U.S. Department of the Interior - Office of Natural Resources Revenue Forms

The U.S. Department of the Interior - Office of Natural Resources Revenue is responsible for the management and collection of revenue from natural resources on federal lands. They oversee the royalties, rents, and bonuses for the extraction of oil, gas, coal, and other minerals from public lands and offshore waters. Their main purpose is to ensure the fair and accurate collection of revenue from the use and development of natural resources in the United States.

Documents:

37

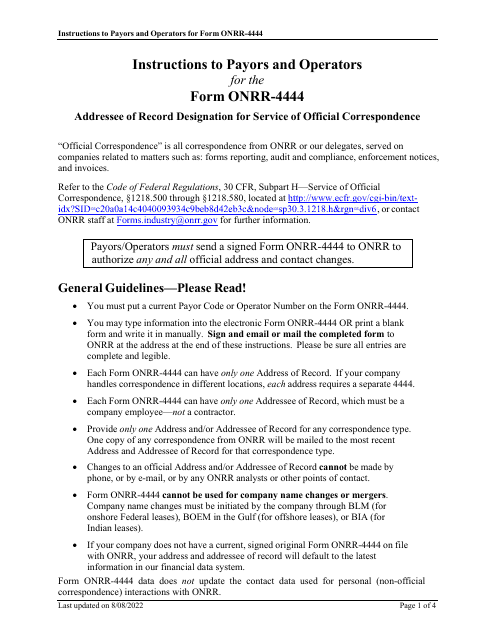

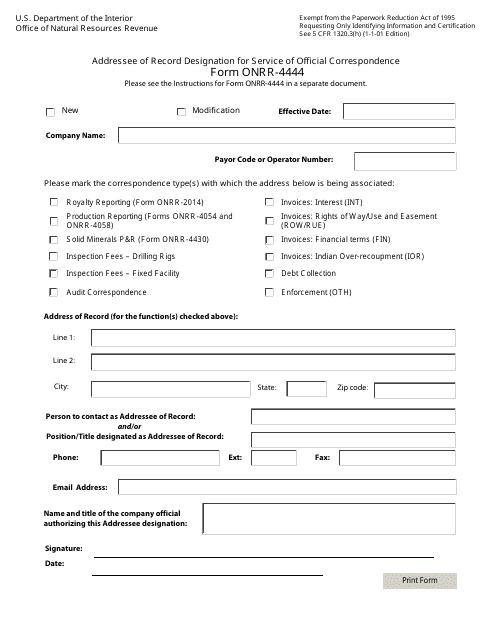

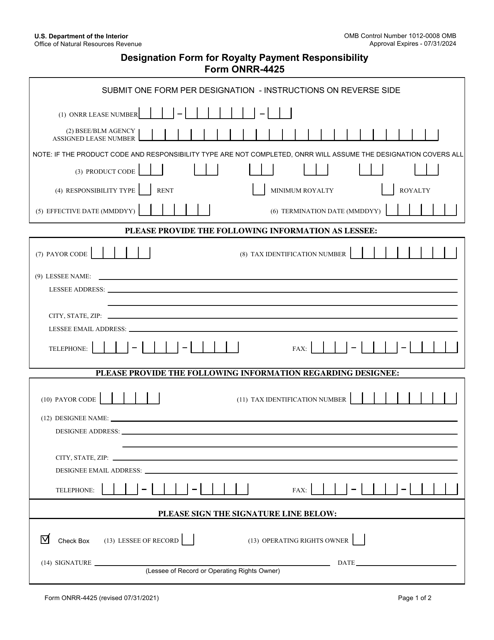

This form is used to designate an addressee for receiving official correspondence from ONRR.

