Texas Office of Consumer Credit Commissioner Forms

The Texas Office of Consumer Credit Commissioner is responsible for regulating and overseeing consumer credit transactions in the state of Texas. Their main goal is to protect consumers by enforcing laws and regulations that govern lending practices, including payday loans, auto title loans, and other types of consumer loans. They ensure that lenders comply with state laws, review license applications, handle consumer complaints, and provide resources and education to help consumers make informed decisions about their credit options.

Documents:

44

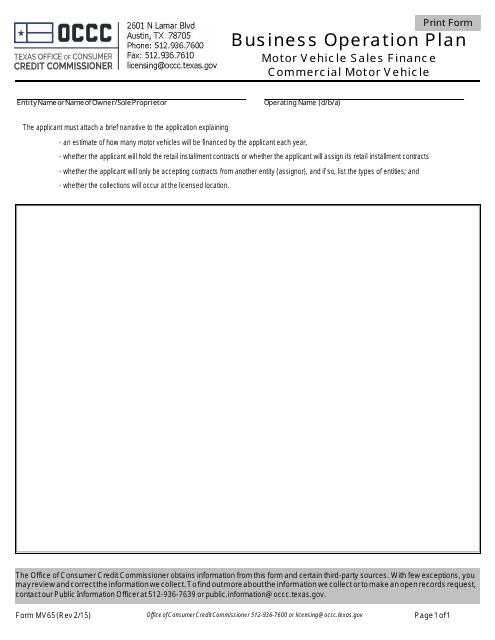

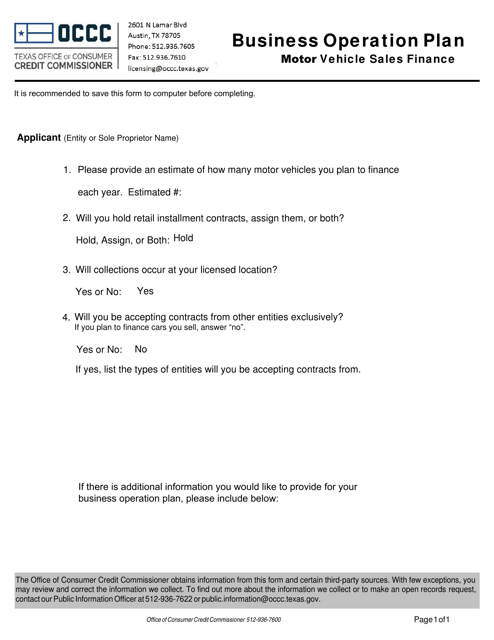

This form is used for creating a business operation plan for motor vehicle sales finance, specifically for commercial motor vehicles in Austin, Texas.

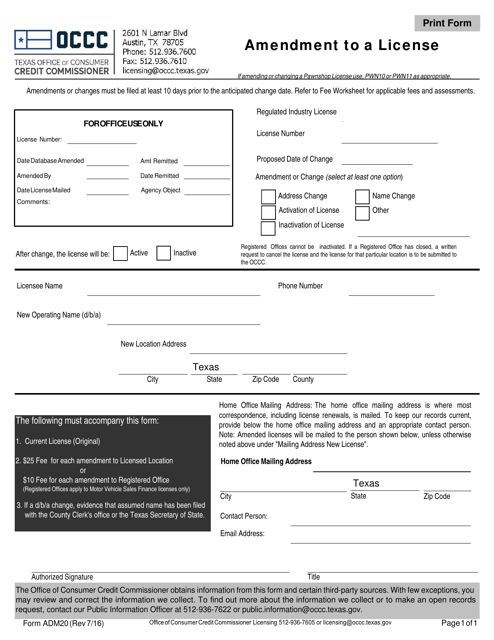

This Form is used for making amendments to a license in the state of Texas.

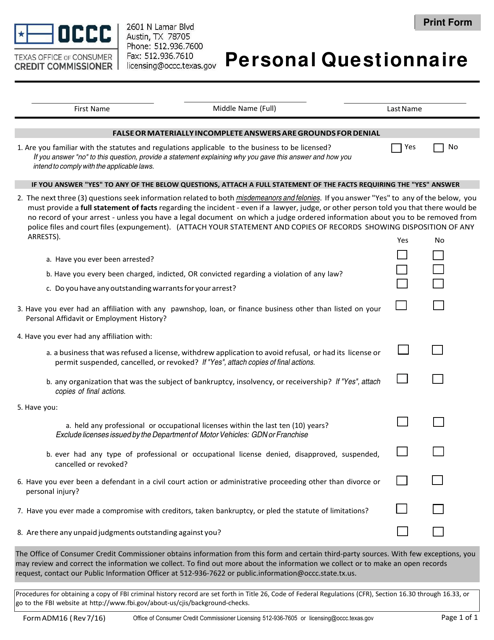

This form is used for completing a personal questionnaire required by the state of Texas.

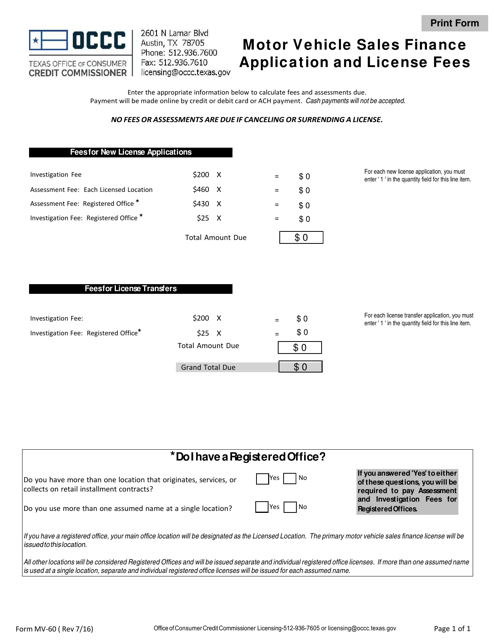

This form is used for applying for motor vehicle sales finance and submitting license fees in the state of Texas.

