Guam Department of Revenue and Taxation Forms

The Guam Department of Revenue and Taxation is responsible for administering and enforcing tax laws in Guam. Their primary role is to collect taxes, such as income tax, gross receipts tax, and property tax, from individuals and businesses. They also provide taxpayer assistance and education, process tax returns, issue tax refunds, and conduct audits to ensure compliance with tax regulations. The department plays a crucial role in generating revenue for the government of Guam and supporting public services and infrastructure projects on the island.

Documents:

2

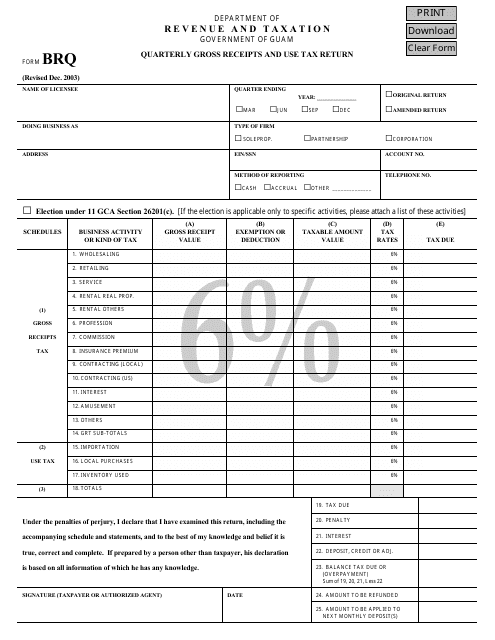

This form is used for reporting quarterly gross receipts and use tax in Guam.

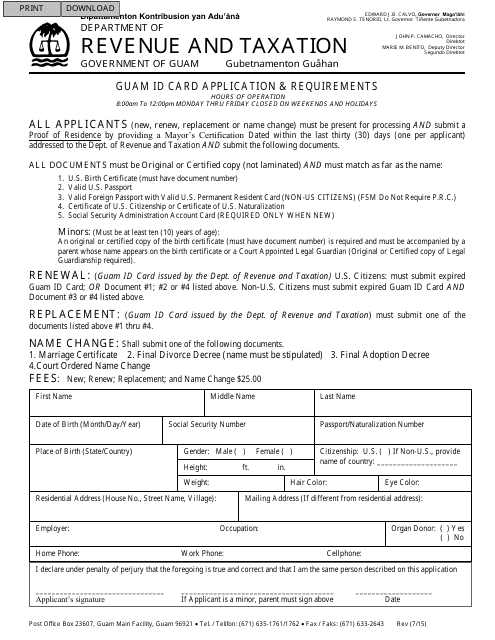

This document provides information on how to apply for an ID card in Guam, as well as the requirements needed for the application process.