Utah State Tax Commission Forms

The Utah State Tax Commission is responsible for the administration and collection of various taxes in the state of Utah. They ensure compliance with state tax laws and provide taxpayer assistance and education. The commission also reviews tax appeals and resolves disputes related to tax issues.

Documents:

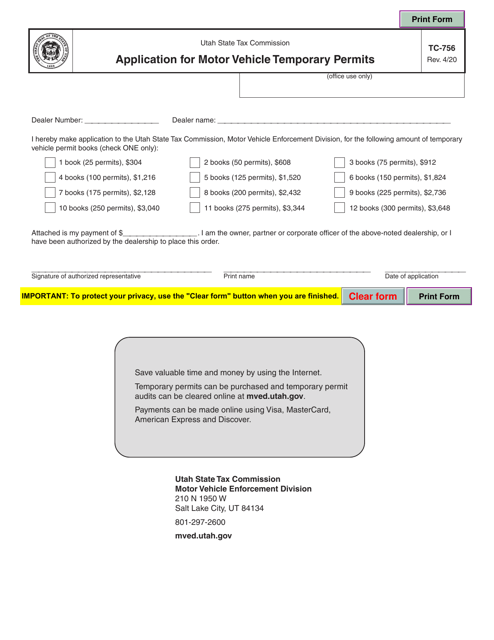

382

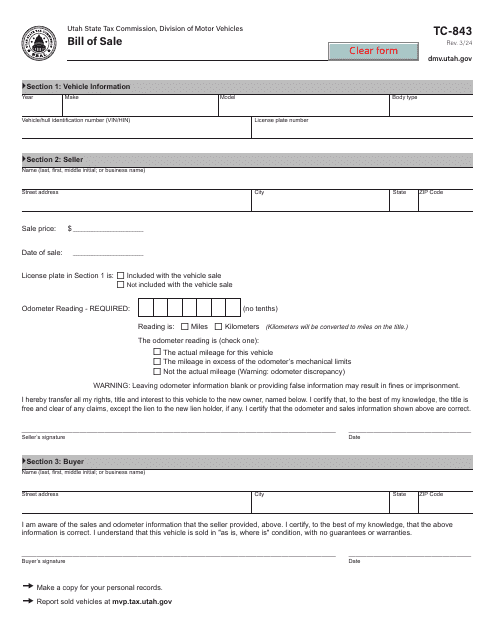

Get this official Utah Bill of Sale that allows a seller and purchaser to exchange a certain amount of money for a motor vehicle. This document is suitable for the sale or purchase of a car, motorcycle, truck, snowmobile or boat in the state.

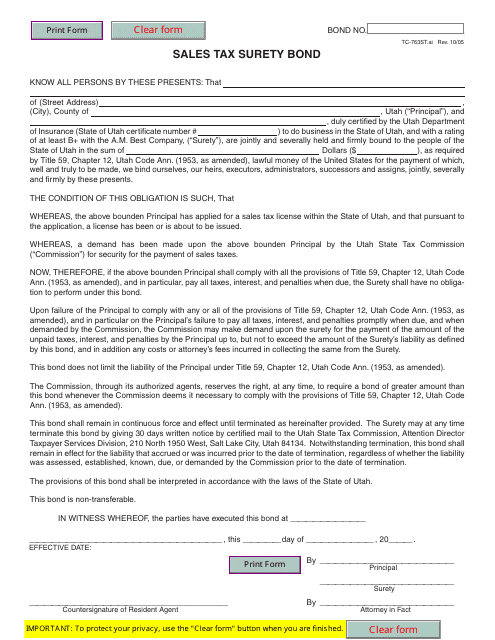

This form is used for obtaining a sales tax surety bond in Utah. The bond serves as a guarantee that the business will pay their sales taxes.

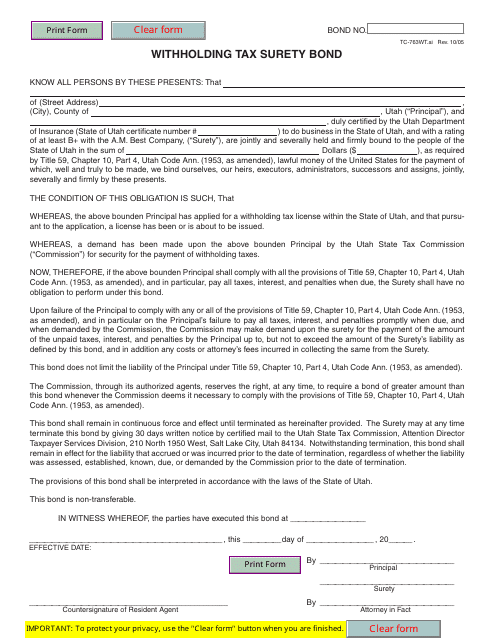

This form is used for filing a withholding tax surety bond in the state of Utah.

