United Kingdom HM Revenue & Customs Forms

The United Kingdom HM Revenue & Customs (HMRC) is the government agency responsible for collecting taxes and administering various customs and excise duties in the United Kingdom. Their main role is to ensure that individuals and businesses comply with tax laws and regulations, and to collect the necessary funds for various public services and government initiatives. They also provide guidance and support to taxpayers, process tax returns, and investigate cases of tax evasion and fraud.

Documents:

43

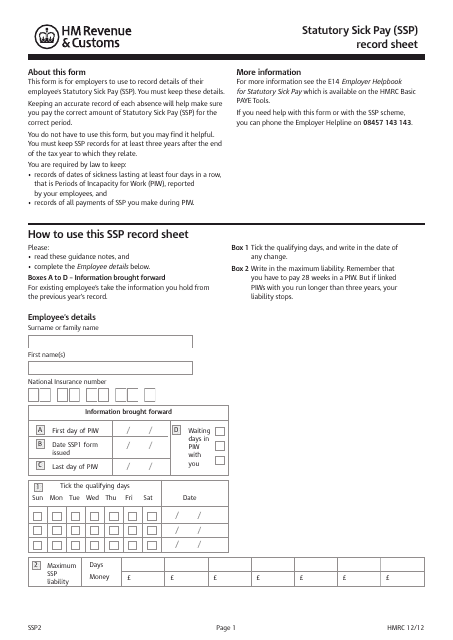

This form is used for keeping a record of Statutory Sick Pay (SSP) in the United Kingdom.

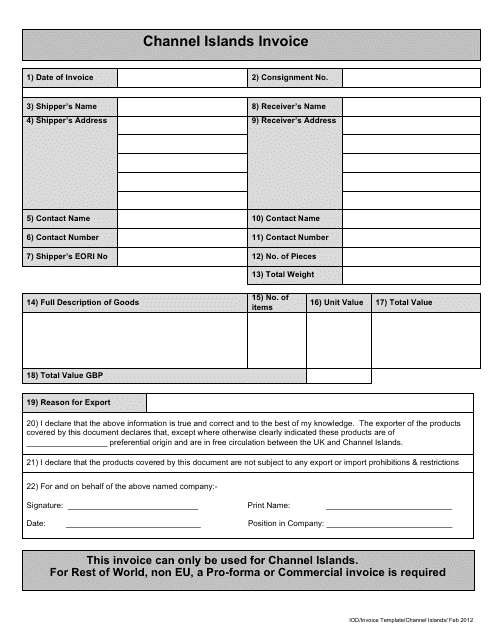

This document is an invoice template specifically designed for conducting business in the Channel Islands, which are located in the United Kingdom. It provides a standardized format for recording and requesting payment for goods or services sold.

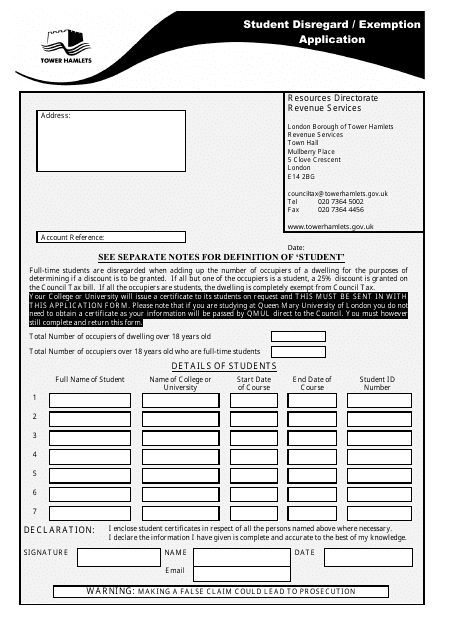

This type of document is used for students to apply for exemptions or request disregard from certain requirements in the London Borough of Tower Hamlets, United Kingdom.

