Texas Comptroller of Public Accounts Forms

Documents:

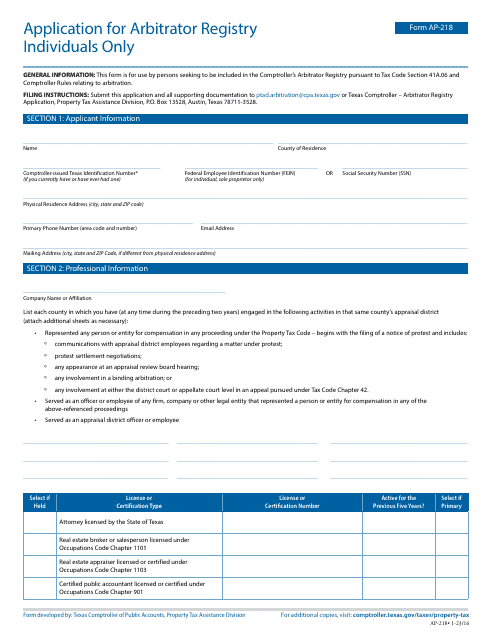

854

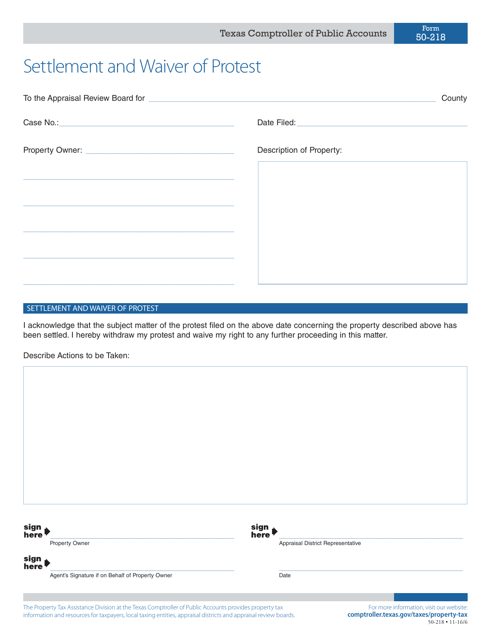

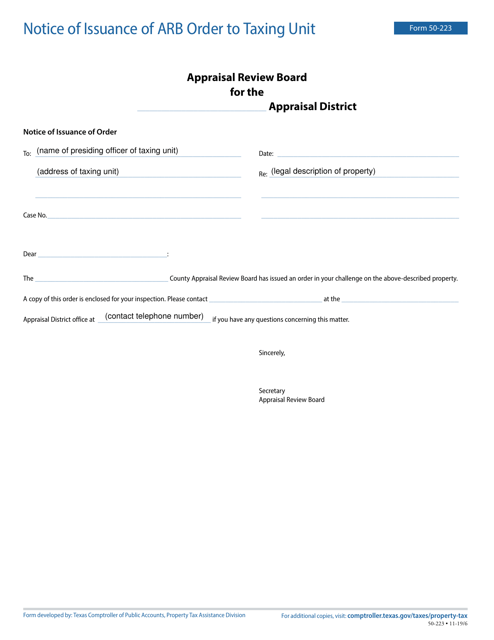

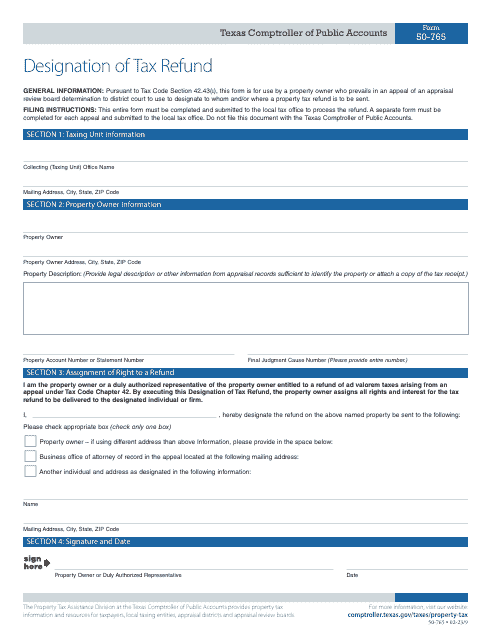

This form is used for settling and waiving a protest in the state of Texas.

