Newfoundland and Labrador Department of Finance Forms

The Newfoundland and Labrador Department of Finance is responsible for managing the financial affairs of the province of Newfoundland and Labrador, Canada. This department is responsible for budgeting, taxation, financial planning, economic analysis, and managing government revenues and expenditures. They play a crucial role in ensuring the financial stability and economic growth of the province.

Documents:

60

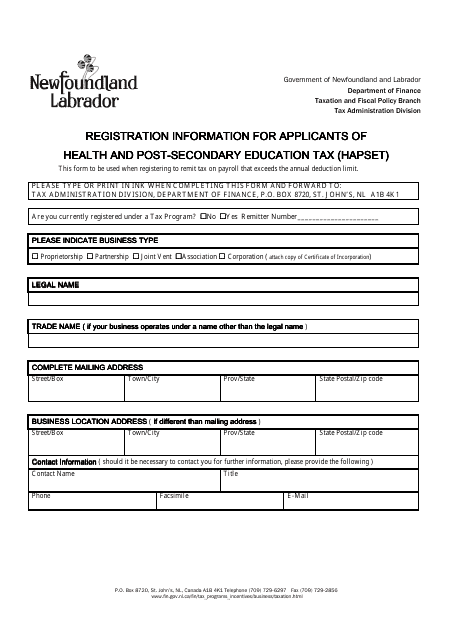

This document provides registration information for applicants of the Health and Post-Secondary Education Tax (HAPSET) in Newfoundland and Labrador, Canada. Learn how to register and fulfill your tax obligations related to health and post-secondary education.

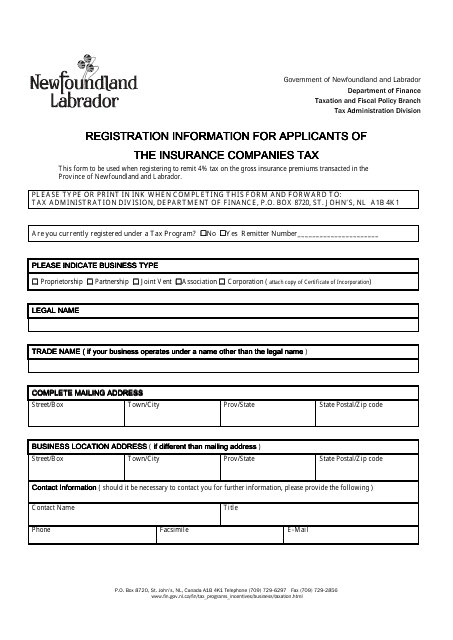

This document provides registration information for individuals who want to apply for the Insurance Companies Tax in Newfoundland and Labrador, Canada.

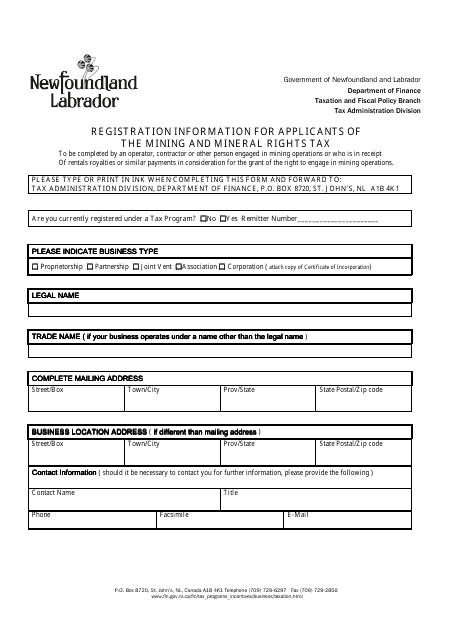

This document provides registration information for applicants applying for the Mining and Mineral Rights Tax in Newfoundland and Labrador, Canada.

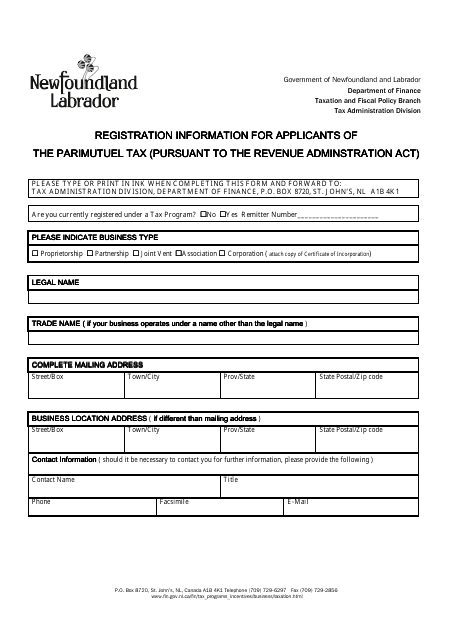

This document provides registration information for applicants of the Parimutuel Tax in Newfoundland and Labrador, Canada. It outlines the requirements and process for individuals or organizations wishing to apply for this tax.

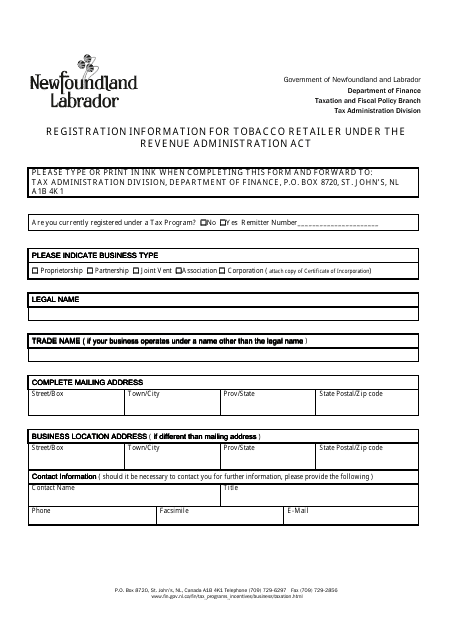

This document is for registering as a tobacco retailer in Newfoundland and Labrador, Canada under the Revenue Administration Act.

