Wisconsin Department of Revenue Forms

Documents:

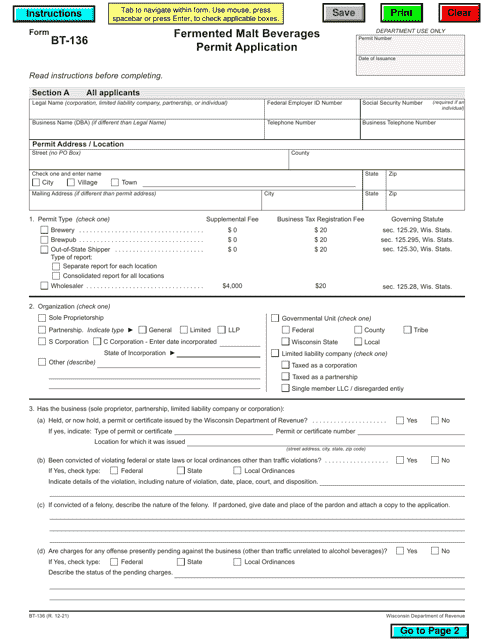

1007

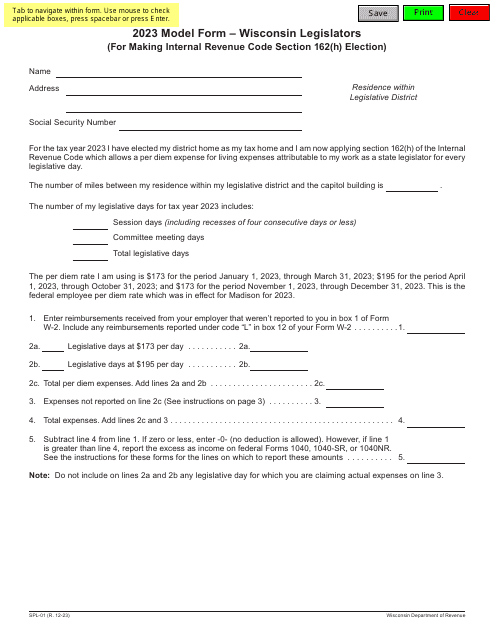

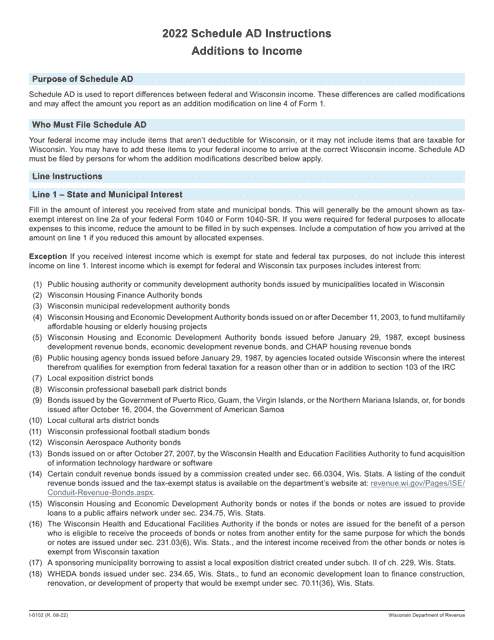

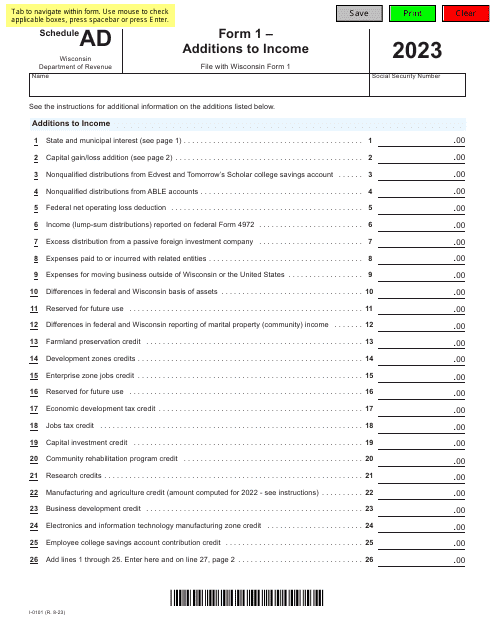

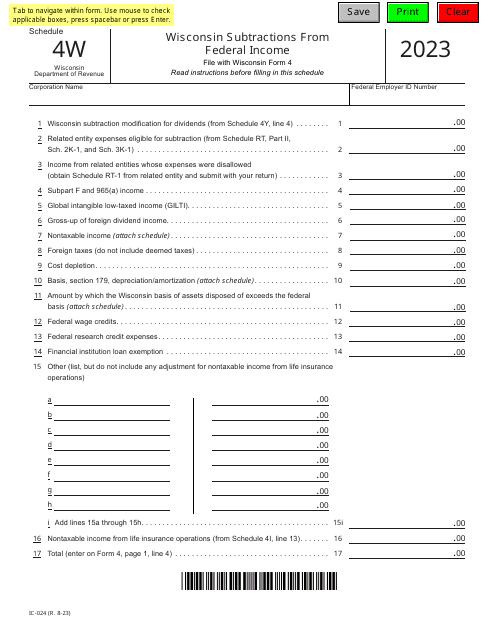

This Form is used for reporting additional income in the state of Wisconsin on Form I-0101 Schedule