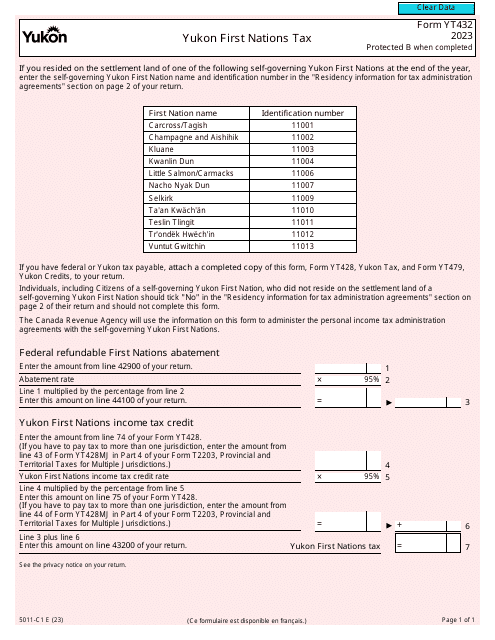

Canadian Revenue Agency Forms

The Canadian Revenue Agency (CRA) is responsible for administering tax laws and programs in Canada. Its main purpose is to collect taxes, enforce tax compliance, and deliver various social benefits on behalf of the Canadian government. The CRA ensures that individuals, businesses, and organizations meet their tax obligations and receive the benefits they are entitled to.

Documents:

3335

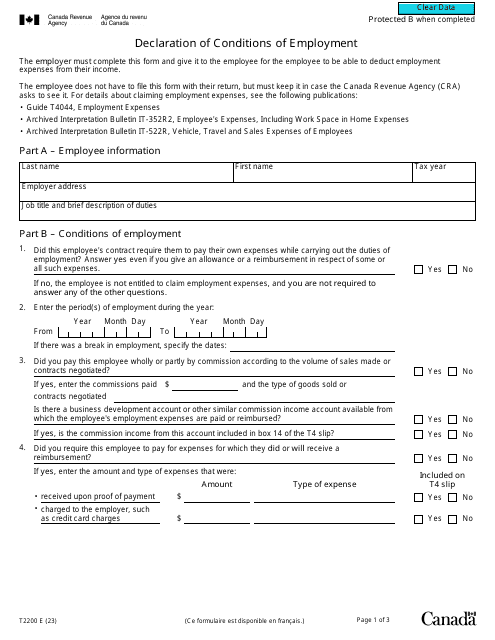

The purpose of the document is to provide an employee with information about employment expenses that can be deducted from their income in Canada.

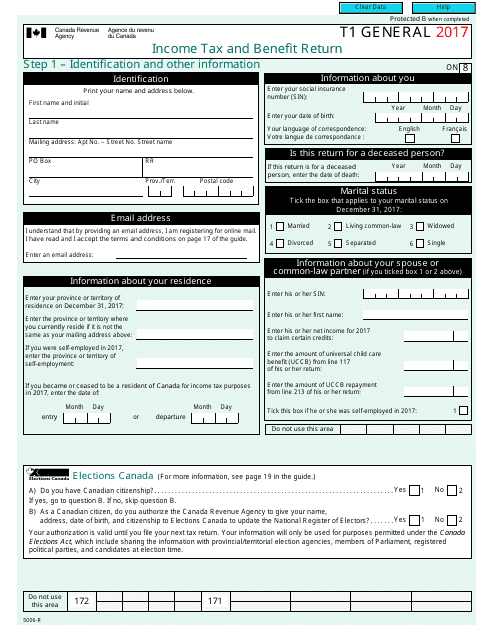

Canadian residents may use this official statement to report their income tax and list all sources of their personal income.

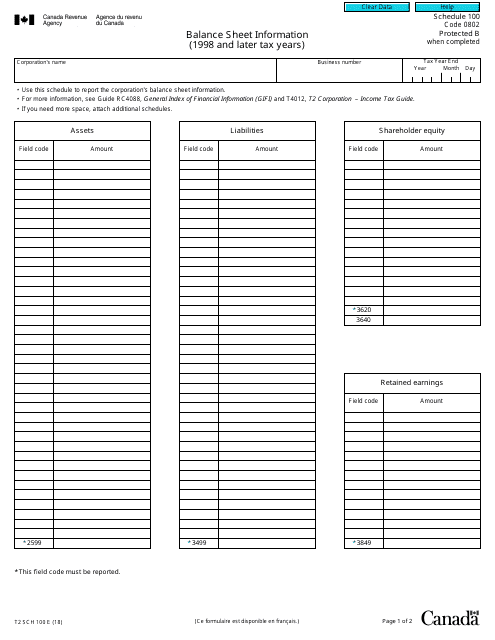

This form is used for providing balance sheet information for Canadian businesses filing the T2 corporate tax return.

