Texas Department of Savings and Mortgage Lending Forms

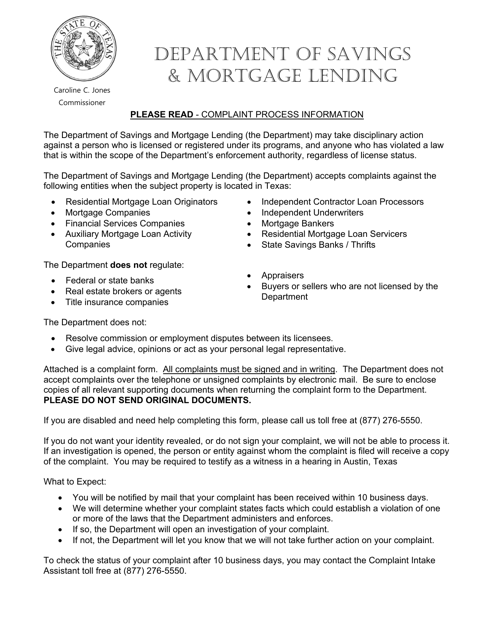

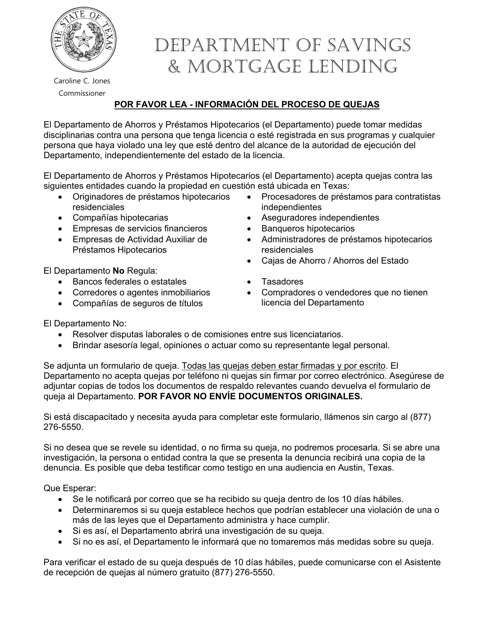

The Texas Department of Savings and Mortgage Lending is responsible for regulating and overseeing the mortgage industry and related financial institutions in Texas. They ensure that mortgage companies, lenders, and other entities comply with state laws and regulations to protect consumers and maintain the integrity of the mortgage market. They also provide licensing and examination services for mortgage professionals and enforce penalties for any violations that occur.

Documents:

19

This document is used for applying for eligibility determination in the state of Texas.

This document is used for disclosing multiple roles in a consumer real estate transaction in the state of Texas. It ensures transparency and notifies all parties involved about any potential conflicts of interest.

This document provides disclosure information specific to mortgage bankers in the state of Texas. It includes important details about the roles and responsibilities of mortgage bankers.

This Form is used for applying for the Recovery Fund in the state of Texas. The Recovery Fund provides financial assistance to individuals and businesses affected by natural disasters or emergencies.

This document provides a warning about the penalty for making a false or misleading statement in Texas.

This document is for the Bond Residential Mortgage Loan Servicer in the state of Texas. It pertains to the responsibilities and regulations of mortgage loan servicing in Texas.

This document is used for making a claim to the Monetary Recovery Fund in Texas.

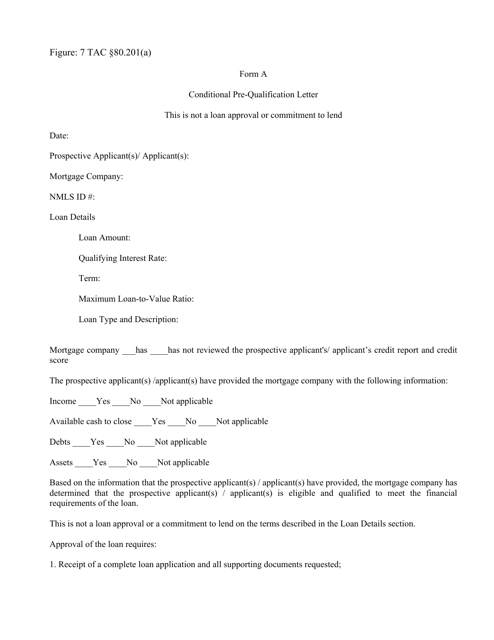

This form is used for obtaining a conditional pre-qualification letter in the state of Texas. It helps individuals determine their eligibility for a loan or mortgage.

