Texas Comptroller of Public Accounts Forms

Documents:

854

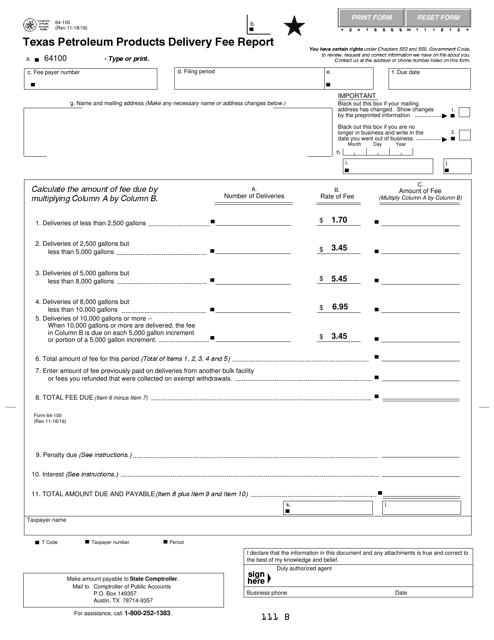

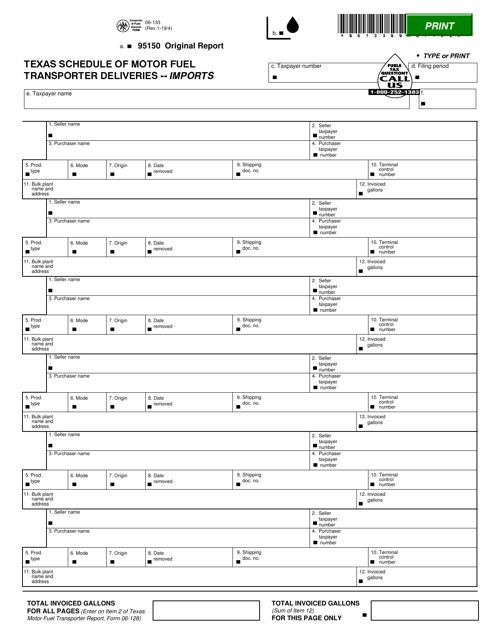

This Form is used for reporting the delivery fees for petroleum products in the state of Texas. It helps track and monitor the fees collected by businesses in the petroleum industry.

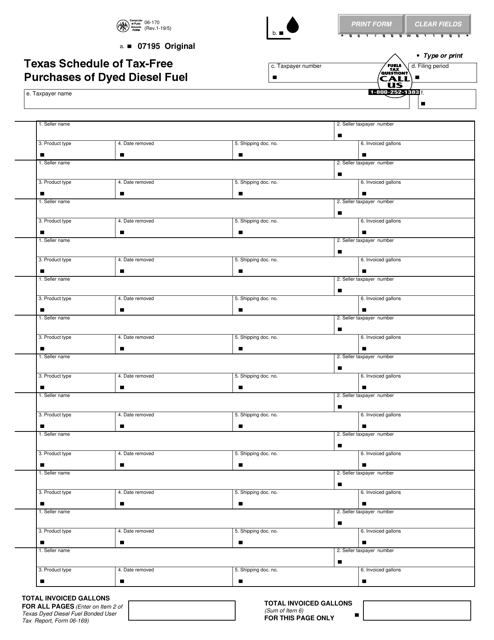

This form is used for reporting tax-free purchases of dyed diesel fuel in Texas.

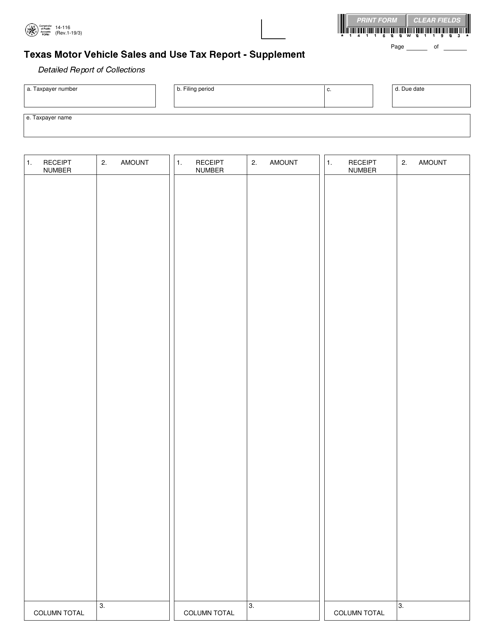

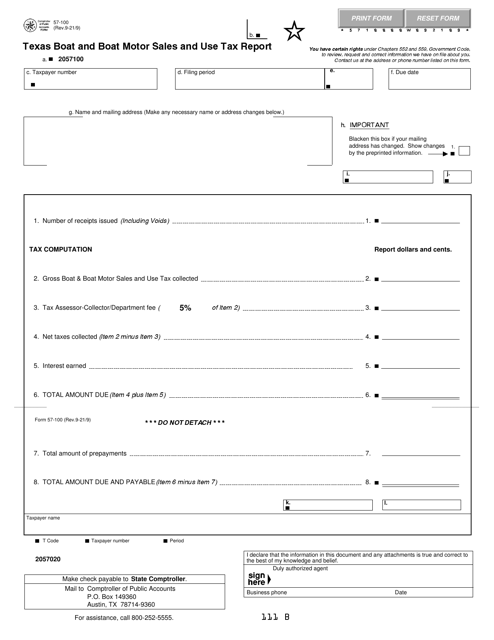

This Form is used for reporting sales and use tax related to motor vehicle transactions in the state of Texas.

