Prince Edward Island Department of Finance Forms

The Prince Edward Island Department of Finance is responsible for the financial management and economic policies of the province. It oversees the government's budgets, taxation, revenue generation, debt management, and financial planning. The department plays a crucial role in ensuring the efficient and effective use of public funds and is responsible for promoting economic growth and stability in Prince Edward Island, Canada.

Documents:

108

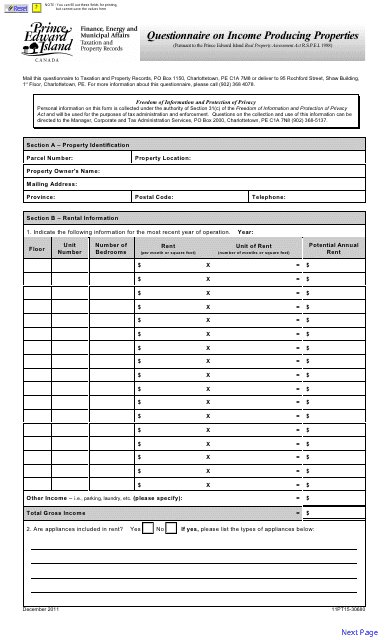

This Form is used for a questionnaire on income producing properties in Prince Edward Island, Canada. It collects information related to income generated from properties in the province.

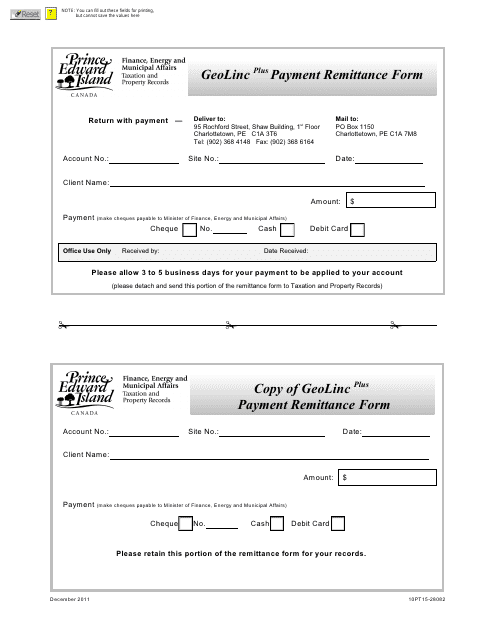

This form is used for making payment remittance in Prince Edward Island, Canada. It is specifically designated for Geolinc payments.

This Form is used for applying for a review of the assessment of a farm building in Prince Edward Island, Canada.

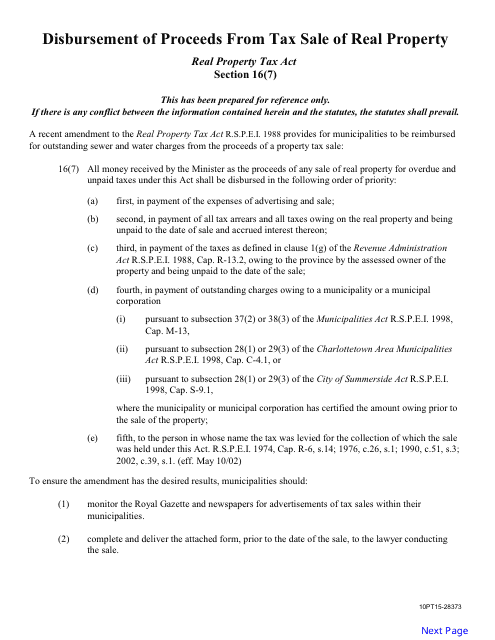

This form is used for requesting payment of outstanding sewer and water charges from the proceeds of a property tax sale in Prince Edward Island, Canada.

This document is used for applying for provincial tax credits in Prince Edward Island, Canada. It is used to claim potential tax deductions and benefits specific to the province.

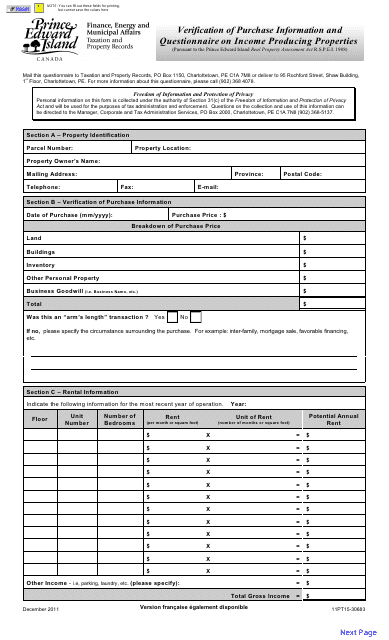

This form is used for verifying purchase information and gathering income-related details for properties in Prince Edward Island, Canada. It helps establish the accuracy of property purchase data and provides information on the income potential of the property.

