Iowa Department of Revenue Forms

The Iowa Department of Revenue is responsible for administering and enforcing tax laws in the state of Iowa. It collects various types of taxes such as income tax, sales tax, property tax, and cigarette tax. The department ensures that individuals and businesses comply with tax obligations, processes tax returns, and provides taxpayer assistance and education. Its primary goal is to fairly and efficiently administer the tax laws to fund government services and programs in Iowa.

Documents:

548

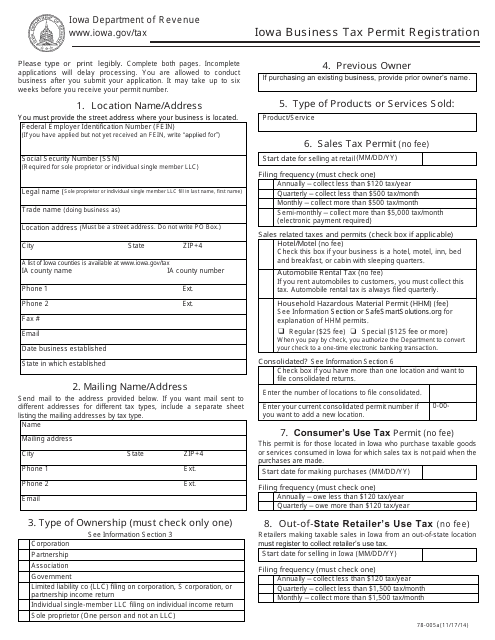

This form is used for business owners in Iowa to register for a tax permit.

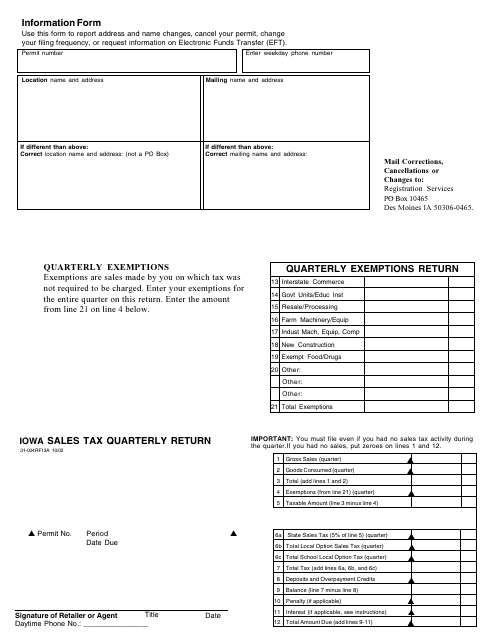

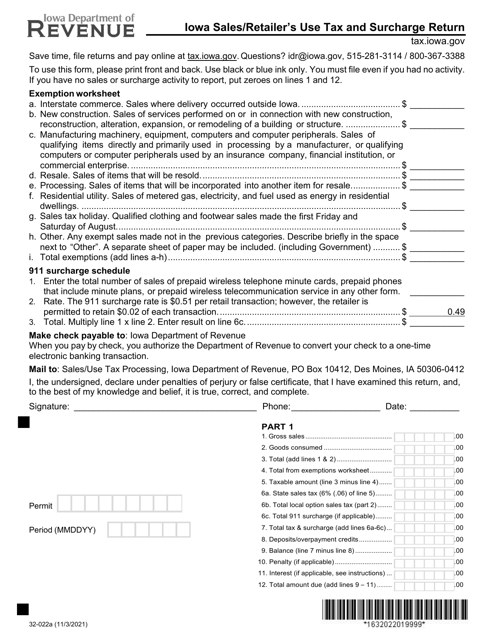

This Form is used for submitting Iowa sales tax quarterly return.

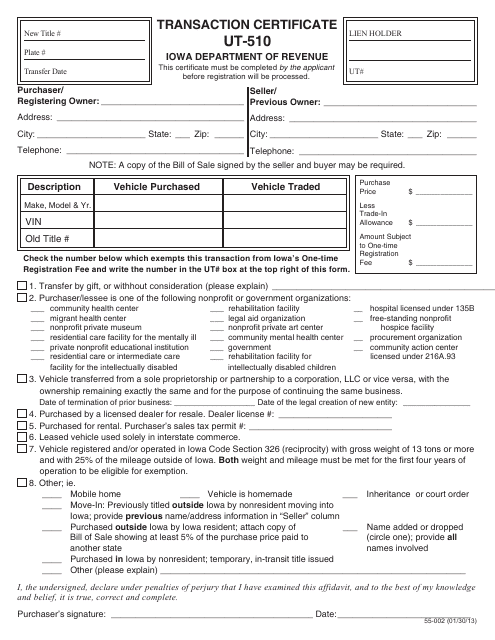

This form is used for obtaining a transaction certificate in Iowa.

