Comptroller of Maryland Forms

The Comptroller of Maryland is a government agency responsible for managing the state's finances and tax collection. Their main purpose is to ensure that individuals and businesses comply with Maryland tax laws and regulations, and to facilitate the collection of taxes owed to the state. Additionally, the Comptroller of Maryland also administers the Unclaimed Property Program, which helps reunite individuals with their lost or abandoned financial assets.

Documents:

32

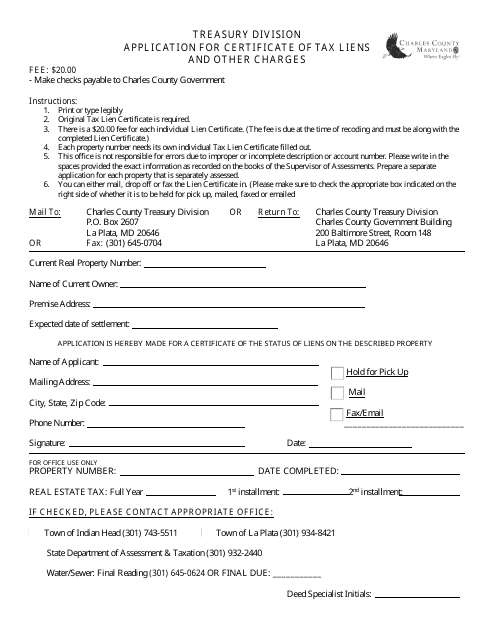

This document is used for applying for a certificate of tax liens and other charges in Charles County, Maryland. It is necessary for individuals or businesses who owe unpaid taxes or other outstanding charges to the county. The certificate serves as proof of the outstanding debts and is often required in real estate transactions or loan applications.

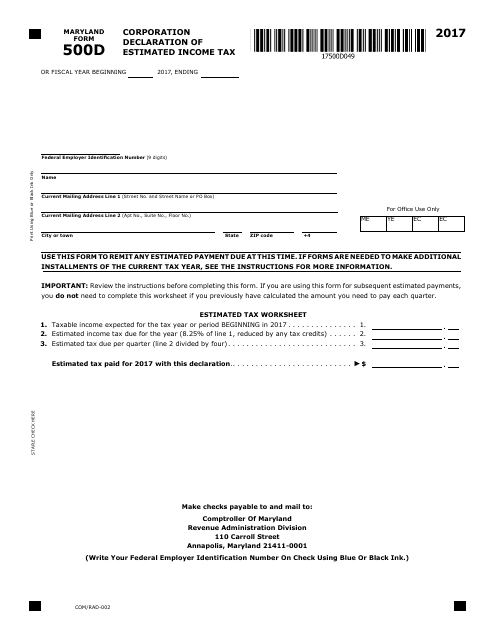

This form is used for Maryland corporations to declare their estimated income tax for the year.

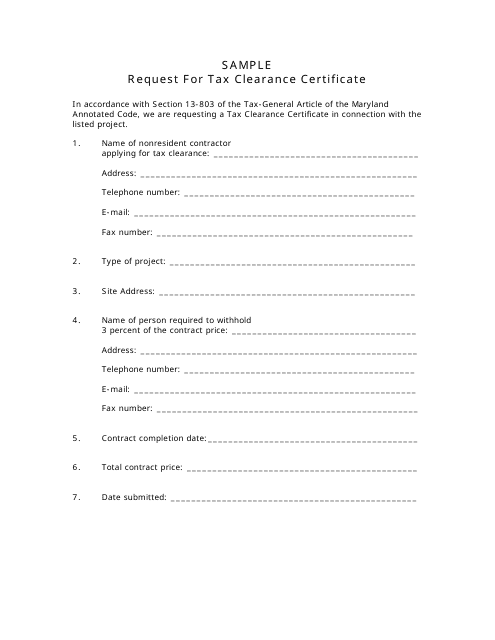

This Form is used for requesting a Tax Clearance Certificate in Maryland. It verifies that the individual or business has paid all their taxes and is clear of any tax liabilities in the state. A Tax Clearance Certificate is often required when applying for certain licenses or permits or during business transactions.

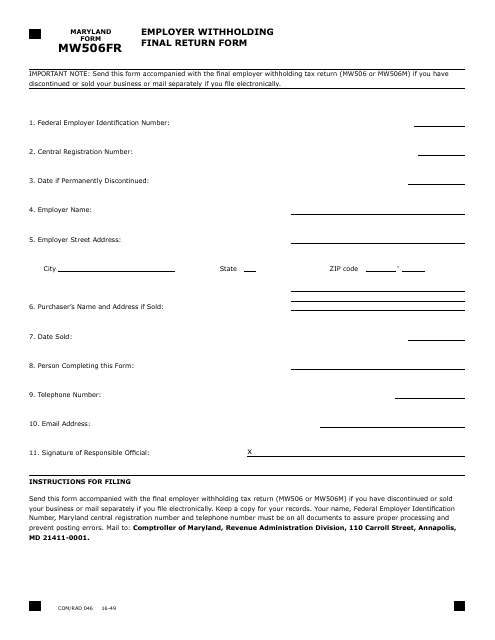

This form is used for filing the final employer withholding return for businesses in the state of Maryland. It is specifically for employers to report and remit any final withholdings from employee wages.

