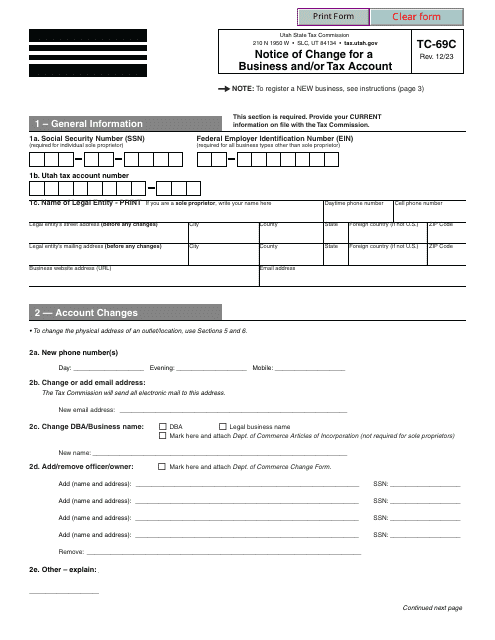

Utah State Tax Commission Forms

Documents:

382

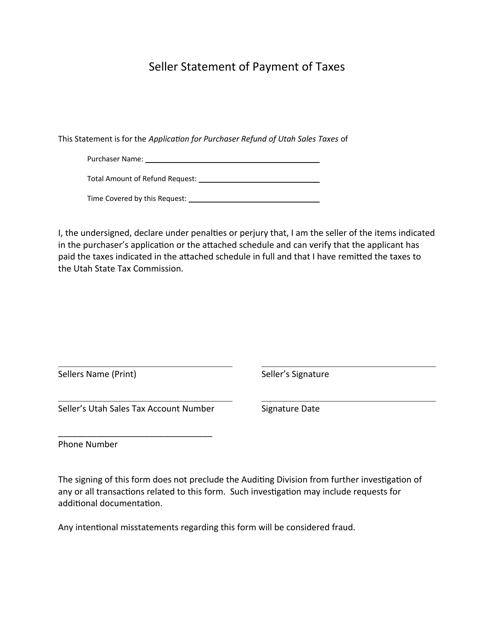

This document is used to confirm that a seller in Utah has paid their taxes.

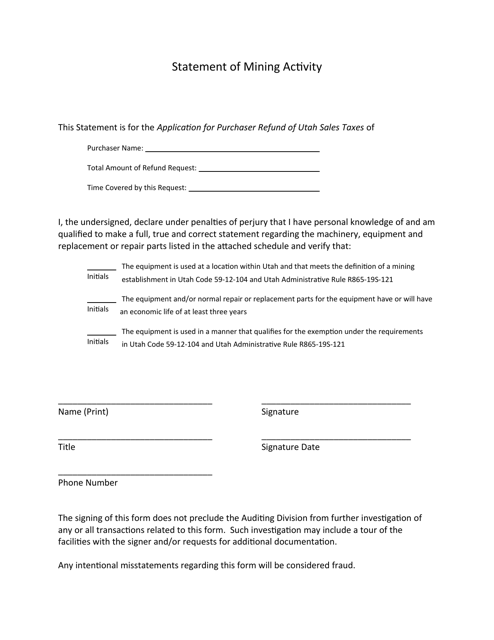

This document is used to provide an overview of mining activities in the state of Utah.

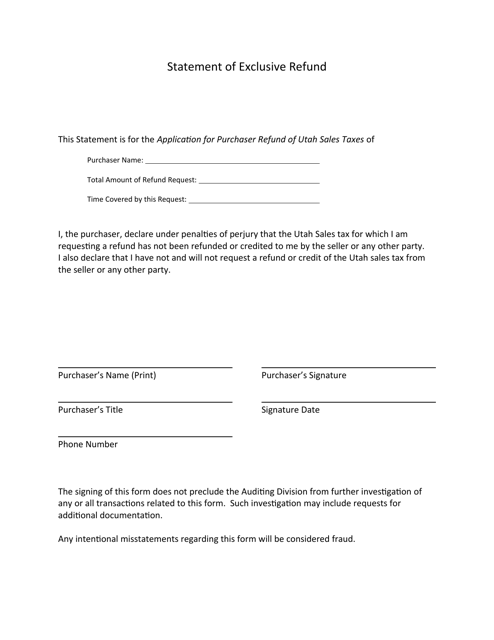

This document is used for requesting a refund from a business or service provider in the state of Utah.

