New Brunswick Finance and Treasury Board Forms

The New Brunswick Finance and Treasury Board is responsible for overseeing the financial management and economic affairs of the province of New Brunswick in Canada. They handle matters related to budgeting, taxation, financial planning, government procurement, and financial management policies. Their goal is to ensure efficient and effective use of public funds and promote economic growth in the province.

Documents:

43

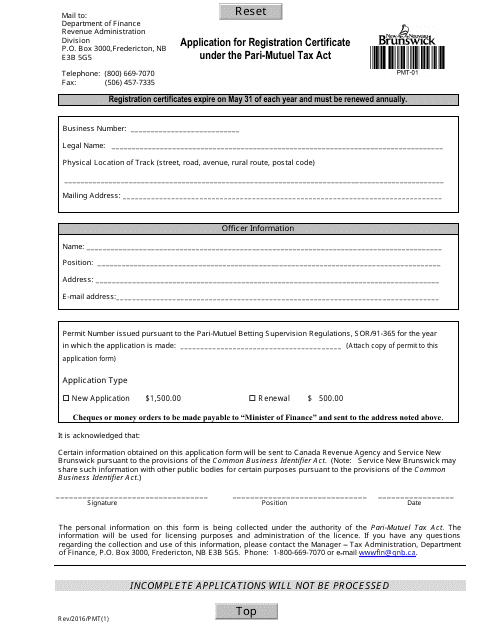

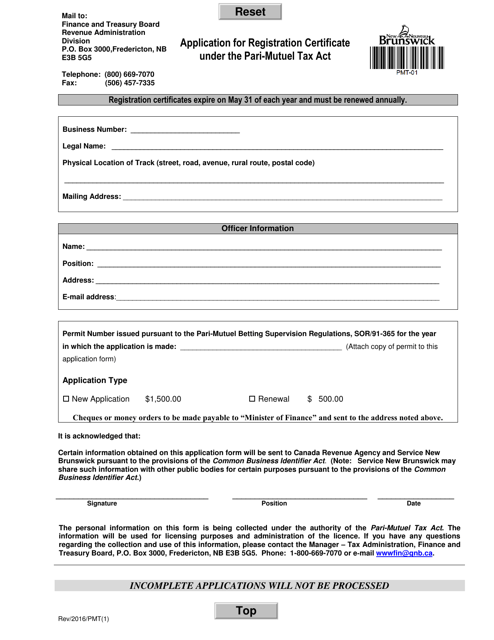

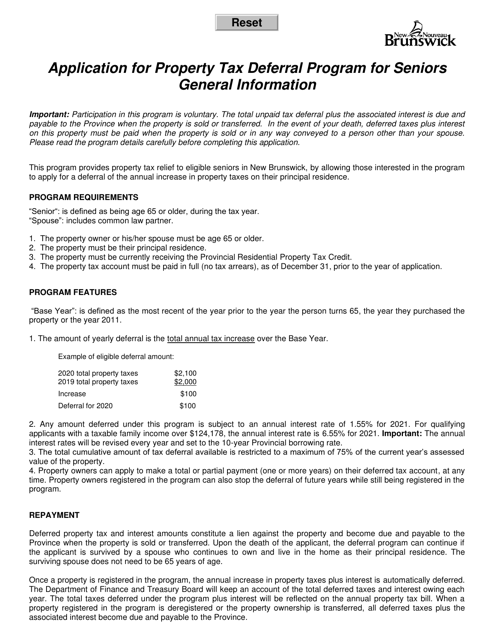

This form is used for applying for a Registration Certificate under the Pari-Mutuel Tax Act in New Brunswick, Canada.