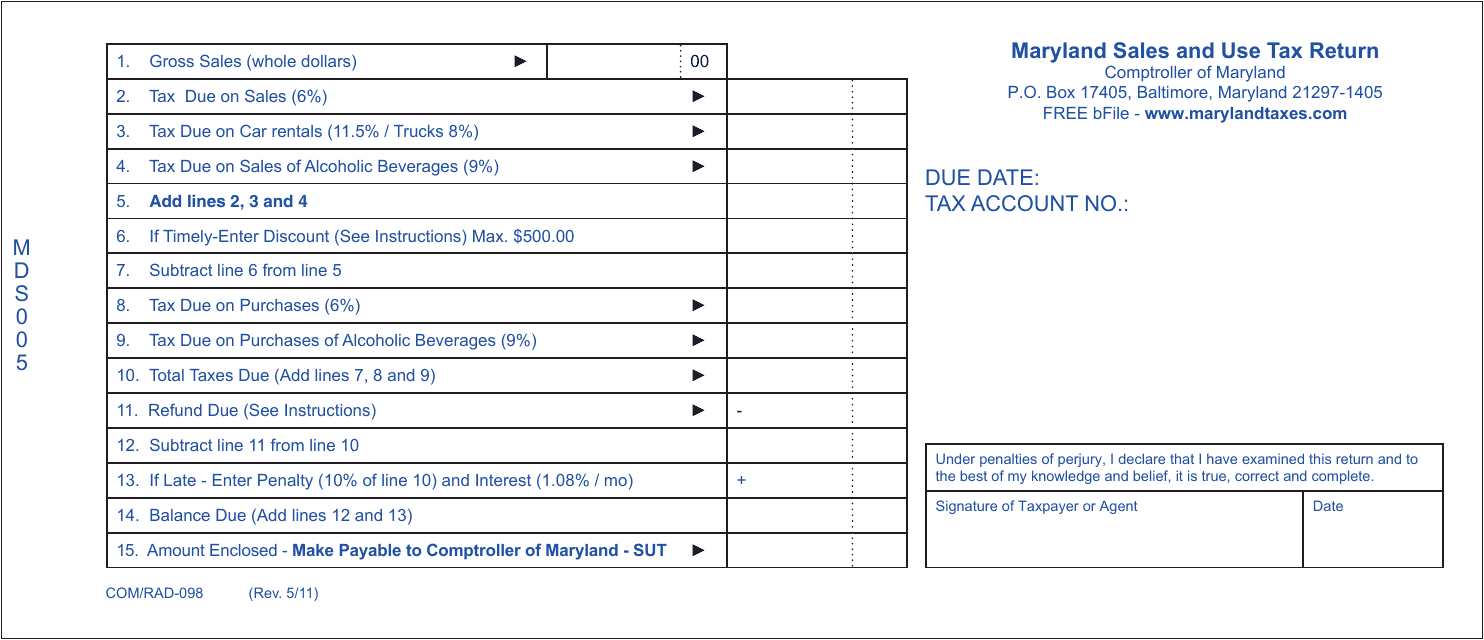

This document is used to report and remit sales and use tax in the state of Maryland. Businesses must submit this return to the Maryland Comptroller's Office to report the sales they have made and the corresponding sales tax collected.

This form is used for reporting sales and use tax in the state of Maryland. It is used by businesses to calculate and pay their tax obligations related to sales of goods and services.

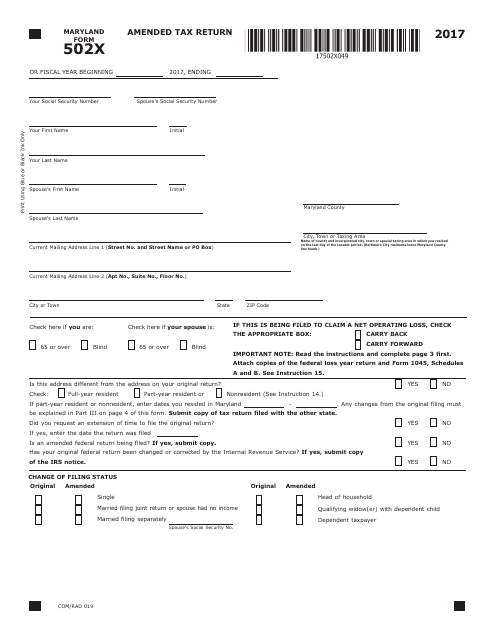

This form is used for filing an amended tax return in the state of Maryland.

