Oklahoma Tax Commission Forms

Documents:

677

This type of document is used for calculating monthly tax for bonded motor fuel importers in Oklahoma.

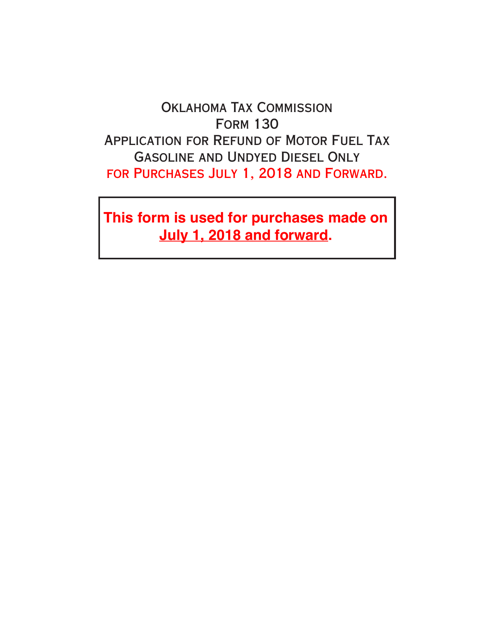

This Form is used for applying for a refund of motor fuel tax for gasoline and undyed diesel purchases made in Oklahoma after July 1, 2018.

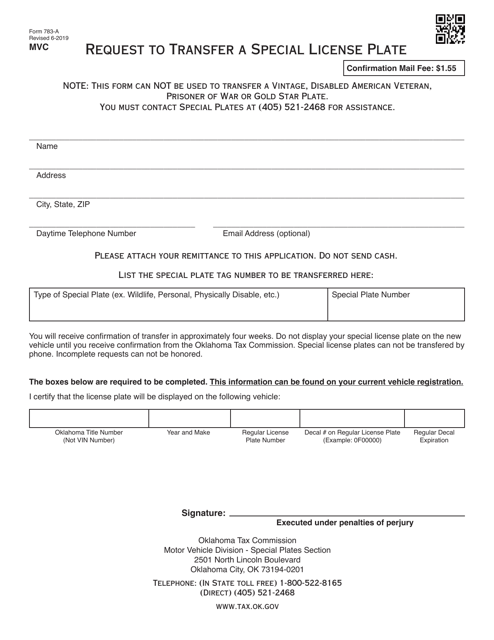

This form is used for requesting the transfer of a special license plate in the state of Oklahoma. It is required to transfer ownership of a specialized license plate from one vehicle to another.

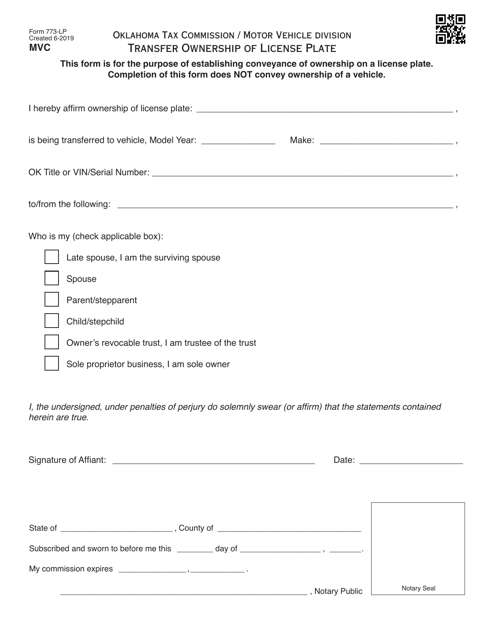

This Form is used for transferring ownership of a license plate in Oklahoma.