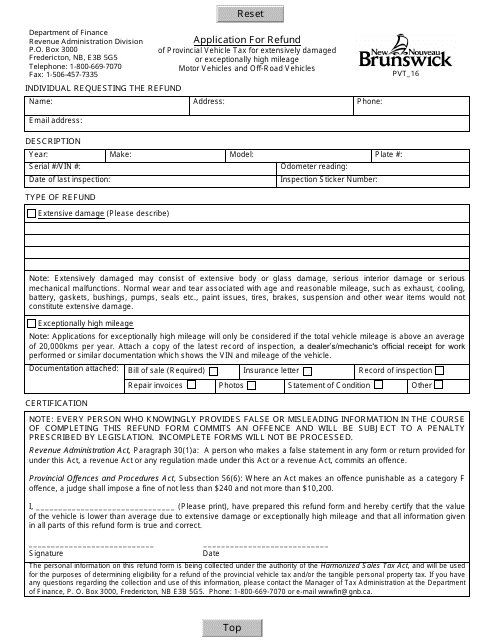

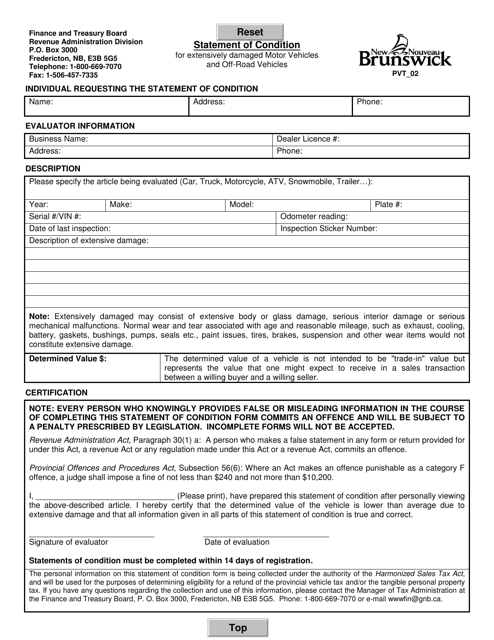

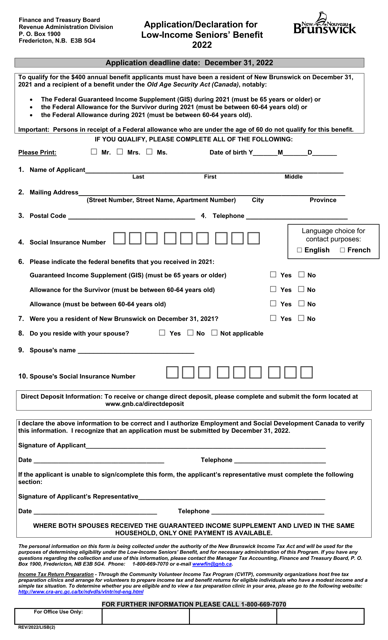

This document is for requesting a refund of provincial vehicle tax in New Brunswick, Canada, for motor vehicles and off-road vehicles that have been extensively damaged or have exceptionally high mileage.

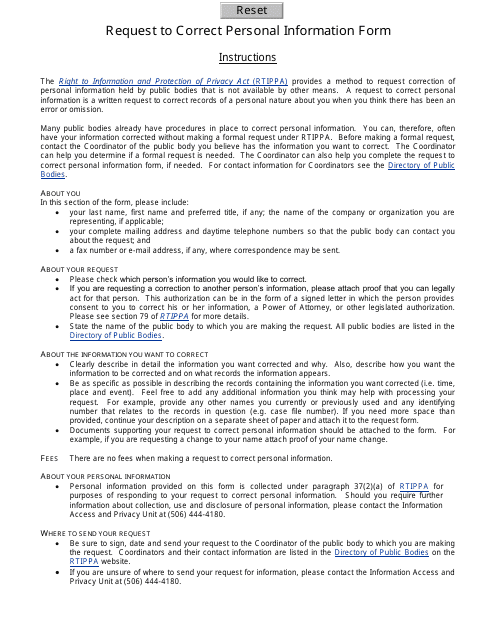

This form is used for requesting to correct personal information in New Brunswick, Canada.

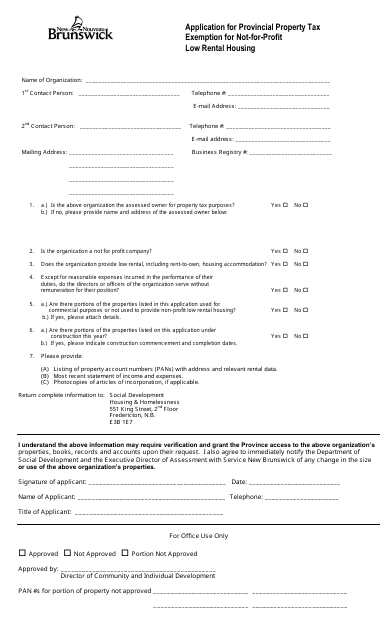

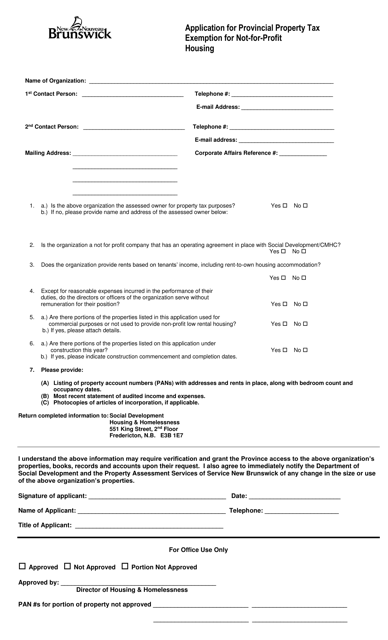

This application form is used for provincial property tax exemption in New Brunswick, Canada for not-for-profit low rental housing.