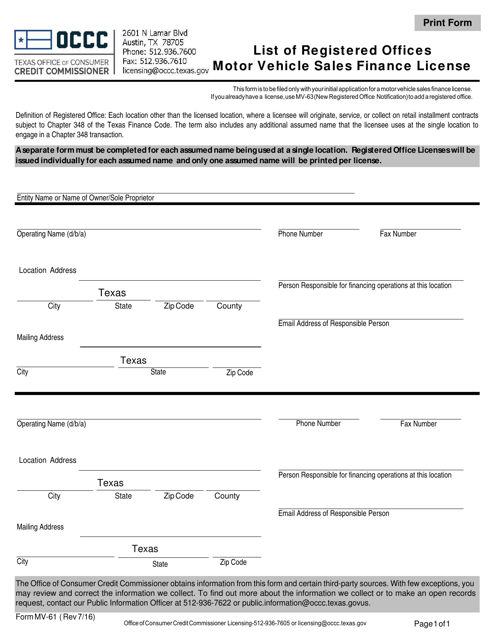

This form is used for listing the registered offices of motor vehicle sales finance licenses in Texas.

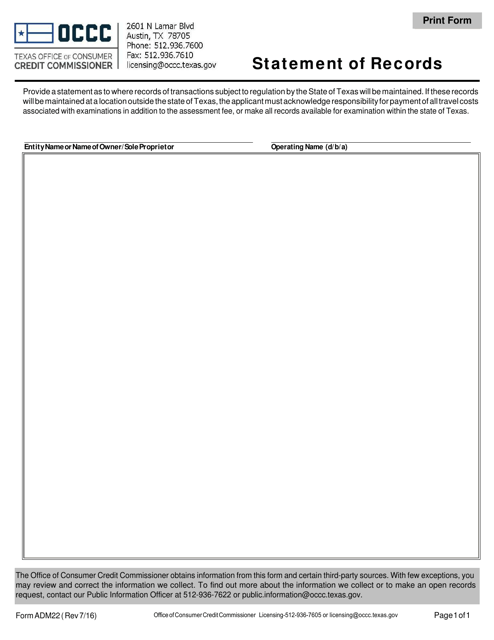

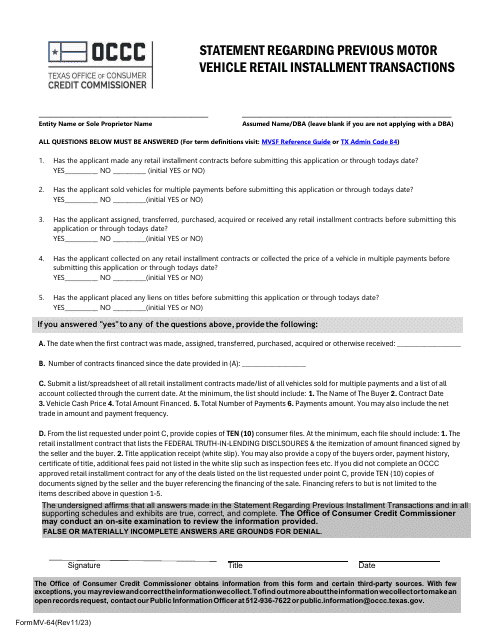

This form is used for submitting a statement of records in the state of Texas. It is used to provide a formal record of information related to a specific entity or individual.

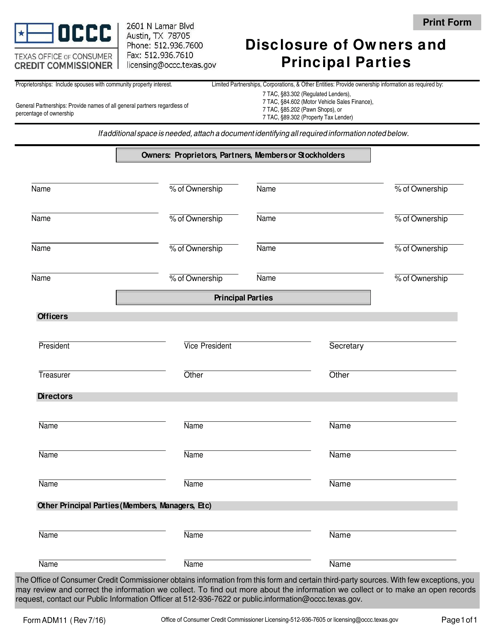

This form is used for disclosing information about the owners and principal parties of a business in the state of Texas.

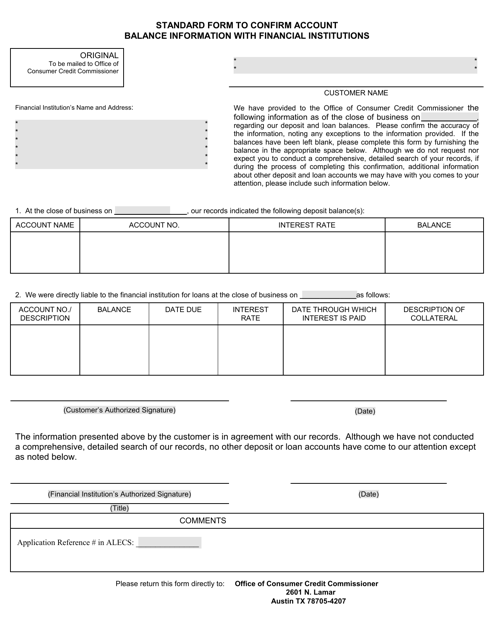

This Form is used to confirm account balance information with financial institutions in Texas. It helps individuals and businesses verify their account balances with banks, credit unions, and other financial institutions in the state.

