West Virginia State Tax Division Forms

The West Virginia State Tax Department is responsible for administering and enforcing various taxes and related laws in the state of West Virginia. They collect taxes, provide taxpayer assistance, and ensure compliance with tax rules and regulations. The department handles both individual and business tax matters, including income tax, sales tax, property tax, and other state taxes. They also provide guidance and resources to help taxpayers understand their tax obligations and file their tax returns accurately.

Documents:

527

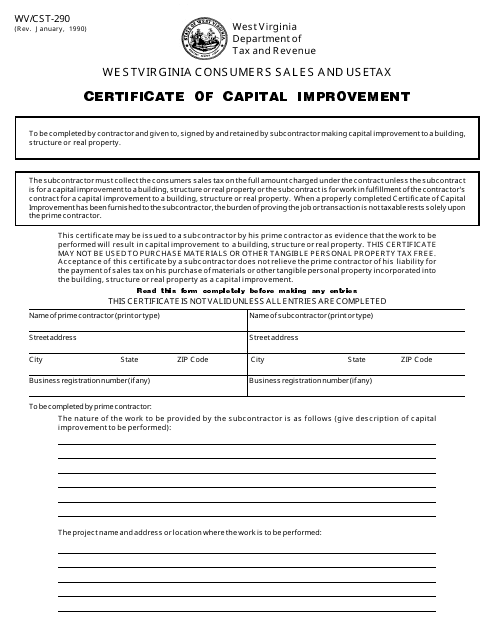

This Form is used for obtaining a certificate of capital improvement in West Virginia. It is used to document and report any capital improvements made to a property.

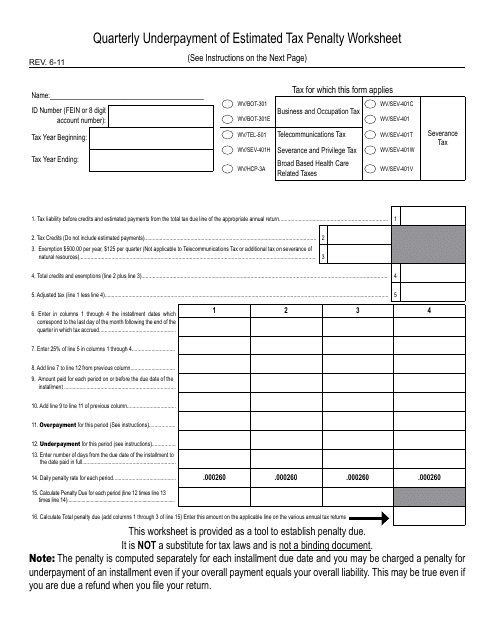

This type of document is used for calculating the penalty for underpayment of estimated tax in West Virginia on a quarterly basis.

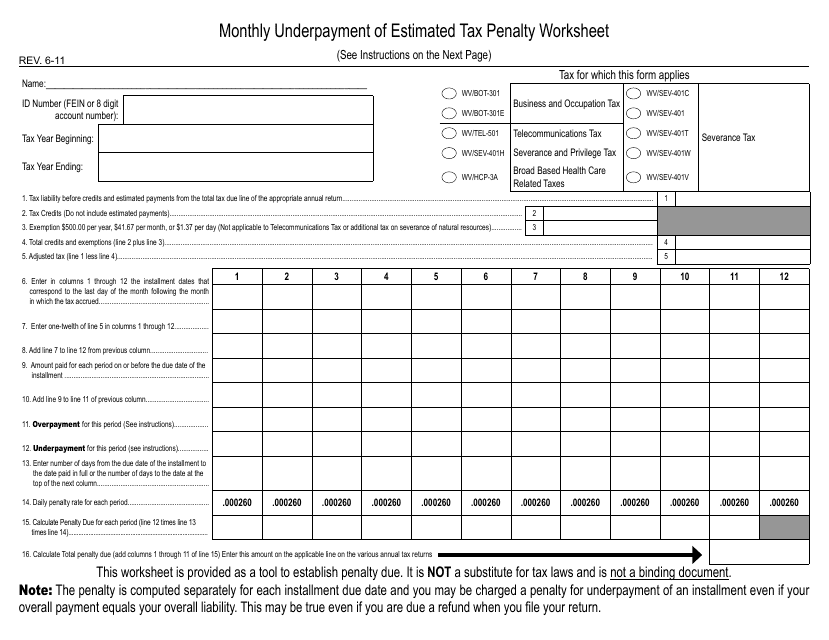

This form is used for calculating the penalty for underpayment of estimated taxes on a monthly basis for taxpayers in West Virginia.

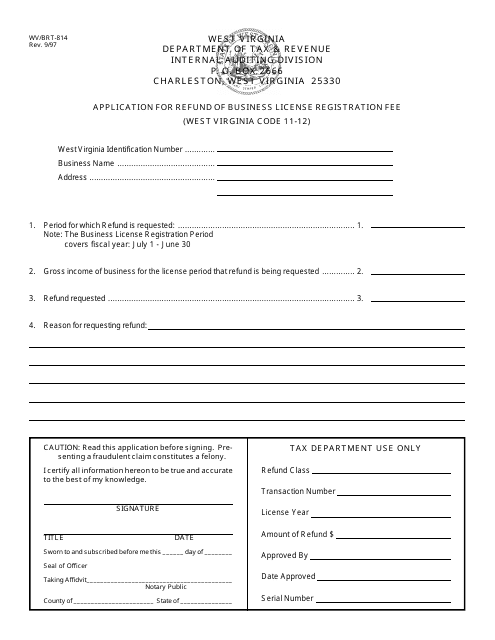

This form is used for applying for a refund of the business license registration fee in West Virginia.

