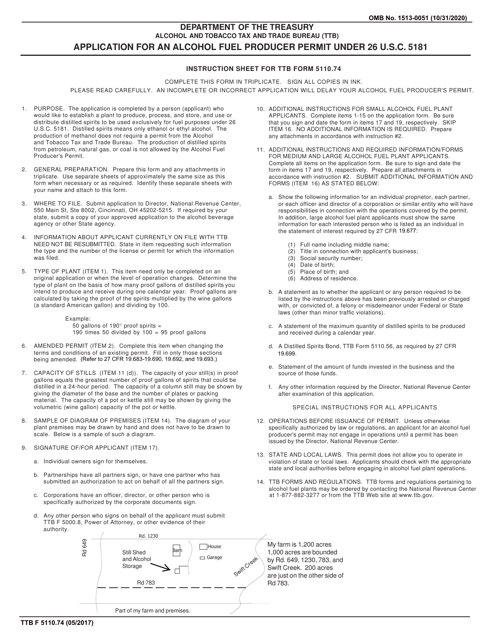

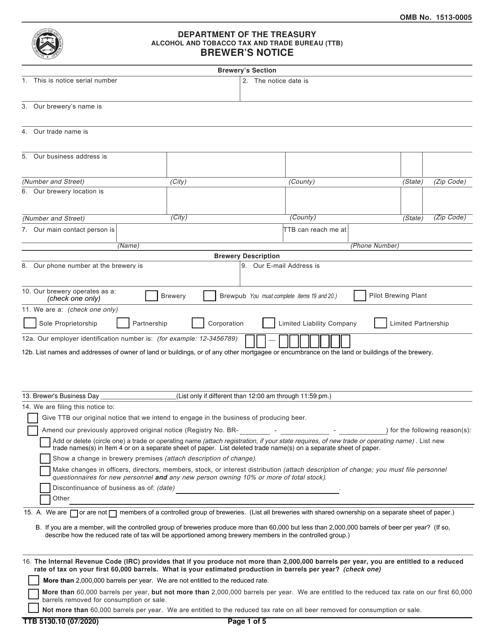

U.S. Department of the Treasury - Alcohol and Tobacco Tax and Trade Bureau Forms

Documents:

103

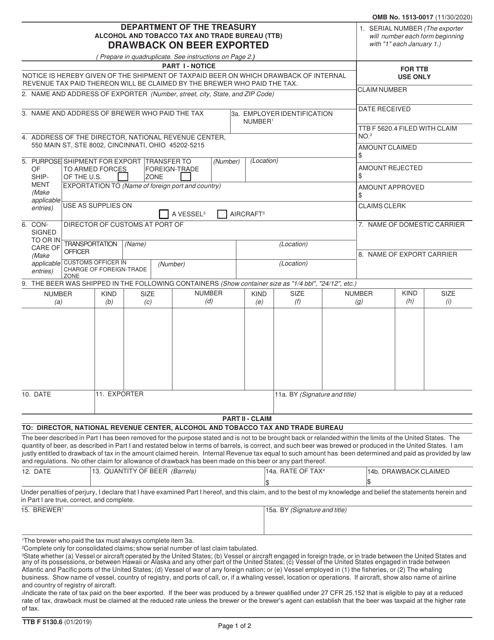

This Form is used for claiming a refund of federal excise tax paid on beer that is exported out of the United States. It is known as the Drawback on Beer Exported Form.

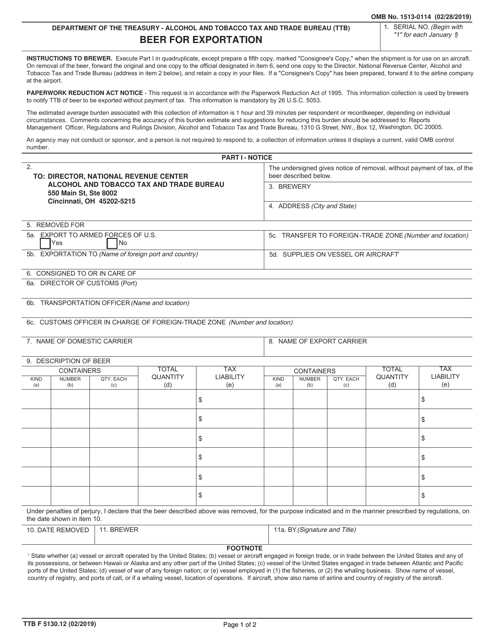

This form is used for exporting beer from the United States. It is required by the Alcohol and Tobacco Tax and Trade Bureau (TTB).

