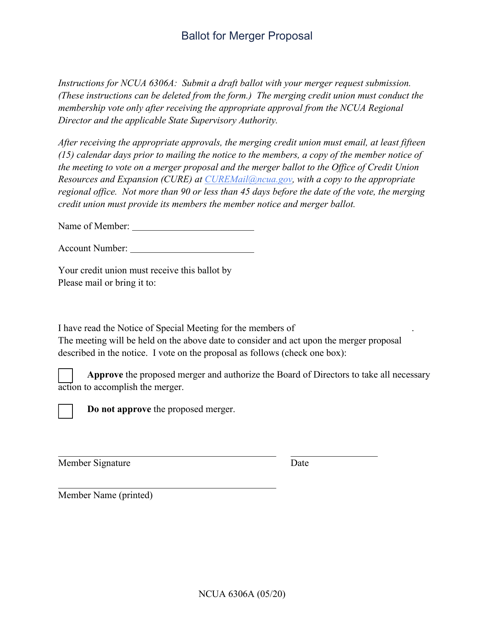

This Form is used for voting on a merger proposal within the National Credit Union Administration (NCUA). It allows members to cast their ballot and provide input on the proposed merger.

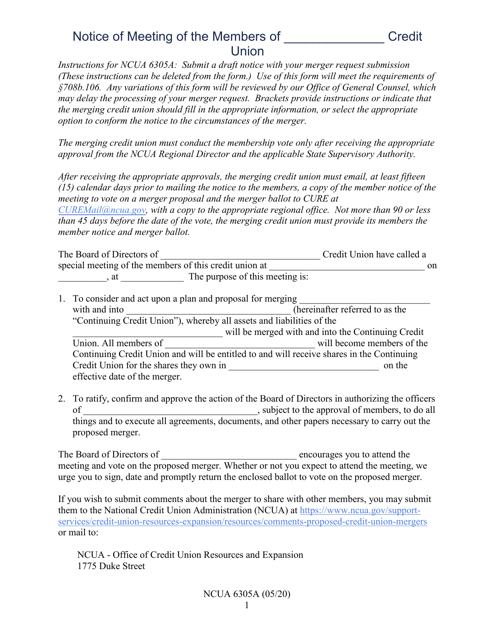

This form is used for notifying the members of a credit union about an upcoming meeting.

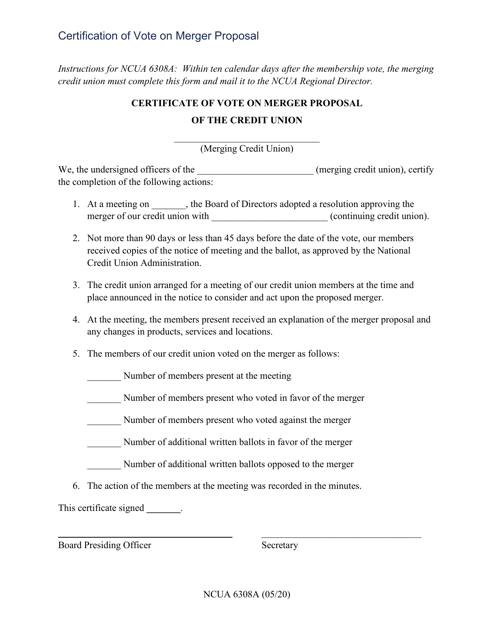

This form is used for certifying the vote on a merger proposal of a credit union.

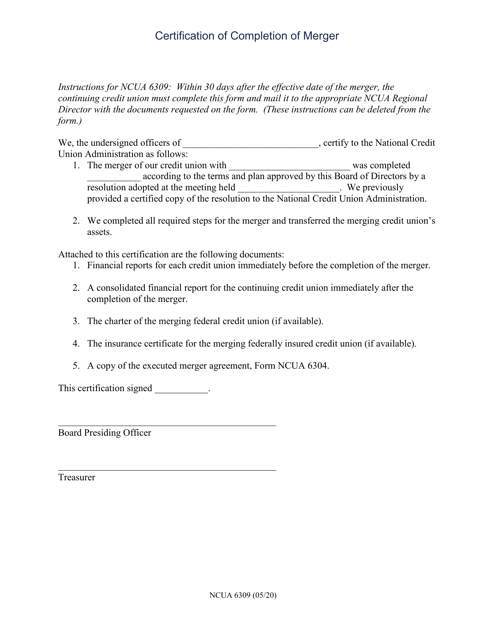

This Form is used for certifying the completion of a merger for credit unions regulated by the National Credit Union Administration (NCUA).

