Berkheimer Tax Administrator Forms

Berkheimer Tax Administrator is a tax collection agency that administers local taxes for various municipalities in Pennsylvania. They are responsible for collecting and processing local income taxes, earned income taxes, local services taxes, and other local taxes for residents and businesses in these municipalities.

Documents:

48

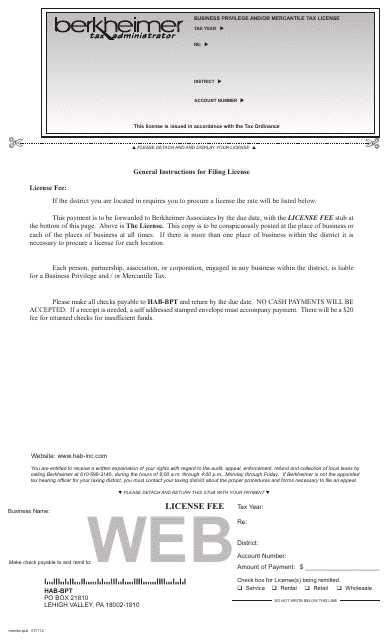

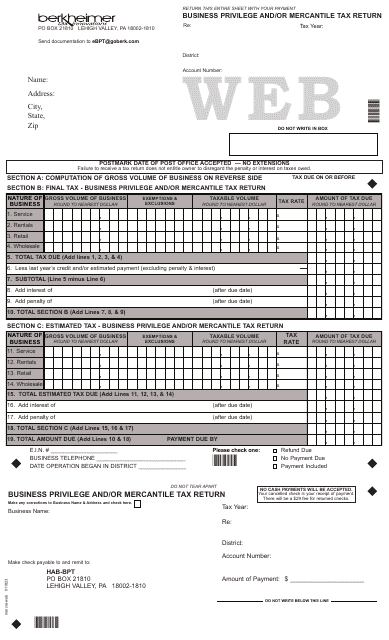

This form is used for obtaining a Business Privilege and/or Mercantile Tax License in the Lehigh Valley, Pennsylvania.

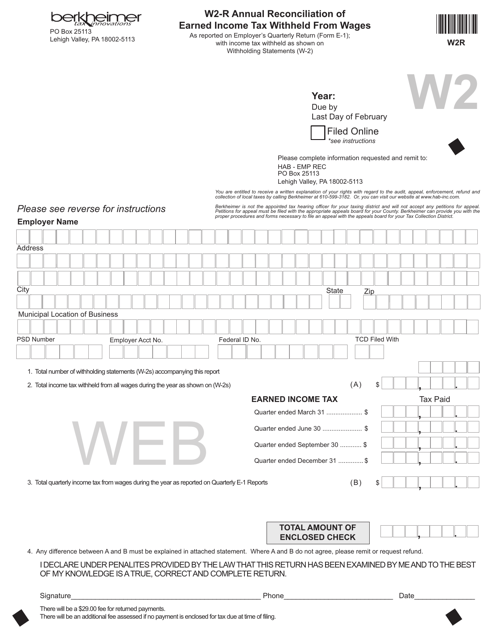

This document is used for reconciling the amount of income tax withheld from wages in Pennsylvania on an annual basis.

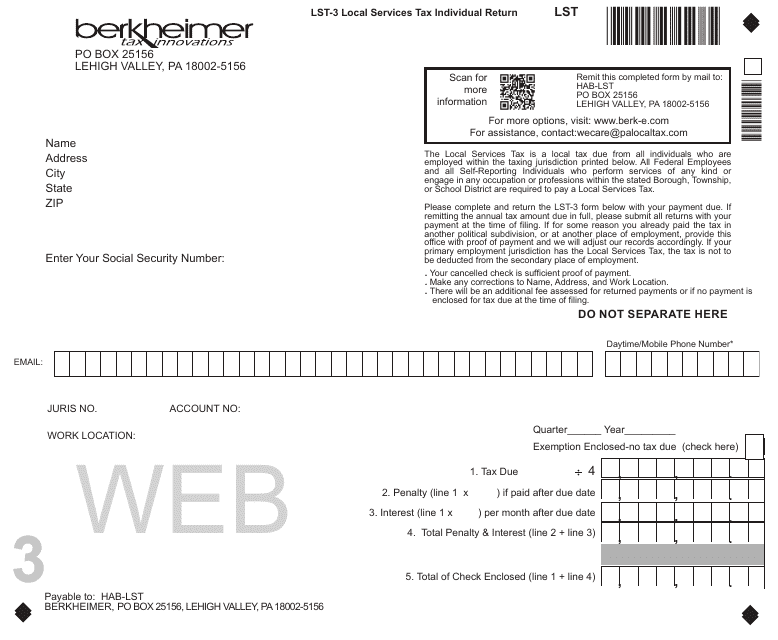

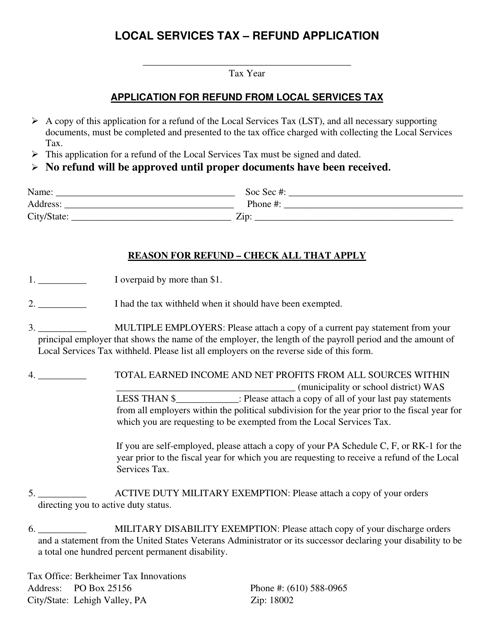

This form is used for applying for a refund of the Local Services Tax in Pennsylvania.

