North Carolina Department of Revenue Forms

Documents:

615

This Form is used for residents of North Carolina to file their state income tax return and claim deductions, credits, and exemptions. The D-400TC Schedule A, AM, PN, PN-1, S are additional schedules that may be necessary depending on your specific tax situation.

This form is used for reporting estimated income tax for a taxed S Corporation in North Carolina.

This form is used for submitting estimated income tax for partnerships that are subject to taxation in North Carolina.

This form is used for nonresident partners to affirm their residency status in North Carolina.

This document is used for reporting additions and deductions for pass-through entities, estates, and trusts in North Carolina. It is a form that taxpayers can use to accurately report their income, expenses, and deductions related to these entities.

This Form is used for making tax payments for partnership income in North Carolina.

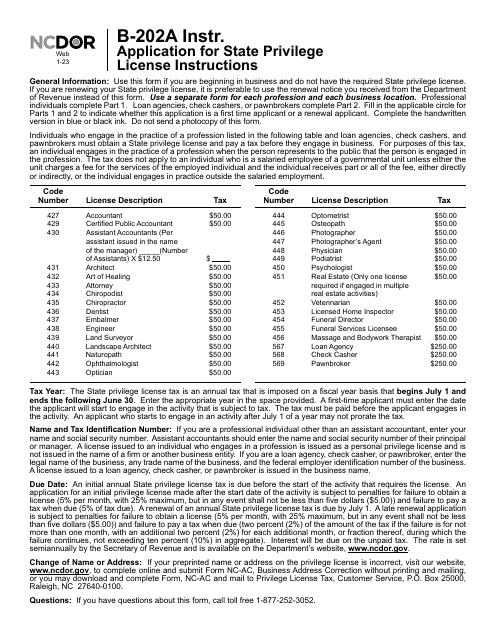

This document provides step-by-step instructions for completing the Form B-202A Application for State Privilege License in North Carolina. It guides applicants on the process of applying for a privilege license and ensures they have all the necessary information and documentation needed to submit their application successfully.

This form is used for monthly reporting of cigarette sales by nonresident distributors in North Carolina.

This form is used for filing the Cigarette Use Tax Return in North Carolina.

This form is used for resident cigarette distributors in North Carolina to report their monthly cigarette sales.