Texas Comptroller of Public Accounts Forms

The Texas Comptroller of Public Accounts is an agency within the state government of Texas that is responsible for managing and overseeing the collection and administration of various taxes, including sales tax, franchise tax, and motor fuel taxes. They also handle various other financial and accounting functions for the state, such as auditing and revenue forecasting. Additionally, the Comptroller's office is responsible for administering programs related to unclaimed property, economic development, and oversight of local government finances. Essentially, their role is to ensure that taxes are collected and managed efficiently and to provide financial transparency and accountability for the state of Texas.

Documents:

854

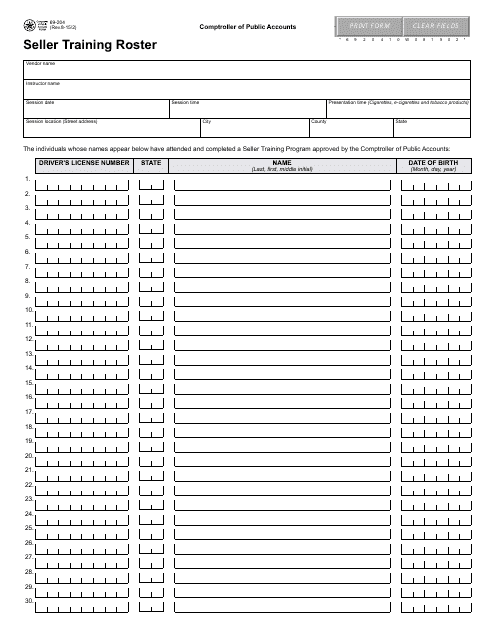

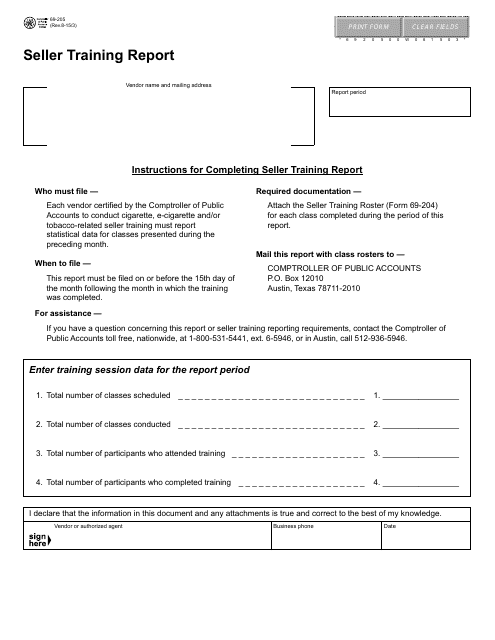

This form is used for documenting the seller training roster in Texas.

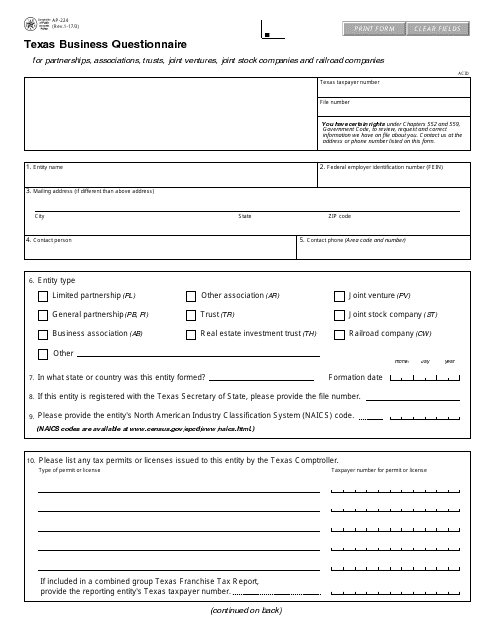

This Form is used for filling out a Texas Business Questionnaire in the state of Texas.

