West Virginia Department of Revenue Forms

The West Virginia Department of Revenue is responsible for administering and enforcing tax laws and regulations in the state of West Virginia. Its main purpose is to collect various taxes, such as income tax, sales tax, and property tax, to fund government operations and services in the state. The department also provides taxpayer assistance, processes tax returns, and conducts audits to ensure compliance with tax laws.

Documents:

5

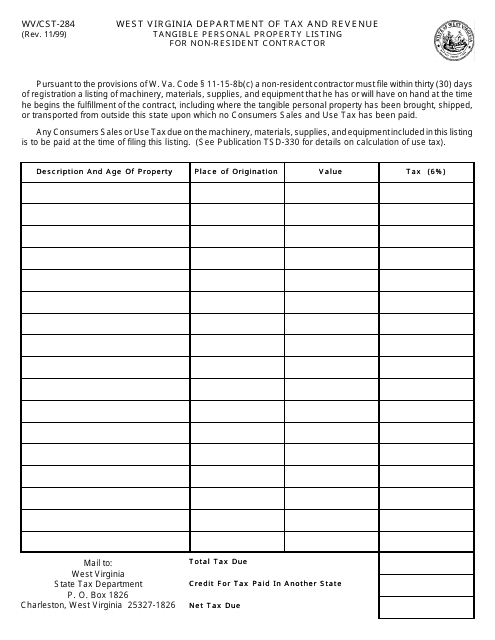

This form is used for non-resident contractors in West Virginia to list their tangible personal property.

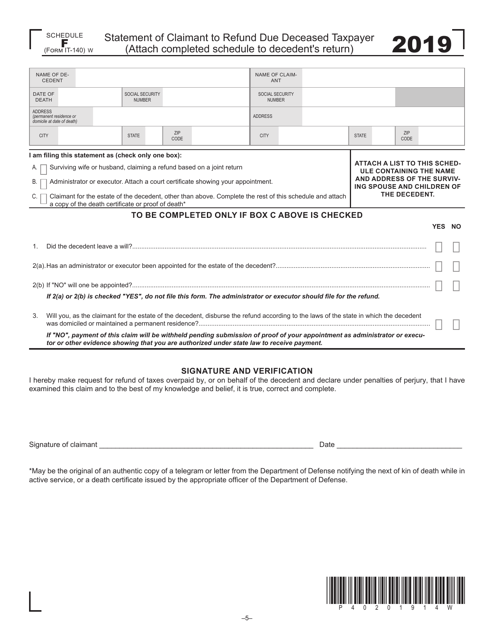

This Form is used for claiming a refund on behalf of a deceased taxpayer in West Virginia.

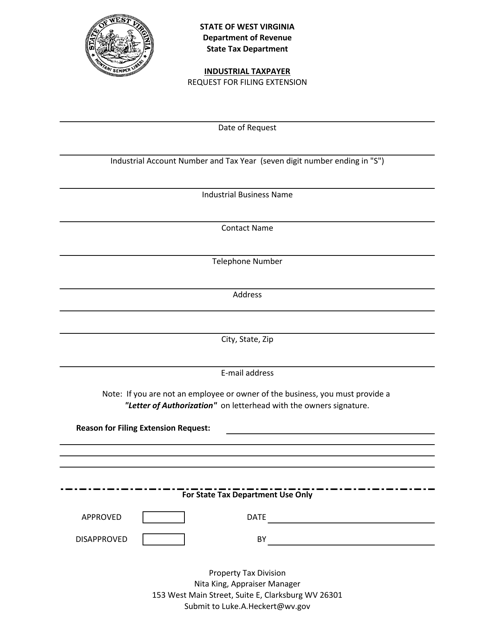

This type of document is a request form for industrial taxpayers in West Virginia to request an extension for filing their taxes.

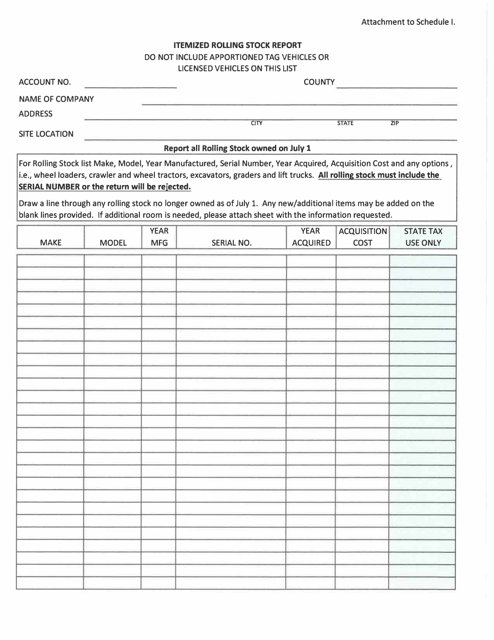

This document is an attachment to Schedule I and is called the Itemized Rolling Stock Report. It is specific to the state of West Virginia.

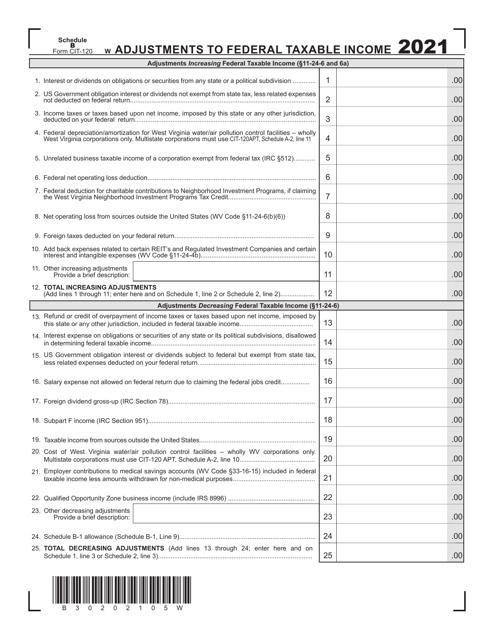

This form is used for making adjustments to your federal taxable income when filing taxes in West Virginia.