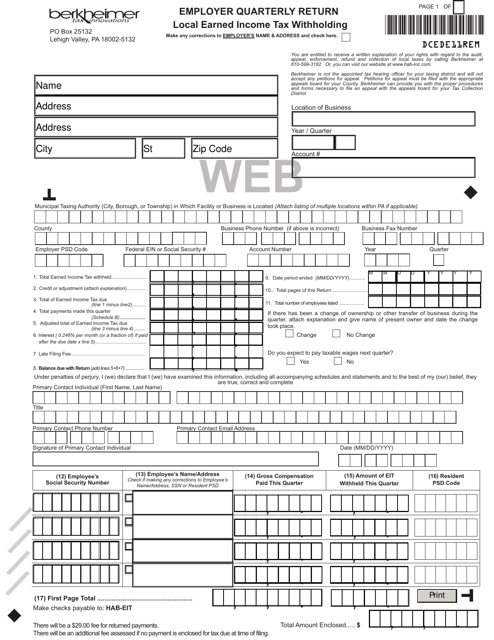

This form is used for reporting quarterly earned income tax withholding for employers in the state of Pennsylvania.

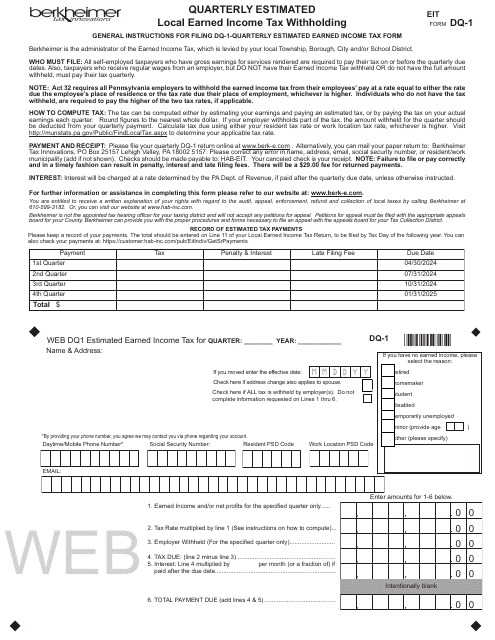

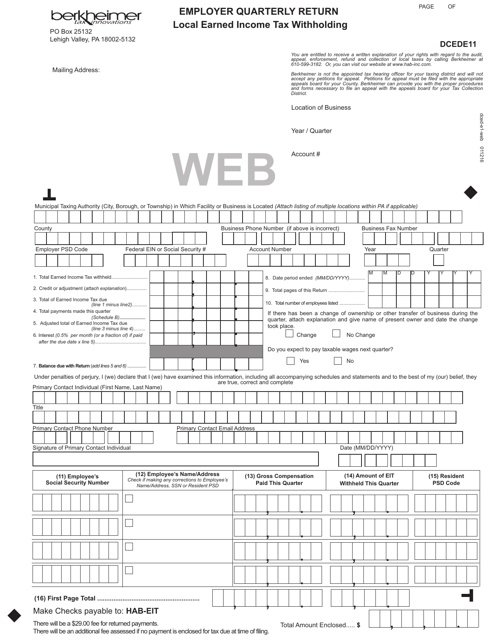

This form is used for reporting local earned income tax withholding and is required by employers in Pennsylvania on a quarterly basis.

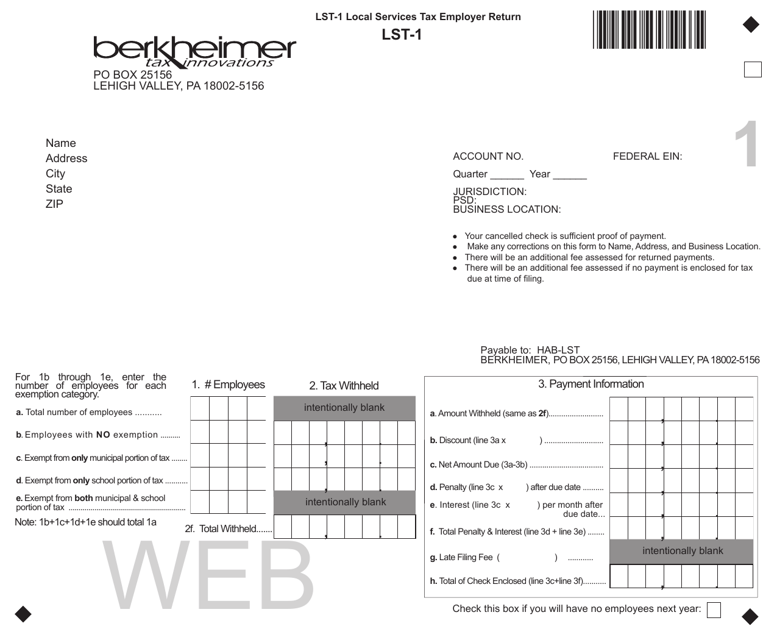

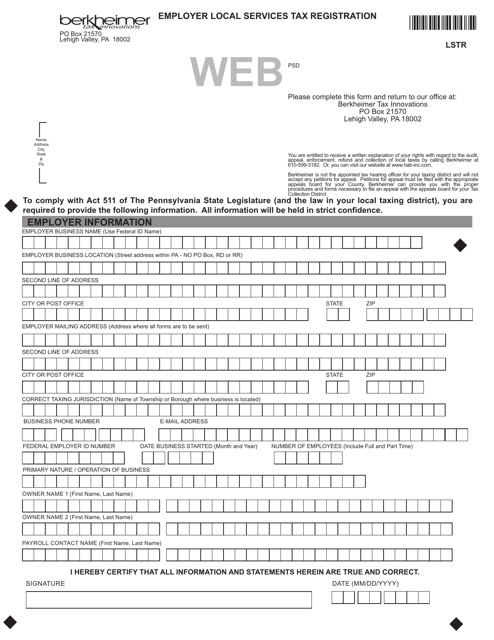

This form is used for employers in Pennsylvania to register for the Local Services Tax.

