Utah State Tax Commission Forms

Documents:

382

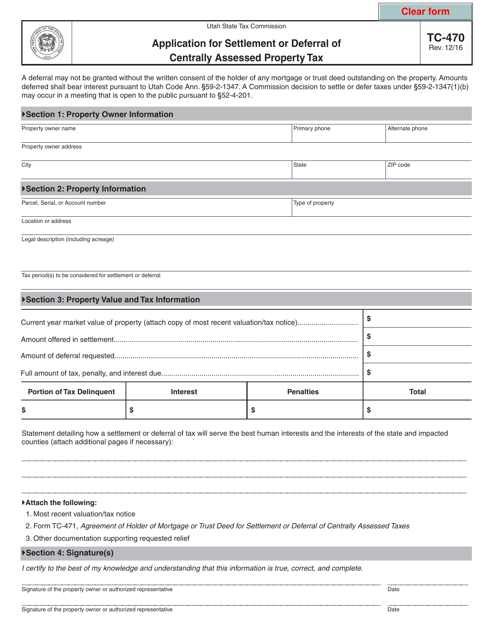

This form is used for applying for settlement or deferral of centrally assessed property tax in the state of Utah.

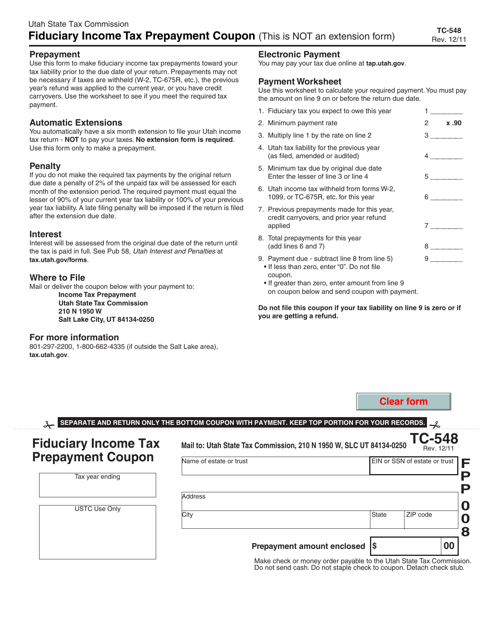

This form is used for making prepayments of fiduciary income tax in Utah.

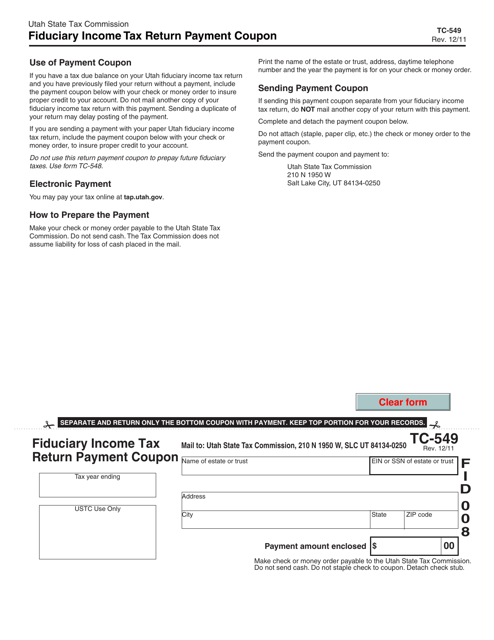

This document is used for making payments for the Utah Fiduciary Income Tax Return.

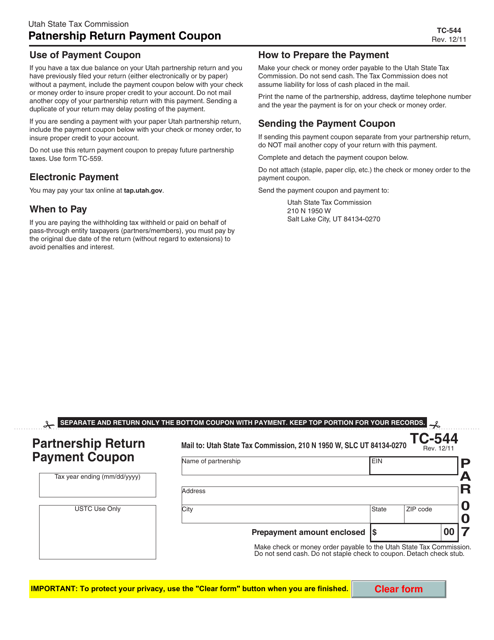

This form is used for making payments for partnership tax returns in Utah.