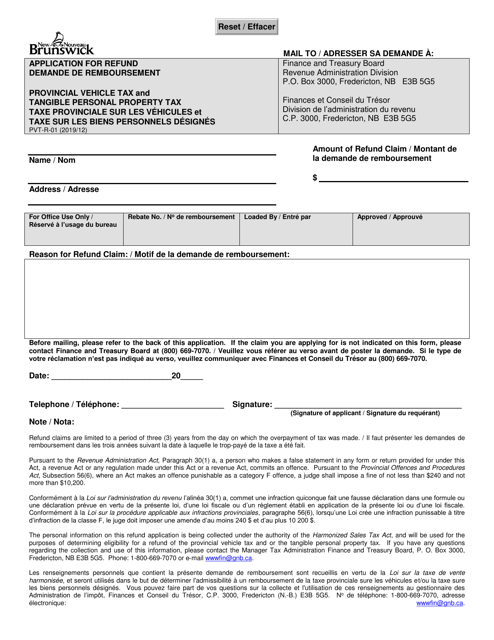

This form is used for applying for a refund for provincial vehicle tax and tangible personal property tax in New Brunswick, Canada. It is available in both English and French.

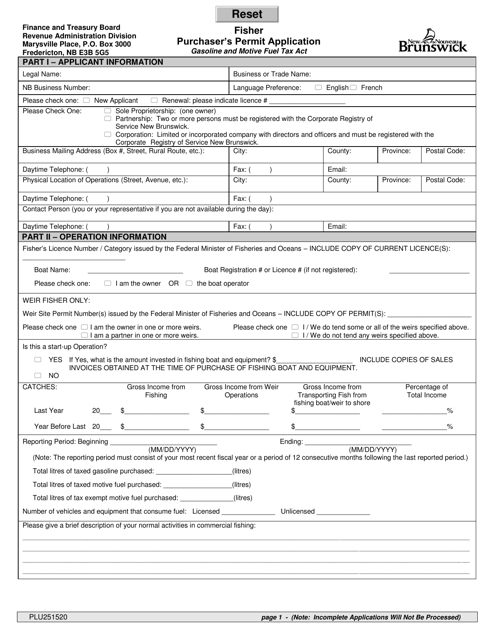

This form is used for applying for a purchaser's permit in Fisher, New Brunswick, Canada.

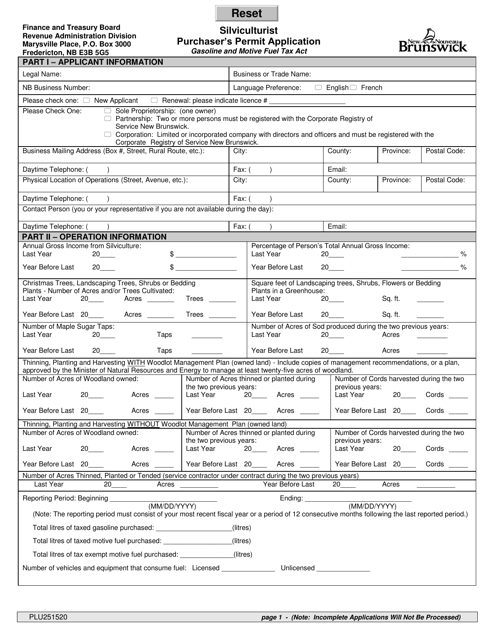

This form is used for applying for a purchaser's permit as a silviculturist in New Brunswick, Canada. It is required if you plan to purchase forest products in the province.

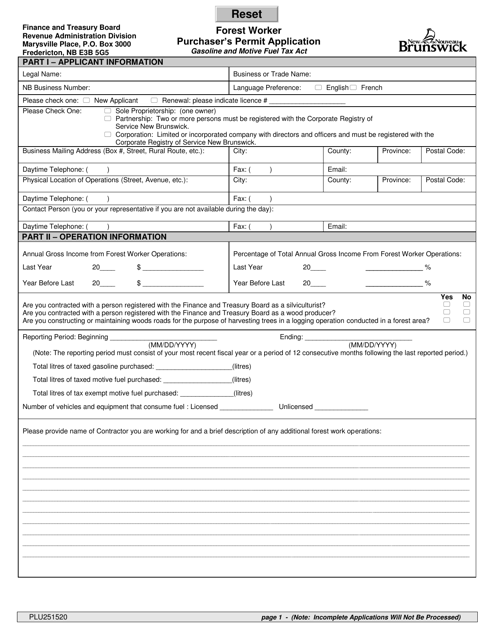

This document is used for applying for a purchaser's permit as a forest worker in New Brunswick, Canada.