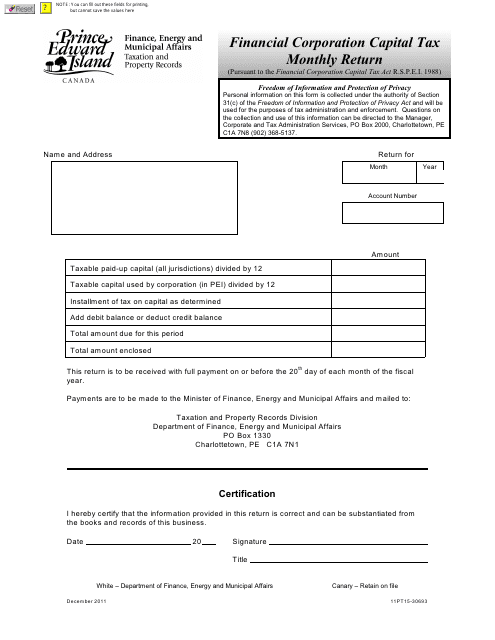

This Form is used for filing the monthly financial corporation capital tax return in Prince Edward Island, Canada. It is compulsory for financial corporations to report their tax liabilities on a monthly basis.

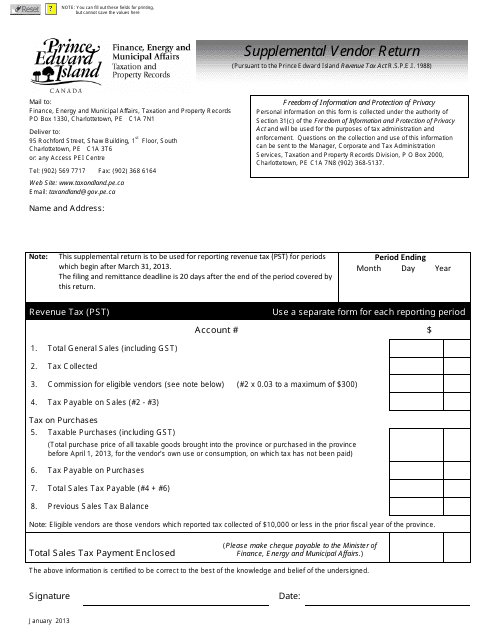

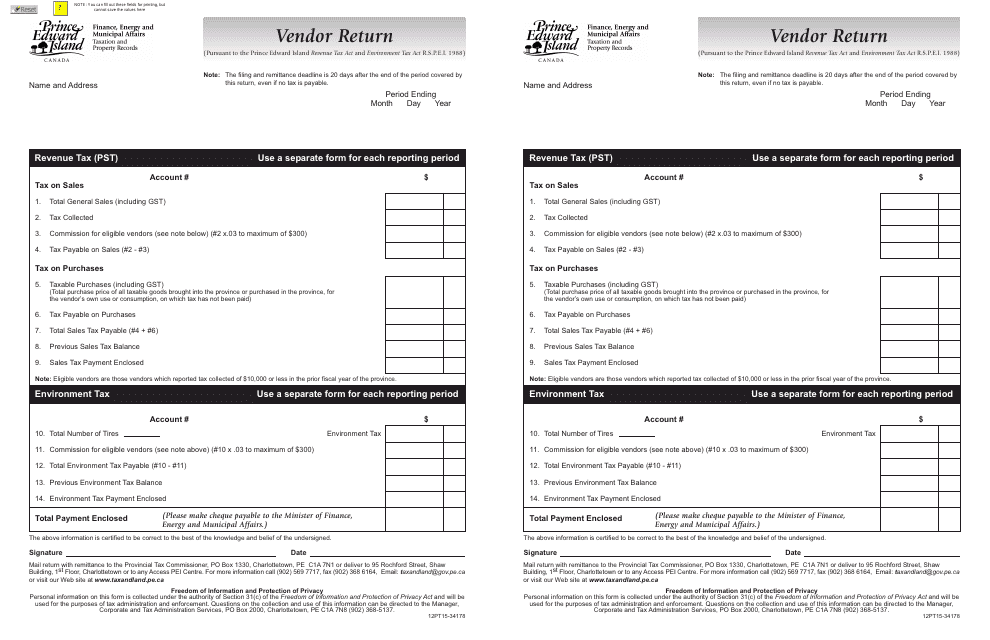

This form is used for submitting additional vendor returns in Prince Edward Island, Canada.

This document is used for filing a vendor return in Prince Edward Island, Canada.

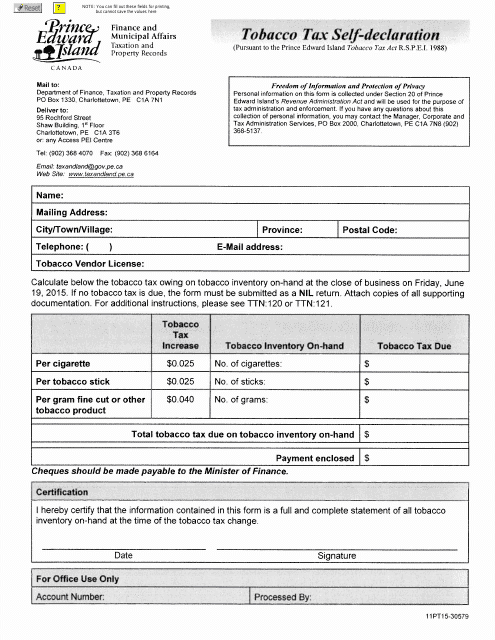

This form is used for individuals and businesses in Prince Edward Island, Canada to self-declare their tobacco taxes.