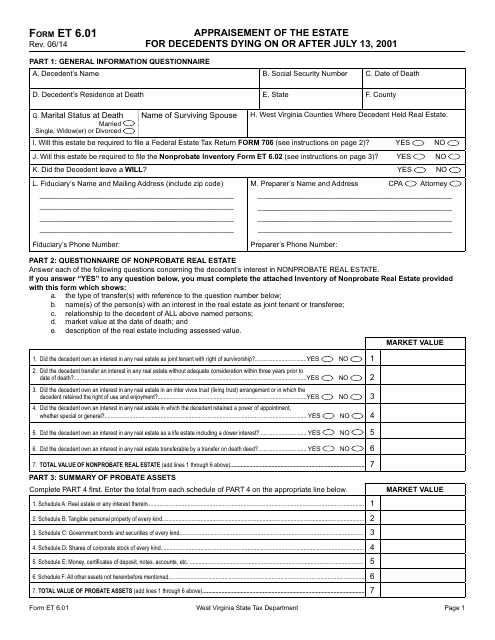

Form ET6.01 Appraisement of the Estate for Decedents Dying on or After July 13, 2001 - West Virginia

This form is used for appraising the estate of individuals who have passed away in West Virginia on or after July 13, 2001.

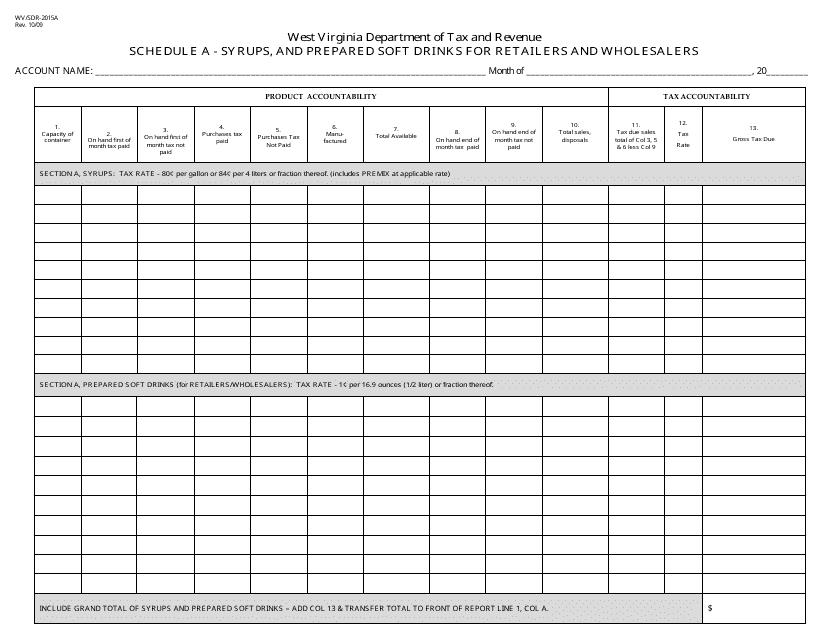

This form is used for retailers and wholesalers in West Virginia to report sales of syrups and prepared soft drinks.

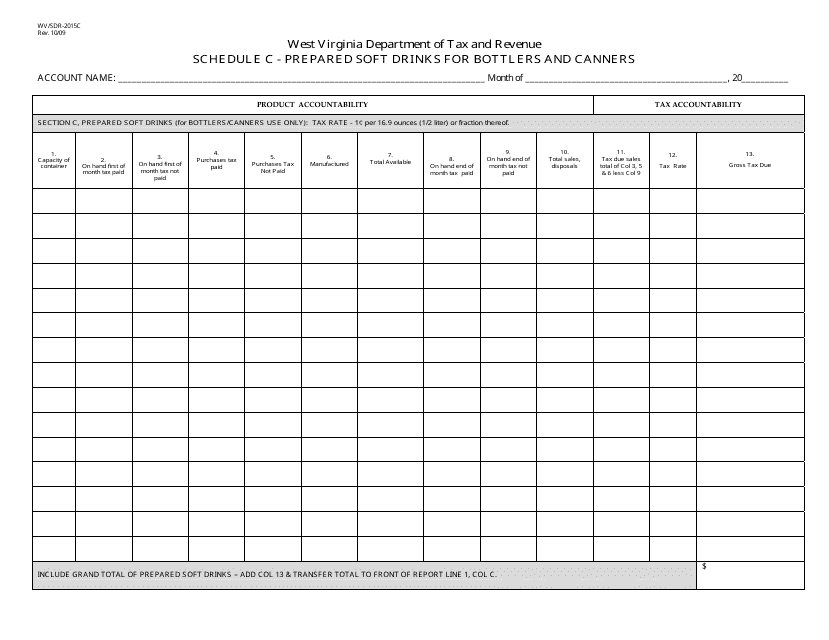

This Form is used for reporting the schedule C prepared soft drinks for bottlers and canners in West Virginia.