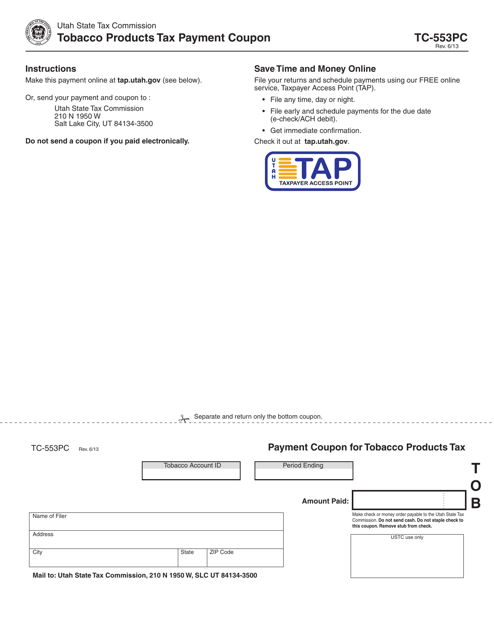

This form is used for making tobacco products tax payments in Utah.

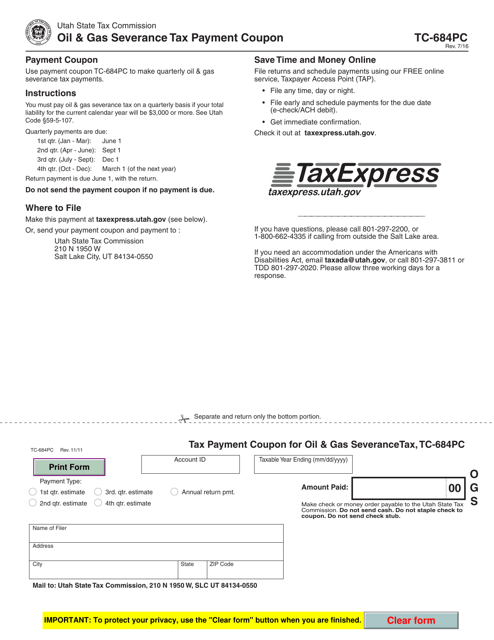

This form is used for making oil and gas severance tax payments in Utah.

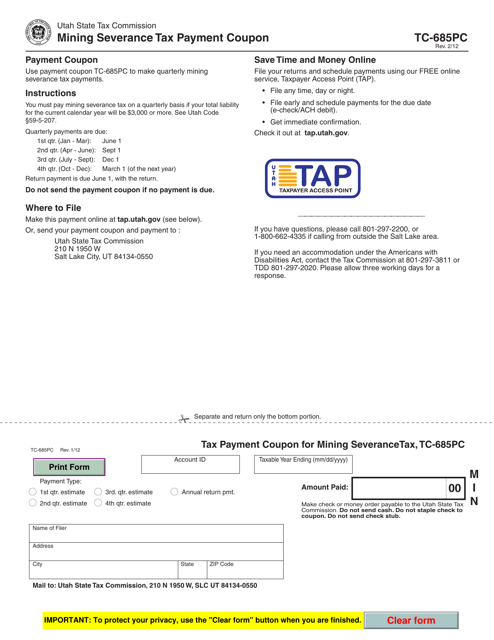

This form is used for making mining severance tax payments in the state of Utah.

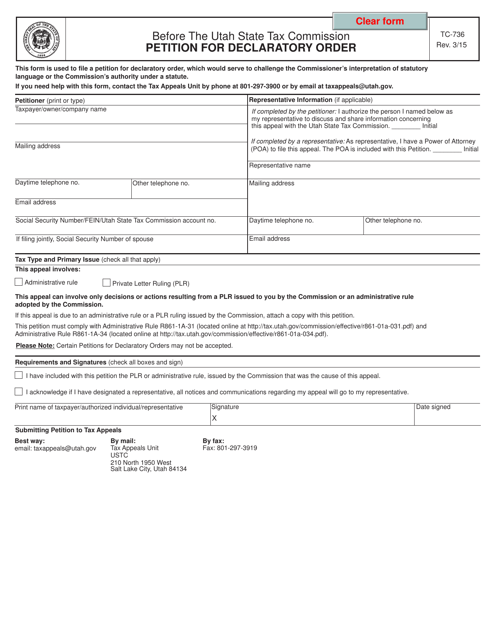

This form is used for filing a petition to request a declaratory order in the state of Utah.