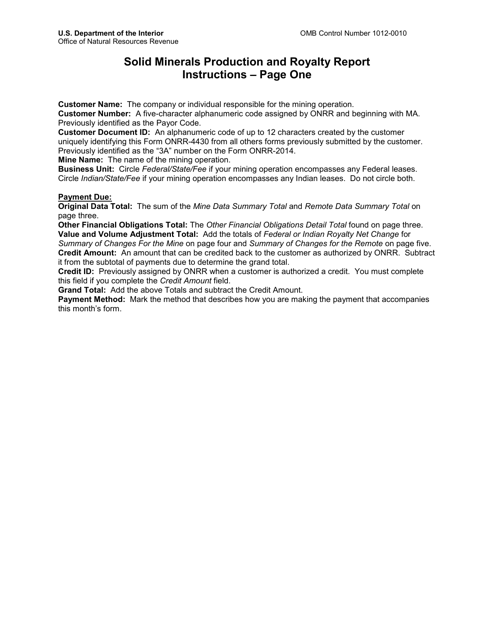

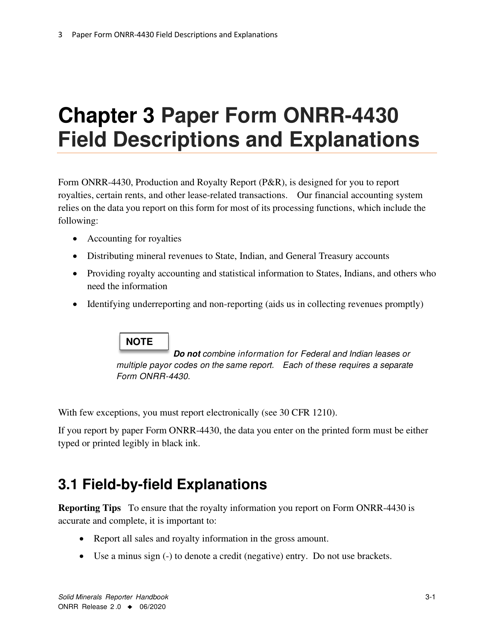

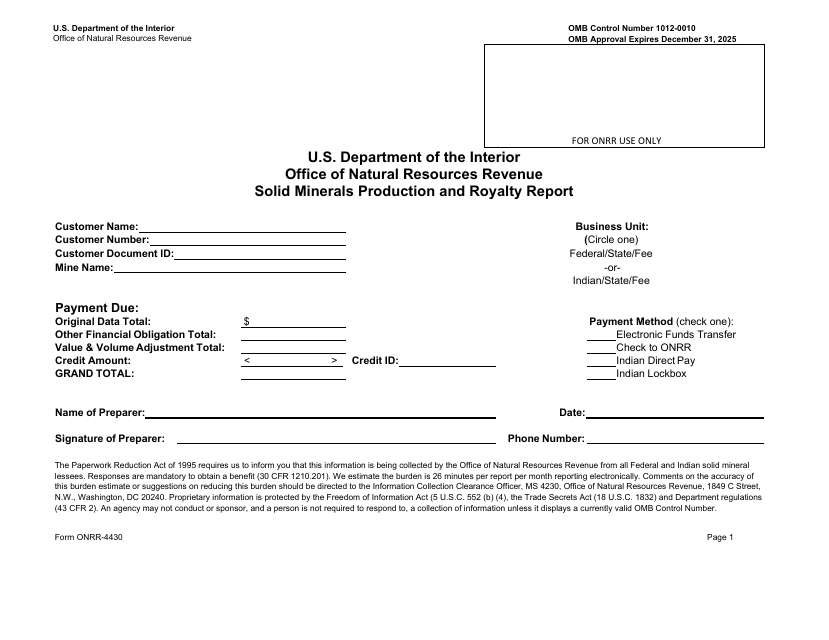

This Form is used for reporting solid minerals production and royalty information to the Office of Natural Resources Revenue (ONRR). It provides instructions on how to complete and submit the Form ONRR-4430.

