Wisconsin Department of Revenue Forms

Documents:

1007

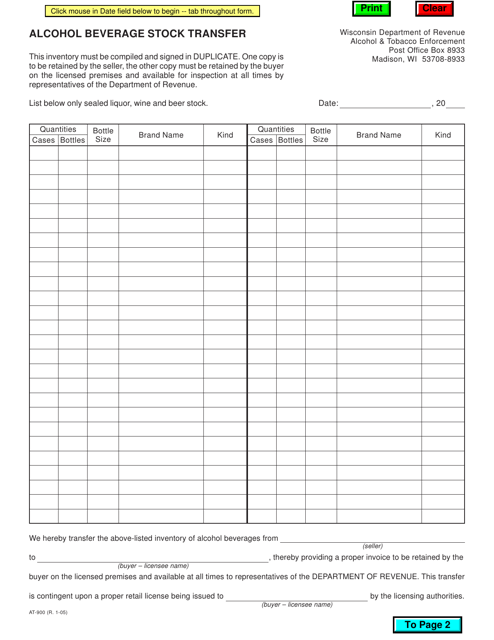

This form is used for transferring stock of alcohol beverages in the state of Wisconsin. It is required by the Wisconsin Department of Revenue for recordkeeping and regulatory purposes.

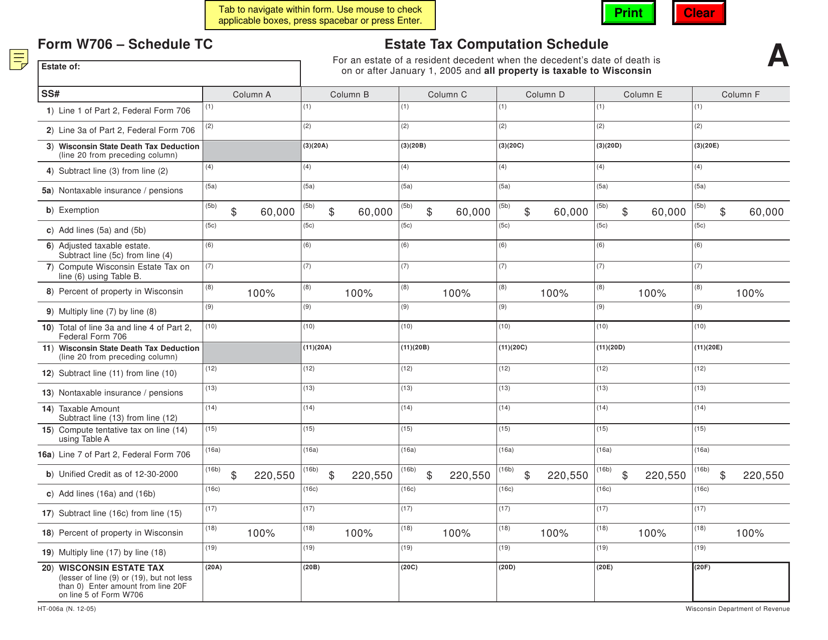

This document is a tax computation schedule used for deaths that occurred on or after January 1, 2005 in Wisconsin. It applies to situations where all property is taxable in Wisconsin.

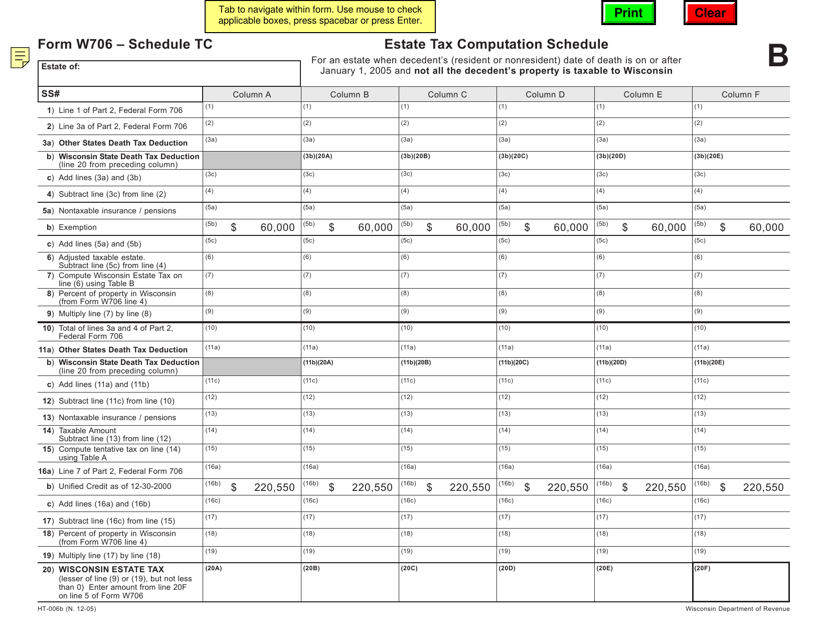

This form is used for calculating the tax for deaths that occurred on or after January 1, 2005, in cases where not all of the deceased person's property is taxable to the state of Wisconsin.

