Ohio Regional Income Tax Agency (Rita) Forms

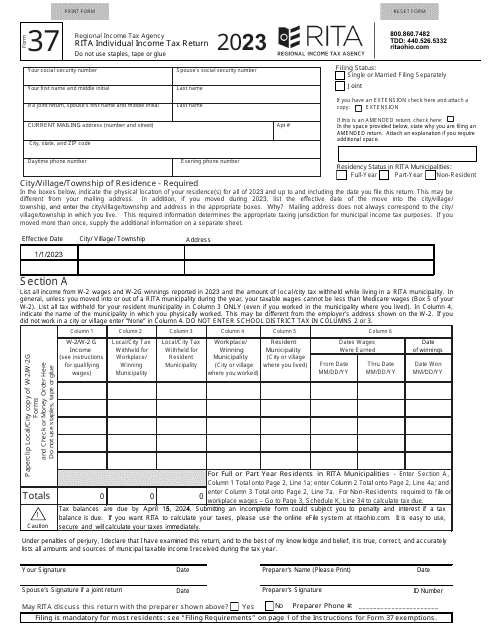

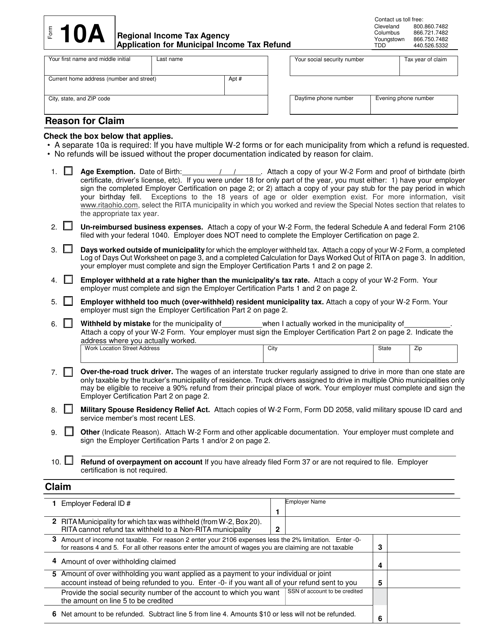

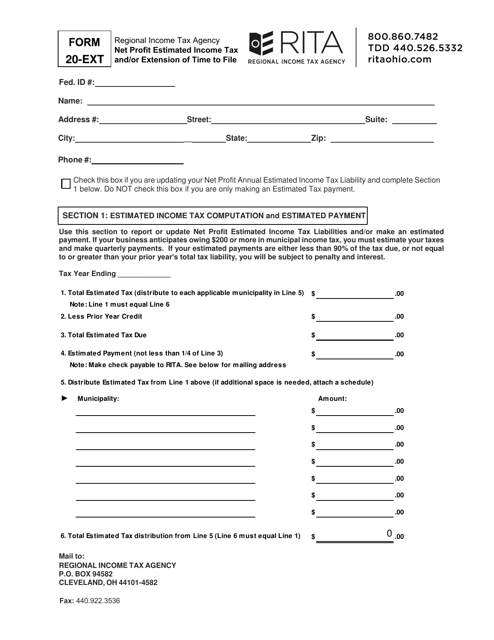

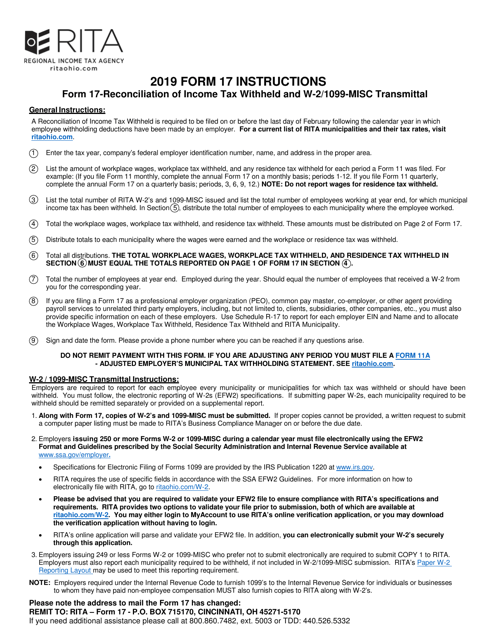

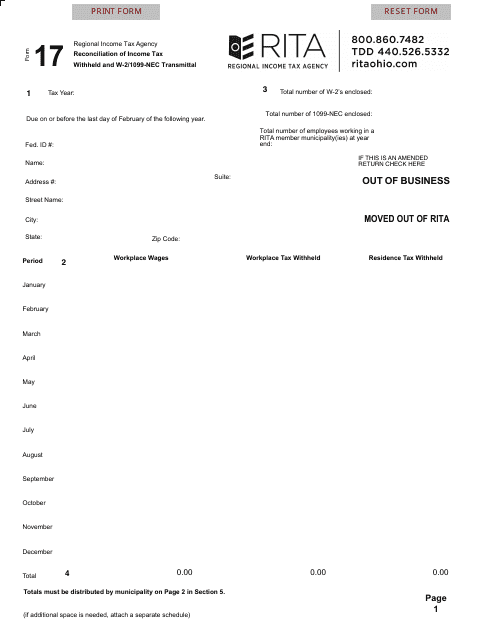

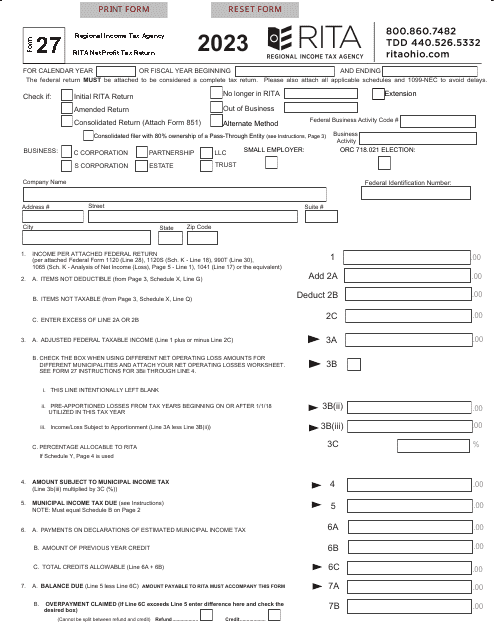

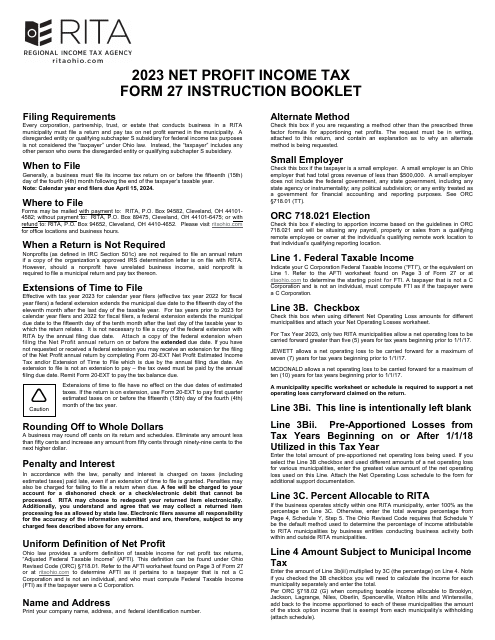

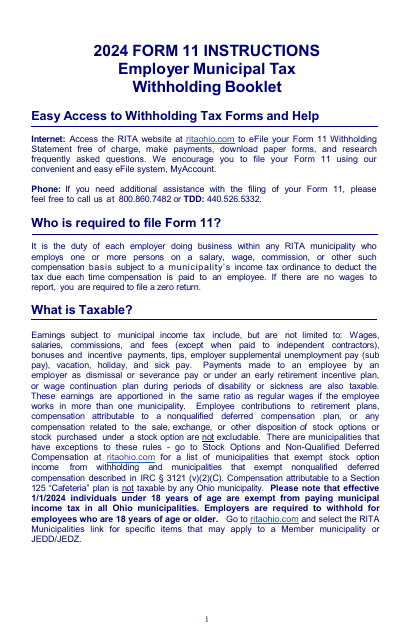

The Ohio Regional Income Tax Agency (RITA) is responsible for administering and collecting municipal income taxes for various cities and municipalities in the state of Ohio. RITA helps individuals and businesses comply with local income tax laws, processes tax returns, and handles tax payments and refunds on behalf of the participating municipalities.