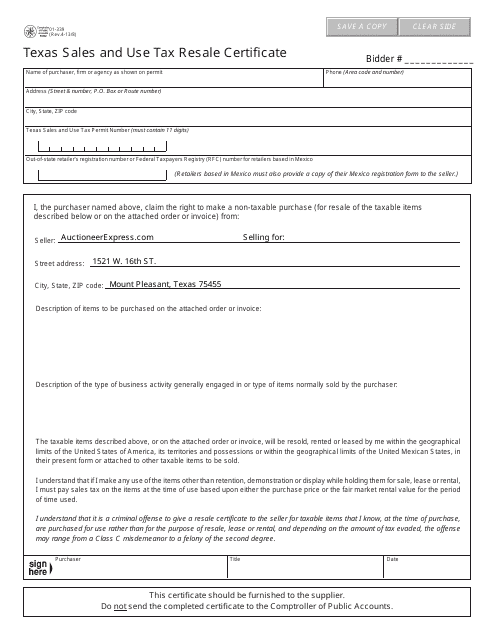

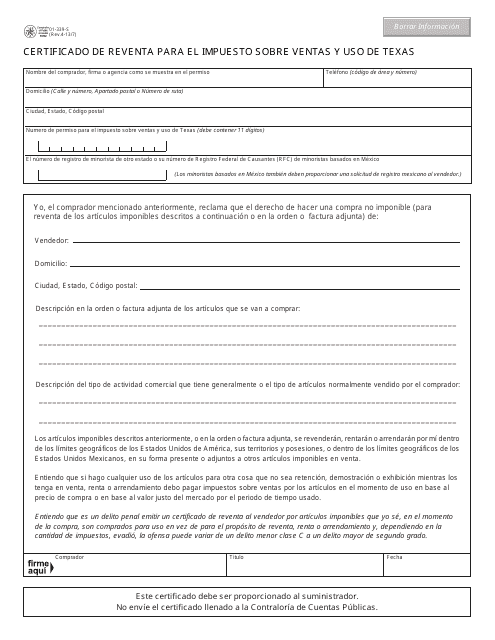

This is a legal form presented by a purchaser to a seller from whom the purchaser buys the goods with the purpose of resale in the state of Texas.

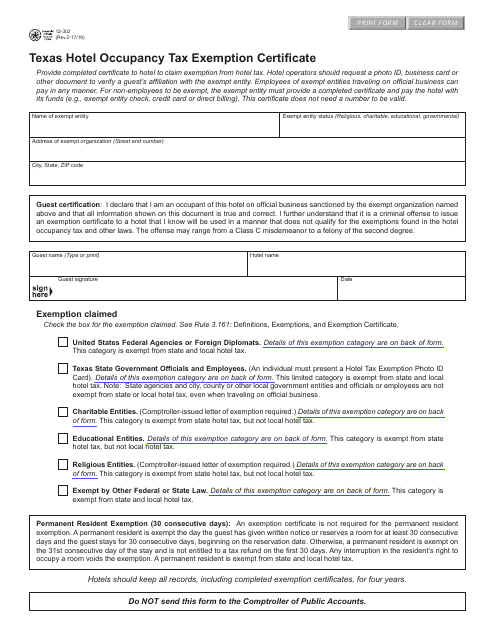

This form is used for requesting exemption from hotel occupancy tax in the state of Texas.

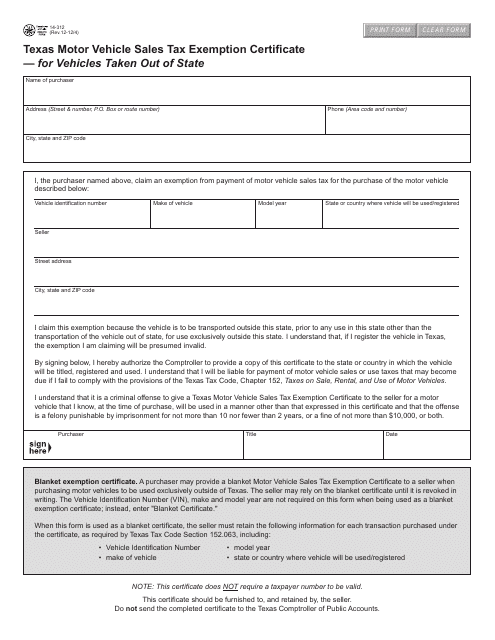

This form is used for claiming a sales tax exemption on motor vehicles that are taken out of the state of Texas.

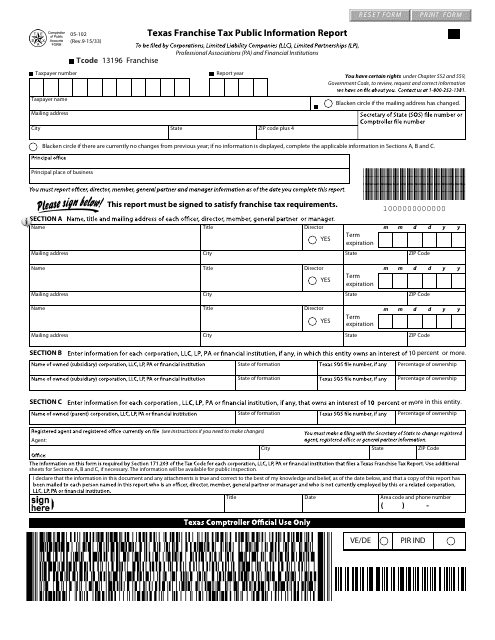

This form must be filed the day a franchise tax report is made and it accompanies the particular franchise tax report and any other tax forms required.

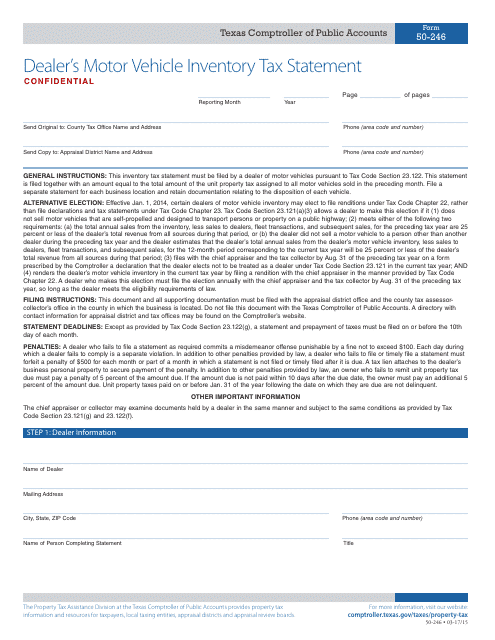

This Form is used for reporting the inventory of motor vehicles held by dealers in Texas for tax purposes.

