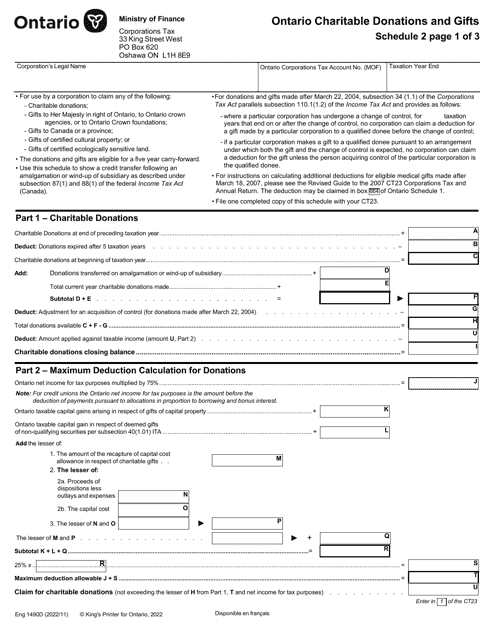

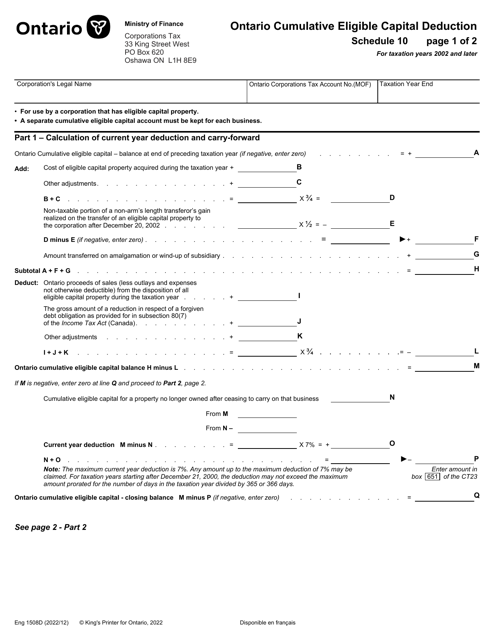

Ontario Ministry of Finance Forms

The Ontario Ministry of Finance is a government department responsible for managing the finances of the province of Ontario in Canada. Its main objectives include budget planning, tax administration, economic and fiscal policy development, and the regulation of financial institutions. The ministry is responsible for collecting taxes, implementing tax policies, and providing financial information and support to individuals, businesses, and other government agencies.

Documents:

345

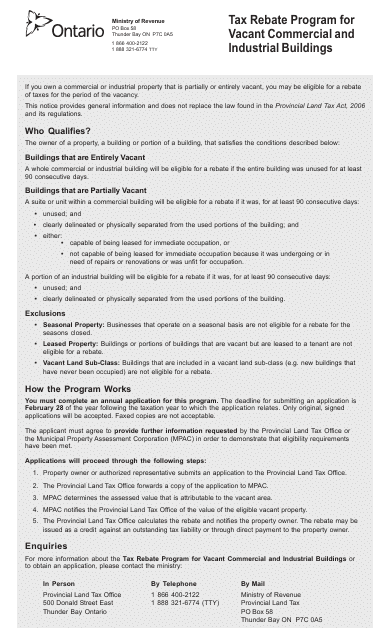

This document is an application for tax rebates available for vacant commercial and industrial buildings under Section 8 of the Provincial Land Tax Act in Ontario, Canada.

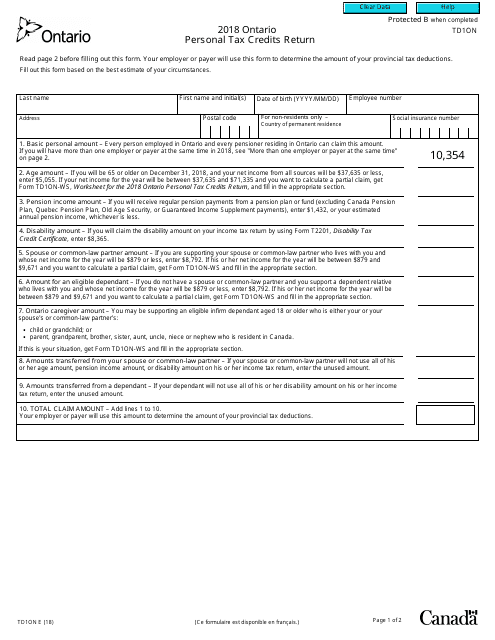

This form is used for reporting personal tax credits and deductions in the province of Ontario, Canada. It is specifically meant for individuals who reside in Ontario and want to claim tax credits that are unique to the province.