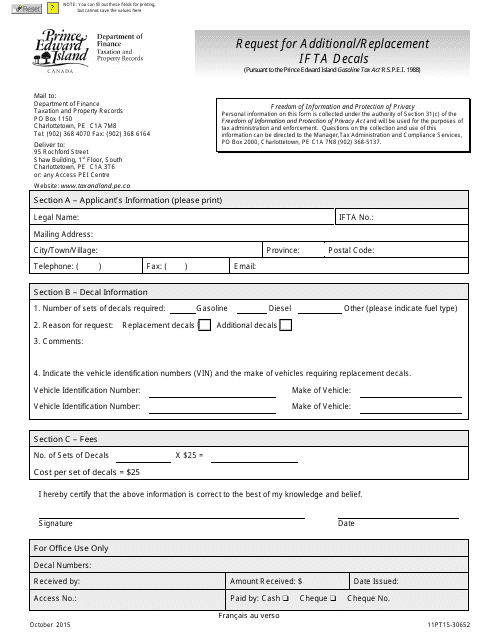

This document is used for requesting additional or replacement IFTA (International Fuel Tax Agreement) decals in Prince Edward Island, Canada.

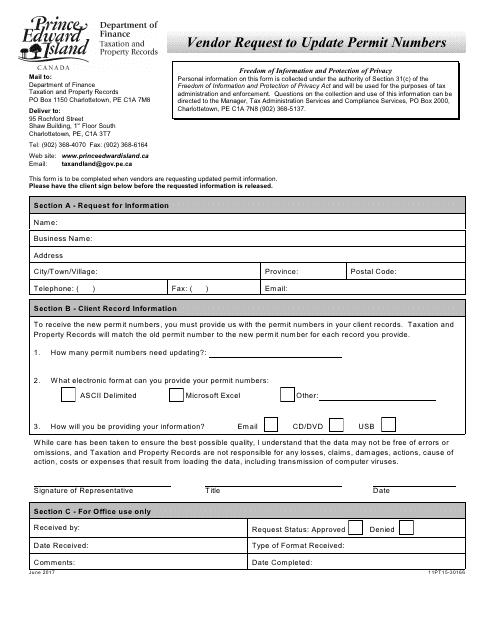

This document is a request from a vendor to update permit numbers in Prince Edward Island, Canada. It is used to ensure compliance with local regulations and licenses.

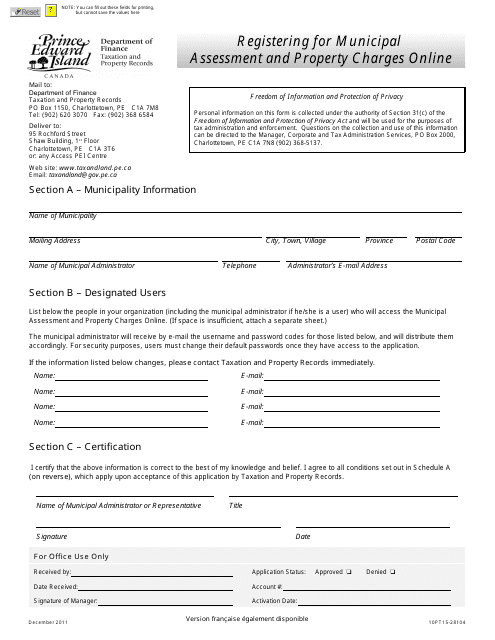

This document is for residents of Prince Edward Island, Canada who want to register for municipal assessment and property charges online.

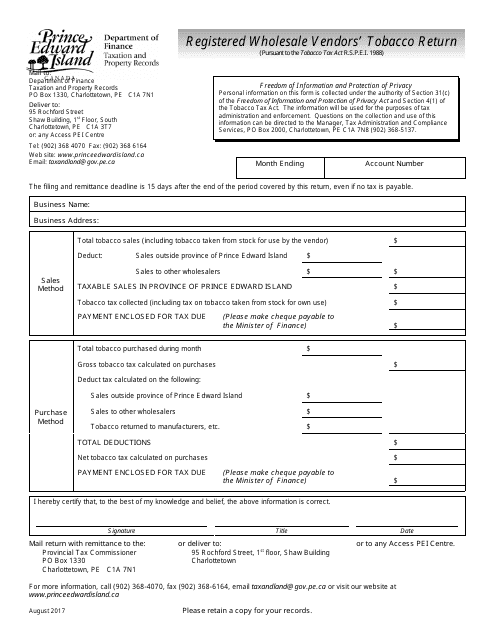

This document is used for registered wholesale vendors to file their tobacco return in Prince Edward Island, Canada.