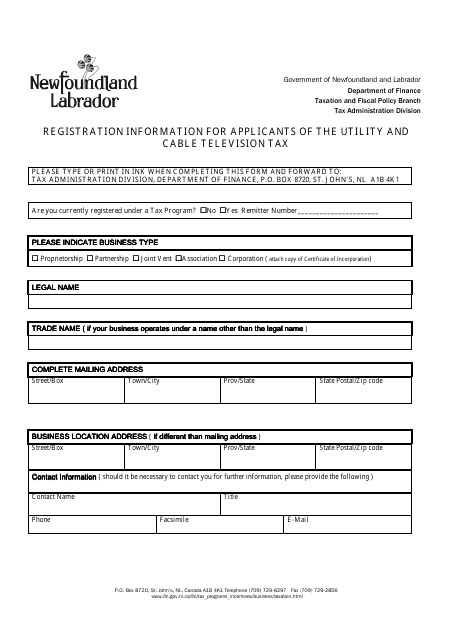

This document provides registration information for individuals applying for the Utility and Cable Television Tax in Newfoundland and Labrador, Canada.

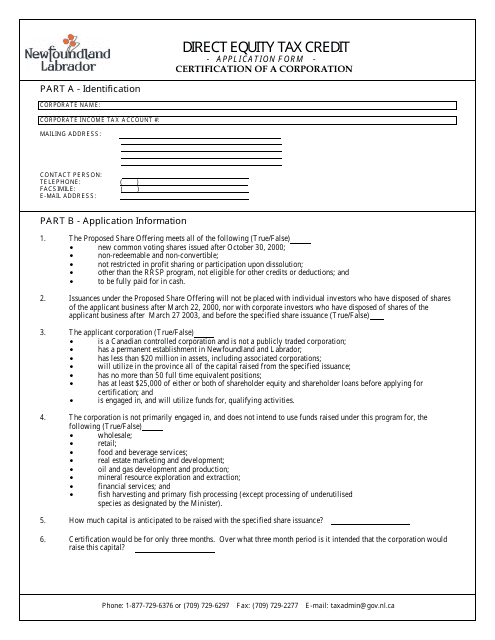

This Form is used for applying to the Direct Equity Tax Credit Program in Newfoundland and Labrador, Canada. This program offers tax credits to individuals and corporations who invest in eligible businesses.

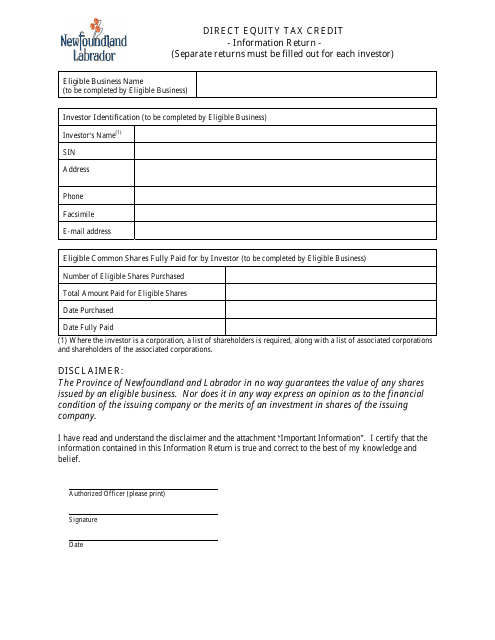

This document provides information on the Direct Equity Tax Credit Program in Newfoundland and Labrador, Canada. The program offers tax credits for investments in eligible businesses.

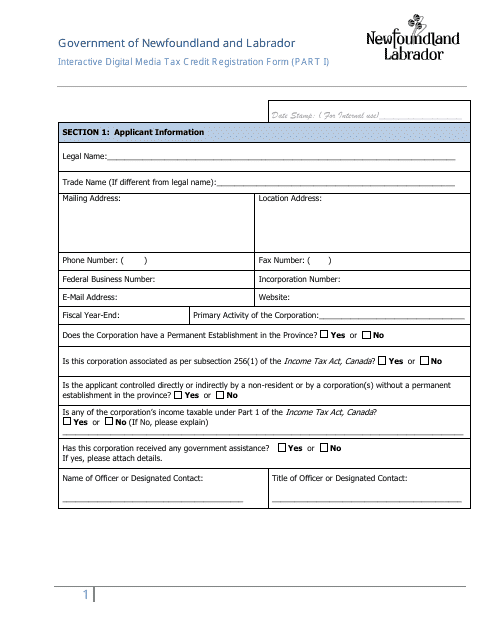

This document is used for registering for the Interactive Digital Media Tax Credit in Newfoundland and Labrador, Canada.