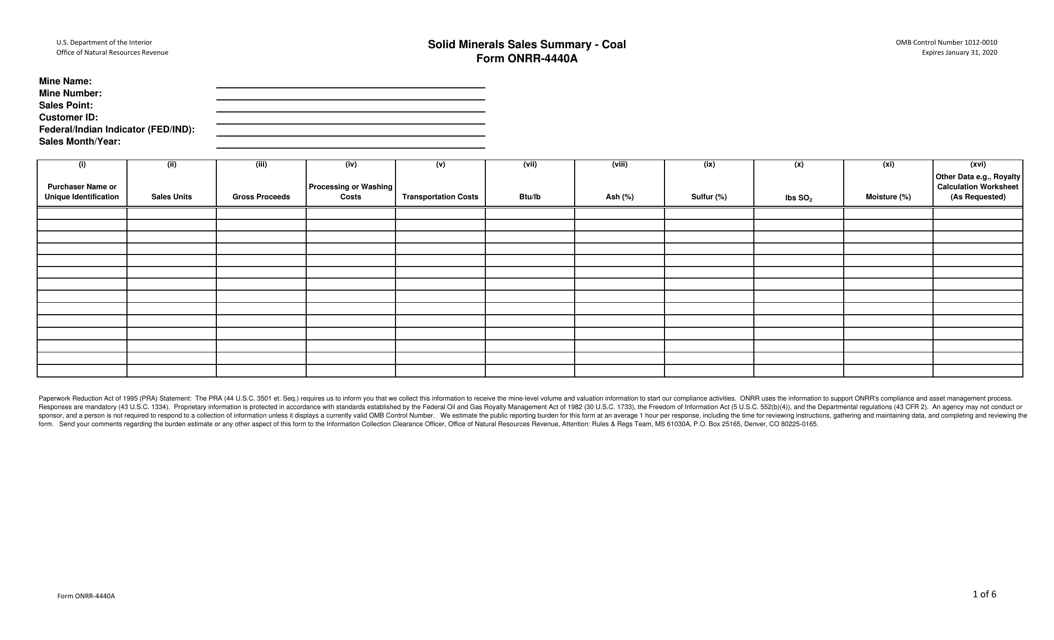

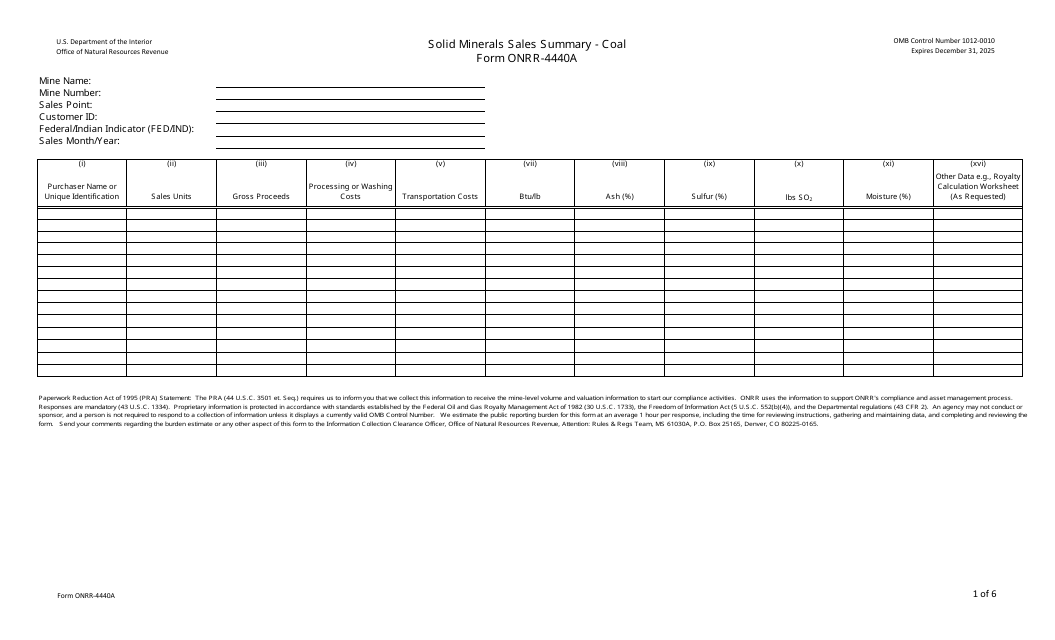

This Form is used for reporting and summarizing the sales of solid minerals.

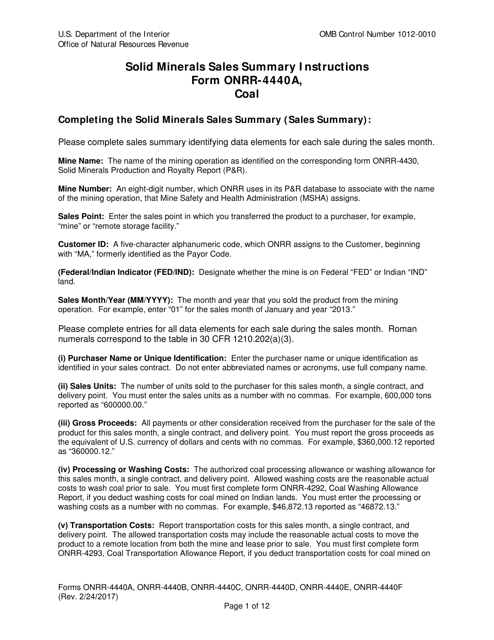

This form is used for reporting sales summary of solid minerals. It provides instructions on how to fill out Form ONRR-4440 and submit accurate information regarding the sales of minerals.

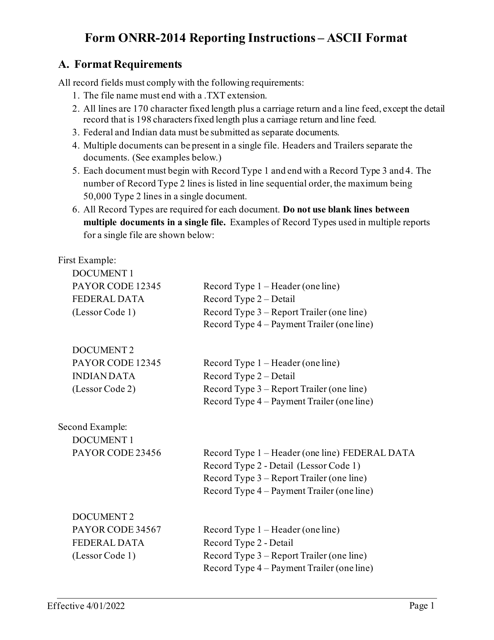

This Form is used for reporting and remitting sales and royalty payments in an Ascii format to the Office of Natural Resources Revenue (ONRR). It provides instructions on how to fill out the form and submit the required information.