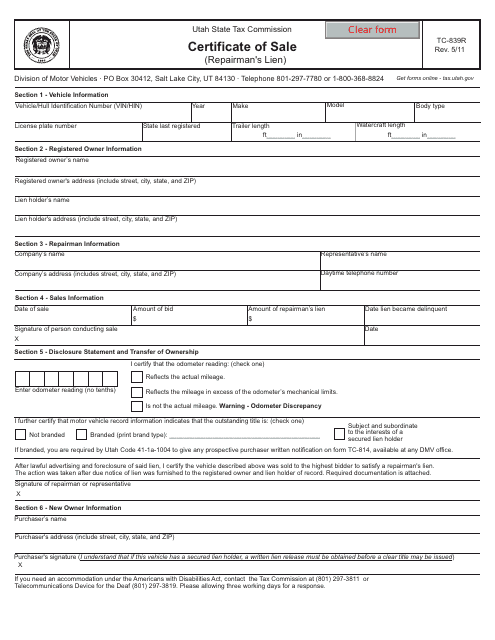

This Form is used for applying for a Certificate of Sale (Repairman's Lien) in the state of Utah. It is used by repairmen to assert their lien rights on a vehicle or equipment that they have repaired or serviced.

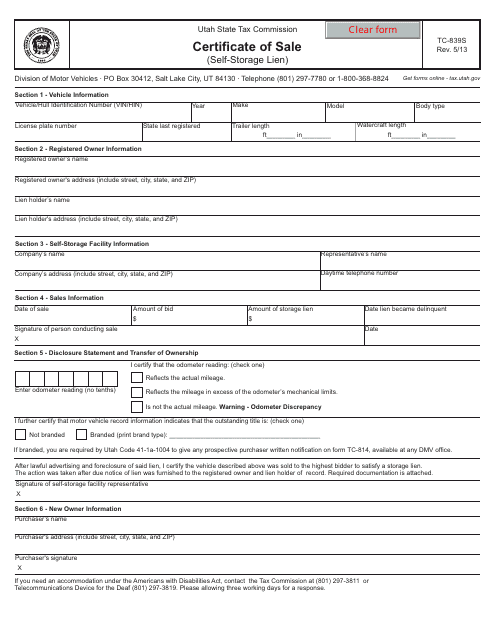

This form is used for obtaining a certificate of sale when a self-storage lien is placed on an individual's property in Utah.

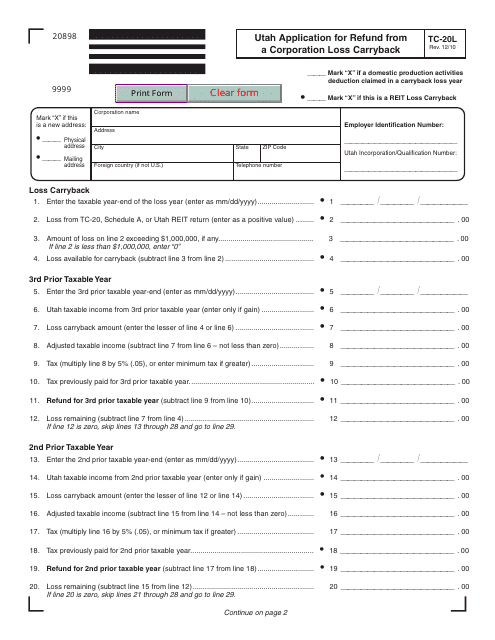

This form is used for corporations in Utah to apply for a refund of taxes from a loss carryback.

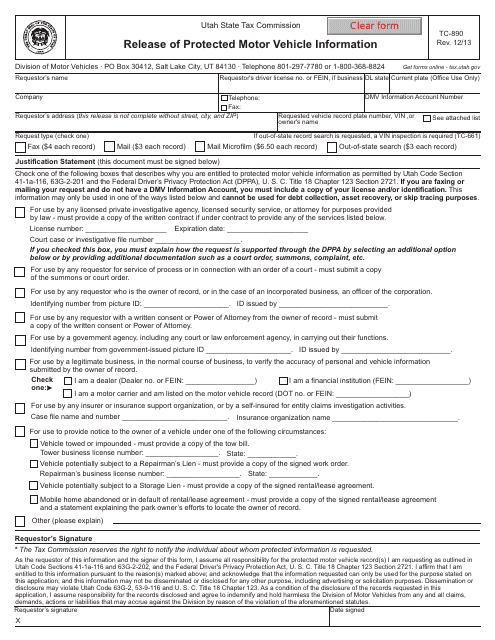

This form is used for requesting the release of protected motor vehicle information in the state of Utah.