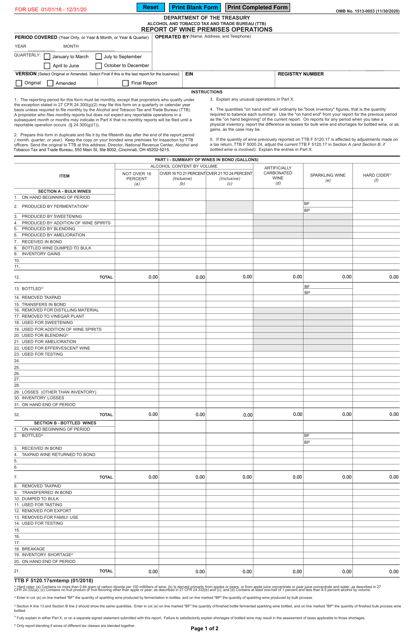

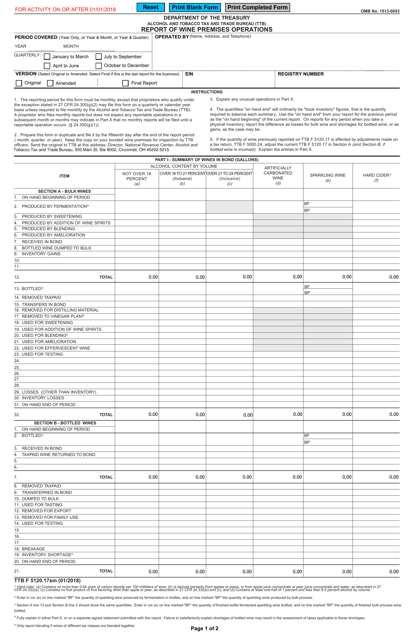

This form is used for reporting activities and operations of wine premises.

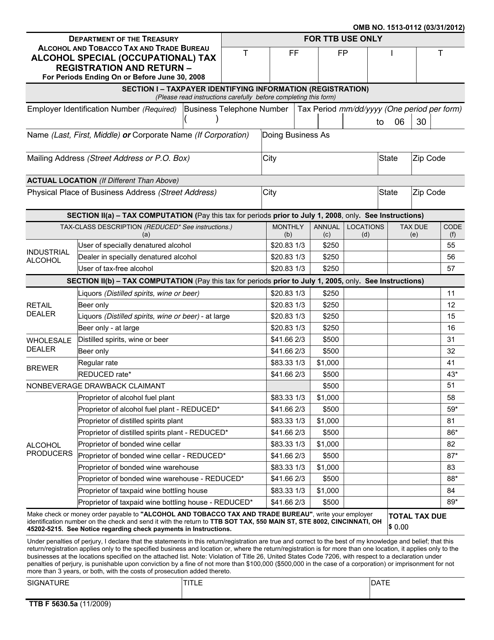

This form is used for registering and reporting the occupational tax for alcohol businesses for periods ending on or before June 30, 2008.

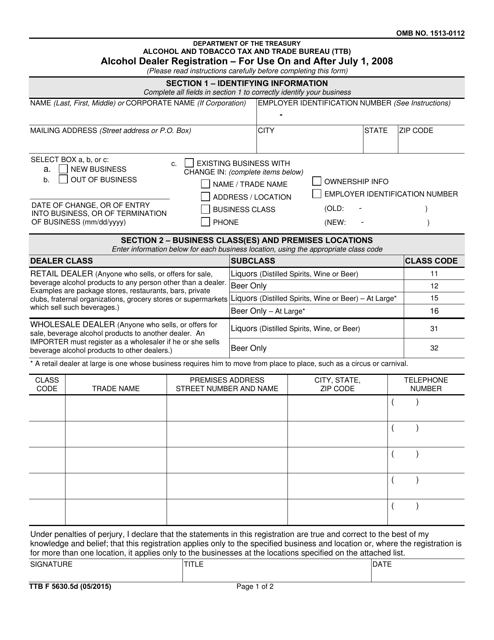

This form is used for alcohol dealers to register with the Alcohol and Tobacco Tax and Trade Bureau (TTB). It is required for businesses involved in the sale or distribution of alcohol.