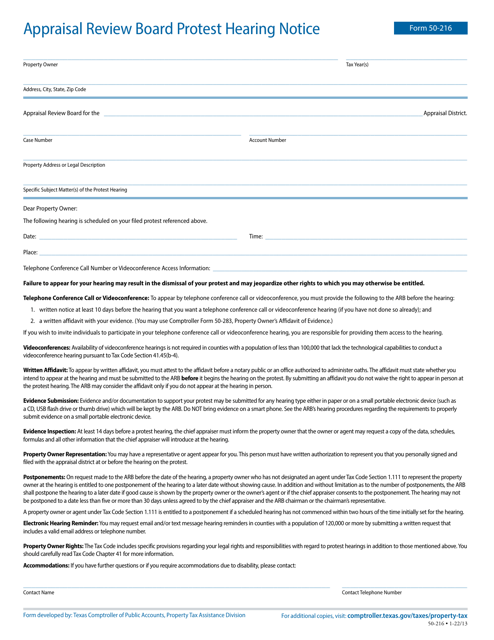

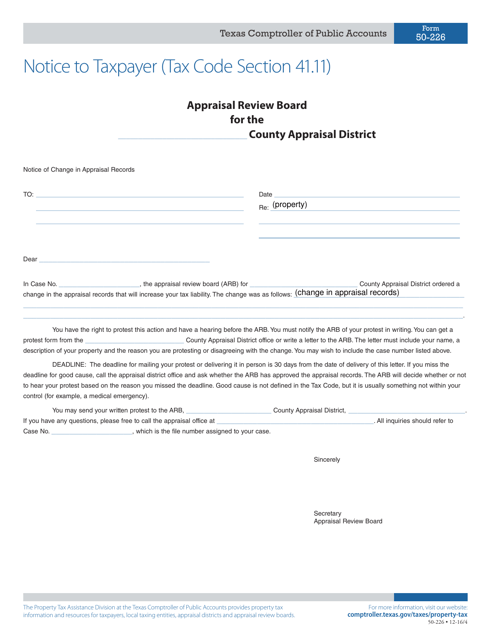

This form is used for providing a notice to taxpayers in Texas regarding Tax Code Section 41.11.

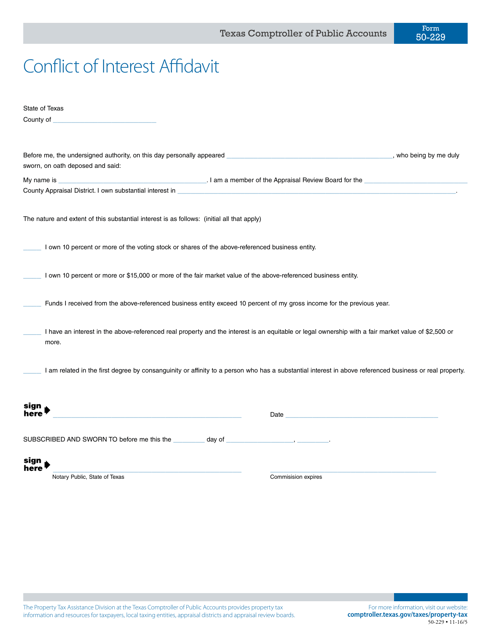

This Form is used for declaring any potential conflicts of interest in Texas.