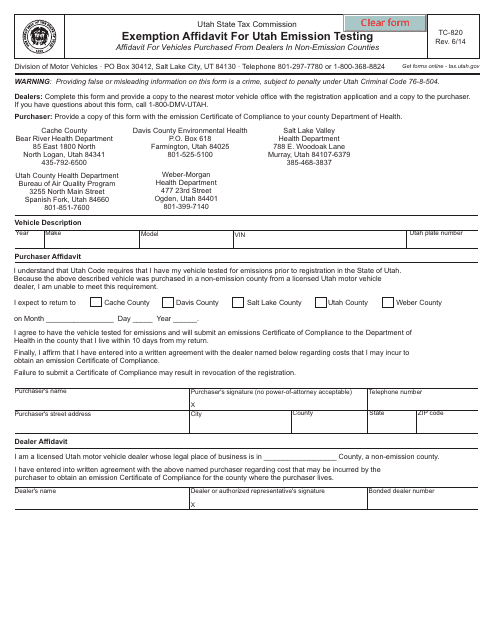

This form is used for applying for an exemption from emission testing in Utah.

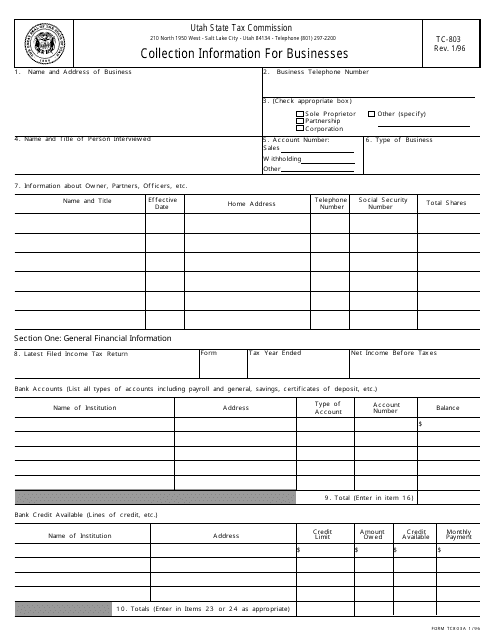

This form is used for businesses in Utah to provide collection information.

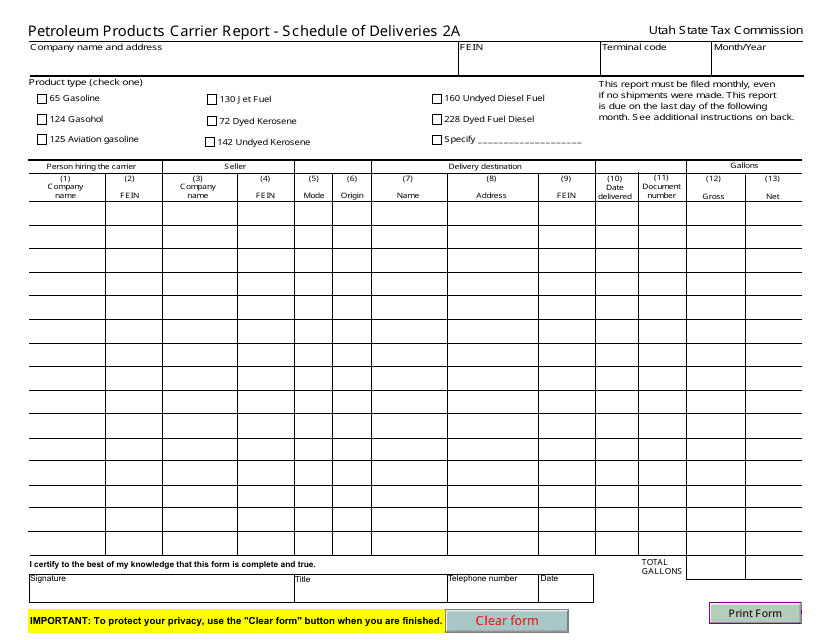

This document is a report that provides a schedule of petroleum product deliveries in Utah.

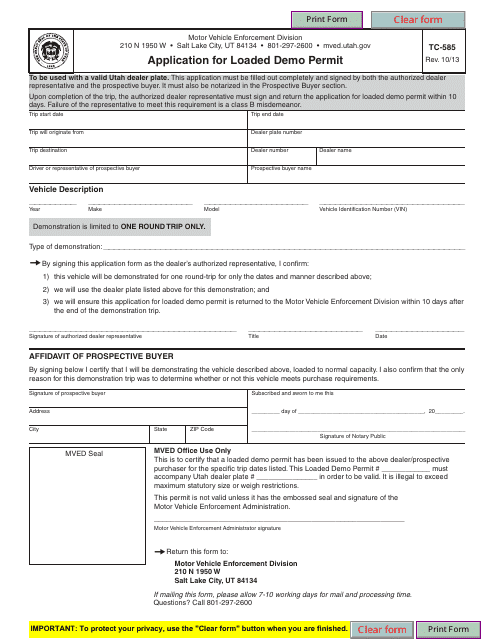

This Form is used for applying for a loaded demo permit in Utah.