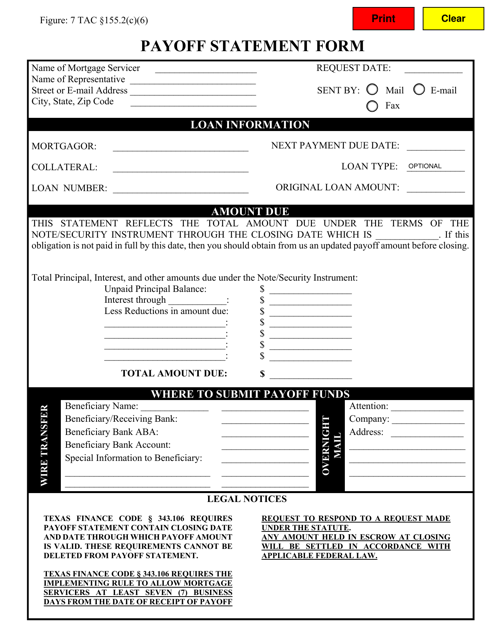

This Form is used for requesting a payoff statement in the state of Texas. A payoff statement provides information on the remaining balance and any additional fees or charges needed to fully satisfy a loan or mortgage.

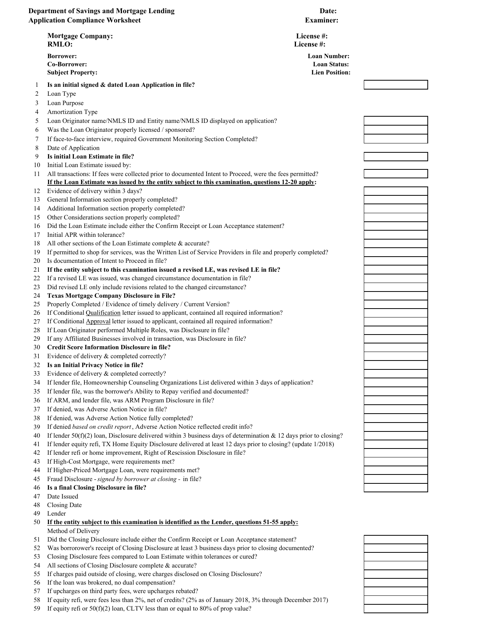

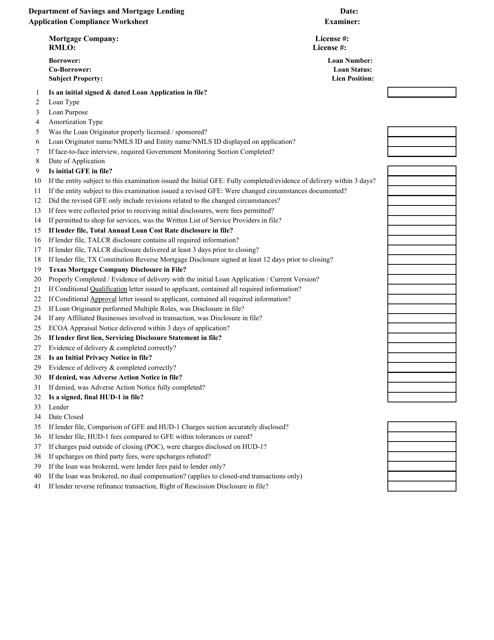

This document is used by a mortgage company in Texas to ensure compliance with the application requirements for mortgage applications.

This document is used by a mortgage company in Texas to assess compliance with regulations for reverse mortgages. It helps ensure that all necessary documents and information are in order for the application process.