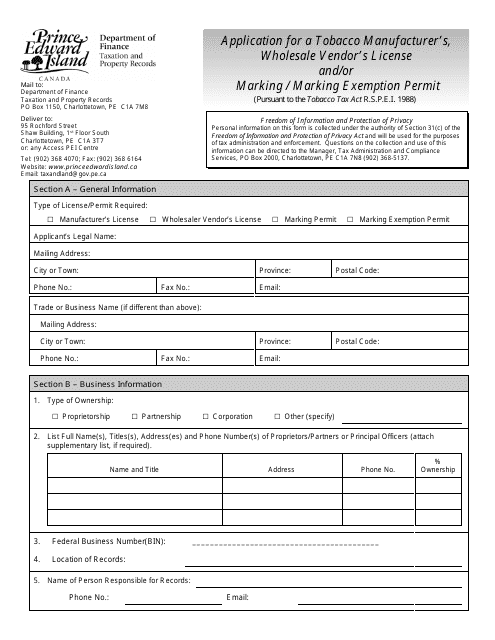

This document is an application for a license and/or permit required for a tobacco manufacturer or wholesale vendor in Prince Edward Island, Canada. It includes the ability to apply for an exemption from marking requirements.

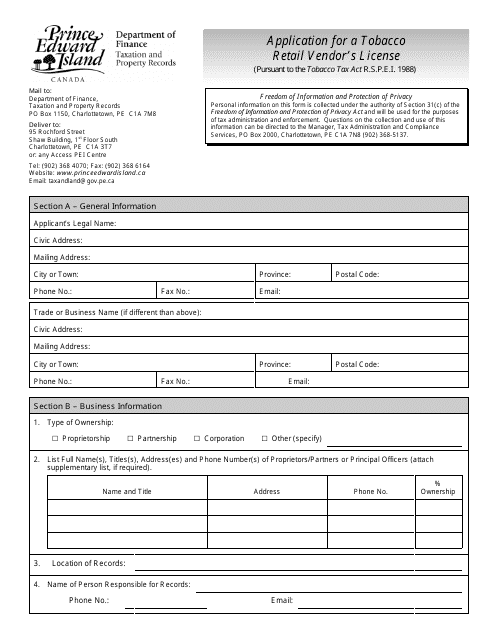

This document is used to apply for a Tobacco Retail Vendor's License in Prince Edward Island, Canada.

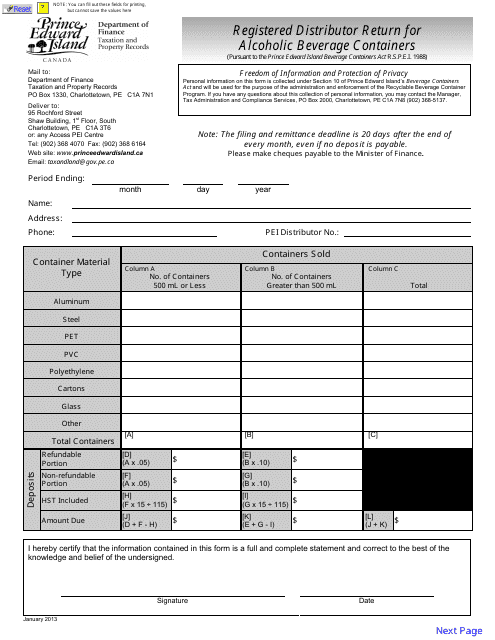

This form is used for registered distributors in Prince Edward Island, Canada to report and return alcoholic beverage containers.

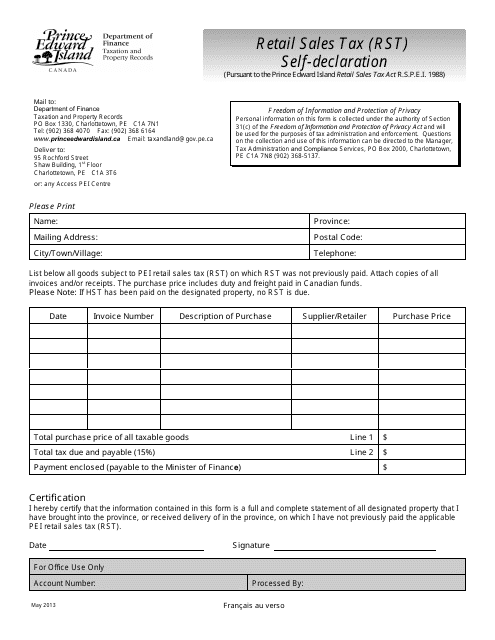

This document is used for self-declaration of Retail Sales Tax (RST) in Prince Edward Island, Canada. It pertains to businesses reporting and paying their retail sales tax obligations to the provincial government.

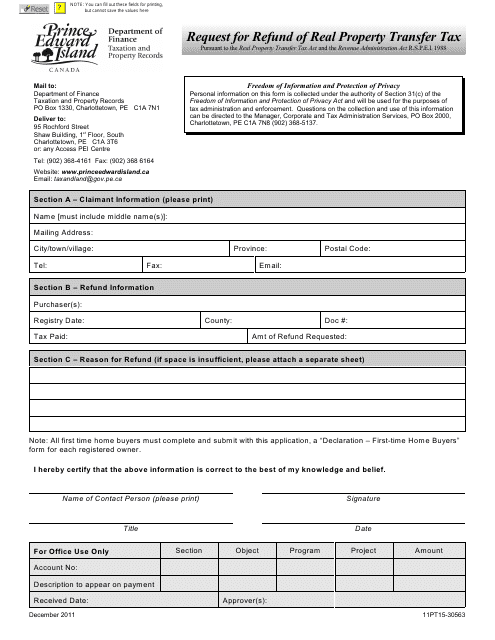

This Form is used for requesting a refund of real property transfer tax in Prince Edward Island, Canada.