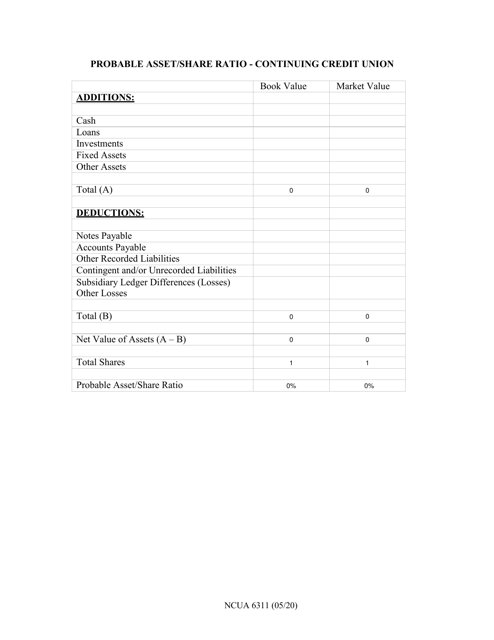

This Form is used for determining the probable asset/share ratio for a continuing credit union.

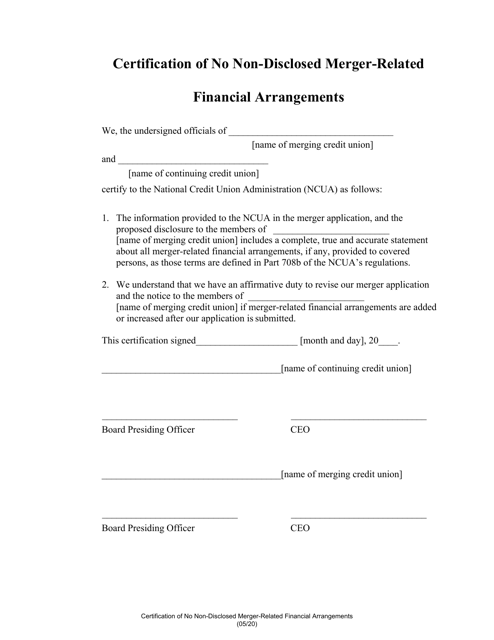

This document certifies that there are no undisclosed financial arrangements related to a merger.

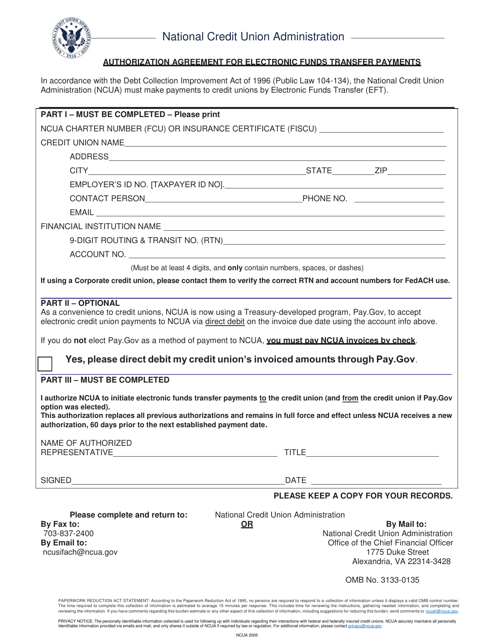

This Form is used for authorizing electronic transfer of funds for payment purposes.