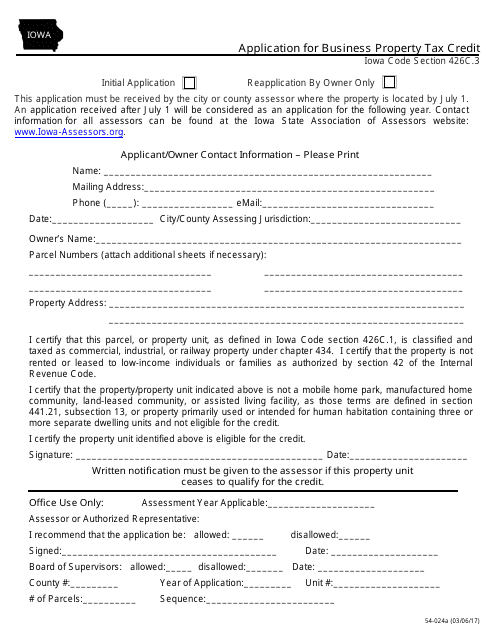

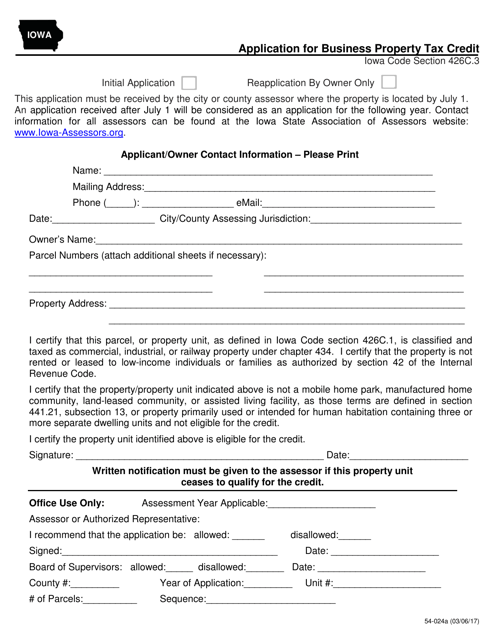

This form is used for applying for the Business Property Tax Credit in Iowa.