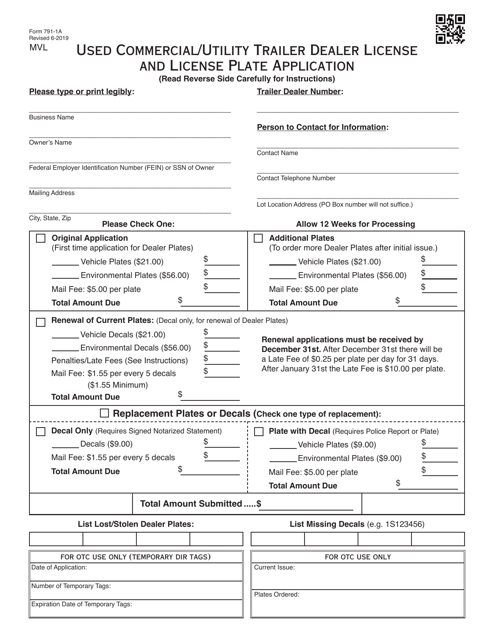

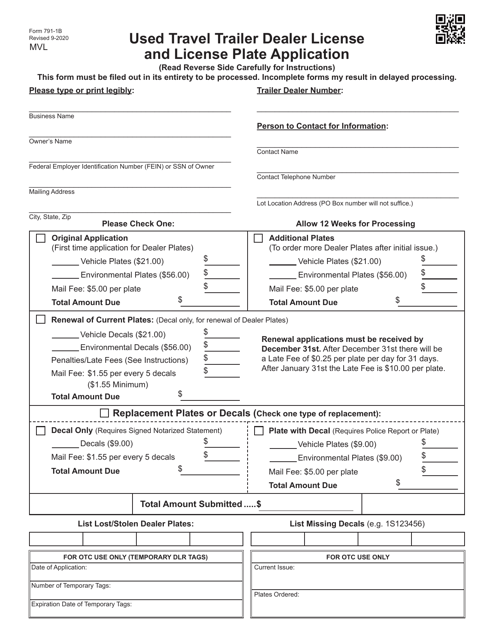

This document is an application form for a commercial/utility trailer dealer license and license plate in Oklahoma.

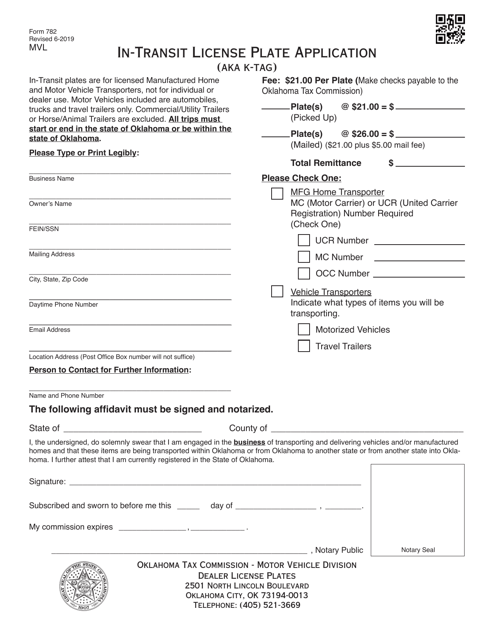

This form is used for applying for an in-transit license plate in Oklahoma, also known as a K-Tag.

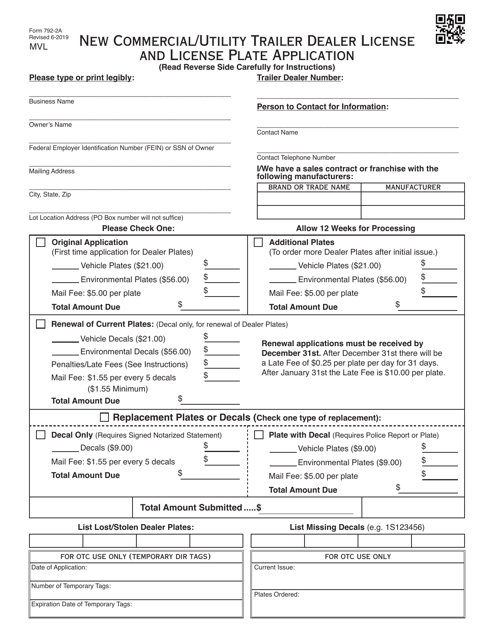

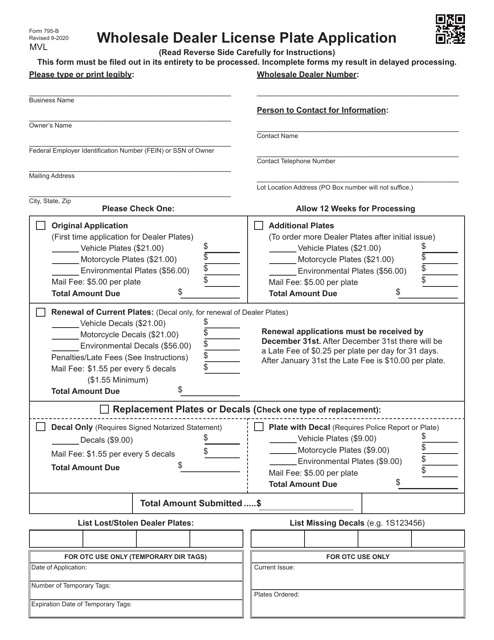

This Form is used for applying for a new license and license plate for commercial/utility trailer dealers in Oklahoma.