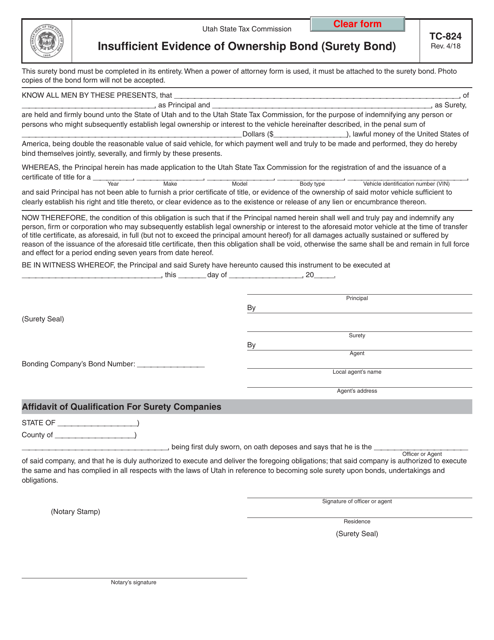

This form is used for submitting an Insufficient Evidence of Ownership Bond (Surety Bond) in the state of Utah. It is required when there is a lack of proof of ownership for a particular asset or property.

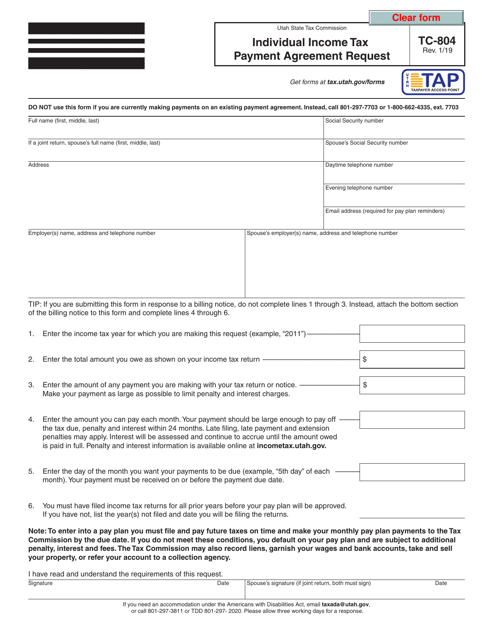

This form is used for requesting an individual income tax payment agreement in the state of Utah.

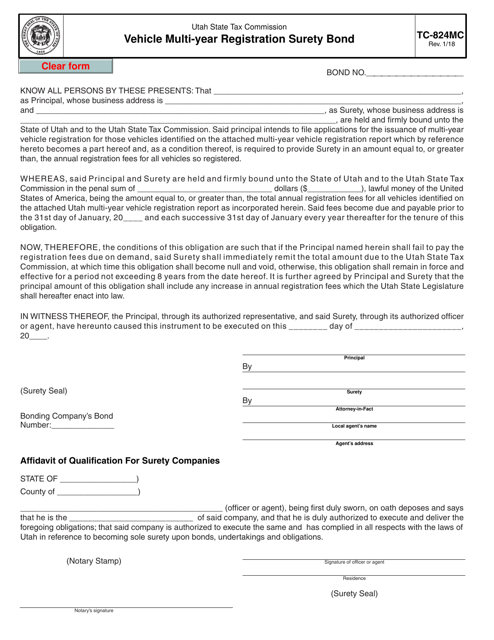

This form is used for obtaining a vehicle multi-year registration surety bond in Utah.

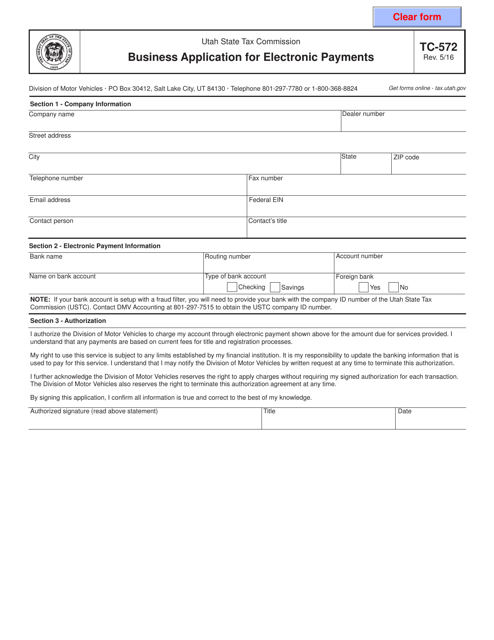

This form is used for businesses in Utah to apply for electronic payment options.