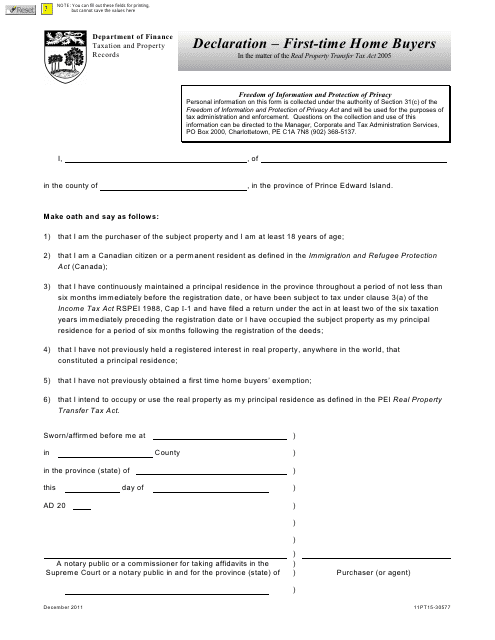

This document is for first-time homebuyers in Prince Edward Island, Canada. It provides information related to the declaration process for individuals purchasing a home for the first time in PEI.

This document is for registering for a Geolinc Plus account in Prince Edward Island, Canada.

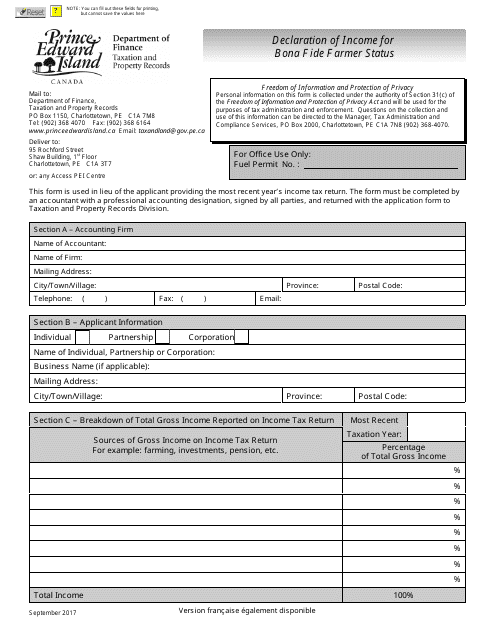

This document is used for declaring income and proving bona fide farmer status in Prince Edward Island, Canada. It is necessary for farmers to qualify for certain benefits and exemptions.

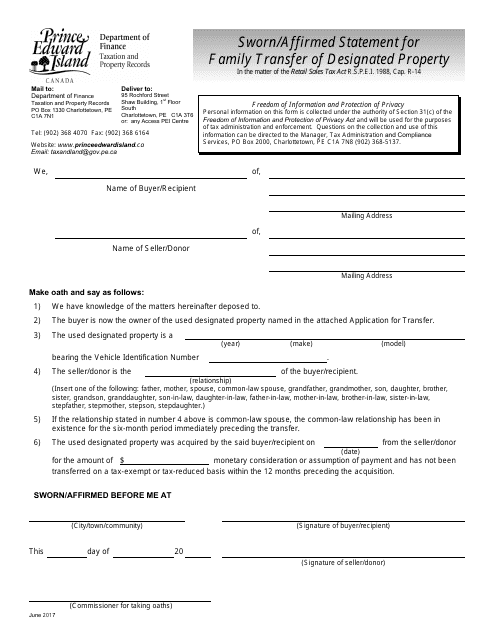

This type of document is a sworn/affirmed statement used for the family transfer of designated property in Prince Edward Island, Canada. It is a legal form that verifies the transfer of property within the family and requires a sworn or affirmed statement.

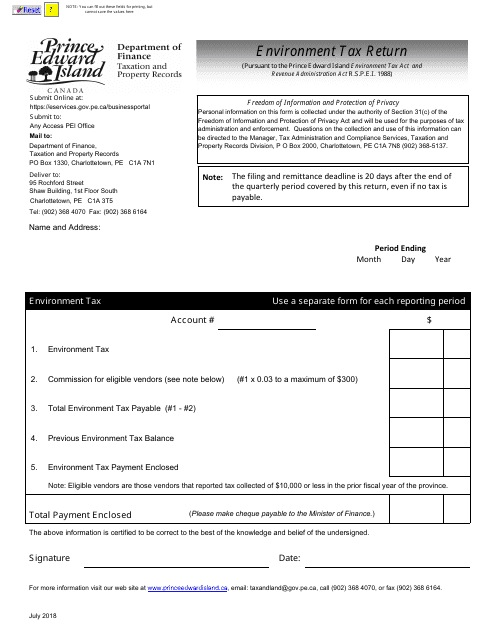

This tax return form is used by residents of Prince Edward Island, Canada to report and pay their taxes related to the environment.