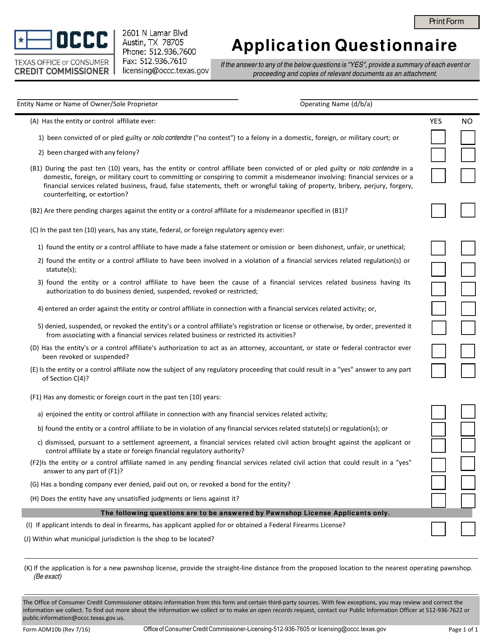

This Form is used for completing an application questionnaire for a specific purpose in the state of Texas. It may be necessary for various purposes such as employment, licensing, or other official processes.

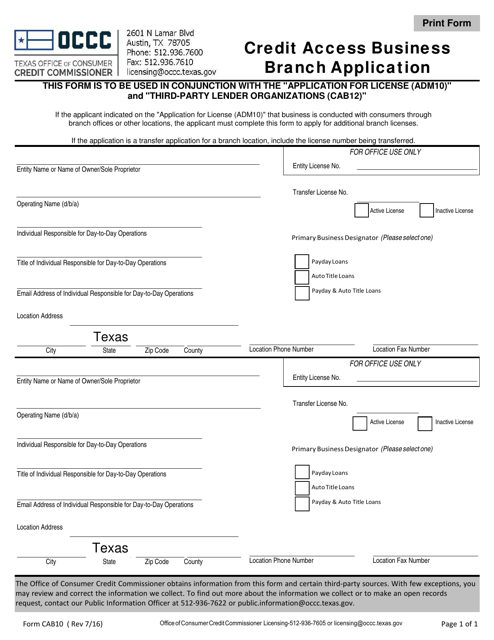

This form is used for applying for a branch license to operate a Credit Access Business in the state of Texas. It is required for businesses that provide payday loans, title loans, or other small dollar loans.

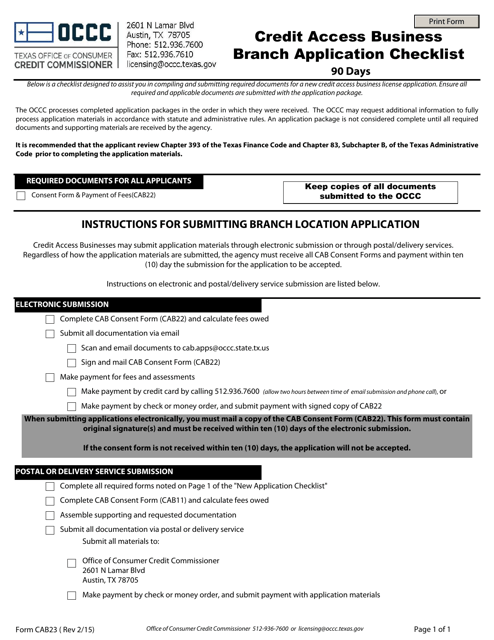

This form is used for applying for a credit access business branch application in Texas. It includes a checklist of required documents and has a 90-day validity period.

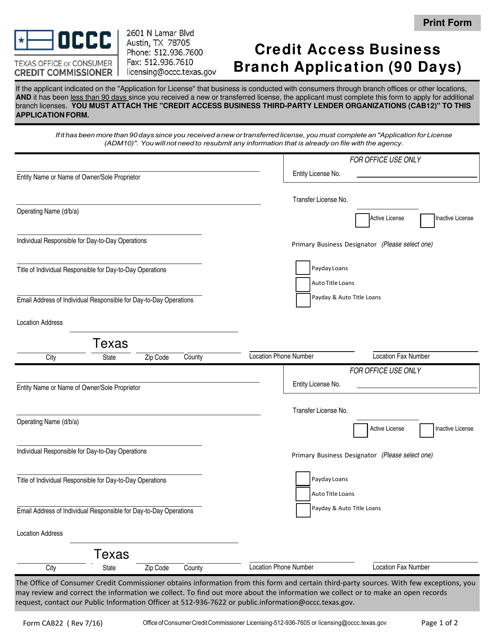

This form is used for applying for a credit access business branch in Texas.