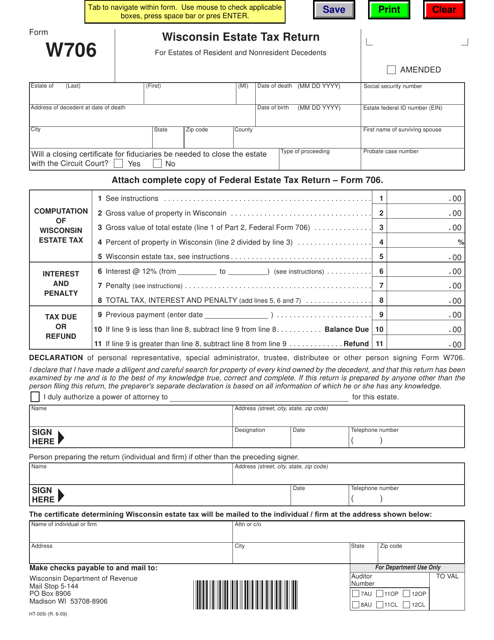

This document is used for filing the Wisconsin Estate Tax Return for estates of resident and nonresident decedents in the state of Wisconsin.

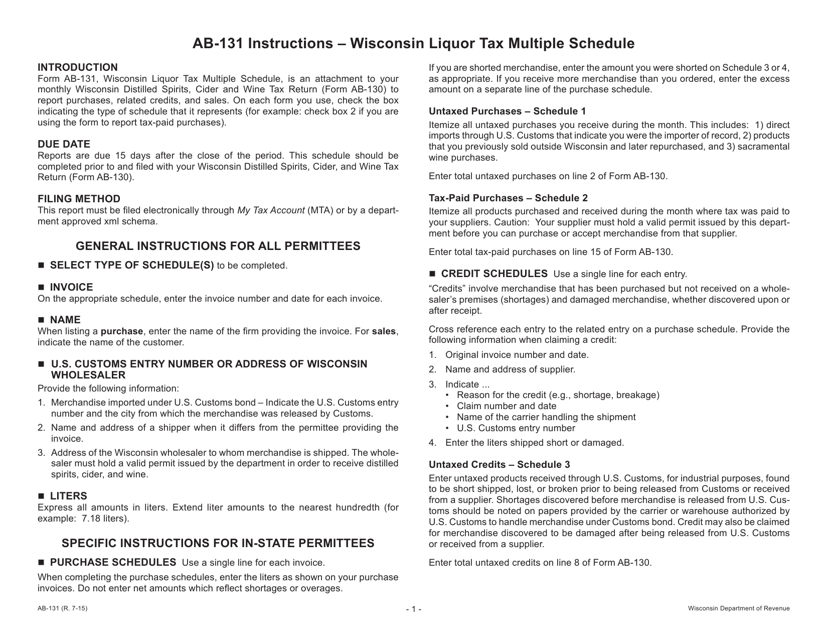

This Form is used for reporting liquor taxes in Wisconsin. It includes multiple schedule options for different types of liquor.

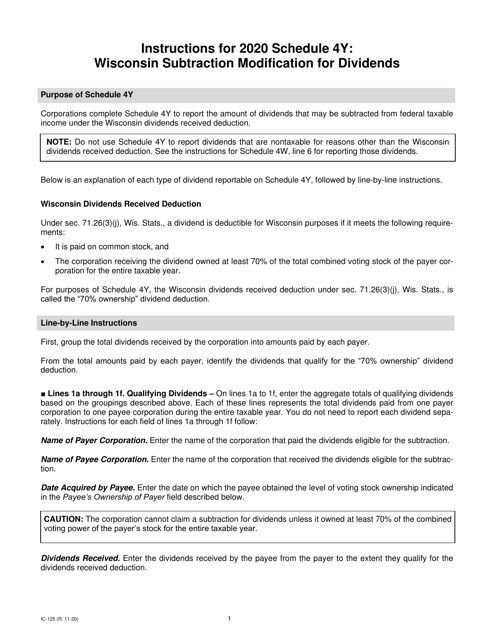

This Form is used for reporting a subtraction modification for dividends in Wisconsin.

Instructions for Form IC-074 Schedule ED Wisconsin Economic Development Tax Credit - Wisconsin, 2023

Instructions for Form IC-034 Schedule HR Wisconsin Historic Rehabilitation Credits - Wisconsin, 2023

This document provides instructions for completing Schedule 2K-1, which calculates a beneficiary's share of income, deductions, and other information related to Wisconsin taxes. These instructions guide taxpayers on how to accurately report their income and deductions on this form.