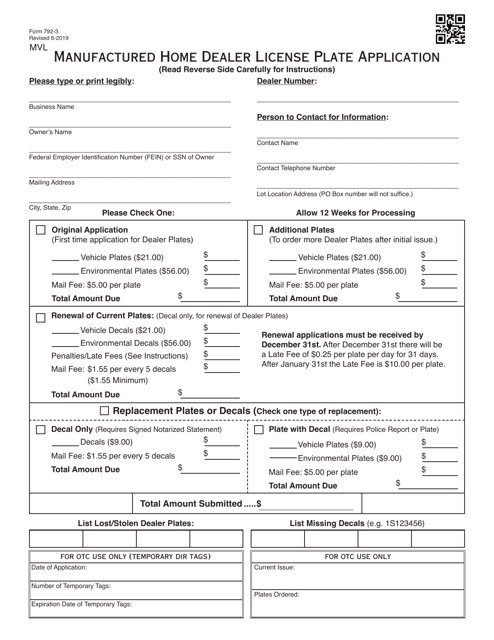

This Form is used for applying for a license plate for manufactured home dealers in Oklahoma.

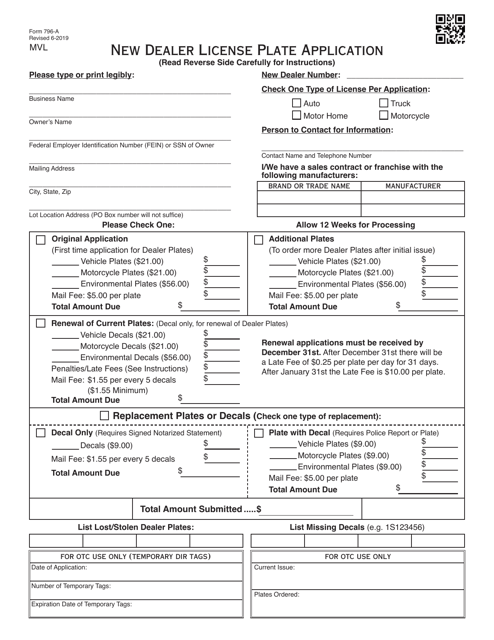

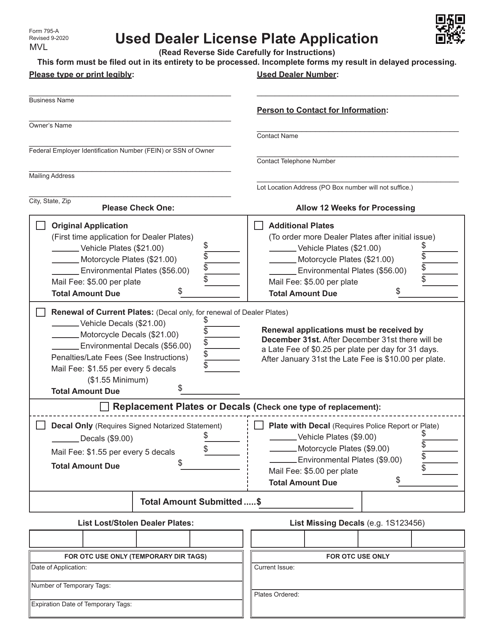

This form is used for applying for a new dealer license plate in Oklahoma.

