South Dakota Department of Revenue Forms

The South Dakota Department of Revenue is responsible for administering and enforcing tax laws in the state of South Dakota. They collect various types of taxes, including income tax, sales tax, motor fuel tax, and excise taxes. The department also oversees the licensing and regulation of certain businesses and professions in the state. Additionally, they provide assistance and resources to taxpayers to help them understand and meet their tax obligations.

Documents:

100

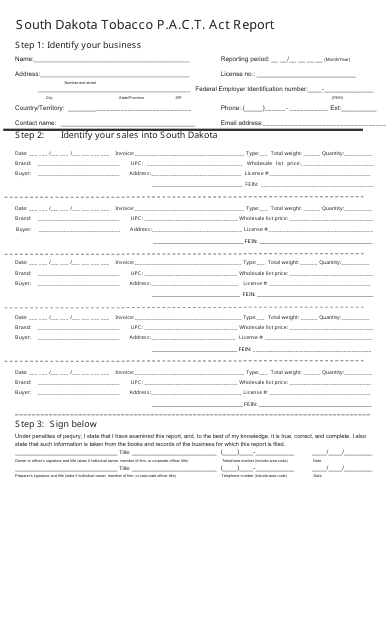

This document is a report filed as per the South Dakota Tobacco P.A.C.T. Act, which regulates the sale and distribution of tobacco products in South Dakota. It contains information related to tobacco sales and compliance in the state.

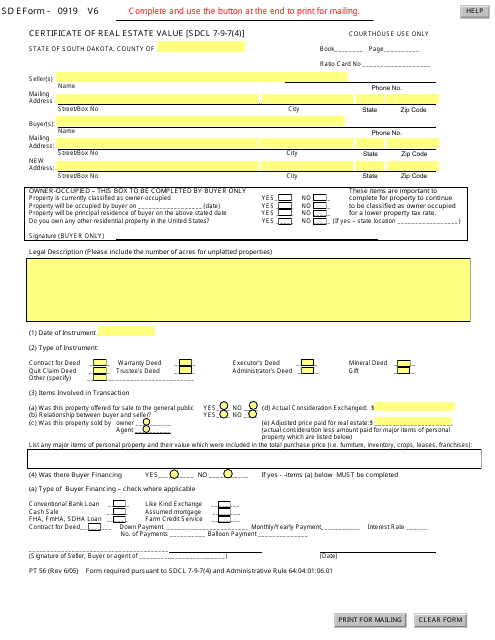

This form is used for reporting the value of real estate transactions in South Dakota. It is required for tax purposes and helps determine the assessment of property values.

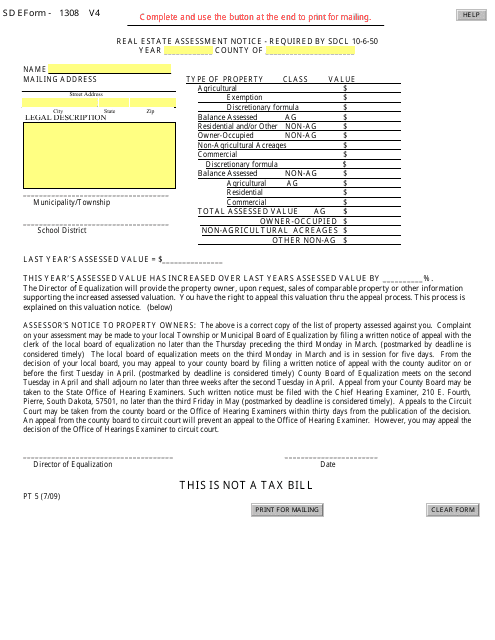

This Form is used for receiving a Real Estate Assessment Notice in South Dakota.

