Export-Import Bank of the United States Forms

The Export-Import Bank of the United States (EXIM Bank) is a government agency that provides financial assistance and support to U.S. exporters. Its main purpose is to promote and finance the exports of American goods and services, thereby contributing to the growth and competitiveness of U.S. businesses in the global market. EXIM Bank offers different loan programs, credit guarantees, and insurance products to help U.S. companies export their products and expand their international sales. By providing these financing tools, EXIM Bank aims to enable American businesses to compete effectively in overseas markets and maintain or create jobs in the United States.

Documents:

93

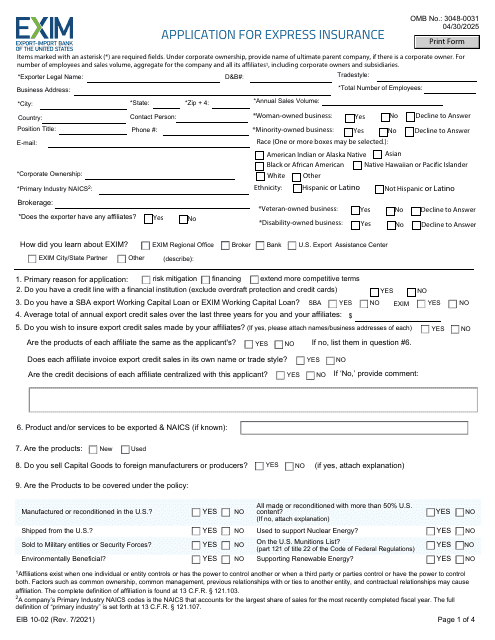

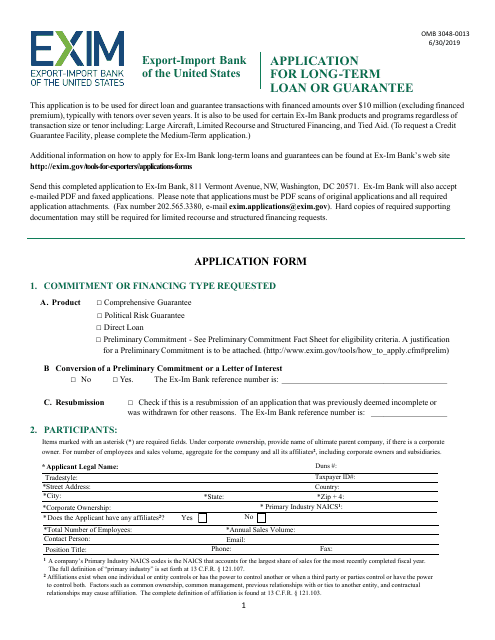

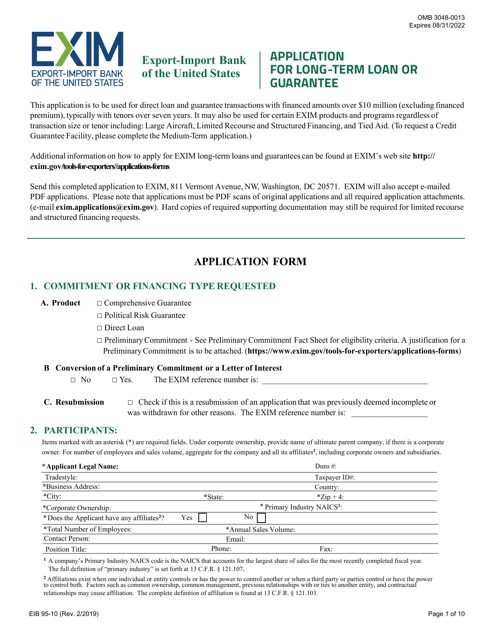

This form is used for applying for a long-term loan or guarantee. It is typically used by individuals or businesses who need financial assistance for an extended period of time.