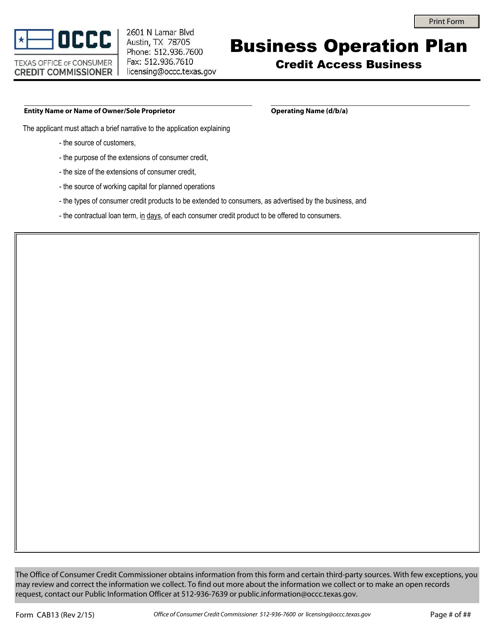

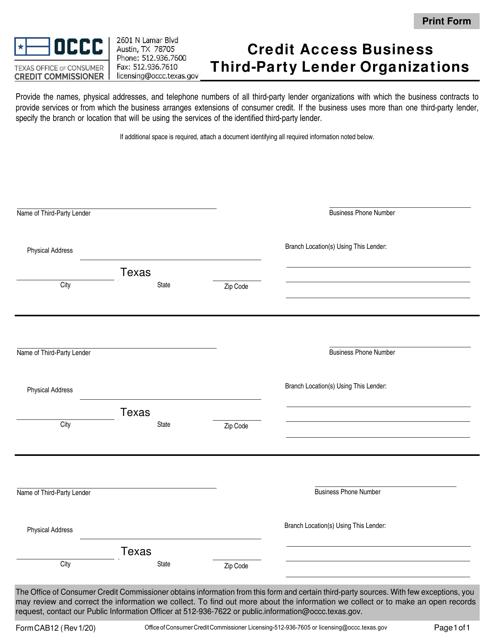

This Form is used for creating a business operation plan specific to Credit Access Businesses in the state of Texas. It provides a template for outlining the key aspects of the business and its operations.

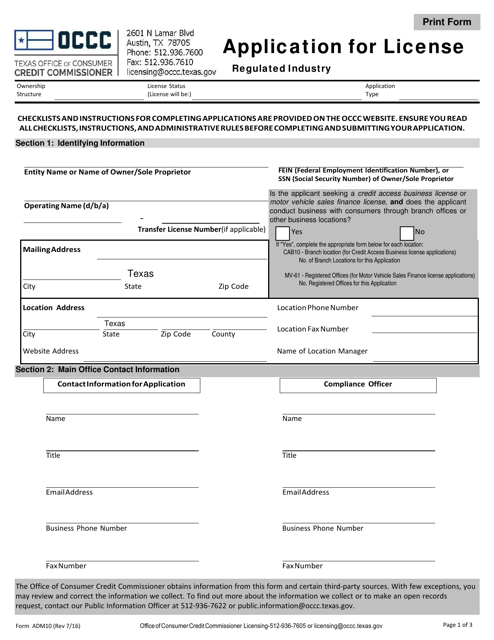

This Form is used for applying for a license in the state of Texas.

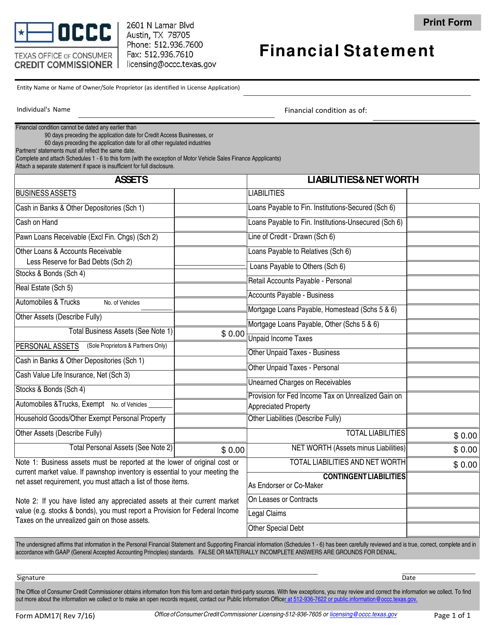

This form is used for submitting a financial statement in the state of Texas. It is required for various purposes such as tax filings and regulatory compliance.

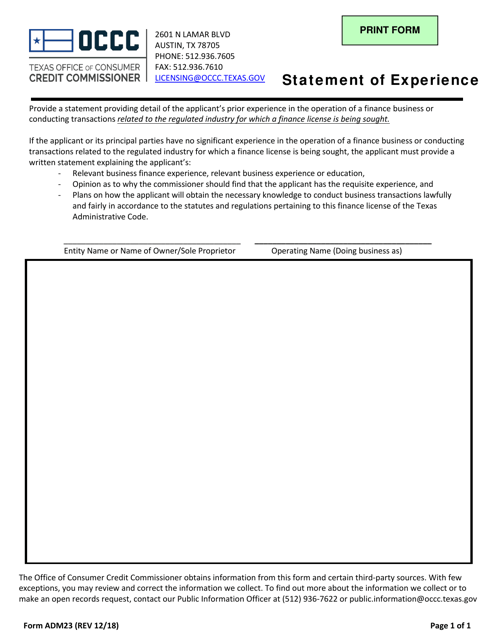

This form is used for individuals to provide a statement of their experience in Texas. It may be required for certain professional licensing or job applications.

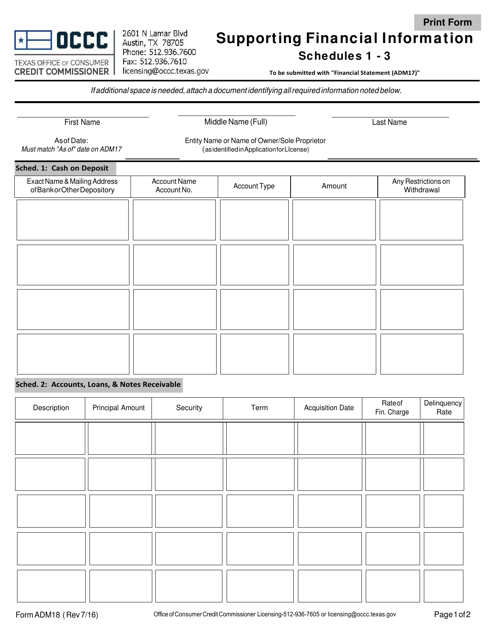

This form is used for providing supporting financial information, including Schedules 1-3, for the state of Texas.