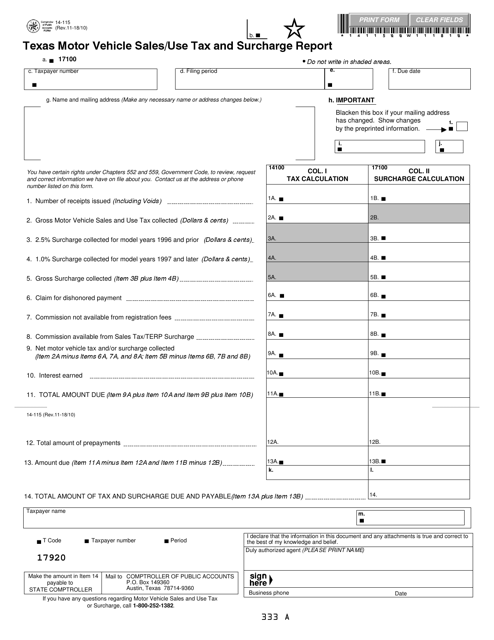

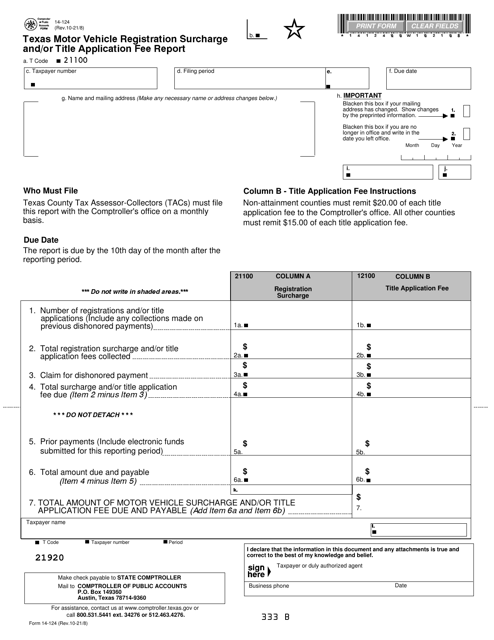

This Form is used for reporting sales and use tax on motor vehicles in Texas. It includes a surcharge report as well.

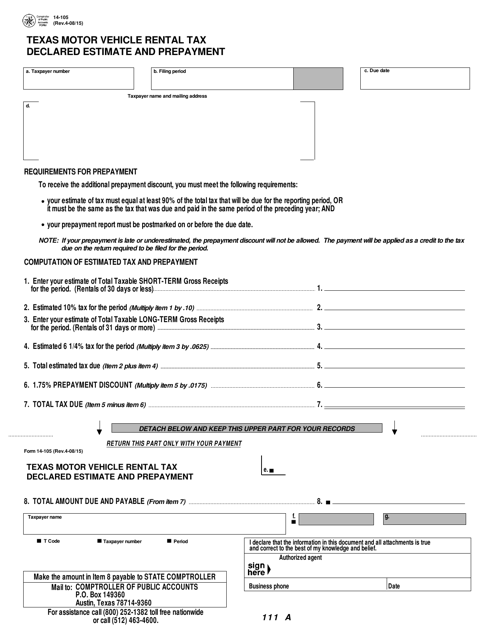

This Form is used for estimating and prepaying the motor vehicle rental tax in Texas. It is required for individuals or businesses engaged in renting motor vehicles.

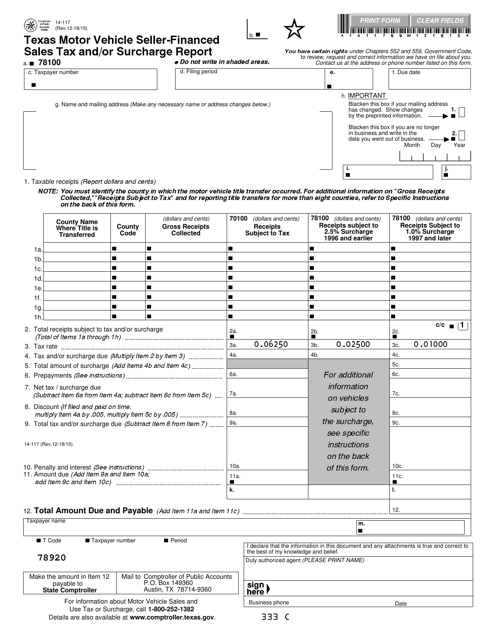

This form is used for reporting motor vehicle seller-financed sales tax and/or surcharge in the state of Texas. It is required for sellers who offer financing options to their customers when selling a motor vehicle.

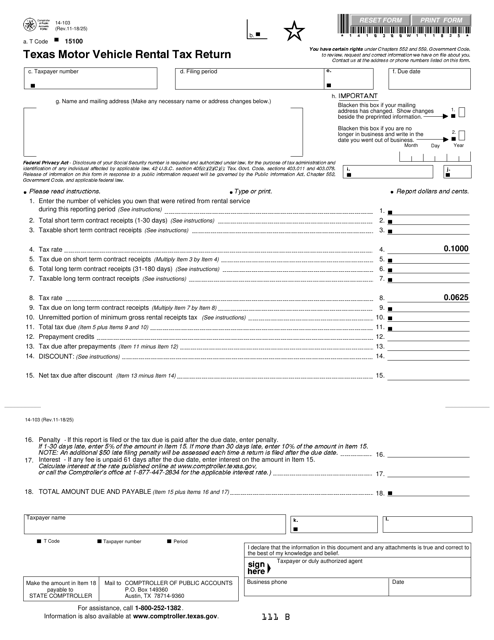

This Form is used for reporting and paying rental tax on motor vehicles in Texas. It is required for businesses that rent out vehicles to collect and remit the appropriate taxes to the state.