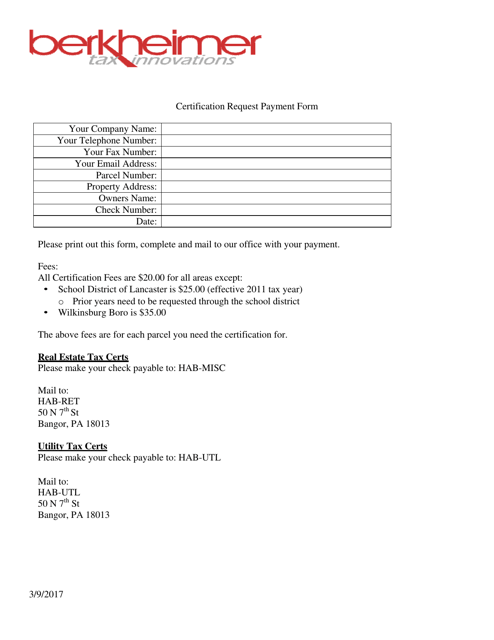

This form is used for submitting payment for a certification request in Pennsylvania.

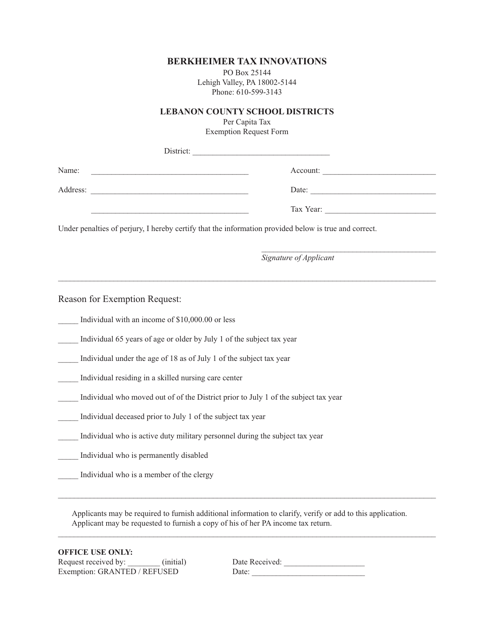

This form is used for requesting a tax exemption for per capita taxes in the Lebanon County School Districts in Pennsylvania.

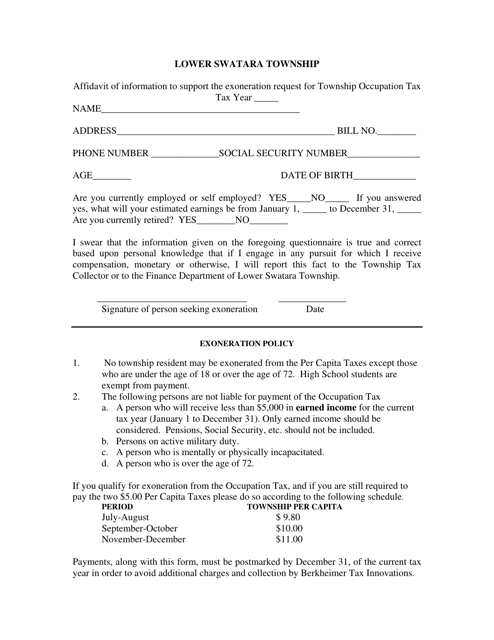

This document is used to provide information supporting a request to be exempt from the Township Occupation Tax in Lower Swatara Township, Pennsylvania.

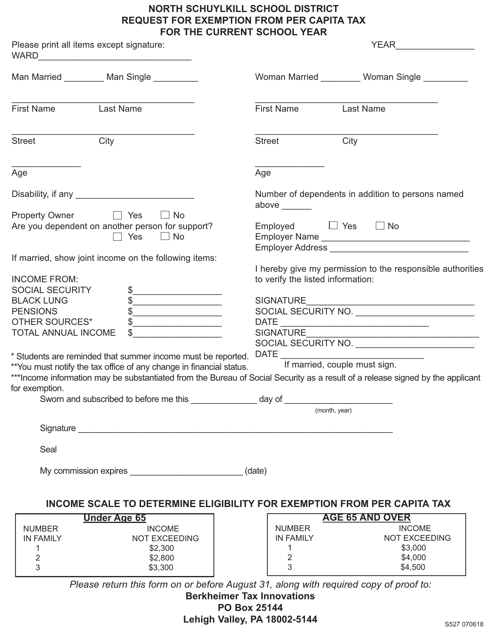

This form is used for requesting an exemption from paying the per capita tax in the North Schuylkill School District in Pennsylvania.