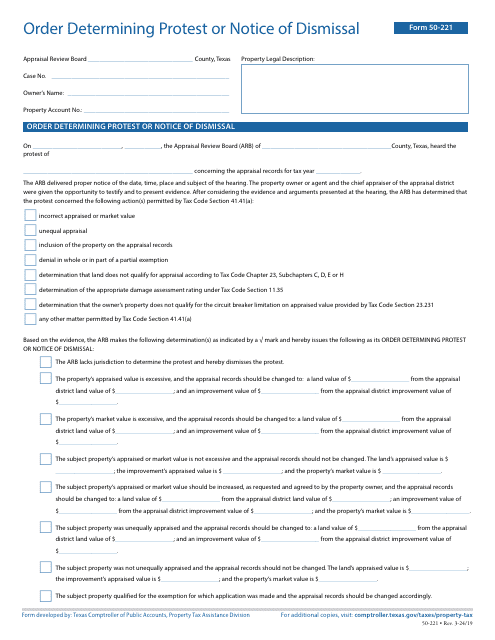

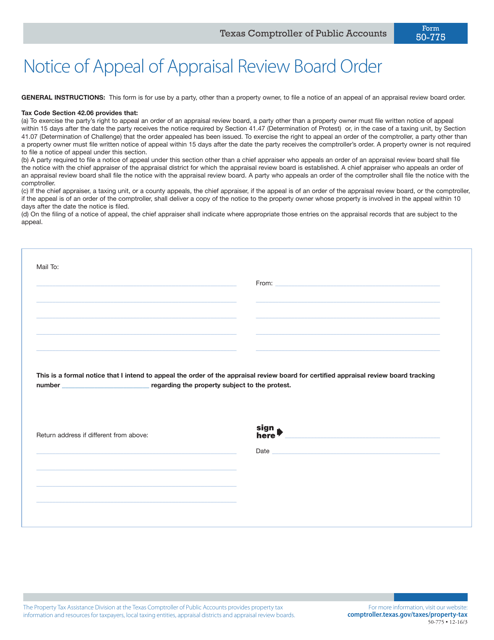

This form is used for filing a notice of appeal against an appraisal review board order in Texas. It allows property owners to challenge the valuation of their property for tax purposes.

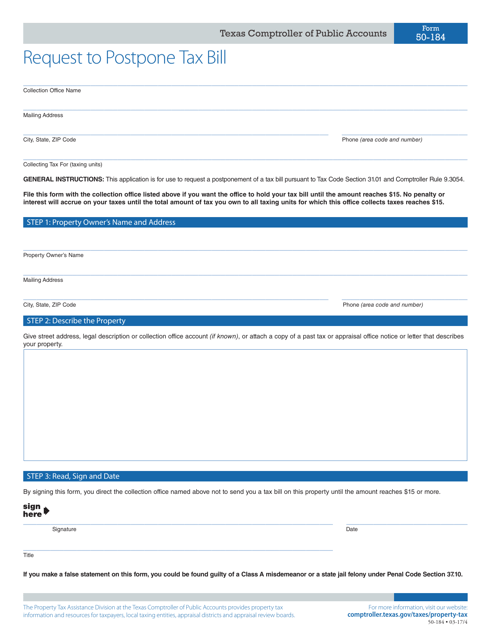

This form is used for requesting a postponement of a tax bill in the state of Texas.

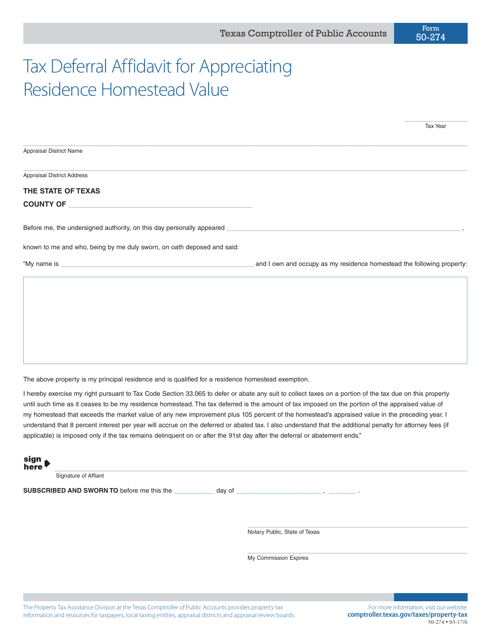

This Form is used for Texas residents to apply for a tax deferral on the appreciation of their residence homestead value.