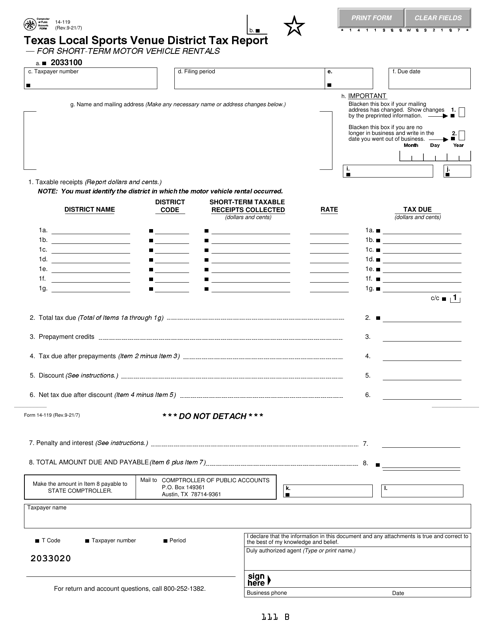

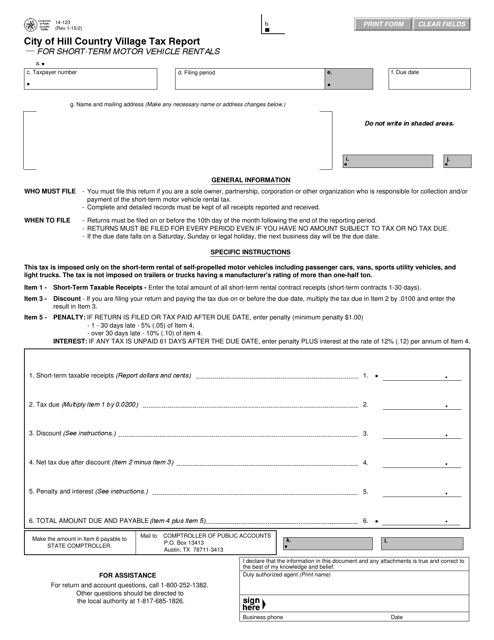

This Form is used for reporting taxes for short-term motor vehicle rentals in Hill Country Village, Texas.

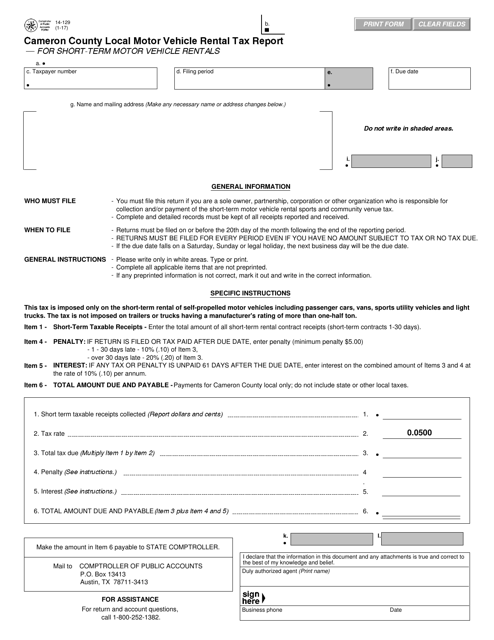

This form is used for reporting the local motor vehicle rental tax for short-term motor vehicle rentals in Cameron County, Texas.

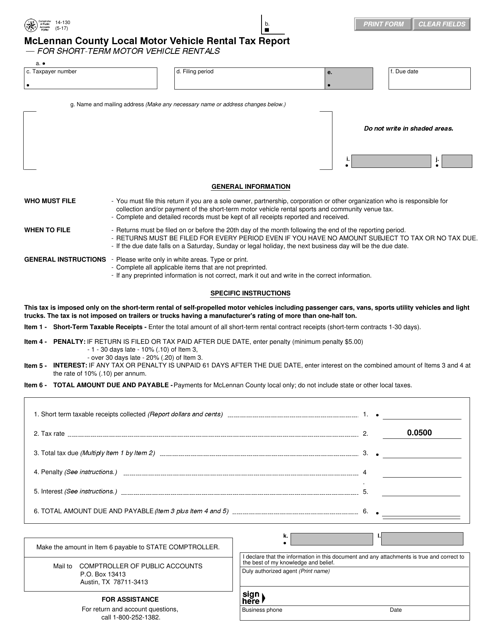

This form is used for reporting local motor vehicle rental tax for short-term vehicle rentals in McLennan County, Texas.

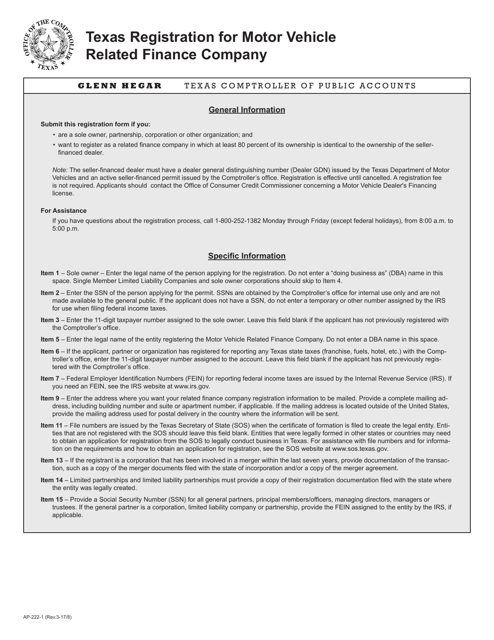

This form is used for registering a motor vehicle related finance company in Texas.