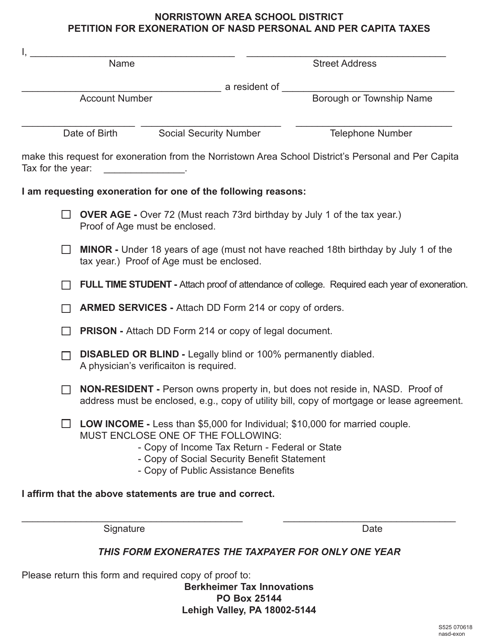

This form is used for petitioning for the exoneration of NASD personal and per capita taxes in the Norristown Area School District, Pennsylvania.

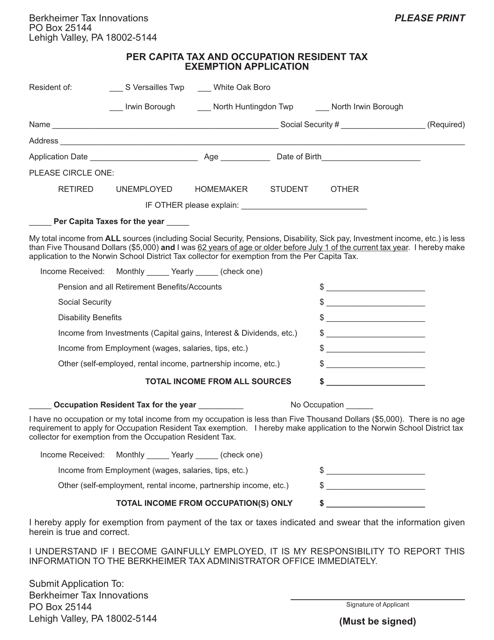

This form is used for applying for a tax exemption for residents of the Norwin School District in Pennsylvania based on their per capita tax and occupation.

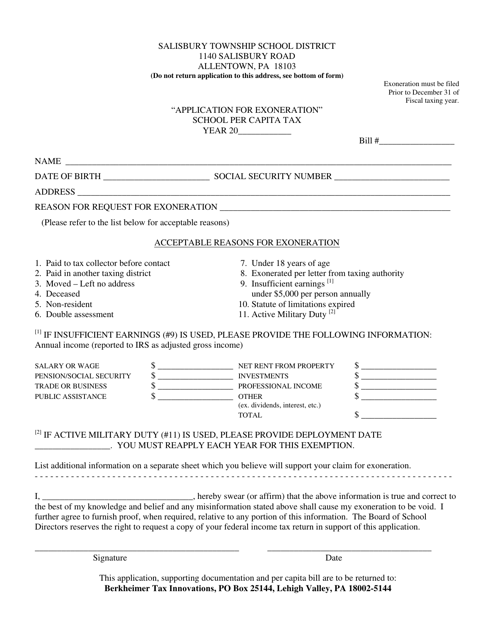

This form is used for applying for exoneration from the school per capita tax in the Salisbury Township School District in Pennsylvania.

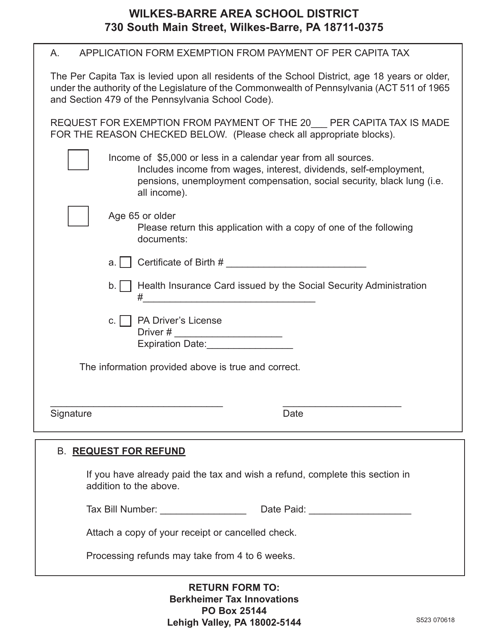

This form is used for applying for an exemption from paying the per capita tax in the Wilkes-Barre Area School District in Pennsylvania.

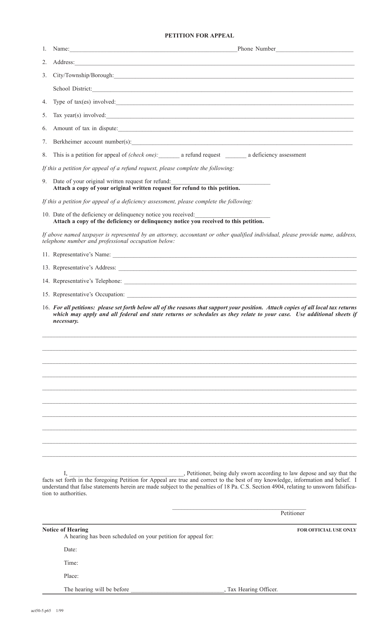

This form is used for filing a petition for appeal in Pennsylvania under Act 50.