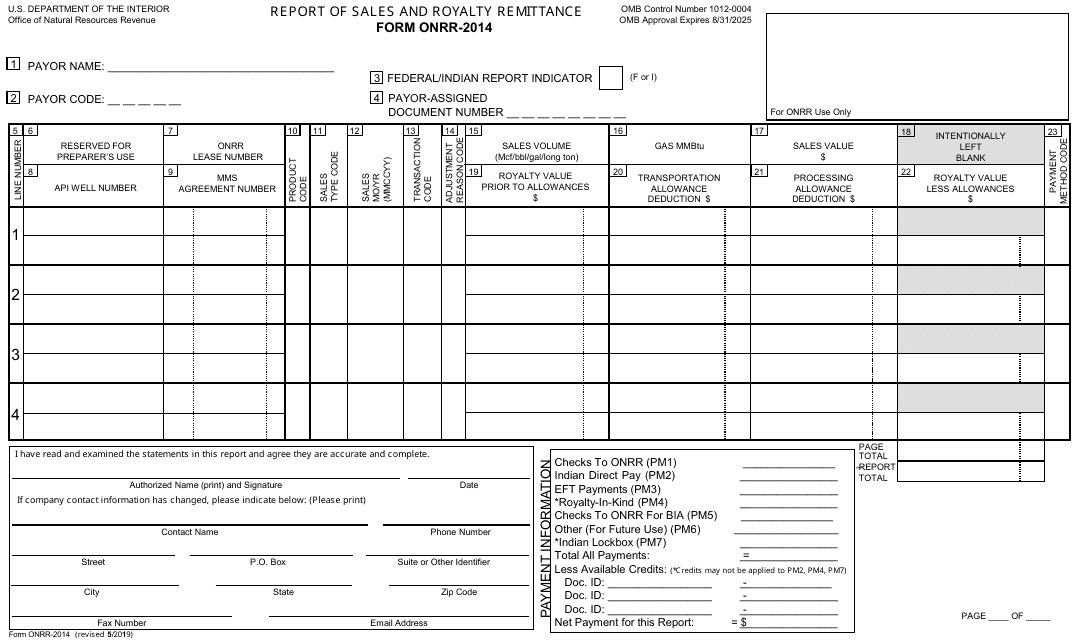

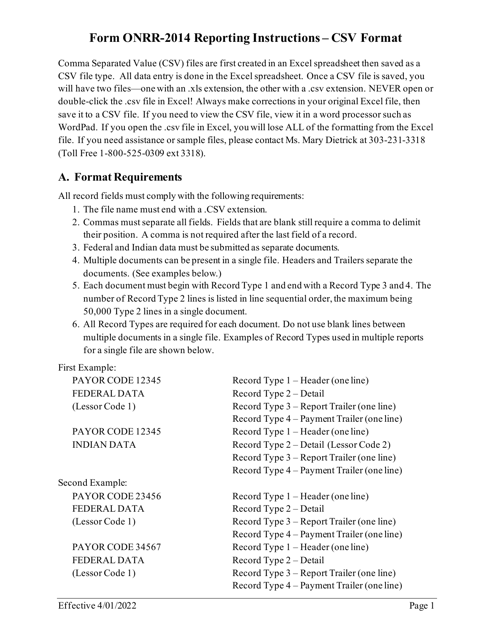

This document provides instructions for completing and submitting Form ONRR-2014, which is used for reporting sales and remitting royalties. It includes a layout guide for the CSV (comma-separated values) record format.

This Form is used for reporting solid minerals production and calculating royalties. It provides instructions on how to fill out the ONRR-4430 form accurately.

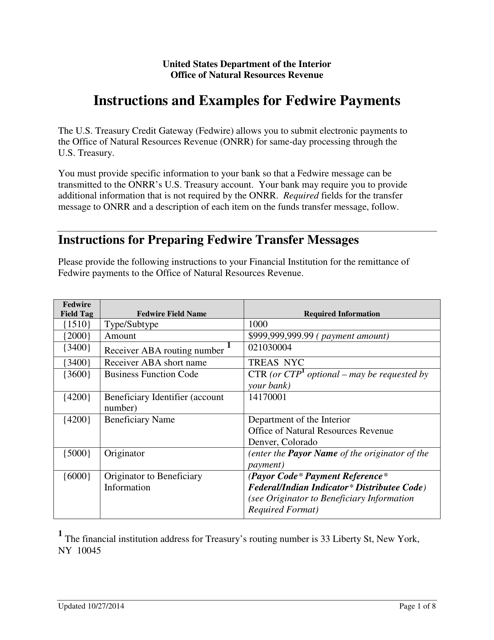

This document provides instructions and examples for making Fedwire payments. It offers guidance on how to complete the necessary forms and includes examples of different types of payment transactions.