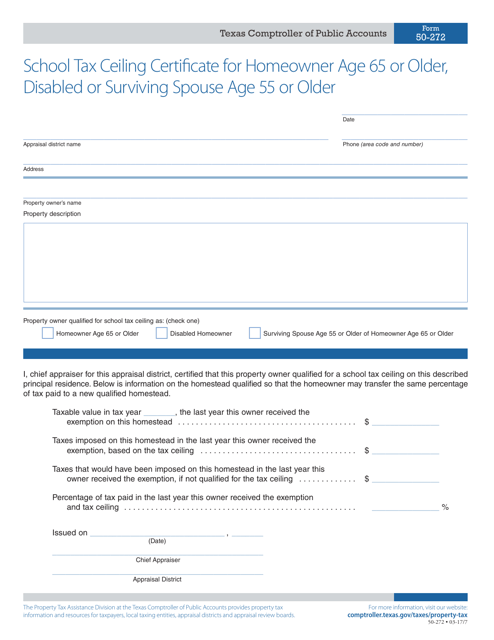

This form is used for homeowners in Texas who are age 65 or older, disabled, or surviving spouse age 55 or older to certify their eligibility for a school tax ceiling.

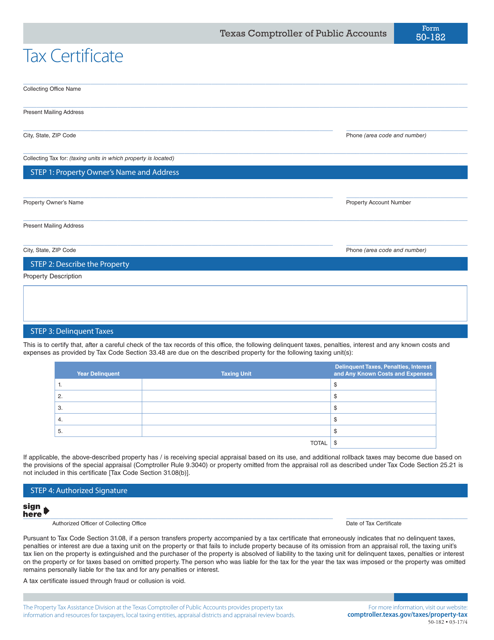

This form is used for obtaining a tax certificate in the state of Texas. It is used to certify a person or business's tax status in the state.

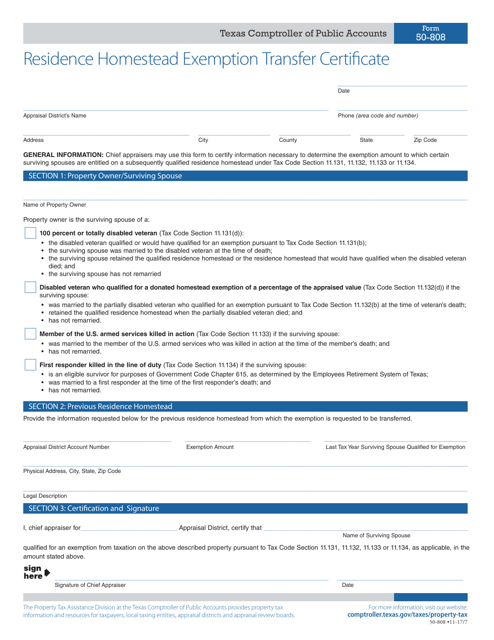

This form is used for transferring residence homestead exemption in Texas. Apply for a transfer certificate to claim tax exemptions on your new homestead property.