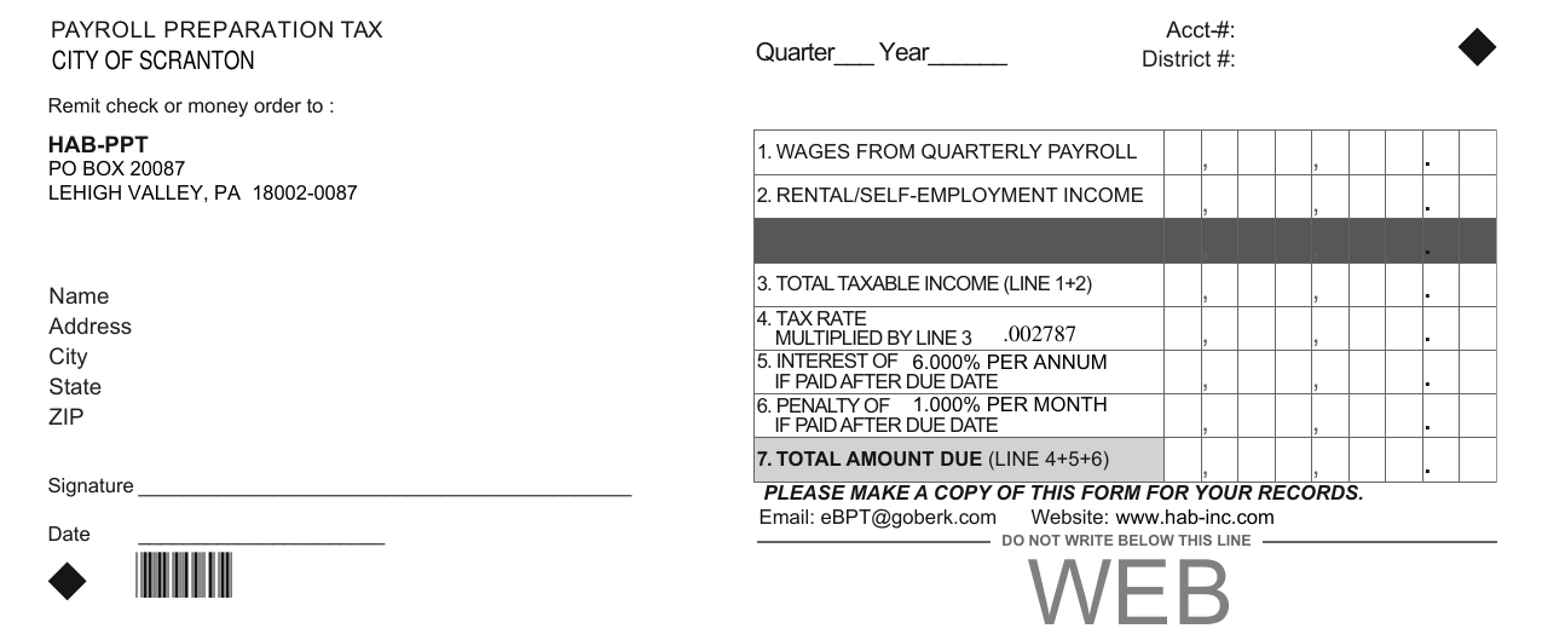

This form is used for payroll preparation and tax filing purposes specifically for the City of Scranton in Pennsylvania.

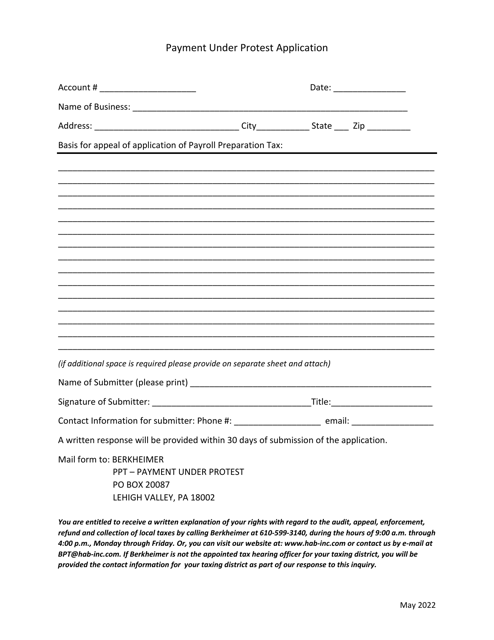

This form is used for applying for payment under protest in the City of Scranton, Pennsylvania.