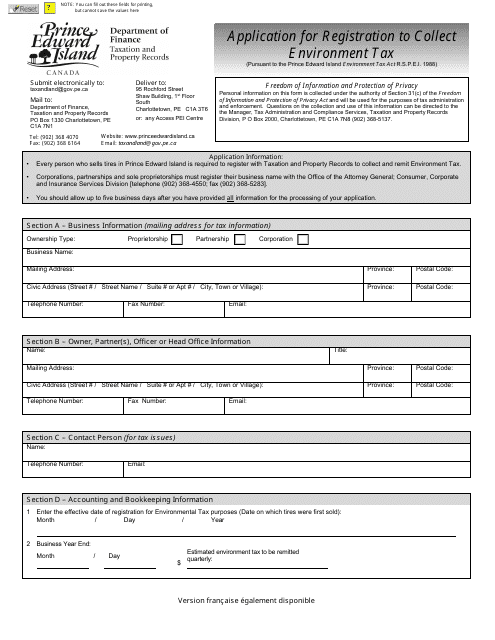

This form is used for applying to register as a collector of environment tax in Prince Edward Island, Canada.

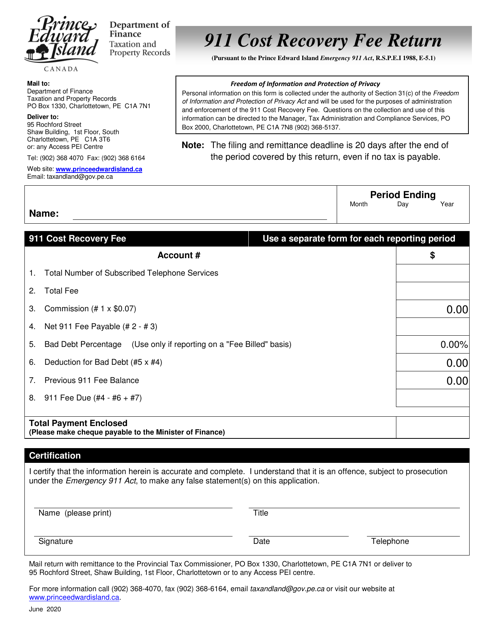

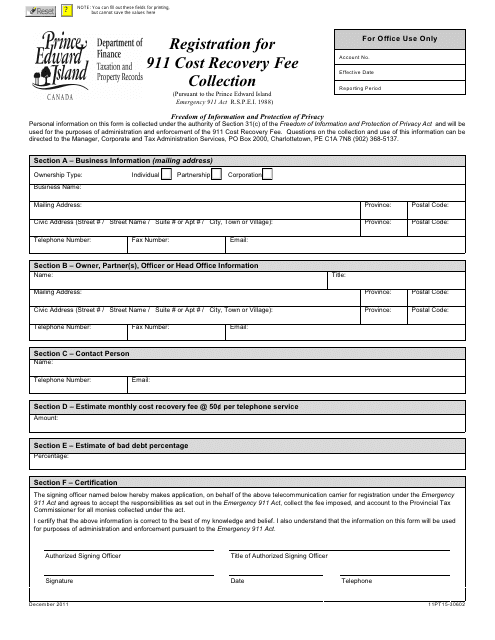

This document is for registration purposes for the 911 Cost Recovery Fee Collection in Prince Edward Island, Canada.

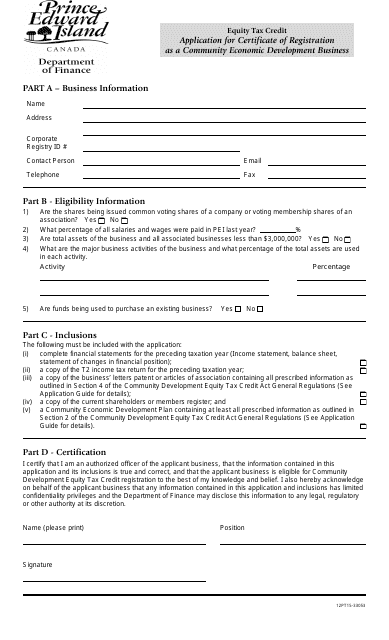

This document is an application form used by businesses in Prince Edward Island, Canada to apply for a Certificate of Registration as a Community Economic Development Business. It is a necessary step for businesses to access certain economic development programs and opportunities in the province.

This document is an application for the Real Property Tax Deferral Program for senior citizens in Prince Edward Island, Canada. This program allows eligible seniors to defer payment of their property taxes.