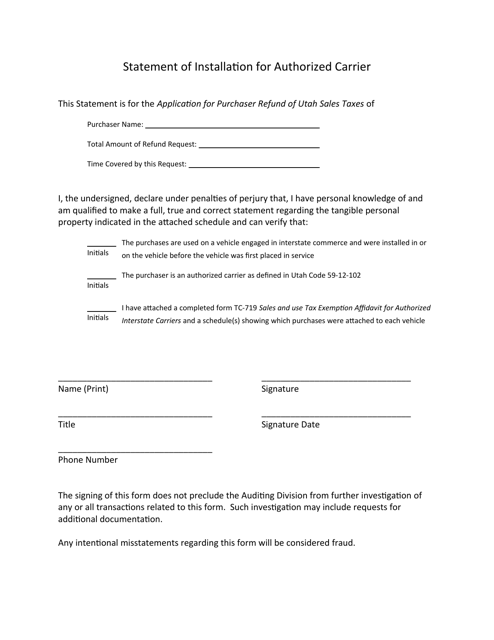

This document is used for establishing the authorized carrier in the state of Utah.

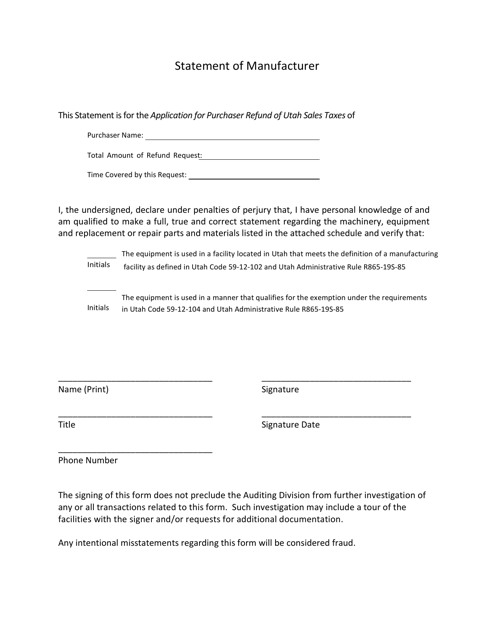

This document is used for refund transactions made by manufacturers in Utah starting from January 1, 2019. It serves as a statement to support the refund request.

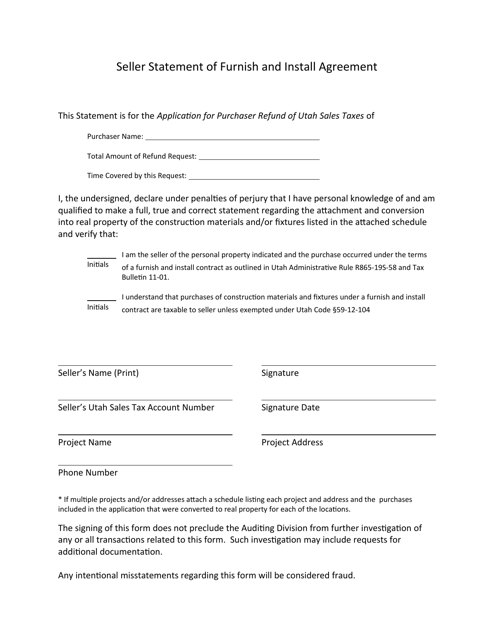

This document is used for the Seller to provide a statement of the goods or services they will furnish and install as part of an agreement in Utah.

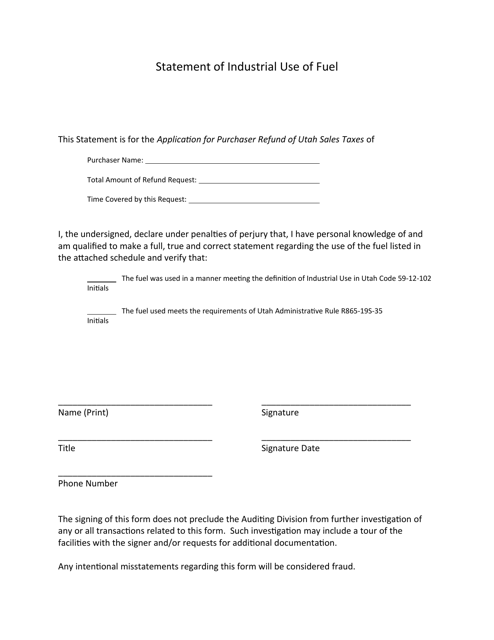

This document is used to provide information about the industrial use of fuel in the state of Utah.

This document is used for contractors or repairmen in Utah to provide a statement regarding their work or services. It may include details about the project, materials used, and any warranties or guarantees.

This document is used for obtaining a statement of manufacturer for refund transactions made in Utah before January 1, 2019.