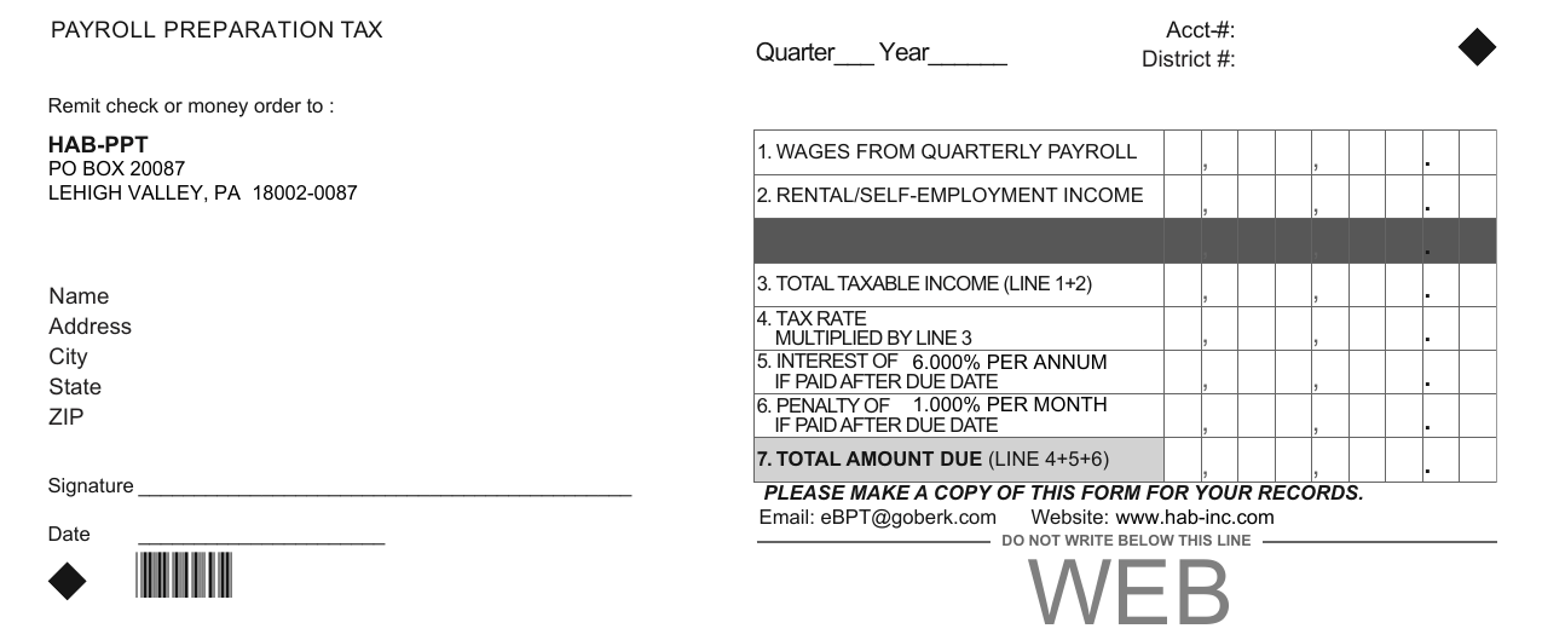

This type of document is used for preparing payroll taxes in the state of Pennsylvania. It is an essential form for employers to calculate and report their tax withholdings and contributions.

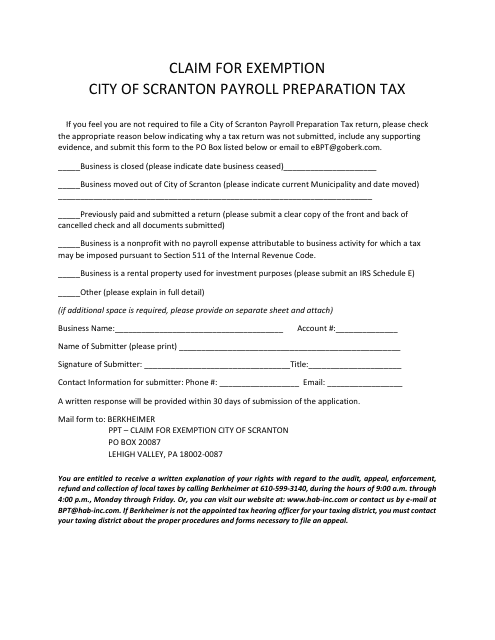

This Form is used for claiming an exemption from the City of Scranton Payroll Preparation Tax in Pennsylvania.

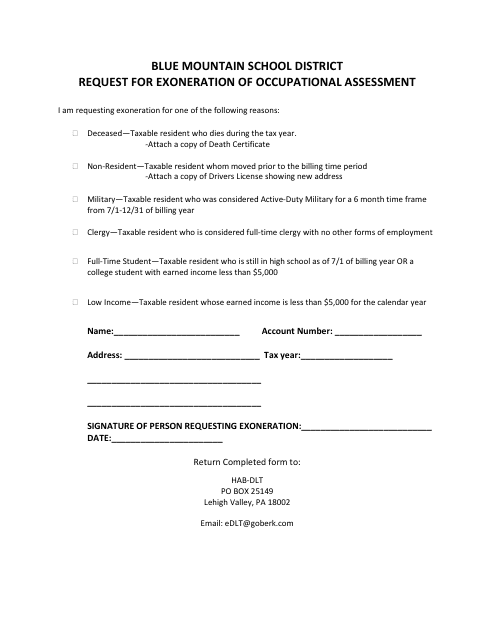

This document is a request for the exoneration of occupational assessment in Blue Mountain School District, Pennsylvania. It is used to waive the assessment for certain occupations.

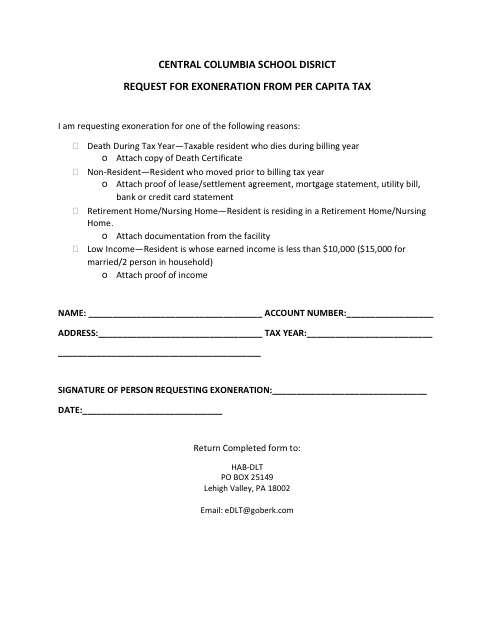

This document is a Request for Exoneration From Per Capita Tax specific to the Central Columbia School District in Pennsylvania. It is used by residents in the school district to request an exemption from paying the per capita tax.