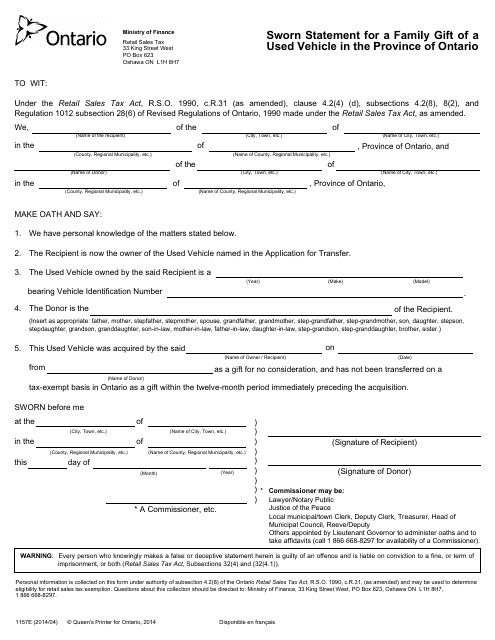

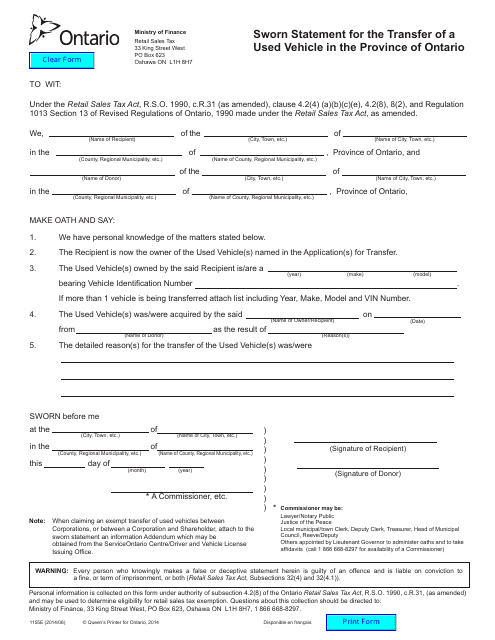

This form is used for declaring a sworn statement for a family gift of a used vehicle in the Province of Ontario, Canada.

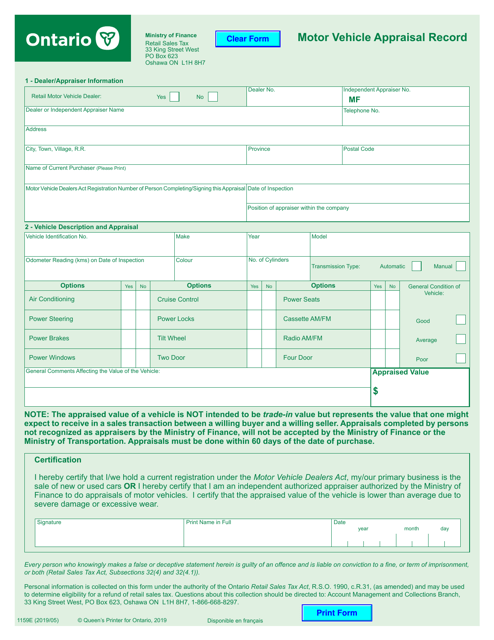

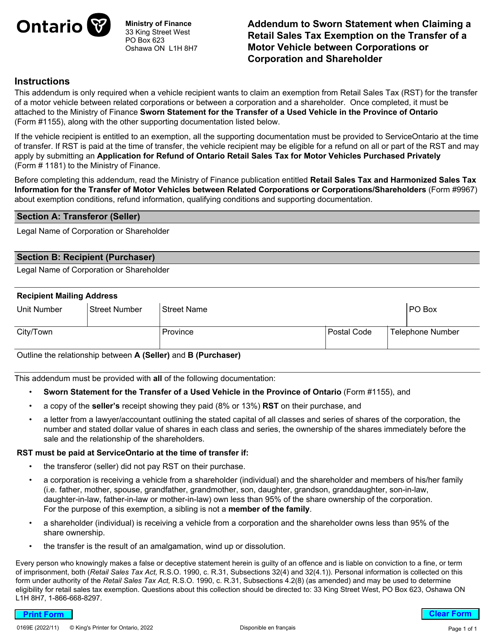

This document is used for the transfer of a used motor vehicle in the Province of Ontario, Canada. It is a sworn statement that confirms the details of the transaction.

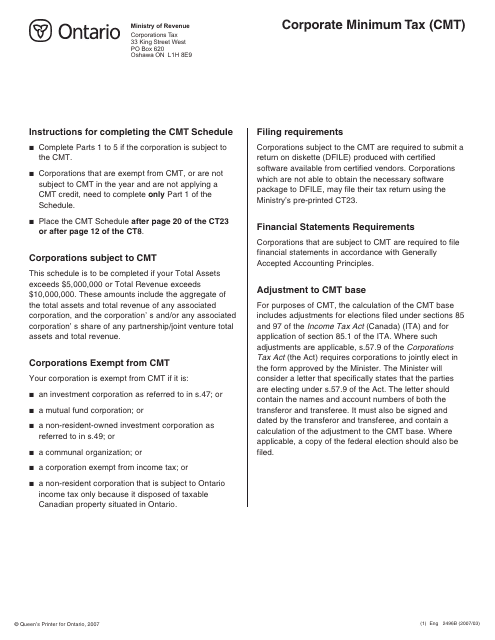

This Form is used for reporting and calculating the Corporate Minimum Tax (Cmt) in the province of Ontario, Canada.