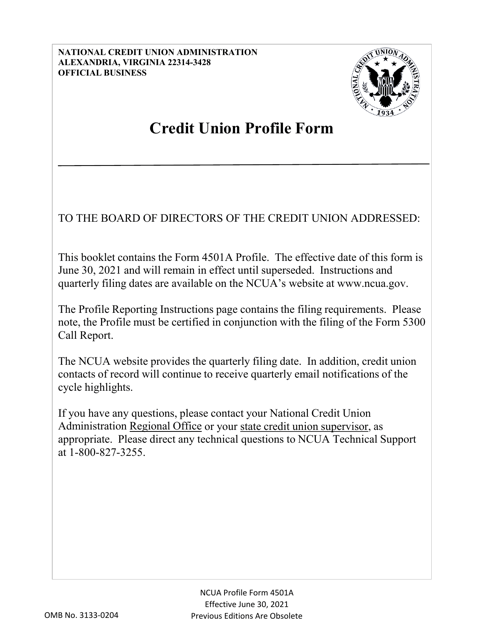

This form is used for credit unions to provide information about their profile to the National Credit Union Administration (NCUA).

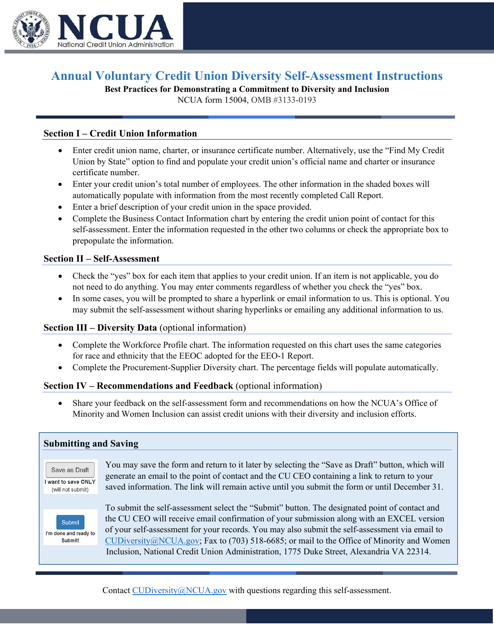

This document provides instructions for completing the NCUA Form 15004, which is an annual voluntary self-assessment for credit unions regarding diversity.

This Form is used for obtaining approval and certification of insurance for an organization by the National Credit Union Administration (NCUA).

This document is used for filing an organization certificate with the National Credit Union Administration (NCUA).

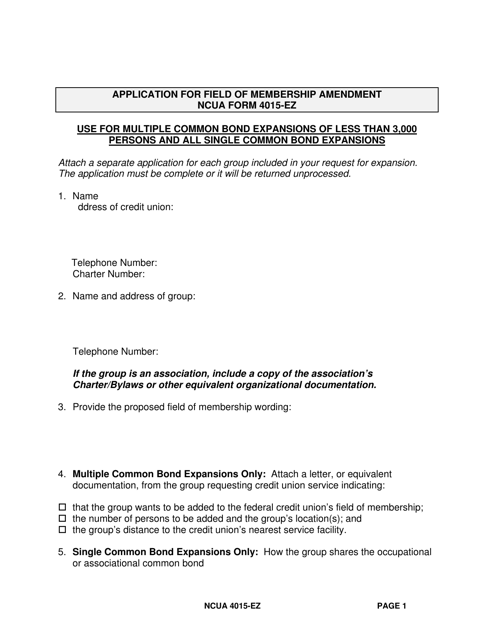

This Form is used for submitting an application to the NCUA for a field of membership amendment for credit unions.