Documents:

72

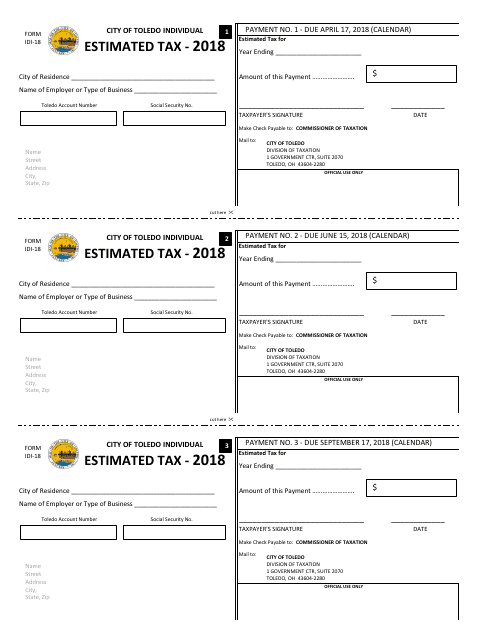

This form is used for individuals in Toledo, Ohio to submit their estimated taxes.

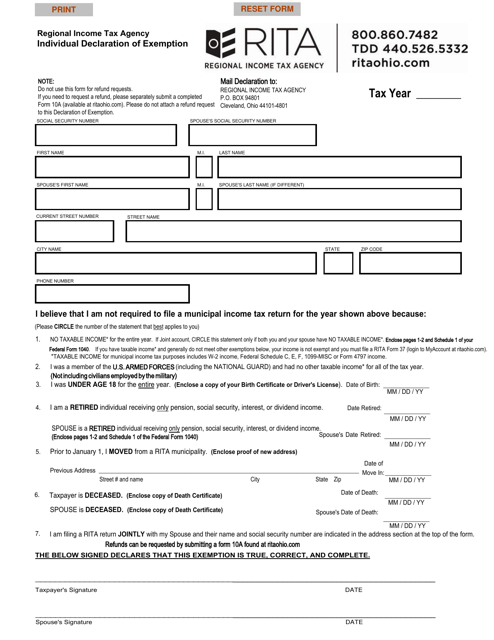

This document is used for individuals in Ohio to declare their exemption from certain taxes or fees. It allows individuals to claim exemptions for specific reasons such as religious beliefs or certain types of income.

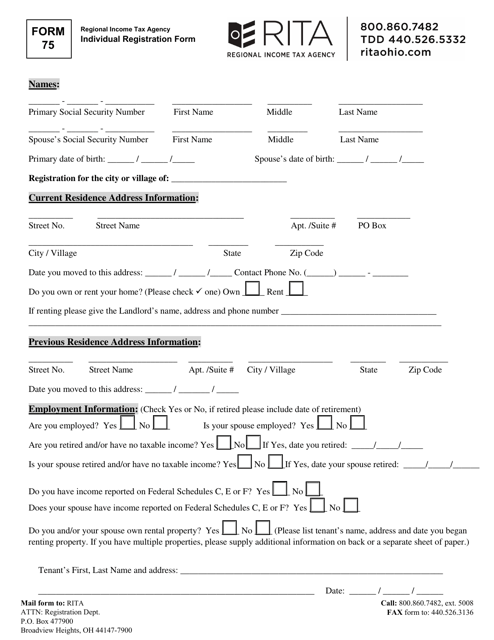

This form is used for individuals in Ohio to register their personal information.

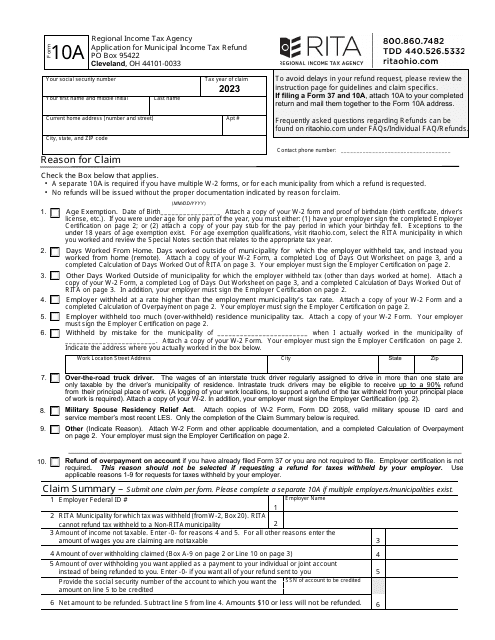

This Form is used for residents of Ohio to apply for a refund of municipal income tax paid.