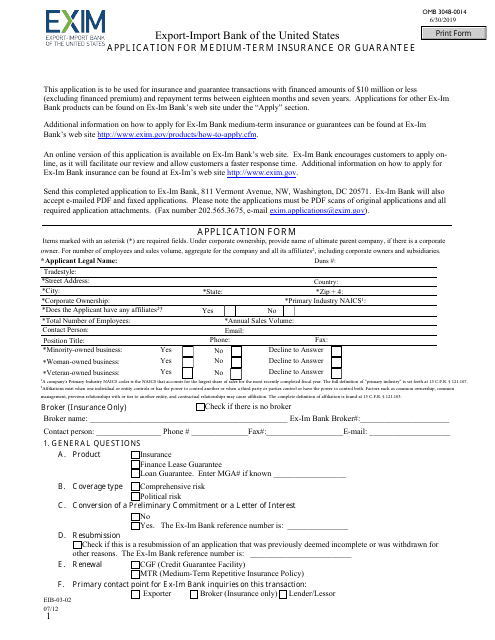

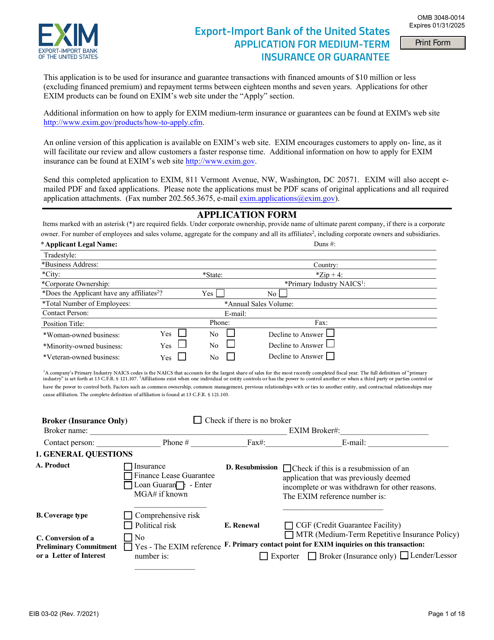

This form is used for applying for medium-term insurance or guarantee.

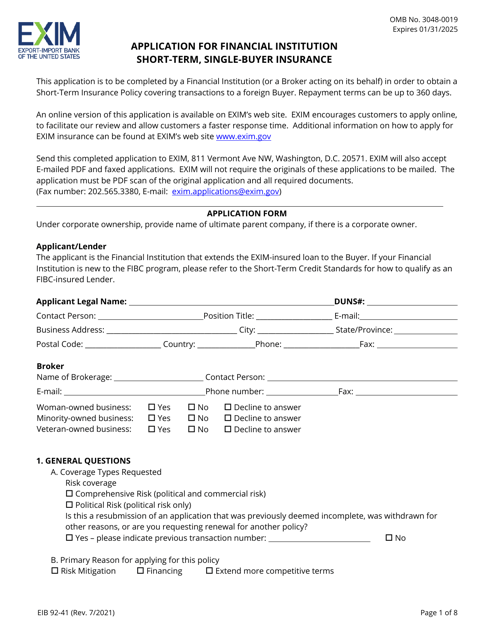

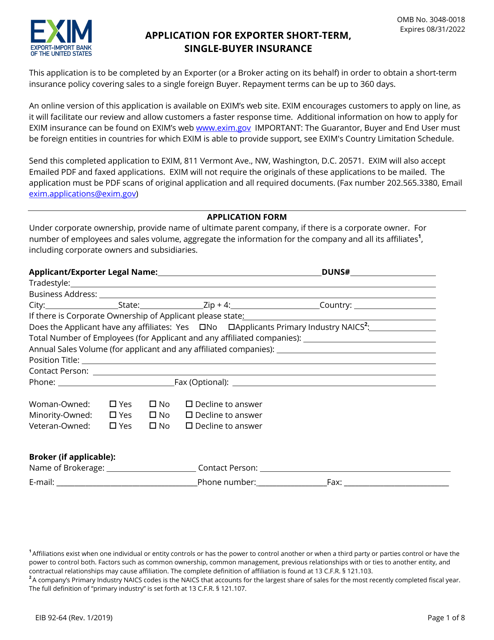

This form is used for applying for short-term, single-buyer insurance for exporters. It helps exporters protect their business when selling goods to a specific buyer by providing insurance coverage against non-payment.