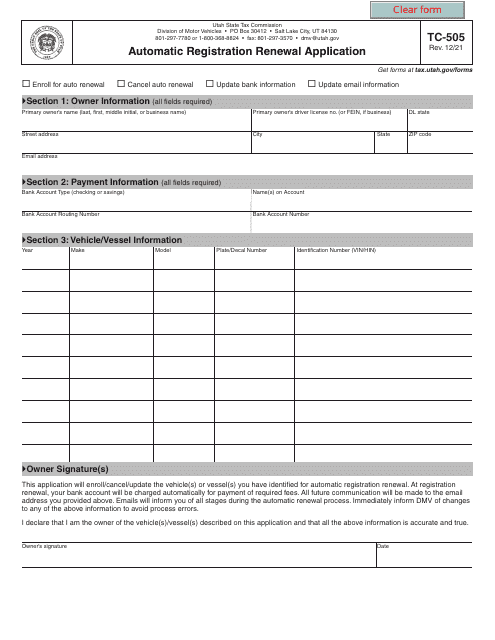

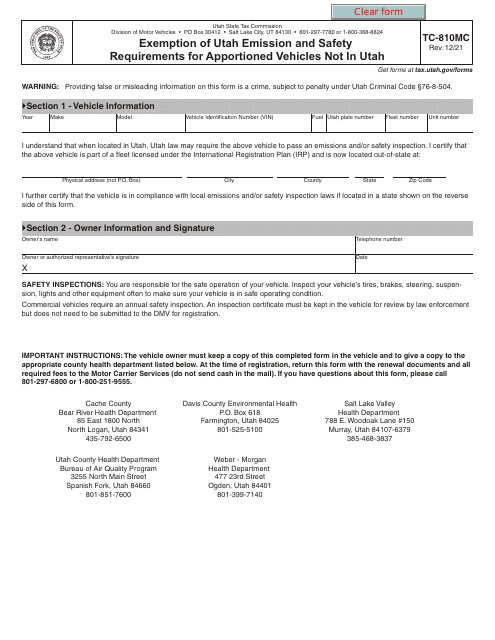

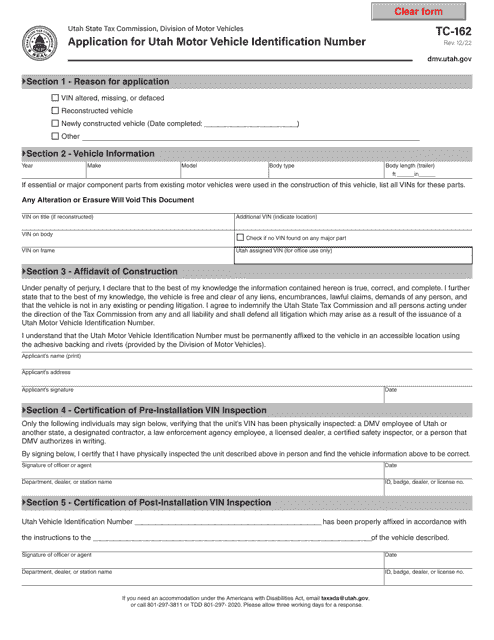

This form is used for the automatic renewal of vehicle registrations in the state of Utah. It allows vehicle owners to easily renew their registrations without having to visit the DMV in person.

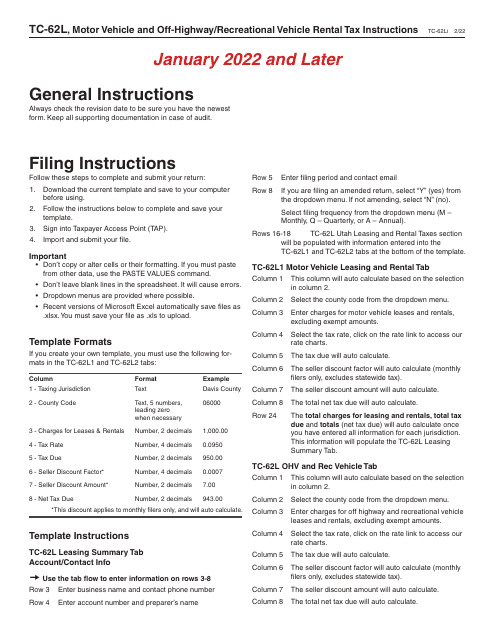

This form is used to report and remit the Motor Vehicle and Off-Highway/Recreational Vehicle Rental Tax in Utah. It provides instructions on how to fill out and submit the form accurately.