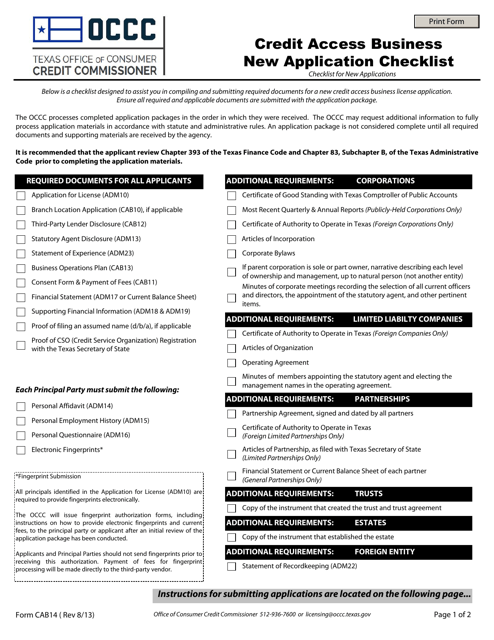

This Form is used for the Credit Access Business New Application Checklist in the state of Texas. It provides a checklist of documents and requirements that need to be submitted when applying for a new credit access business license.

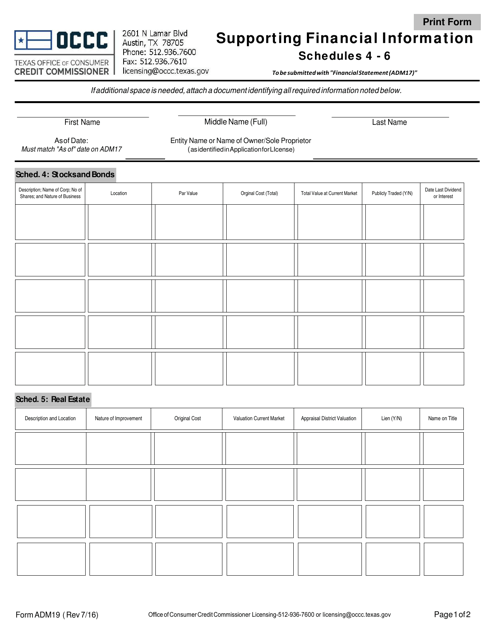

This form is used for providing supporting financial information, specifically Schedules 4-6, in the state of Texas.

This document outlines the operational plan for businesses involved in financing motor vehicle sales in the state of Texas. It provides a roadmap for how these businesses should operate and comply with relevant regulations.

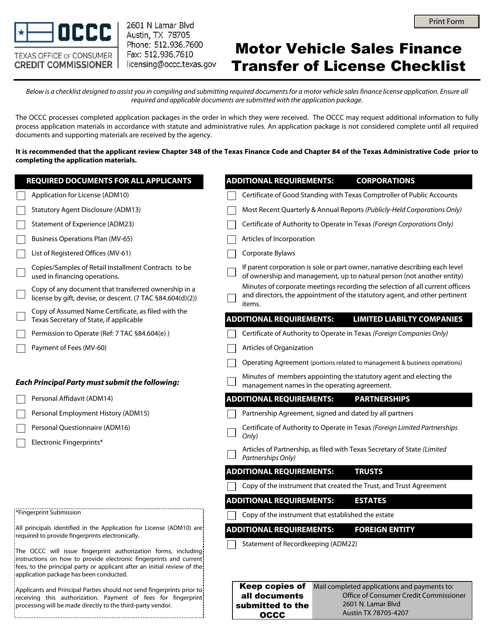

This document is a checklist used in Texas for transferring a motor vehicle sales finance license. It provides a step-by-step guide and requirements for completing the license transfer process.

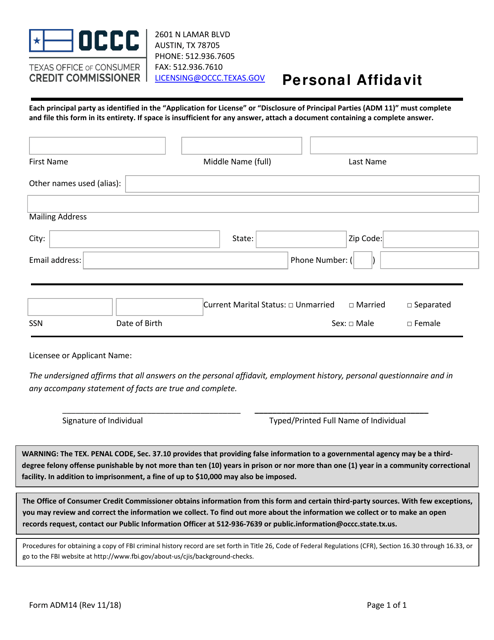

This form is used for creating a personal affidavit in the state of Texas. It is a legal document where an individual declares certain facts to be true under oath.