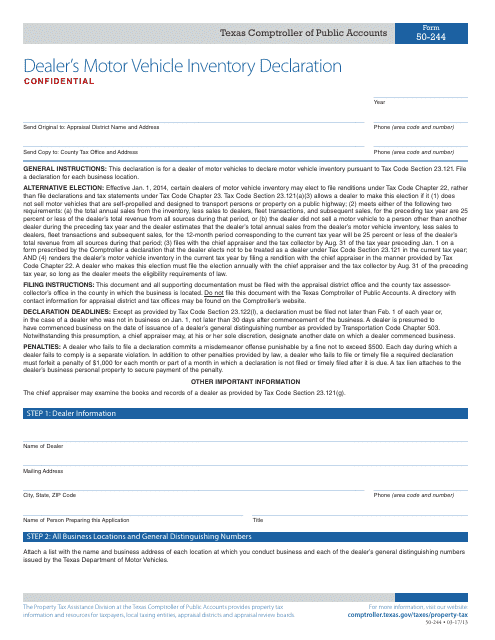

This form is used for dealers in Texas to declare their motor vehicle inventory. It helps the state keep track of the vehicles held by dealerships for sale.

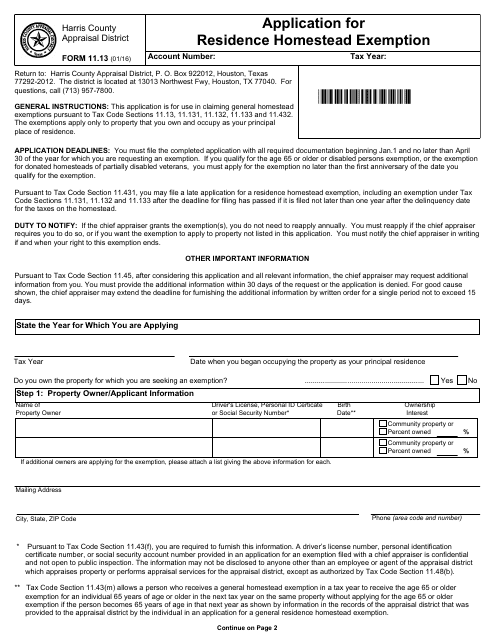

This Form is used for applying for a residence homestead exemption with the Harris County Appraisal District in Texas.

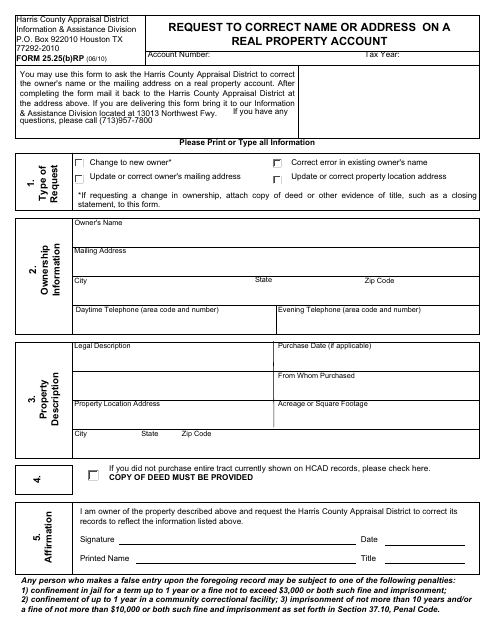

This form is used for requesting a correction of name or address on a real property account in Harris County Appraisal District, Texas.

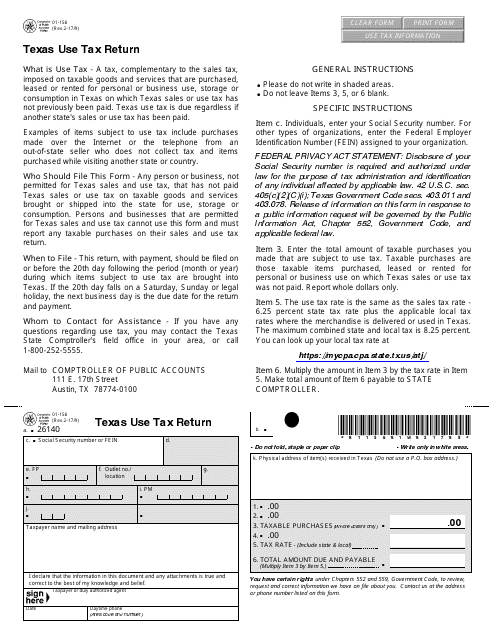

This form is used for reporting and filing use tax in the state of Texas. Use tax is a tax on purchases made out of state that would have been subject to sales tax if purchased within the state.