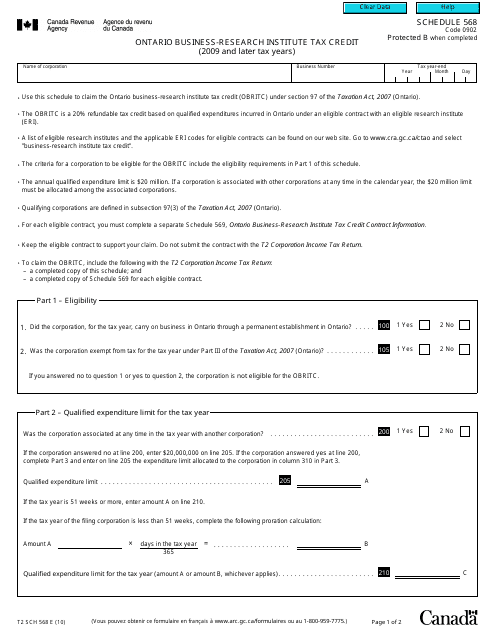

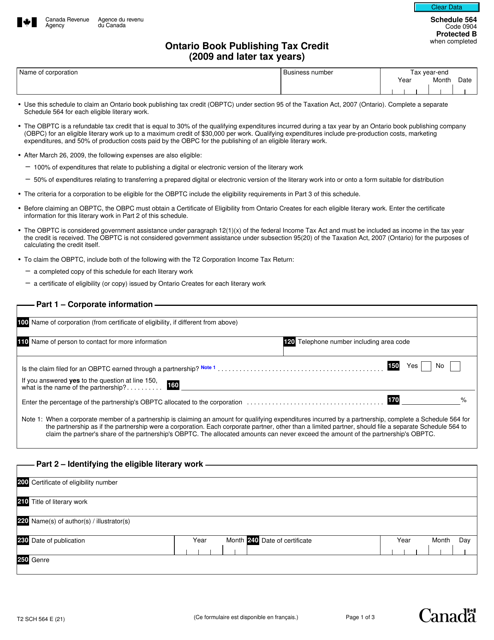

This form is used for claiming the Ontario Business-Research Institute Tax Credit for tax years 2009 and later in Ontario, Canada.

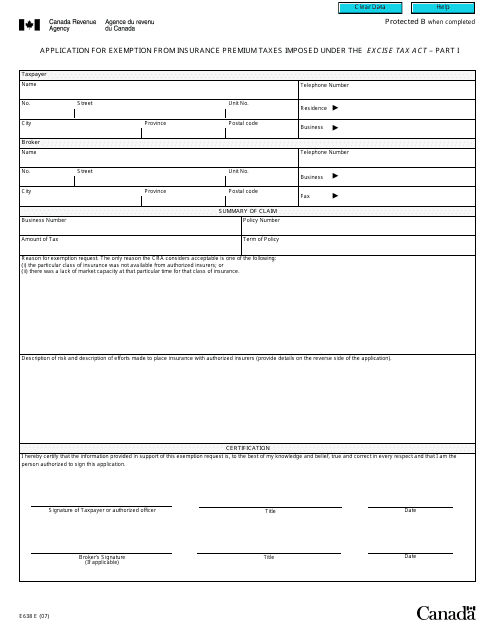

This form is used for applying for an exemption from insurance premium taxes imposed under the Excise Tax Act in Canada.

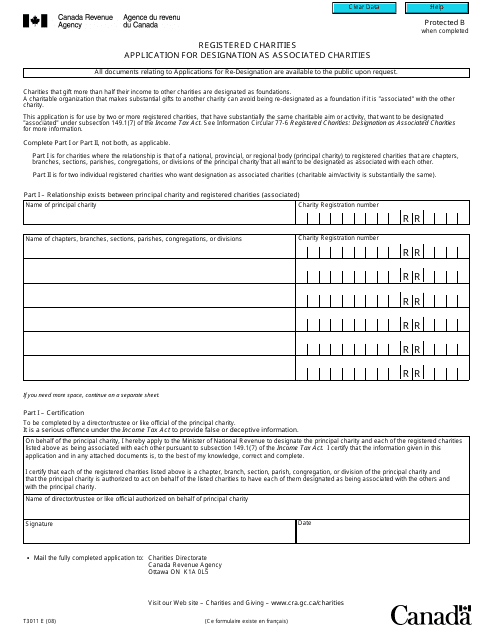

This form is used for applying for designation as associated charities in Canada.