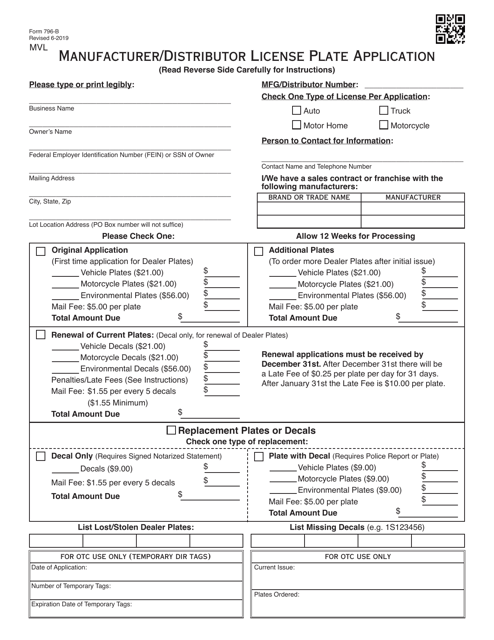

This Form is used for applying for a Manufacturer or Distributor License Plate in Oklahoma.

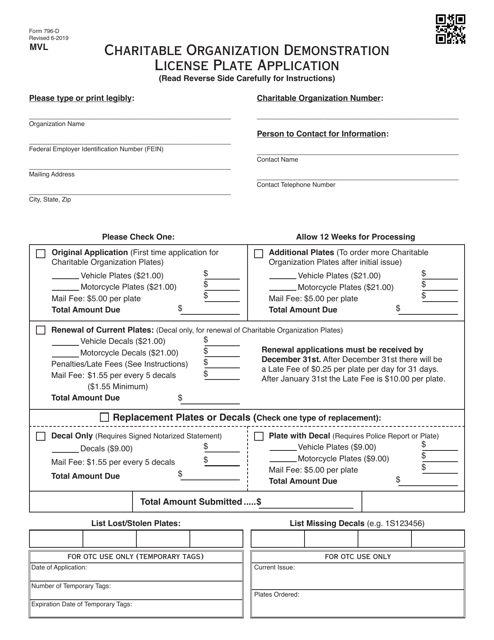

This form is used for applying for the Charitable Organization Demonstration License Plate in Oklahoma.

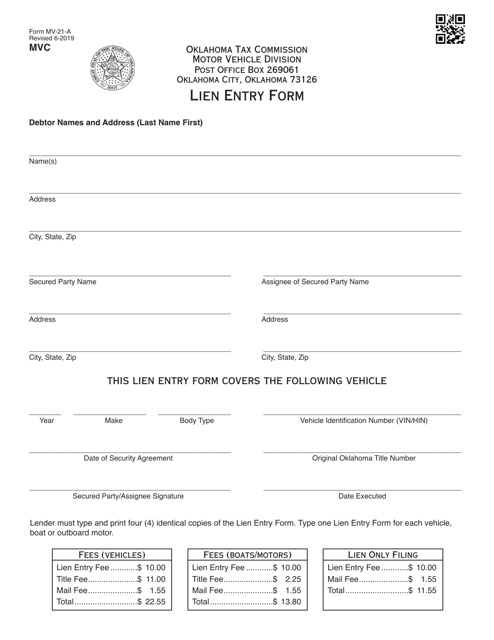

This form is used for recording liens on vehicles in the state of Oklahoma.

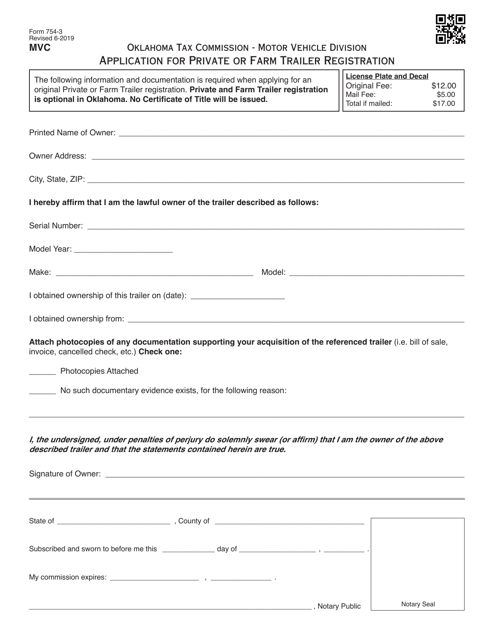

This form is used for applying for private or farm trailer registration in the state of Oklahoma.