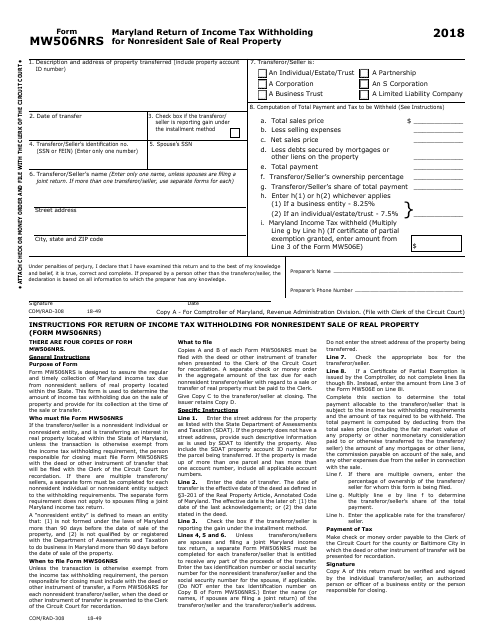

This form is used for reporting income tax withholding on the sale of real property in Maryland by nonresidents.

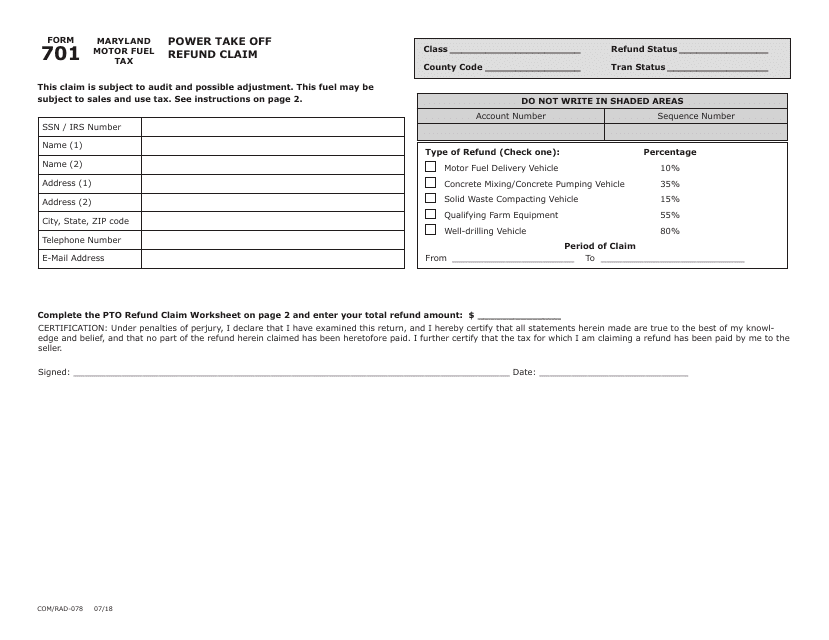

This form is used for claiming a refund for power take-off (PTO) equipment in the state of Maryland.

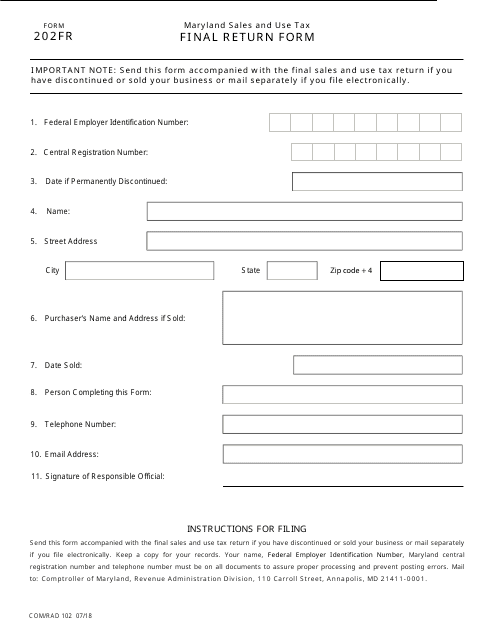

This document is used for submitting the final sales and use tax return in the state of Maryland.

