Saskatchewan Ministry of Finance Forms

The Saskatchewan Ministry of Finance is responsible for managing the fiscal affairs of the province of Saskatchewan, Canada. Its main role is to oversee the collection and administration of various taxes and revenue sources, such as sales tax and income tax. Additionally, the ministry is responsible for the development and implementation of financial policies, budget planning, and economic forecasting for the province.

Documents:

39

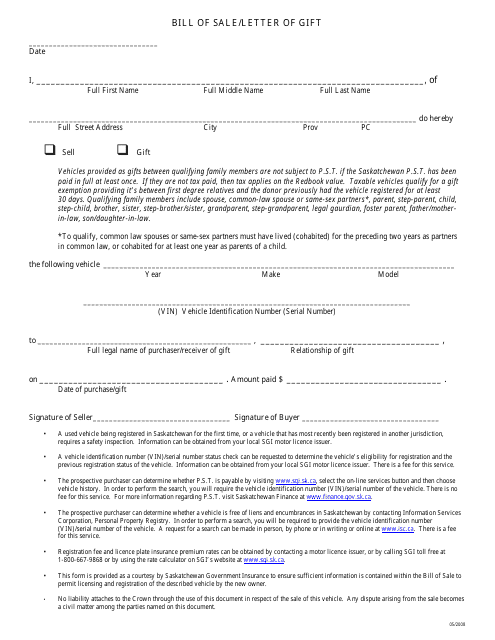

This document is used in Saskatchewan, Canada for transferring ownership of a personal property through a sale or a gift. It serves as legal proof of the transaction and the transfer of ownership.

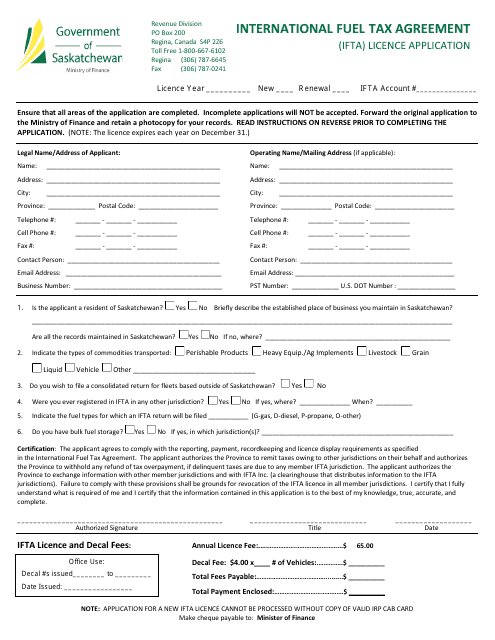

This document is used for applying for an International Fuel Tax Agreement (IFTA) license in Saskatchewan, Canada.

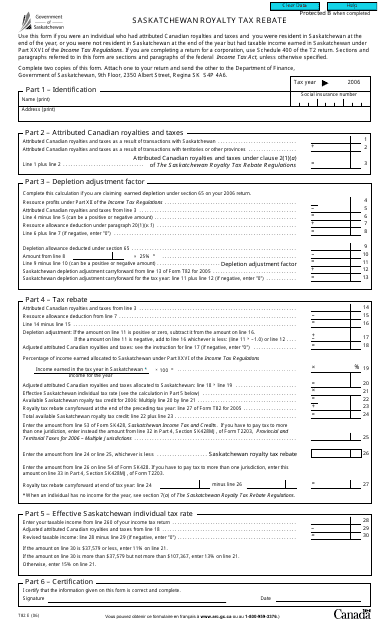

This form is used for applying for the Saskatchewan Royalty Tax Rebate in Saskatchewan, Canada. It allows individuals or businesses to claim back a portion of the royalties paid on certain types of resource extraction. The rebate is meant to encourage economic development and investment in the province.

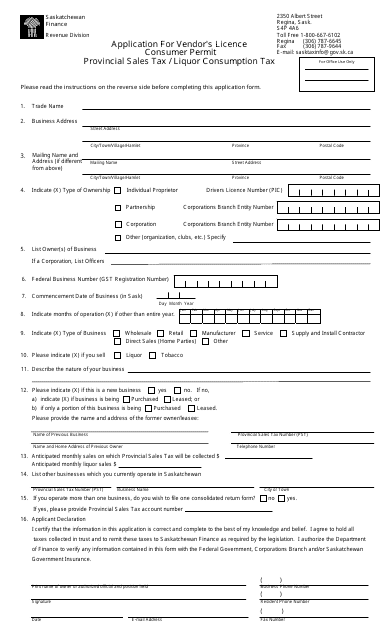

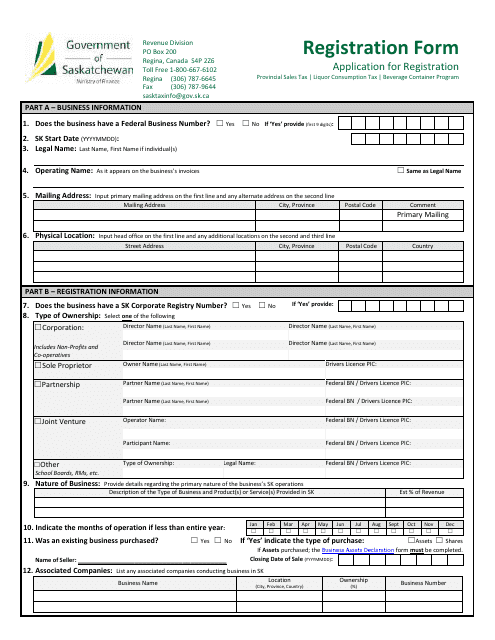

This document is an application form for obtaining a Vendor's Licence and Consumer Permit for selling products subject to Provincial Sales Tax and Liquor Consumption Tax in Saskatchewan, Canada.