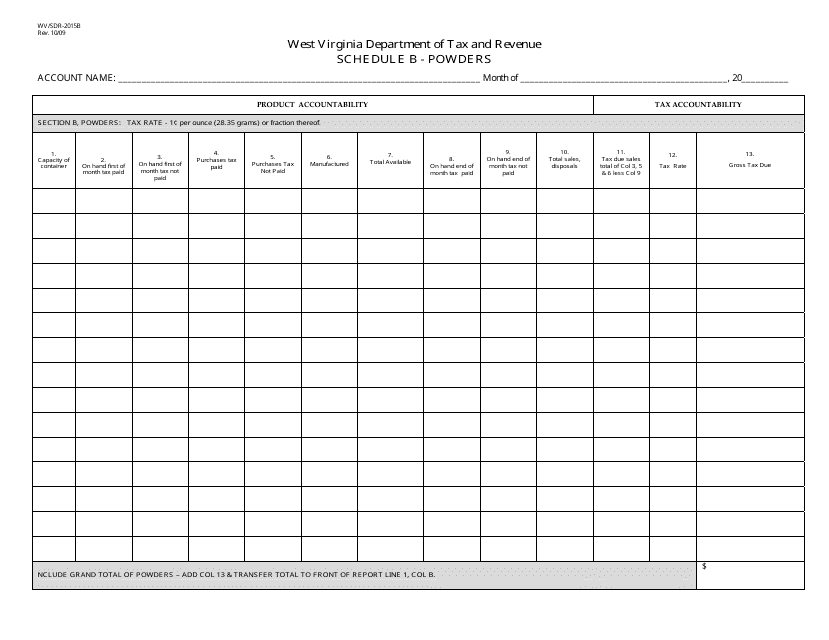

This Form is used for reporting the schedule of powders used in West Virginia.

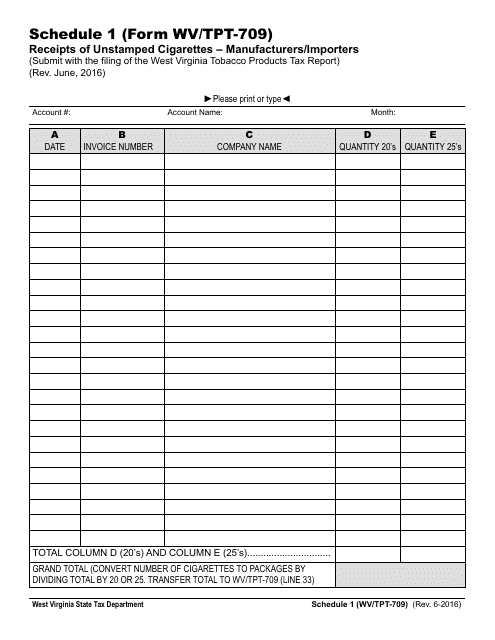

This form is used for reporting the receipts of unstamped cigarettes by manufacturers and importers in West Virginia.

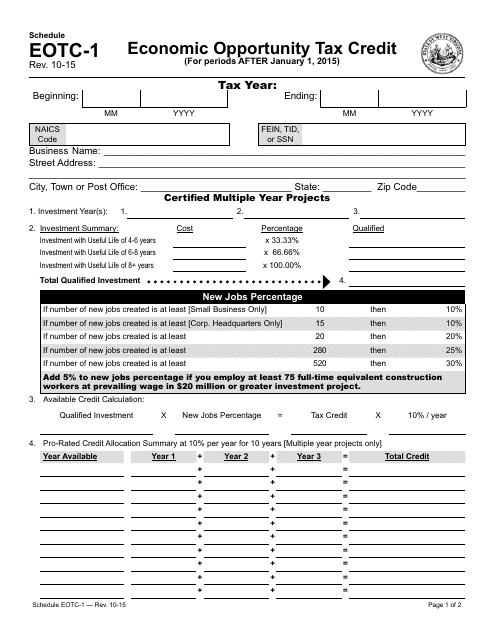

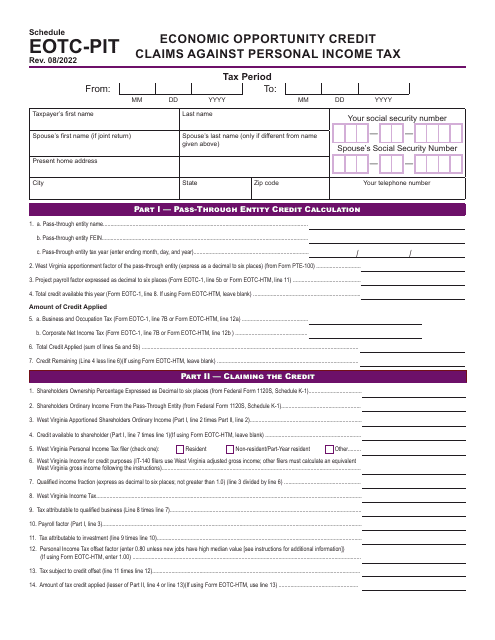

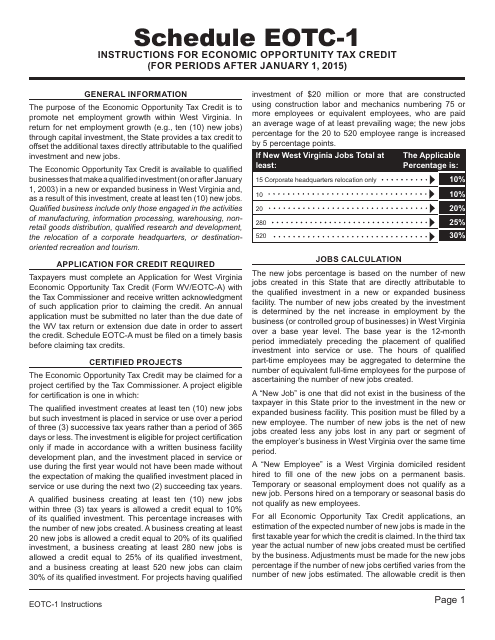

This document is for claiming the Economic Opportunity Tax Credit in West Virginia. It is used to report and apply for this tax credit available to businesses who have made qualified investments in designated distressed areas in the state.