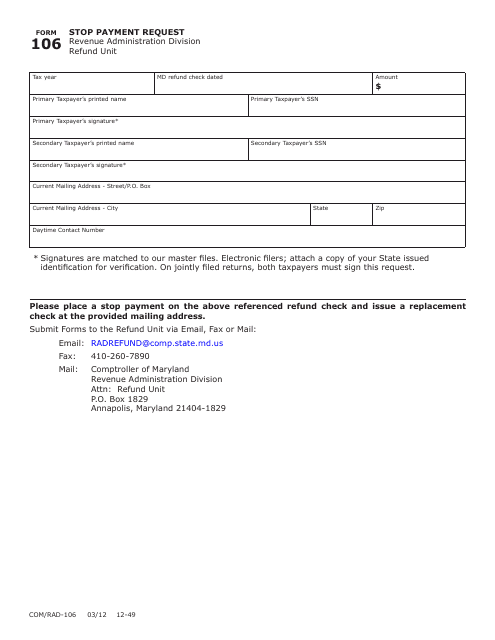

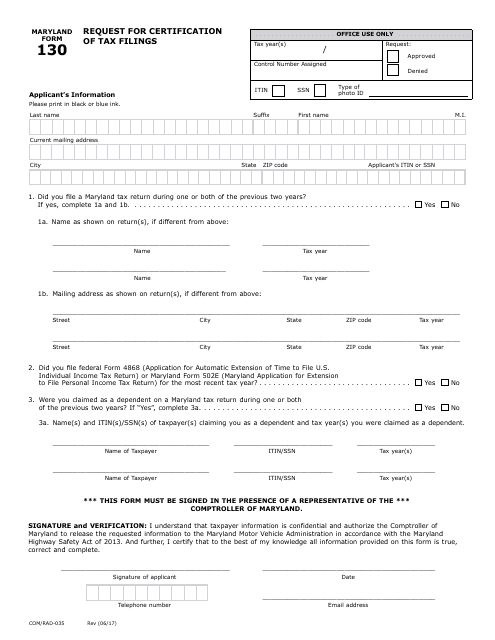

This form is used for requesting certification of tax filings in the state of Maryland.

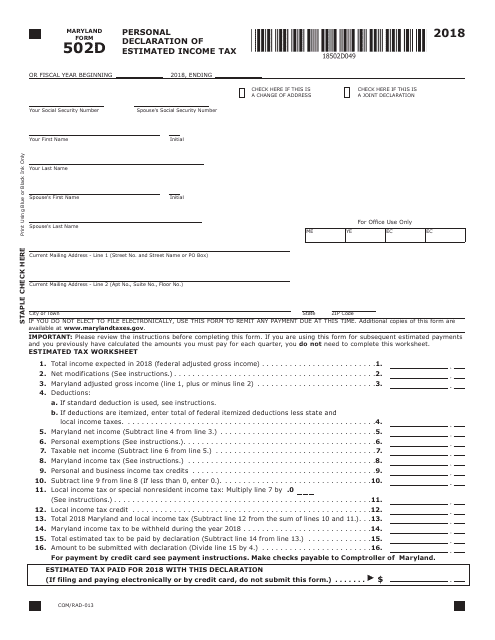

This form is used for residents of Maryland to declare their estimated income tax for the year. It allows individuals to calculate and submit their projected income tax liability to the state.

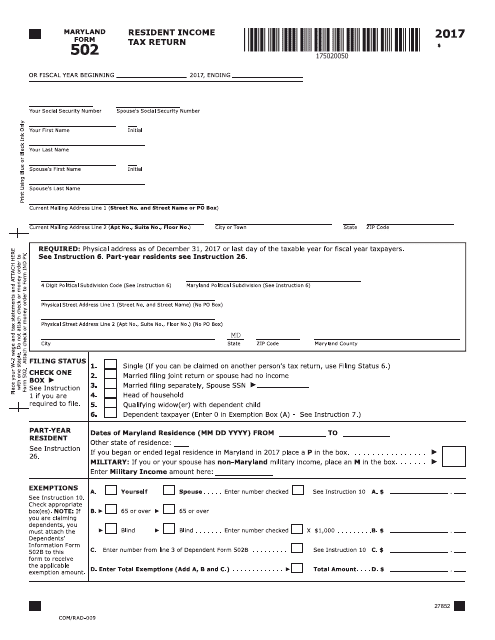

This tax form is used for Maryland residents to report their income and calculate state taxes owed or refunds.