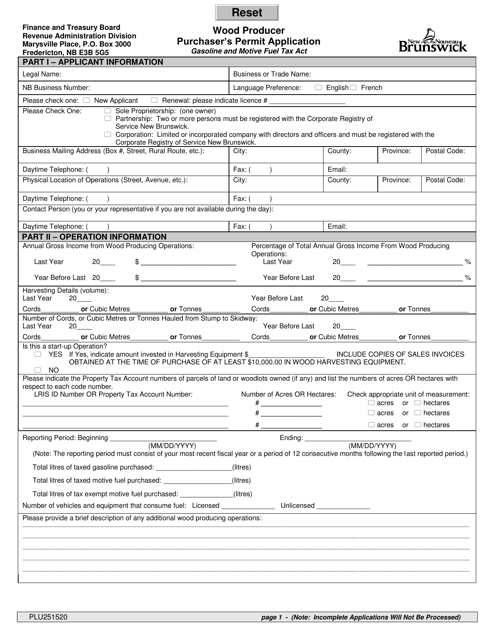

This form is used for applying for a purchaser's permit if you are a wood producer in New Brunswick, Canada.

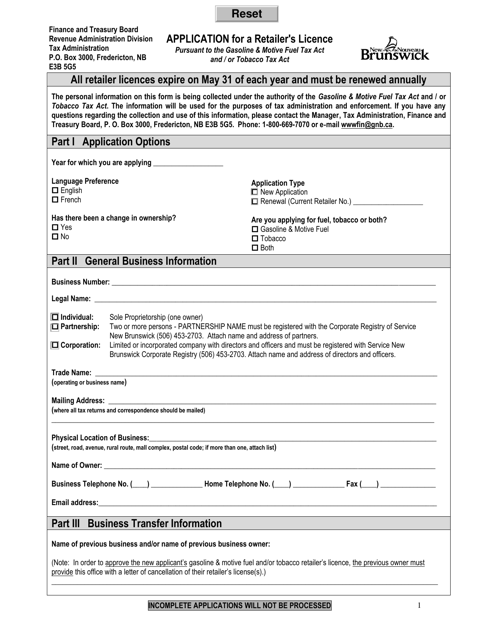

This Form is used for applying for a tobacco retailer's license in New Brunswick, Canada. This document is necessary for individuals or businesses who wish to sell tobacco products in the province.

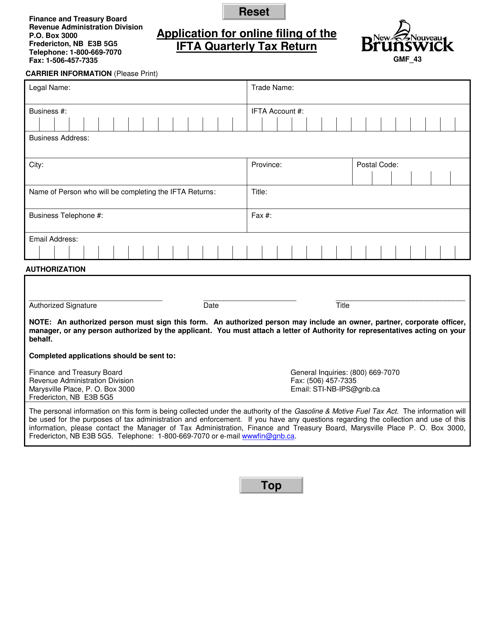

This form is used for online filing of the Ifta Quarterly Tax Return in New Brunswick, Canada.

This form is used for applying for a registration certificate under the Pari-Mutuel Tax Act in New Brunswick, Canada.

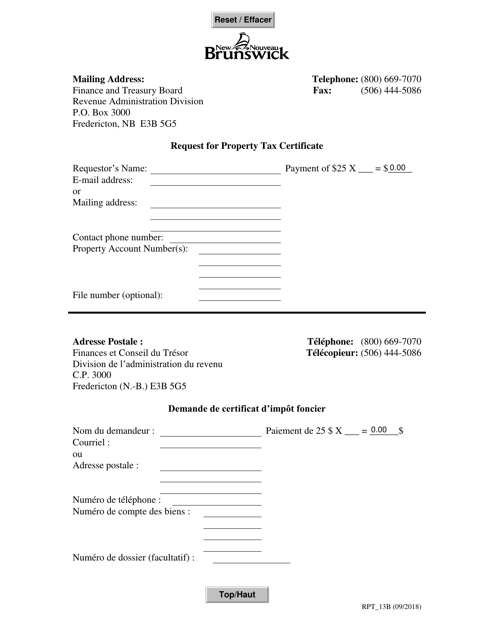

This form is used for requesting a Property Tax Certificate in New Brunswick, Canada. It is used to obtain information regarding the property's tax status and any outstanding taxes or liens.