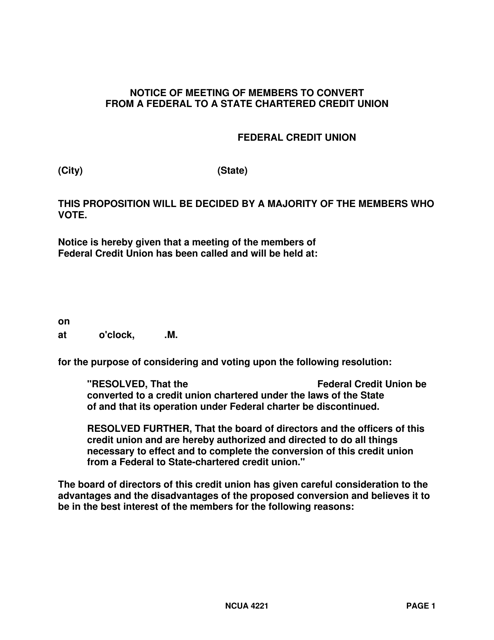

This document is used for notifying members about a meeting to discuss converting a federal credit union to a state-chartered credit union.

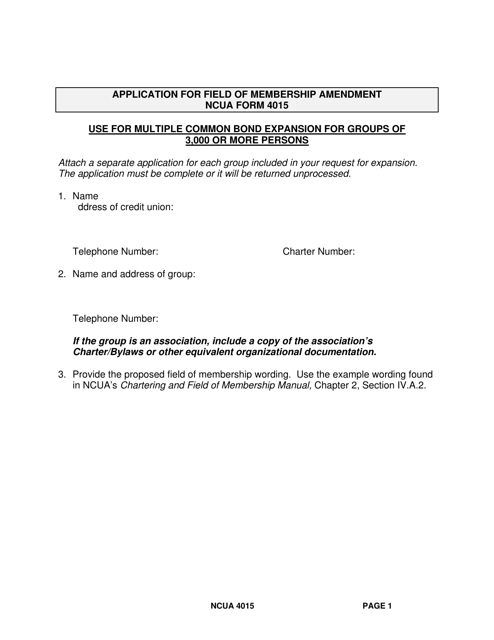

This Form is used for applying for a field of membership amendment with the National Credit Union Administration (NCUA).

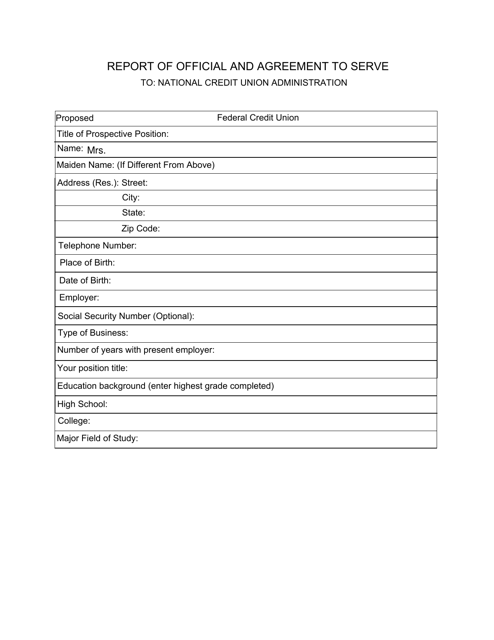

This Form is used for reporting officials and agreements to serve in the NCUA (National Credit Union Administration).

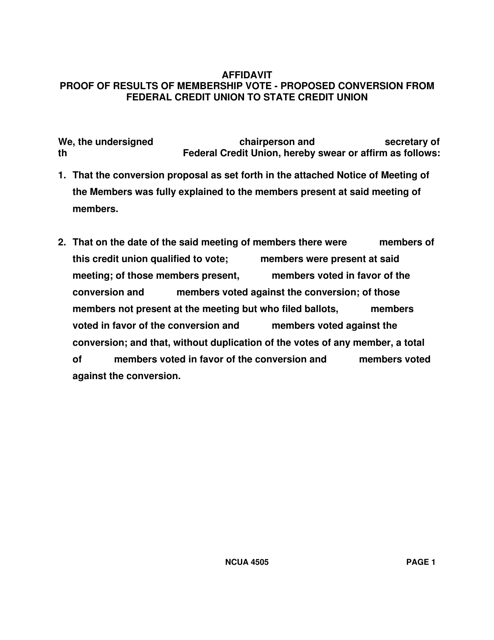

This form is used for providing proof of the results of a membership vote in a federal credit union that is proposed to convert to a state credit union.