AD. It provides instructions on how to accurately report and calculate the additions to your income for tax purposes.

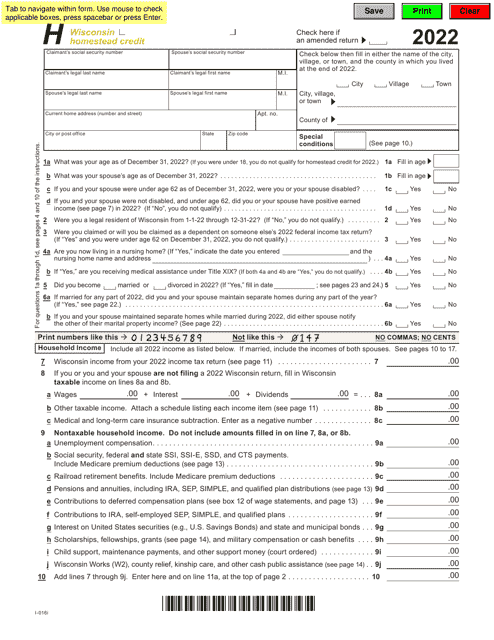

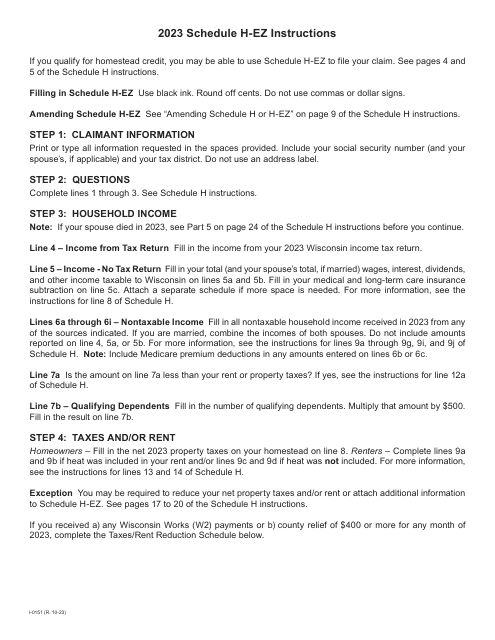

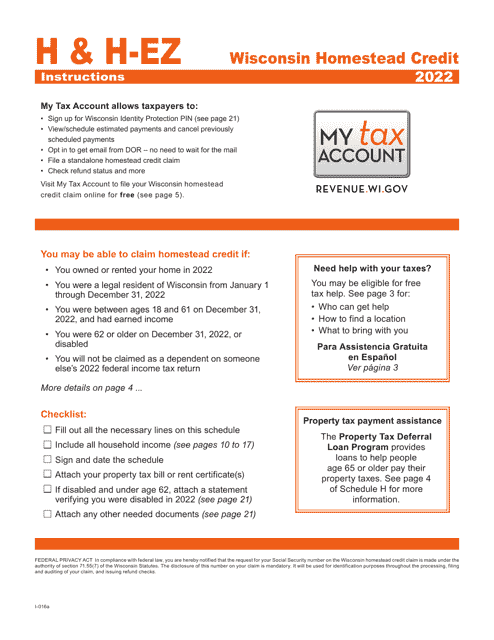

This Form is used for providing instructions for Form I-016I and Schedule H, H-EZ specific to the state of Wisconsin.