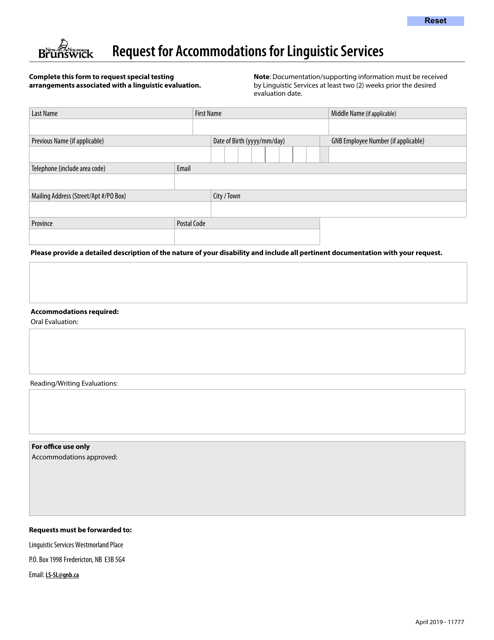

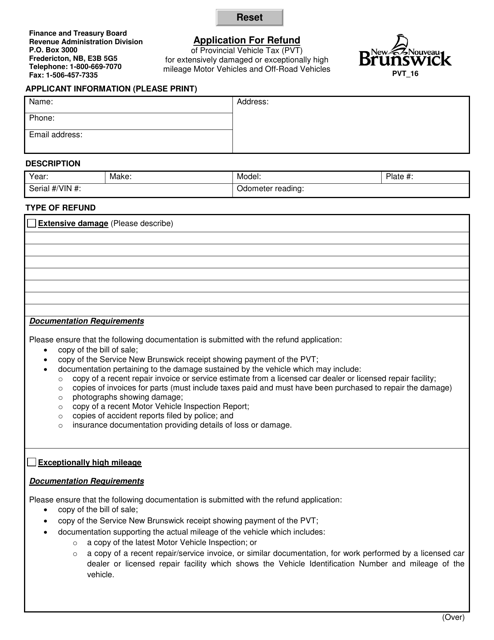

This document is for requesting accommodations for linguistic services in New Brunswick, Canada.

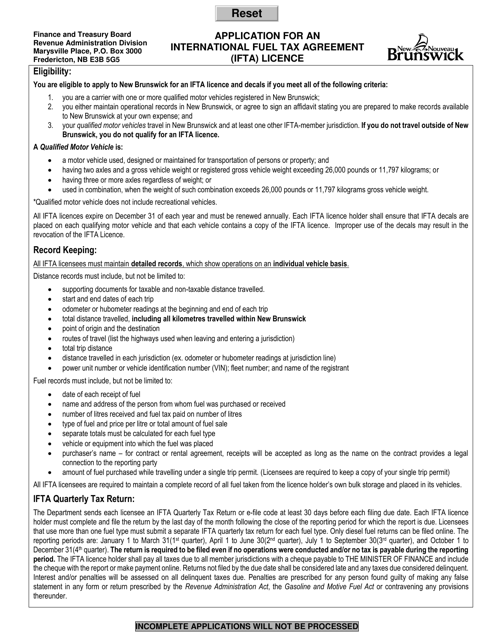

This form is used for applying for an International Fuel Tax Agreement (IFTA) license in New Brunswick, Canada. It allows individuals or businesses to report and pay taxes on fuel use for qualified motor vehicles operating in multiple jurisdictions.

This form is used for reporting the condition of extensively damaged motor vehicles and off-road vehicles in New Brunswick, Canada.

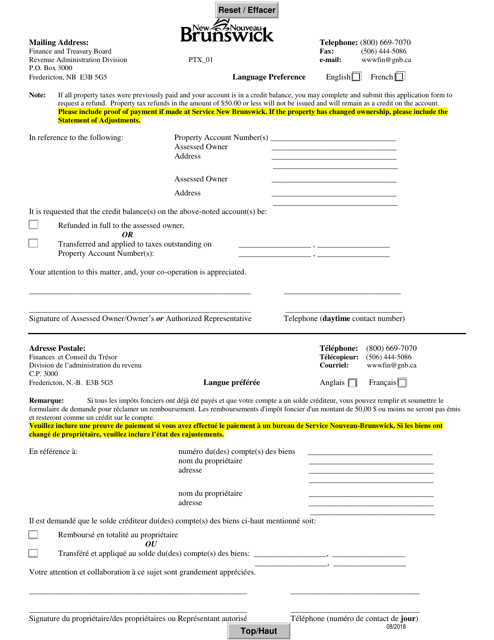

This form is used for applying for a property tax refund or transfer in New Brunswick, Canada. It is available in both English and French.