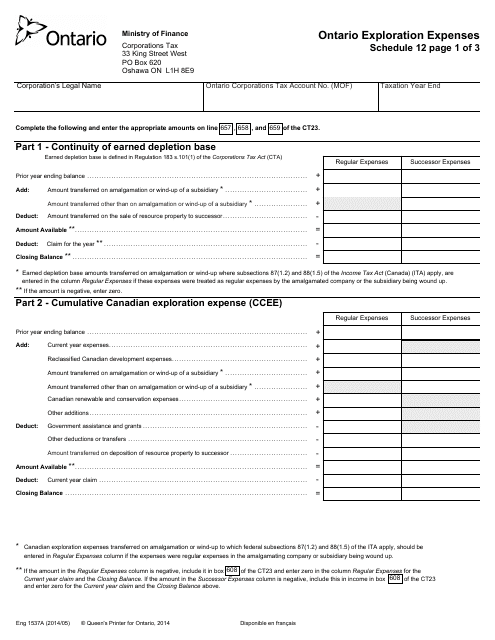

This Form is used for reporting Ontario exploration expenses in Ontario, Canada.

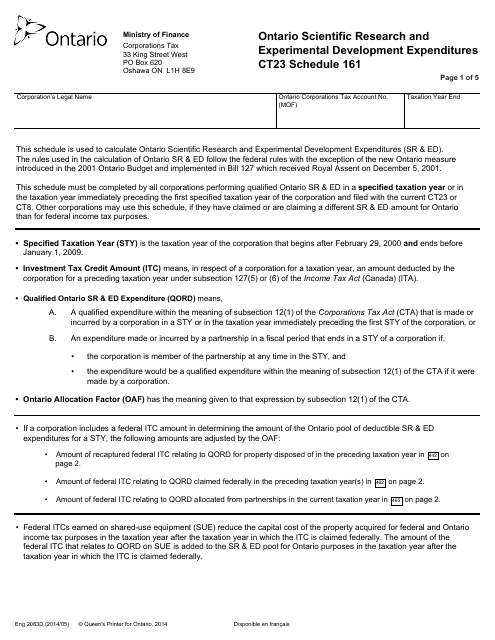

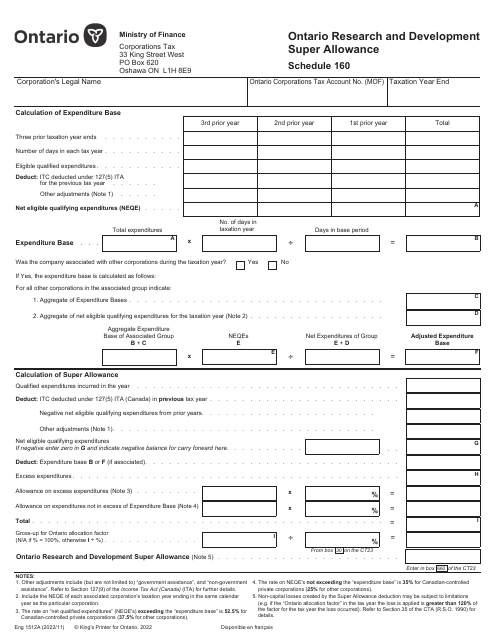

This form is used for reporting Ontario Scientific Research and Experimental Development (SR&ED) expenditures in Ontario, Canada.

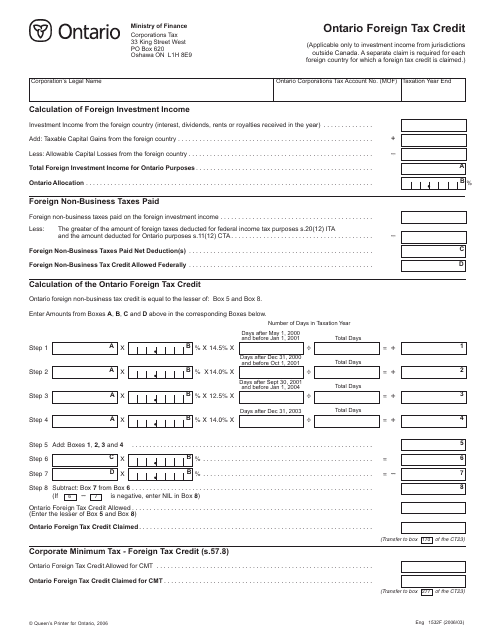

This Form is used for claiming a foreign tax credit in Ontario, Canada.