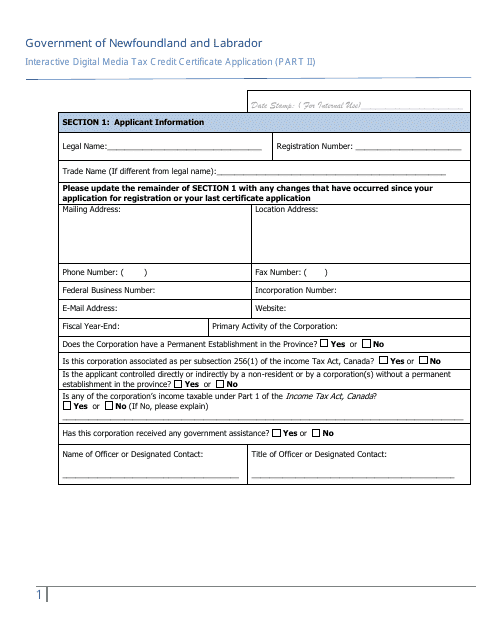

This document is an application form for the Interactive Digital Media Tax Credit Certification in Newfoundland and Labrador, Canada. It is used by individuals or companies involved in the interactive digital media industry to apply for tax credits.

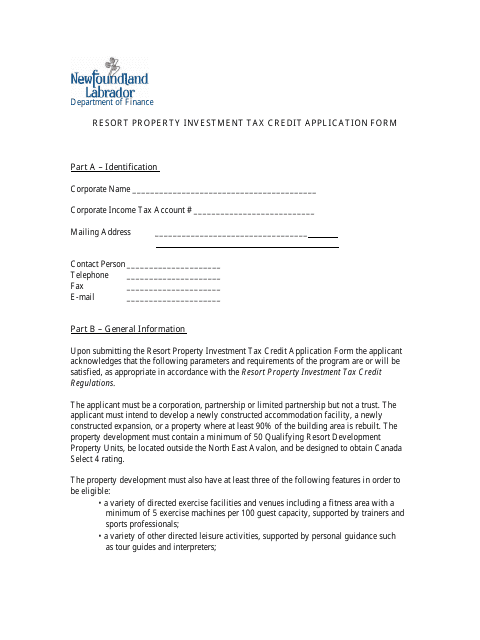

This Form is used for applying for the Resort Property Investment Tax Credit in Newfoundland and Labrador, Canada.

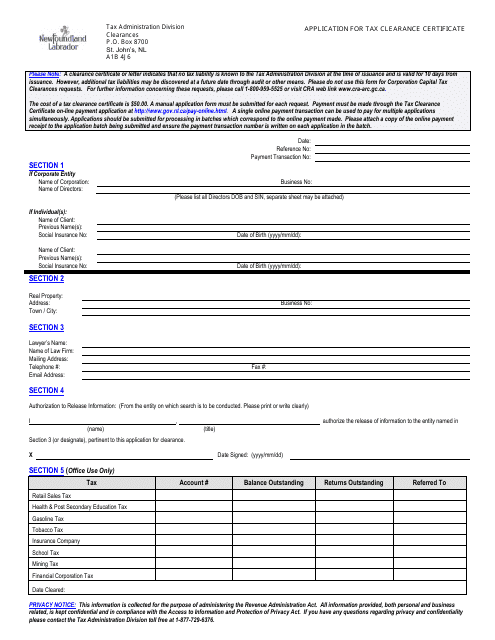

This document is used to apply for a Tax Clearance Certificate in the province of Newfoundland and Labrador, Canada. It is required when conducting certain business transactions or when closing a business.

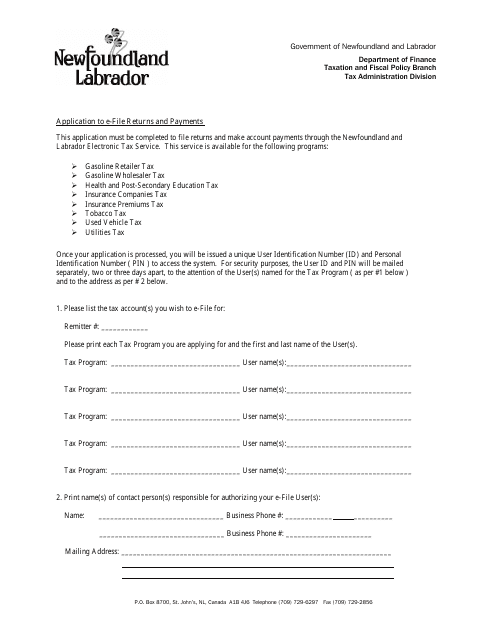

This document is an application form for individuals or businesses in Newfoundland and Labrador, Canada, who want to electronically file their tax returns and make online payments. It enables them to conveniently and securely submit their tax information and payments using electronic channels.

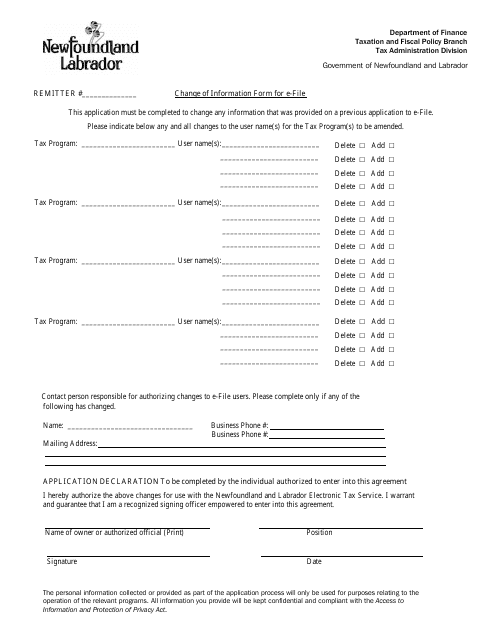

This Form is used for updating personal information for electronic filing in Newfoundland and Labrador, Canada.