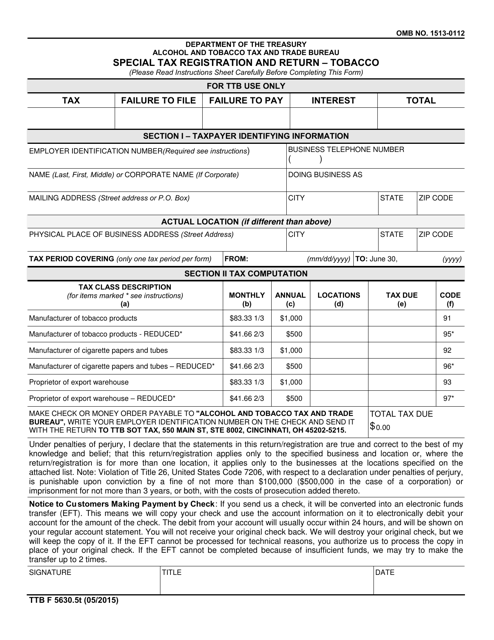

This form is used for special tax registration and return for tobacco products.

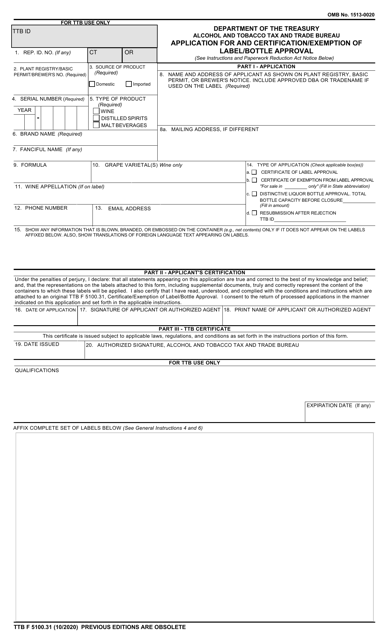

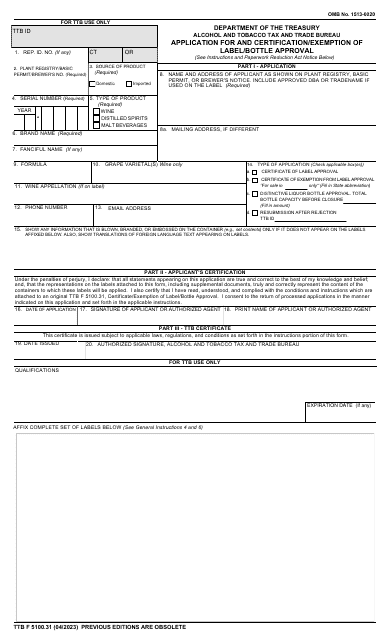

This form is used for applying for and certifying an exemption for label and bottle approval for alcohol products.

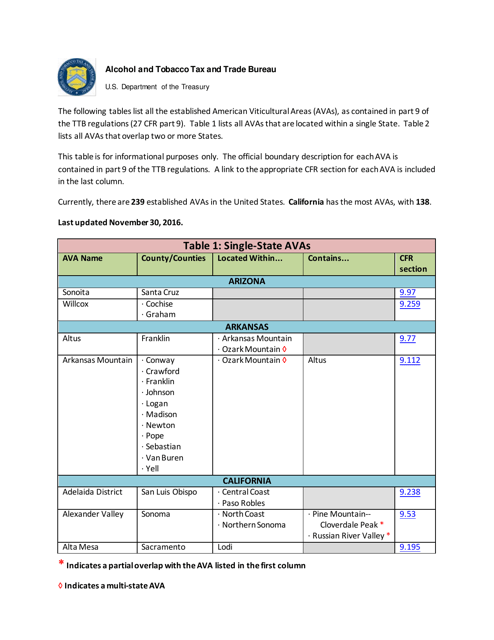

This document provides a list of officially recognized American Viticultural Areas (AVAs) in the United States. An AVA is a designated wine grape-growing region with distinct geographic and climatic features that contribute to unique wine characteristics.

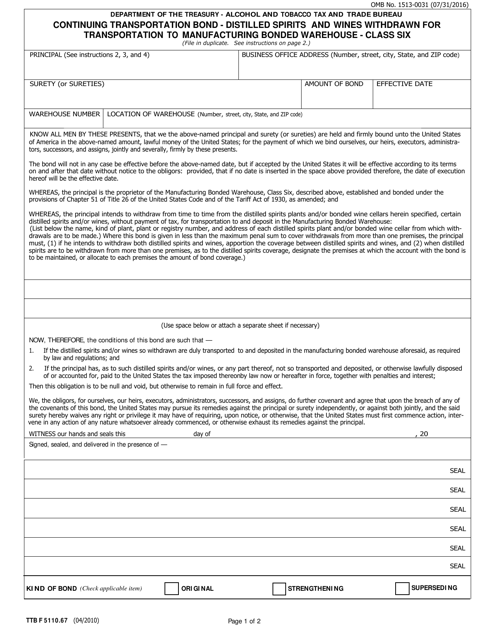

This form is used for continuing transportation bonds for distilled spirits and wines that are being withdrawn for transportation to a manufacturing bonded warehouse.