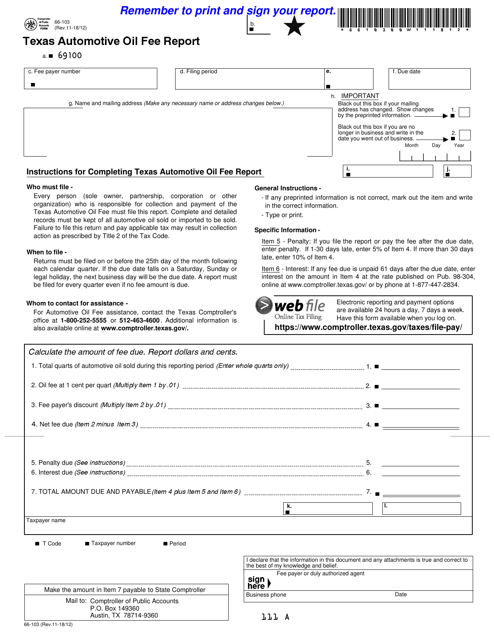

This Form is used for reporting the automotive oil fee in the state of Texas.

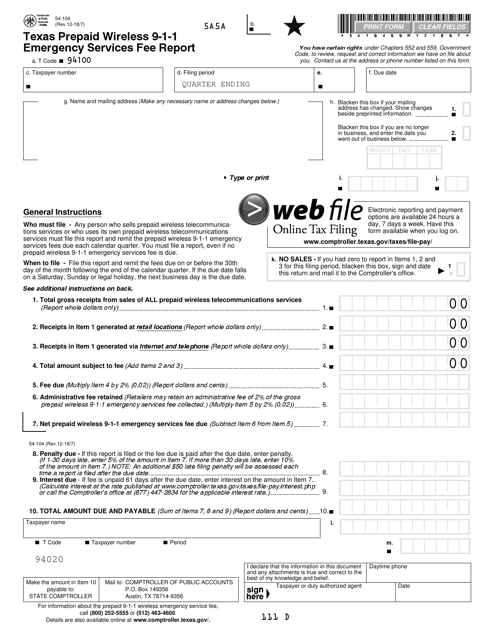

This form is used for reporting the prepaid wireless 9-1-1 emergency services fee in Texas.

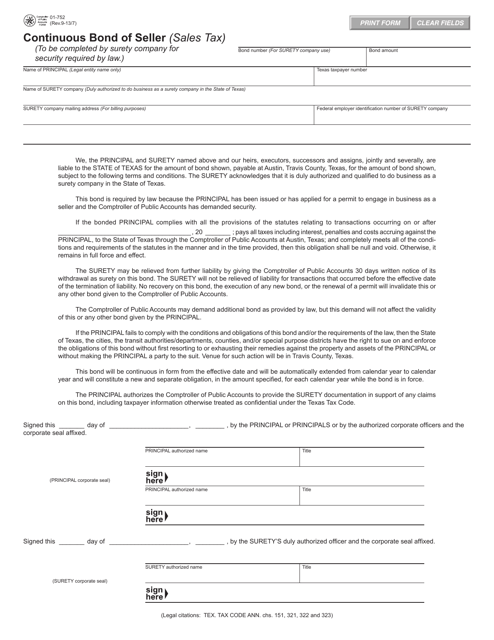

This form is used for submitting a continuous bond of seller for sales tax in the state of Texas.

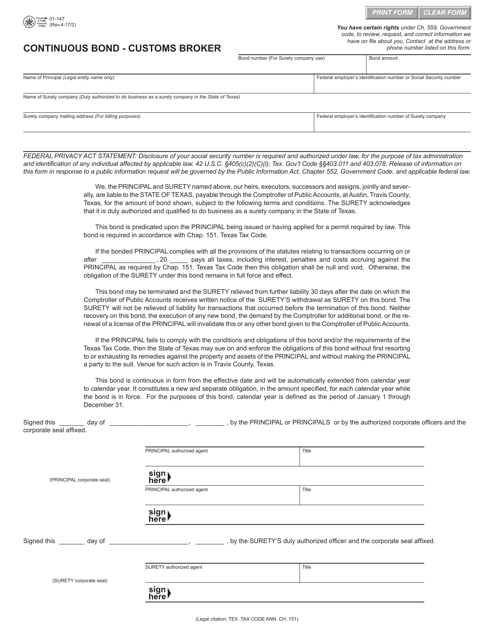

This Form is used for applying for a continuous bond for customs brokers in Texas.

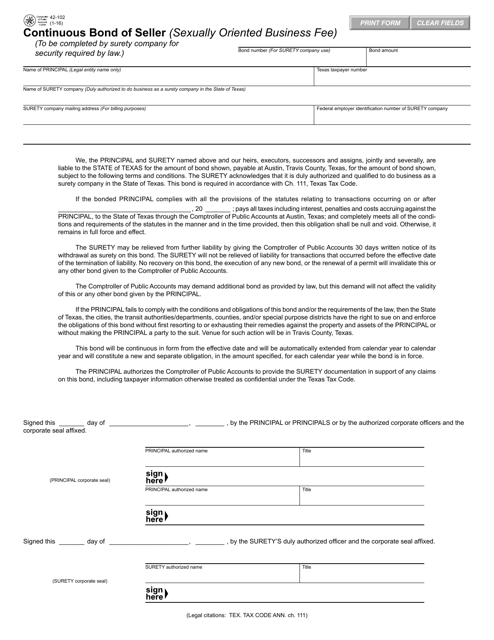

This form is used for obtaining a continuous bond of seller for the sexually oriented business fee in Texas. It is necessary for businesses involved in the adult entertainment industry to comply with state regulations.