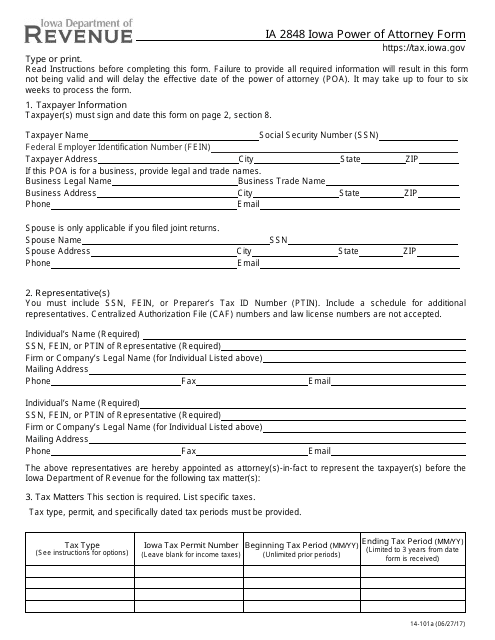

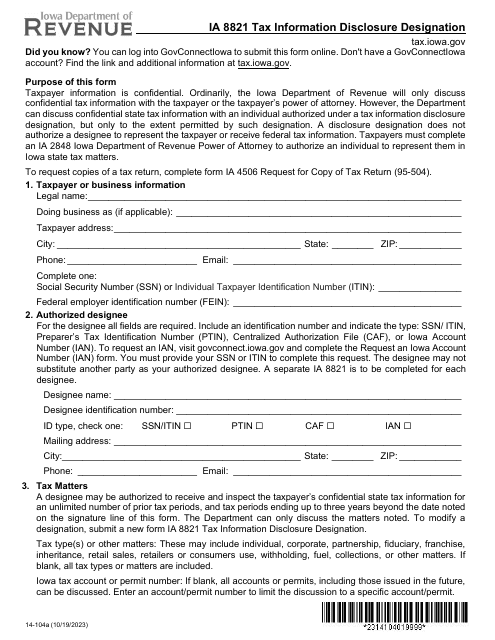

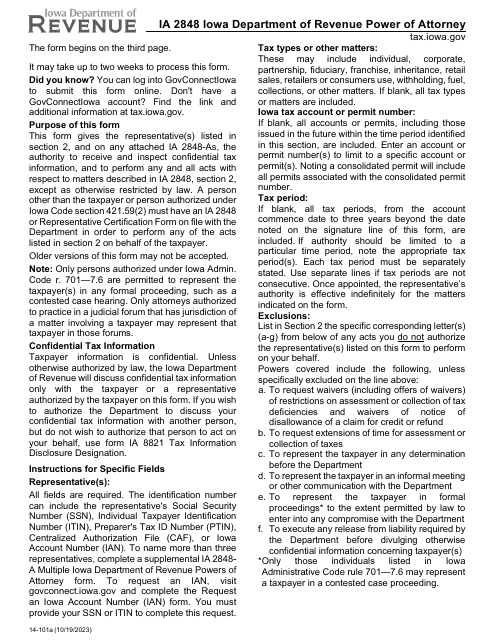

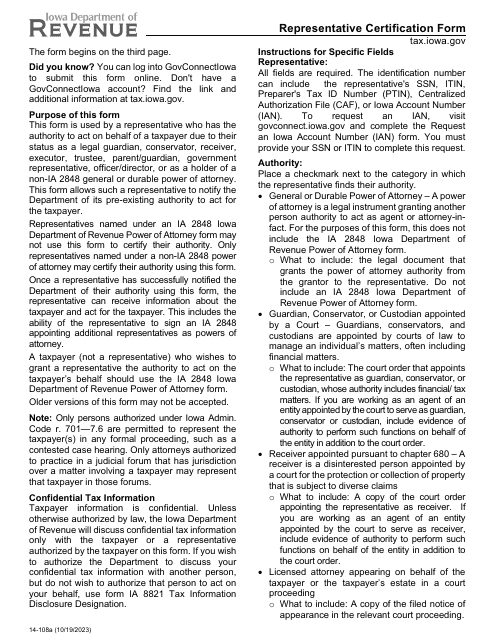

This Form is used for Iowa residents to appoint a power of attorney in Iowa. It allows the designated person to act on the individual's behalf in legal and financial matters.

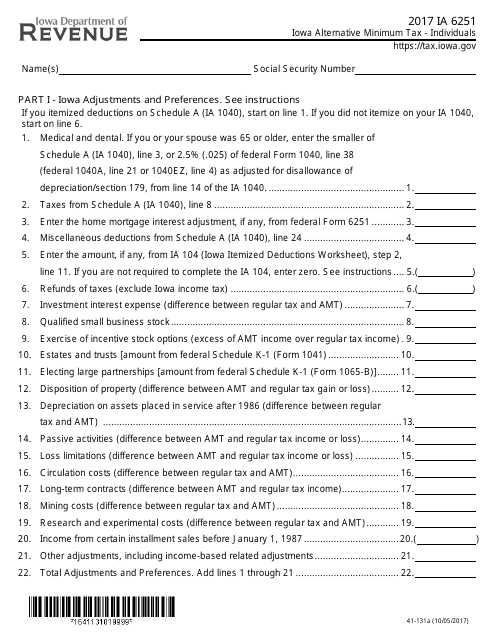

This Form is used for calculating the alternative minimum tax for individuals in the state of Iowa.