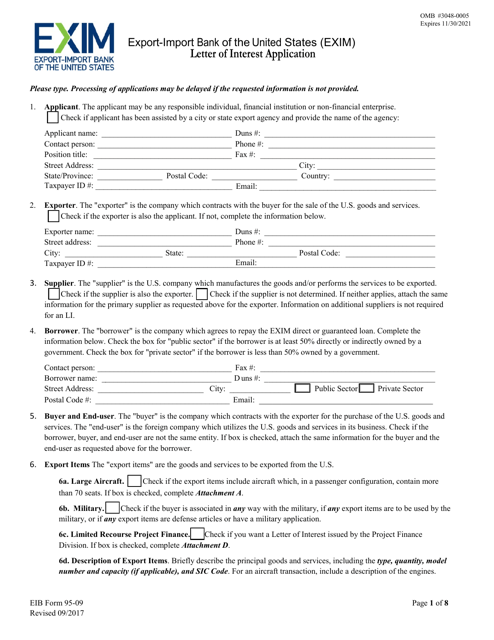

This document is used for submitting a letter of interest application for the Form EIB95-09.

This Form is used for applying for an Export Working Capital Guarantee, which provides financial assistance to businesses for exporting goods and services. It helps businesses obtain the necessary working capital needed for international trade.

This Form is used for applying for a long-term loan or guarantee from the EIB (European Investment Bank).

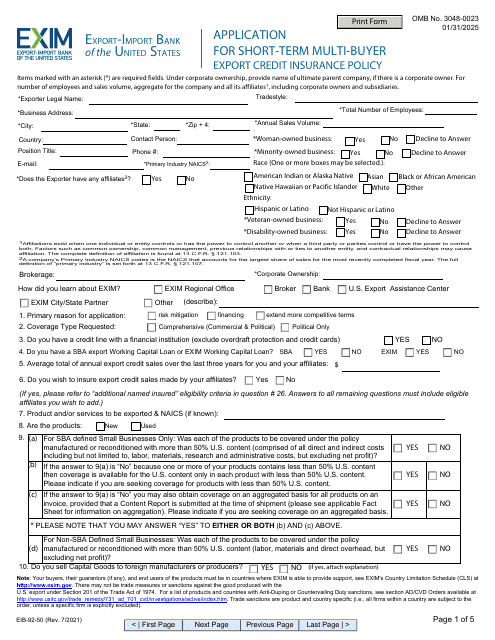

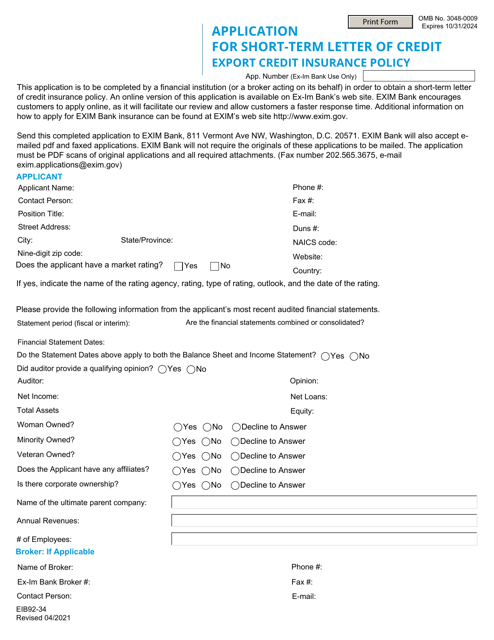

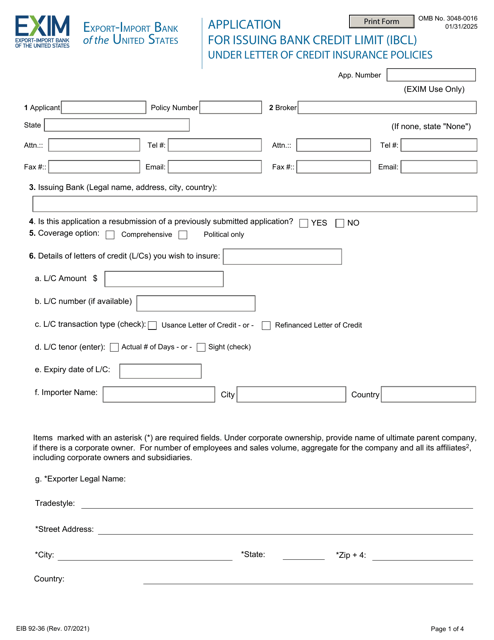

This form is used for applying for a short-term letter of credit export credit insurance policy.