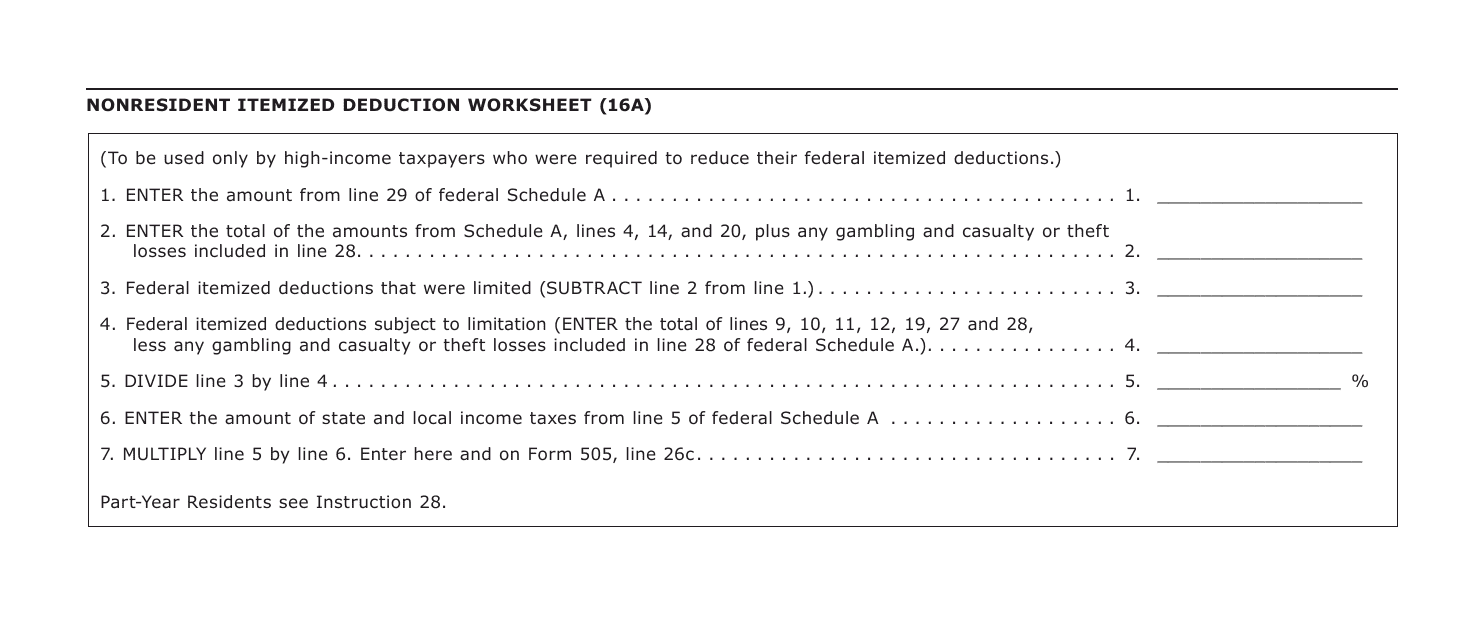

This form is used for calculating nonresident itemized deductions for Maryland state taxes.

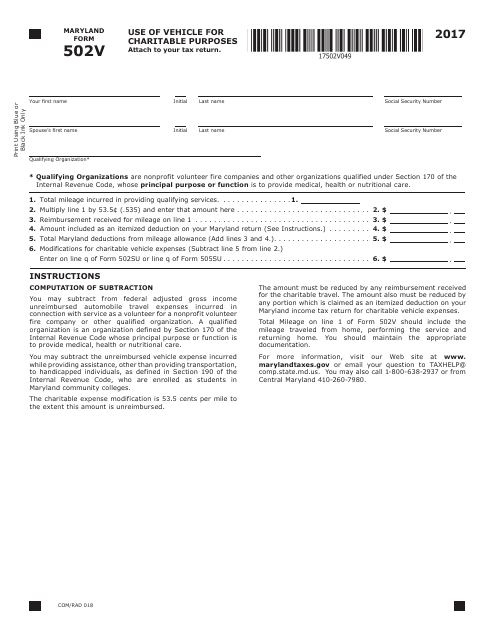

This form is used for reporting the use of a vehicle for charitable purposes in Maryland.

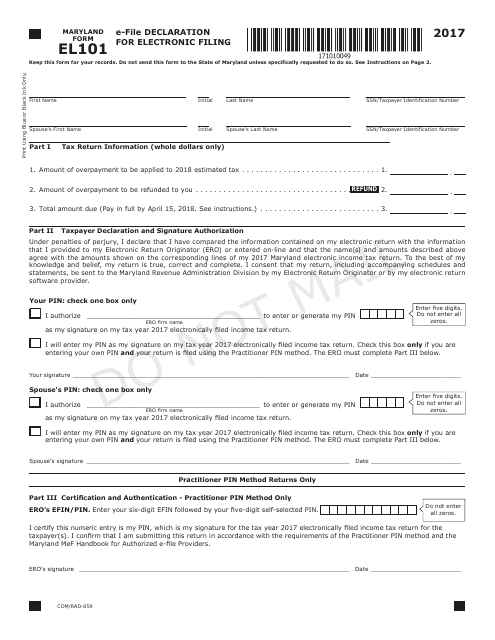

This form is used for declaring electronic filing in the state of Maryland. It is specifically for individuals who want to e-file their tax returns.

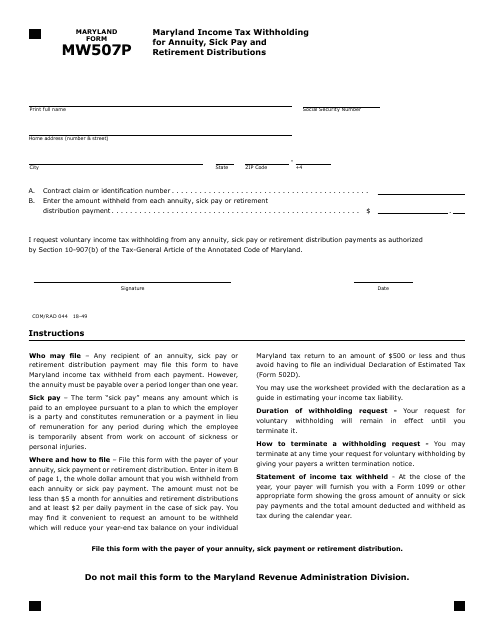

This form is used for Maryland residents to indicate their income tax withholding preferences for annuity, sick pay, and retirement distributions.