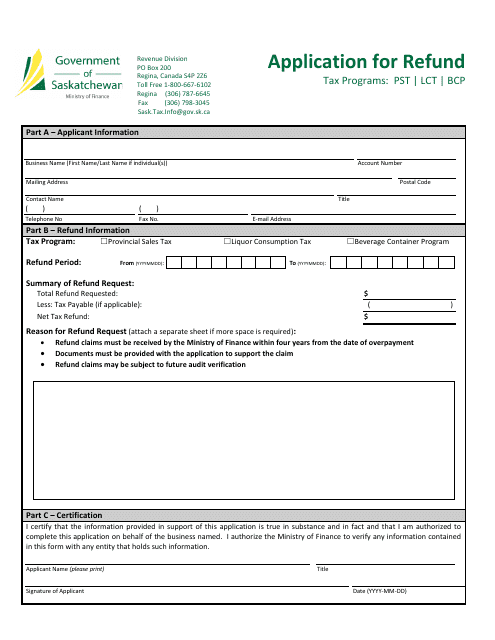

This Form is used for applying for a refund in the province of Saskatchewan, Canada. It is used when individuals or businesses want to request a refund for certain expenses or taxes paid.

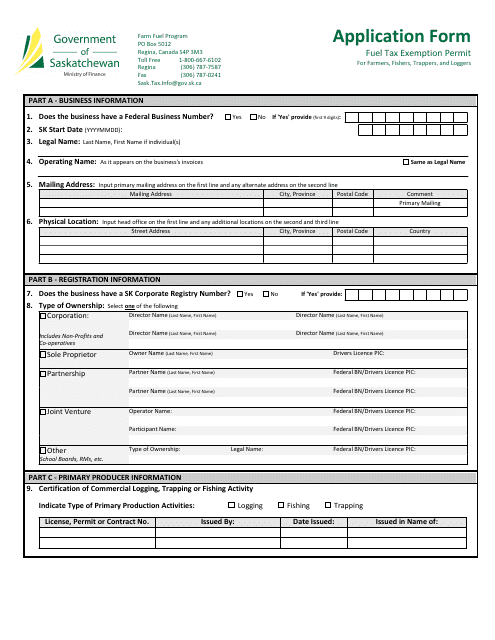

This document is used for applying for a fuel tax exemption permit in Saskatchewan, Canada.

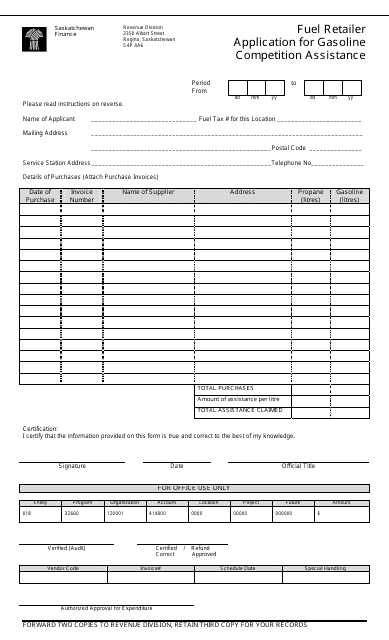

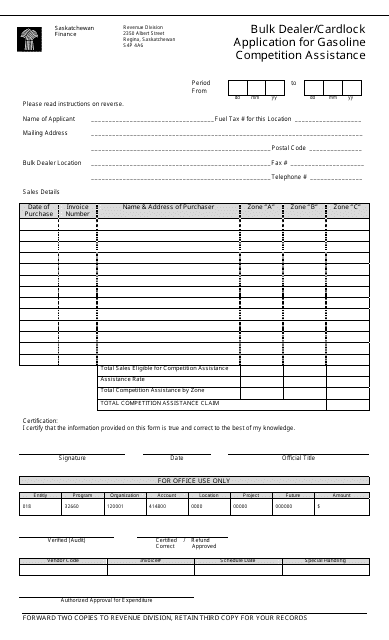

This form is used to apply for assistance with gasoline competition in Saskatchewan, Canada, for fuel retailers.

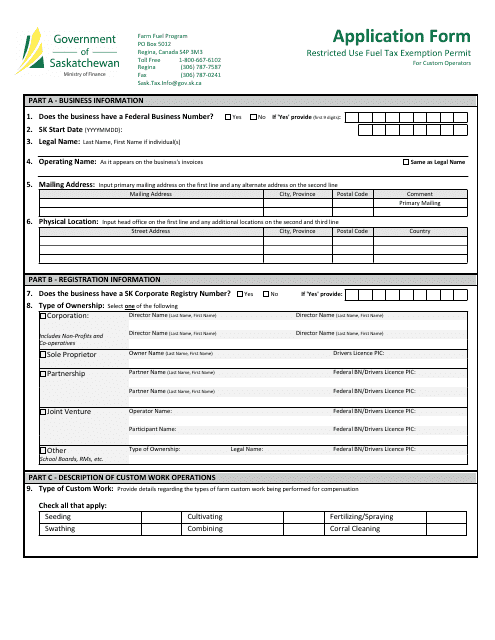

This document is an application form for custom operators in Saskatchewan, Canada to apply for a Restricted Use Fuel Tax Exemption Permit. It allows operators to be exempt from paying fuel taxes for certain activities.

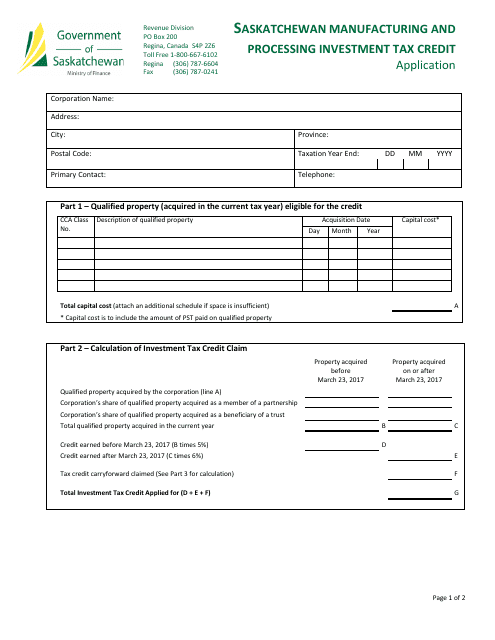

This Form is used for applying for the Manufacturing and Processing Investment Tax Credit in the province of Saskatchewan, Canada.