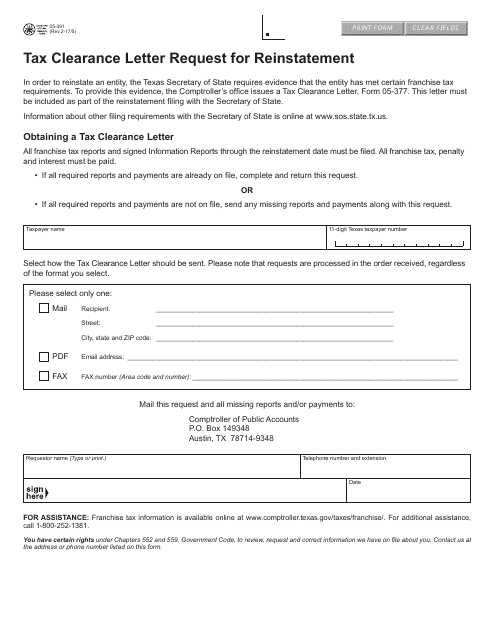

This form is used for requesting a tax clearance letter for reinstatement in the state of Texas.

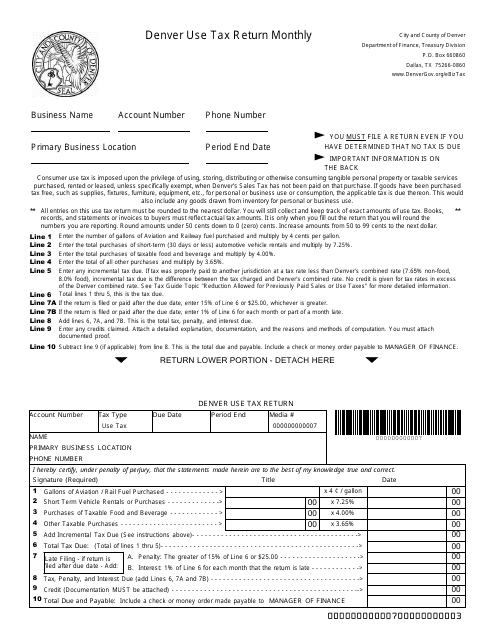

This Form is used for reporting and paying monthly use tax to the City and County of Denver, Texas.

This document is used for submitting a seller training report in the state of Texas.

This Form is used for submitting quarterly occupational privilege tax return to the City and County of Denver, Texas.

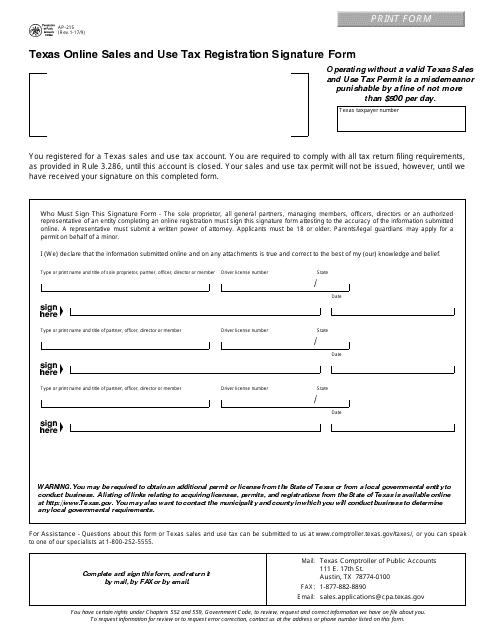

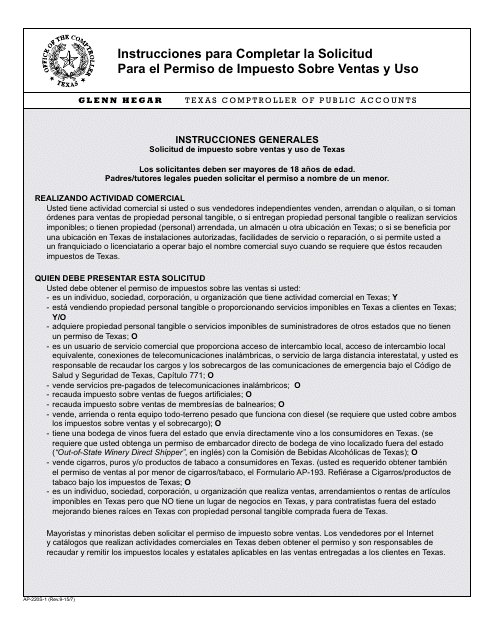

This document is used for registering for sales and use tax in Texas, and it requires your signature.

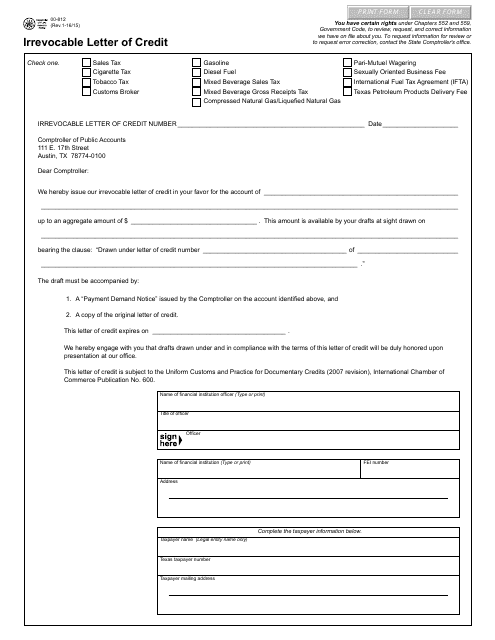

This Form is used for issuing an irrevocable letter of credit in the state of Texas.