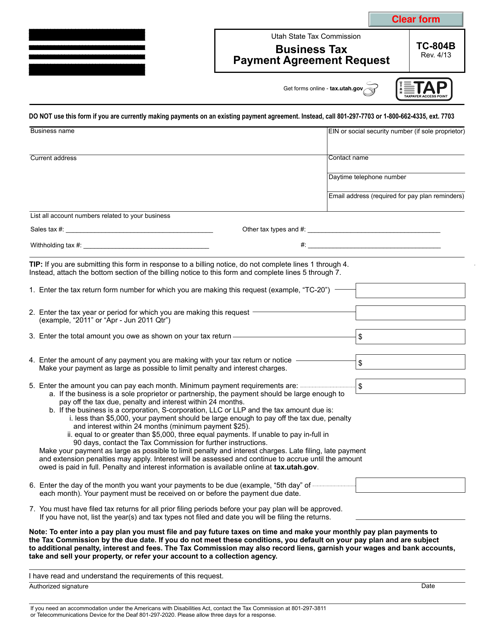

This Form is used for requesting a tax payment agreement for businesses in Utah. It allows businesses to set up a plan to pay their taxes over time.

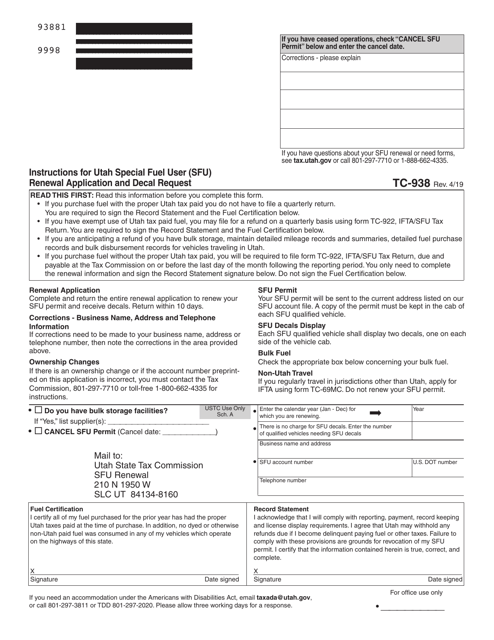

This document provides instructions for individuals in Utah who need to renew their Special Fuel User (SFU) License and request a decal. It outlines the process and requirements for completing the application.

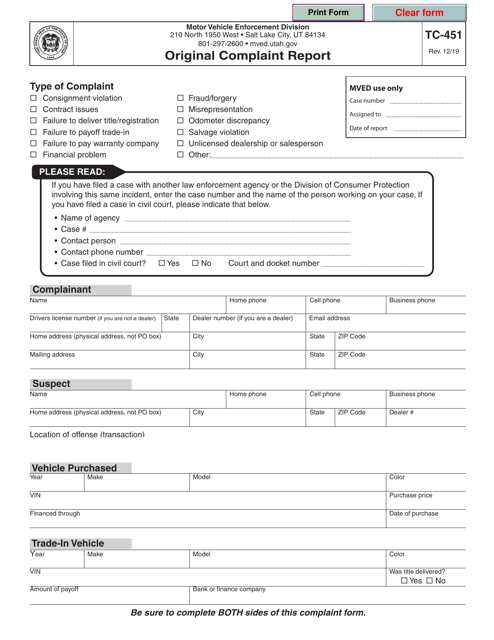

This form is used for filing an original complaint report in the state of Utah.