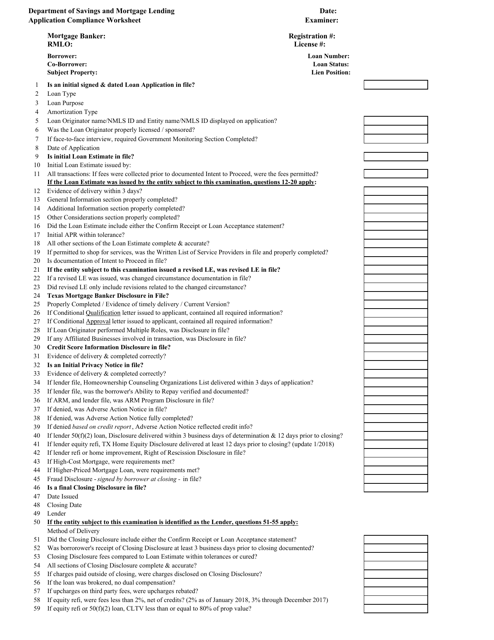

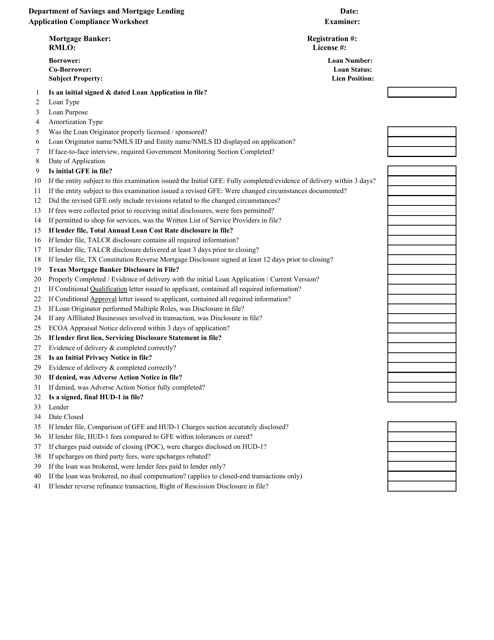

This document is used for assessing the compliance of mortgage bankers in Texas with the application requirements. It helps ensure that mortgage bankers are following the necessary guidelines and regulations.

This Form is used for assessing the compliance of reverse mortgage applications by mortgage bankers in Texas.

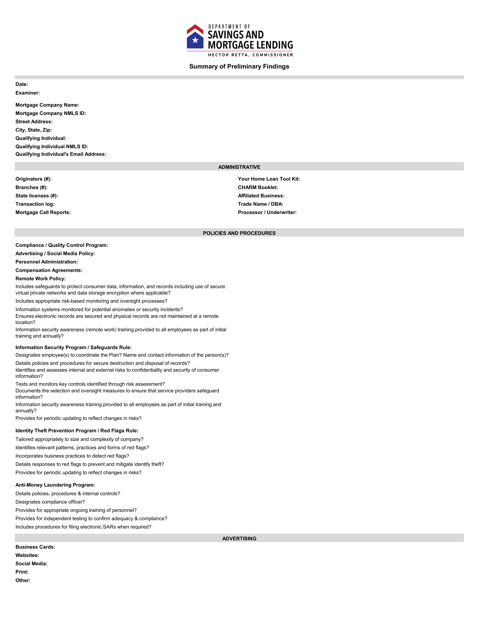

This document provides an overview of the initial findings made by a mortgage company in Texas. It gives a summary of the observations and conclusions made during the preliminary evaluation.

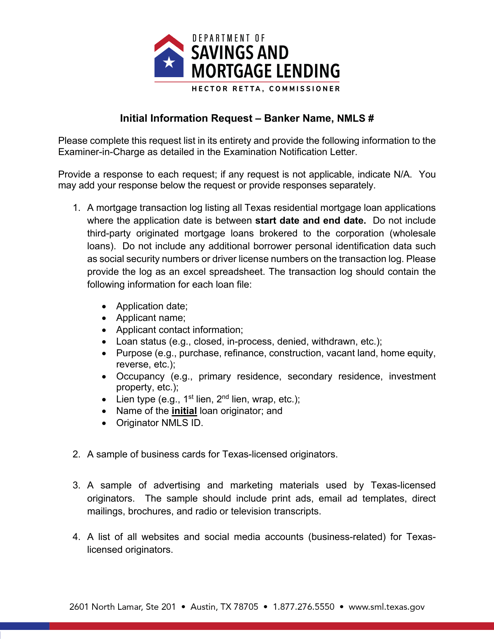

This document is for requesting initial information from a mortgage banker in Texas. It is used to gather necessary details for the mortgage application process.

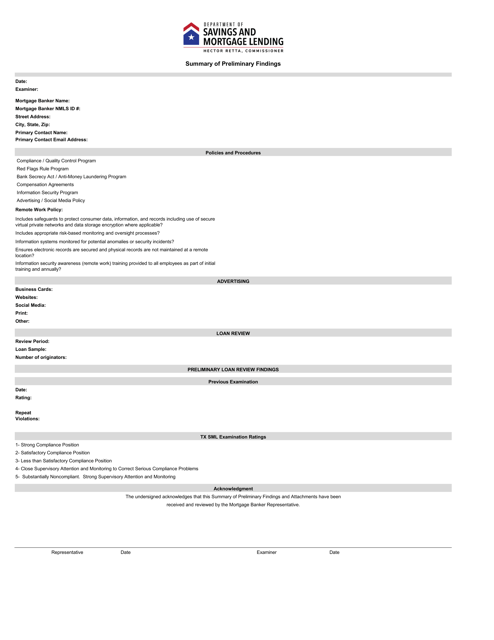

This document summarizes the preliminary findings of a mortgage banker in Texas. It provides an overview of the findings related to mortgage lending practices and trends in Texas.