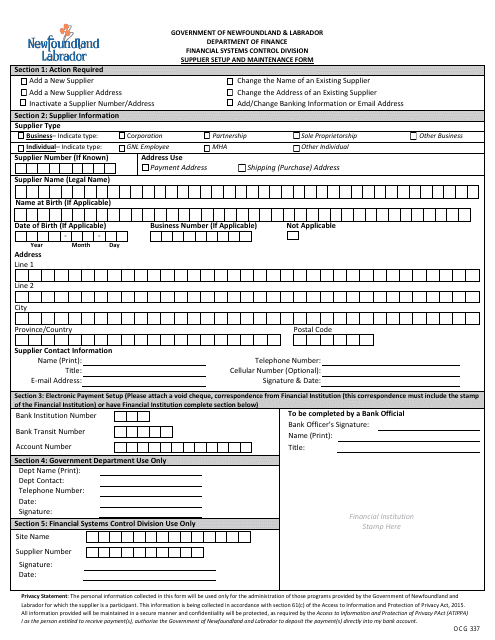

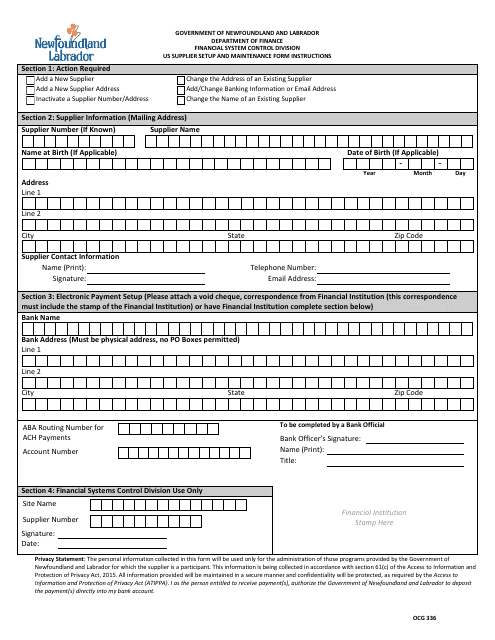

This form is used for supplier setup and maintenance in Newfoundland and Labrador, Canada.

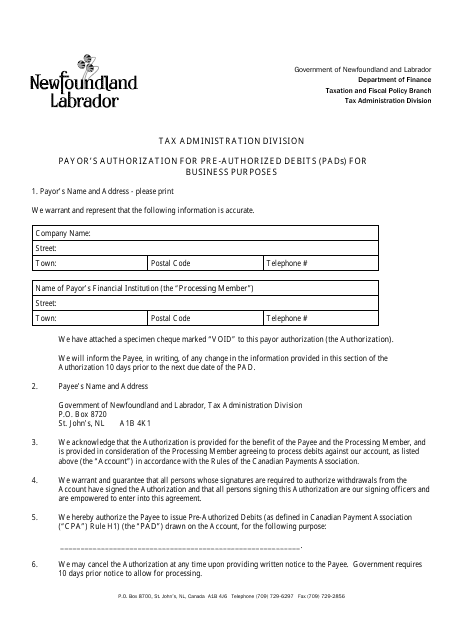

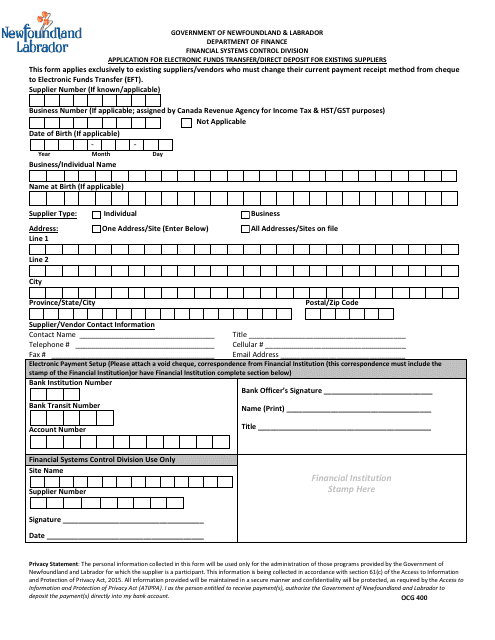

This Form is used for existing suppliers in Newfoundland and Labrador, Canada to apply for electronic funds transfer/direct deposit.

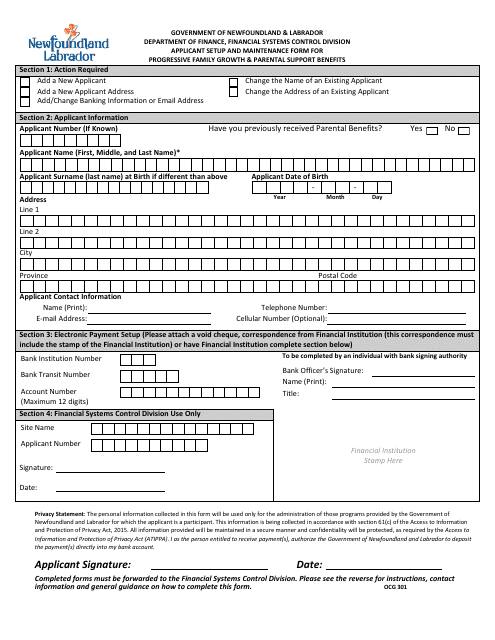

This form is used for setting up and maintaining applicant information for the Progressive Family Growth & Parental Support Benefits in Newfoundland and Labrador, Canada.