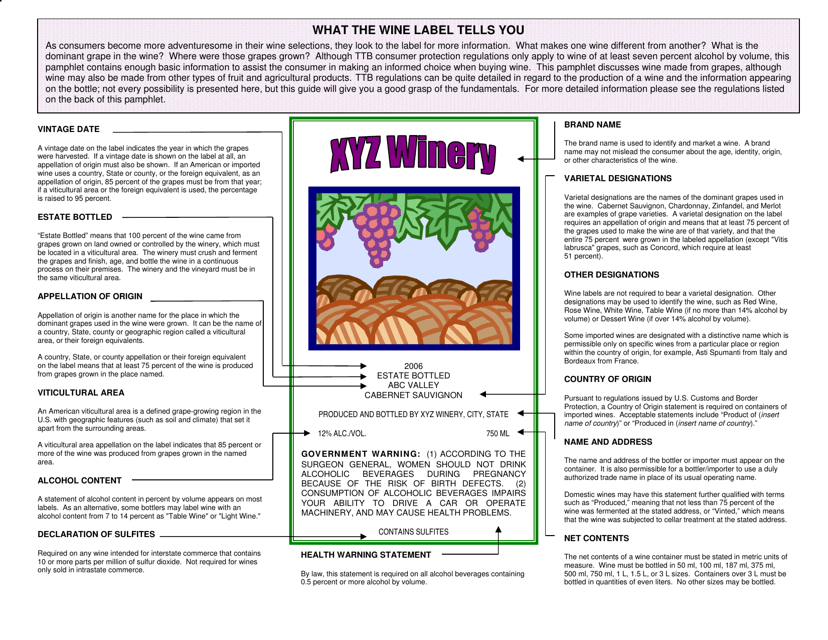

This type of document explains what information can be found on a wine label and what it tells you about the wine.

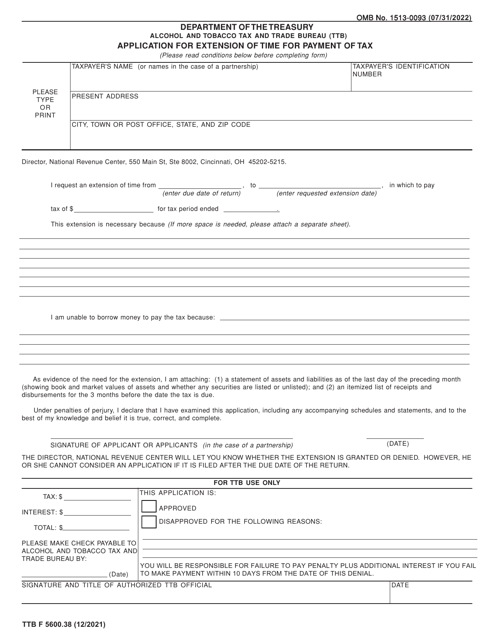

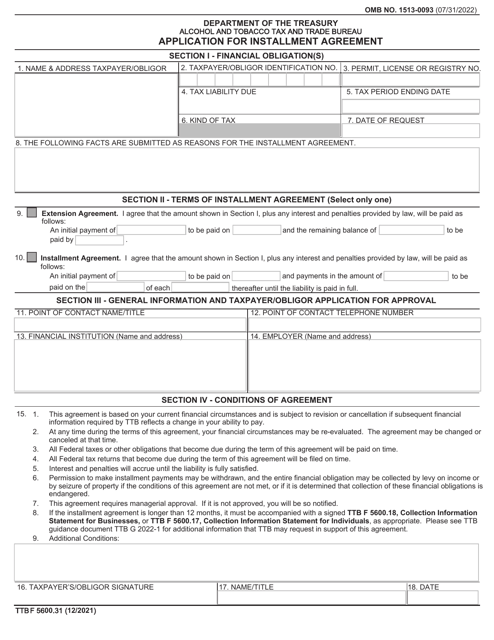

This Form is used for applying for an installment agreement with the Alcohol and Tobacco Tax and Trade Bureau (TTB). It is for businesses that owe excise taxes on alcohol, tobacco, and firearms and need to make payments in smaller, manageable installments.