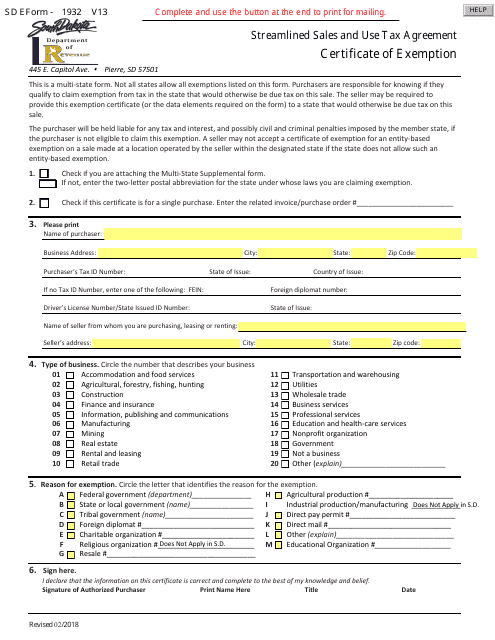

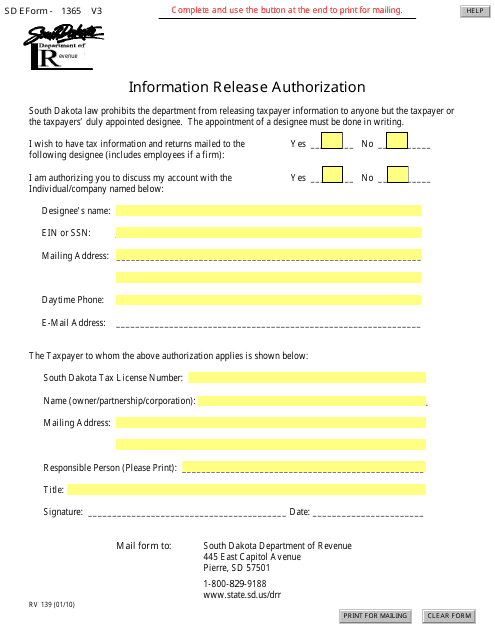

This form is used to authorize the release of information in the state of South Dakota.

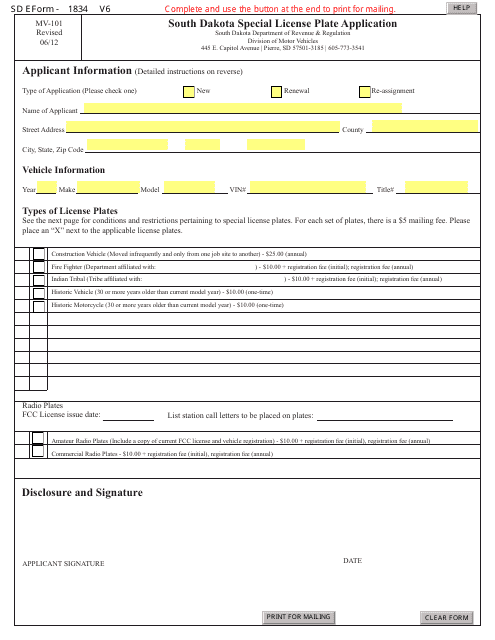

This Form is used for applying for special license plates in South Dakota.

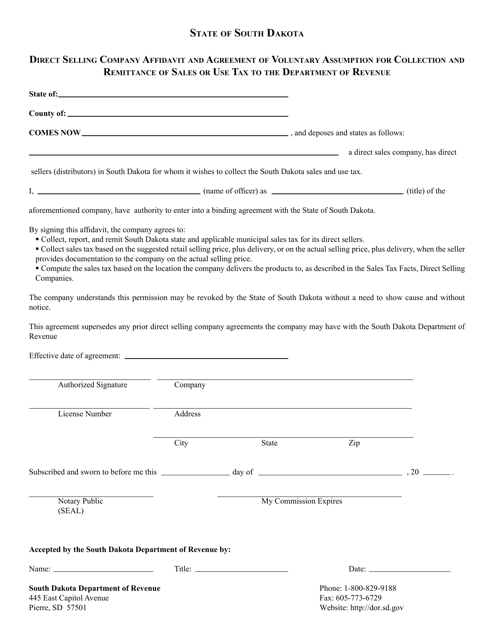

This document is used for a direct selling company to acknowledge and agree to voluntarily assume the responsibility of collecting and remitting sales or use tax to the Department of Revenue in South Dakota.