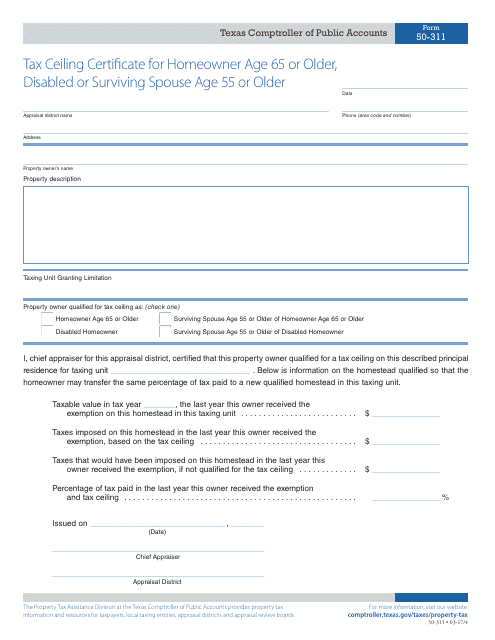

This form is used for homeowners in Texas who are age 65 or older, disabled, or surviving spouse age 55 or older to apply for a tax ceiling certificate. This document helps eligible individuals receive property tax relief.

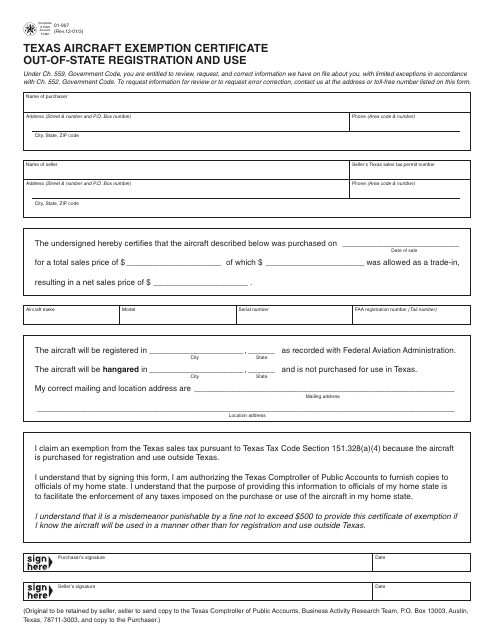

This form is used for obtaining a Texas Aircraft Exemption Certificate for out-of-state registration and use in Texas.

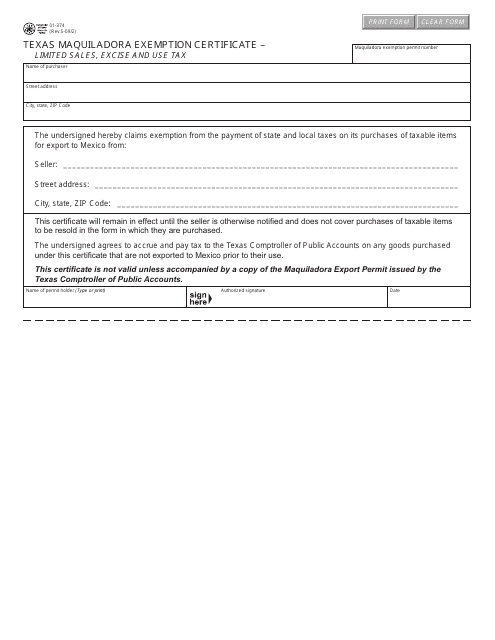

This form is used for businesses operating in Texas to claim exemption from certain taxes for goods produced in a maquiladora (manufacturing facility) in Mexico.

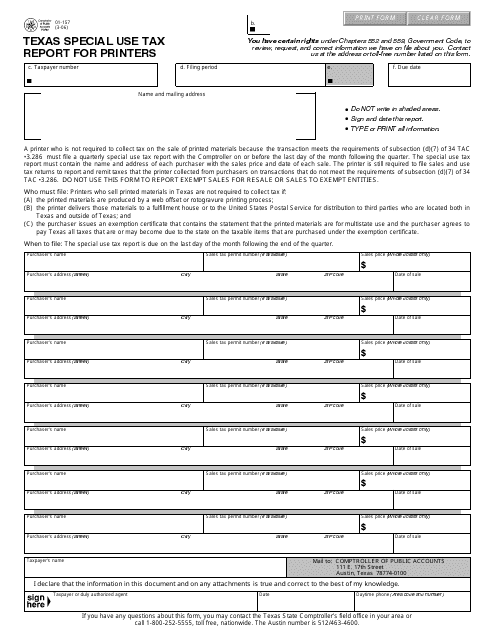

This form is used for reporting special use tax for printers in Texas.