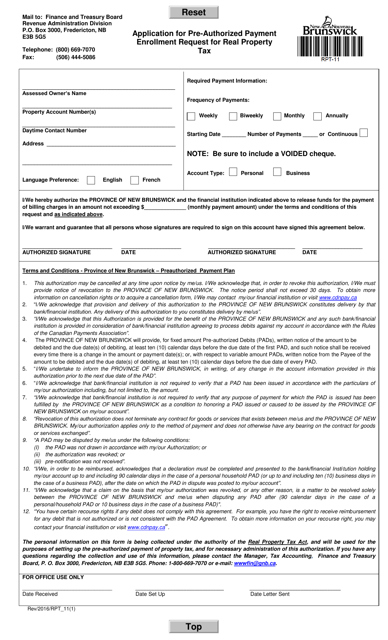

This document is used for requesting pre-authorized payment enrollment for real property tax in New Brunswick, Canada.

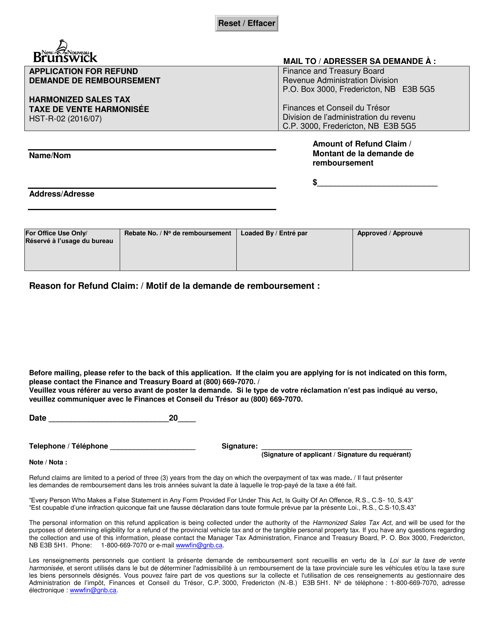

Form HST-R-02 Application for Refund - Harmonized Sales Tax - New Brunswick, Canada (English/French)

This document is used for applying for a refund of harmonized sales tax (HST) in New Brunswick, Canada. It is available in both English and French languages.

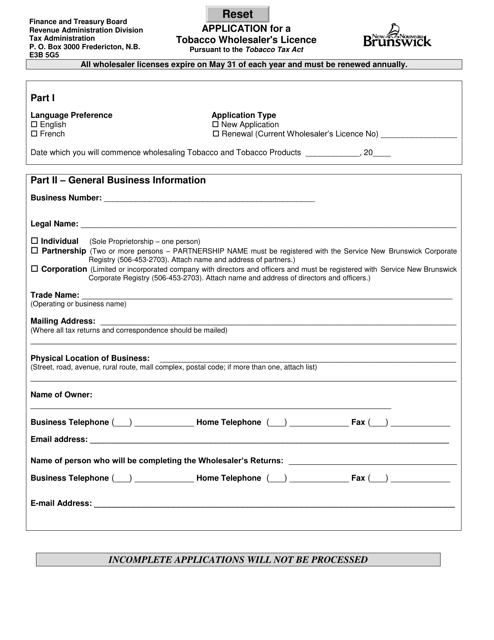

This form is used for applying for a tobacco wholesaler's license in New Brunswick, Canada.