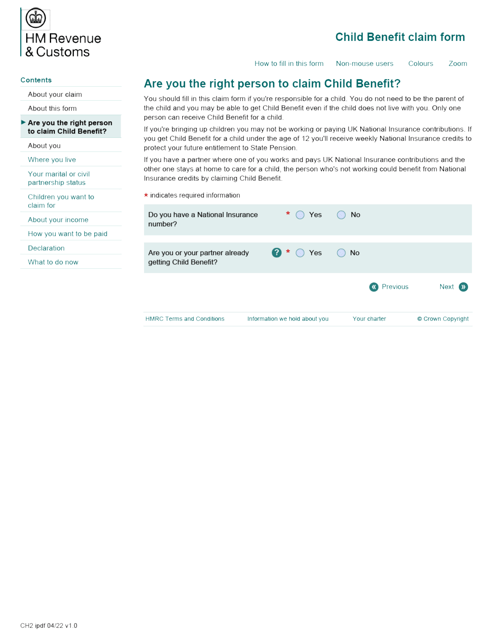

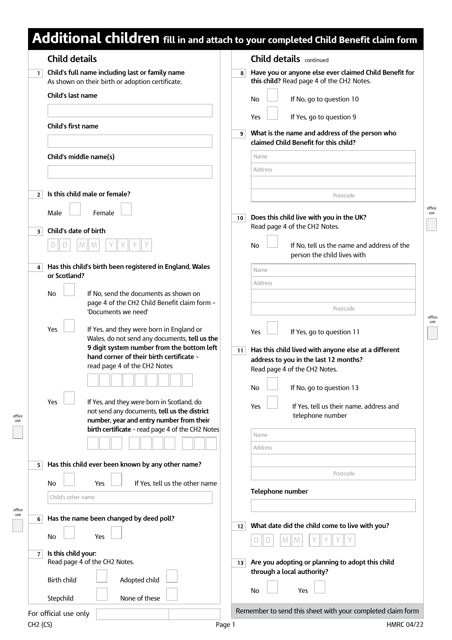

The parent or future adoptive parent of a child may use this form to request a Child Tax Benefit.

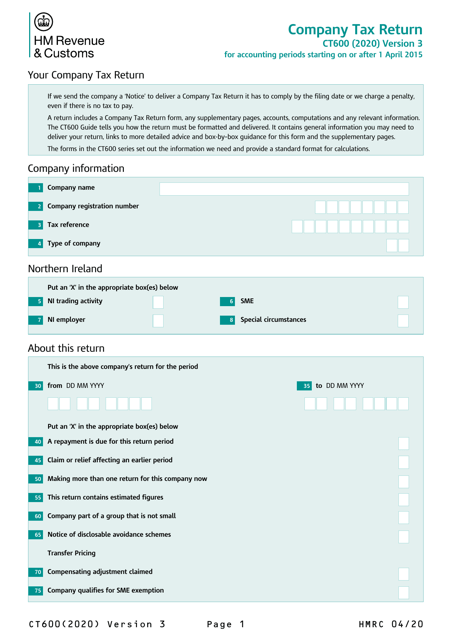

Certain businesses based in the UK may use this form when they are required to submit a corporation tax return.

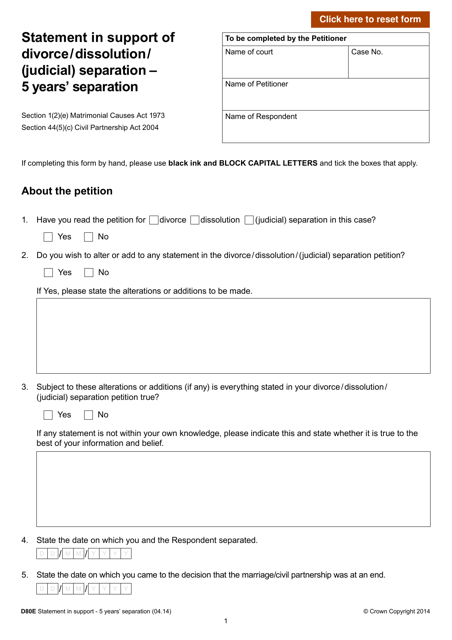

This Form is used for providing a statement in support of divorce, dissolution or judicial separation in the United Kingdom based on 5 years' separation.

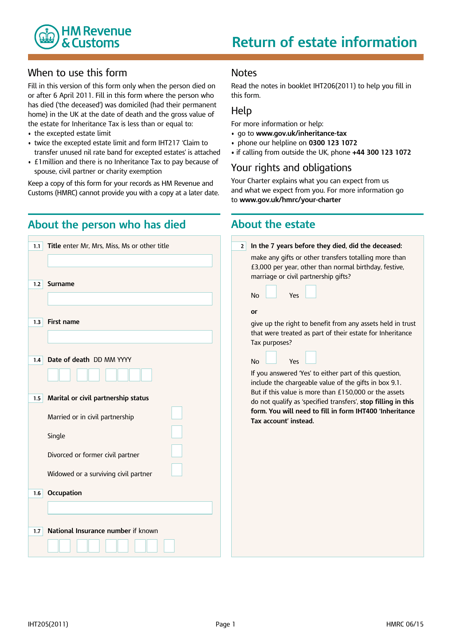

Individuals may prepare this supplemental document when they file an application for a grant of probate or a grant of letters of administration and have to confirm there is no inheritance tax due on the estate.