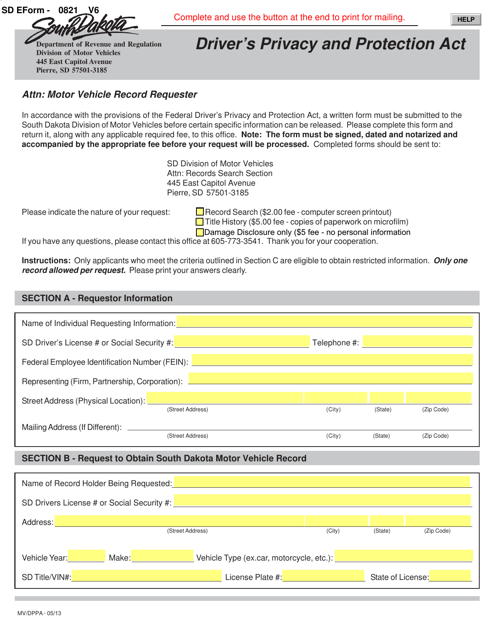

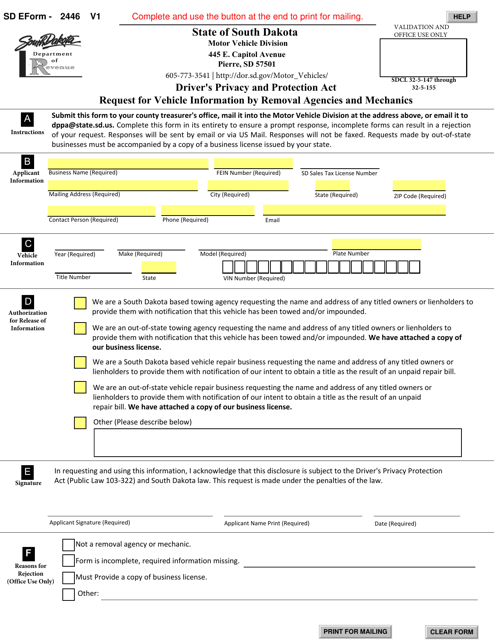

This form is used for Driver's Privacy and Protection Act in South Dakota.

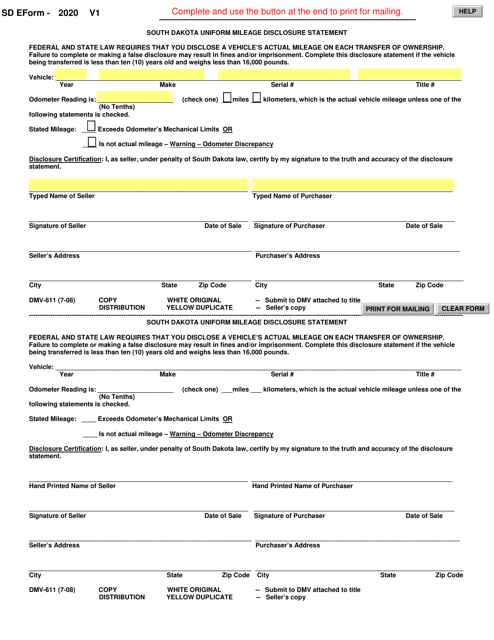

This Form is used for disclosing vehicle mileage in the state of South Dakota.