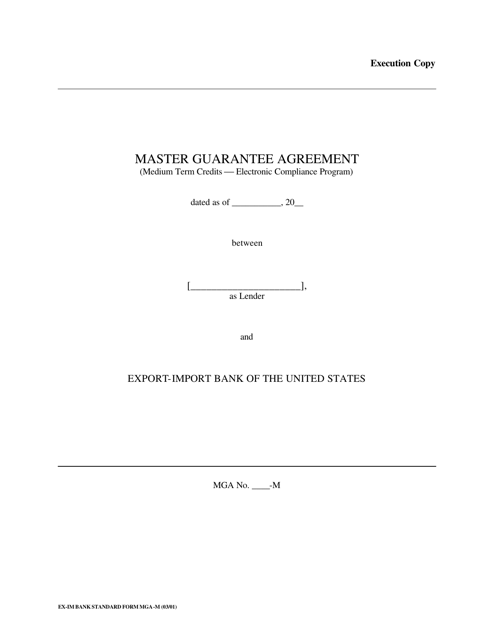

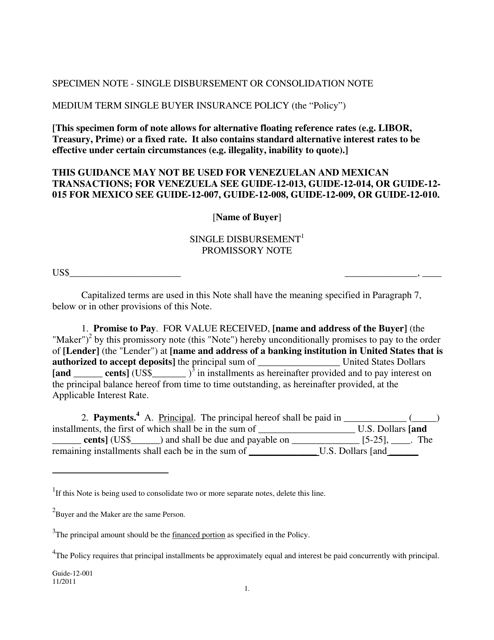

This Form is used for medium term credits under the Electronic Compliance Program.

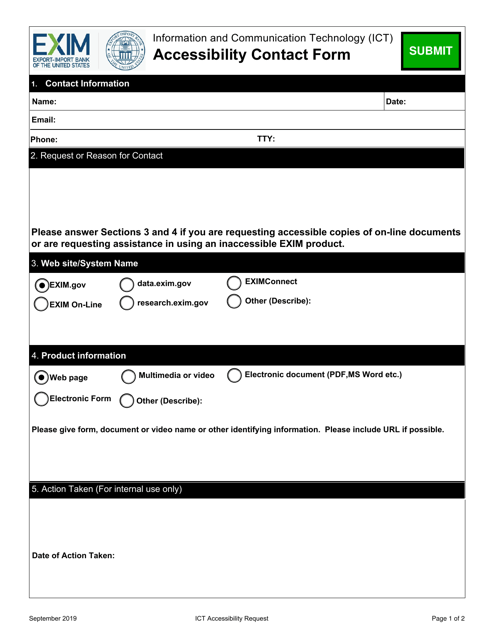

This form is used for contacting the organization regarding accessibility concerns or issues related to Information and Communication Technology (ICT).