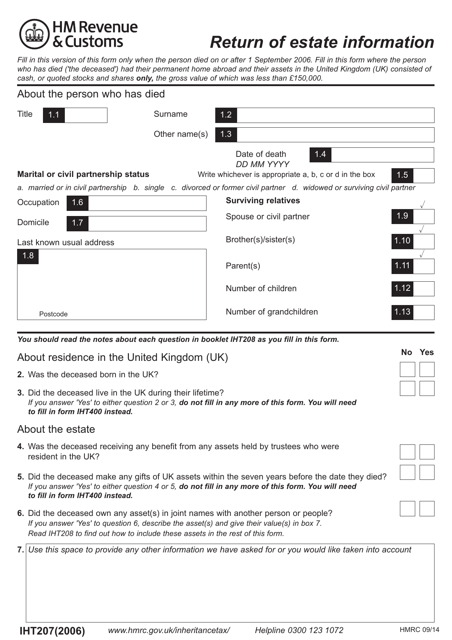

This form needs to be completed when a resident or citizen of the United Kingdom has passed away and their surviving relatives need to calculate the total assets left behind.

This is an outdated document that was completed for new employees to find out the correct amount of income tax to withhold.

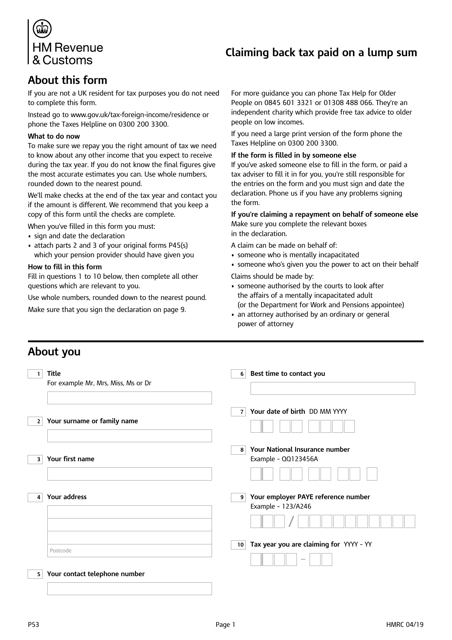

Individuals that reside in the United Kingdom may use this form when they want to claim back tax the government owes them on a lump sum they have obtained.

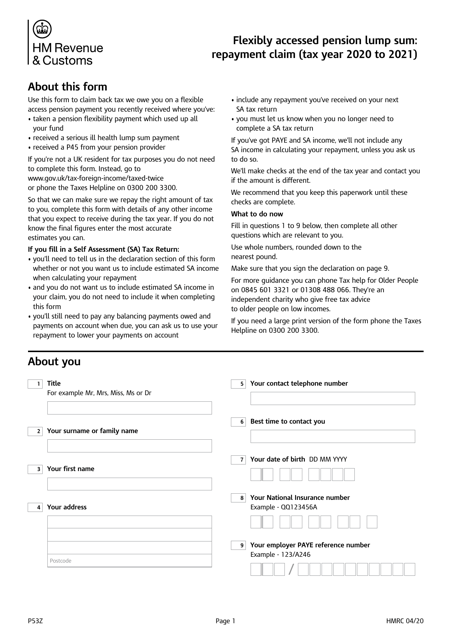

Individuals can complete this form to request that the government repay them the tax owed after a flexible pension payment was obtained.

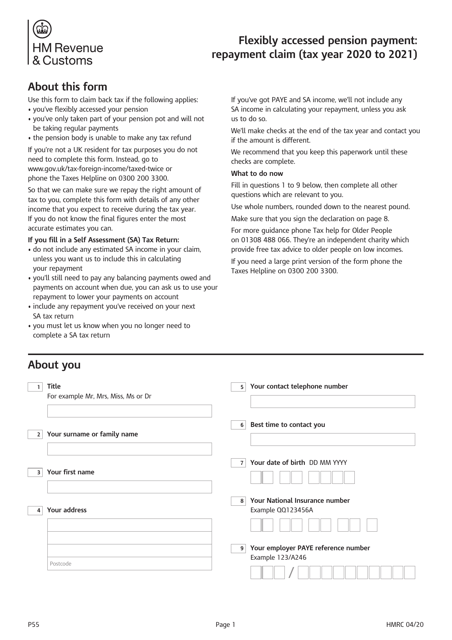

Form P55 Flexibly Accessed Pension Payment: Repayment Claim (Tax Year 2020 to 2021) - United Kingdom

This an official form that retired individuals can use to request the government to pay them back the tax they are owed.