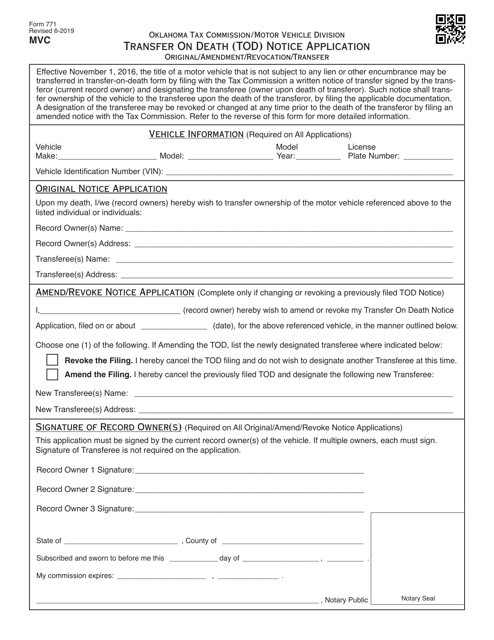

This form is used for applying for a Transfer on Death (TOD) Notice in Oklahoma.

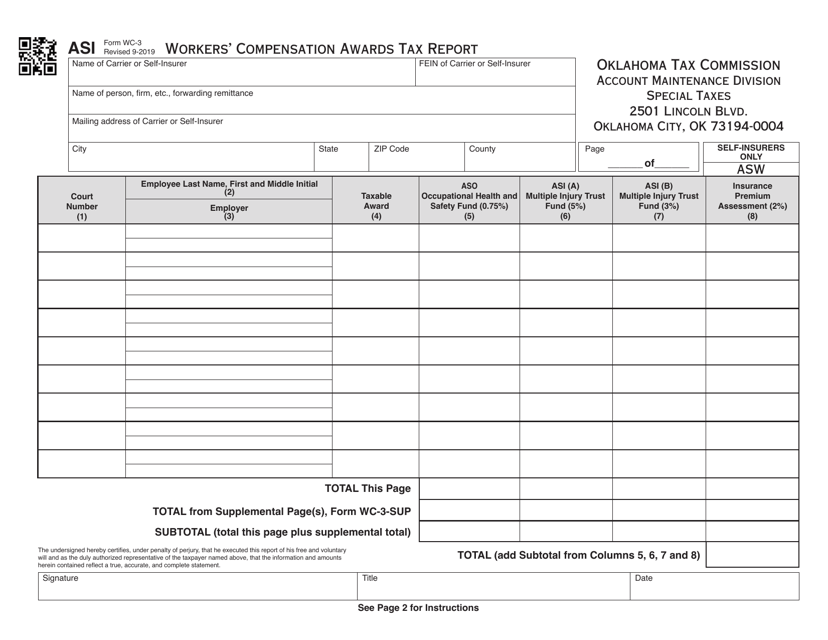

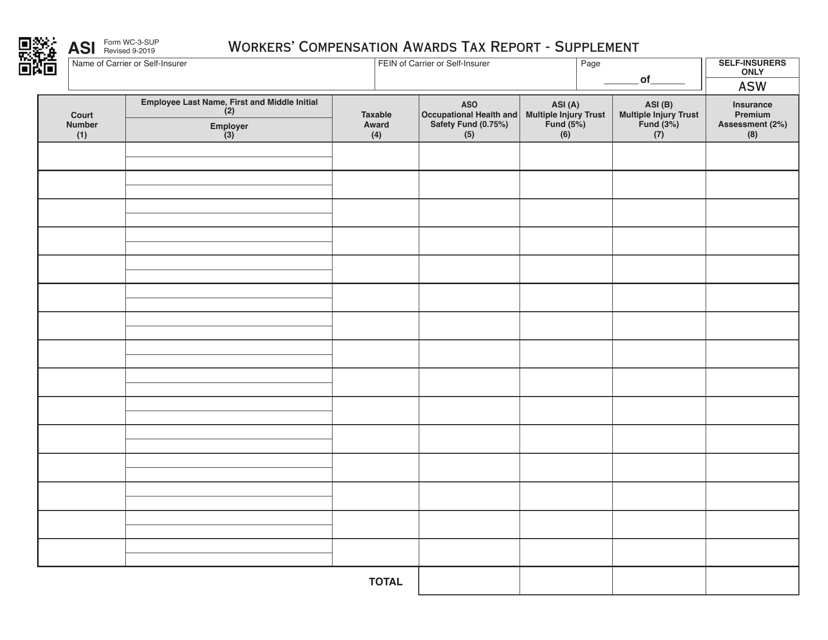

This Form is used for reporting Workers' Compensation Awards for tax purposes in the state of Oklahoma.