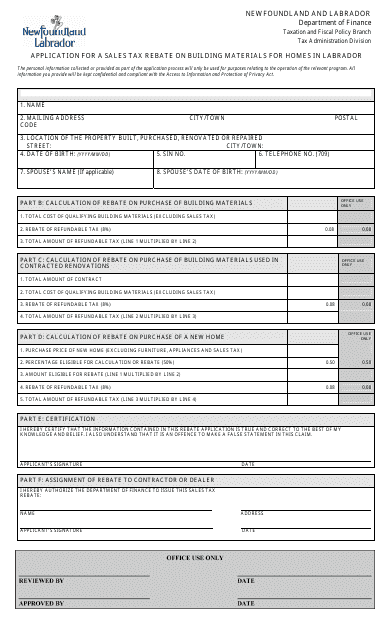

This document is used for applying for a sales tax rebate on building materials for homes in Labrador, Newfoundland and Labrador, Canada.

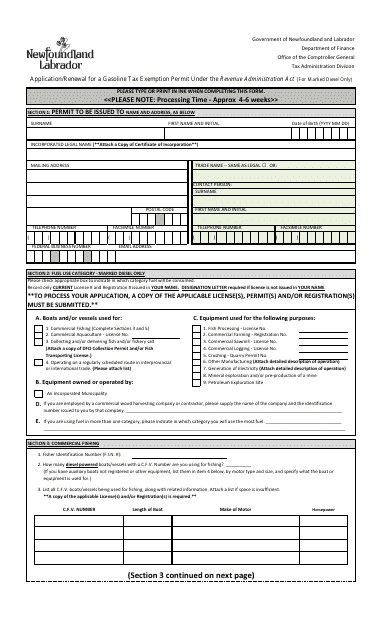

This document is used for applying or renewing a gasoline tax exemption permit for marked diesel fuel under the Revenue Administration Act in Newfoundland and Labrador, Canada.

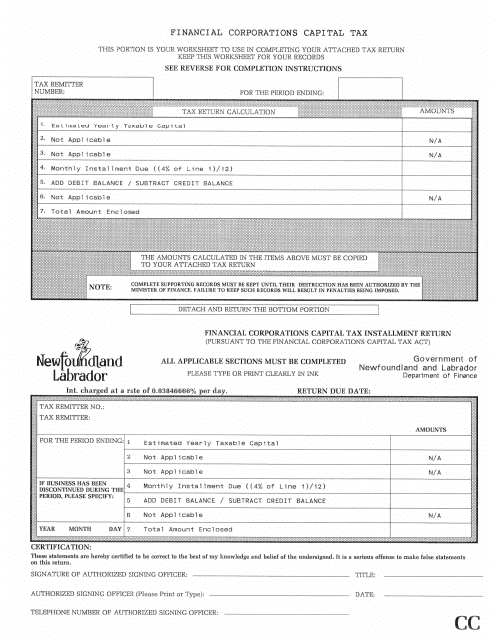

This document is for regular financial corporations in Newfoundland and Labrador, Canada to report and pay capital tax.

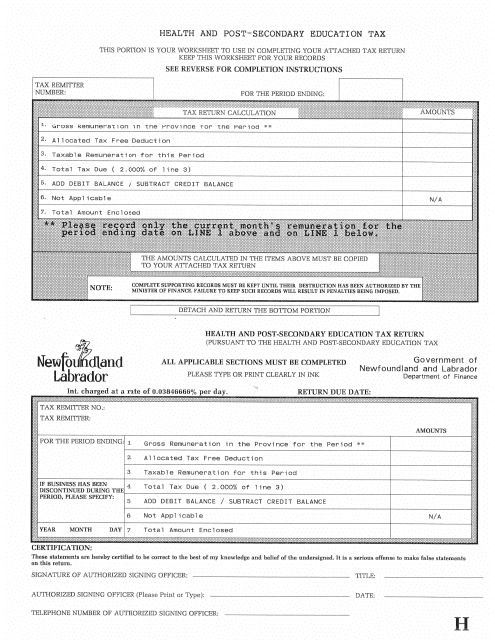

This document is for residents of Newfoundland and Labrador, Canada who want to claim health and post-secondary education tax credits.

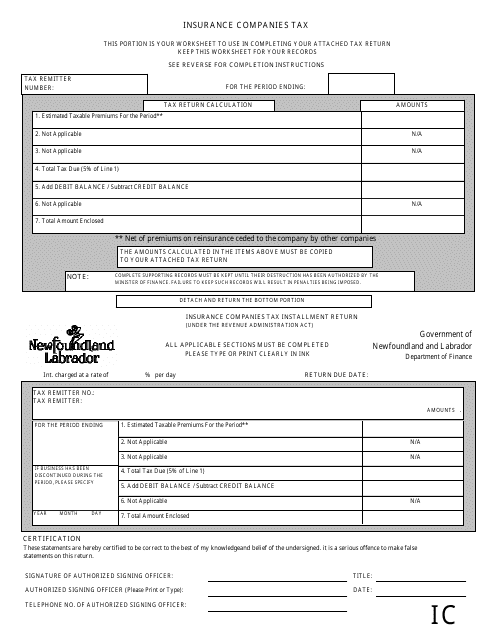

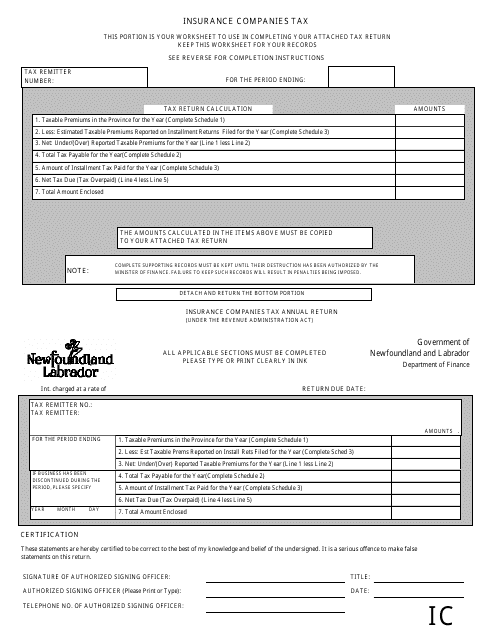

This document is for installment payments with insurance companies in Newfoundland and Labrador, Canada. It outlines the process for making payments in installments for insurance coverage.