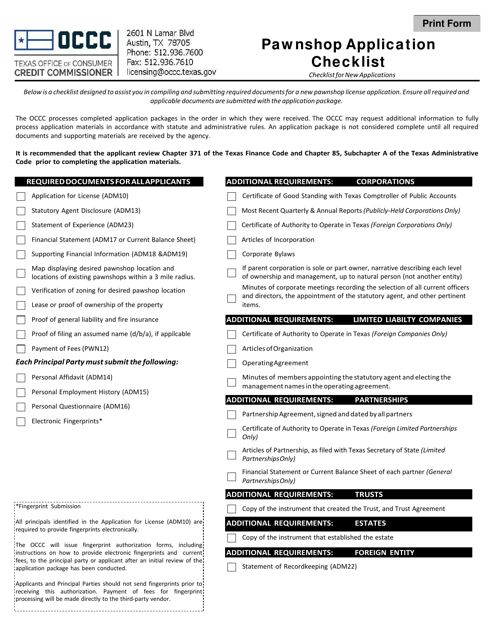

This document is a checklist for applying for a pawnshop license in Texas. It outlines the required documents and steps for the application process.

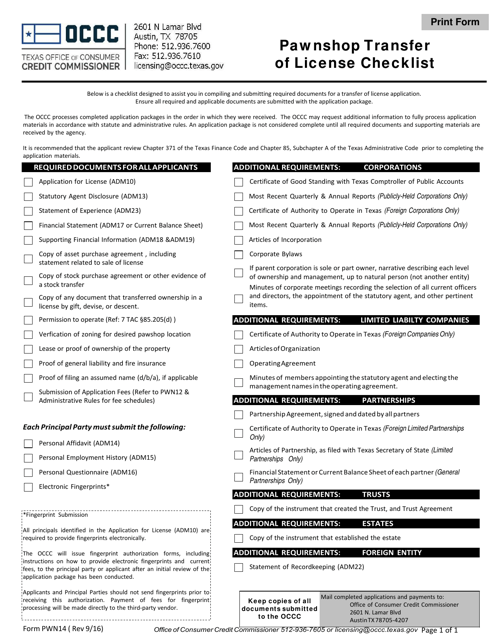

This form is used for a checklist to transfer a pawnshop license in the state of Texas. It ensures that all necessary requirements are met for the license transfer process.

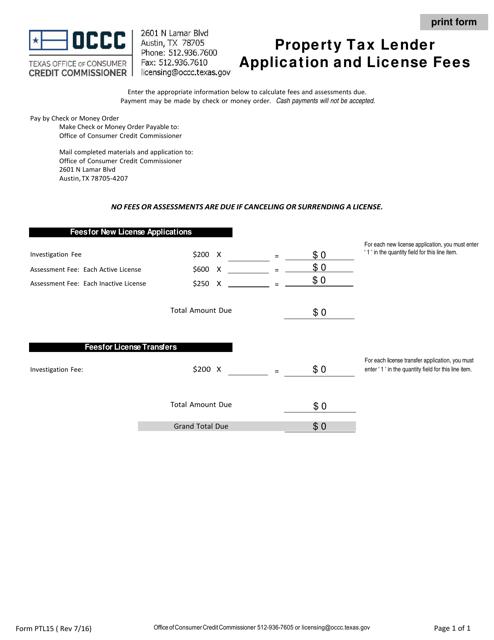

This Form is used for applying for a property tax lender license in Texas and paying the associated license fees.

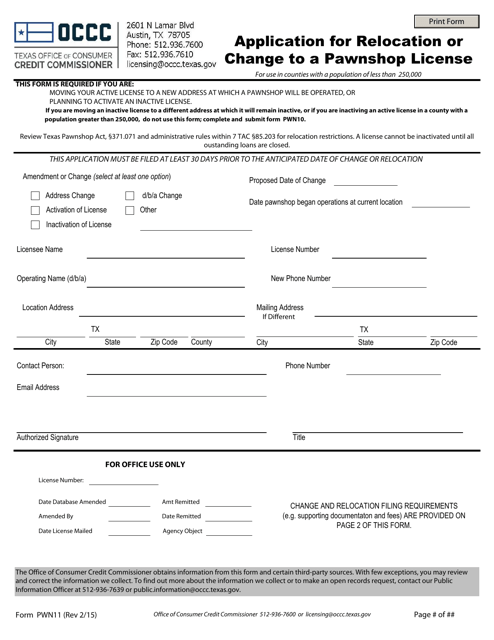

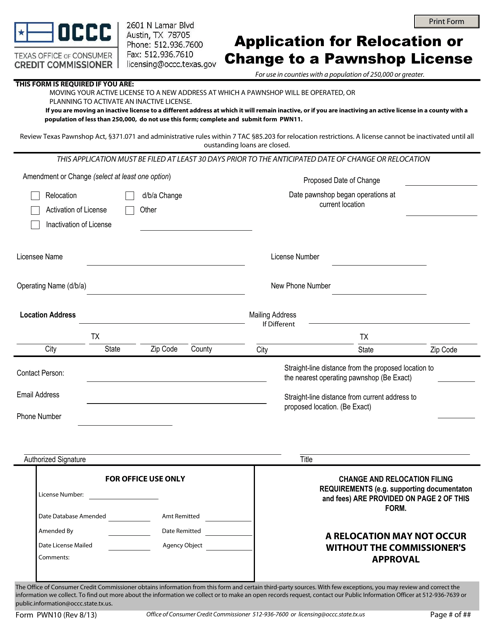

This form is used for applying to relocate or change a pawnshop license in Texas.