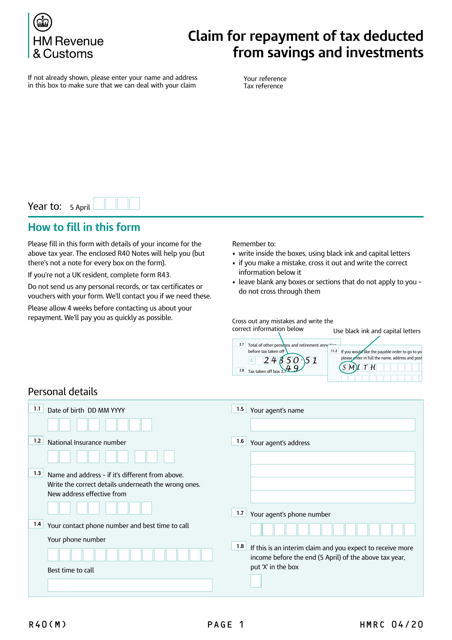

This is a document that may be used when an individual wants to claim a repayment of tax on their savings interest.

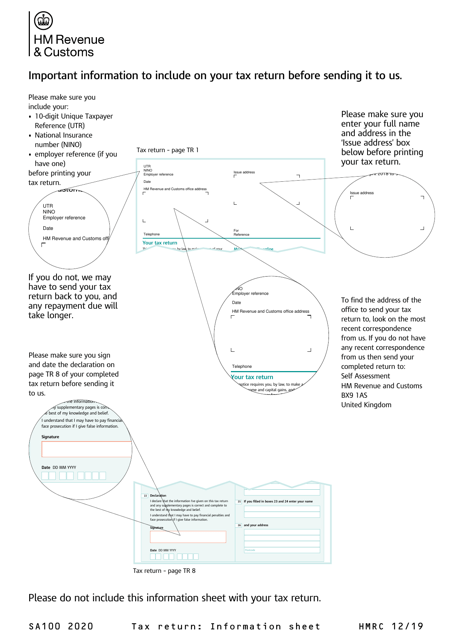

This form is used for reporting income, loan repayments, pensions, annuities, charitable contributions, and tax allowances.

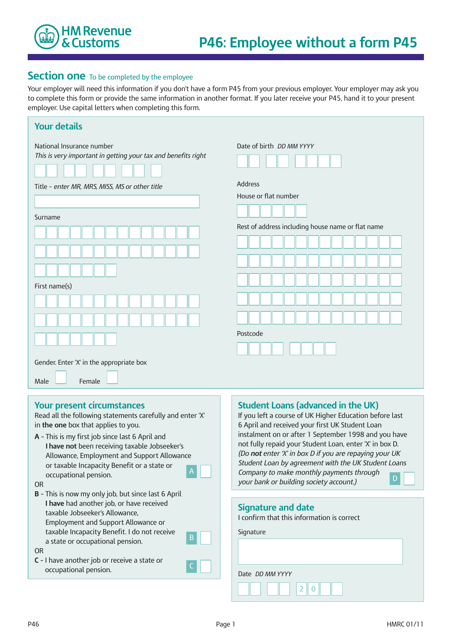

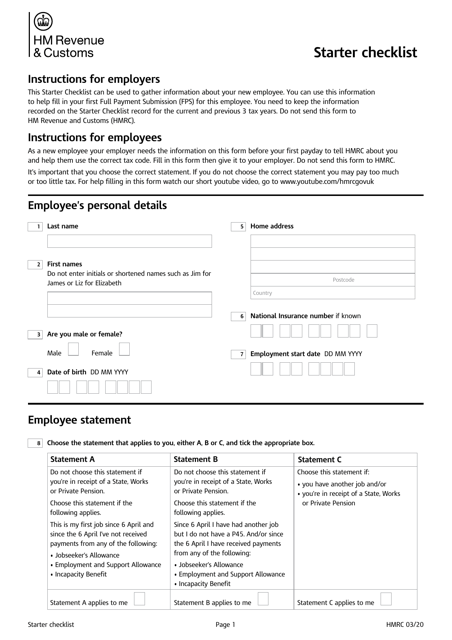

Employers may use this form to collect information about their employees, their previous employment, and the pension and benefits they are entitled to.

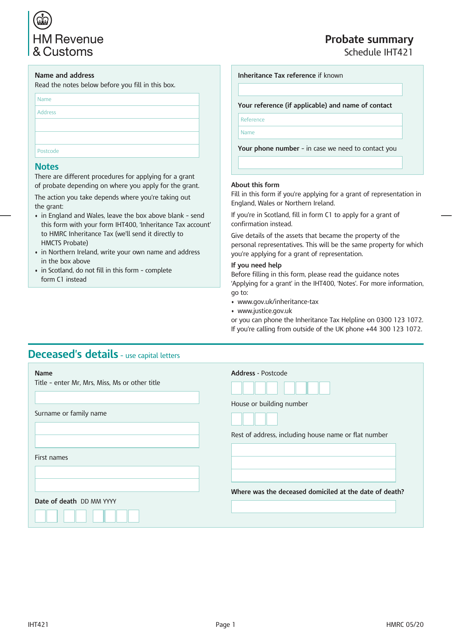

This form allows people responsible for the estates of deceased individuals to confirm the monetary value of those estates and apply for a grant of representation.