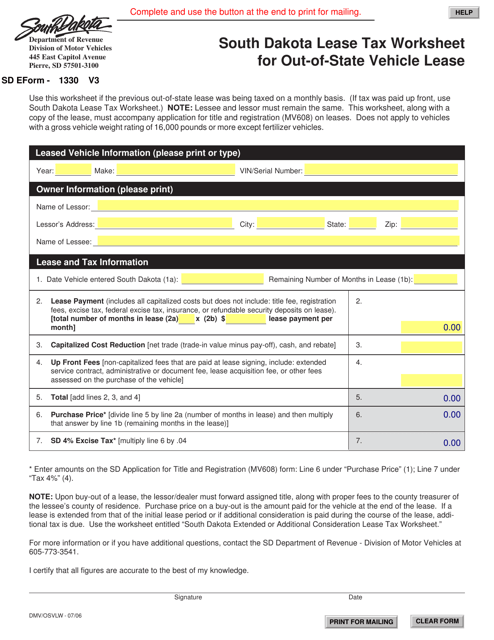

This Form is used for calculating lease tax on out-of-state vehicle leases in South Dakota.

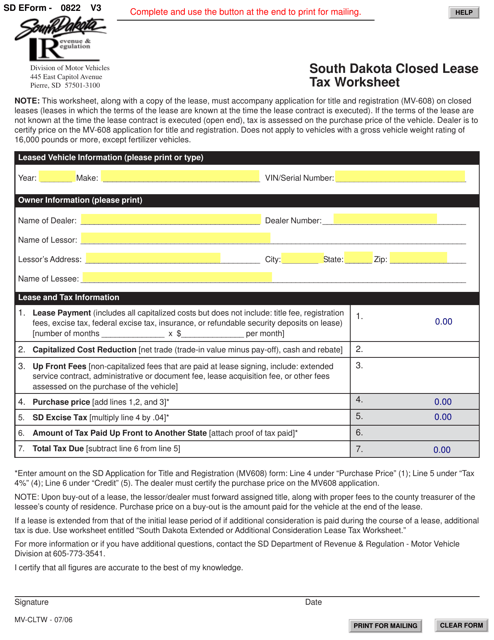

This document is a tax worksheet specific to South Dakota for closed lease transactions. It is used to calculate and report taxes related to the lease of a vehicle in South Dakota.

This form is used for requesting vehicle information by removal agencies and mechanics in South Dakota.

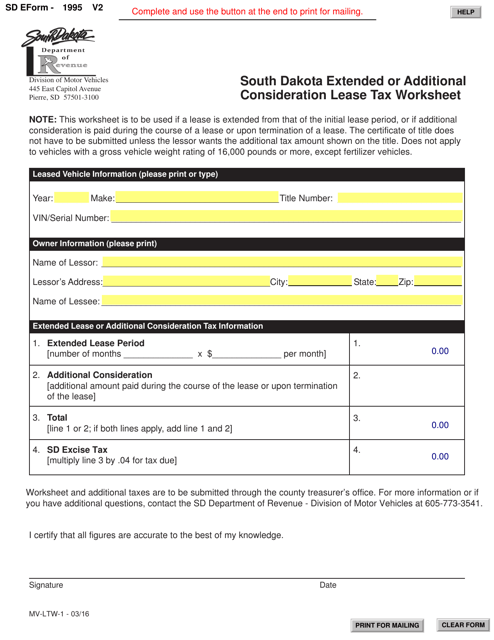

This document is used for calculating the extended or additional consideration lease tax in South Dakota.

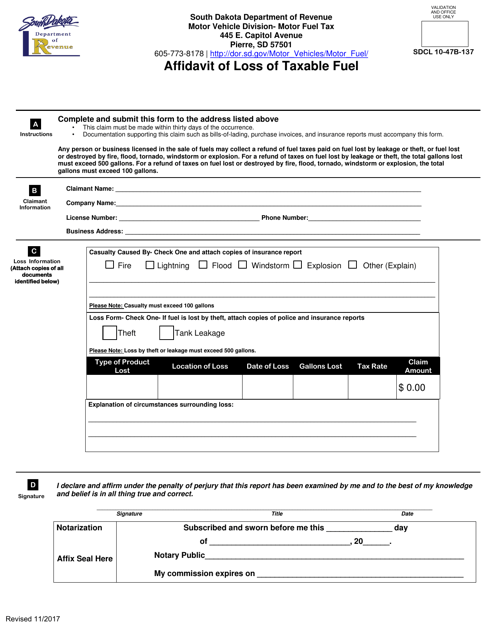

This document is used for reporting the loss of taxable fuel in the state of South Dakota. It is used to provide sworn statements about the lost fuel and its applicable taxes.