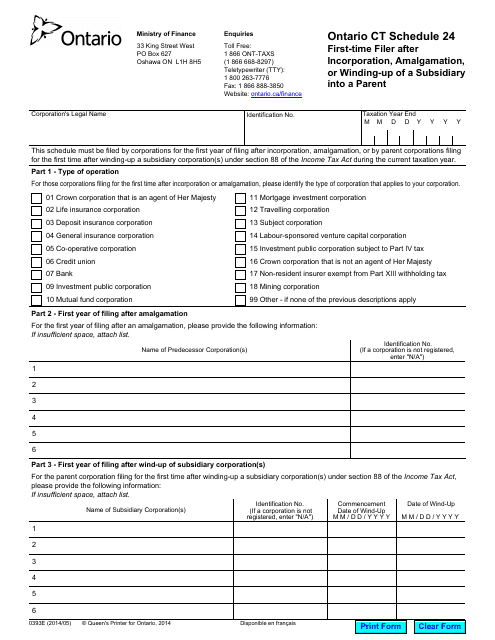

This form is used for first-time filers in Ontario, Canada after the incorporation, amalgamation, or winding-up of a subsidiary into a parent company.

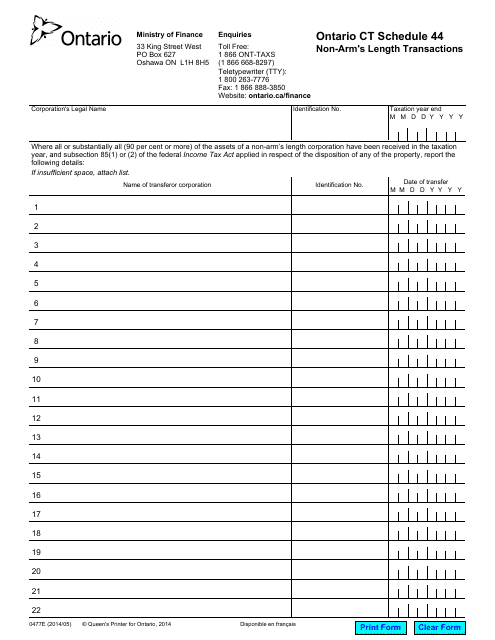

This form is used for reporting non-arm's length transactions in the province of Ontario, Canada.