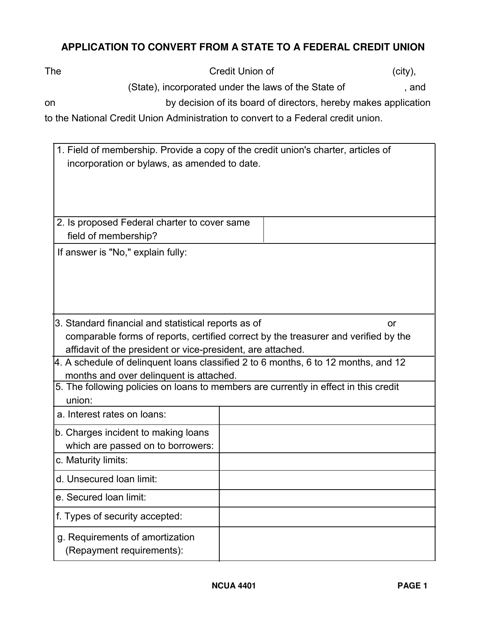

This Form is used for credit unions looking to convert from a state charter to a federal charter. This document helps facilitate the application process.

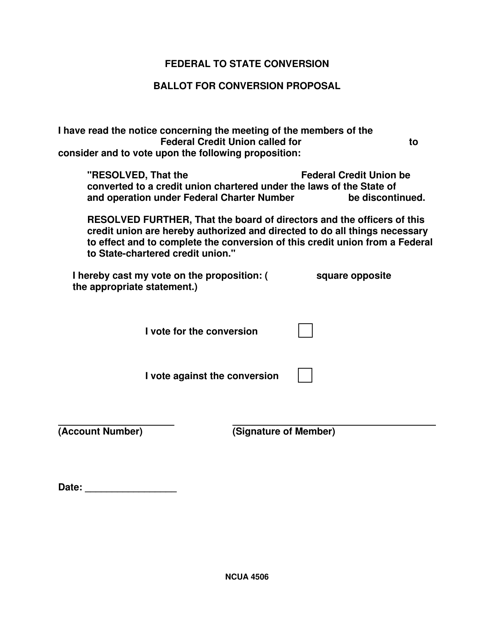

This form is used for submitting a ballot to support or oppose the proposal to convert a federal credit union to a state credit union.

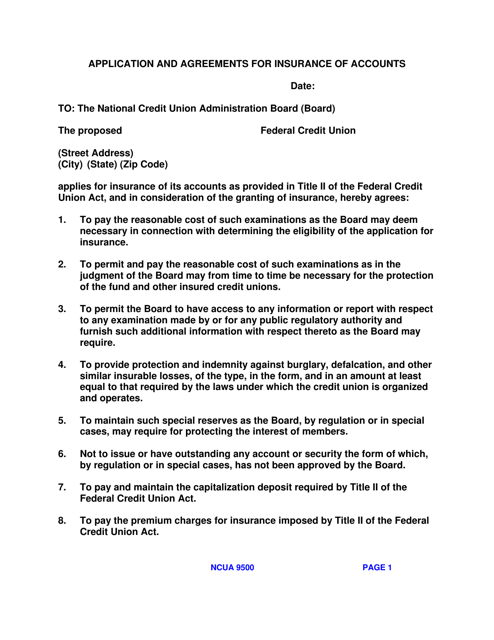

This Form is used for applying for insurance of accounts with the National Credit Union Administration (NCUA) and includes all necessary agreements.

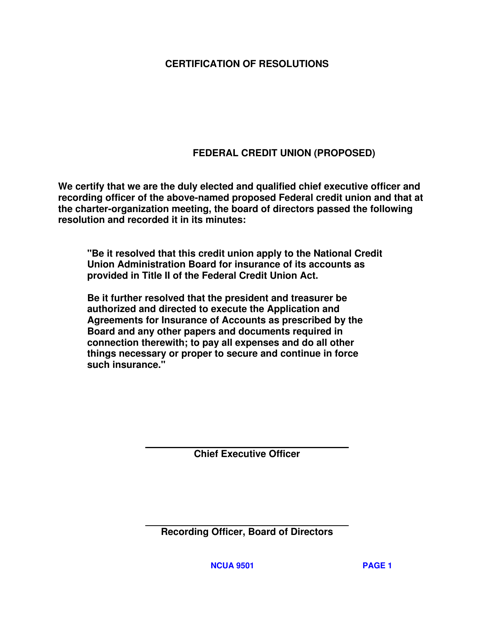

This document is used for certifying resolutions related to the National Credit Union Administration (NCUA).