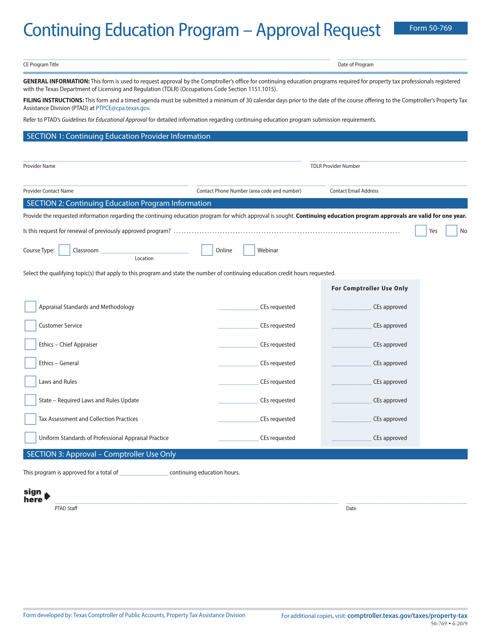

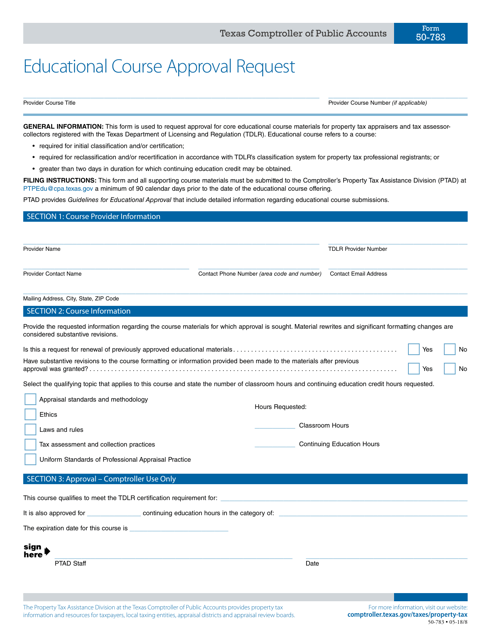

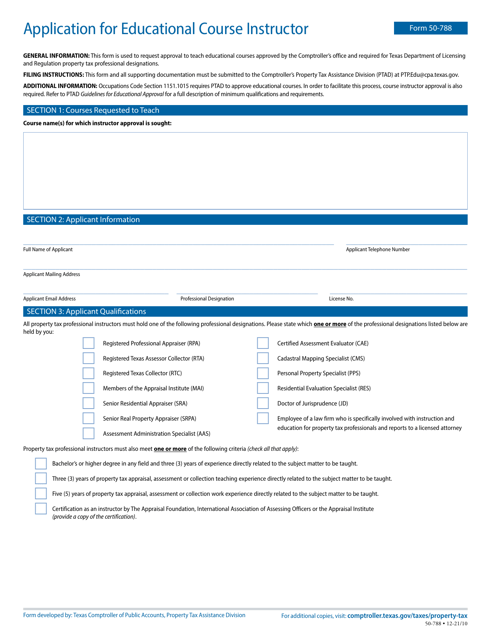

This form is used for requesting approval for educational courses in Texas.