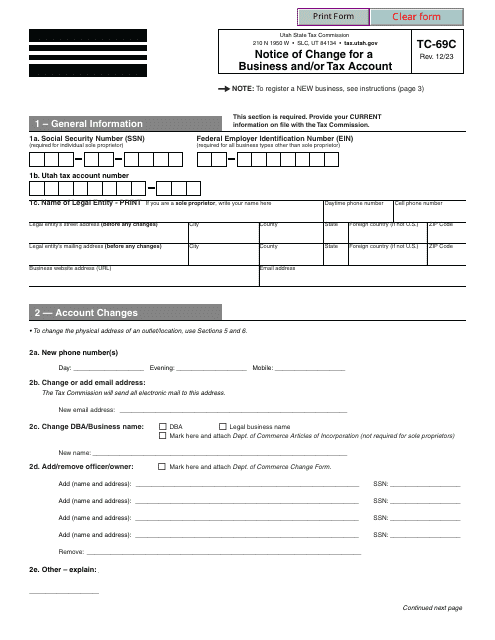

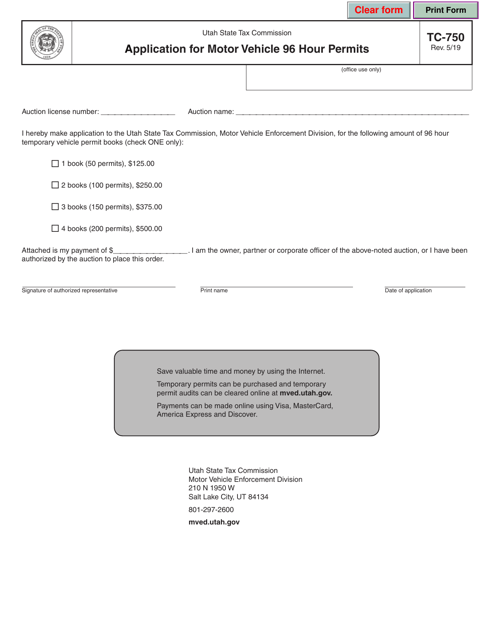

This form is used for applying for a 96-hour permit to operate a motor vehicle in Utah.

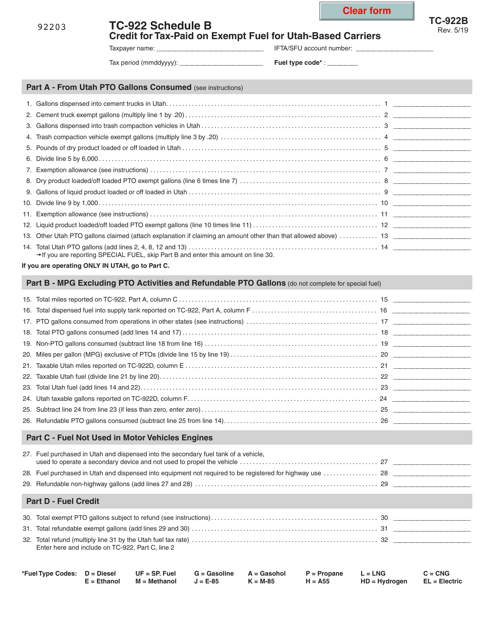

This form is used for Utah-based carriers to claim a credit for tax paid on exempt fuel.

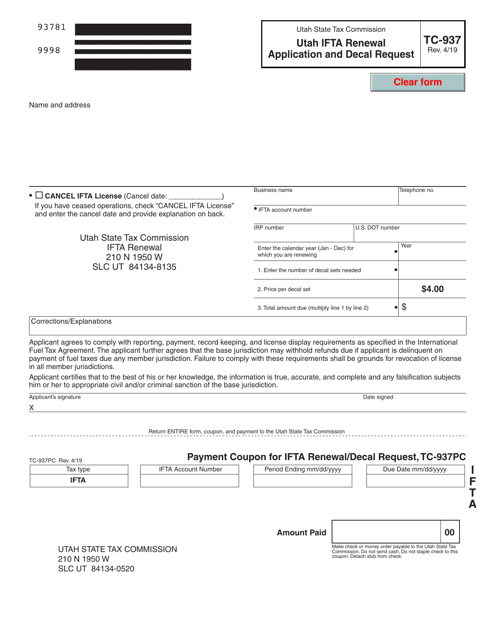

This Form is used for the renewal of an IFTA (International Fuel Tax Agreement) license in Utah and to request decals for commercial vehicles.