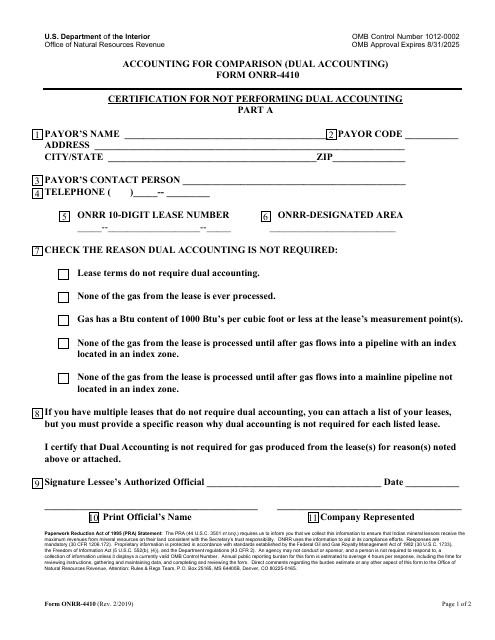

This form is used for accounting and comparison purposes, specifically for dual accounting.

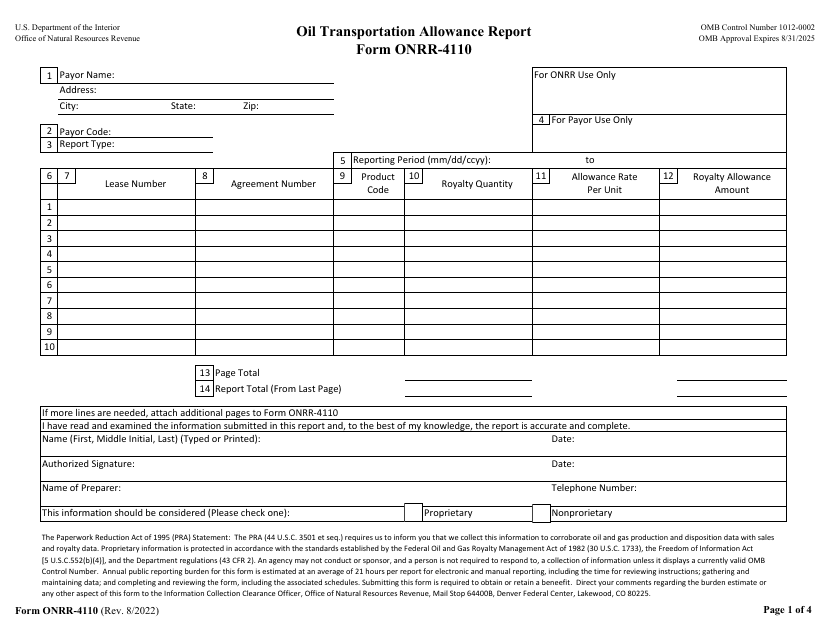

This form is used for reporting oil transportation allowances.

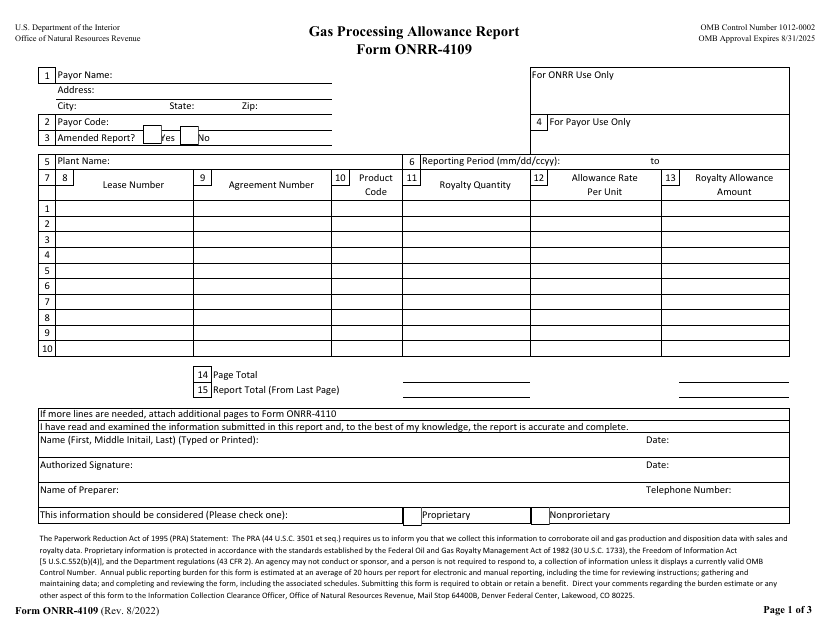

This form is used for reporting gas processing allowances related to the extraction of natural gas.