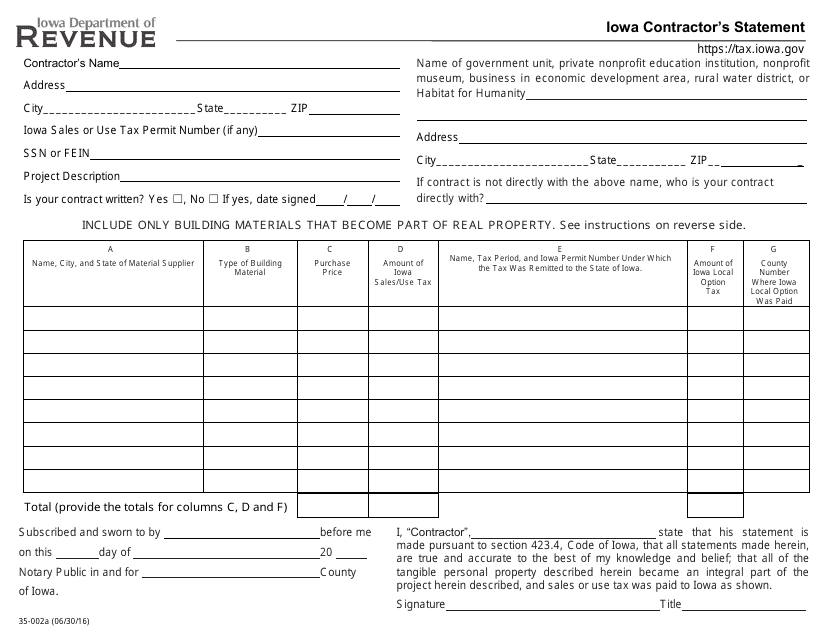

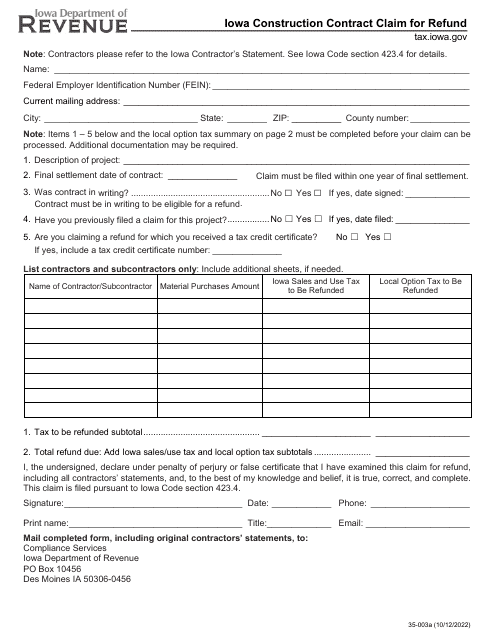

This form is used for Iowa contractors to provide a statement regarding their work.

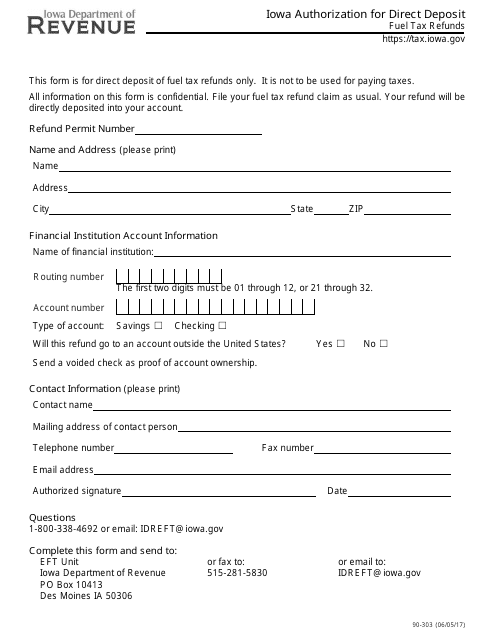

This form is used for applying to have fuel tax refunds directly deposited into your account in Iowa.