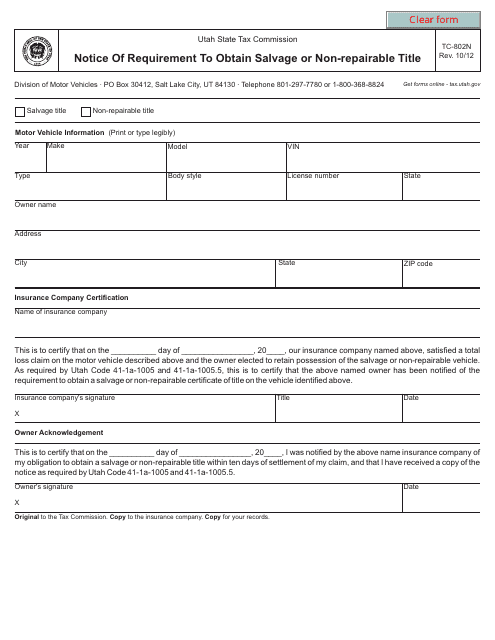

This Form is used for notifying vehicle owners in Utah about the requirement to obtain a salvage or non-repairable title for their vehicle.

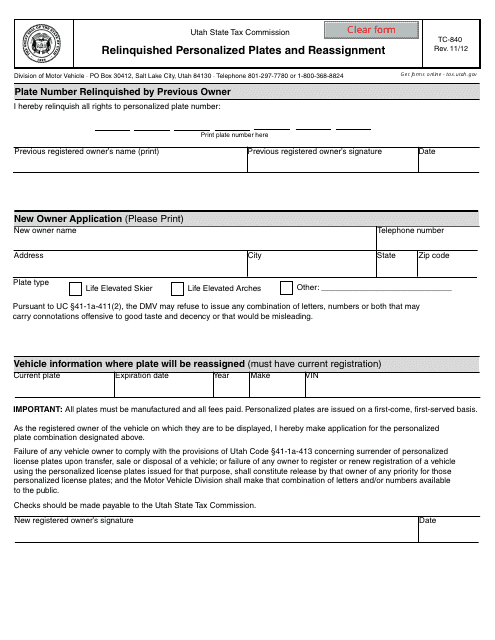

This document is used for relinquishing personalized license plates and reassigning them in the state of Utah.

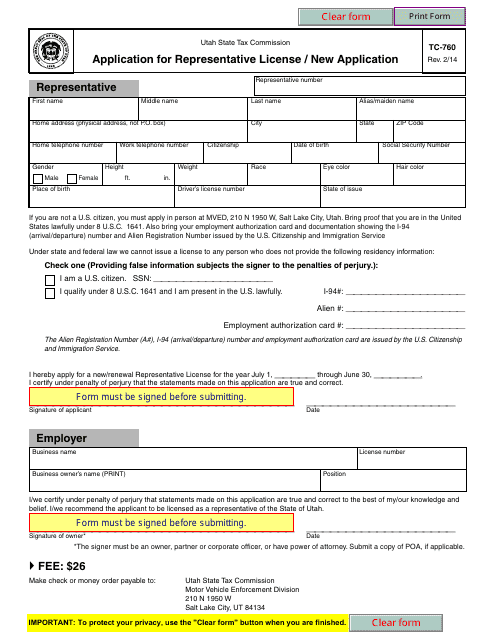

This form is used for applying for a representative license in Utah.

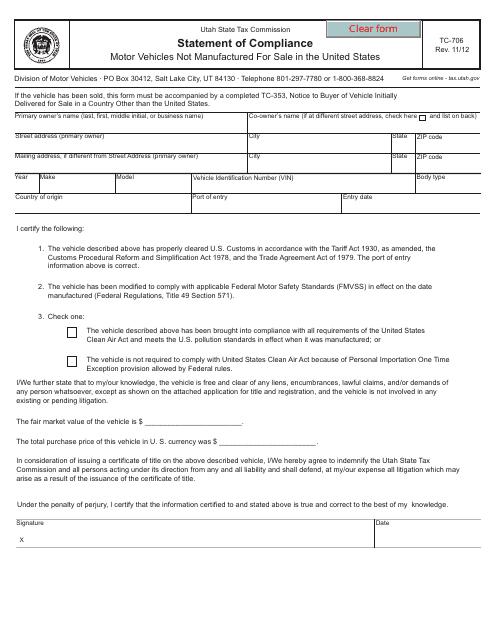

This form is used for motor vehicles that were not manufactured for sale in the United States and are being registered in Utah. It is used to provide a statement of compliance with state requirements.