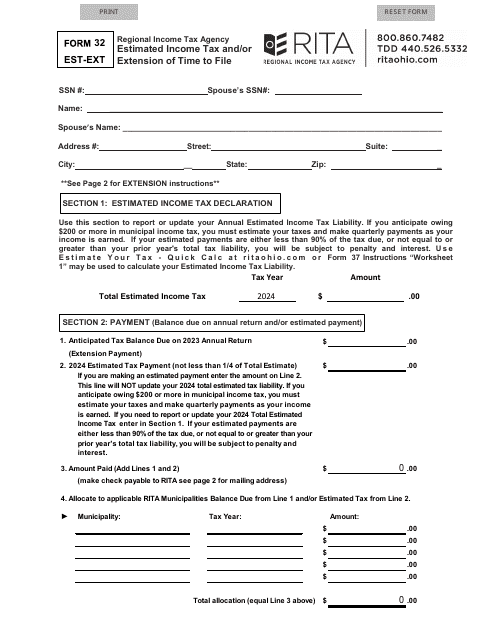

This Form is used for estimating net profit income tax and requesting an extension of time to file taxes in Ohio.

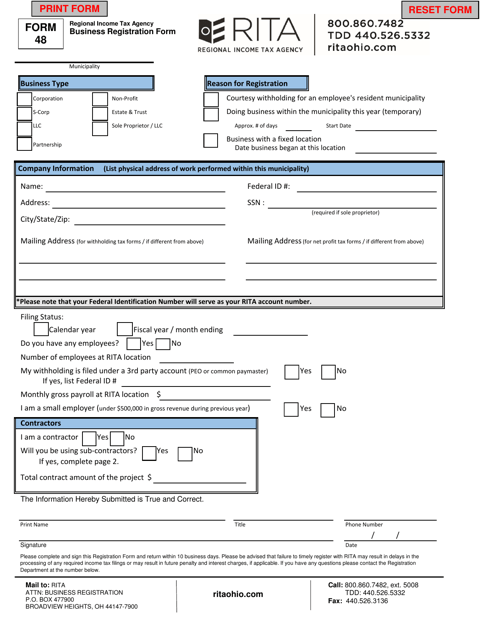

This Form is used for registering a business in the state of Ohio. It gathers the necessary information required for business registration.

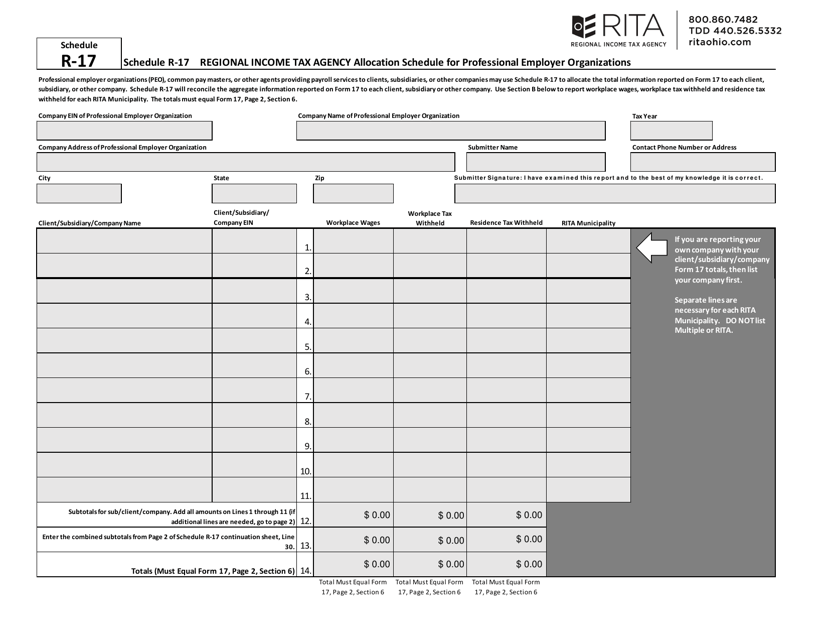

This document is a Schedule R-17 used in Ohio for the allocation of income tax agency for Professional Employer Organizations (PEOs). It is used to determine appropriate tax allocation for PEOs operating in different regions within Ohio.