This type of document provides information about insurance companies operating in Newfoundland and Labrador, Canada on an annual basis. It includes details about the insurance providers and their services offered in the province.

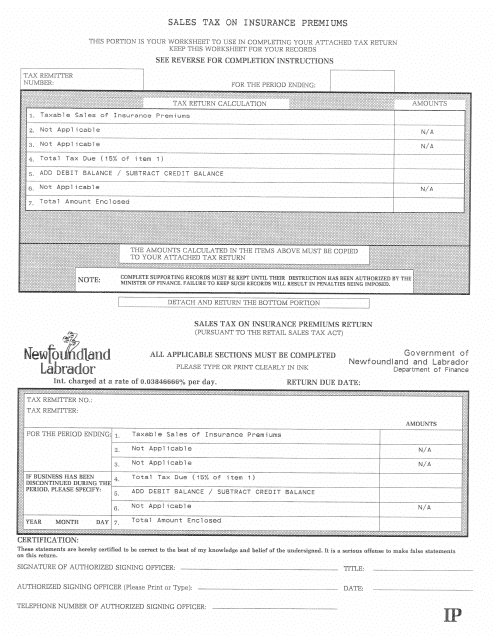

This document explains the sales tax applicable to insurance premiums in Newfoundland and Labrador, Canada.

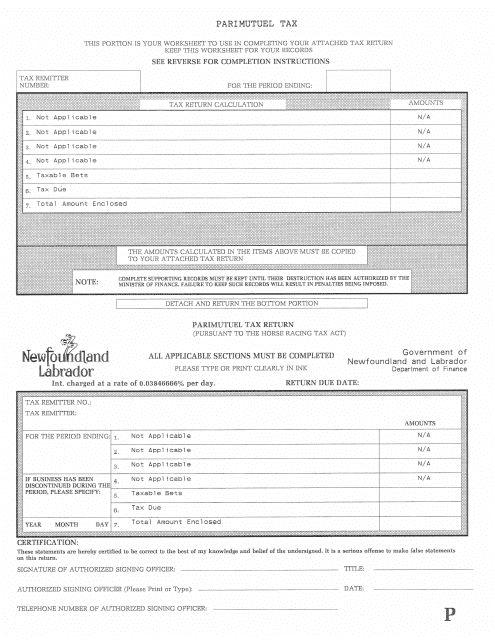

This document is a form for reporting and paying the parimutuel tax in Newfoundland and Labrador, Canada. This tax is applicable to betting on horse races and other forms of parimutuel gambling in the province. If you engage in these activities, you may be required to fill out and submit this form to fulfill your tax obligations.

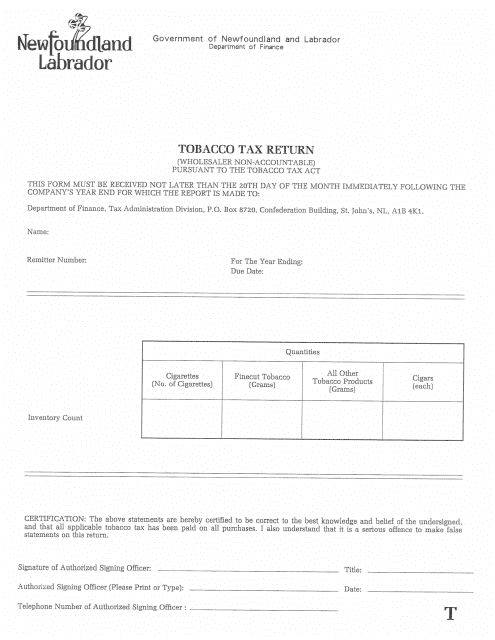

This form is used for reporting and paying tobacco taxes for wholesalers in Newfoundland and Labrador, Canada. It is specifically for wholesalers who are not required to keep detailed records of their tobacco sales.

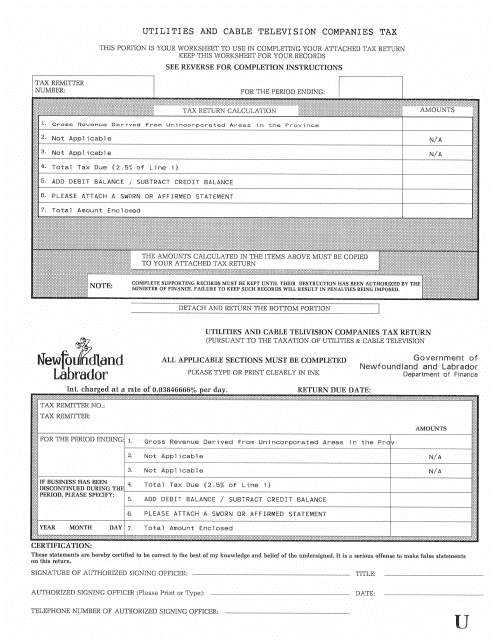

This document is for the tax regulations related to utilities and cable television companies in Newfoundland and Labrador, Canada. It provides information on the taxes applicable to these industries in the province.