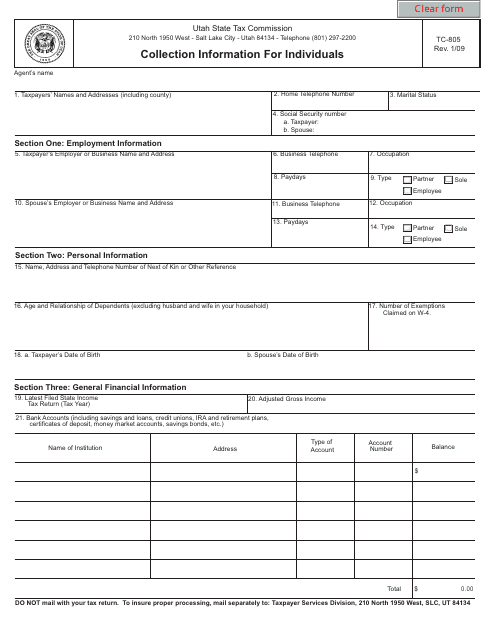

This form is used for collecting information from individuals in Utah for tax purposes. It helps the government determine an individual's ability to pay their taxes.

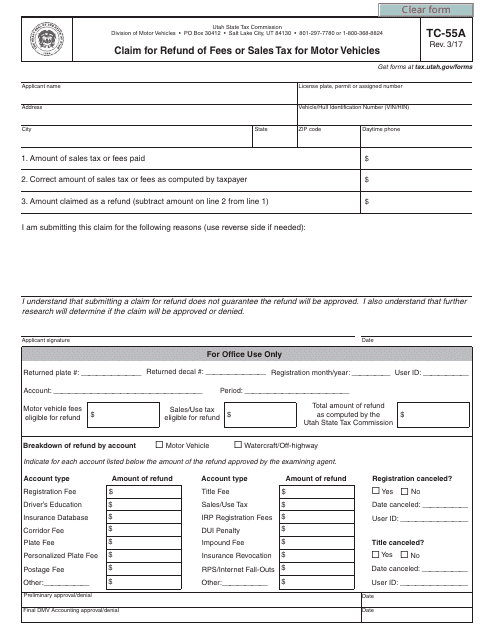

This form is used for claiming a refund of fees or sales tax paid for motor vehicles in Utah.

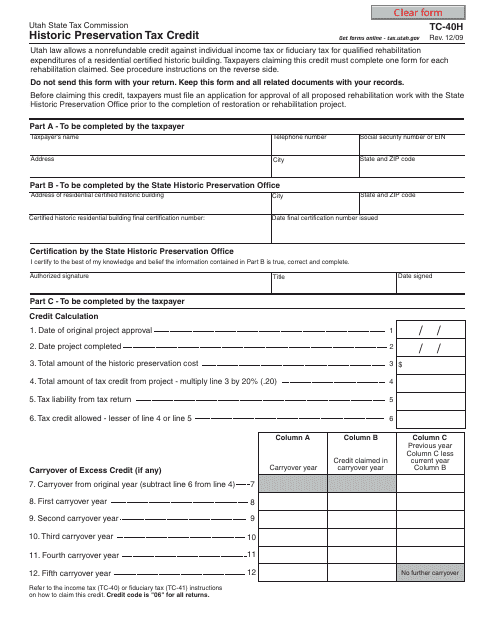

This form is used for claiming the Historic Preservation Tax Credit in Utah. It helps eligible individuals or businesses to receive tax credits for the rehabilitation or preservation of historic buildings or structures in the state.

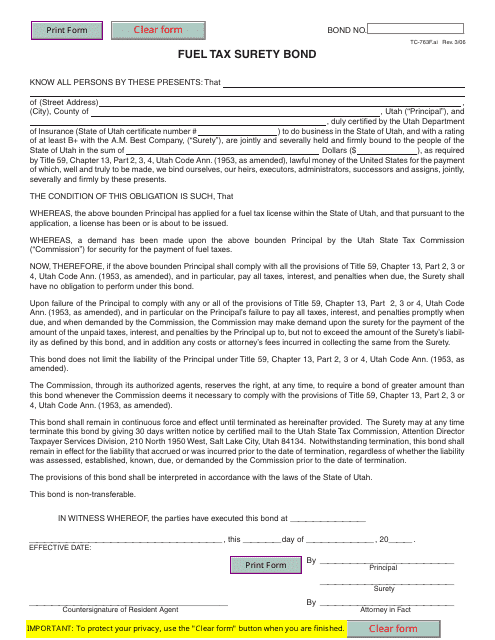

This form is used for filing a fuel tax surety bond in Utah.