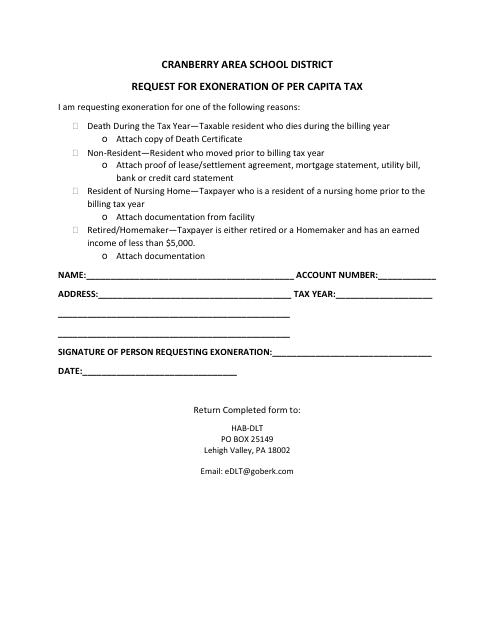

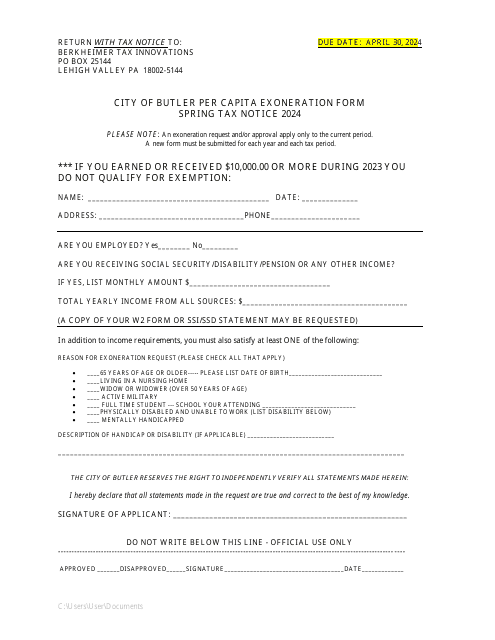

This form is used for requesting the exoneration of per capita tax in the Cranberry Area School District in Pennsylvania.

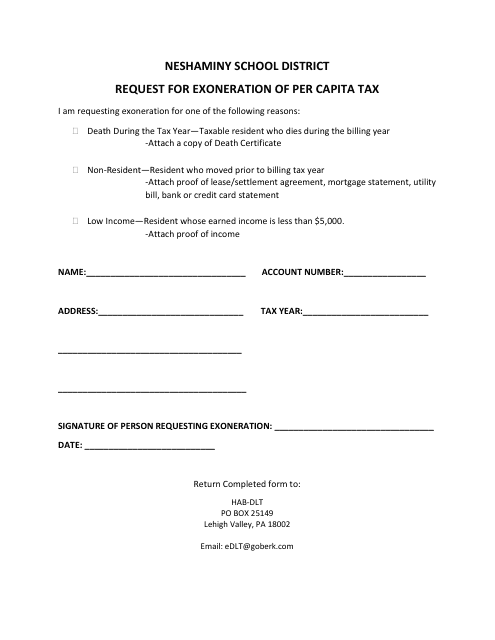

This document is a request to be exempted from paying the per capita tax in the Neshaminy School District in Pennsylvania.

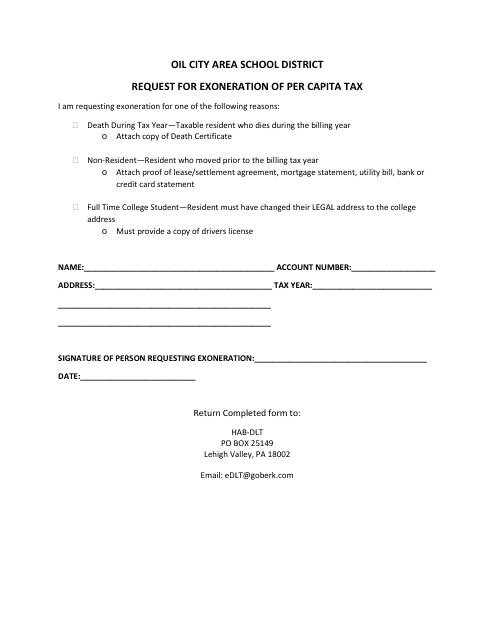

This document is used for requesting exoneration from paying the per capita tax in the Oil City Area School District in Pennsylvania.