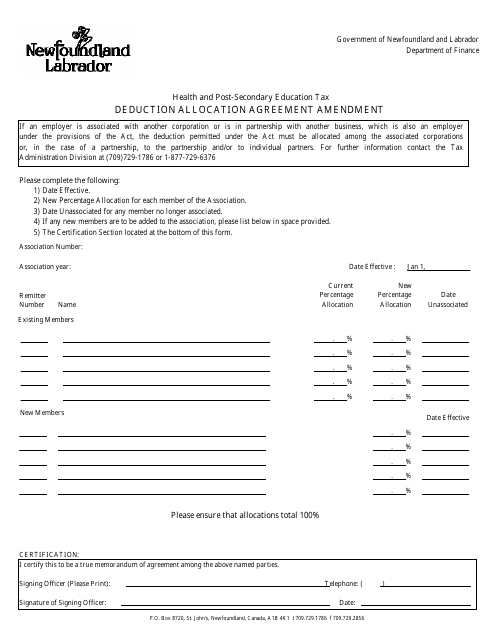

This document is used for amending the Health and Post-secondary Education Tax Deduction Allocation Agreement in Newfoundland and Labrador, Canada.

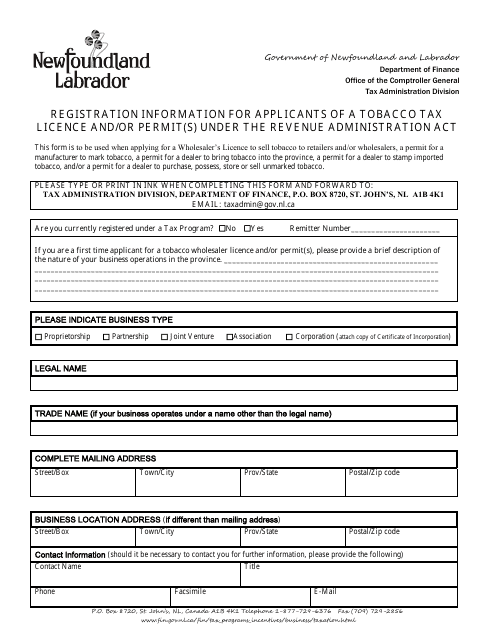

This document provides registration information for individuals applying for a tobacco tax licence and/or permit(s) in Newfoundland and Labrador, Canada under the Revenue Administration Act.

This form is used for setting up and maintaining a US supplier in Newfoundland and Labrador, Canada.

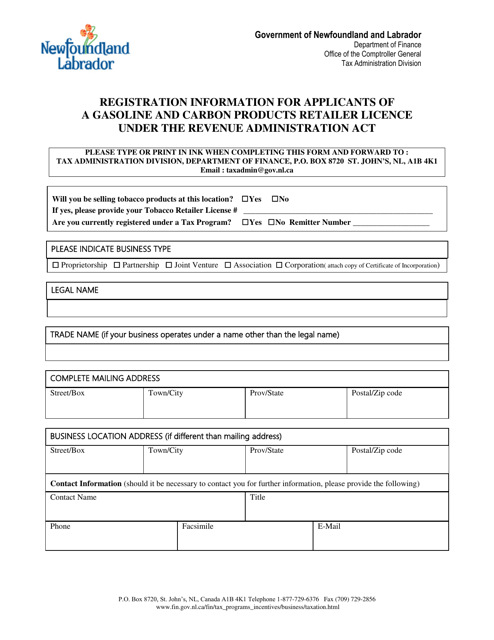

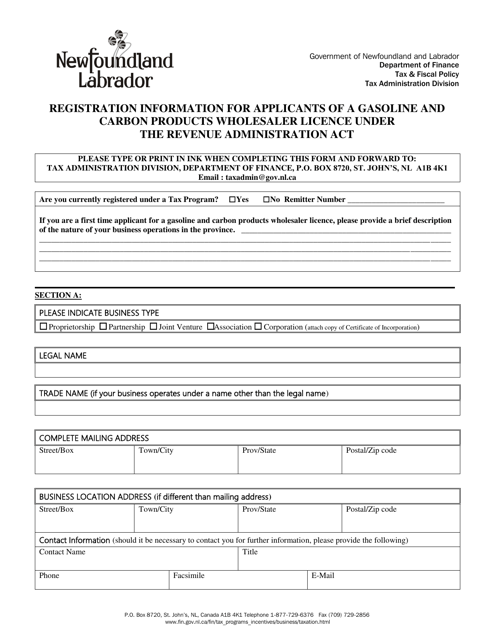

This document provides registration information for individuals or businesses applying for a Gasoline and Carbon Products Retailer License in Newfoundland and Labrador, Canada. It outlines the requirements and process for obtaining the license under the Revenue Administration Act.

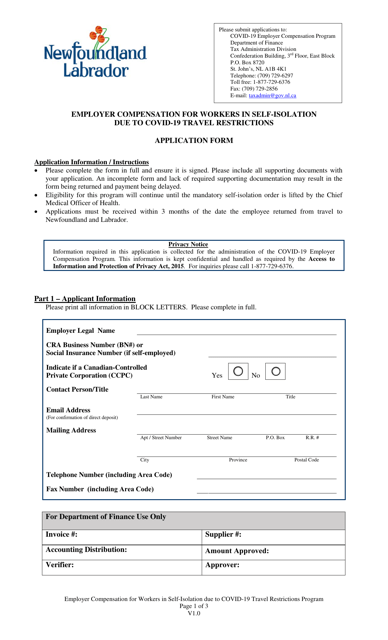

This Form is used for applying for employer compensation in Newfoundland and Labrador, Canada, if you are a worker who is required to self-isolate due to Covid-19 travel restrictions.