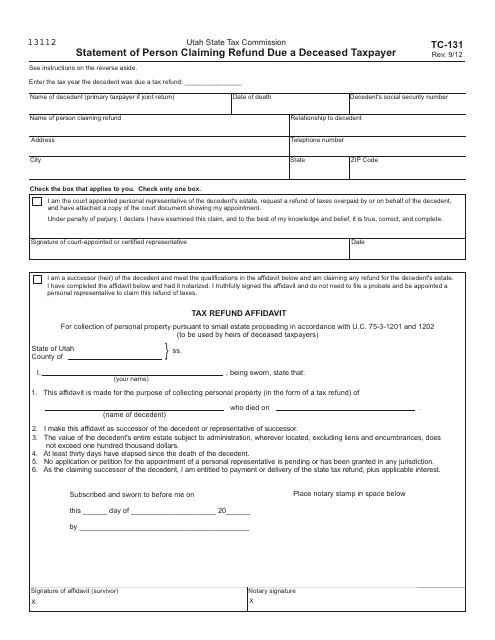

This form is used for individuals claiming a refund on behalf of a deceased taxpayer in the state of Utah.

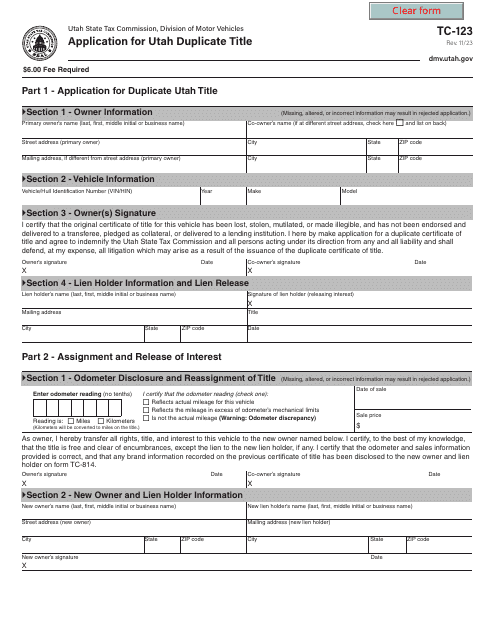

This is a form that must be filled out and submitted by the owner of a vehicle to apply for a duplicate certificate of title in the state of Utah.

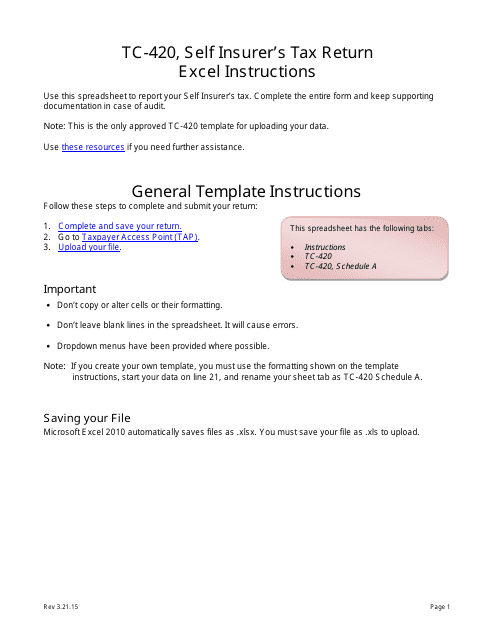

This Form is used for filing the Self-insurer's Tax Return in Utah. It provides instructions to self-insurers on how to properly complete and file their tax return.

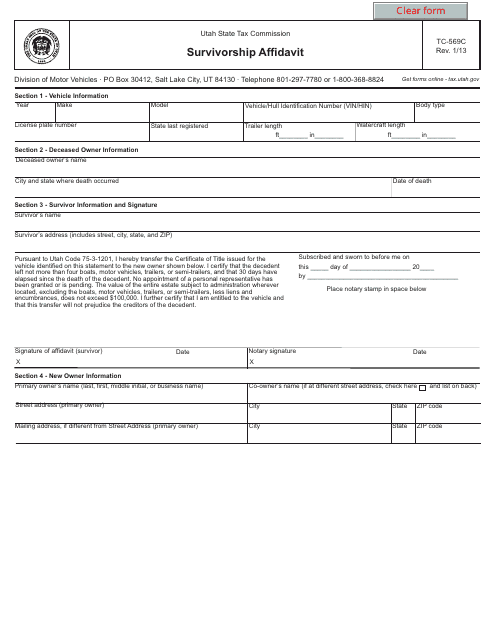

This form is used for completing a survivorship affidavit in the state of Utah. It is used to transfer ownership of property from a deceased individual to one or more surviving co-owners.

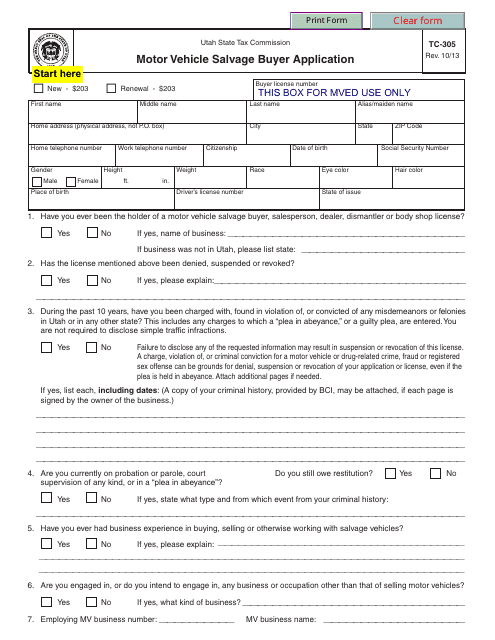

This form is used for individuals or businesses in Utah who want to become a motor vehicle salvage buyer. It serves as an application to obtain the necessary license to legally purchase salvage vehicles in the state.