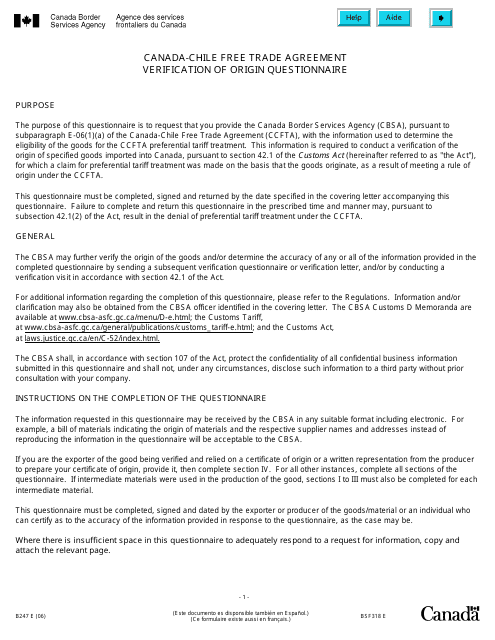

This document is a questionnaire used in Canada to verify the origin of goods under the Canada-Chile Free Trade Agreement.

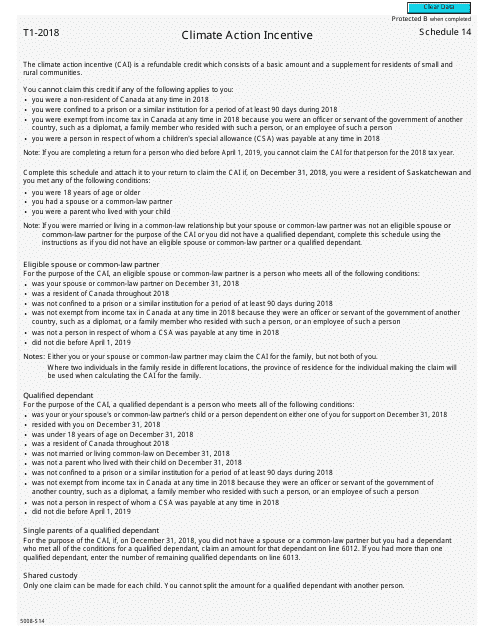

This document is used for completing Schedule 14 in Form 5008-S14 to claim climate action incentives in Canada.

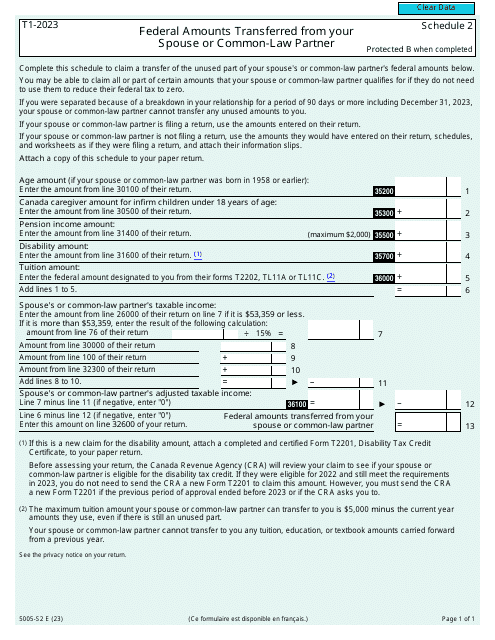

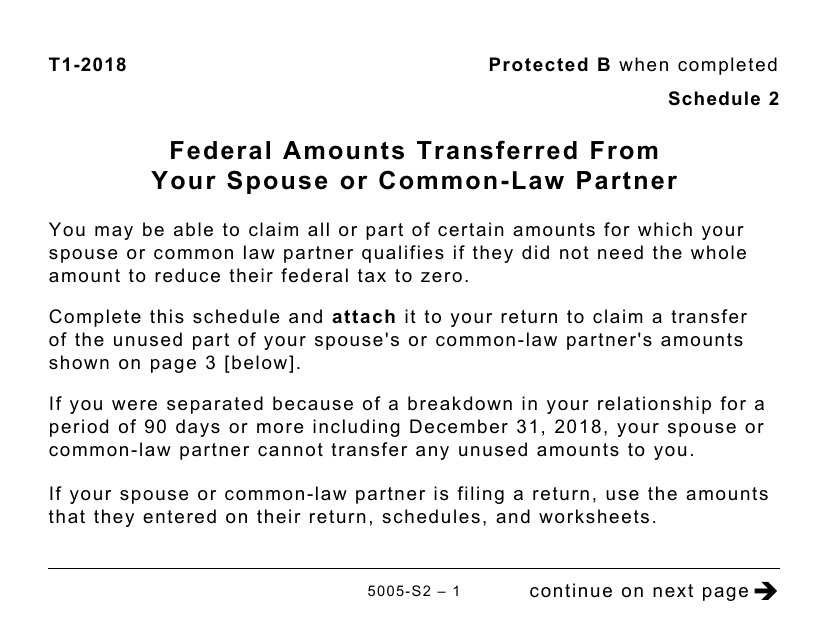

This form is used for transferring federal amounts from your spouse or common-law partner in Canada. The large print version provides easier readability for individuals with visual impairments.