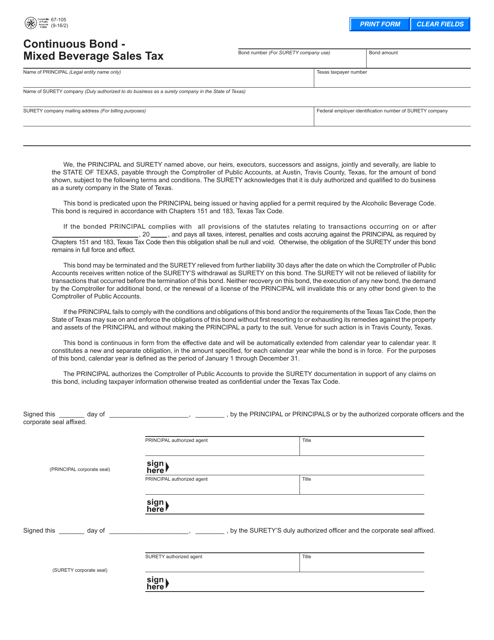

This form is used for reporting and paying mixed beverage sales tax for businesses in Texas.

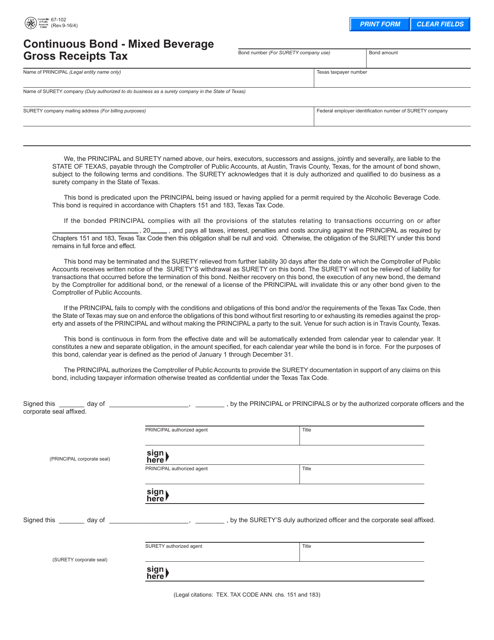

This Form is used for reporting and paying the mixed beverage gross receipts tax in the state of Texas.

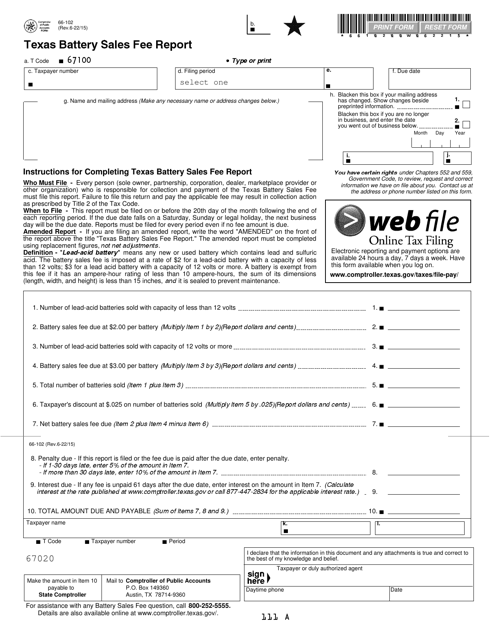

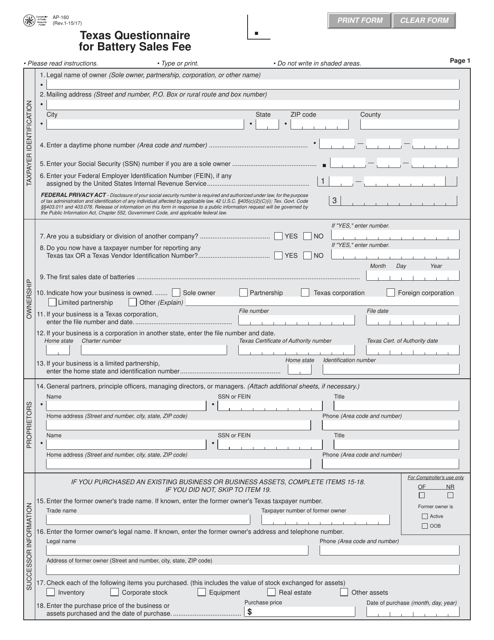

This Form is used for documenting the information required for the Battery Sales Fee in Texas.

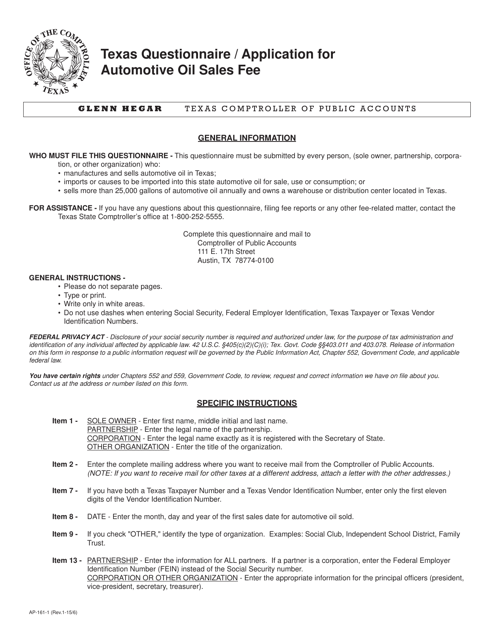

This Form is used for applying for the Automotive Oil Sales Fee in Texas.