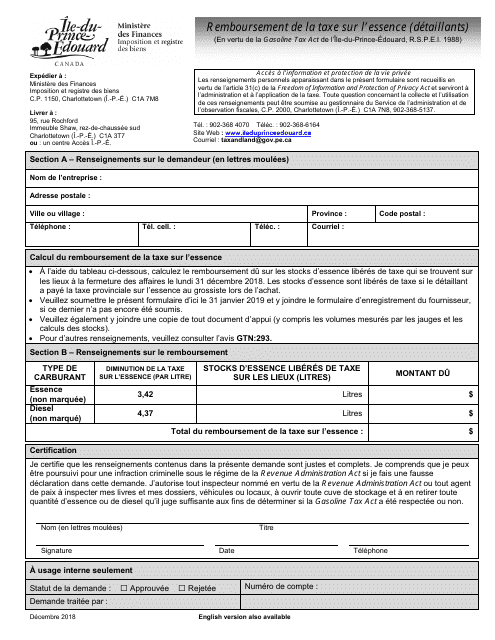

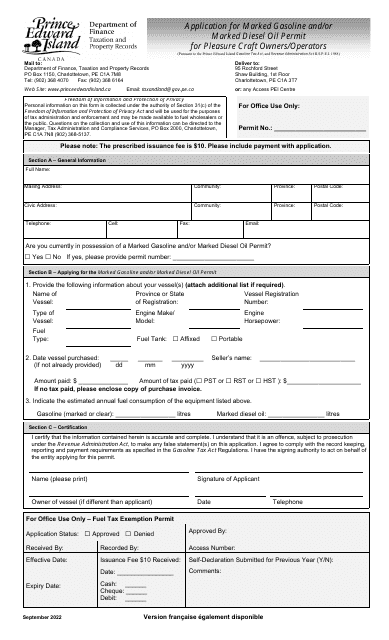

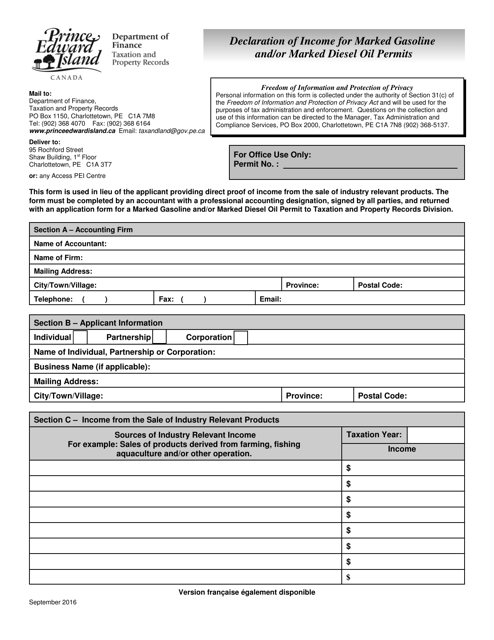

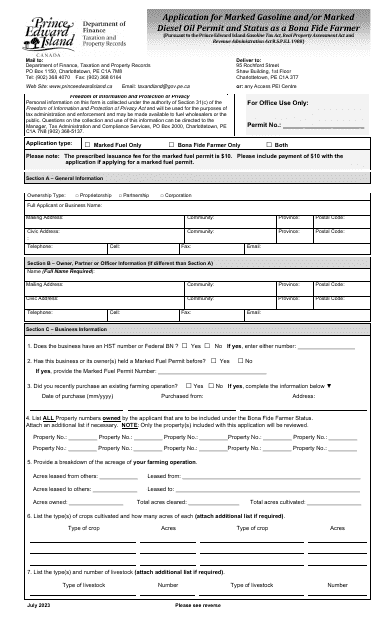

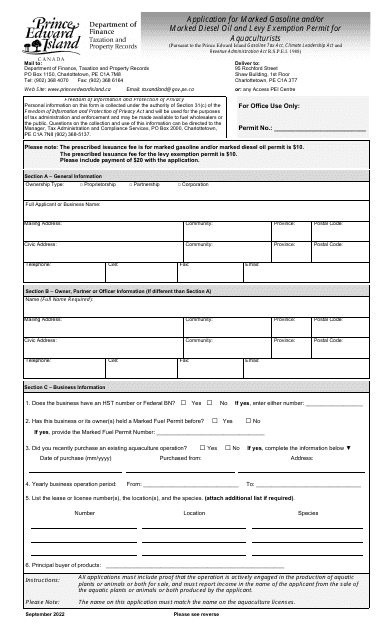

This document is for declaring income related to permits for marked gasoline and/or marked diesel oil in Prince Edward Island, Canada.

This document is for applying for Bona Fide Farmer Status Property Assessment in Prince Edward Island, Canada. It is used to determine if a property qualifies for special assessment as a bona fide farm.

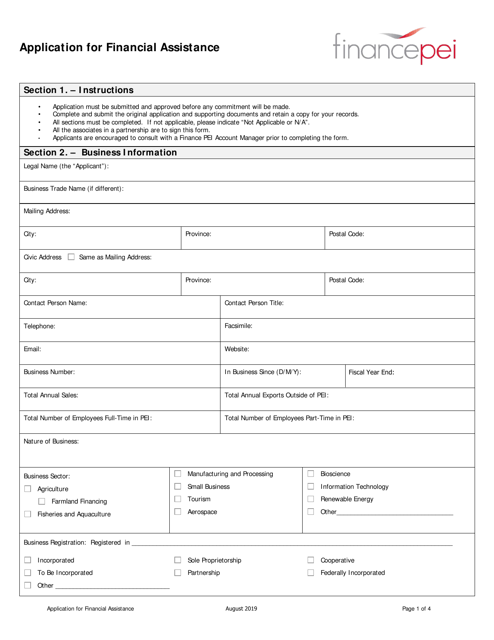

This Form is used for applying for financial assistance in Prince Edward Island, Canada.