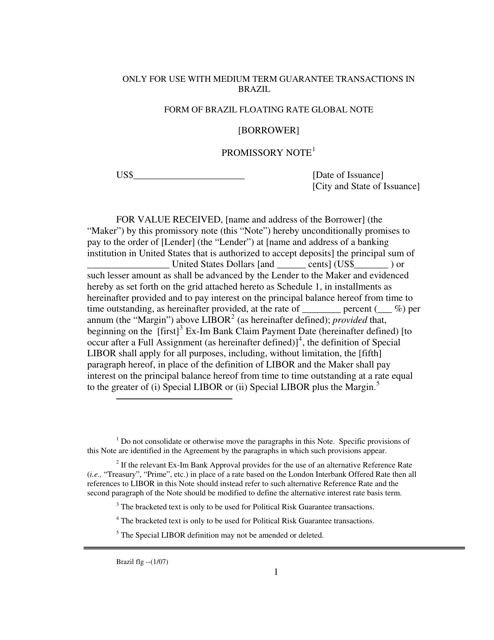

This document is a form of Brazil Floating Rate Global Note.

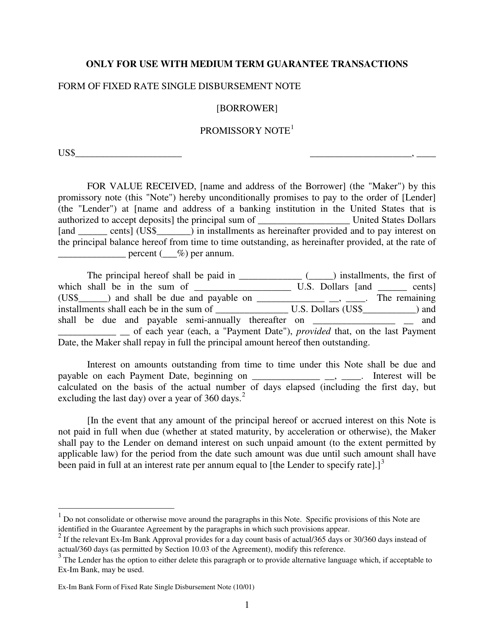

This form is used for signing a fixed rate single disbursement loan agreement. It outlines the terms and conditions of the loan, including the interest rate and repayment schedule.

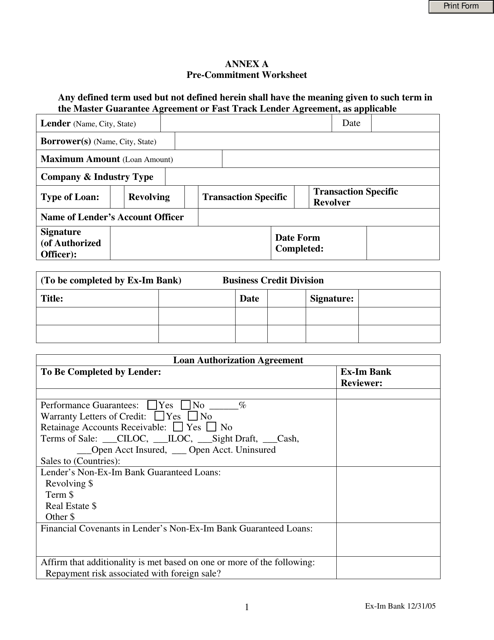

This form is used for completing a fast track pre-commitment worksheet for EBD-W-23C Annex A.

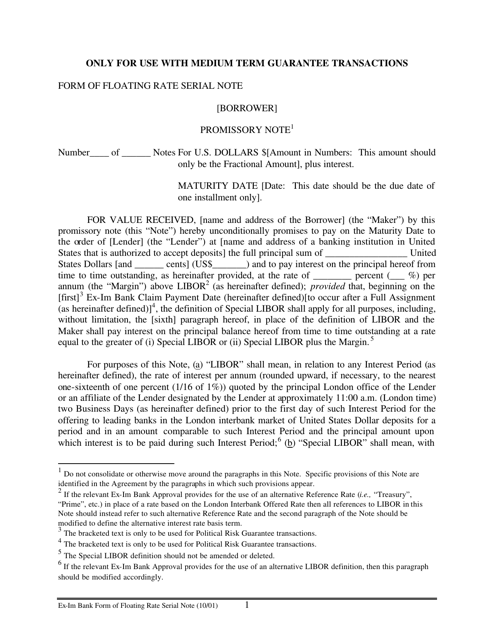

This form of document is used for issuing floating rate serial notes, which are financial instruments with interest rates that adjust periodically based on market conditions.