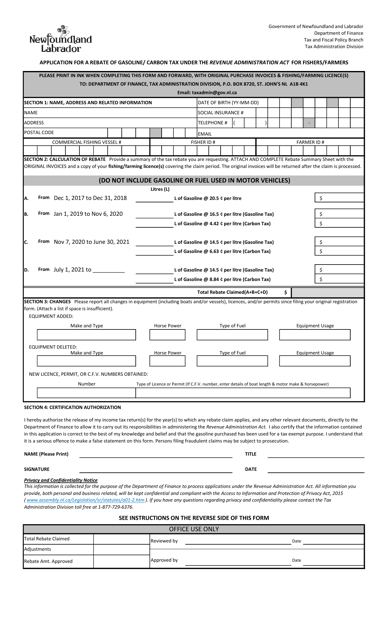

This form is used for fishers and farmers in Newfoundland and Labrador, Canada to apply for a rebate of gasoline/carbon tax under the Revenue Administration Act.

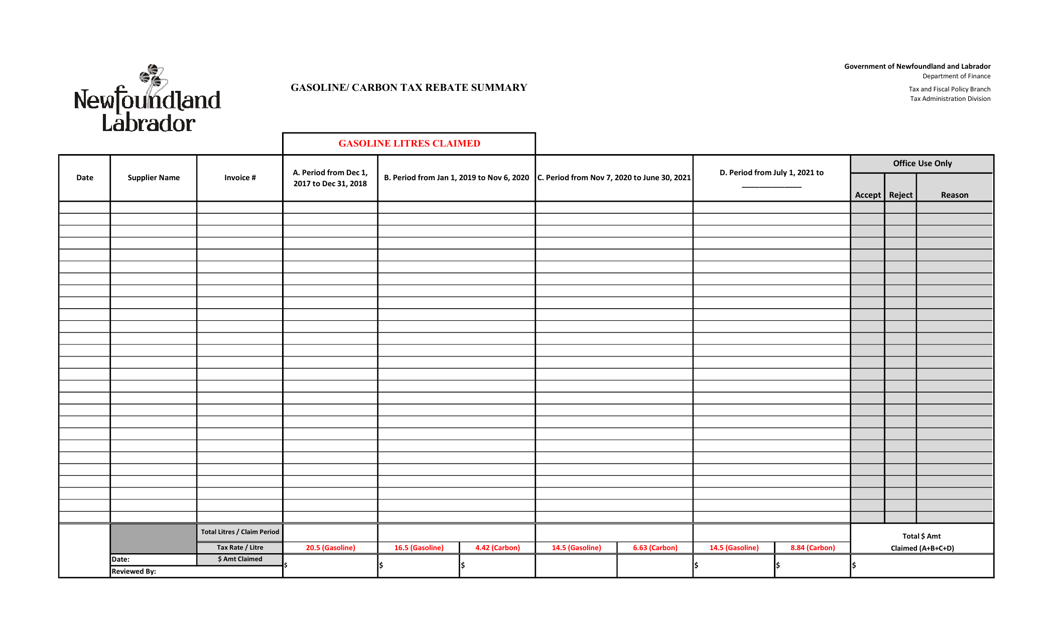

This document provides a summary of the gasoline/carbon tax rebate program in Newfoundland and Labrador, Canada. It outlines how residents can receive rebates for the taxes paid on gasoline and carbon emissions.

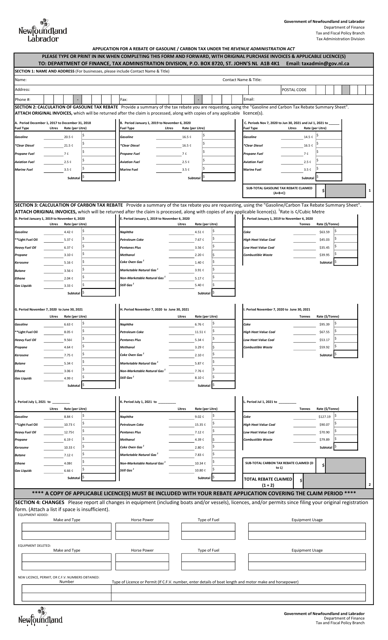

This form is used for applying for a rebate of gasoline or carbon tax in Newfoundland and Labrador, Canada, under the Revenue Administration Act.

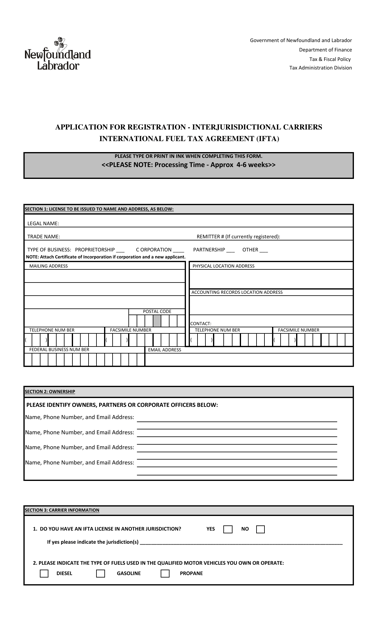

This document is used for applying to register as an interjurisdictional carrier under the International Fuel Tax Agreement (IFTA) in Newfoundland and Labrador, Canada.