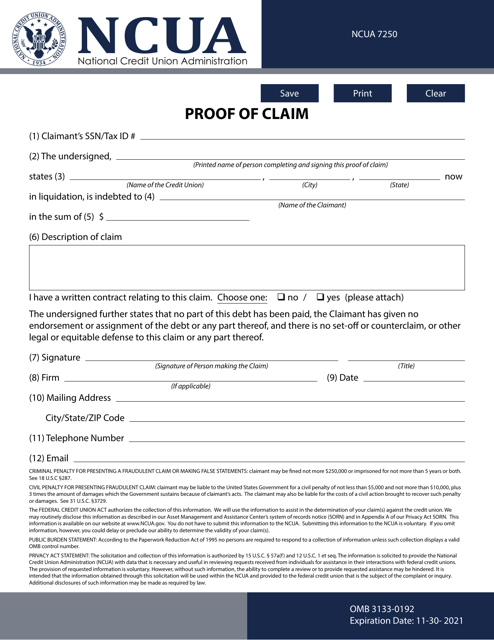

This Form is used for filing a proof of claim with the National Credit Union Administration (NCUA) for a debt owed by a credit union.

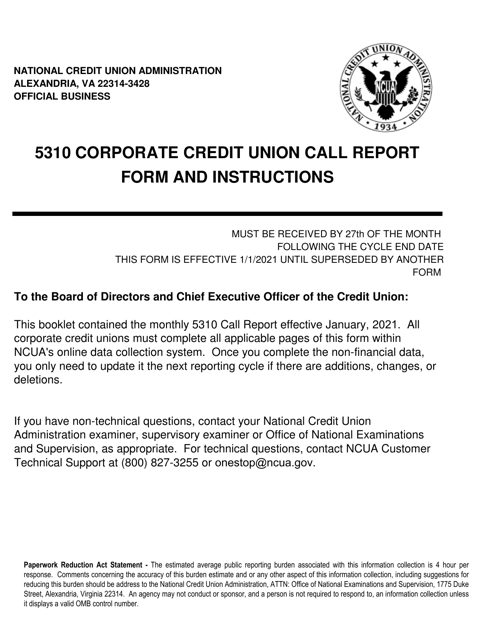

This form is used for reporting financial information by corporate credit unions to the National Credit Union Administration (NCUA). It helps the NCUA assess the financial health and performance of these institutions.

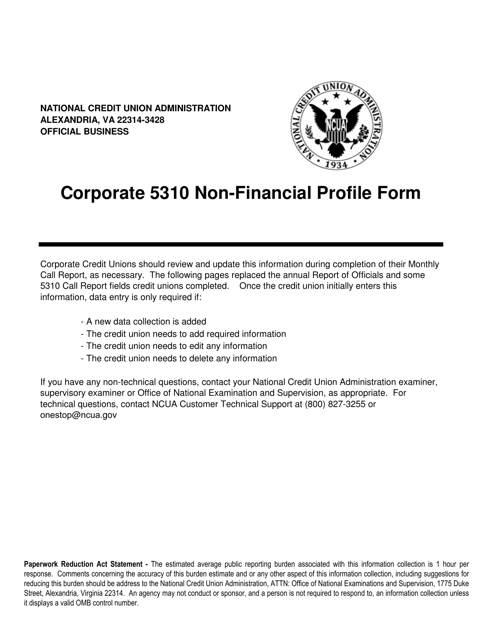

This document is used for creating a corporate non-financial profile form for NCUA (National Credit Union Administration).