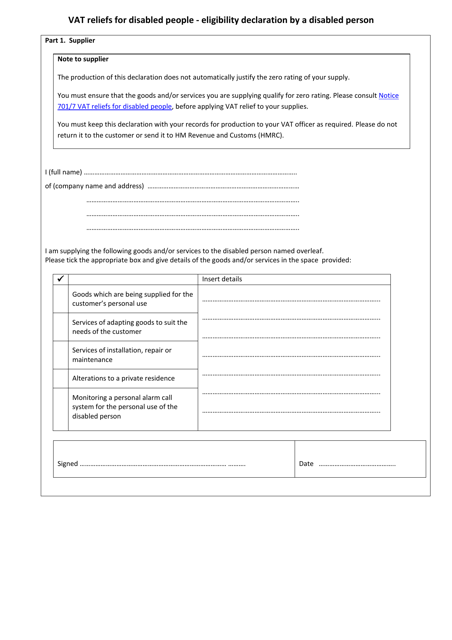

Eligible disabled individuals may use this form to certify they do not have to pay the usual Value Added Tax (VAT) on goods and services they purchase for their personal or domestic needs.

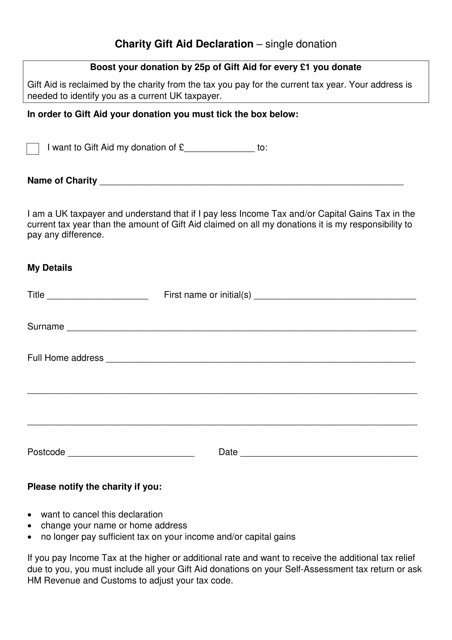

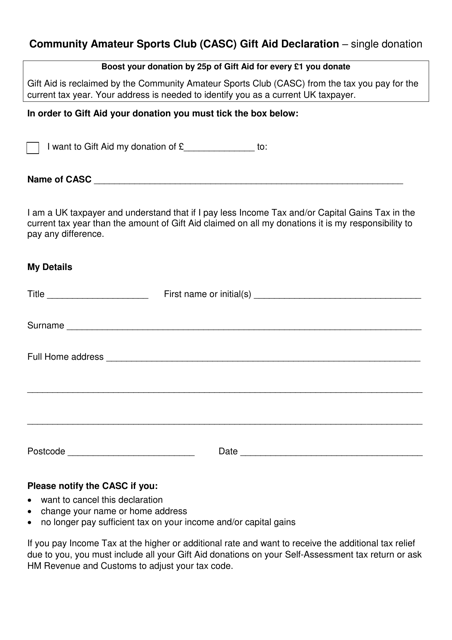

This Form is used for making a single donation to a charity in the United Kingdom and declaring to gift aid the donation.