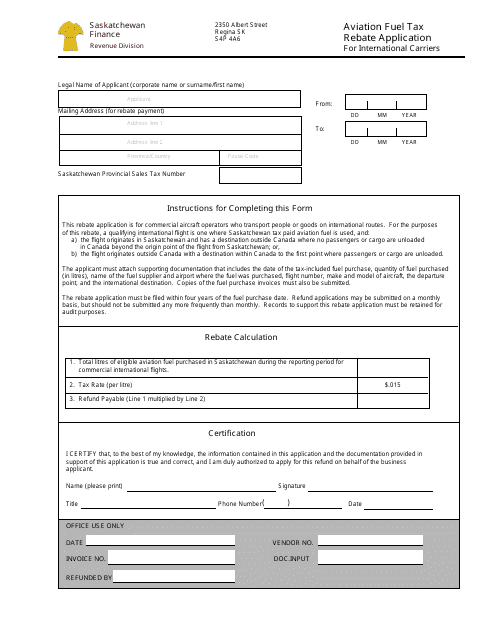

This form is used for international carriers operating in Saskatchewan, Canada to apply for a rebate on aviation fuel taxes paid.

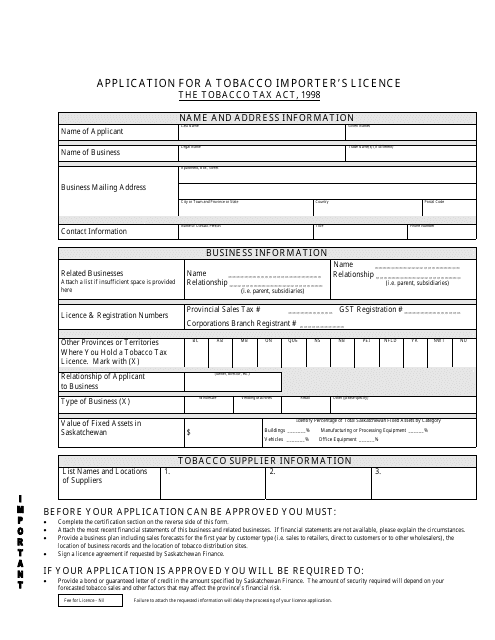

This document is for applying for a tobacco importer's license in the province of Saskatchewan, Canada. It is necessary for individuals or businesses who wish to import tobacco products into Saskatchewan.

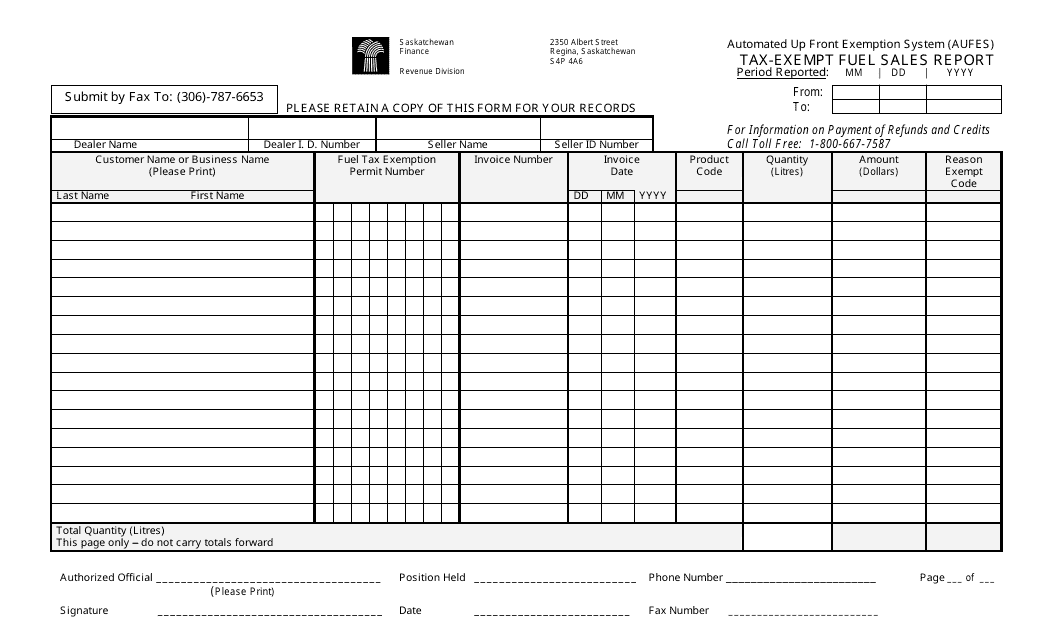

This document is used for reporting tax-exempt fuel sales in Saskatchewan, Canada.

This document is used for applying for a vendor's licence or consumer registration in the province of Saskatchewan, Canada. It is necessary for individuals or businesses who wish to sell goods or provide services to obtain this license/registration.

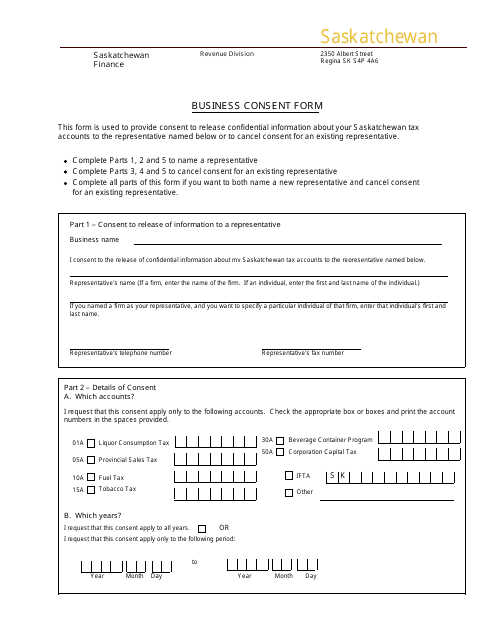

This document is used for obtaining consent from businesses in Saskatchewan, Canada. It is often required for various business transactions and activities.