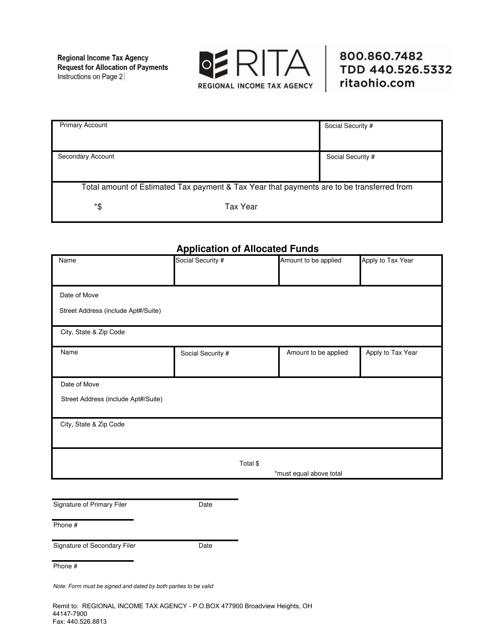

This document is used for requesting the allocation of payments in the state of Ohio. It helps individuals or organizations specify how they want their payments to be distributed.

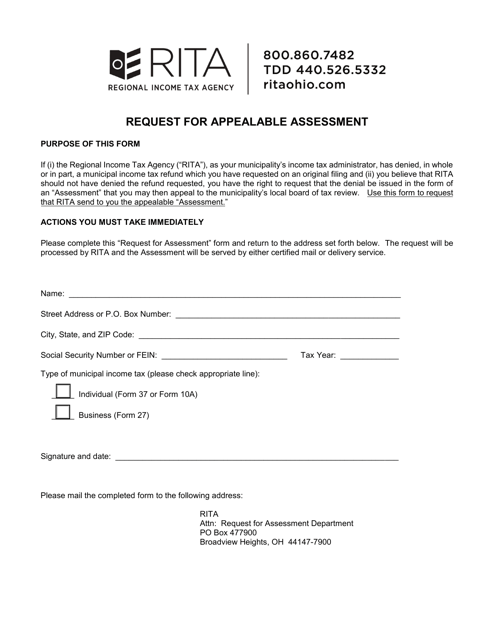

This form is used for requesting an appealable assessment in the state of Ohio.

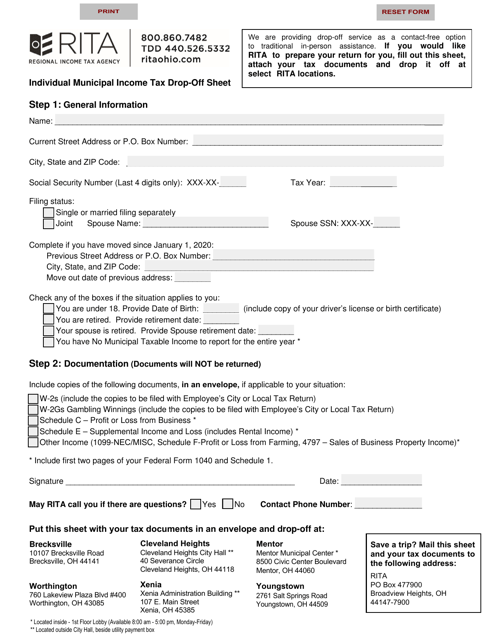

This document is used for dropping off individual income tax forms in Ohio municipalities.

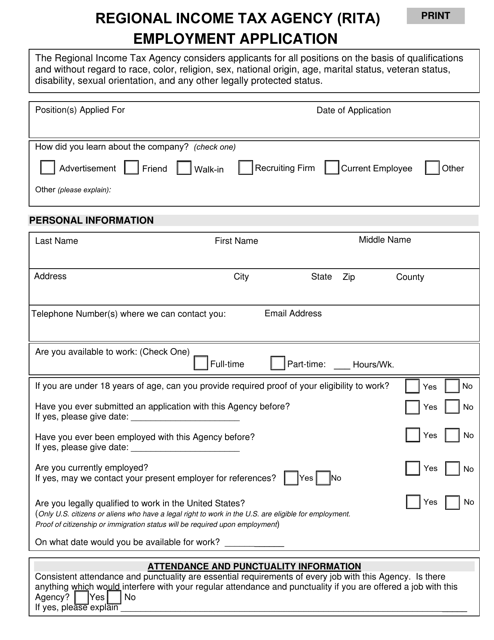

This document is the employment application for the Regional Income Tax Agency (RITA) in Ohio.