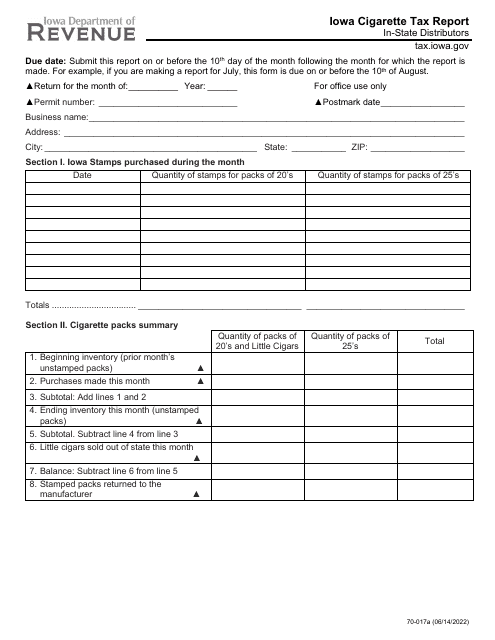

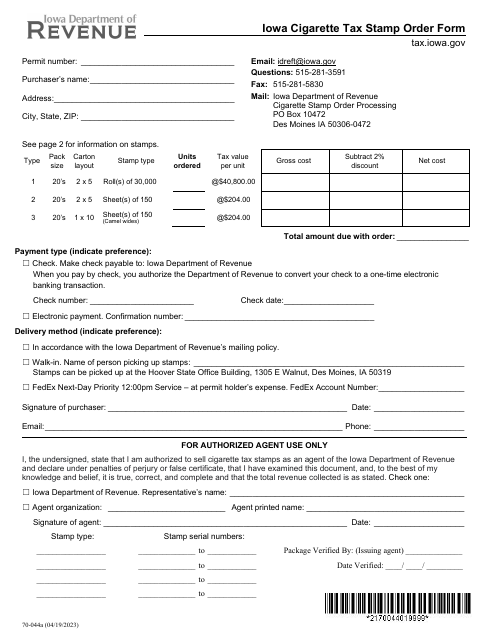

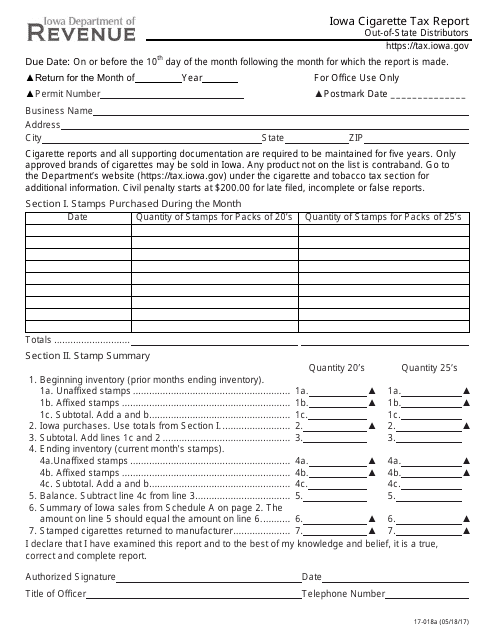

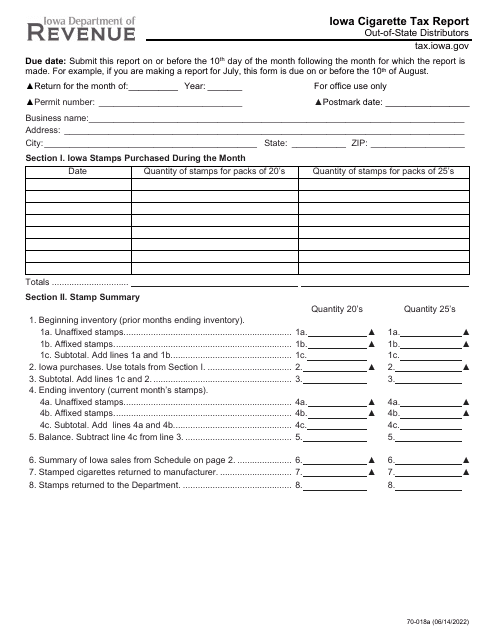

This form is used for Iowa cigarette tax report specifically for out-of-state distributors in Iowa. It helps in reporting and paying the required taxes for distributing cigarettes in the state of Iowa.

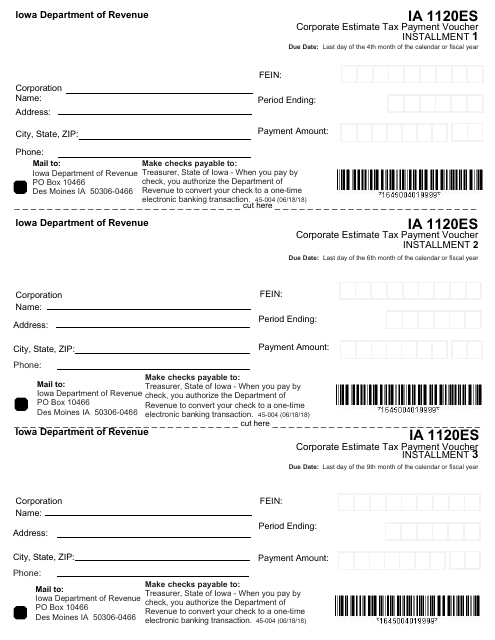

This form is used for making estimated tax payments by corporations in Iowa.

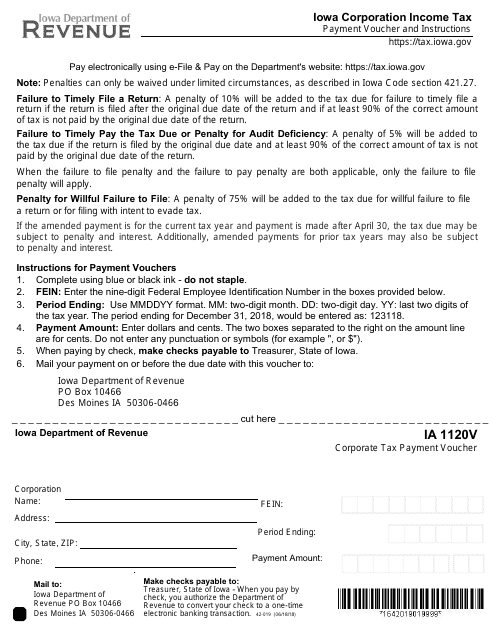

This form is used for making corporate tax payments in the state of Iowa.