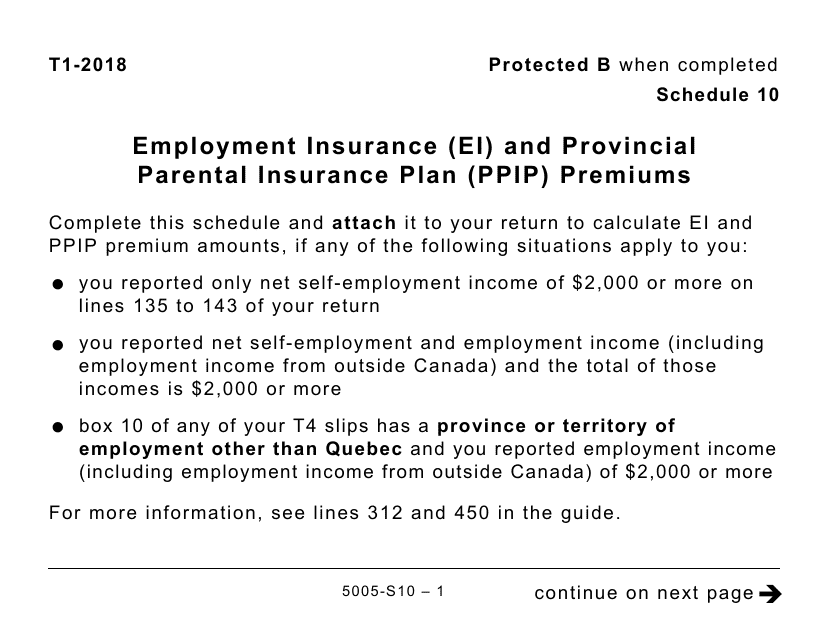

This form is used for reporting Employment Insurance (EI) and Provincial Parental Insurance Plan (PPIP) premiums in Canada. It is a large print version of the form.

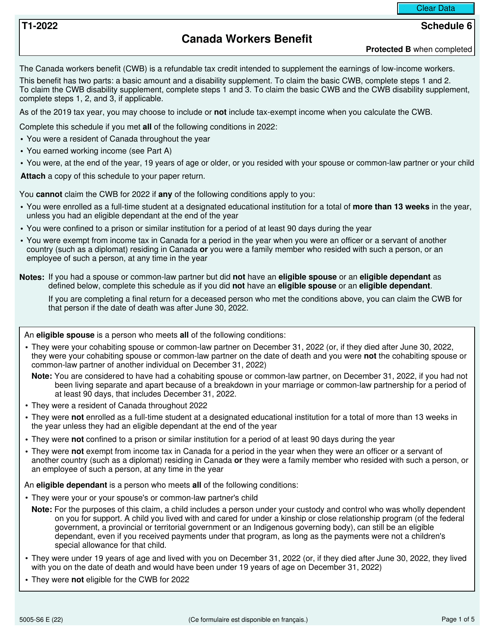

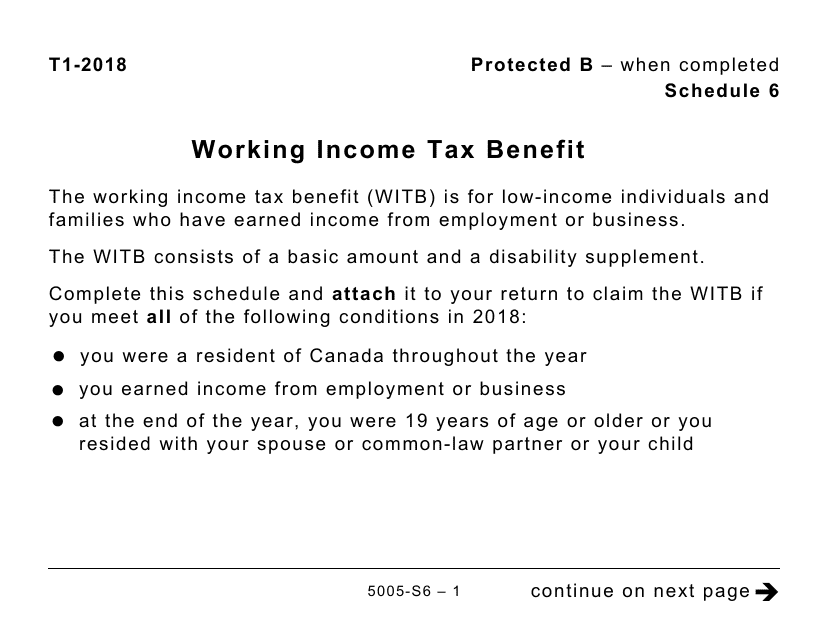

This form is used for reporting the Working Income Tax Benefit for individuals with visual impairments. It provides large print instructions for completing the Schedule 6.