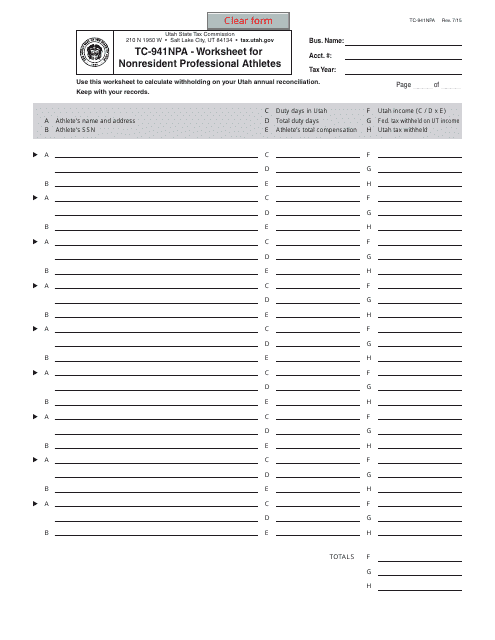

This form is used for nonresident professional athletes in Utah to calculate taxes owed.

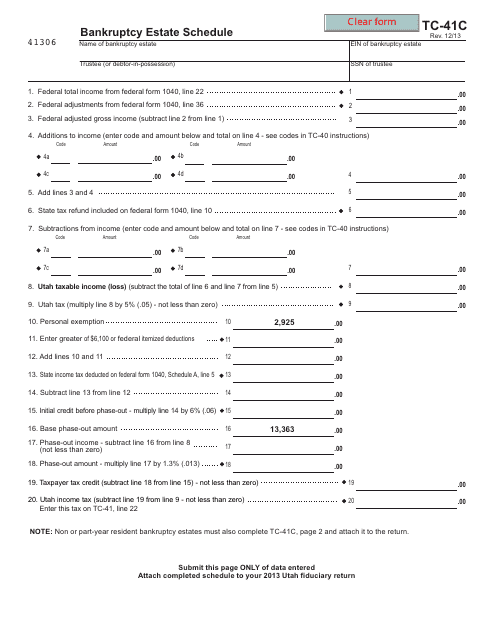

This form is used for filing bankruptcy estate schedule specifically for the state of Utah.

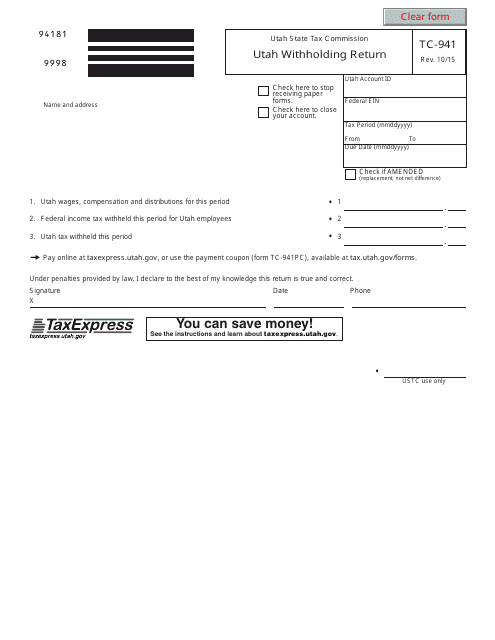

This Form TC-941 is used for reporting and remitting Utah income tax withholdings. Employers in Utah use this form to calculate the amount of state income tax that should be withheld from employees' wages and to report and remit those withholdings to the Utah State Tax Commission.

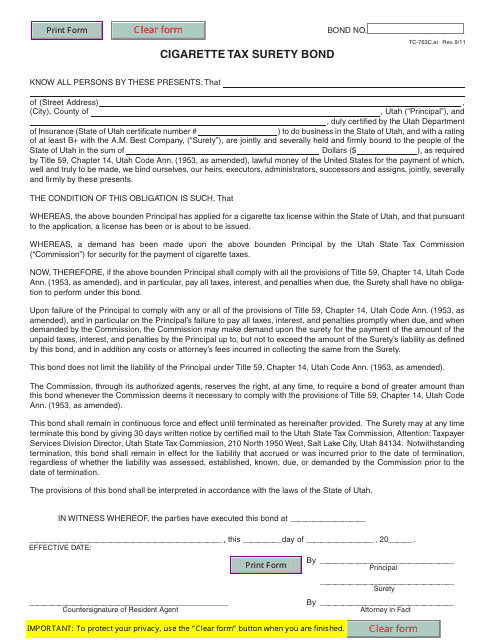

This form is used for obtaining a cigarette tax surety bond in the state of Utah. The bond ensures the payment of cigarette taxes by businesses.