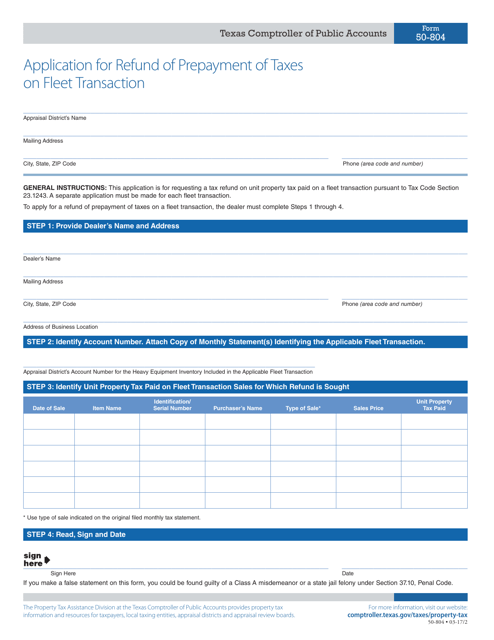

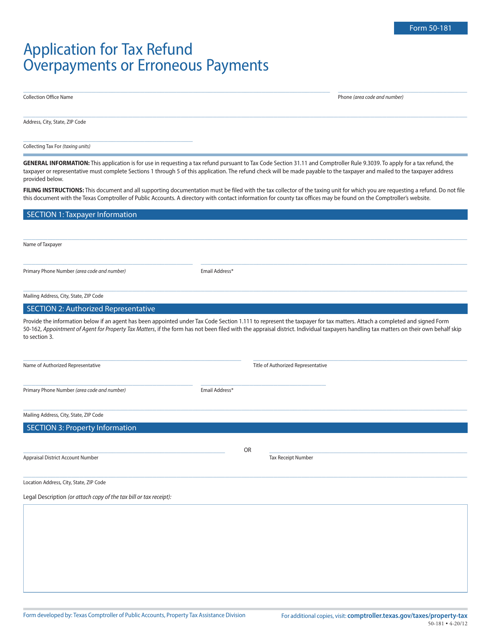

This Form is used for requesting a refund of prepayment of taxes on fleet transactions in the state of Texas.

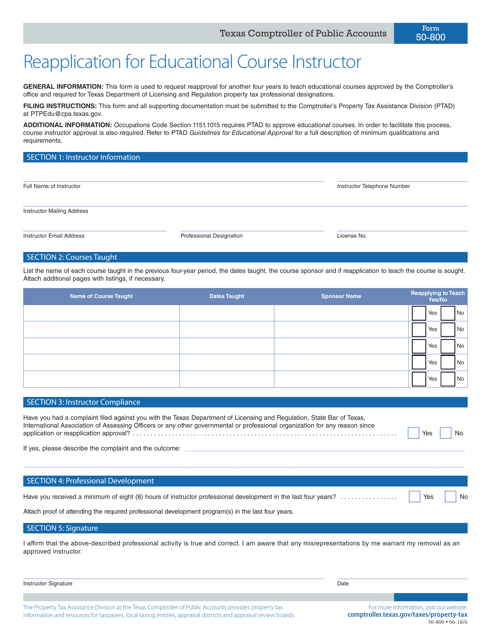

This form is used for reapplying to become an educational course instructor in Texas.

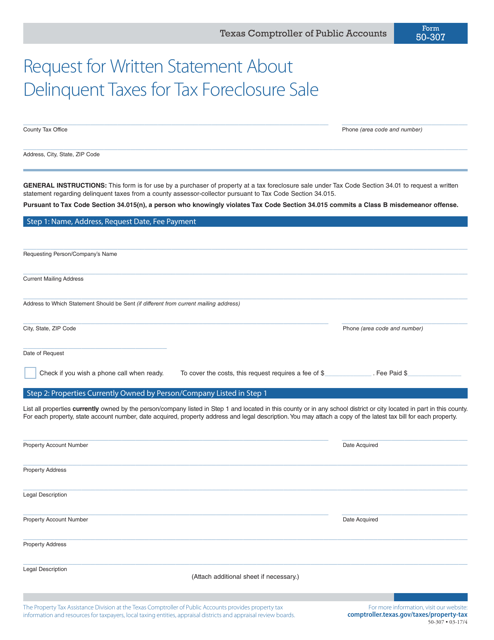

This form is used for requesting a written statement about delinquent taxes for a tax foreclosure sale in Texas.