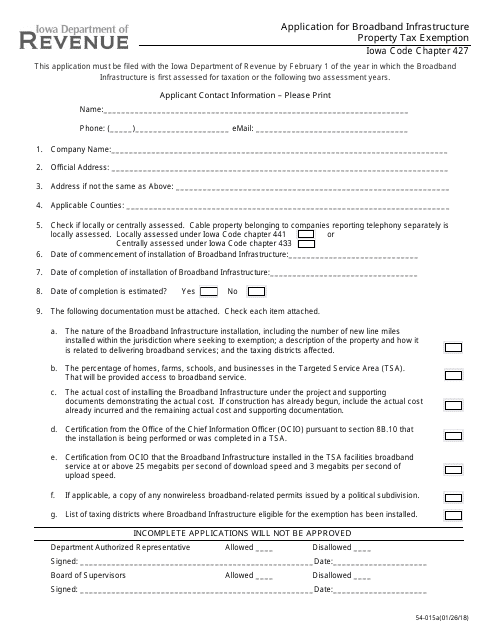

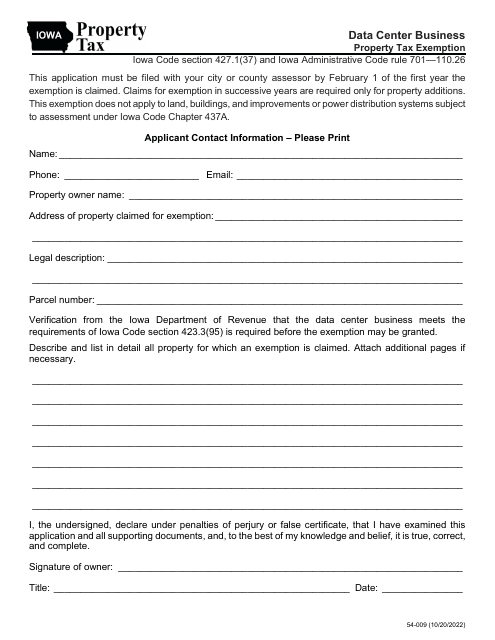

This Form is used for applying for a property tax exemption for broadband infrastructure in Iowa.

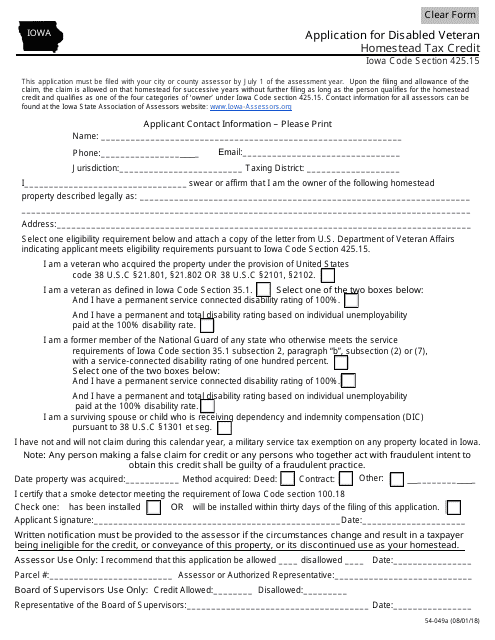

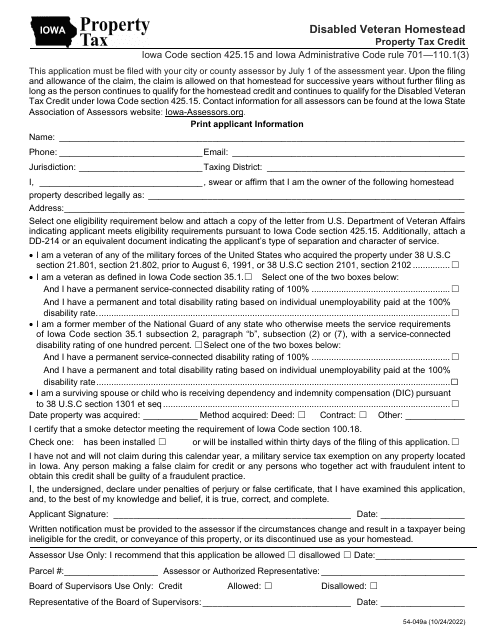

This form is used for applying for the Disabled Veteran Homestead Tax Credit in Iowa. It is specifically designed for disabled veterans who own a homestead property in Iowa and wish to receive property tax benefits. The form must be completed and submitted to the appropriate local taxing authority.