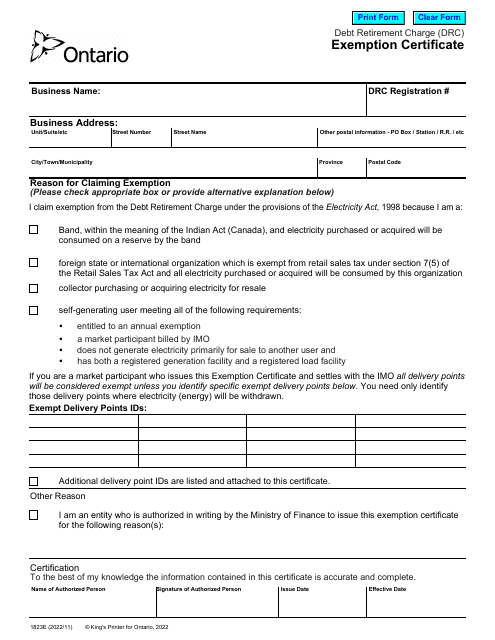

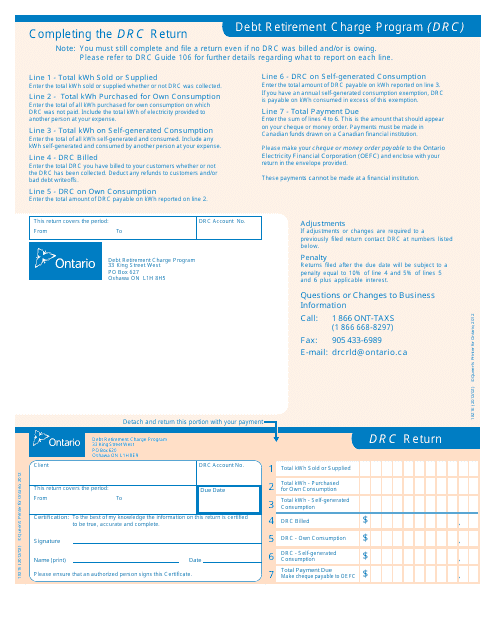

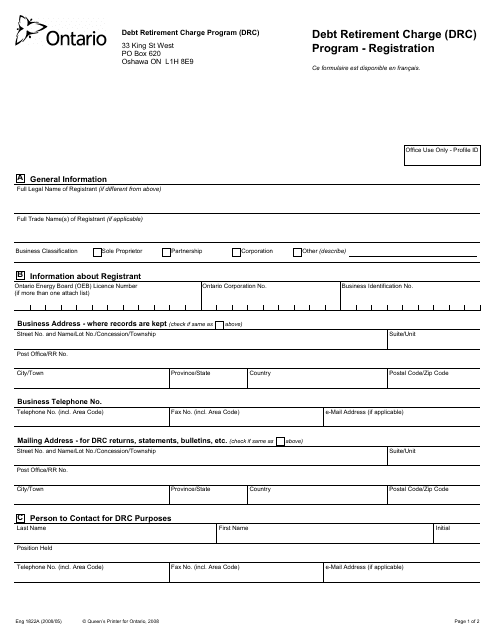

This form is used for filing the Debt Retirement Charge (DRC) return in Ontario, Canada. It is used by businesses to report and remit the DRC amount collected from their customers. The Debt Retirement Charge is a fee that was implemented to help pay off the stranded debt from the former Ontario Hydro. It is applicable to electricity consumed in Ontario.

This form is used for registering for the Debt Retirement Charge in Ontario, Canada.

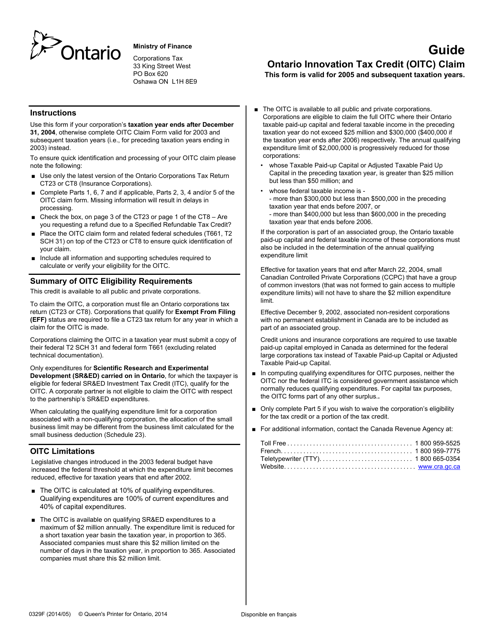

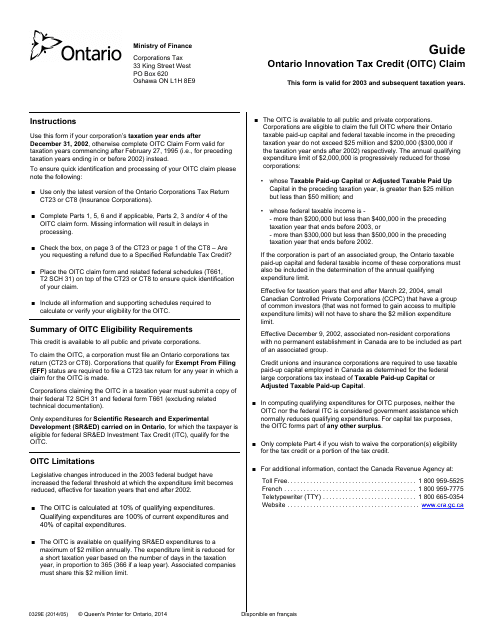

This Form is used for claiming the Ontario Innovation Tax Credit (OITC) in Ontario, Canada.