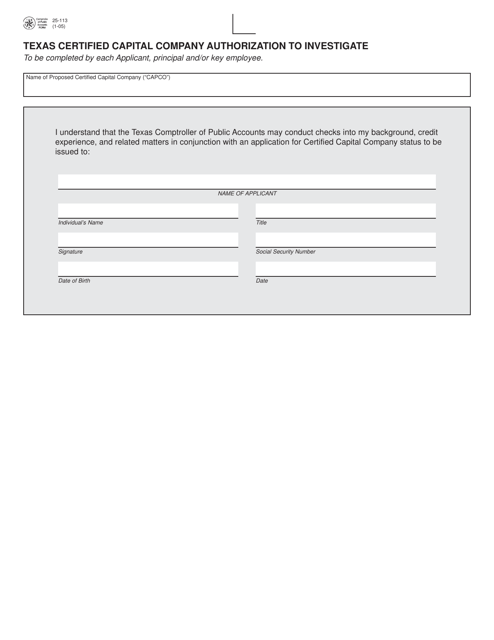

This Form is used for requesting authorization to investigate a certified capital company in Texas.

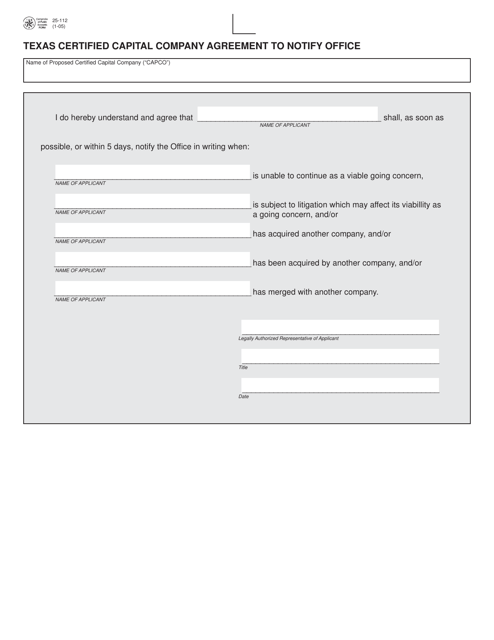

This form is used for notifying the office in Texas about the agreement made by a Texas certified capital company.

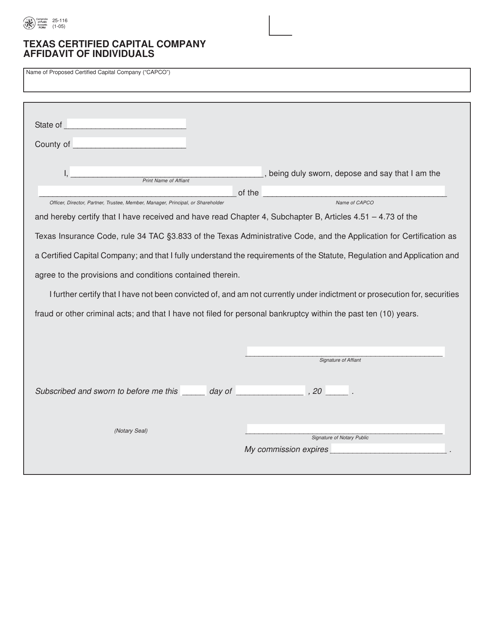

This form is used for individuals to provide an affidavit for the Texas Certified Capital Company program in Texas.

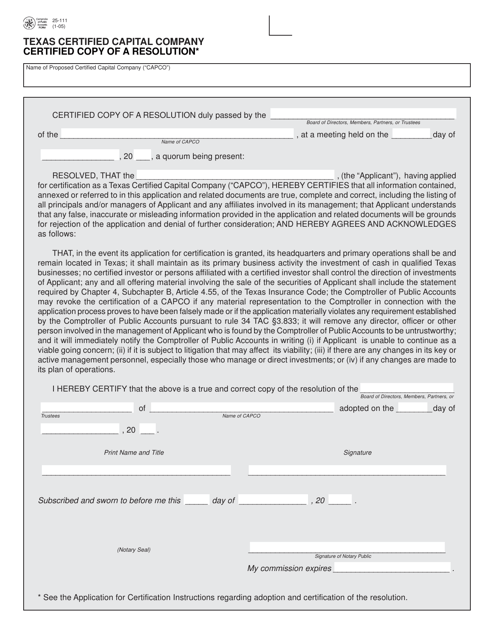

This form is used for obtaining a certified copy of a resolution by a Texas Certified Capital Company.

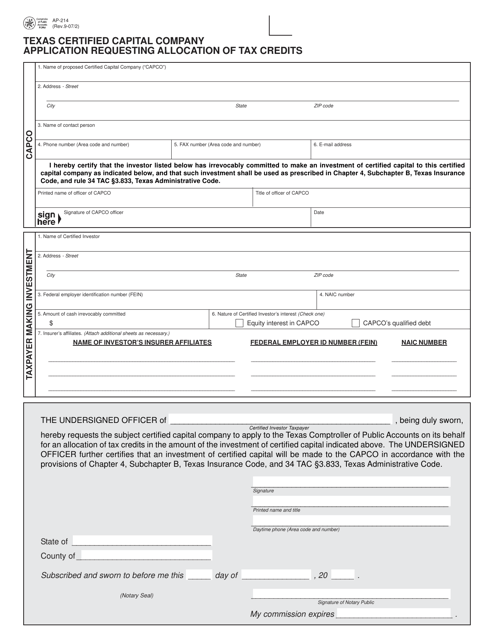

Form AP-214 Texas Certified Capital Company Application Requesting Allocation of Tax Credits - Texas

This form is used for requesting allocation of tax credits to Texas Certified Capital Companies in Texas.