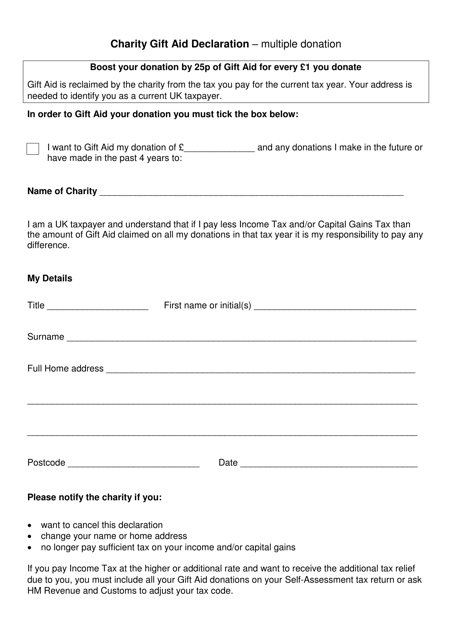

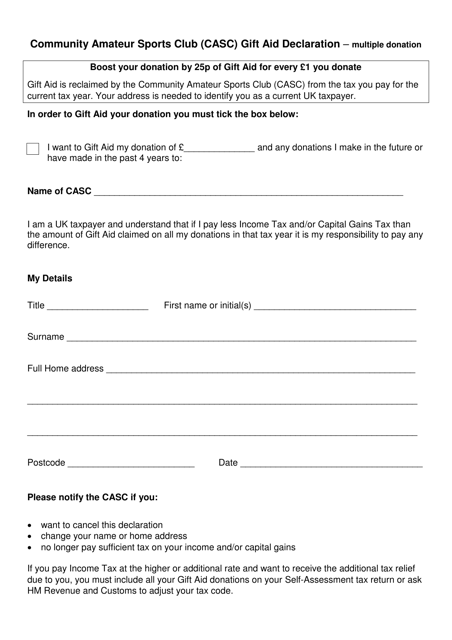

This document is used for multiple donations in the United Kingdom to declare Gift Aid and maximize the value of charitable contributions.

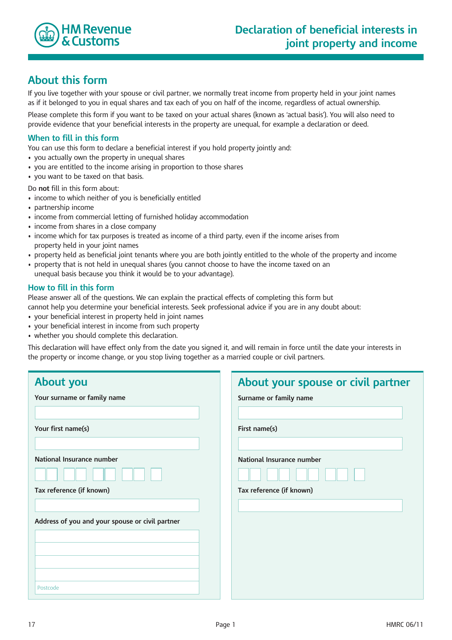

The purpose of this declaration is to inform the appropriate government authority that joint owners would like to change the portion of the income from their property for tax purposes.

If you are a national of the United Kingdom and are going to work in a foreign country within the European Economic Area, this form may be used to decide which country's legislation will be applied to your social security.

British individuals may use this form when they wish to get confirmation of their National Insurance number or inform the government about a change to their personal information.

This document is a gift aid declaration specifically for single donations made to a Community Amateur Sports Club (CASC) in the United Kingdom. It enables the CASC to claim gift aid on the donation, which provides financial benefits to the club.

This document is used for making multiple donations to a Community Amateur Sports Club (CASC) in the United Kingdom and includes a Gift Aid declaration.

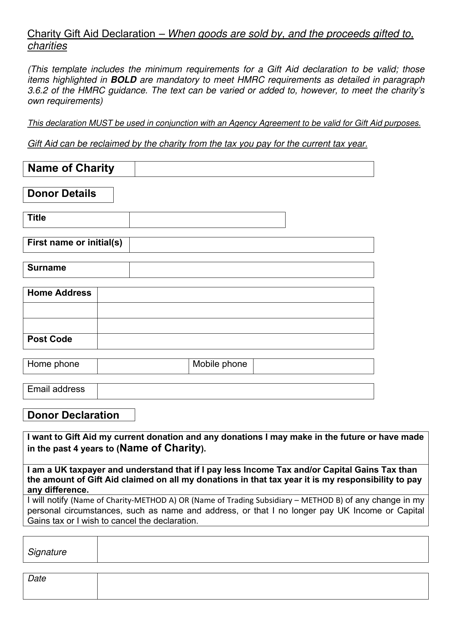

This Form is used for declaring gift aid when selling goods and donating the proceeds to charities in the United Kingdom.