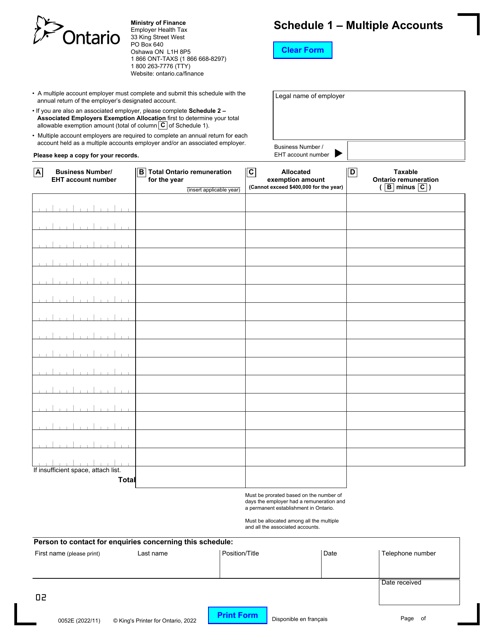

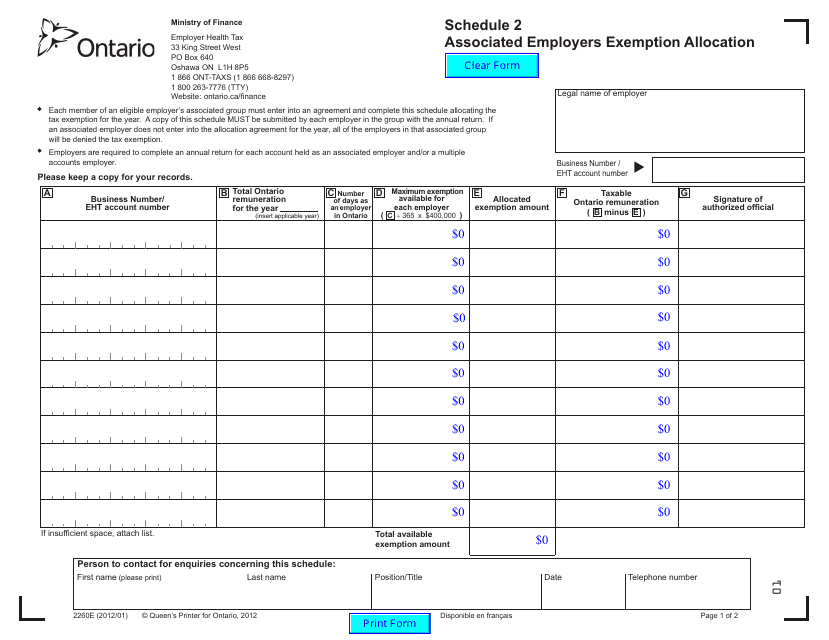

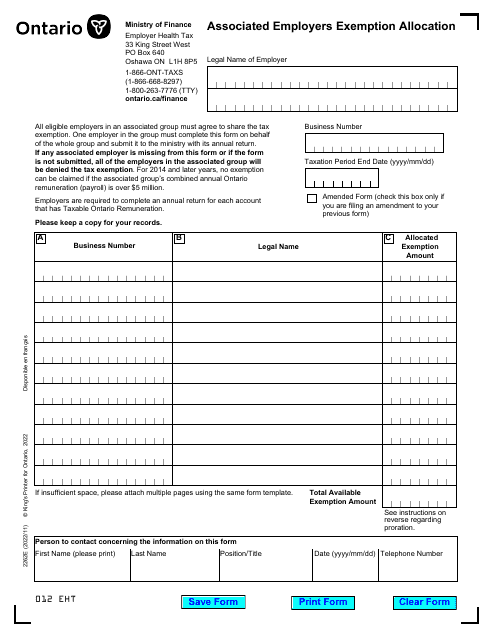

This Form is used for allocating the exemption for associated employers in Ontario, Canada. It helps determine the amount that each employer is eligible to claim.

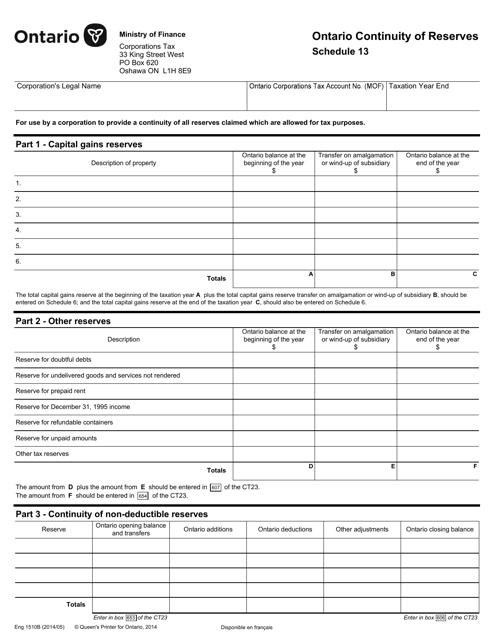

This Form is used for declaring the continuity of reserves in Ontario, Canada. It is specific to Schedule 13 of Form 1510B.

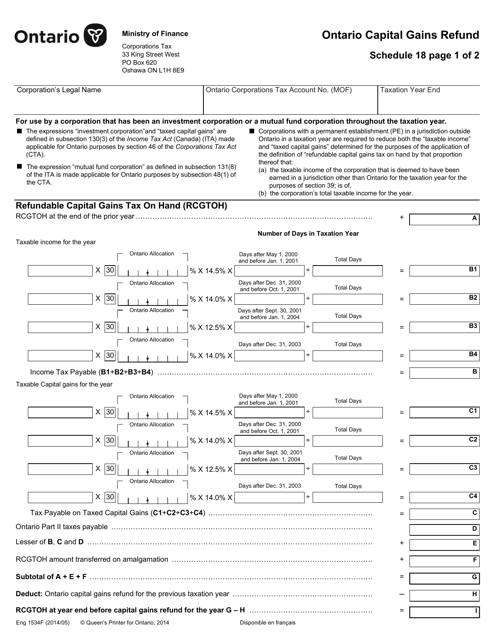

This Form is used for claiming a capital gains refund in Ontario, Canada.