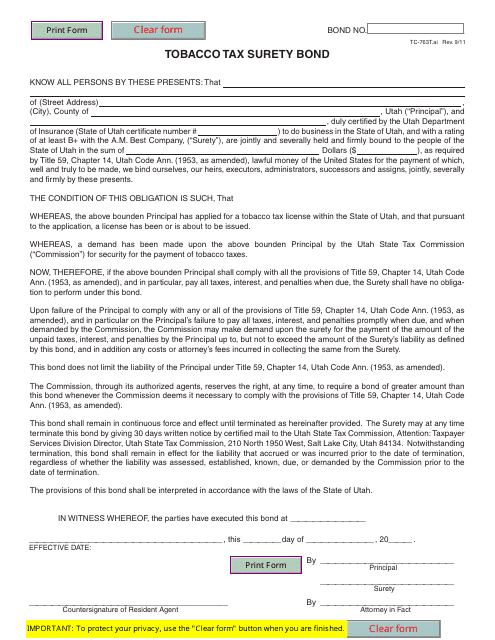

This form is used for obtaining a tobacco tax surety bond in Utah.

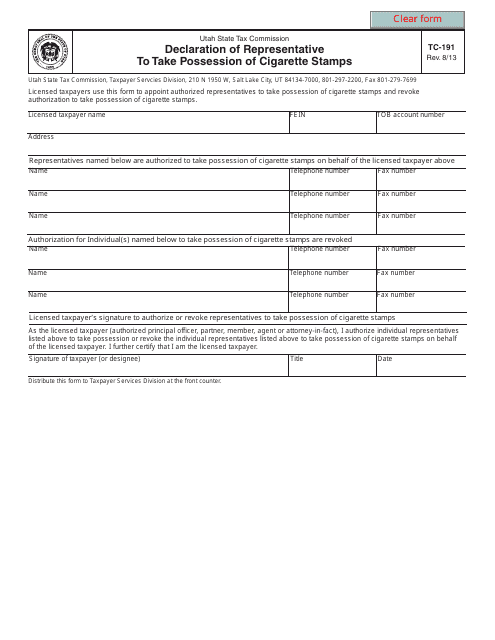

This form is used for declaring a representative who can take possession of cigarette stamps in Utah.

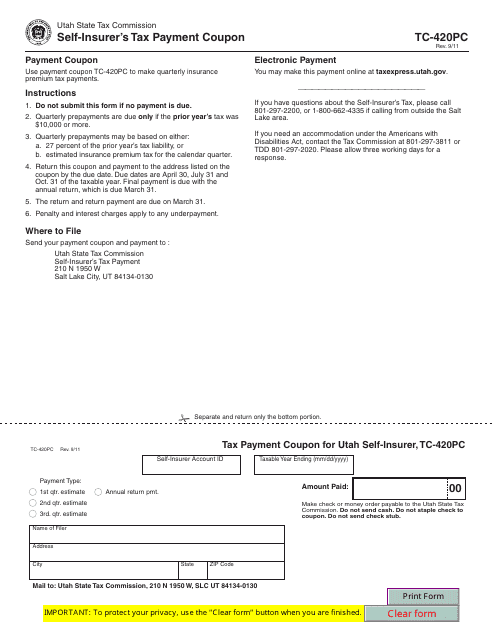

This form is used for self-insurers in Utah to make tax payments.

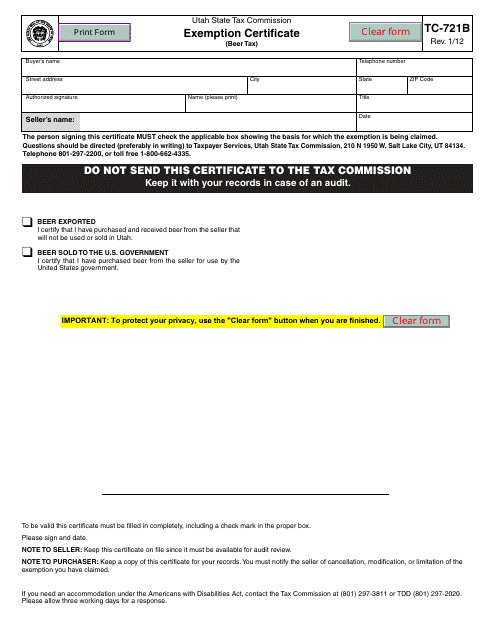

This form is used for claiming an exemption on beer tax in the state of Utah. Businesses can use this form to apply for a tax exemption on beer purchases.