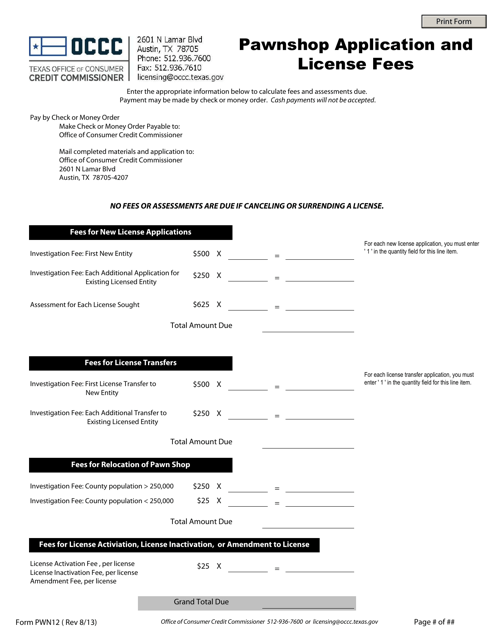

This form is used for applying for a license to operate a pawnshop in the state of Texas. It includes information on the required application fees.

This document is used for applying for relocation or making changes to a pawnshop license in Texas.

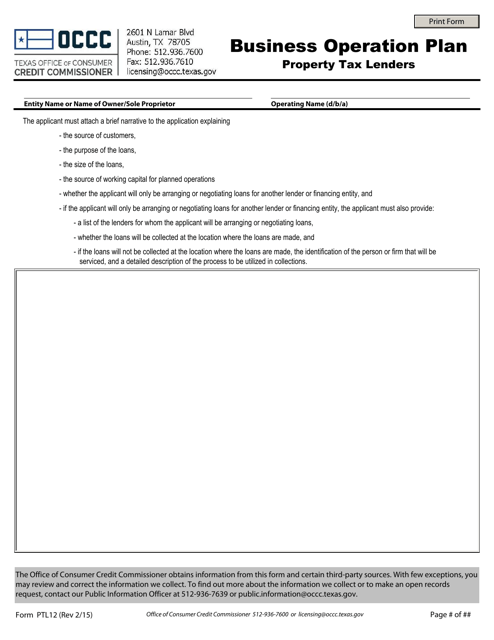

This form is used to create a business operation plan for property tax lenders in Texas. It outlines the details and strategies for operating a property tax lending business in the state.

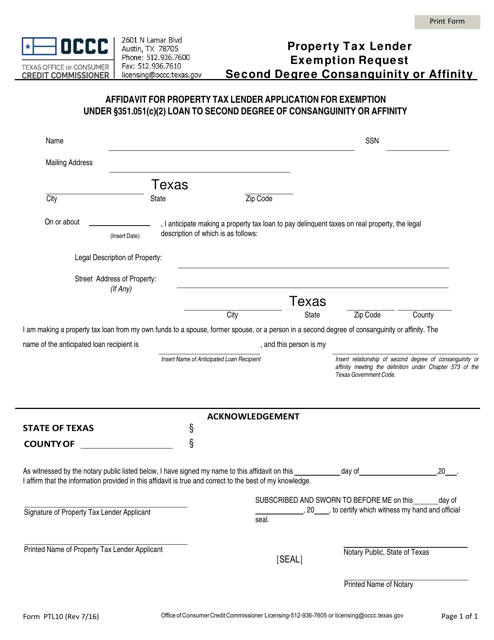

This form is used for requesting an exemption from property tax for property held by a lender who is related to the property owner by second-degree consanguinity or affinity in Texas.

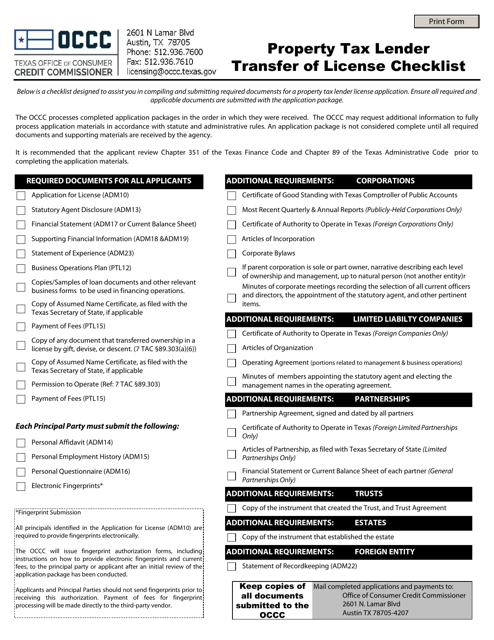

This checklist is used in Texas for transferring a property tax lender license to another individual or entity. It helps ensure that all necessary steps and requirements are met during the transfer process.

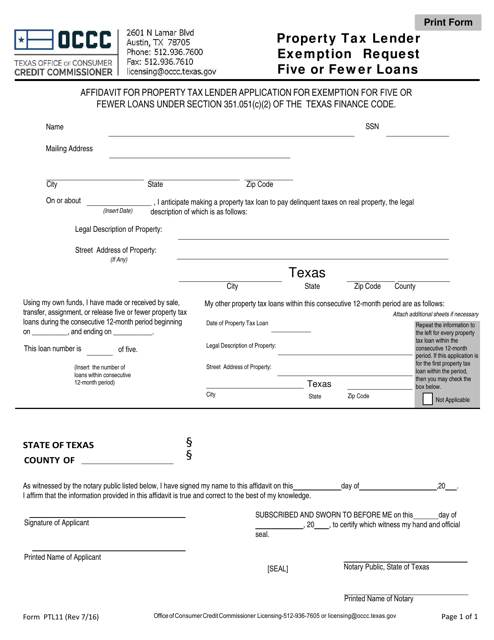

This form is used for requesting an exemption for property tax lenders in Texas who have issued five or fewer loans.