This document is for businesses in Saskatchewan, Canada that want to apply for assistance under the Bulk Dealer/Cardlock program to compete in the gasoline industry.

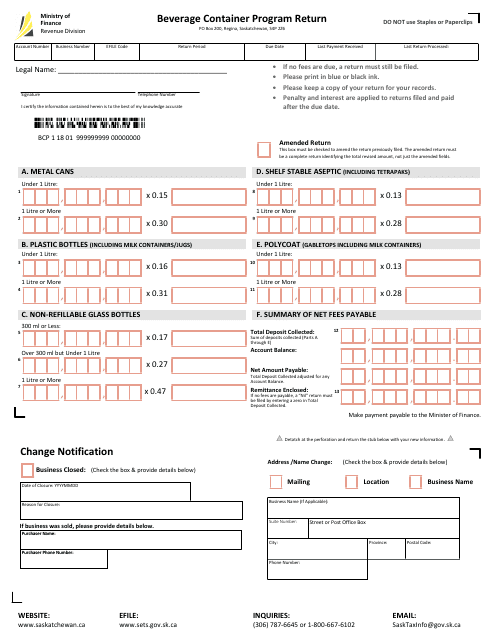

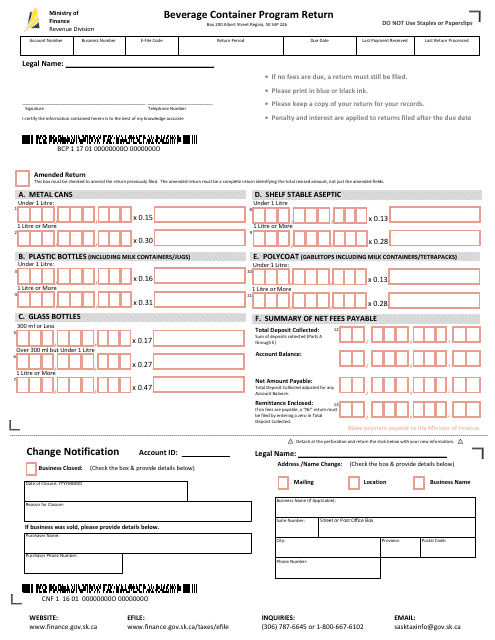

This type of document is used for returning beverage containers under the beverage container program in Saskatchewan, Canada.

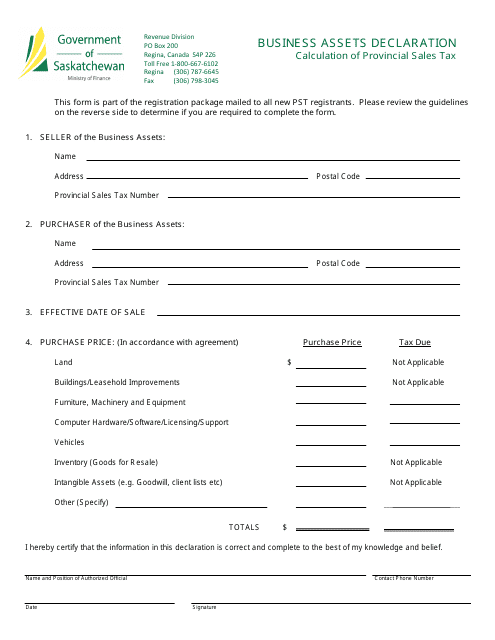

This document is used for declaring business assets in the province of Saskatchewan, Canada. It is an important step in the process of managing and reporting business assets for tax and regulatory purposes.

This document is for returning beverage containers in Saskatchewan, Canada, for periods prior to April 1, 2018.

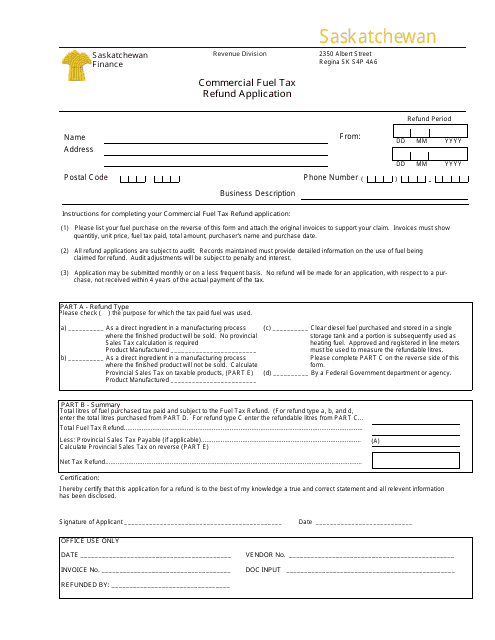

This Form is used for applying for a refund of fuel tax for commercial vehicles in Saskatchewan, Canada.

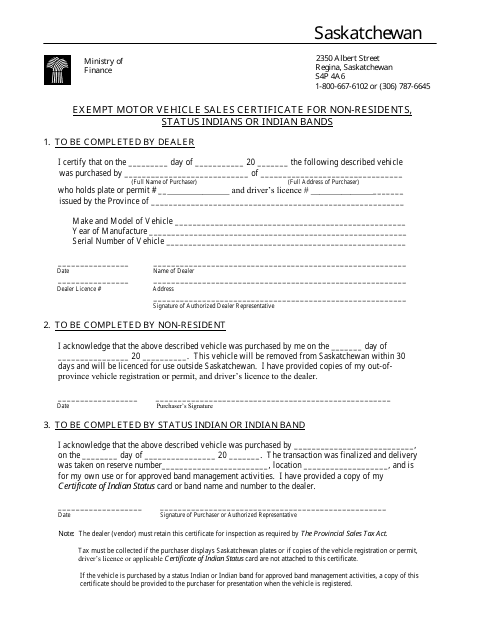

This document is for non-residents, status Indians, or Indian bands who are seeking an exempt motor vehicle sales certificate in Saskatchewan, Canada. It outlines the requirements and process for obtaining this certificate.