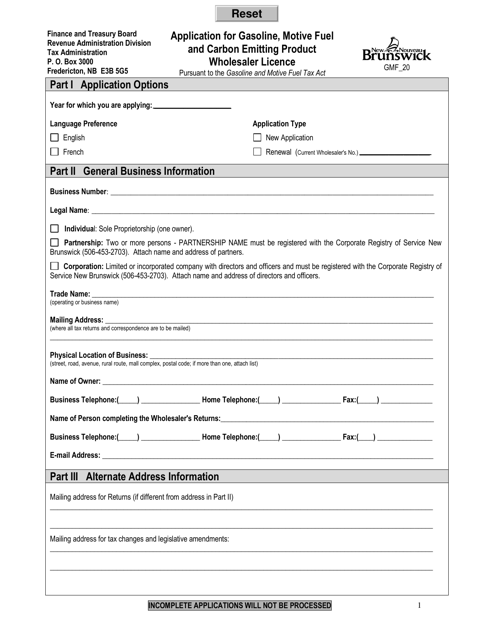

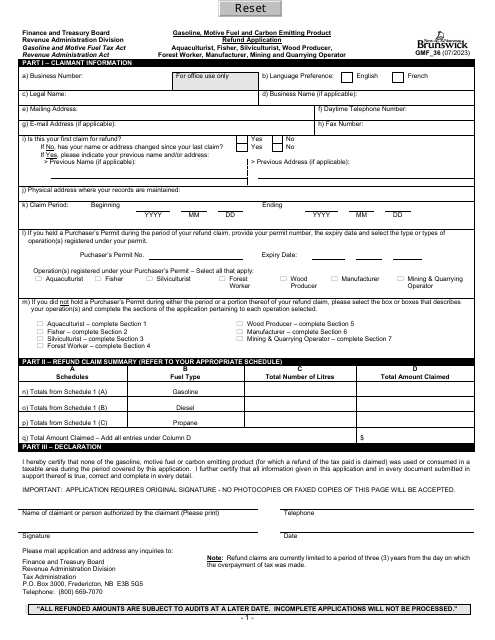

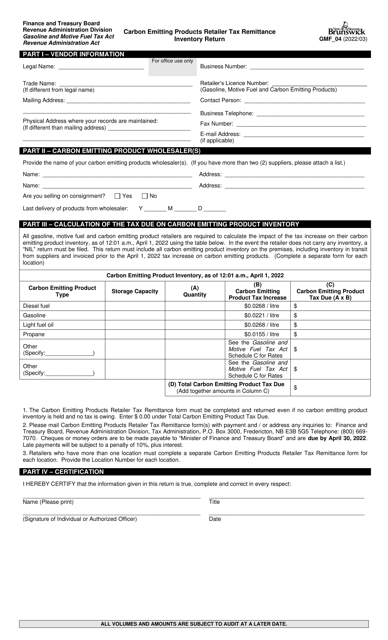

This form is used for applying for a gasoline, motive fuel, and carbon emitting product wholesaler license in New Brunswick, Canada.

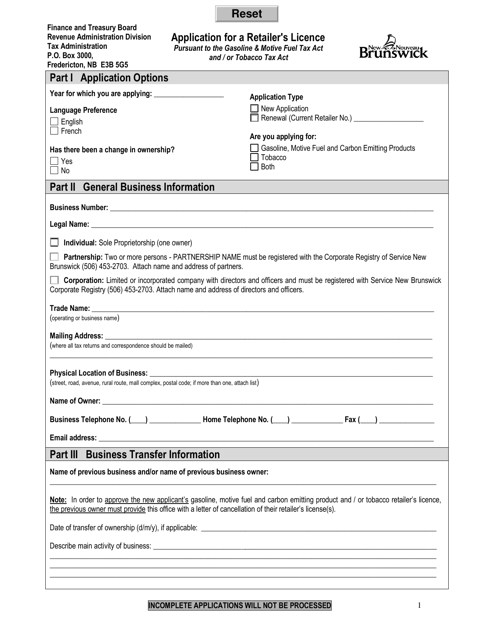

This document is used to apply for a retailer's license in the province of New Brunswick, Canada. It is required for individuals or businesses who want to operate a retail establishment in the province. The license allows the vendor to legally sell goods or services to customers in New Brunswick.

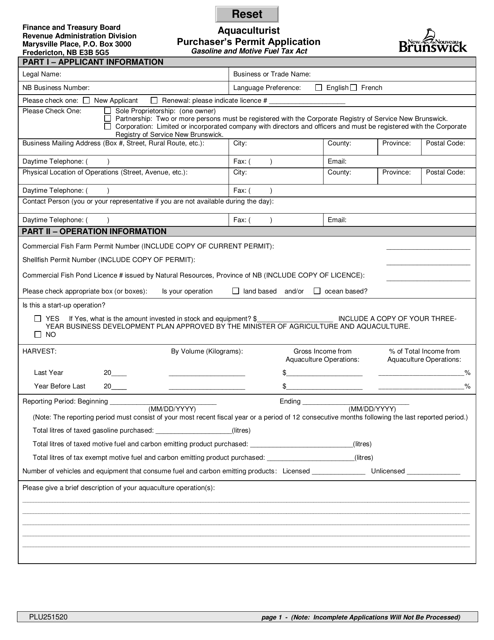

This form is used for applying for a Aquaculturist Purchaser's Permit in New Brunswick, Canada.