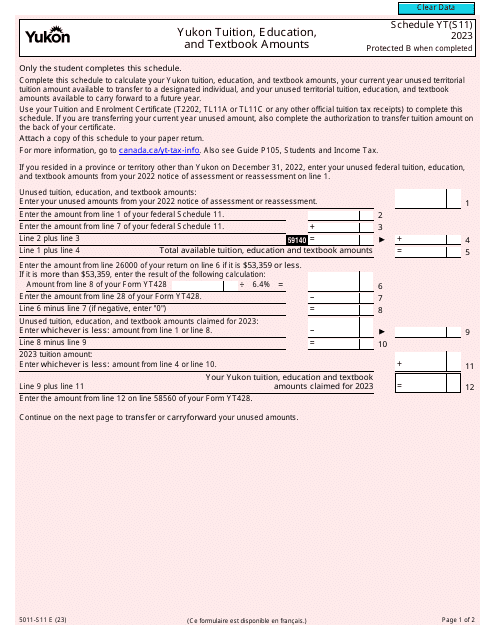

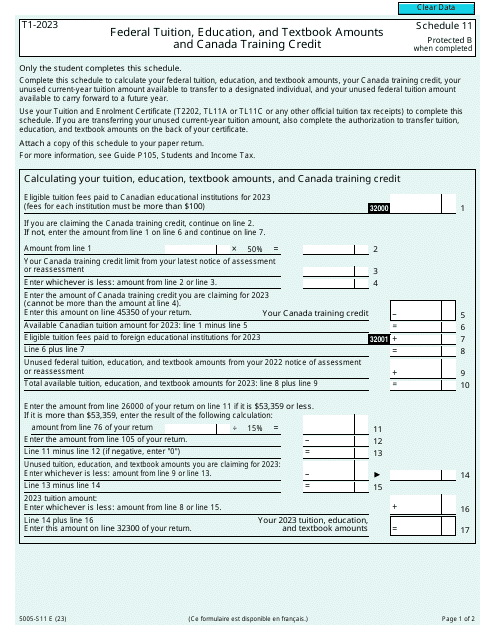

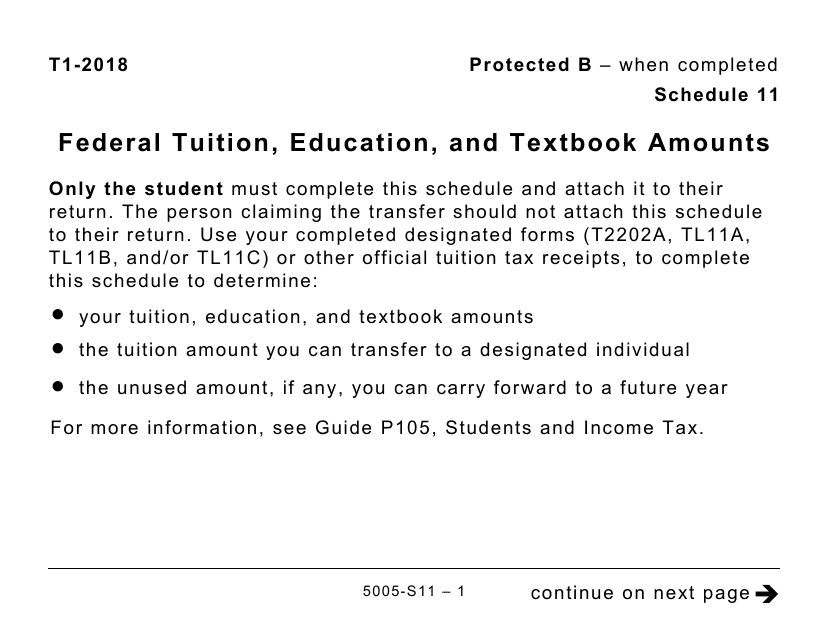

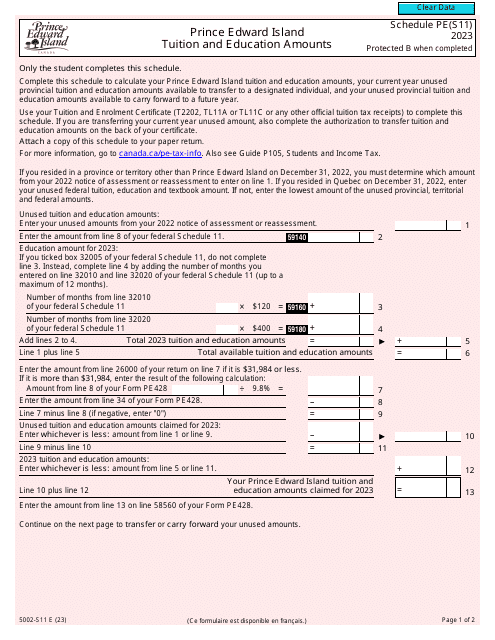

This form is used for reporting federal tuition, education, and textbook amounts in Canada. It is available in large print format for easy reading.