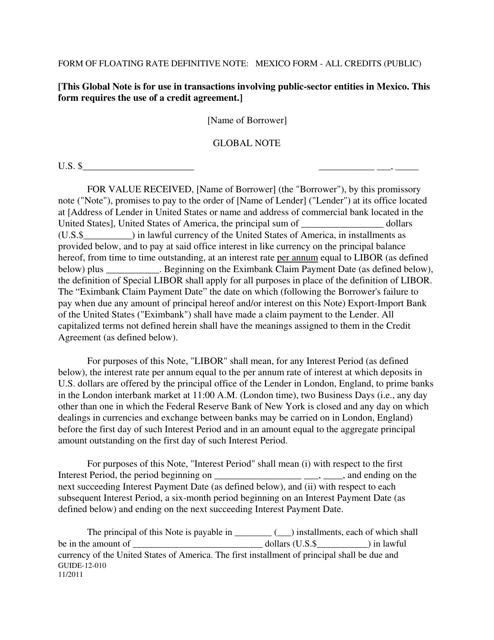

This form is used for issuing a floating rate global note, which is a type of bond with a variable interest rate. It allows the issuer to adjust the interest rate based on market conditions.

This Form is used for a type of loan agreement known as a Floating Rate Single Disbursement Note.

This Form is used for providing the contact information of the lender.

This document certifies activities related to the implementation of sanctions against Iran.

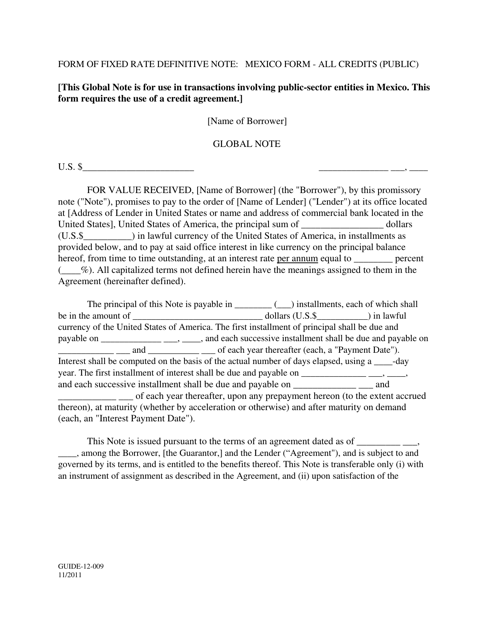

This form is used for creating a Mexican Promissory Note with a fixed interest rate for all types of credit.

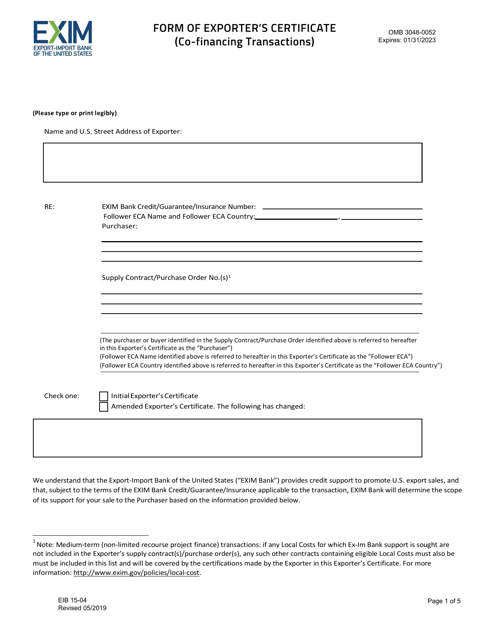

This form is used for co-financing transactions. It is an exporter's certificate required for certain export transactions.