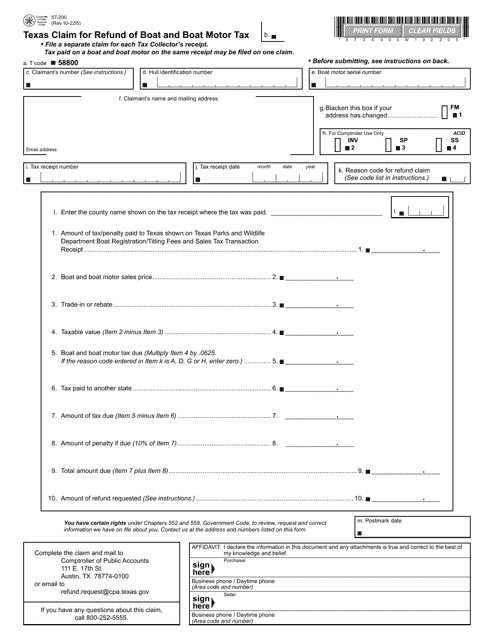

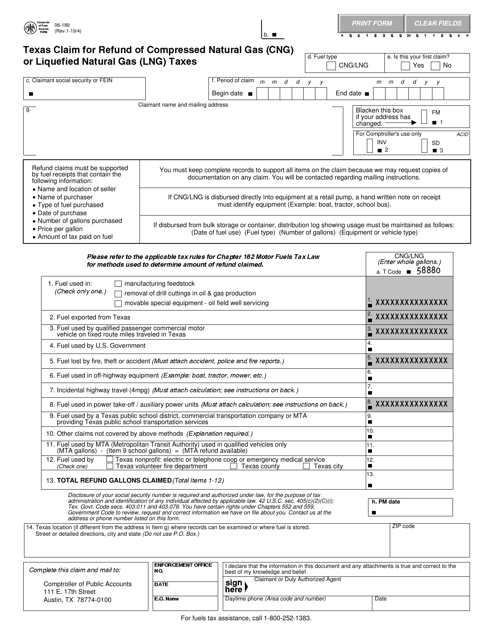

This form is used for claiming a refund of compressed natural gas (CNG) or liquefied natural gas (LNG) taxes in Texas.

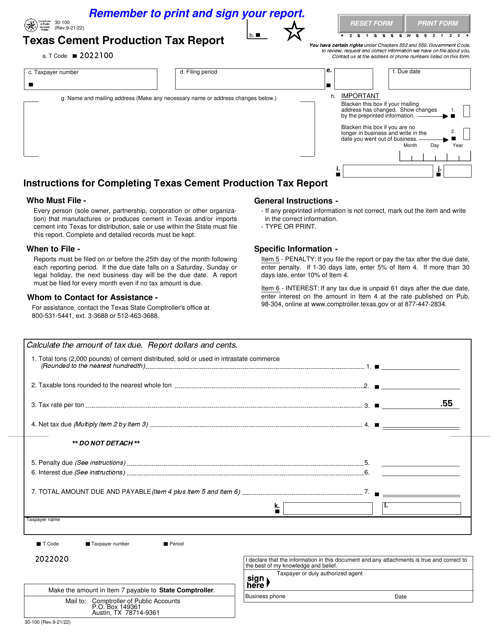

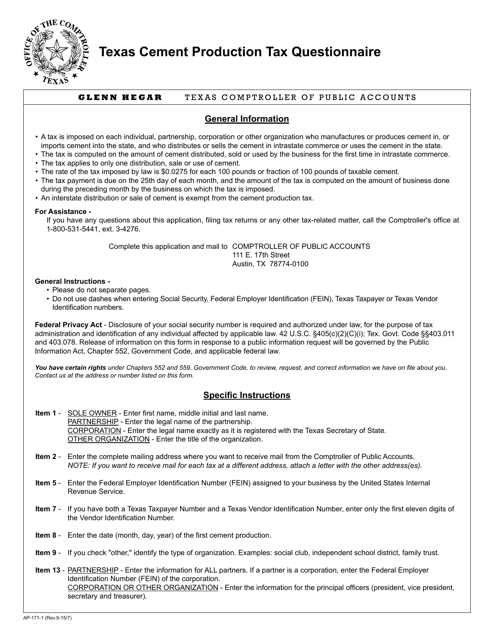

This form is used for the Texas Cement Production Tax Questionnaire in Texas. It is required for businesses involved in cement production to report and pay the appropriate taxes.

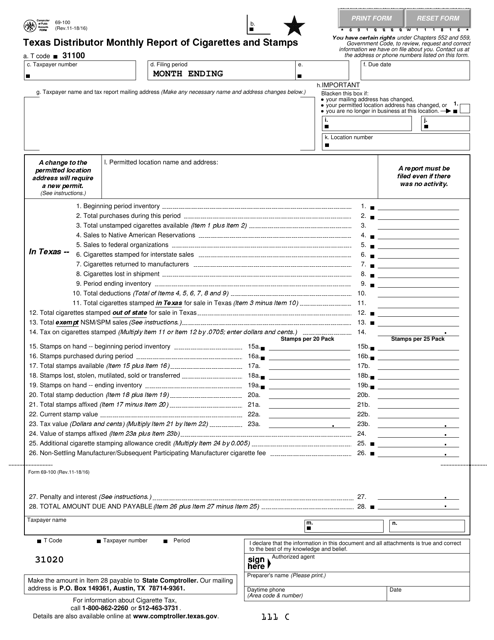

This form is used for the monthly reporting of cigarette sales and stamp inventory by distributors in the state of Texas.