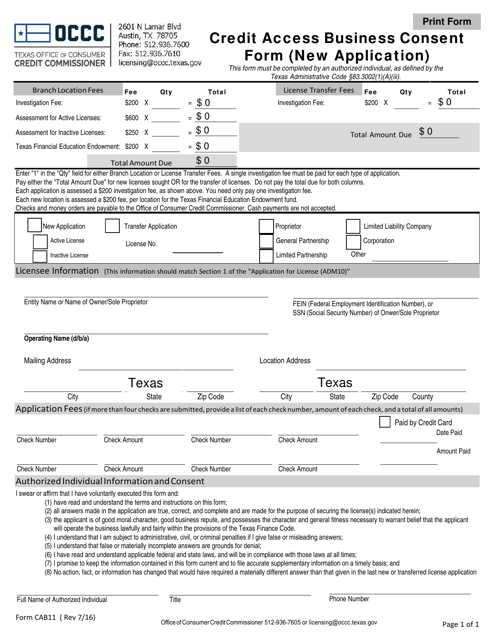

This Form is used for obtaining consent from the applicant for a new credit access business (CAB) application in Texas.

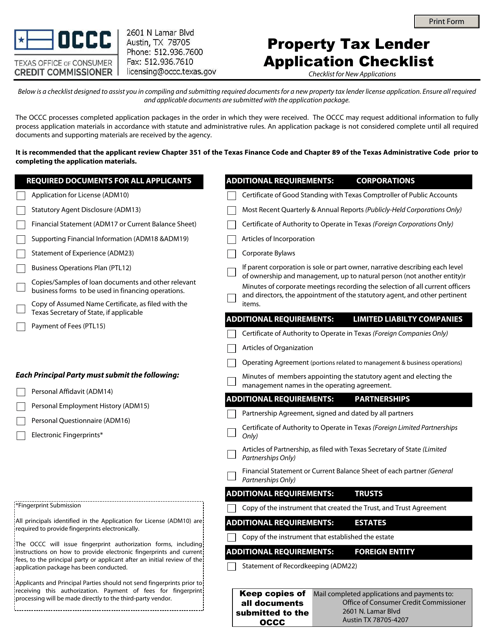

This checklist is used for applying for a property tax lender in Texas.

This Form is used for applying to become a regulated lender in Texas and for paying the required license fees.

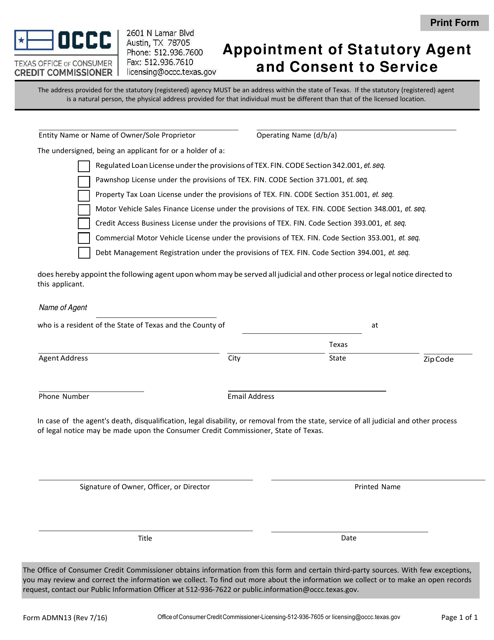

This Form is used for appointing a Statutory Agent and giving consent to service in the state of Texas.

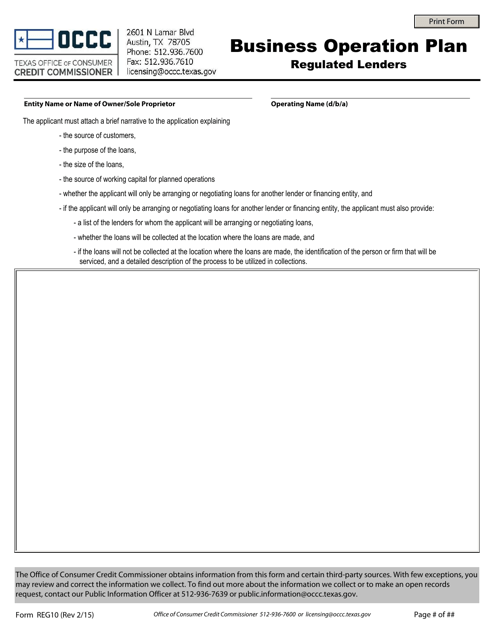

This form is used for creating a business operation plan for regulated lenders in Texas.

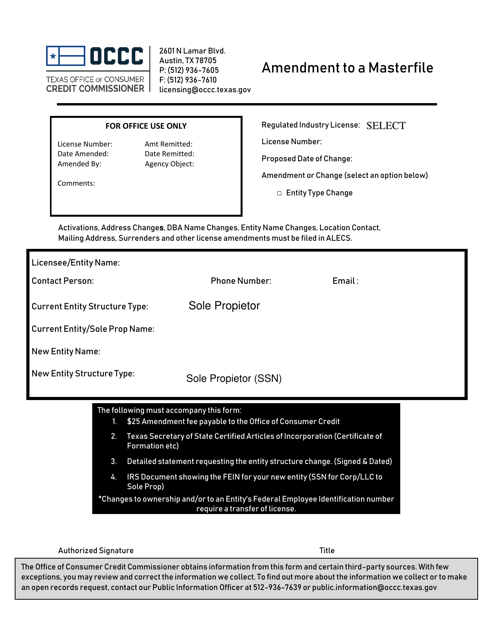

This document is an amendment to a Masterfile in the state of Texas. It is used to make changes or updates to the information contained in the Masterfile.