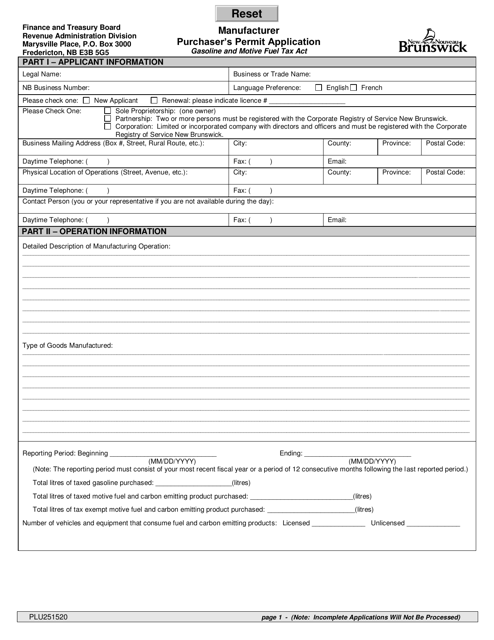

This document is for individuals or businesses in New Brunswick, Canada who want to apply for a Purchaser's Permit to receive tax exemptions on certain purchases from manufacturers.

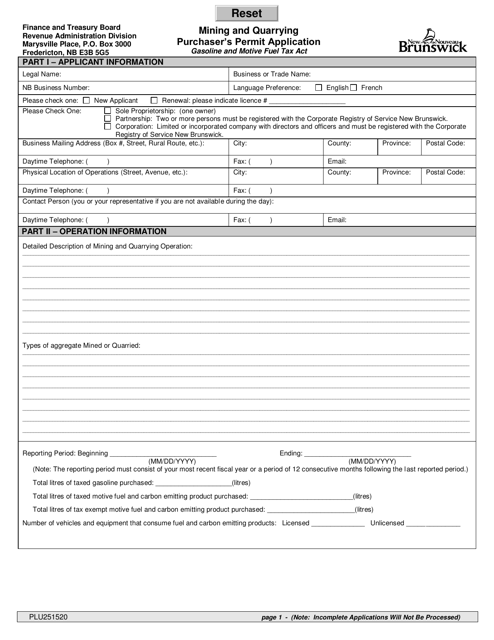

This Form is used for applying for a Mining and Quarrying Purchaser's Permit in the province of New Brunswick, Canada.

This document is used for applying for a refund of provincial vehicle tax in New Brunswick, Canada for extensively damaged or exceptionally high mileage motor vehicles and off-road vehicles.

This form is used for requesting accommodations for linguistic services in New Brunswick, Canada.

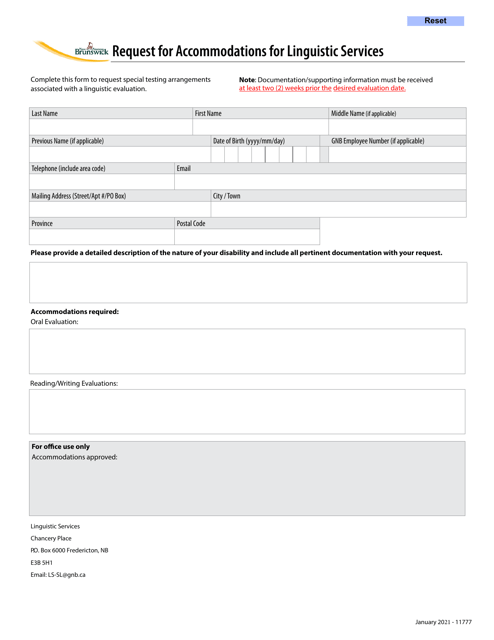

This document is for seniors in New Brunswick, Canada who want to apply for the Property Tax Deferral Program. It allows eligible seniors to defer paying their property taxes.

Application for Provincial Property Tax Exemption for Not-For-Profit Housing - New Brunswick, Canada

This form is used for applying for a property tax exemption for not-for-profit housing in New Brunswick, Canada.

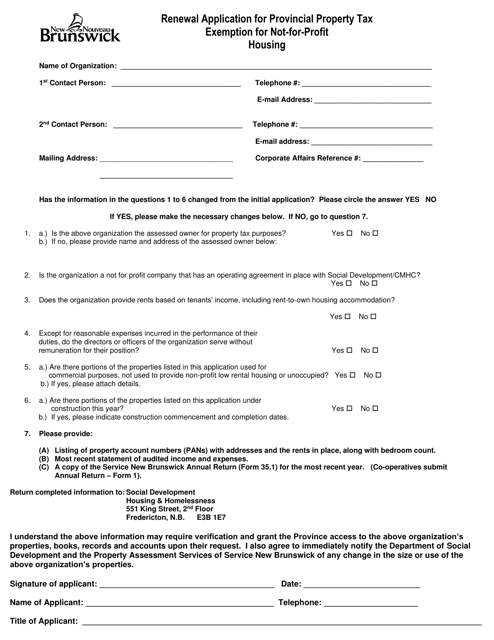

This document is for individuals or organizations in New Brunswick, Canada seeking to renew their application for provincial property tax exemption for not-for-profit housing. It is used to request an exemption from paying property taxes for housing that is operated by a not-for-profit organization.