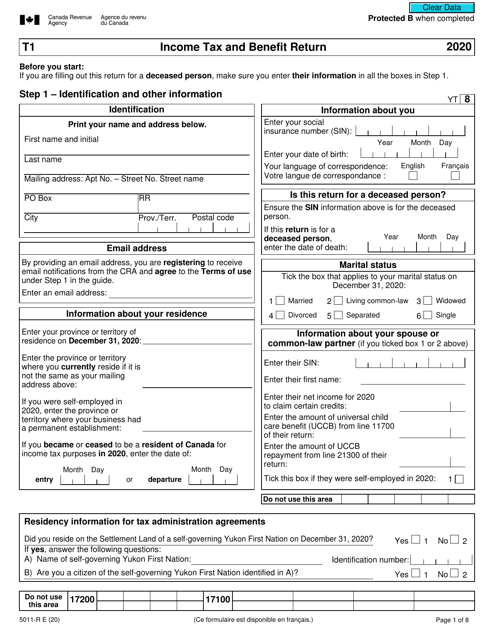

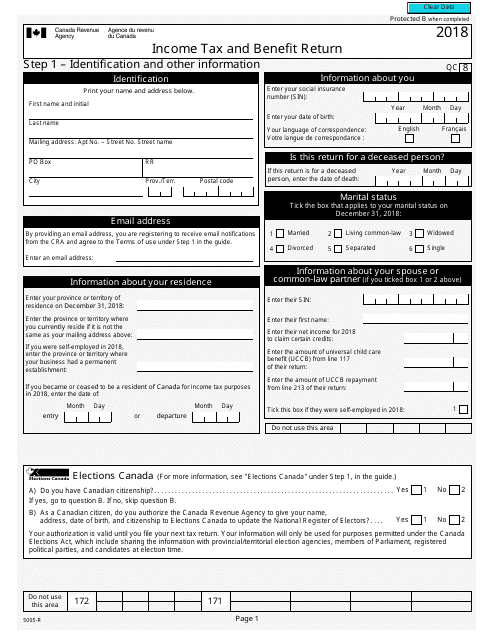

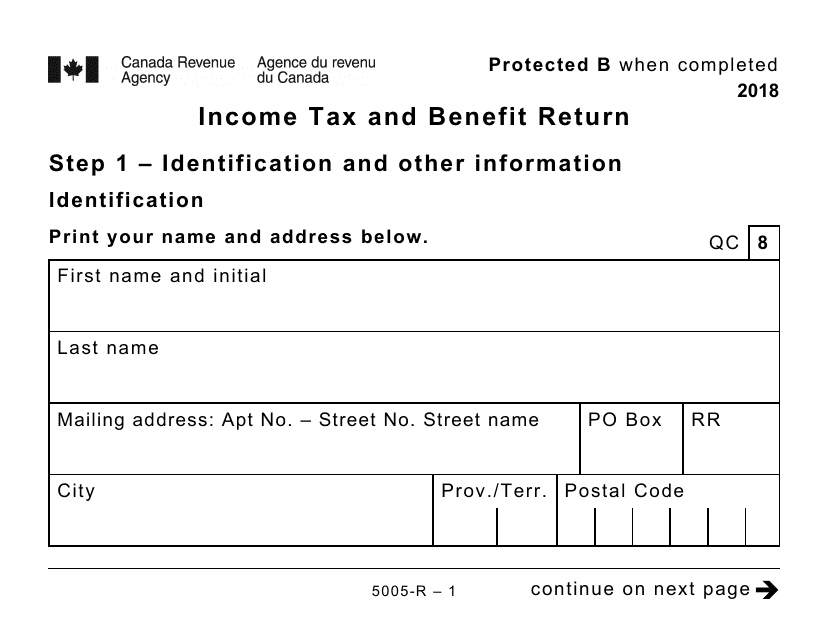

This Form is used for filing your annual income tax and benefit return in Canada. It helps you report your income, claim deductions and credits, and calculate your tax payable or refund.