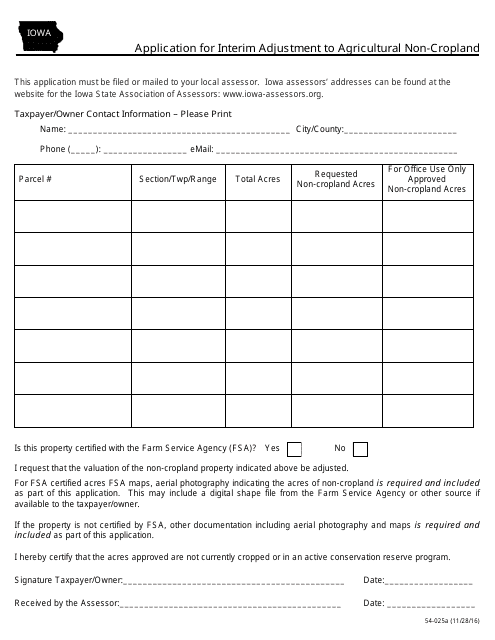

This form is used for applying for an interim adjustment to agricultural non-cropland in Iowa.

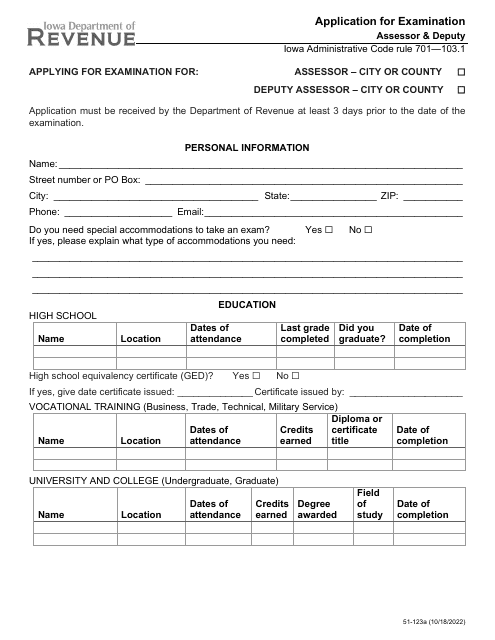

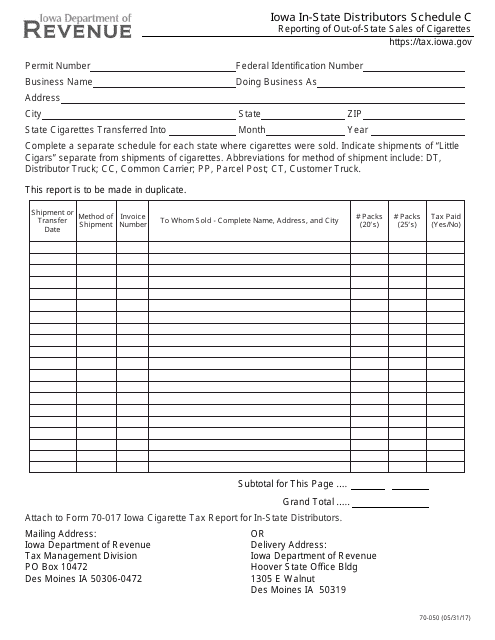

This Form is used for reporting out-of-state sales of cigarettes by in-state distributors in Iowa.

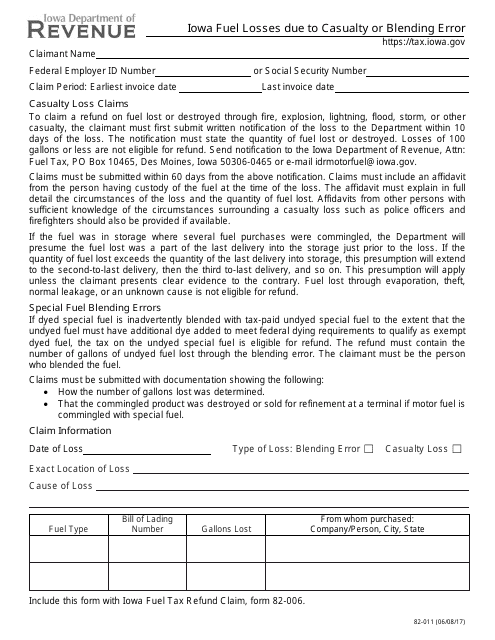

This Form is used for reporting fuel losses in Iowa due to casualty or blending error.