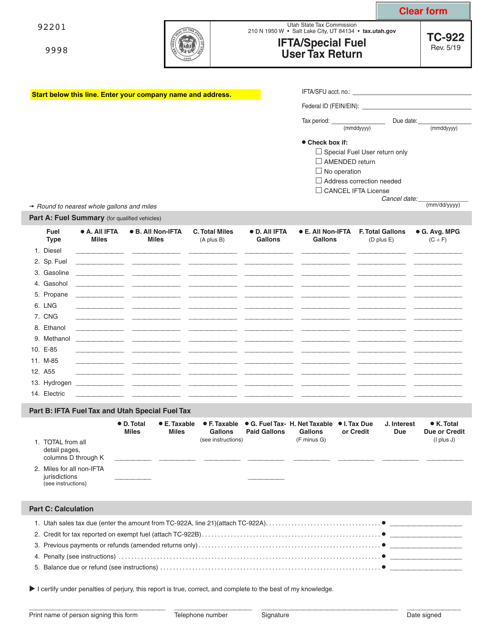

This document is used for filing IFTA (International Fuel Tax Agreement) and Special Fuel User Tax Return in the state of Utah.

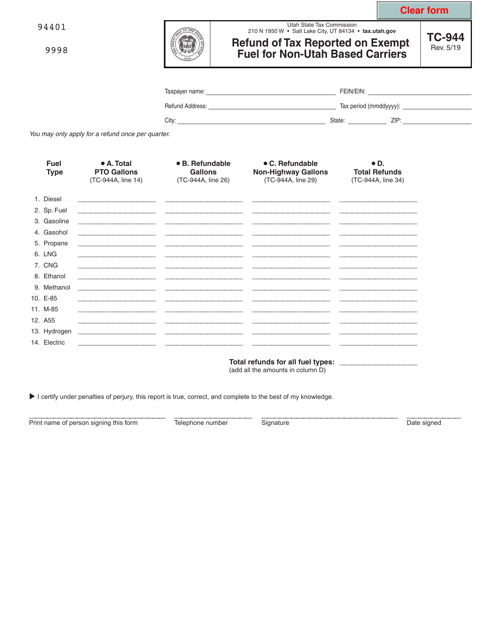

This form is used for requesting a refund of tax reported on exempt fuel for non-Utah based carriers in the state of Utah.

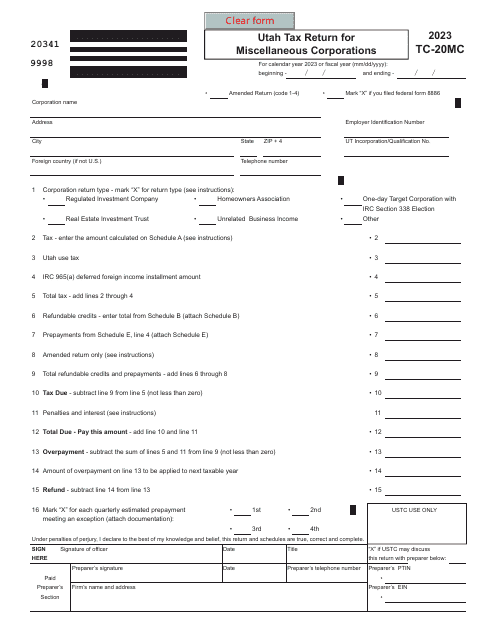

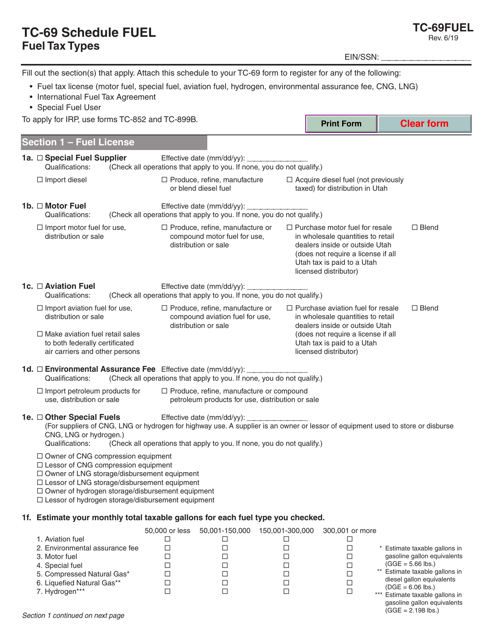

This Form is used for reporting different types of fuel tax in the state of Utah.