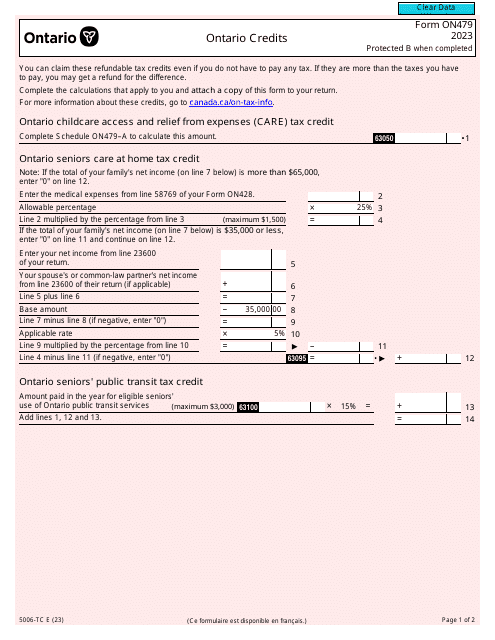

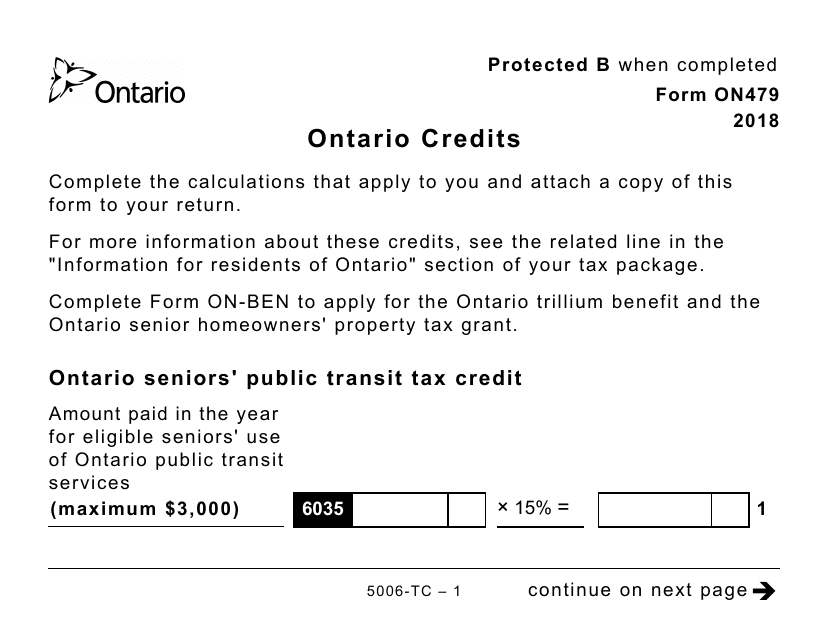

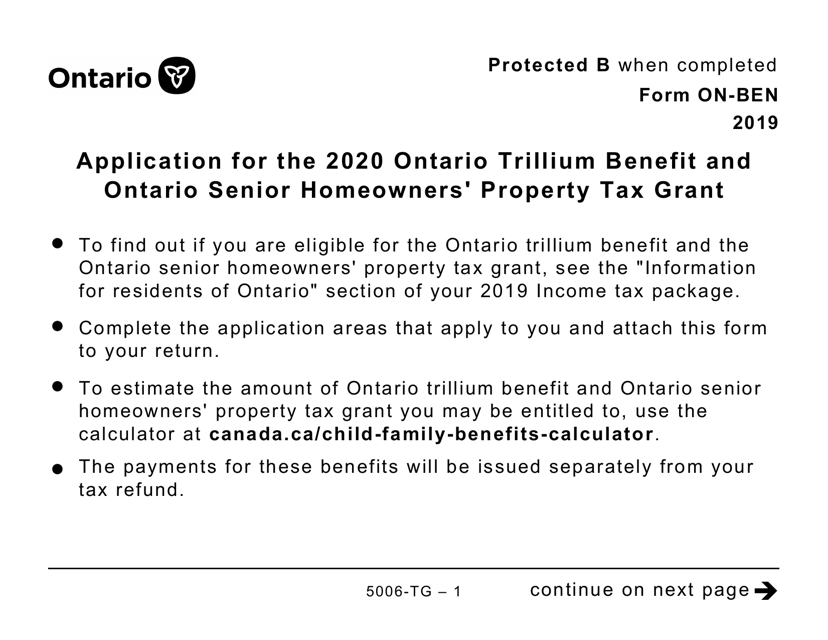

This document is a large print version of Form 5006-TC (ON479) used in Ontario, Canada to claim various tax credits.

This form is used for filing income tax and benefit returns in Canada. It is specifically designed and formatted for individuals who require a larger print size for easier readability.