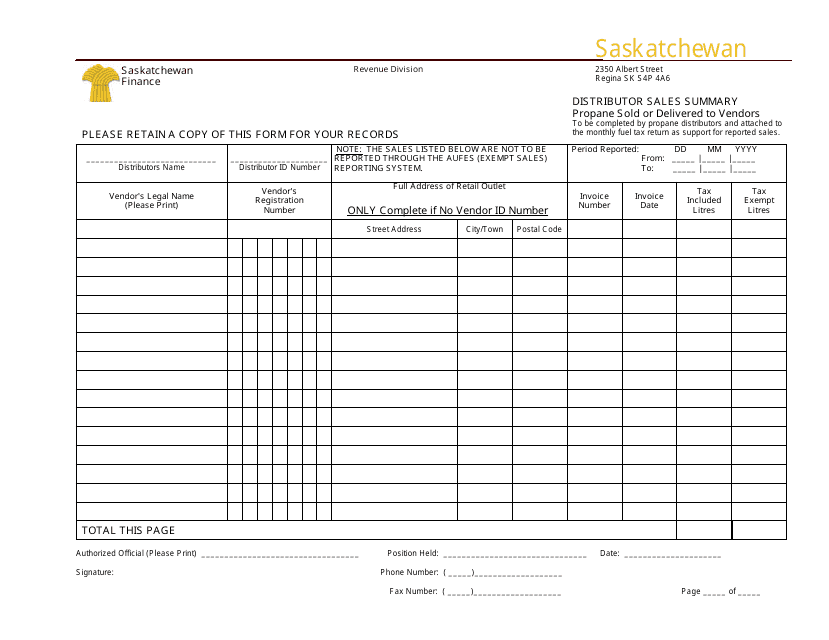

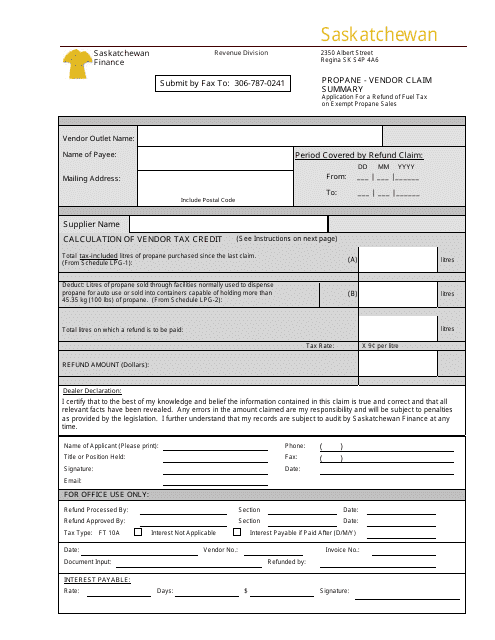

This document provides a summary of propane sales or deliveries to vendors in Saskatchewan, Canada by a distributor. It includes information about the quantity of propane sold and delivered.

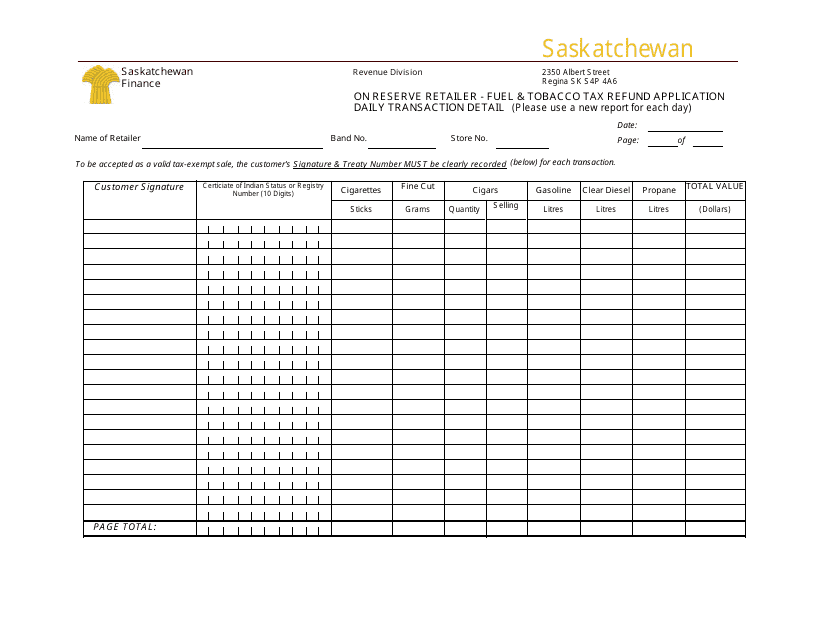

This document is used to track daily transactions and details related to fuel and tobacco tax refund applications for reserve retailers in Saskatchewan, Canada.

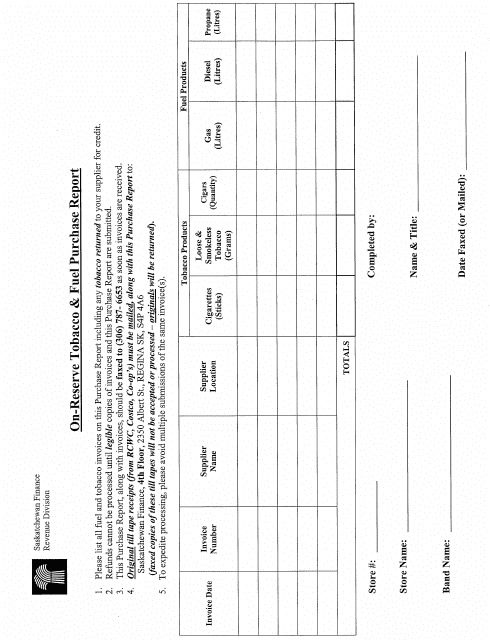

This form is used for reporting purchases of tobacco and fuel on reserves in Saskatchewan, Canada.