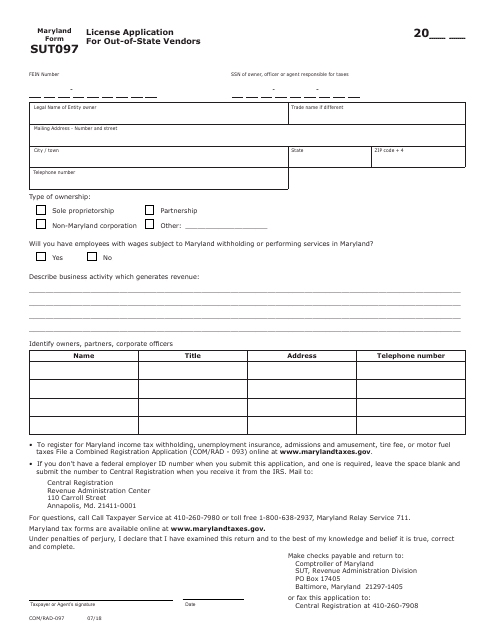

This form is used for applying for a license as an out-of-state vendor in Maryland.

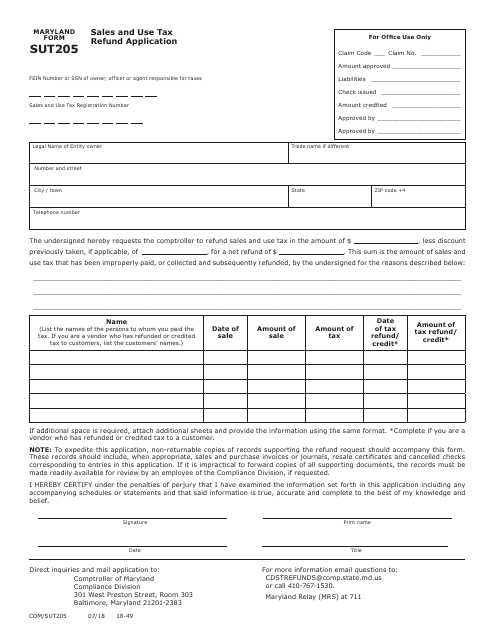

This form is used for applying for a refund of sales and use tax in the state of Maryland.

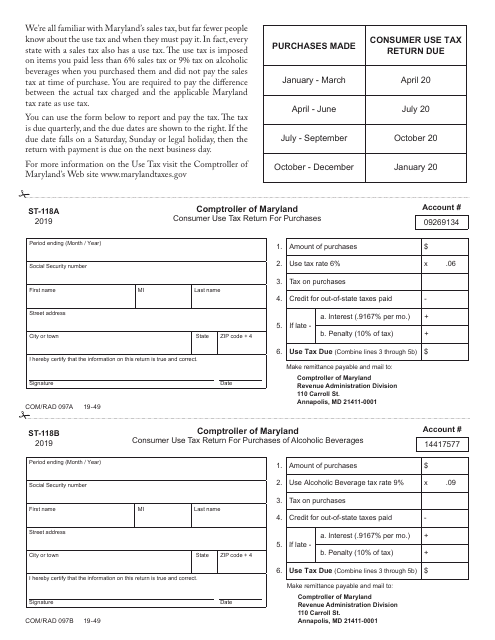

This Form is used for reporting and paying consumer use tax on purchases made in Maryland.

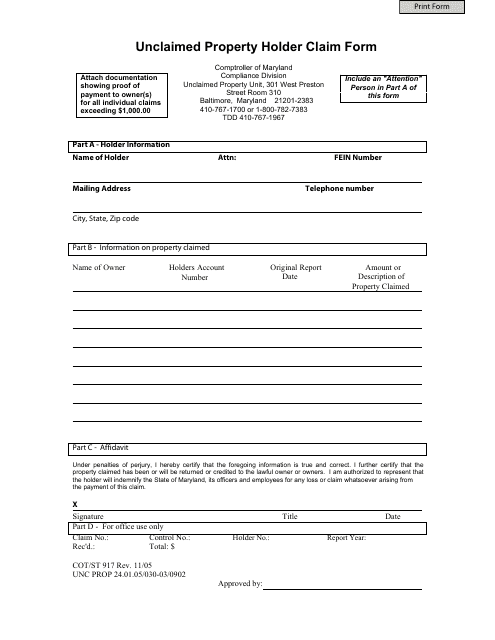

This form is used for holders of unclaimed property in Maryland to make a claim.