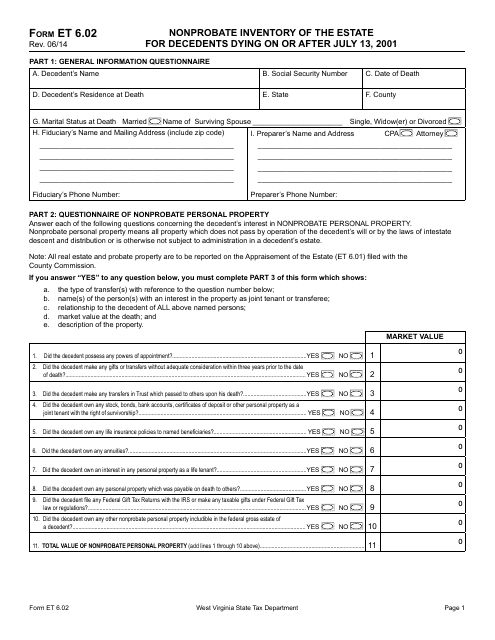

This Form is used for creating a Nonprobate Inventory of the Estate for Decedents Dying on or After July 13, 2001 in West Virginia.

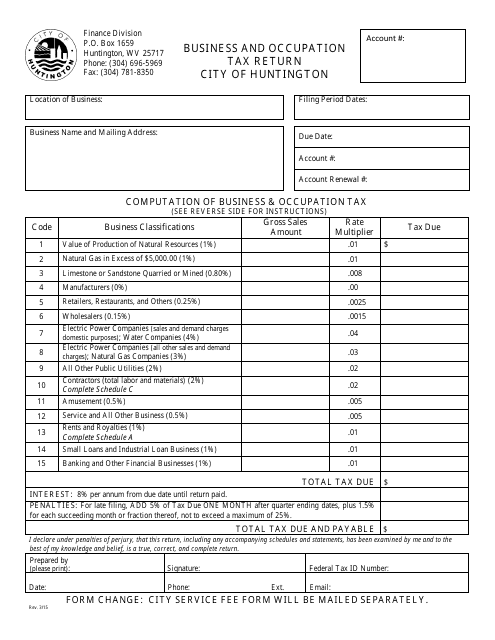

This form is used for reporting and paying business and occupation taxes to the City of Huntington, West Virginia.

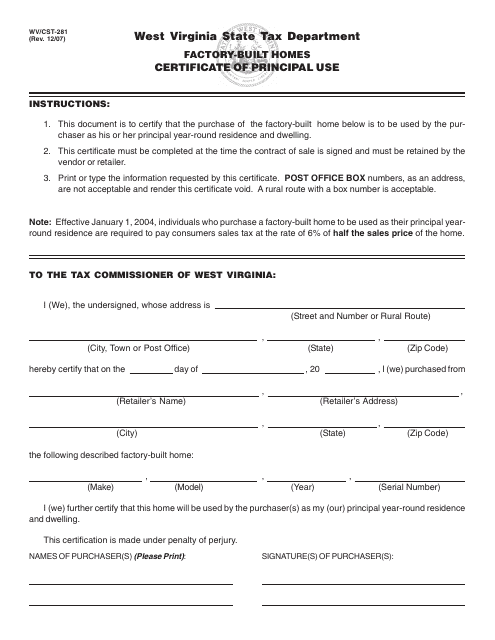

This form is used for obtaining a certificate of principal use for factory-built homes in West Virginia.

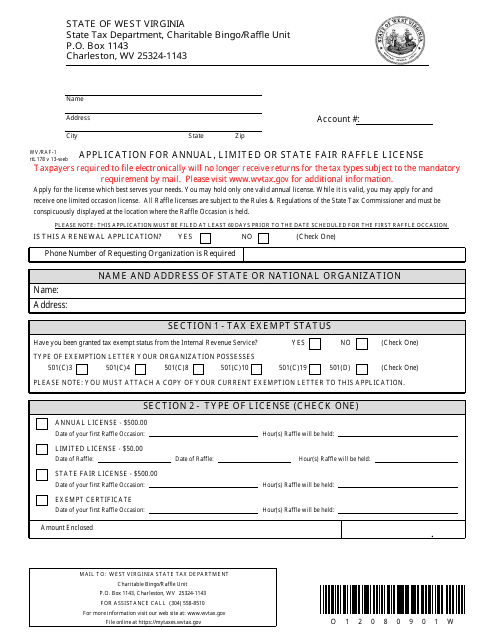

This form is used to apply for an annual, limited, or State Fair raffle license in West Virginia.