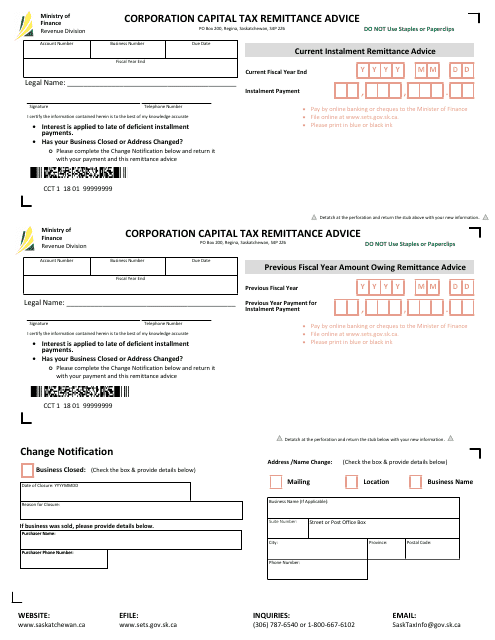

This document is used for remitting capital tax owed by corporations in the province of Saskatchewan, Canada.

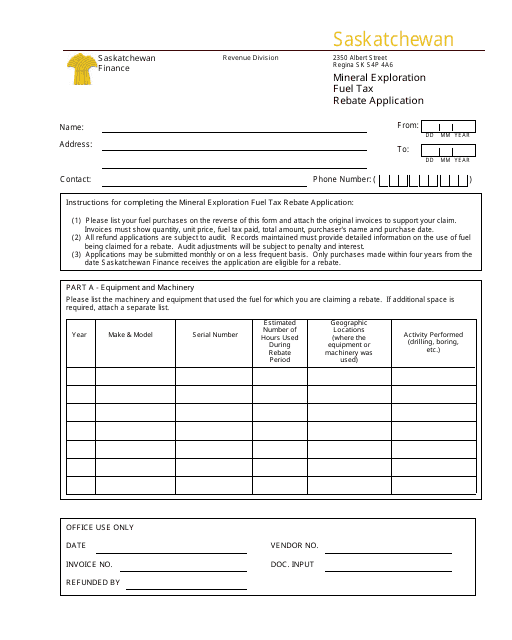

This form is used for applying for a fuel tax rebate in Saskatchewan, Canada for mineral exploration activities.

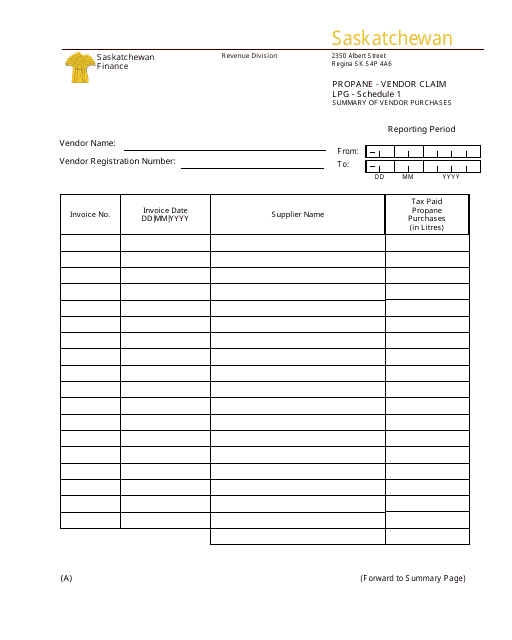

This document is a summary of propane vendor purchases in the province of Saskatchewan, Canada. It is used for claiming LPG purchases.

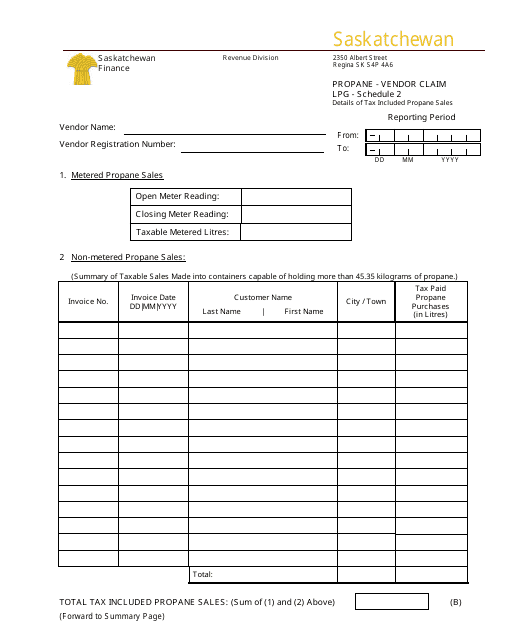

Schedule 2 Propane - Vendor Claim Lpg - Details of Tax Included Propane Sales - Saskatchewan, Canada

This document is a vendor claim form for Schedule 2 Propane sales in Saskatchewan, Canada. It includes details of tax-included propane sales made by the vendor.

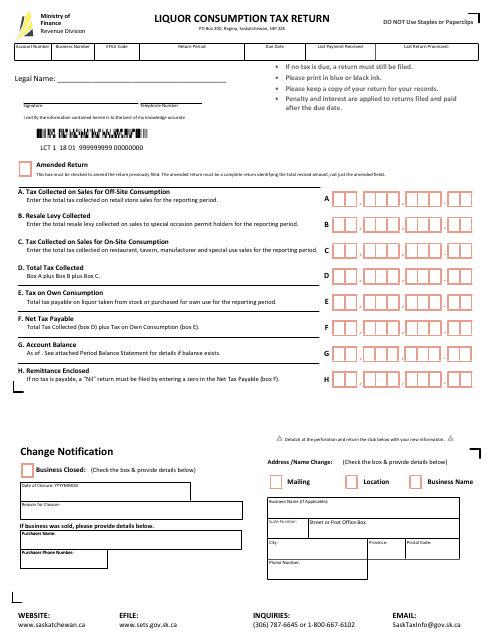

This Form is used for reporting and paying the liquor consumption tax in the province of Saskatchewan, Canada. It is to be filed by businesses that sell or serve alcoholic beverages.