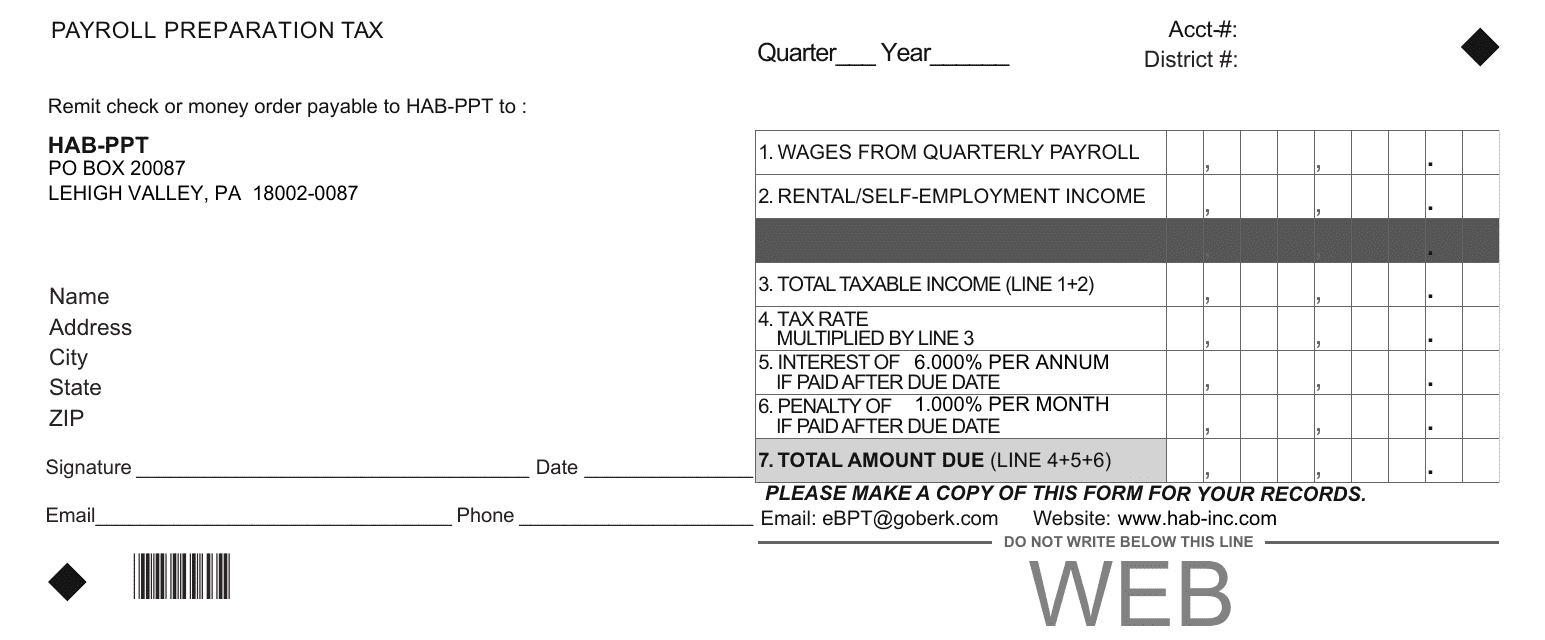

This document is for the preparation of payroll taxes in the state of Pennsylvania. It provides guidelines and instructions for calculating and filing payroll taxes for businesses operating in Pennsylvania.

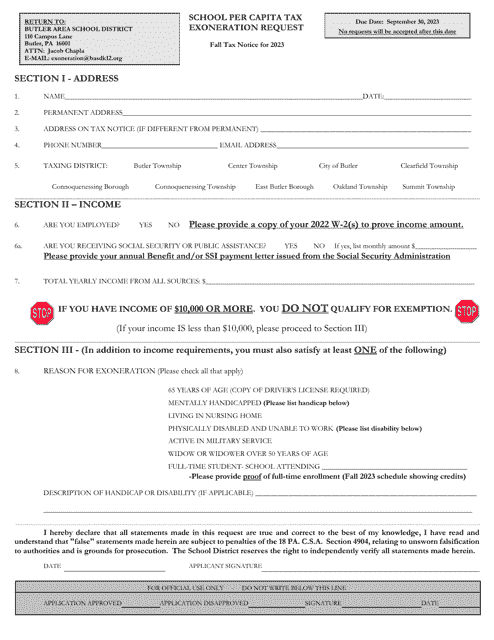

This document is a Per Capita Tax Exoneration Request for the Butler Area School District located in Pennsylvania.

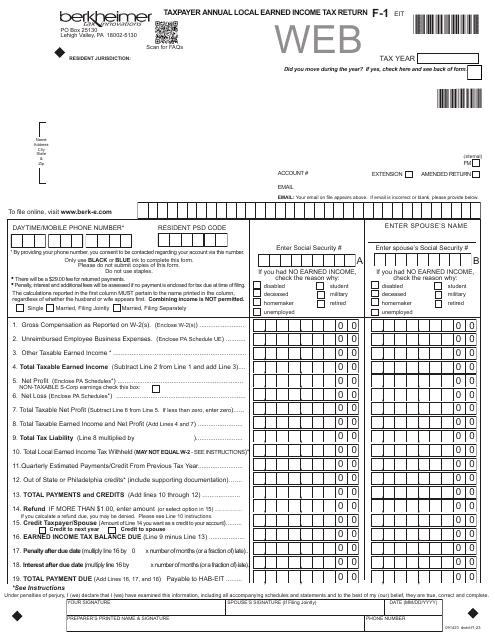

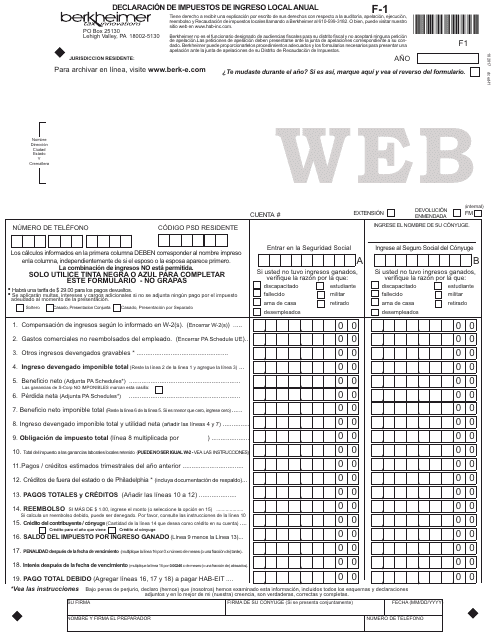

This Form is used for filing annual local income taxes in Pennsylvania.