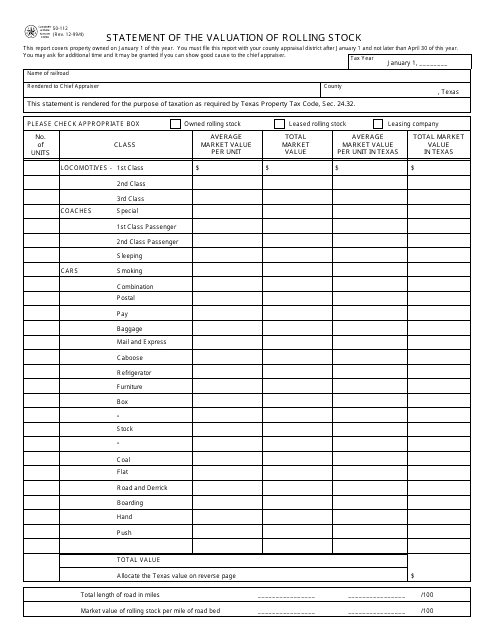

This form is used for reporting the valuation of rolling stock, such as locomotives and freight cars, in the state of Texas.

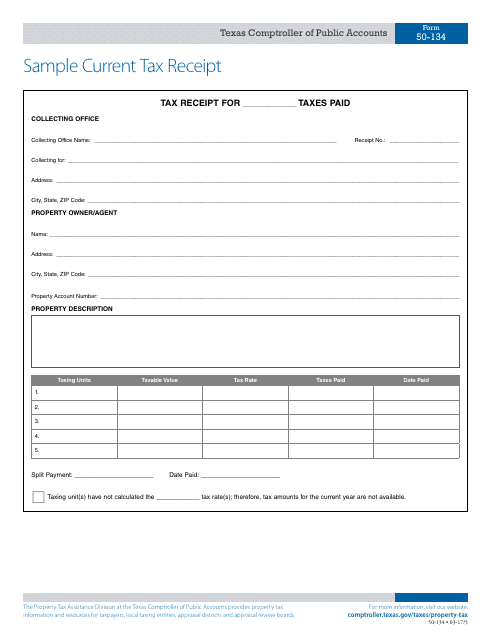

This type of document, Form 50-134, is used for providing a sample current tax receipt in the state of Texas. It showcases how a tax receipt may look like for reference purposes.

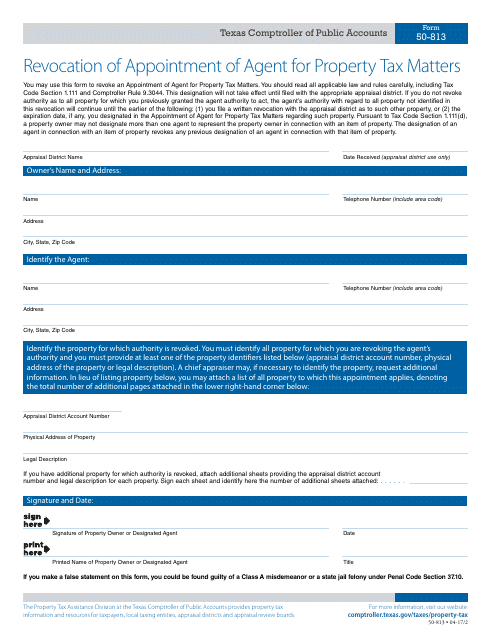

This Form is used for revoking the appointment of an agent for property tax matters in the state of Texas. It allows individuals to cancel the authorization given to an agent to handle their property tax affairs.

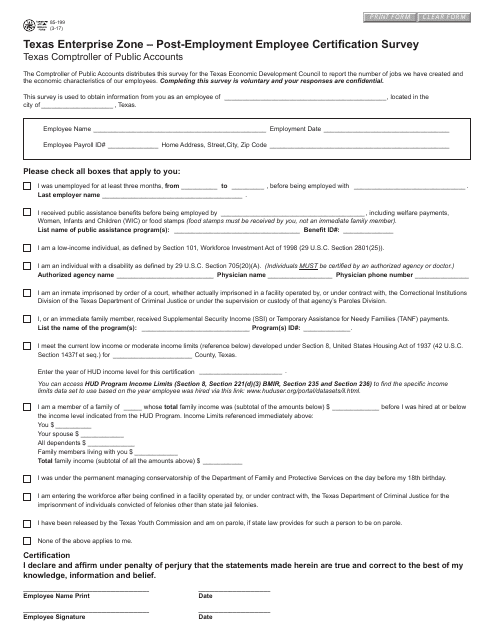

This form is used for the post-employment employee certification survey in Texas Enterprise Zone. It helps gather information about the employment status of individuals who have participated in the program.