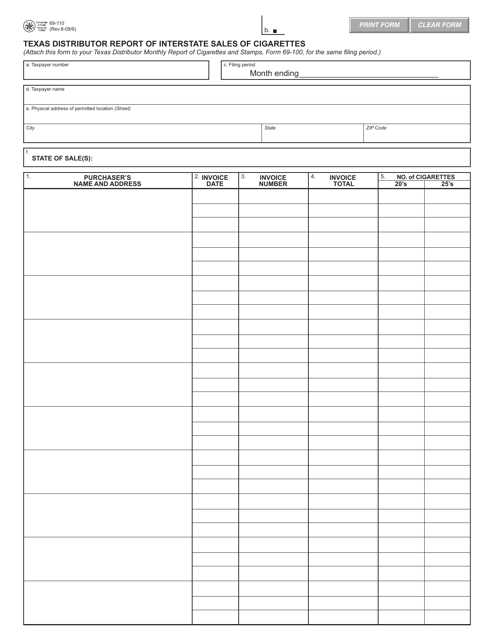

This Form is used for reporting interstate sales of cigarettes made by distributors in Texas.

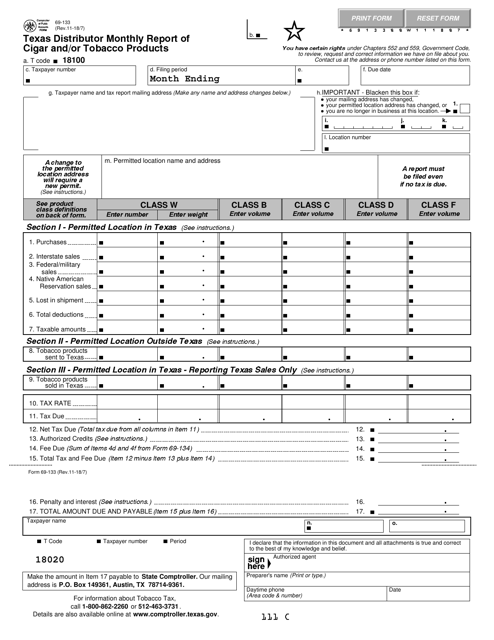

This document is used for reporting monthly sales of cigars and/or tobacco products by distributors in Texas.

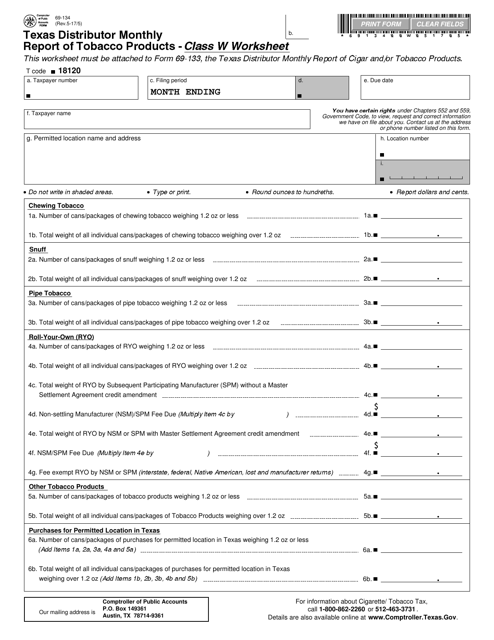

This form is used for Texas distributors to report their monthly sales of tobacco products. It is specifically for Class W products.

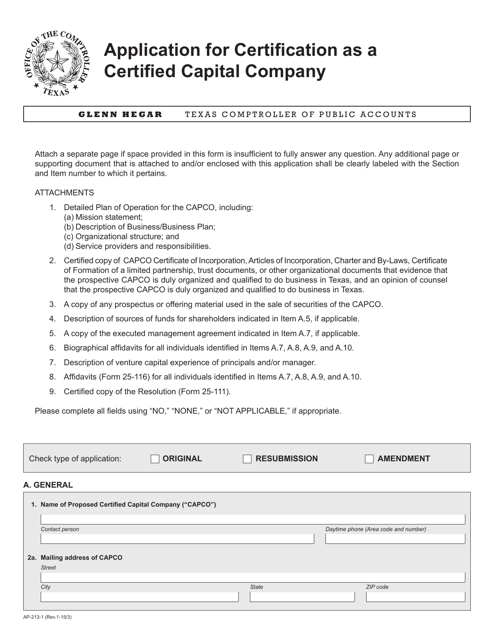

This Form is used for applying for certification as a Certified Capital Company in the state of Texas.

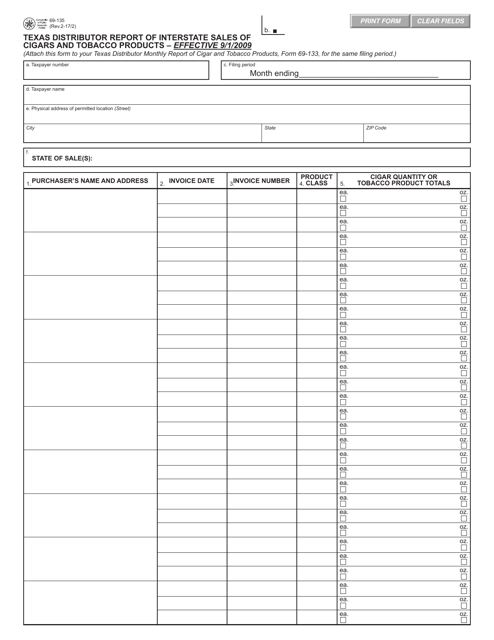

This form is used for reporting interstate sales of cigars and tobacco products in Texas.