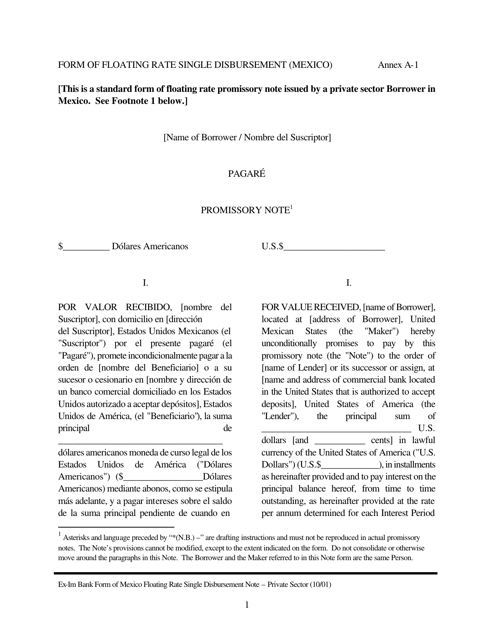

This Form is used for a Mexican Promissory Note with a Floating Rate. It is applicable to all types of credits and is designed for public use.

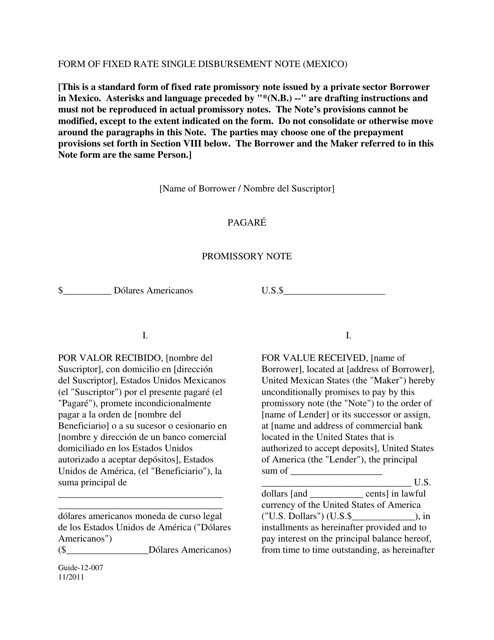

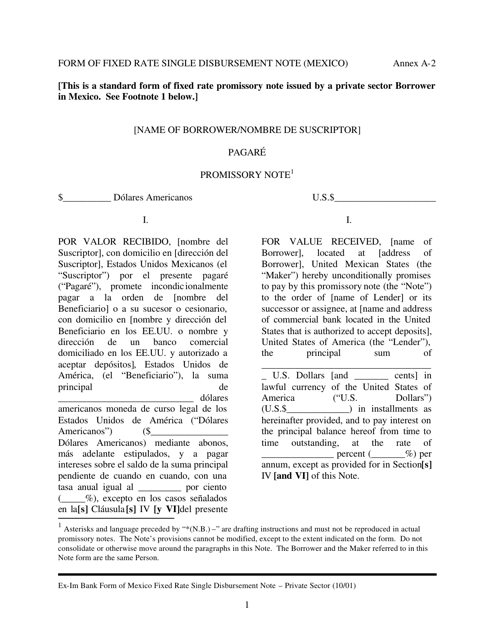

This document is a form that can be used in Mexico for a fixed rate single disbursement note. It is available in both English and Spanish.

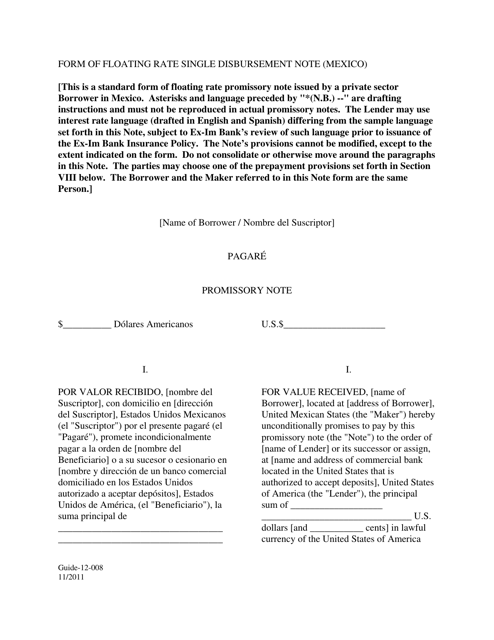

This document is a form used for a floating rate single disbursement note in Mexico. It is available in both English and Spanish.