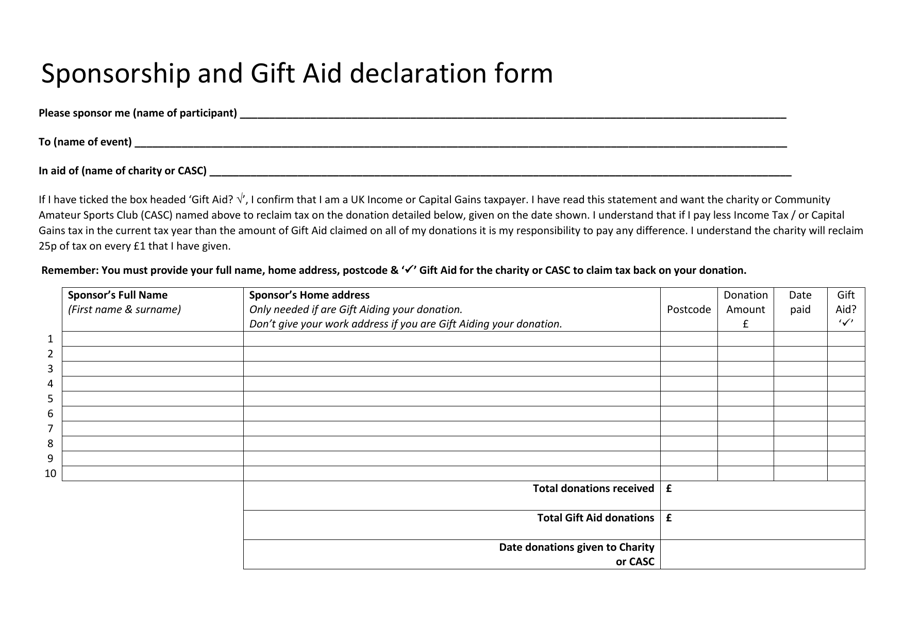

This document is used in the United Kingdom for declaring sponsorship and gift aid. It allows individuals to declare their sponsorship and provide consent to claim gift aid on their donations.

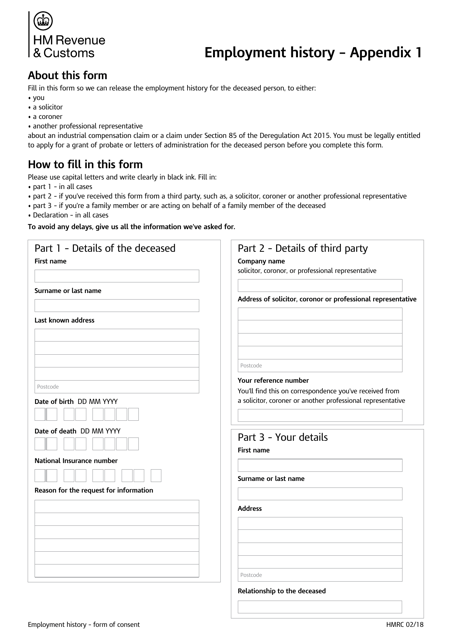

This document is for recording employment history in the United Kingdom.

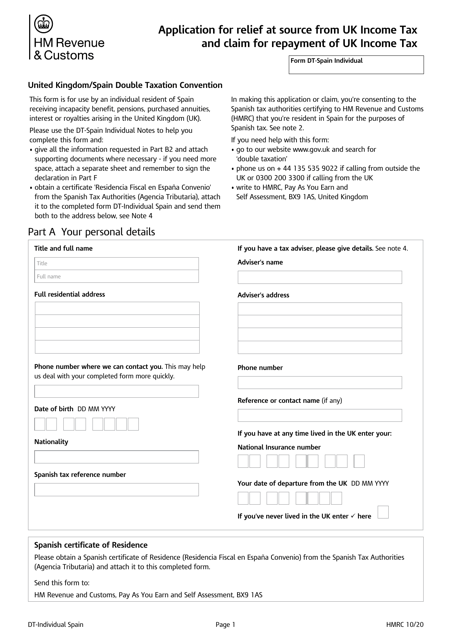

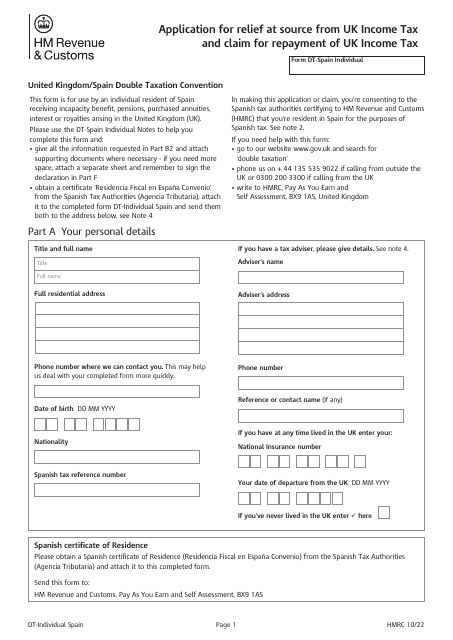

This form is used by individuals residing in Spain to apply for relief at source from UK income tax and claim for repayment of UK income tax.