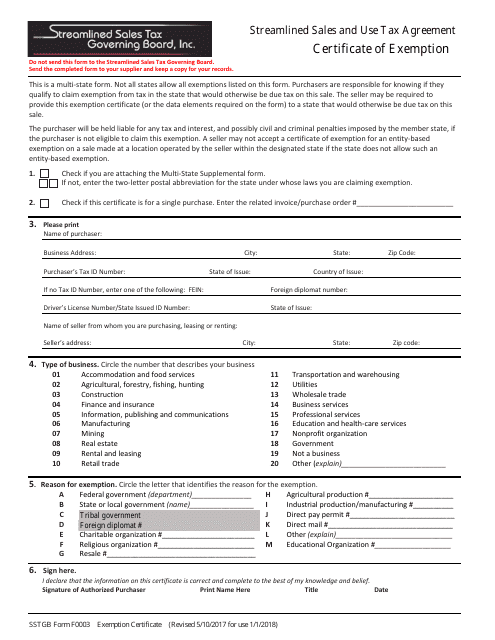

This form is used for applying for a Certificate of Exemption under the Streamlined Sales and Use Tax Agreement in West Virginia.

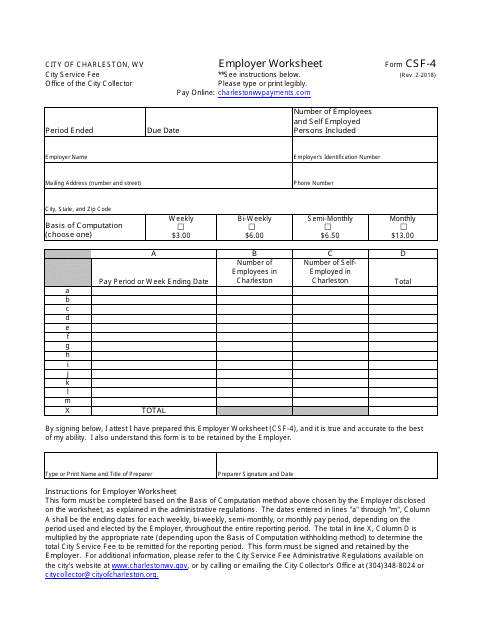

This form is used for employers in the City of Charleston, West Virginia to fill out and provide information related to their business.

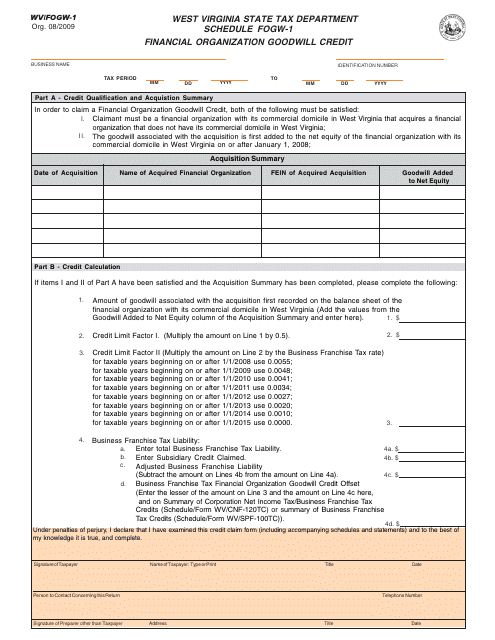

This document is used to report financial organization goodwill credit in West Virginia.

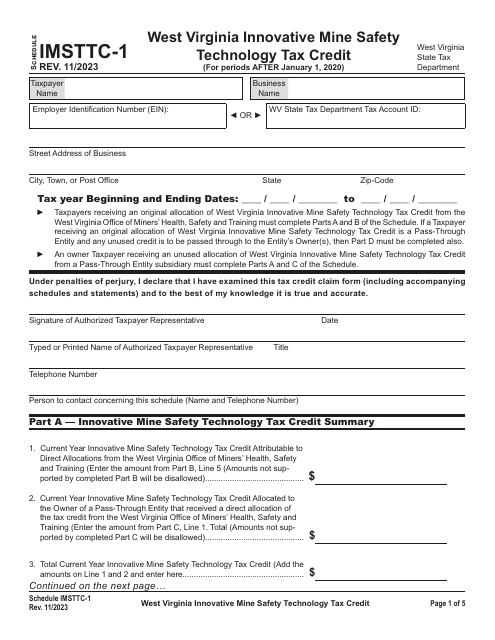

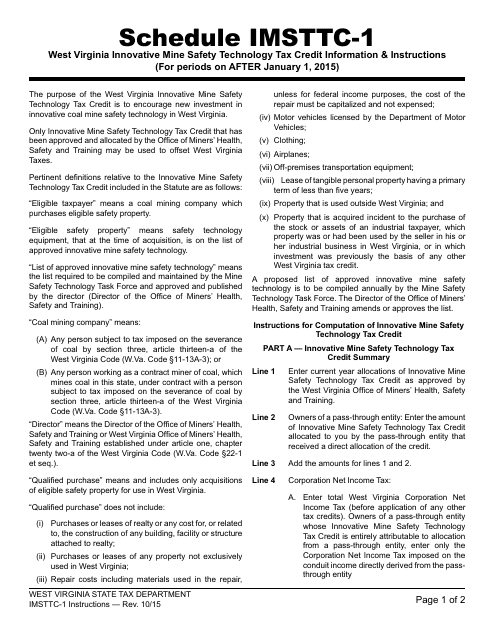

This document provides instructions for completing Schedule IMSTTC-1, which is the West Virginia Innovative Mine Safety Technology Tax Credit. The schedule is used by individuals and businesses in West Virginia to claim a tax credit for innovative mine safety technology investments.