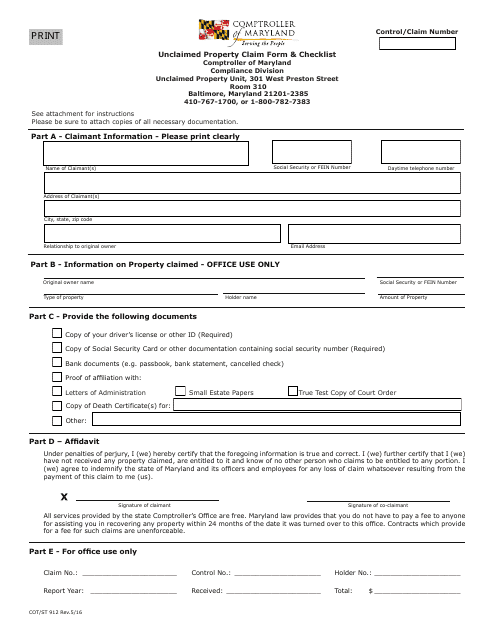

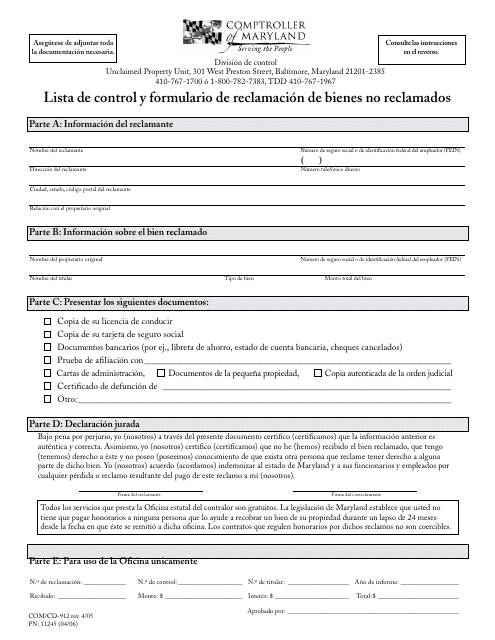

This form is used for making a claim to recover unclaimed property in the state of Maryland. It also includes a checklist to ensure all required documents are included with the claim.

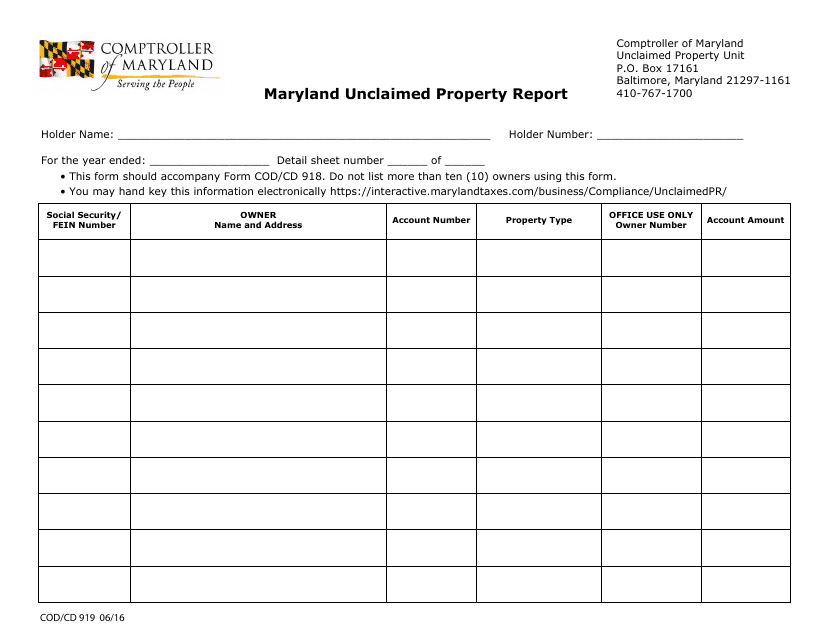

This form is used for reporting unclaimed property in the state of Maryland.

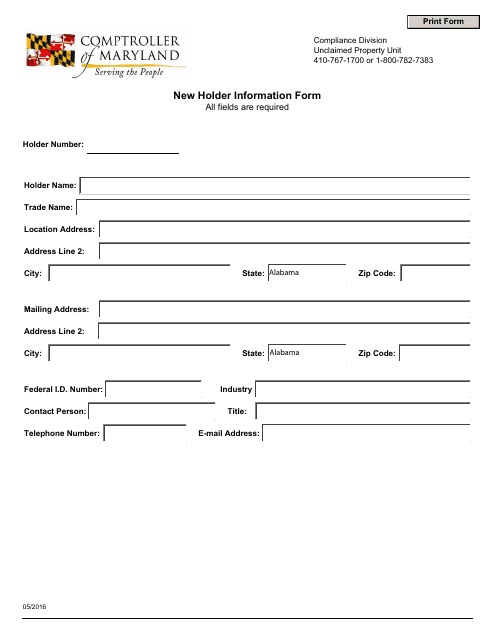

This Form is used for updating holder information in the state of Maryland.