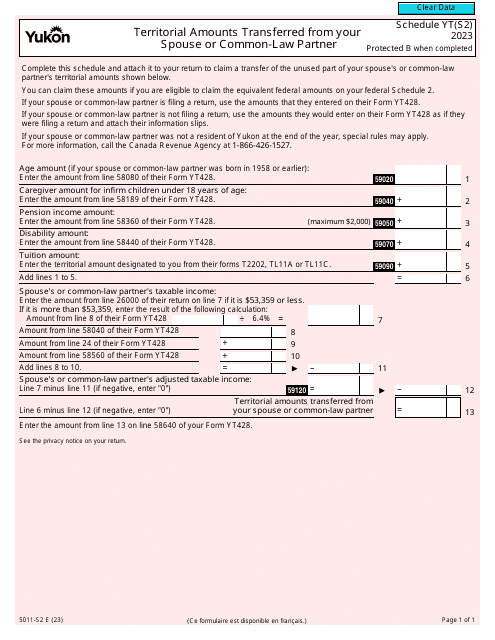

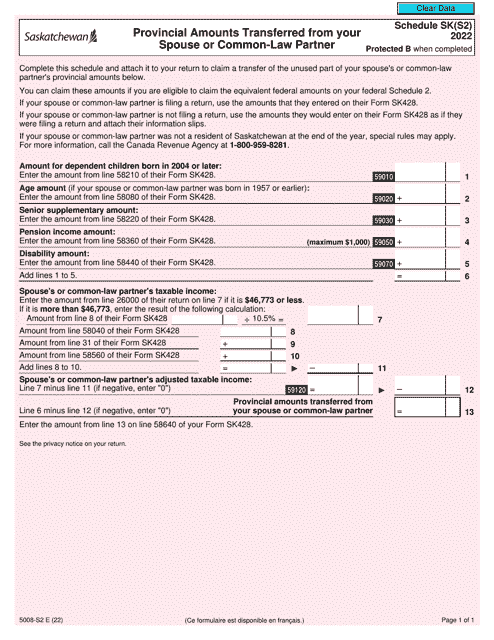

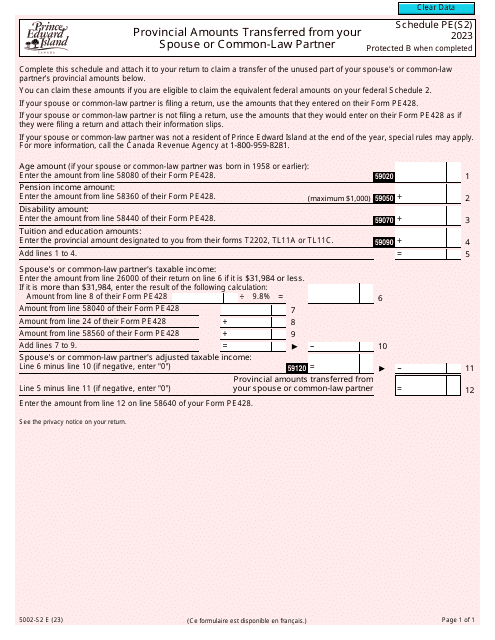

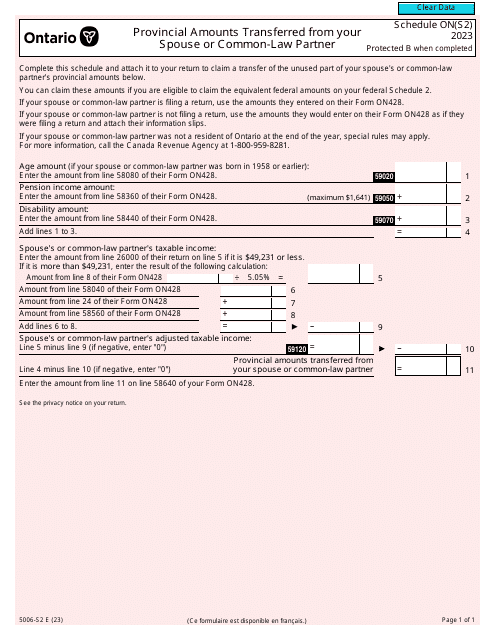

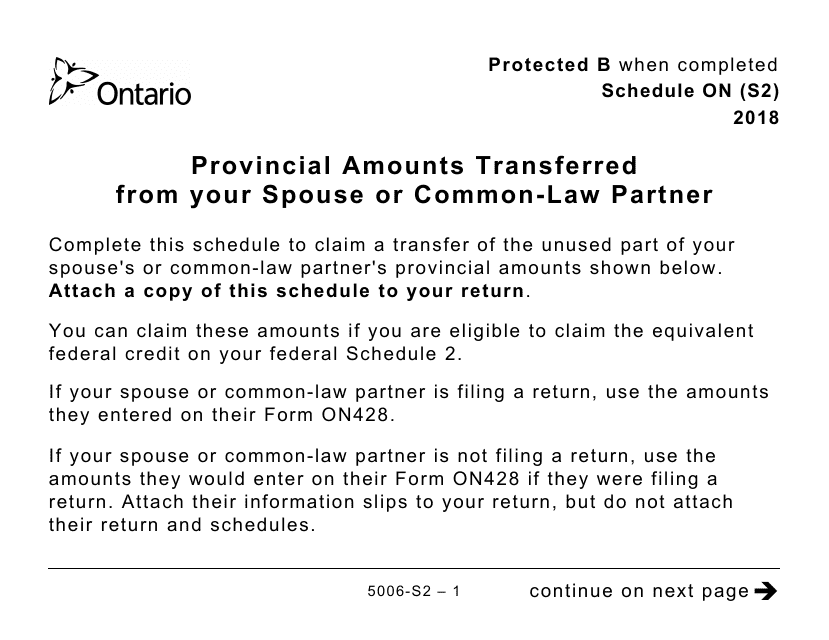

This form is used for reporting provincial amounts transferred from your spouse or common-law partner on your tax return. It is a large print version of Schedule ON (S2) for residents of Canada.