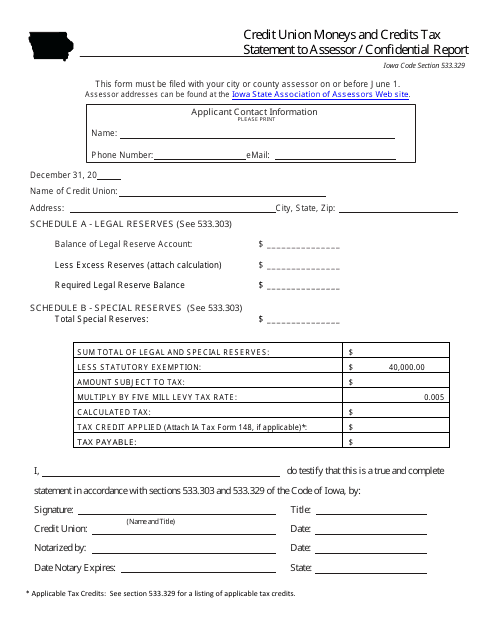

This document is used for reporting the moneys and credits of a credit union to the assessor in Iowa. It is a confidential report form.

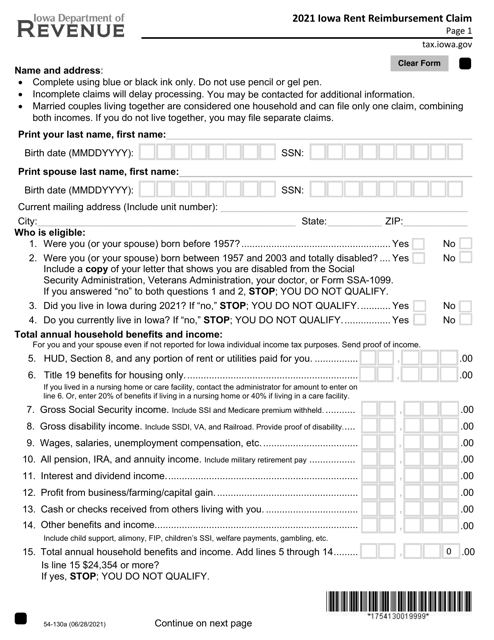

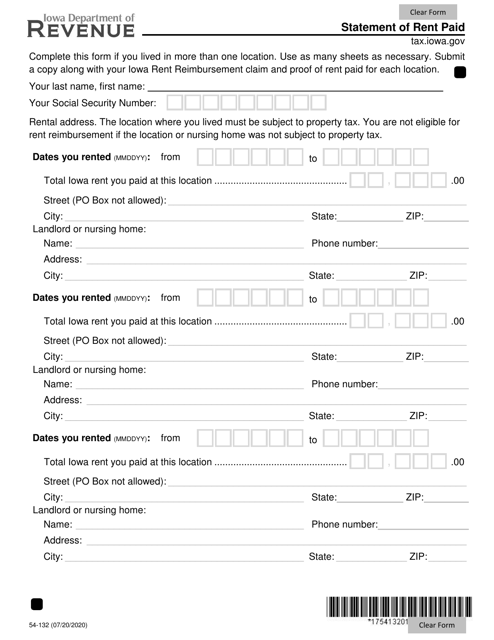

Iowa residents may fill in this form to get a refund for a portion of rent assumed to cover property tax paid on a rented unit.

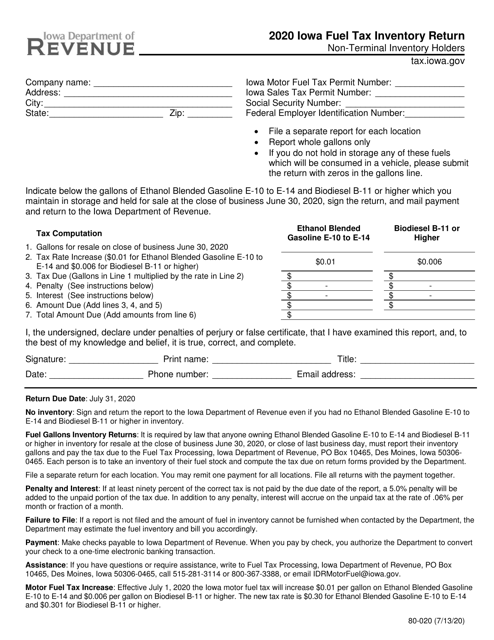

This Form is used for reporting fuel inventory for non-terminal holders in Iowa for tax purposes.

This form is used for applying for a business property tax credit in Iowa. It allows individuals to claim a credit on their taxes for eligible business property.