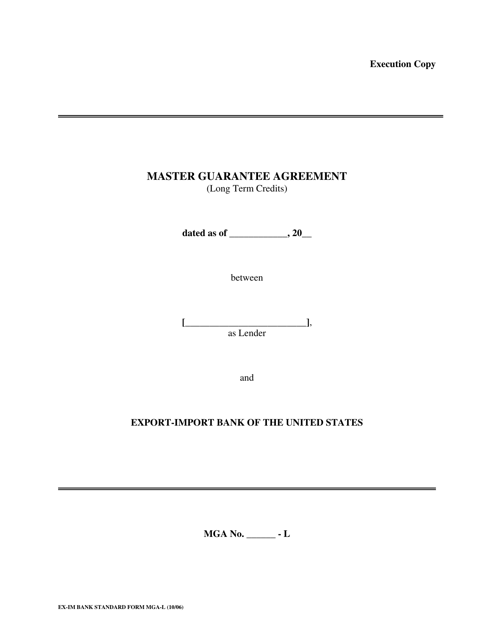

This Form is used for a Master Guarantee Agreement for long term credits.

This document is an Annex A-2 Form of Fixed Rate Single Disbursement Note (Mexico) that is available in both English and Spanish.

This Form is used for obtaining a single disbursement with a floating interest rate in Mexico. It is available in both English and Spanish.

This form is used for a Master Guarantee Agreement for agencies granting long term credits.

This Form is used for the Master Guarantee Agreement for Long Term Political Risk Guarantees.

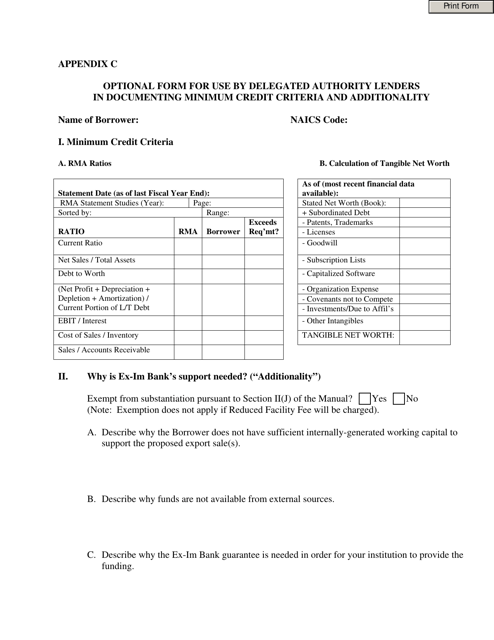

This document is used by delegated authority lenders to document the minimum credit criteria and additionality for loans.

This Form is used for adding a foreign currency supplement to the Master Guarantee Agreement (MGA) for medium-term credits under the Electronic Compliance Program.

This Form is used for the Master Guarantee Agreement for a Finance Lease in a foreign currency. It is a supplement for Medium Term Credits under the Electronic Compliance Program.

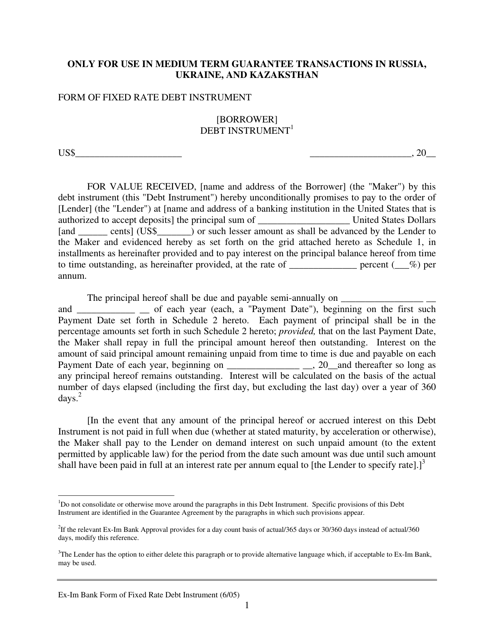

This document is used to describe fixed-rate debt instruments issued by Russia, Ukraine, and Kazakhstan. These debt instruments are used as an investment option and have a predetermined interest rate that remains fixed over a specific period of time.