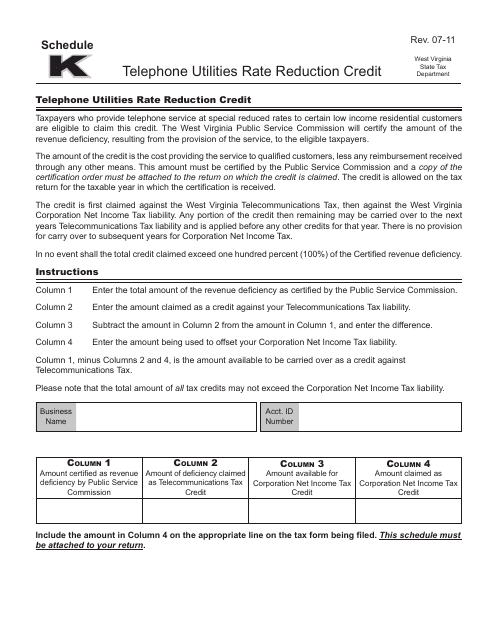

This Form is used for claiming the Telephone Utilities Rate Reduction Credit in West Virginia. This credit may help reduce the amount of tax you owe on your telephone bill.

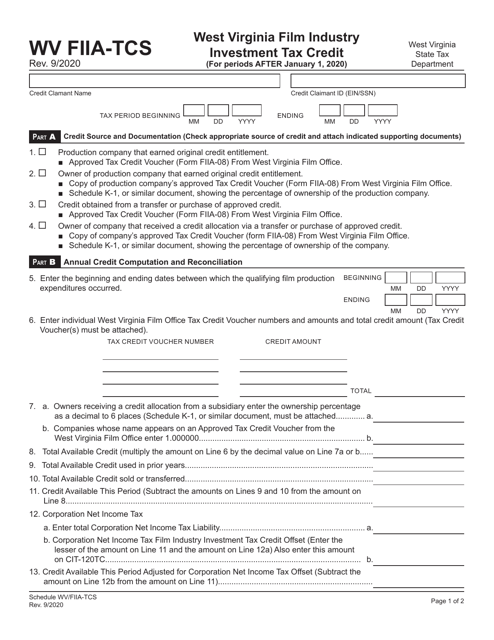

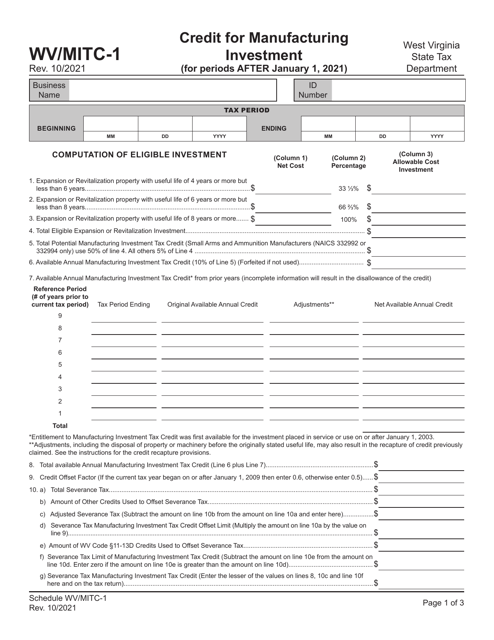

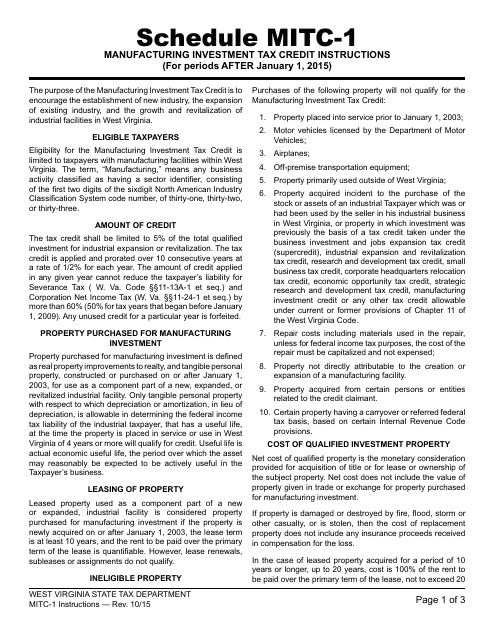

This Form is used to claim a tax credit for manufacturing investment in West Virginia for periods after January 1, 2015. It provides instructions on how to fill out the form and what documentation is required.