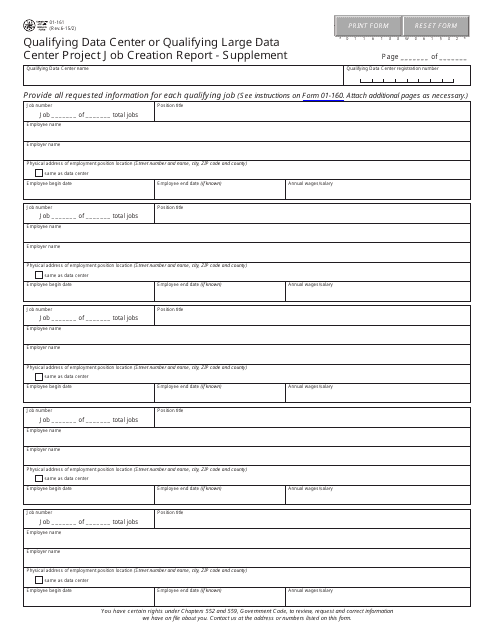

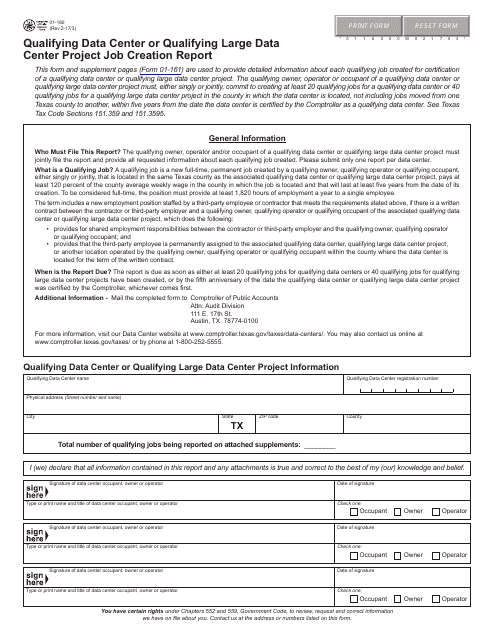

This form is used for reporting job creation in qualifying data center projects in Texas.

This Form is used to report job creation for a qualifying data center or qualifying large data center project in Texas.

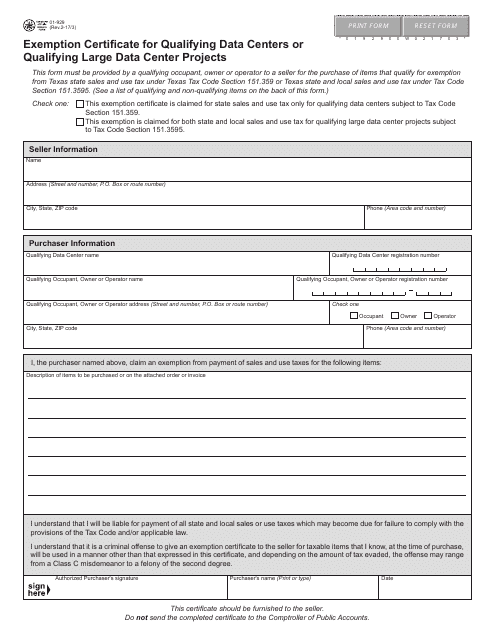

This document is used to apply for an exemption certificate for qualifying data centers or qualifying large data center projects in Texas.

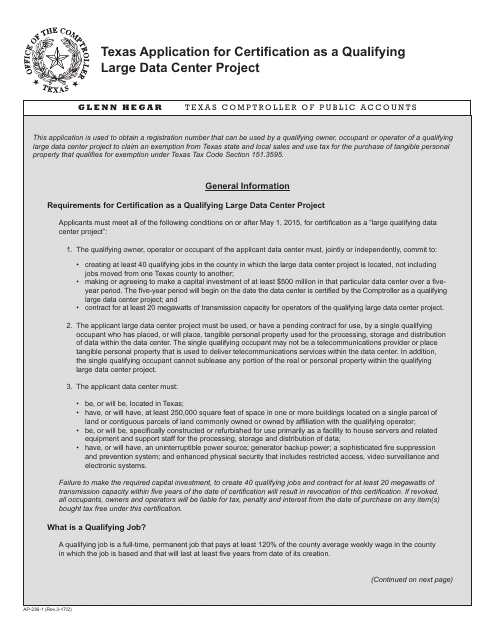

This Form is used for certification as a qualifying large data center project in Texas.

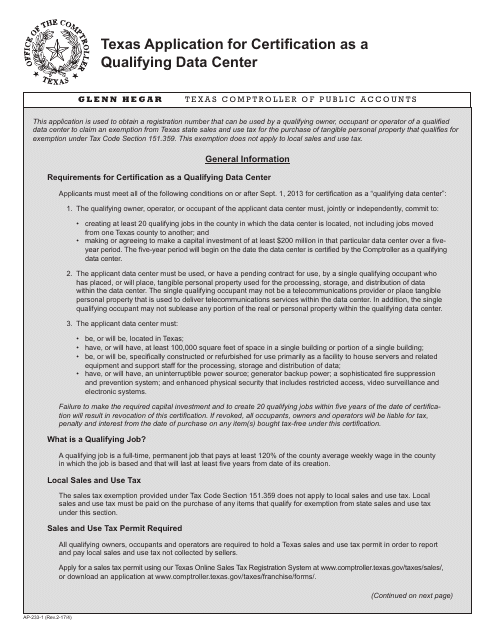

This Form is used for companies to apply for certification as a qualifying data center in Texas.

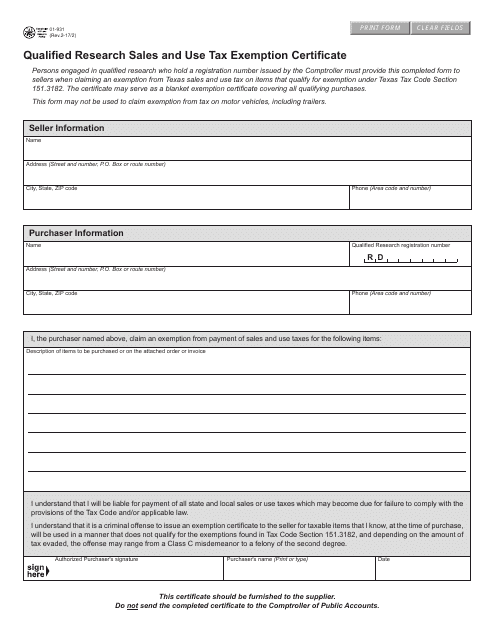

This form is used for obtaining a sales and use tax exemption on qualified research activities in the state of Texas.