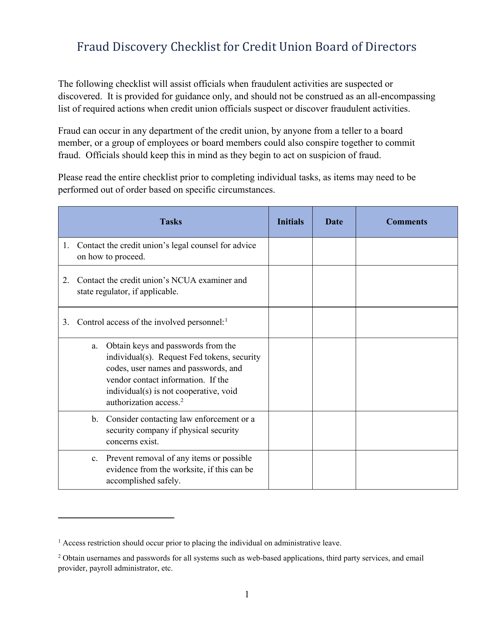

This document outlines a checklist specifically designed for Credit Union Board of Directors to detect and prevent fraud. It provides guidance and measures to ensure the security and integrity of the credit union's operations.

This Form is used for reporting financial information and activities of credit unions to regulatory authorities. It helps monitor the financial health and compliance of credit unions.

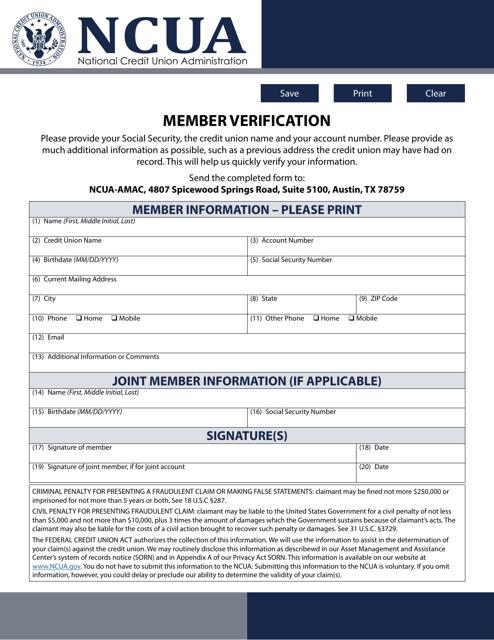

This is a type of document used for verifying the authenticity and membership of an individual or organization. It helps confirm that the person or entity is a legitimate member of a specific group or association.

This document certifies that the board of directors adopted an amendment to the company's charter. It is used to confirm the change made to the charter by the board of directors.

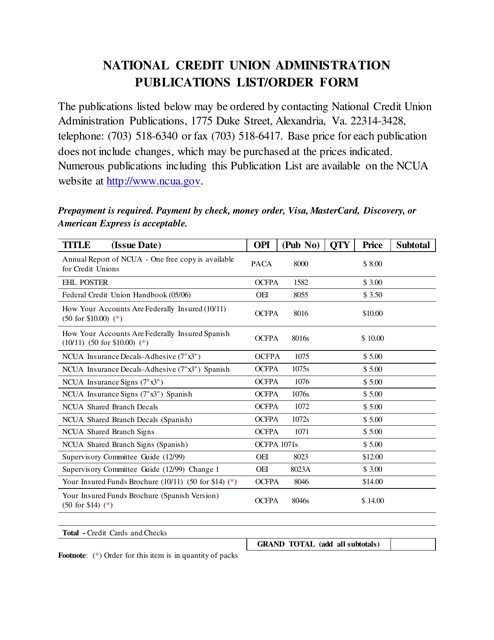

This document provides a list and order form for publications from the National Credit Union Administration. Obtain essential resources and information about credit unions and their regulations.