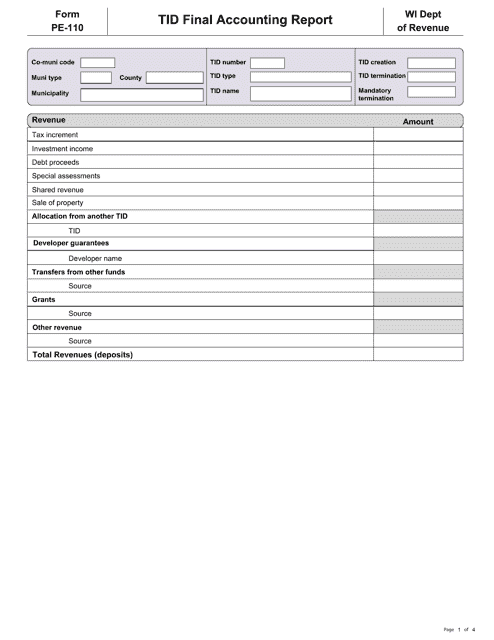

This form is used for submitting a final accounting report in the state of Wisconsin. It is known as Form PE-110 TID.

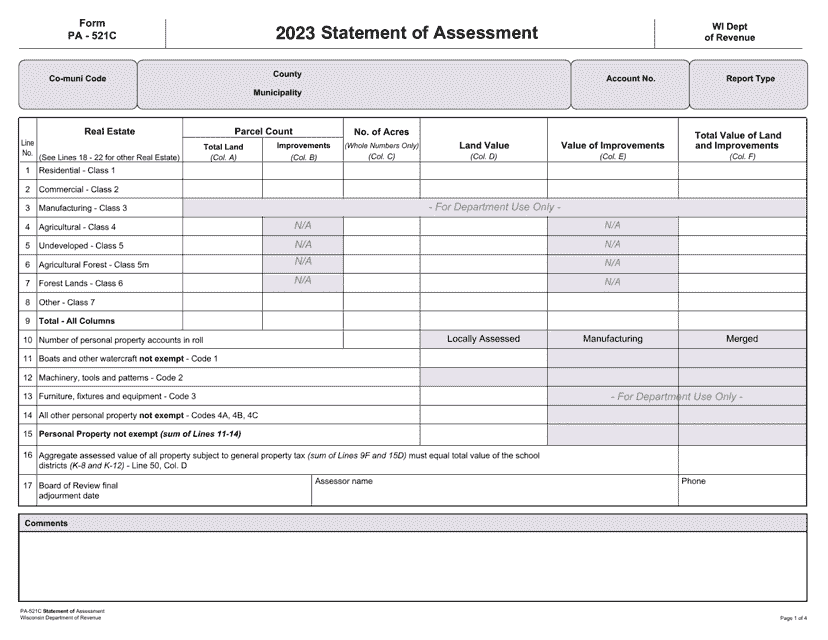

This form is used for filing a statement of assessment in the state of Wisconsin. It is used to report the assessed value of real or personal property for tax purposes.