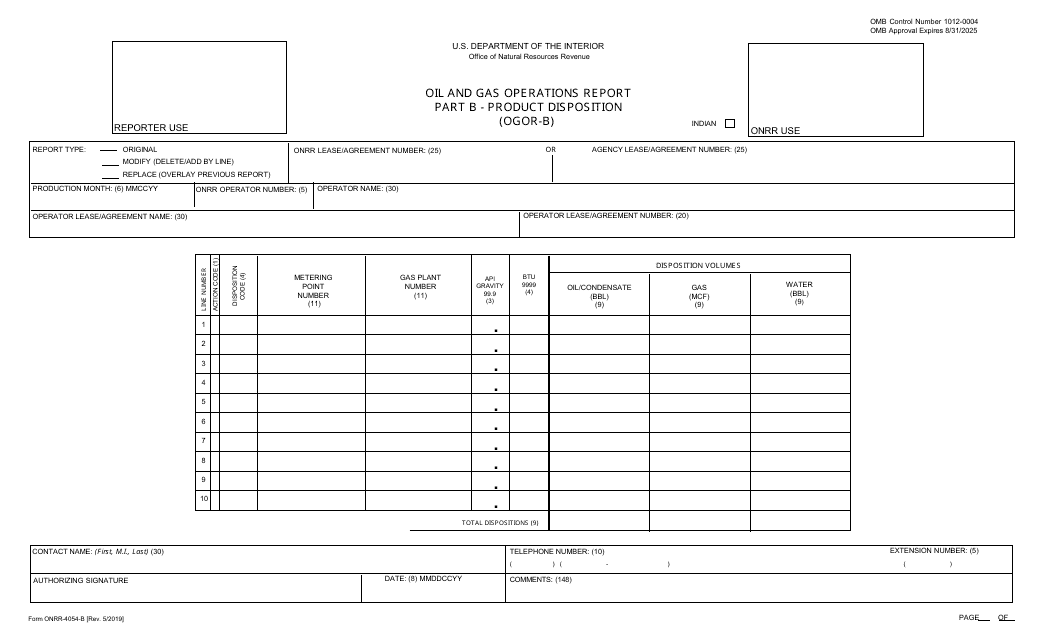

This document is used for reporting the disposition of oil and gas products in part B of the ONRR-4054 form for oil and gas operations.

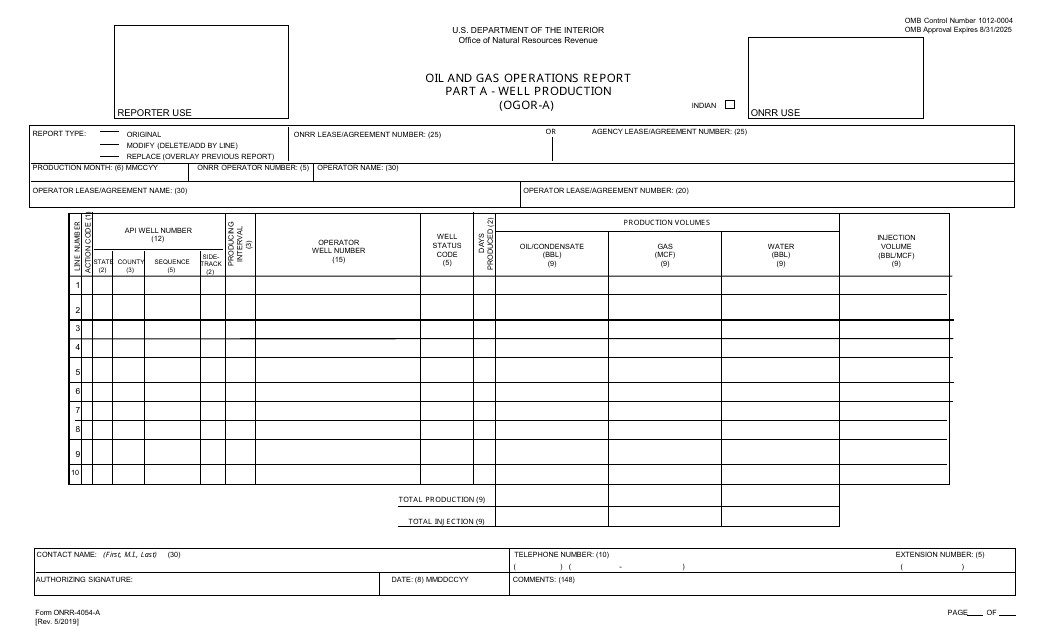

This Form is used for reporting well production data for oil and gas operations.