This document is a supplemental tax report used in Oklahoma for reporting workers' compensation awards.

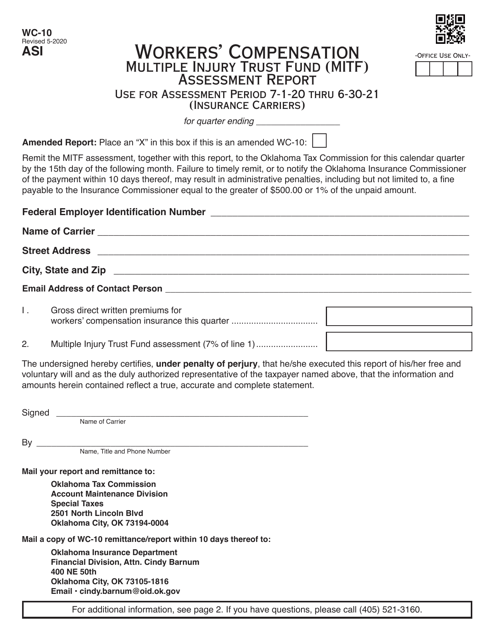

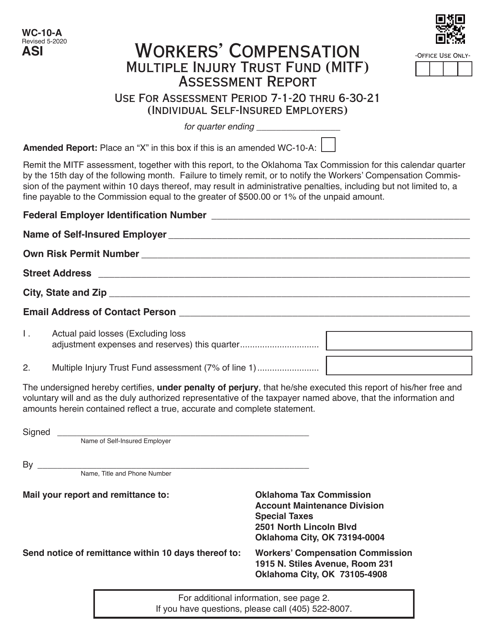

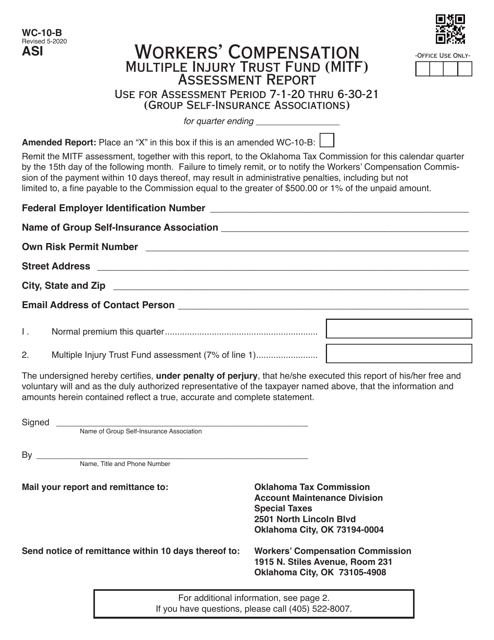

This form is used for reporting the assessment for the Workers' Compensation Multiple Injury Trust Fund (MITF) in Oklahoma during the specified assessment period.

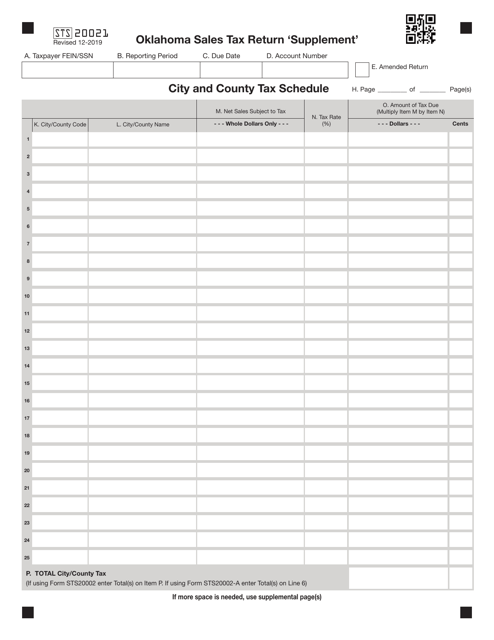

This form is used for filing a sales tax return in the state of Oklahoma. It is a supplemental form that must be filed along with the regular sales tax return.