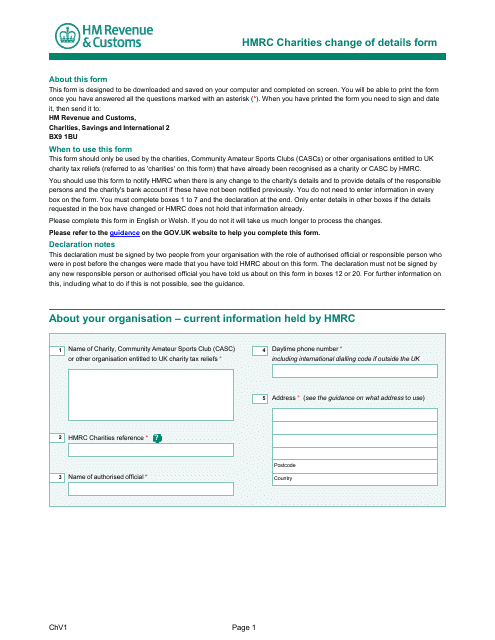

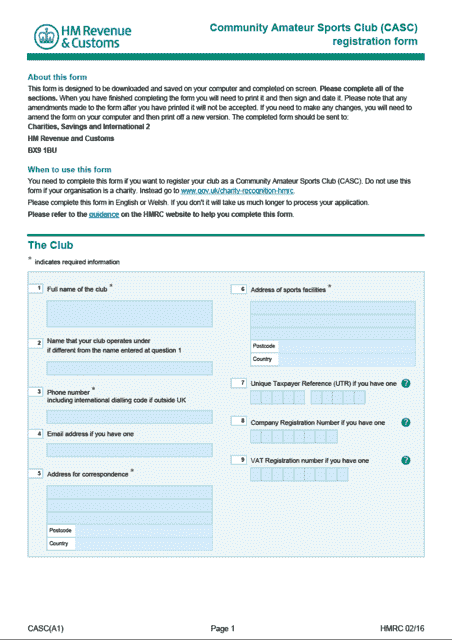

This document is used for registering a Community Amateur Sports Club (CASC) in the United Kingdom. It is a form that must be filled out to establish the club's legal status and eligibility for certain tax benefits.

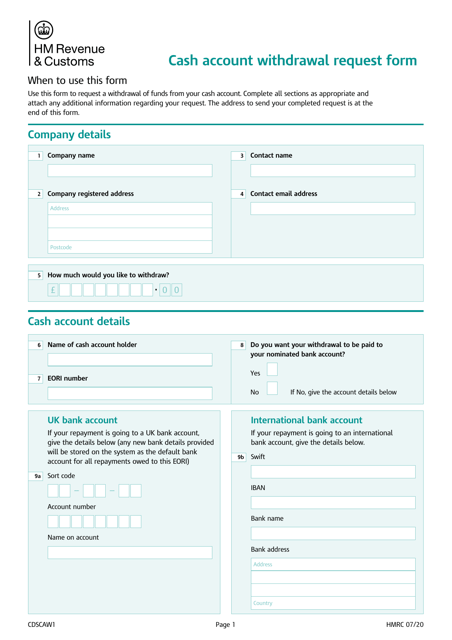

This document is a Cash Account Withdrawal Request Form used in the United Kingdom.

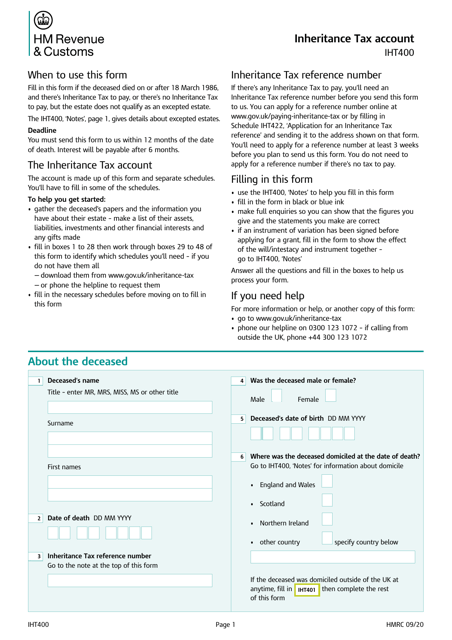

This form is used for filing an Inheritance Tax Account in the United Kingdom. It is a document that needs to be completed by individuals who are responsible for administering a deceased person's estate.

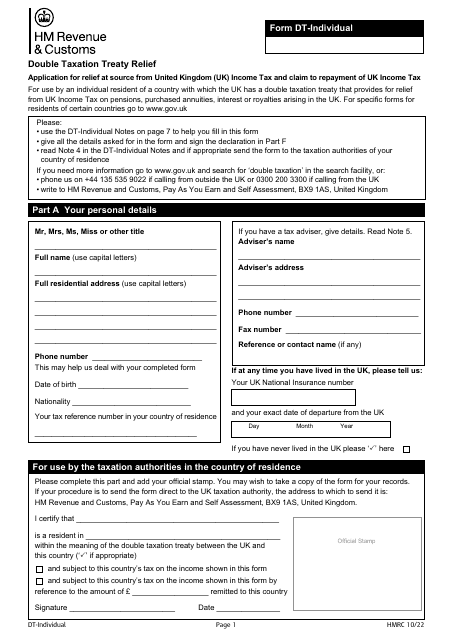

This document is for individuals in Spain who want to apply for relief at source from UK income tax and claim a repayment of UK income tax.