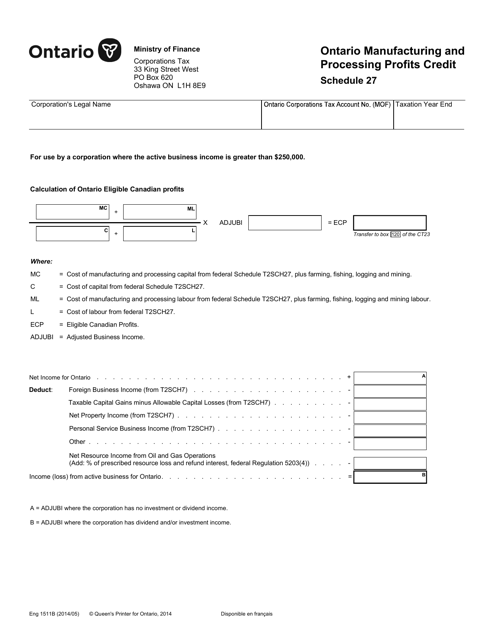

This form is used for claiming the Ontario Manufacturing and Processing Profits Credit in Ontario, Canada. It is specifically designed for businesses engaged in manufacturing and processing activities in Ontario to reduce their tax liability.

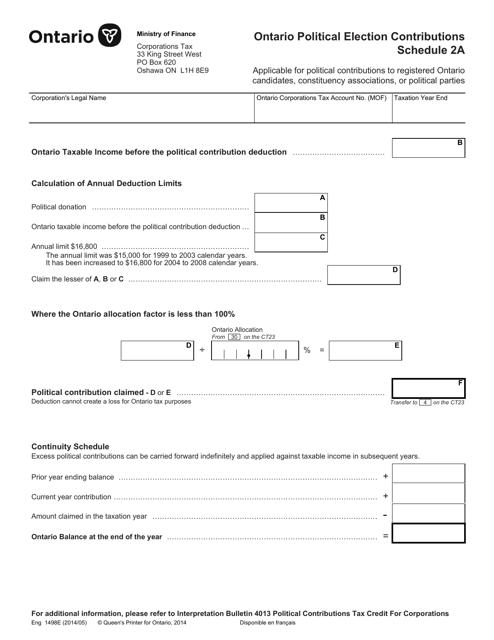

This Form is used for reporting political election contributions in Ontario, Canada.

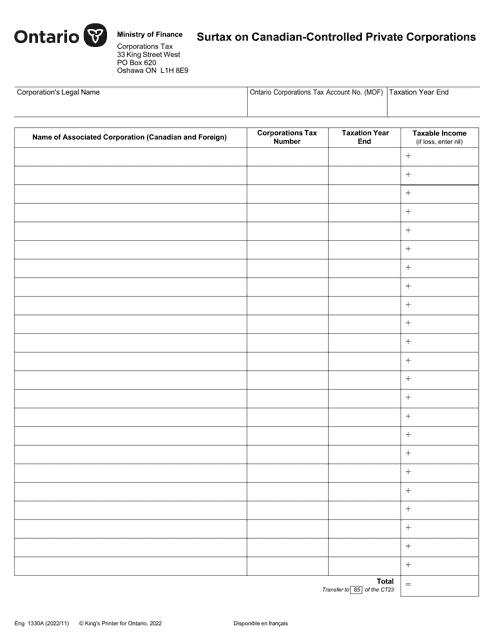

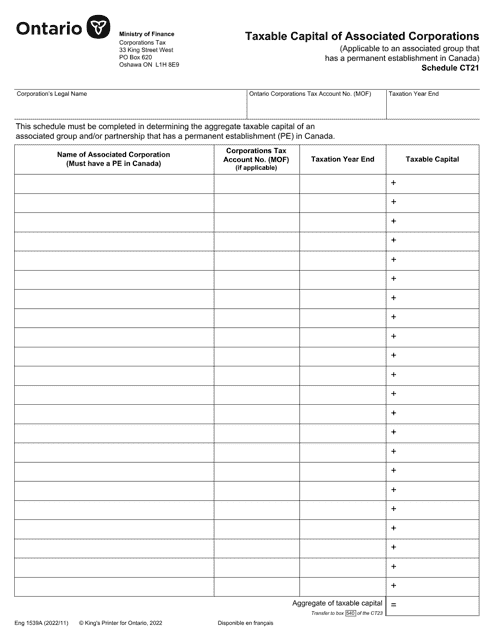

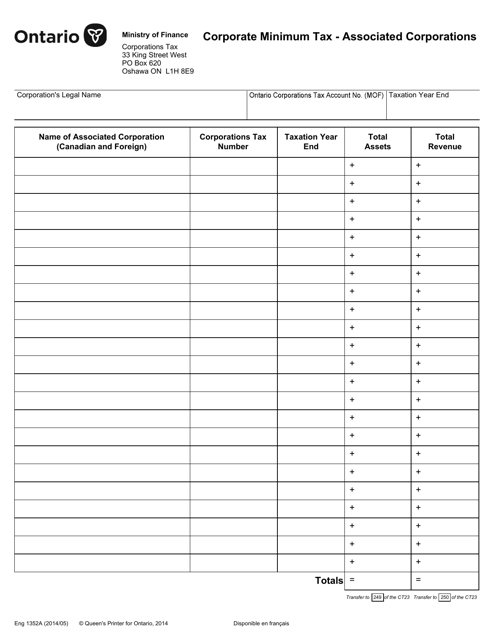

This form is used for calculating and reporting the corporate minimum tax for associated corporations in the province of Ontario, Canada.