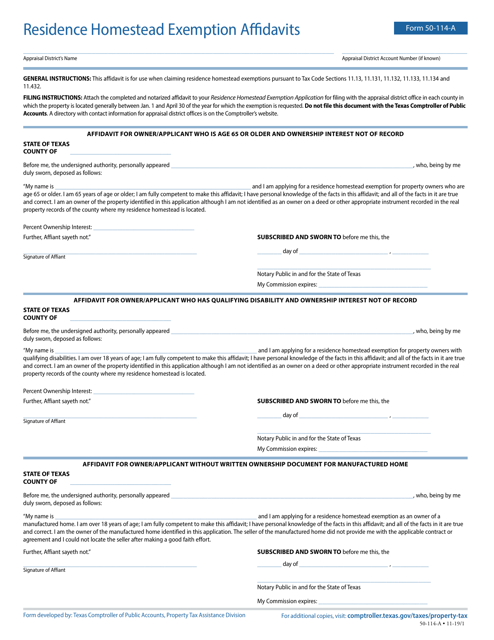

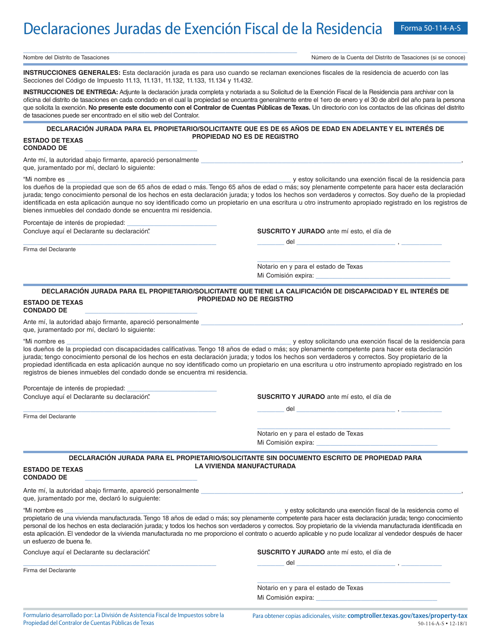

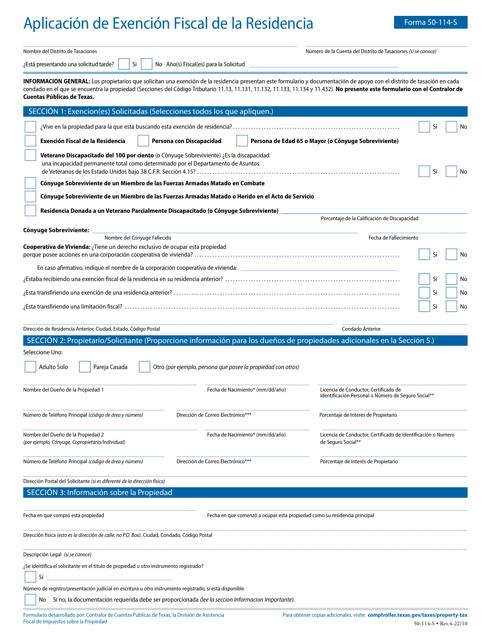

This Form is used for declaring tax exemption for residence in Texas.