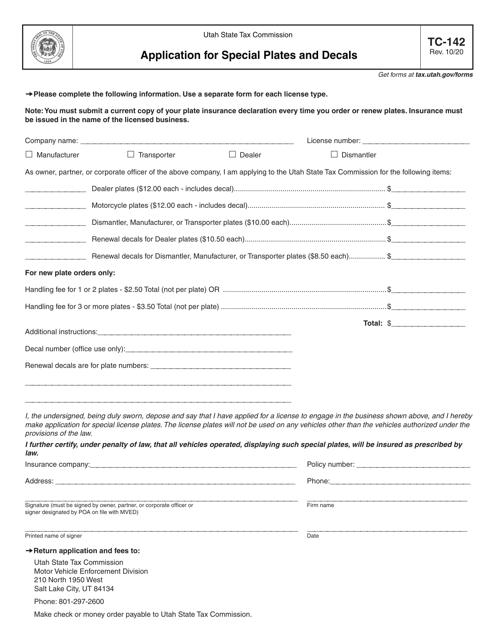

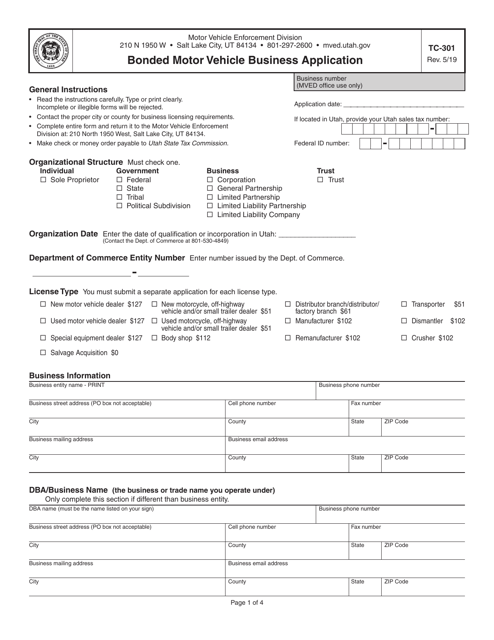

This form is used for businesses in Utah that want to apply for a bonded motor vehicle license.

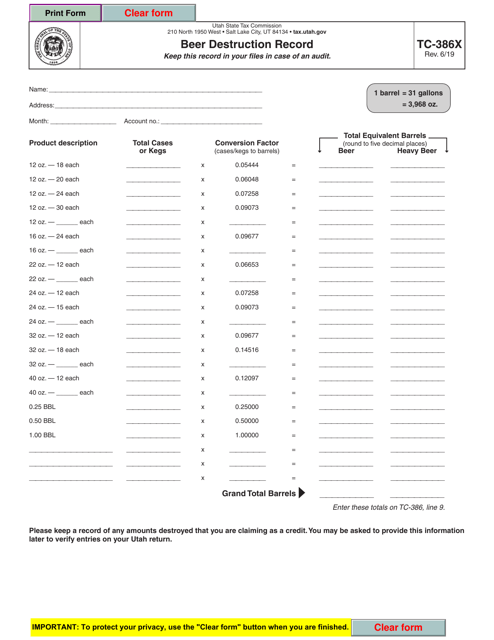

This form is used for recording the destruction of beer in Utah. It helps to document the proper disposal of alcoholic beverages.

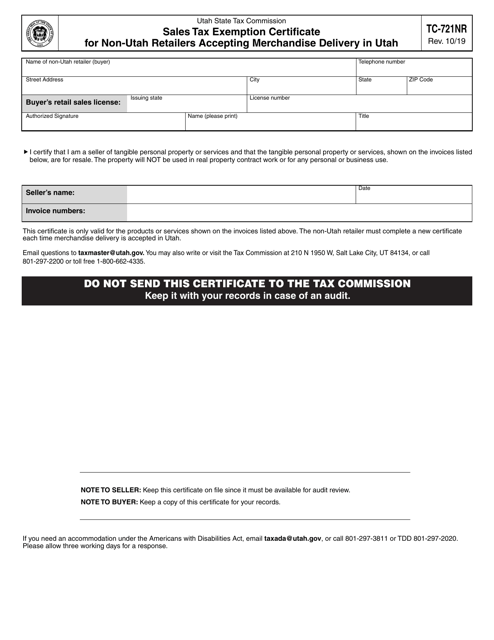

This form is used for non-Utah retailers who are accepting merchandise delivery in Utah to claim exemption from paying sales tax.