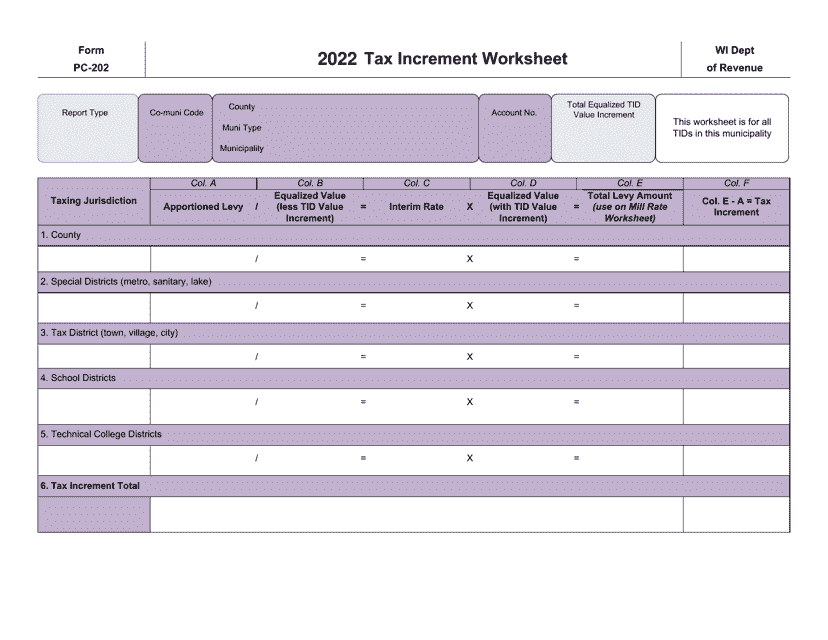

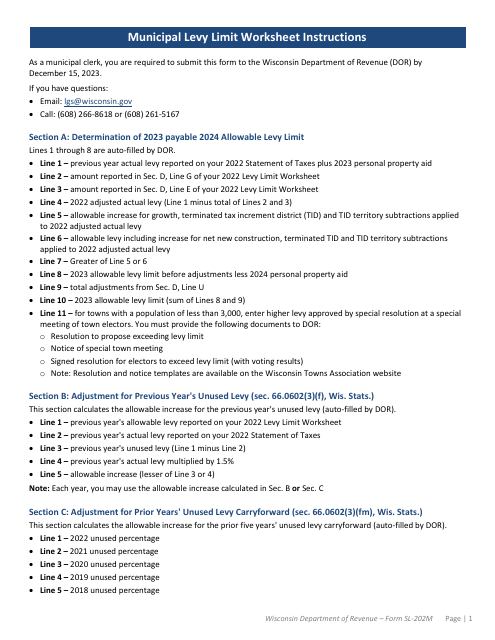

This Form is used for calculating tax increment in the state of Wisconsin.

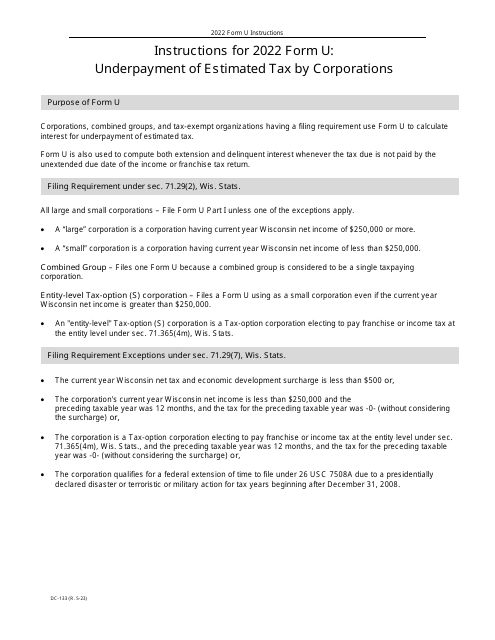

This form is used for reporting any underpayment of estimated tax by corporations in the state of Wisconsin. It provides instructions on how to calculate and report the underpayment.