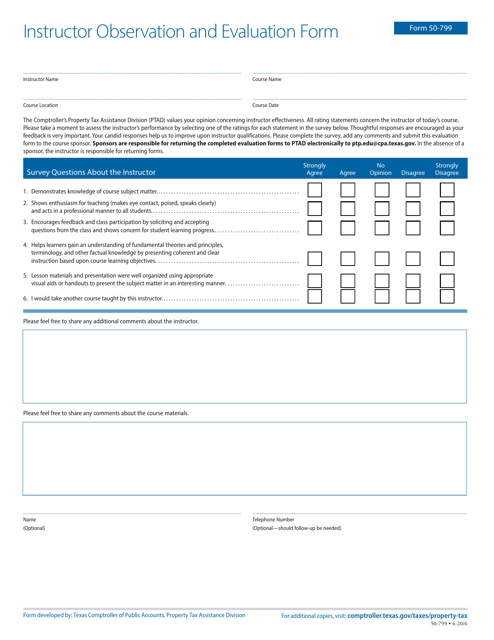

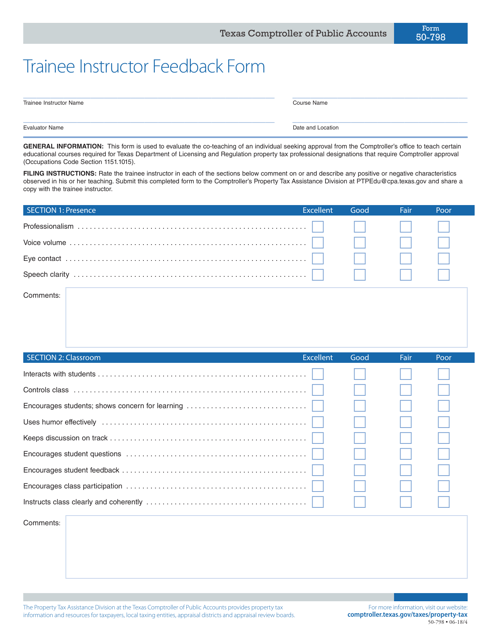

This form is used for gathering feedback from trainees regarding their instructors in Texas.

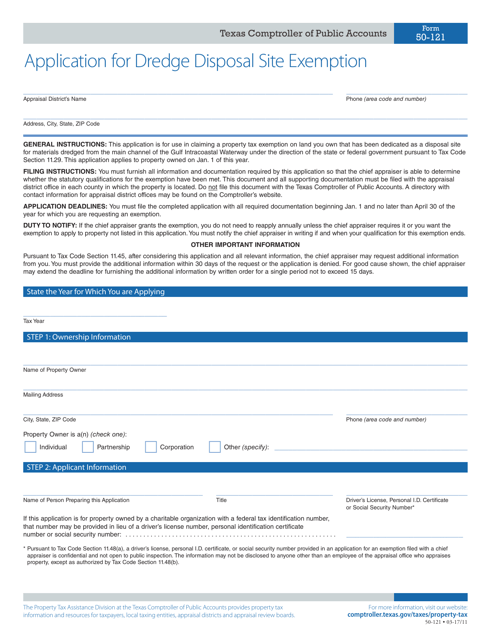

This form is used for applying for an exemption for a dredge disposal site in the state of Texas.

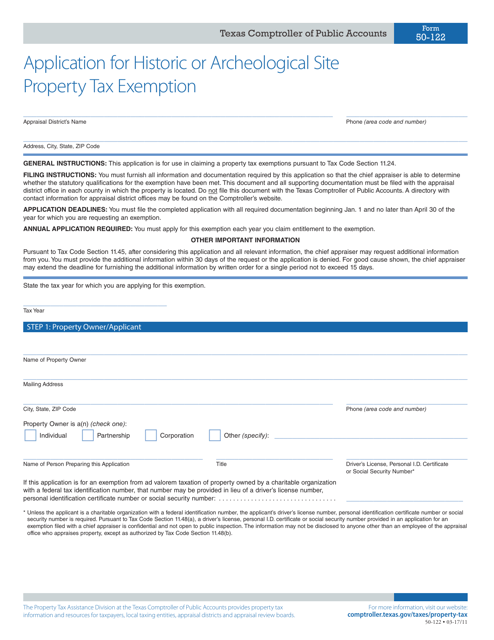

This Form is used for applying for a property tax exemption for historic or archaeological sites in Texas.

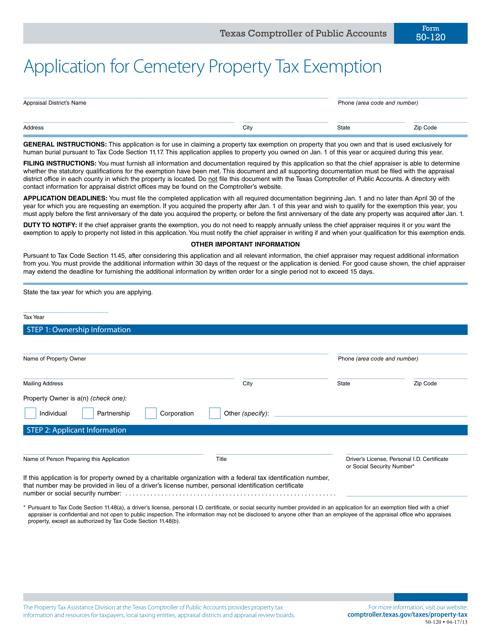

This form is used for applying for a property tax exemption for cemetery property in Texas.