This document provides a summary of vendor claims related to the purchase and delivery of propane in Saskatchewan, Canada. It outlines the details of the claim, including the vendor involved and the nature of the dispute.

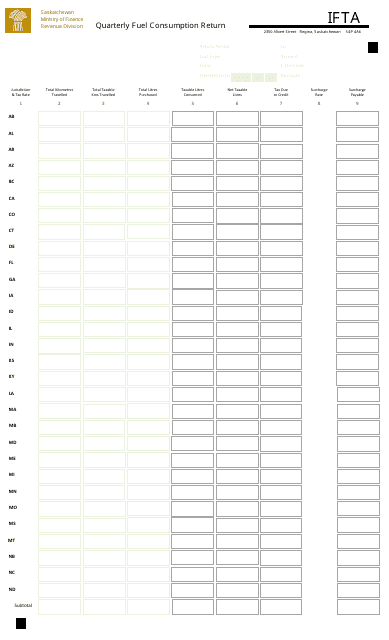

This document is used for reporting the quarterly fuel consumption in the province of Saskatchewan, Canada.

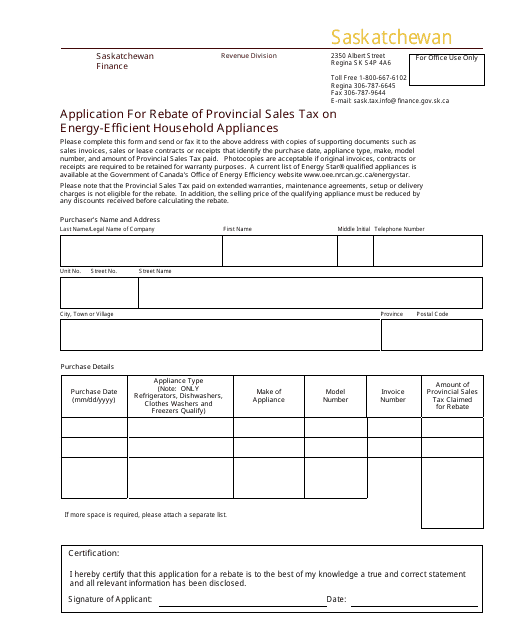

This form is used for applying for a rebate on the provincial sales tax for energy-efficient household appliances in Saskatchewan, Canada.

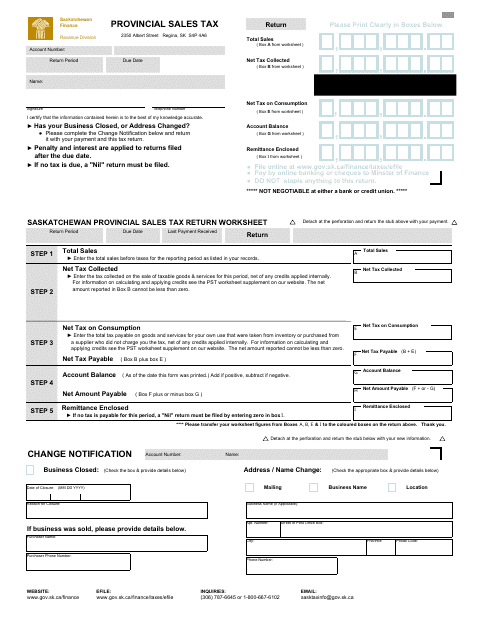

This Form is used for reporting and remitting the Provincial Sales Tax in the province of Saskatchewan, Canada.

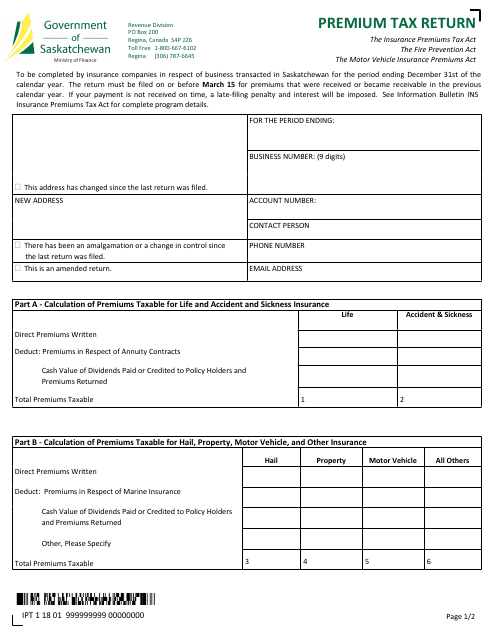

This document is used for filing your premium tax return in the province of Saskatchewan, Canada.

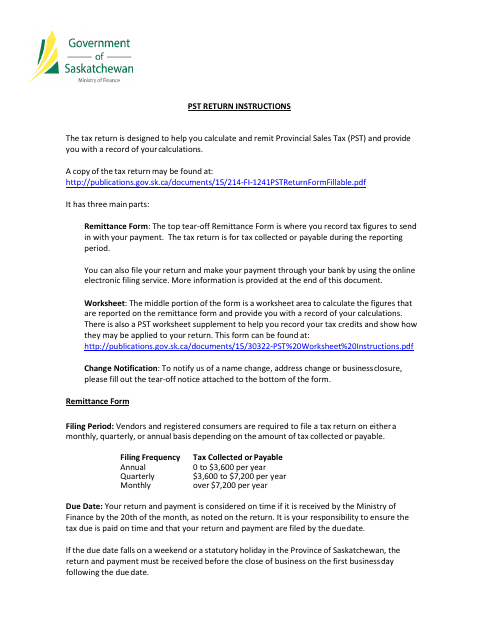

This document provides instructions for completing and filing the Provincial Sales Tax Return in Saskatchewan, Canada. It guides taxpayers on how to report and pay their sales tax obligations to the provincial government.