This document is a checklist and claims form for unclaimed property in Maryland.

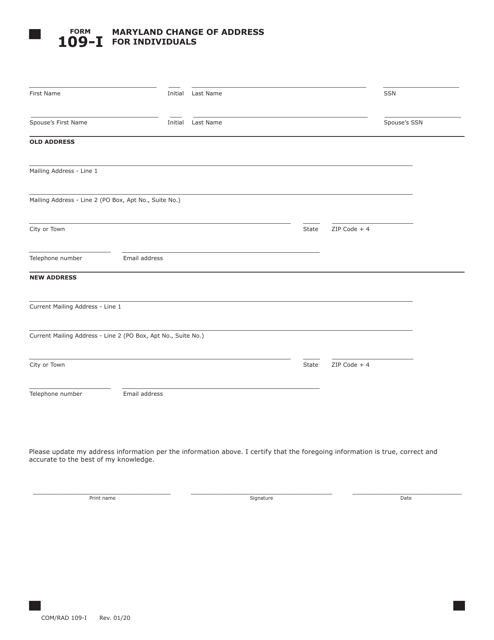

This form is used for changing your address in Maryland as an individual.

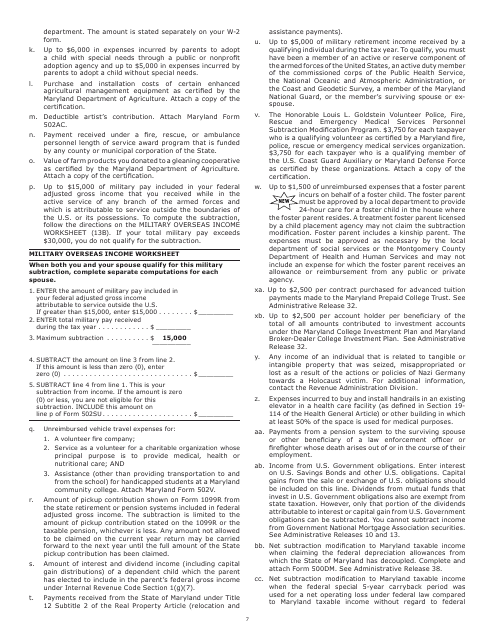

This document is used for reporting military income earned overseas in the state of Maryland.

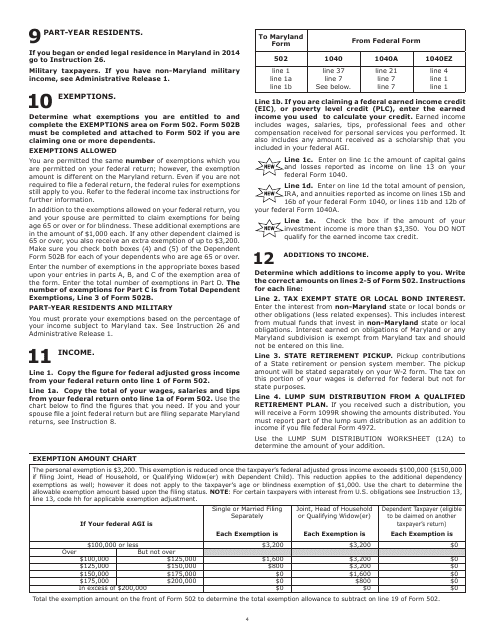

This document provides an exemption amount chart specifically for the state of Maryland. It details the specific amounts that individuals or businesses may be exempt from certain taxes or fees in Maryland.

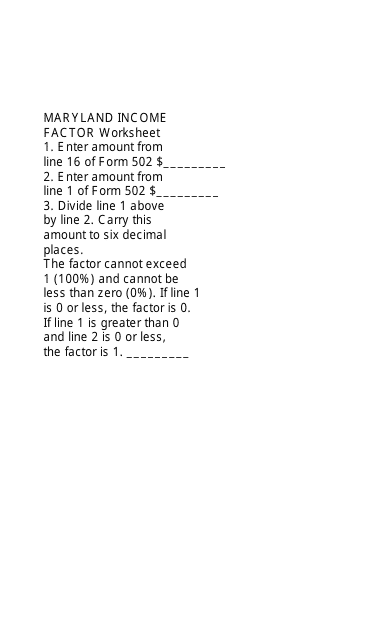

This worksheet is used in Maryland to calculate the income factor for tax purposes. It helps individuals and businesses determine their taxable income based on specific factors set by the state of Maryland.