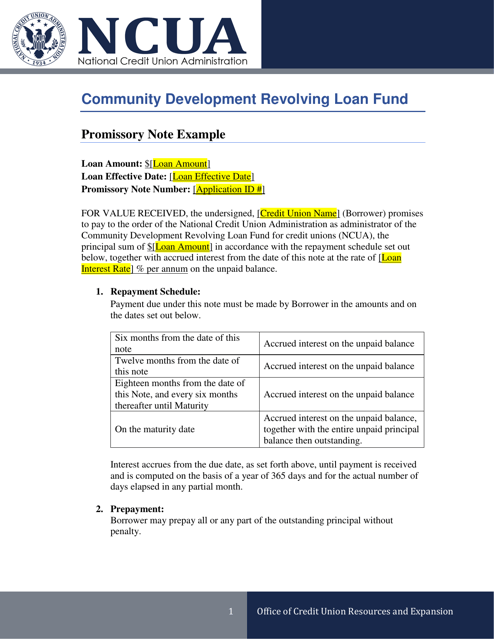

This document is a legal agreement between a lender and borrower that outlines the terms and conditions of a loan and the borrower's promise to repay the borrowed amount.

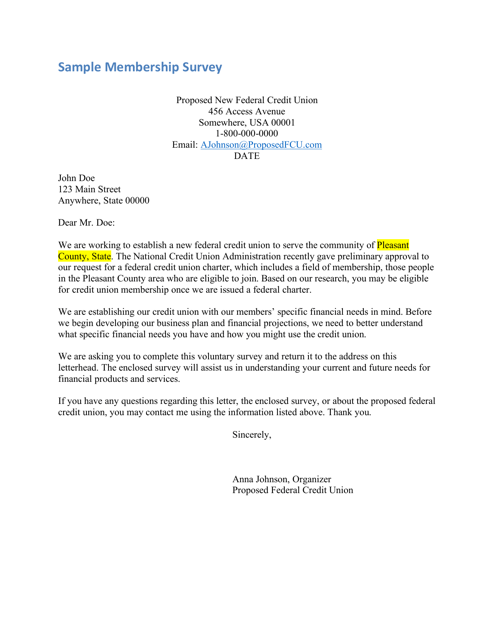

This document is a survey used to gather information from members of an organization or group. It helps collect feedback, opinions, and preferences to improve the membership experience.

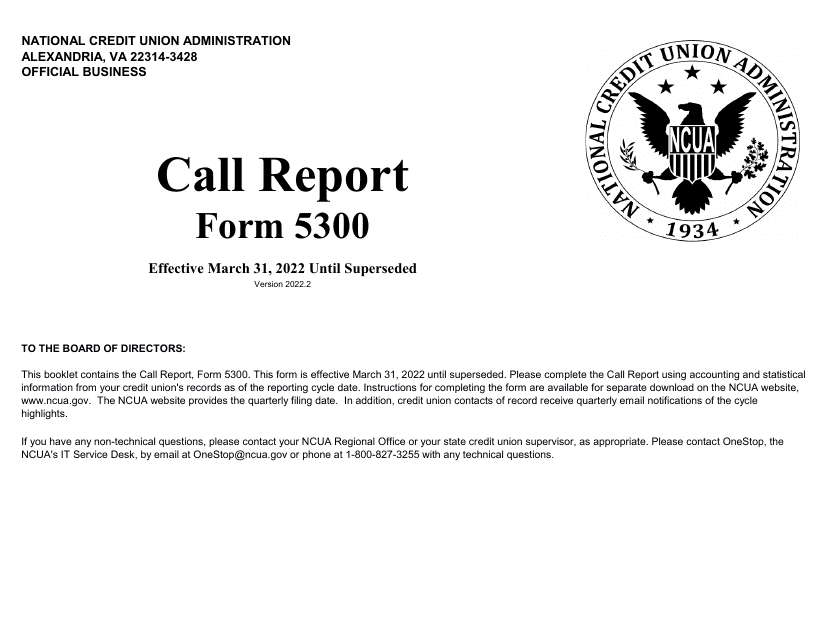

This form is used for credit unions to file their financial and statistical data with the National Credit Union Administration (NCUA). It provides a comprehensive overview of the credit union's operations and helps the NCUA assess its financial health.