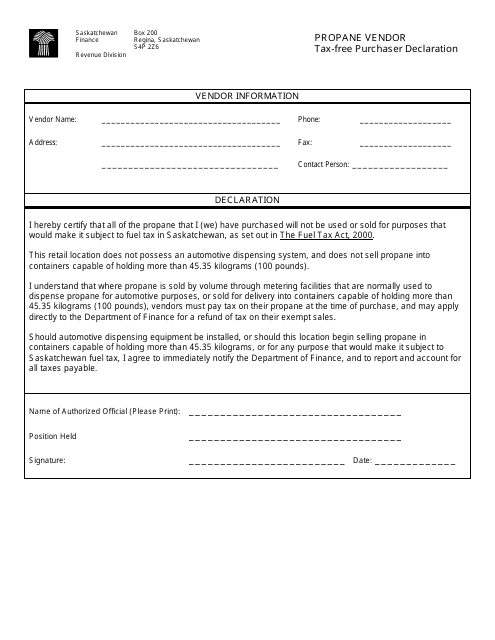

This form is used for declaring tax-free purchases of propane made by vendors in Saskatchewan, Canada.

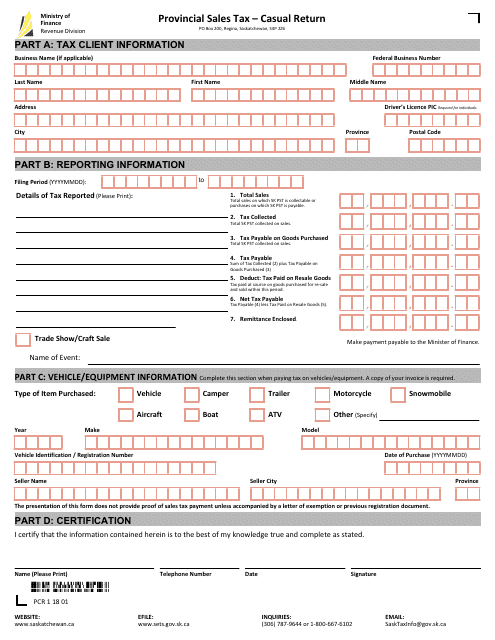

This form is used for reporting and remitting provincial sales tax on casual transactions in the province of Saskatchewan, Canada. It is required for individuals or businesses who are not registered for sales tax but make occasional sales in the province.

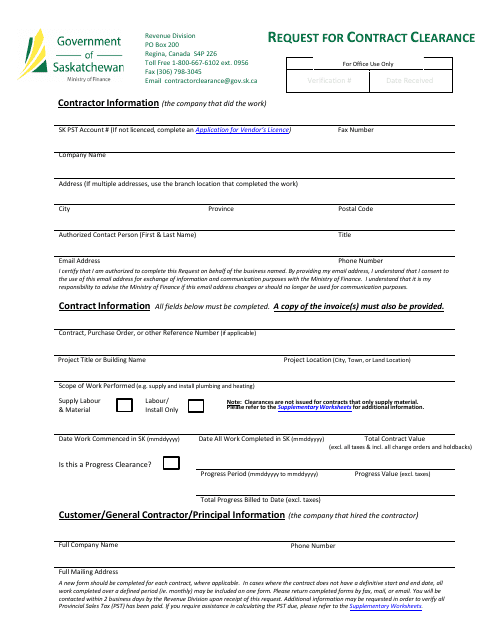

This Form is used for requesting contract clearance in the province of Saskatchewan, Canada. It is a formal process used to ensure a contract is reviewed and approved before it is finalized.

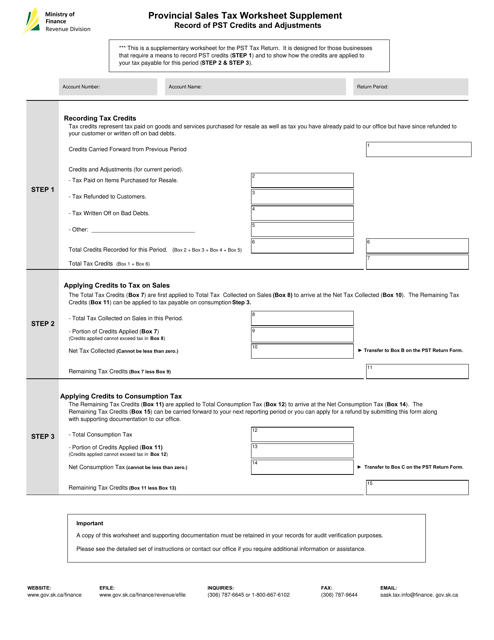

This document is a supplement for the Provincial Sales Tax Worksheet in Saskatchewan, Canada. It provides additional information and calculations specific to the province's sales tax requirements.

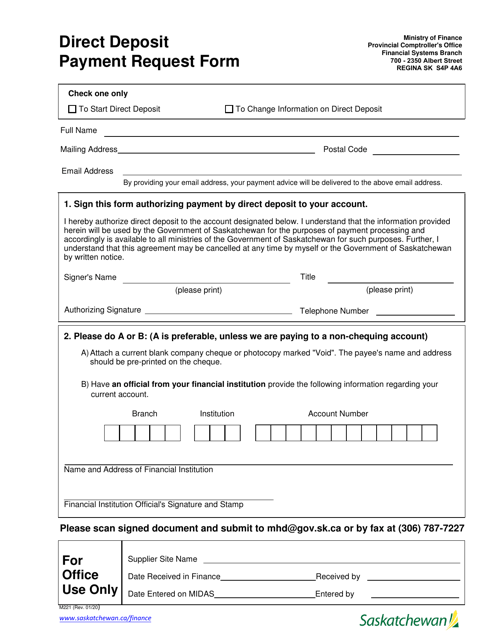

This form is used for requesting direct deposit payments in Saskatchewan, Canada.