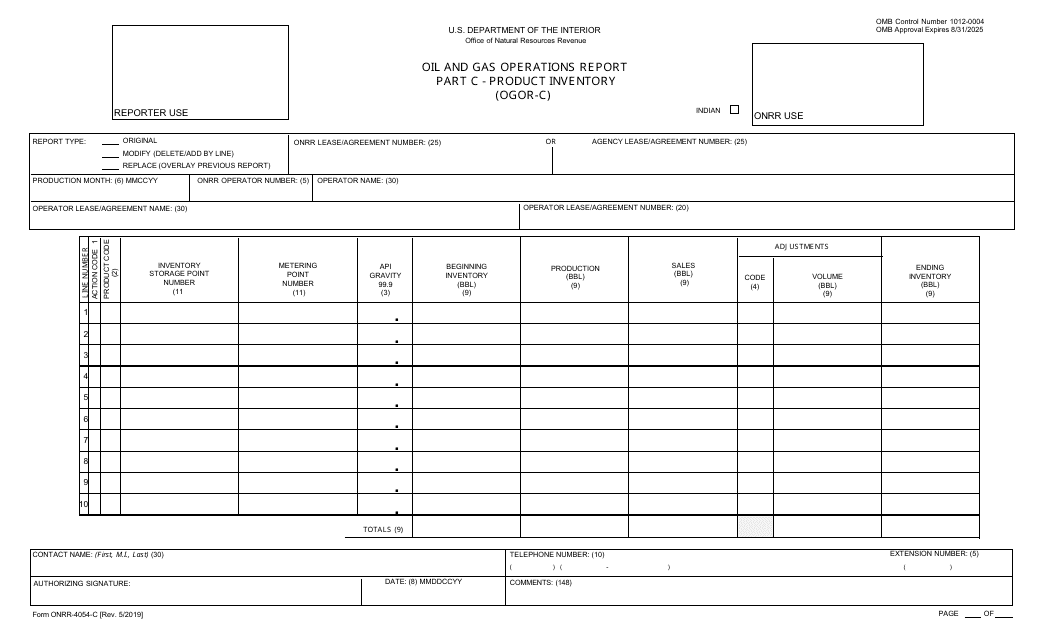

This form is used for reporting the inventory of oil and gas products in Part C of the ONRR-4054 form.

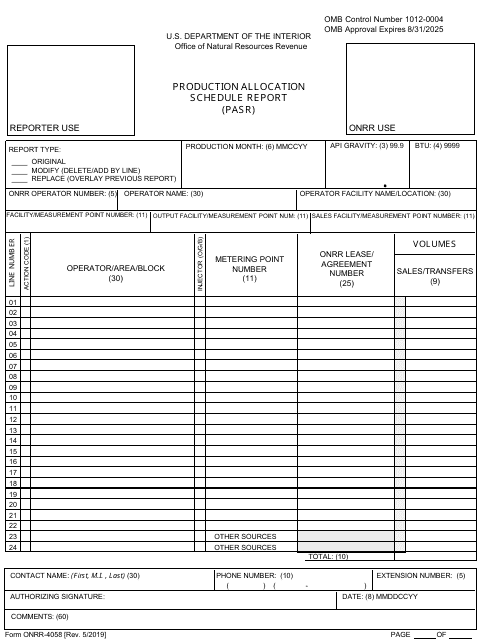

This Form is used for reporting production allocation schedules for revenue purposes.