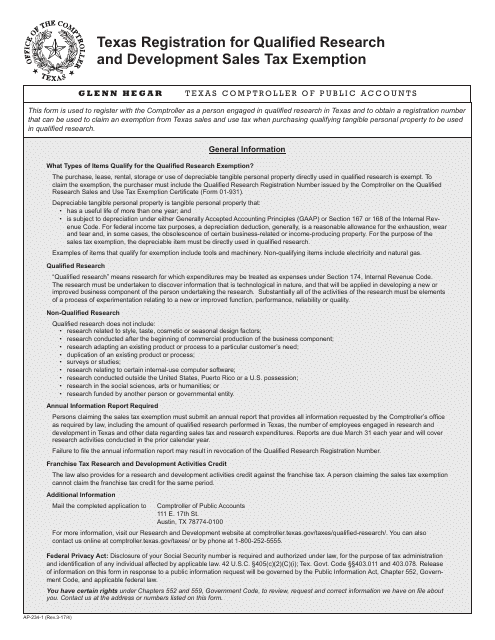

This form is used for businesses in Texas to register for a sales tax exemption for qualified research and development activities.

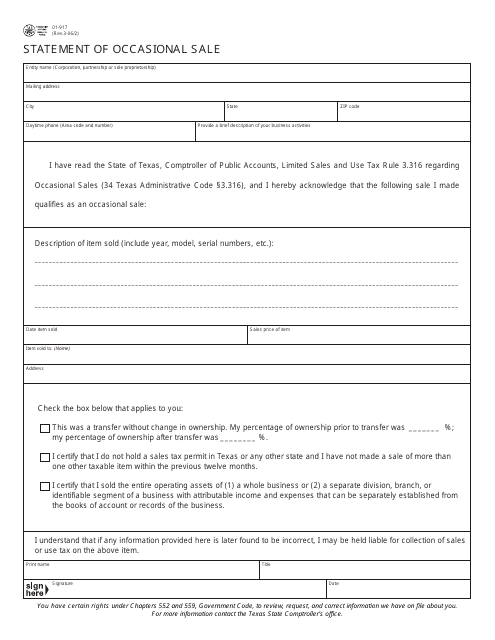

This Form is used for reporting occasional sales in the state of Texas. It is required for individuals or businesses who are not regularly engaged in selling taxable items.

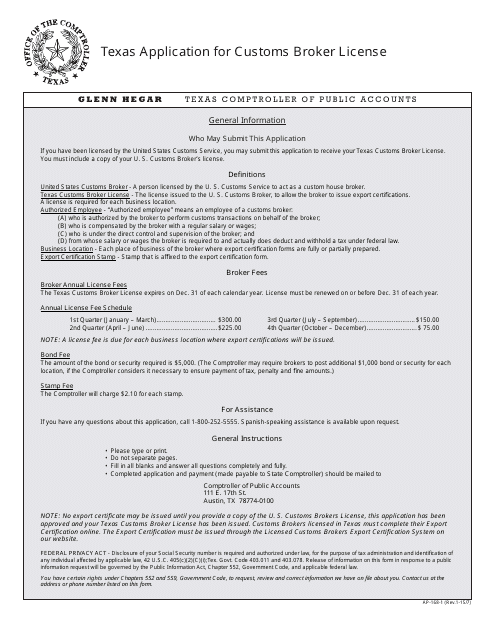

This Form is used for applying for a customs broker license in Texas.

This document is used for obtaining a resale certificate or an exemption certificate for sales and use tax in Texas. It is necessary for businesses to provide this form to suppliers to assert their tax-exempt status.

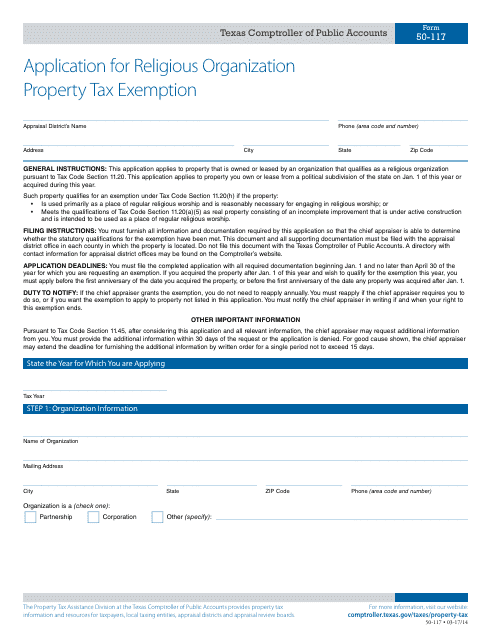

This form is used for applying for a property tax exemption for religious organizations in Texas.