This form is used for filing sales tax returns in the state of Oklahoma. It is necessary for businesses to report and pay their sales tax liability to the Oklahoma Tax Commission.

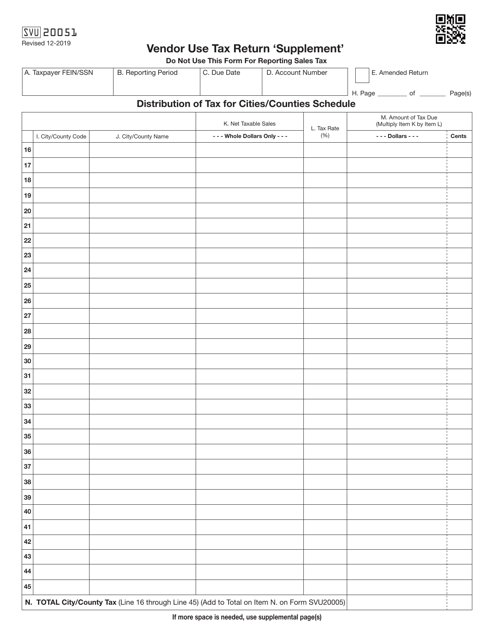

This form is used for submitting a supplemental Vendor Use Tax Return in the state of Oklahoma. This document is specifically for vendors who need to report and pay use tax on items purchased for their business from out-of-state sellers.

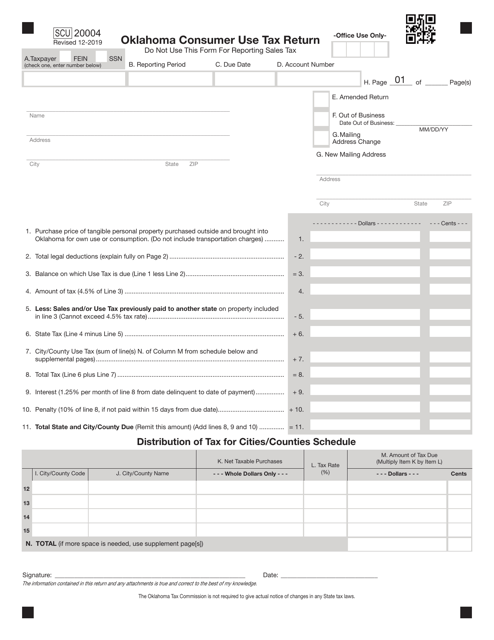

This form is used for reporting and paying consumer use tax in the state of Oklahoma. It is used by individuals and businesses to report any purchases made from out-of-state sellers that were not taxed at the time of purchase.

This form is used for reporting and paying lodging taxes in the state of Oklahoma.

This form is used for reporting and paying the voluntary tire recycling fee in the state of Oklahoma.

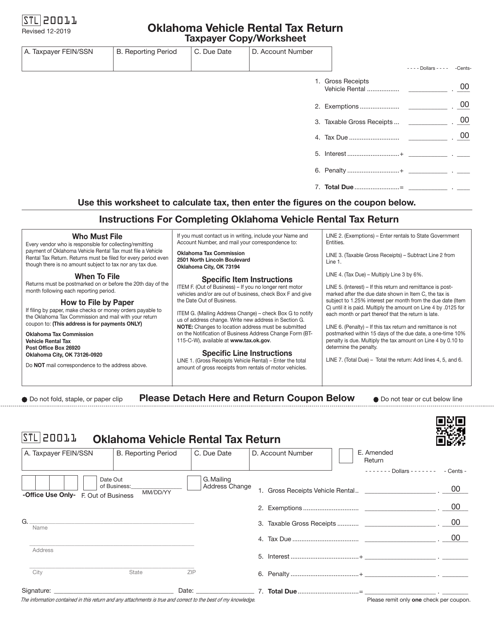

This form is used for reporting and paying vehicle rental taxes in Oklahoma. It is the taxpayer's copy or worksheet to keep track of their rental activities.