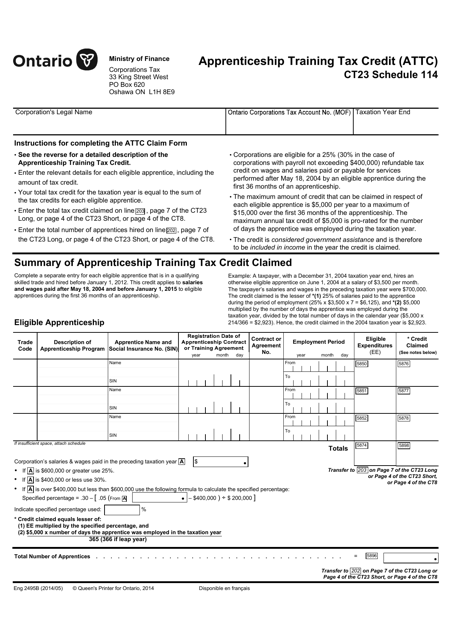

This form is used for claiming the Apprenticeship Training Tax Credit in Ontario, Canada. It is a schedule that needs to be filed along with Form CT23 (2495B).

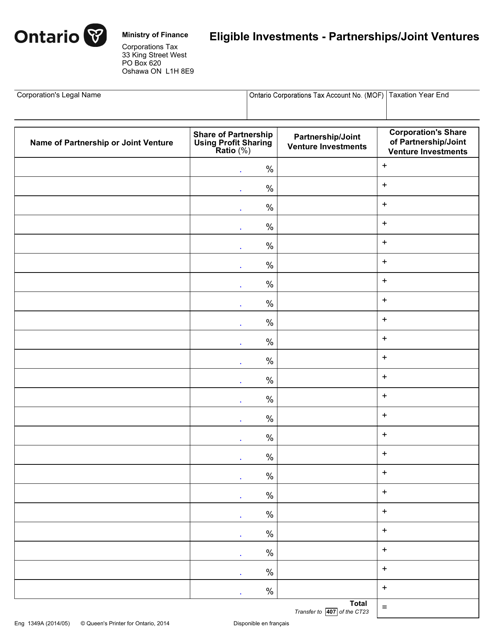

This form is used for reporting eligible investments in partnerships and joint ventures in Ontario, Canada. It provides information on the investment and is required for tax purposes.

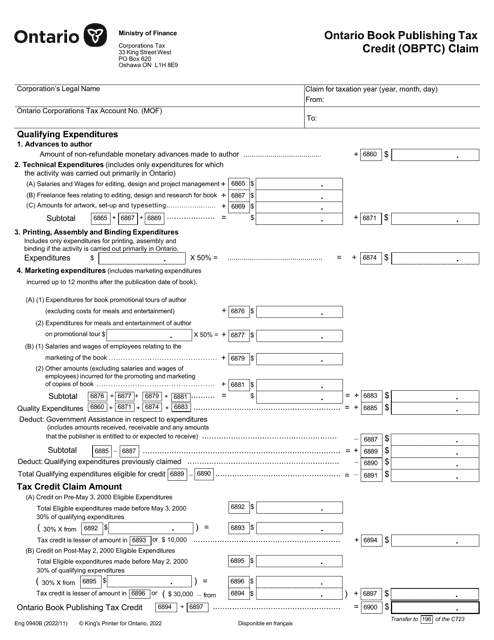

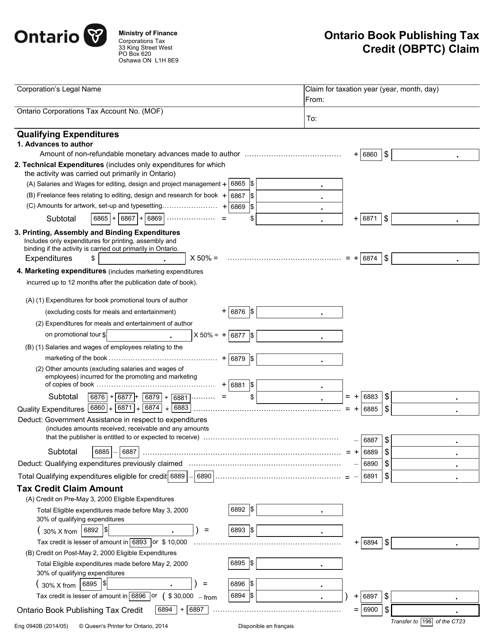

This Form is used for claiming the Ontario Book Publishing Tax Credit (OBPTC) in Ontario, Canada.