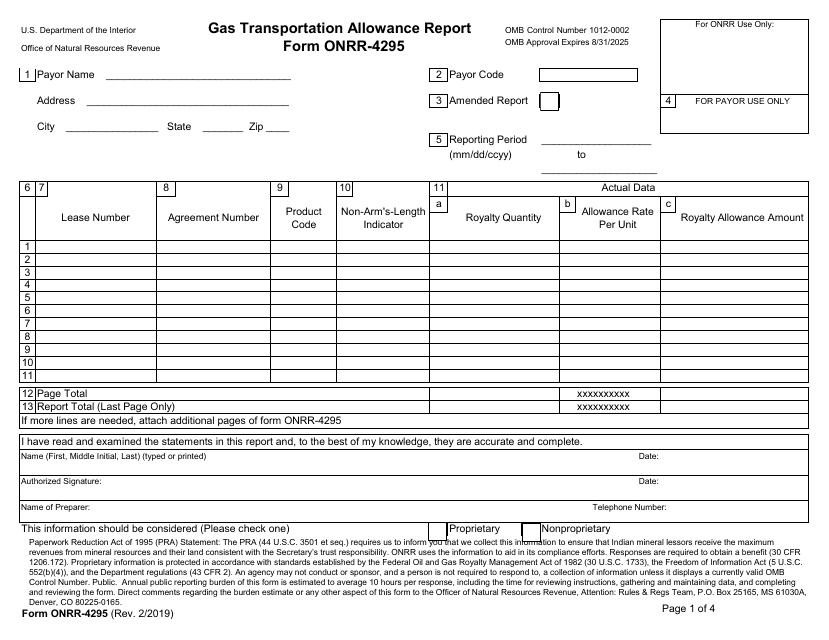

This form is used for reporting gas transportation allowances to the Office of Natural Resources Revenue (ONRR).

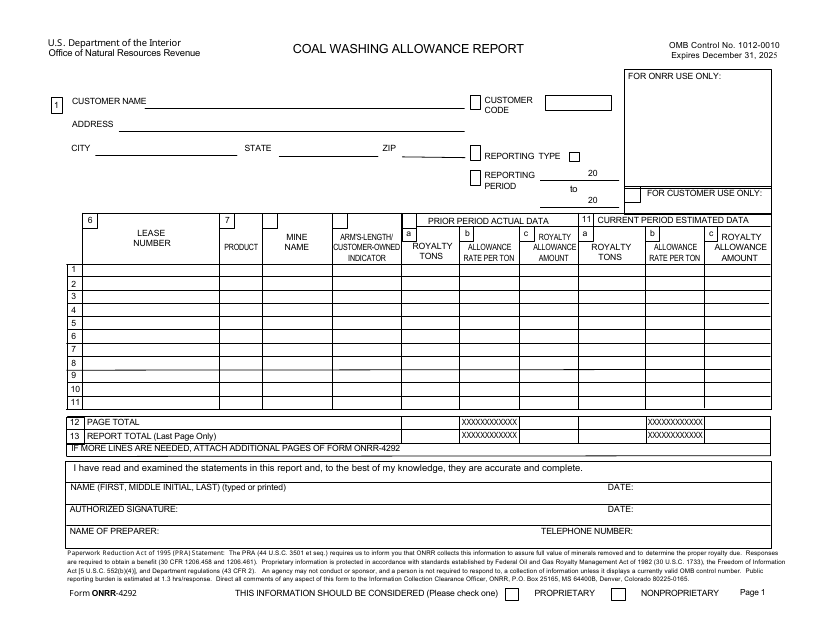

This form is used for reporting coal washing allowance in the United States.

This form is used for reporting and summarizing sales of solid minerals. It is specifically designed for the Office of Natural Resources Revenue (ONRR).

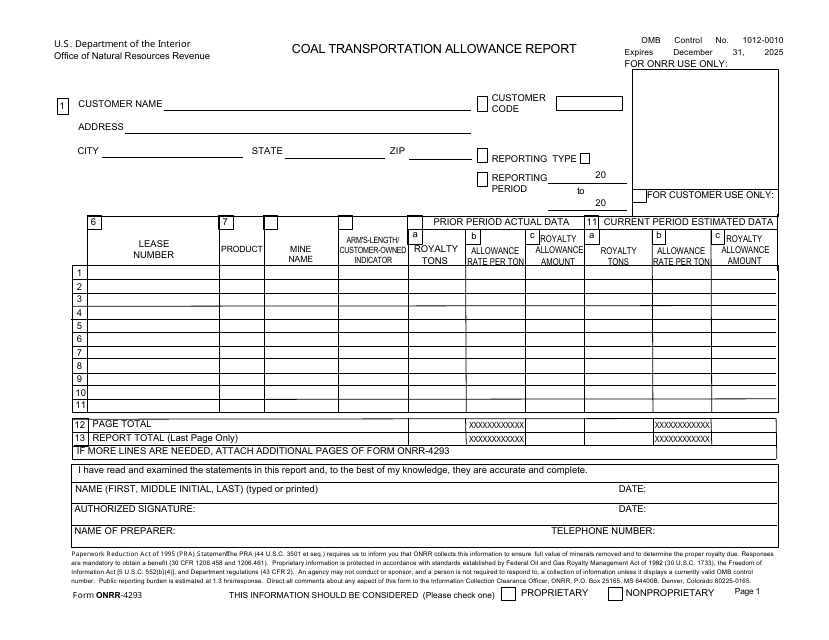

This Form is used for reporting the coal transportation allowance.

This Form is used for reporting and calculating production and royalty payments for solid minerals in the United States.