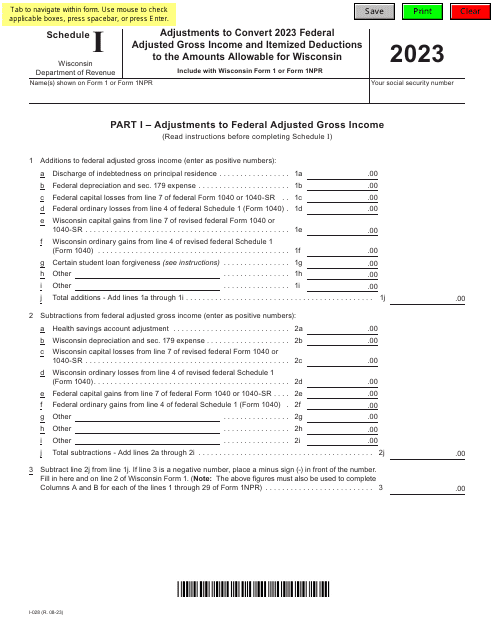

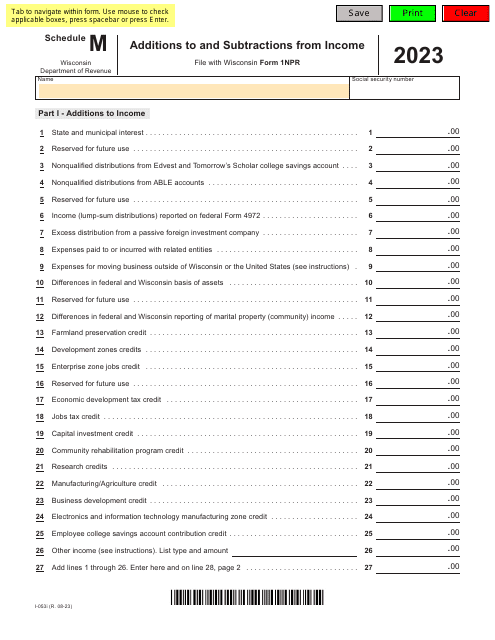

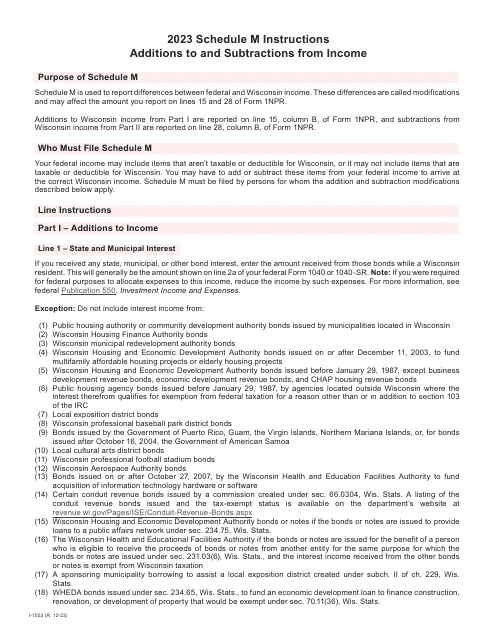

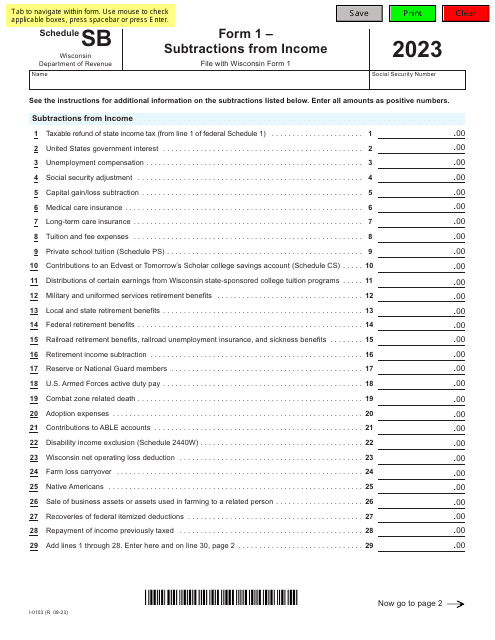

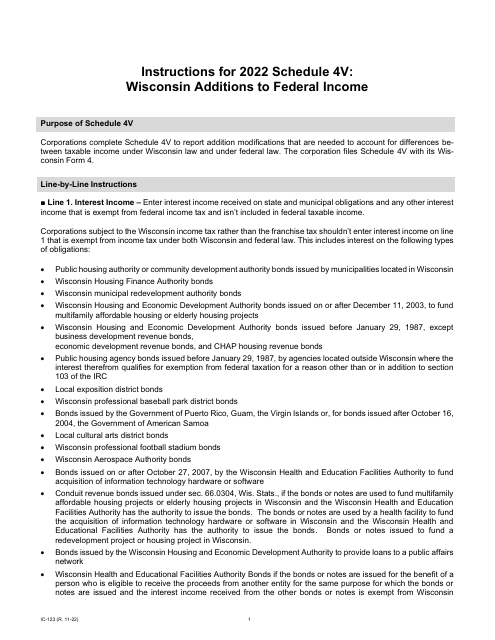

This form is used for reporting additions to your federal income for tax purposes in the state of Wisconsin. It is specifically for residents of Wisconsin who need to report these additions on their state tax return.