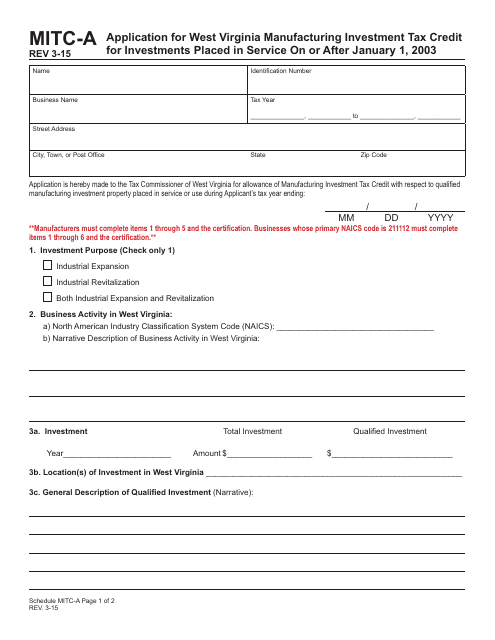

This Form is used for applying for the West Virginia Manufacturing Investment Tax Credit for investments made after January 1, 2003.

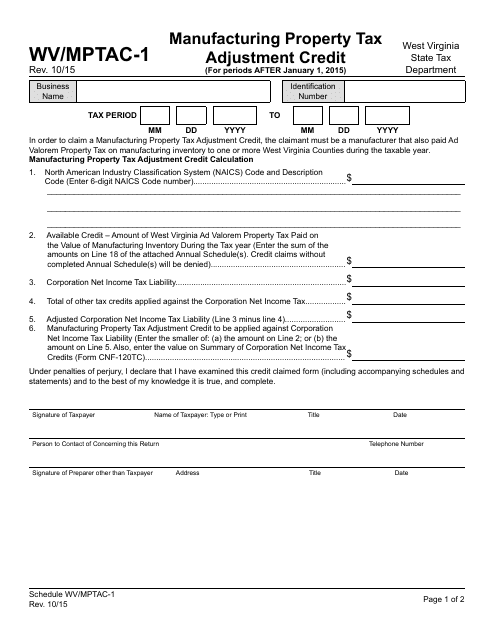

This Form is used for claiming the Manufacturing Property Tax Adjustment Credit in West Virginia. It is specifically for manufacturing companies to seek a reduction in their property tax liability.

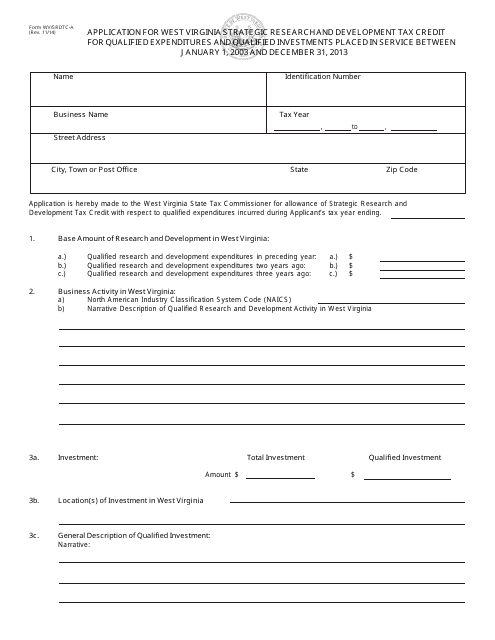

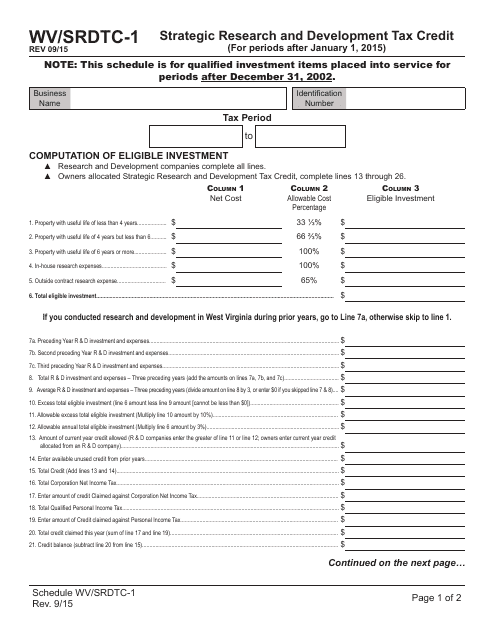

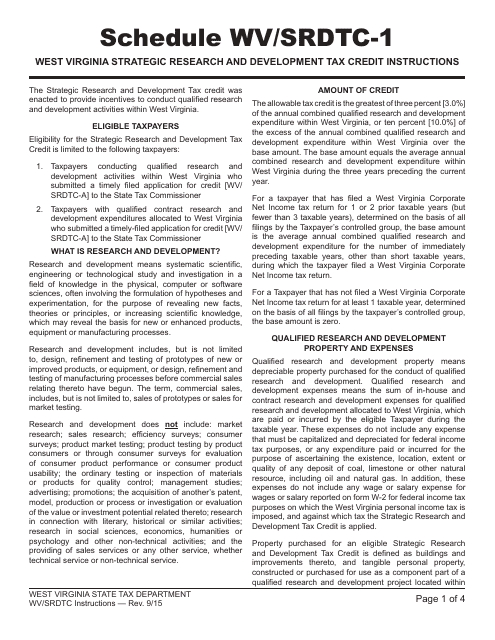

This Form is used for applying for the West Virginia Strategic Research and Development Tax Credit. It applies to qualified expenditures and qualified investments placed in service on or after January 1, 2003.