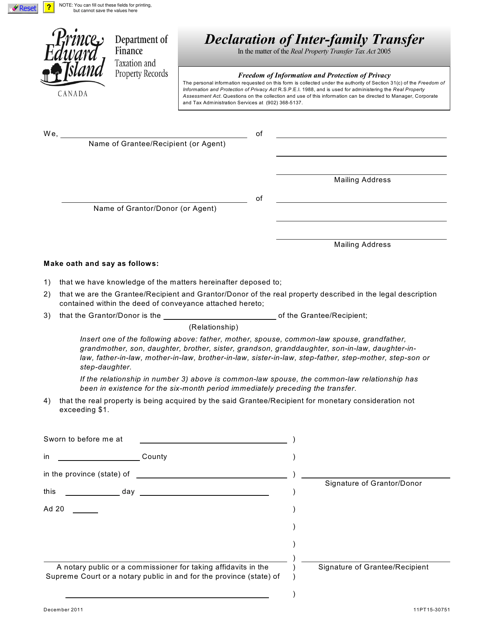

This document is used for transferring ownership of property or assets between family members within the province of Prince Edward Island, Canada.

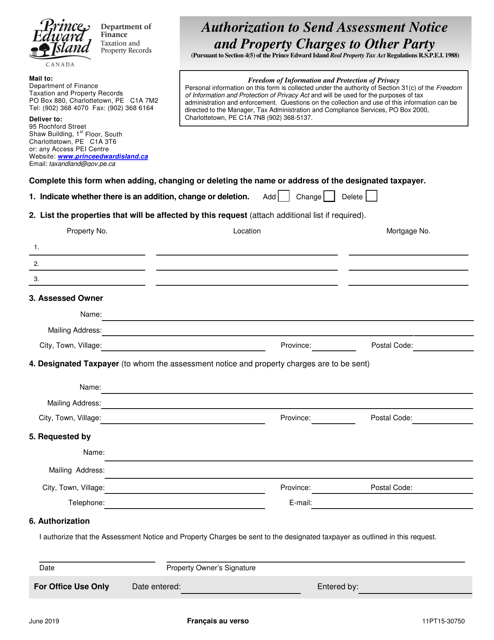

This document authorizes the sending of assessment notices and property charges to another party in Prince Edward Island, Canada.

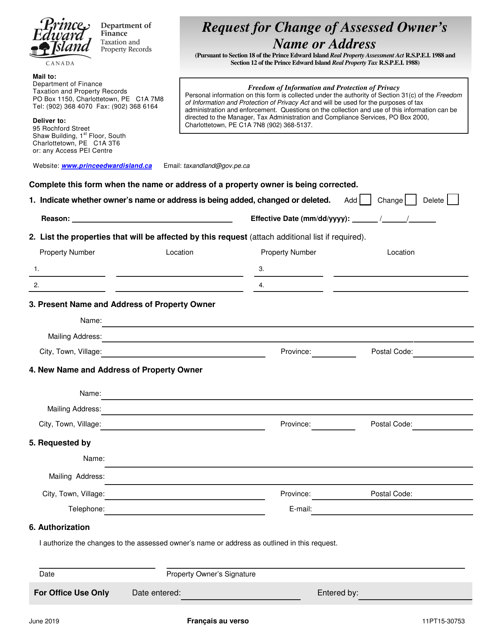

This Form is used for requesting a change of assessed owner's name or address in Prince Edward Island, Canada.

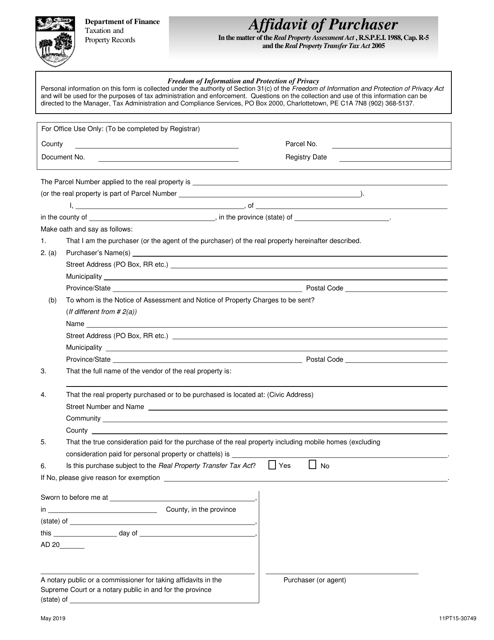

This form is used for filing an Affidavit of Purchaser in Prince Edward Island, Canada.