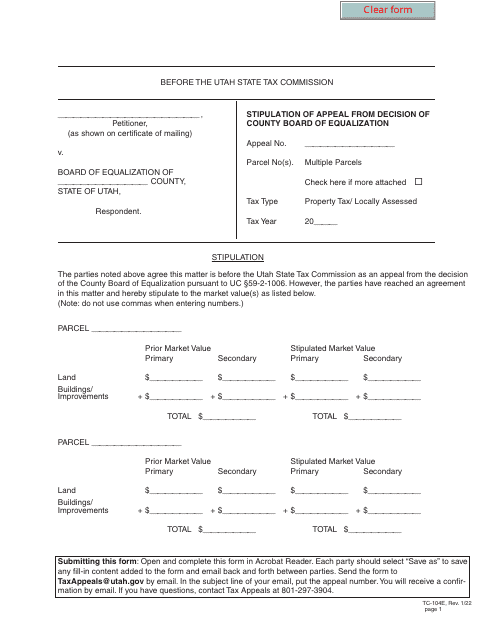

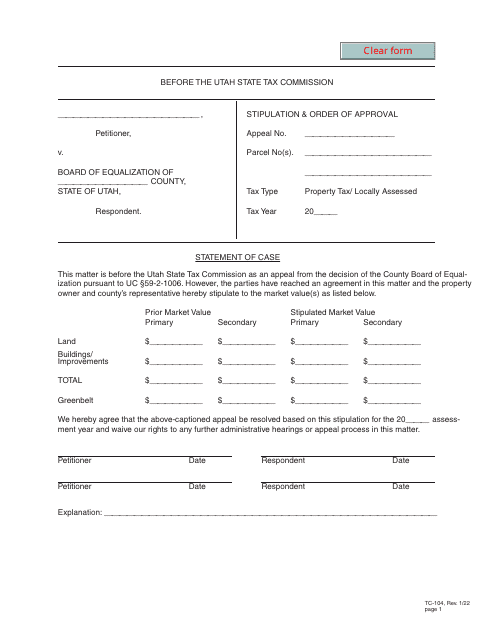

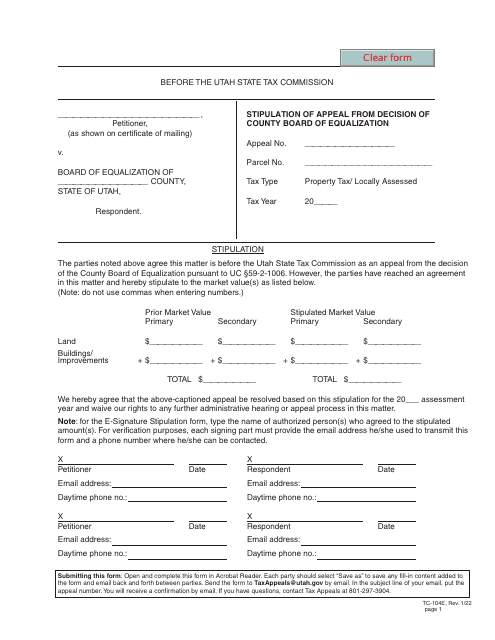

This form is used for filing a stipulation of appeal from the decision of the county board of equalization for multiple parcels in Utah.

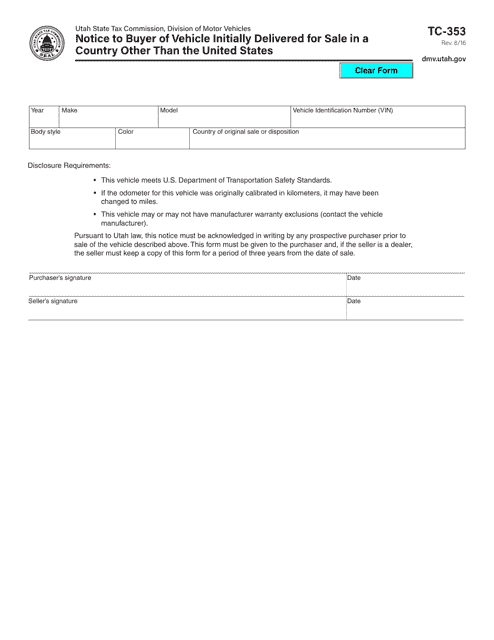

This form is used for notifying the buyer of a vehicle that was initially delivered for sale in a country other than the United States, specifically in the state of Utah.

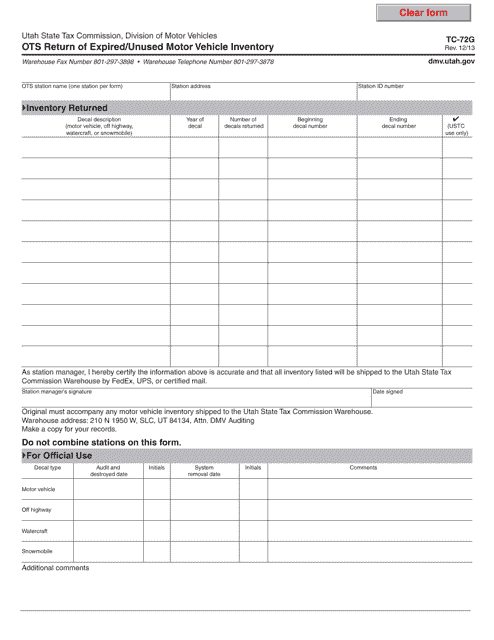

This form is used for returning expired or unused motor vehicle inventory in Utah.