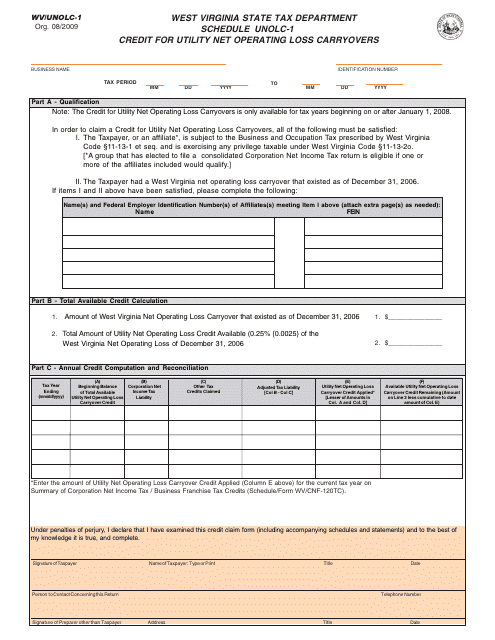

This form is used for claiming credits for utility net operating loss carryovers in West Virginia.

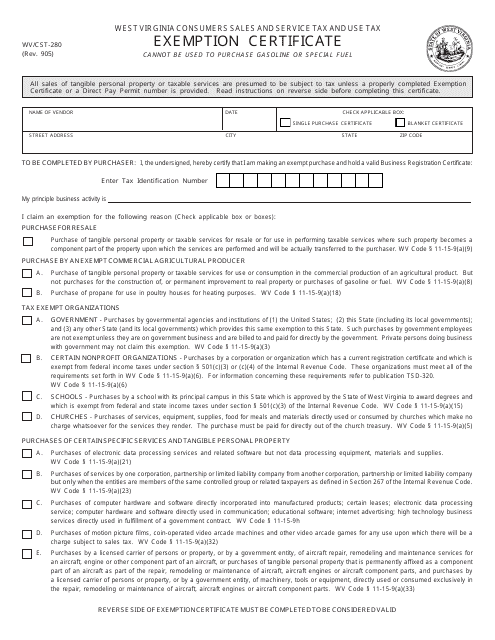

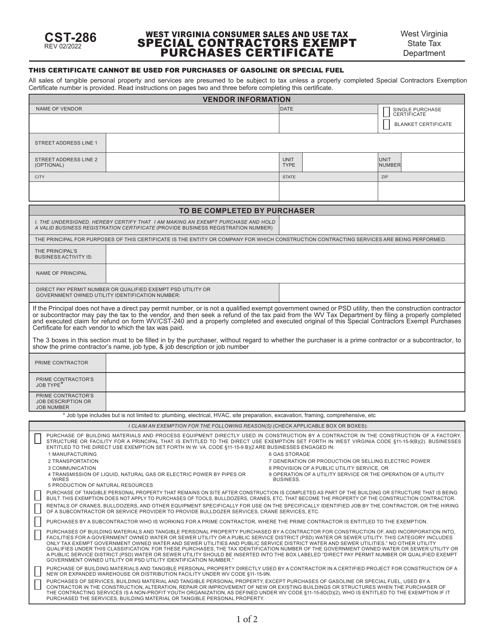

This form is used in the state of West Virgina to claim exemption from paying sales tax on the purchase of tangible personal property or services which will be used for exempt purposes.

This document is for scheduling the WV/SRDTC-1 Strategic Research and Development Tax Credit in West Virginia.

This Form is used for claiming the West Virginia Strategic Research and Development Tax Credit in the state of West Virginia.

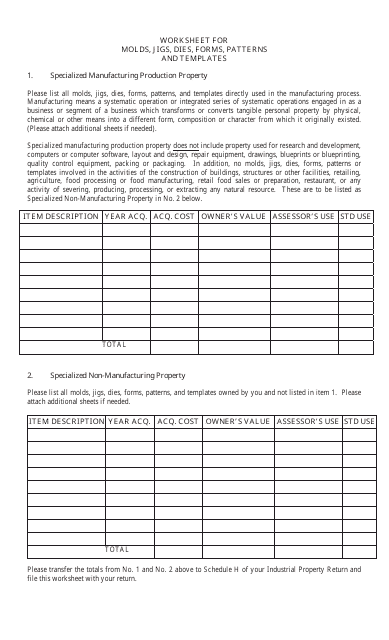

This document is a worksheet used in West Virginia for molds, jigs, dies, forms, patterns, and templates. It helps to organize and track these items for various purposes.

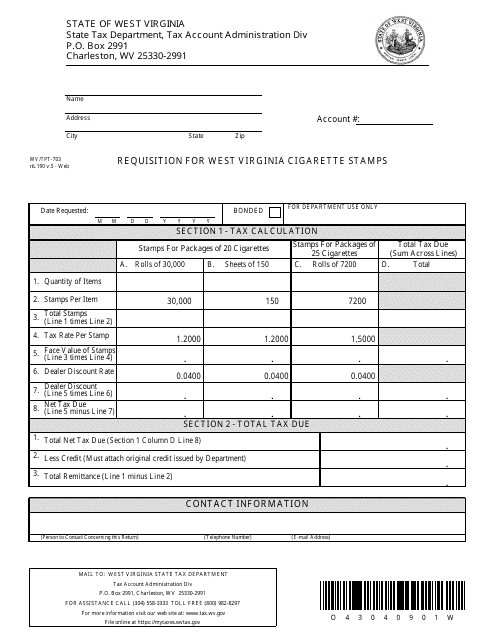

This form is used for requesting West Virginia cigarette stamps in the state of West Virginia.