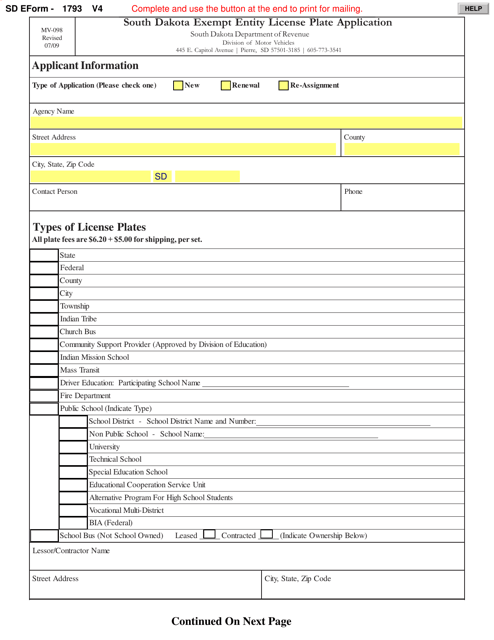

This Form is used for applying for an exempt entity license plate in South Dakota.

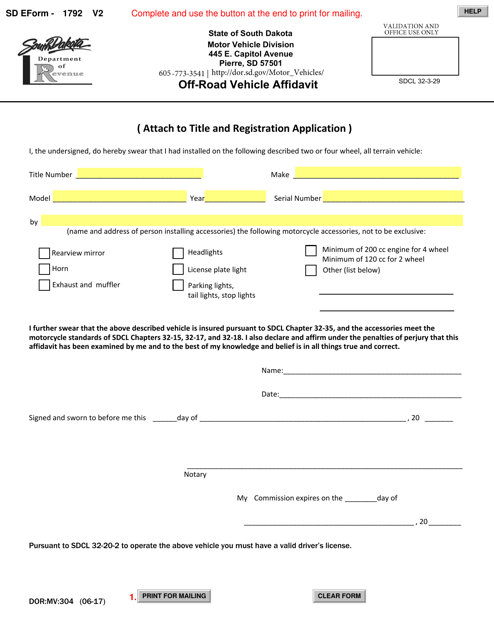

This document is used for submitting an Off-Road Vehicle Affidavit in South Dakota. It is required for registering and operating off-road vehicles in the state.

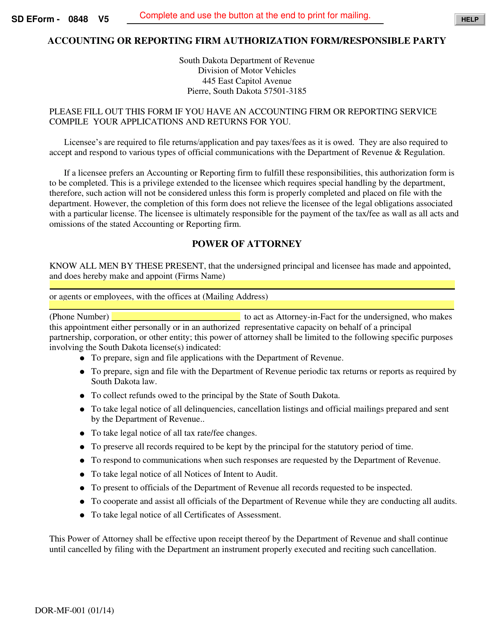

This Form is used for authorizing an accounting or reporting firm as the responsible party in South Dakota.

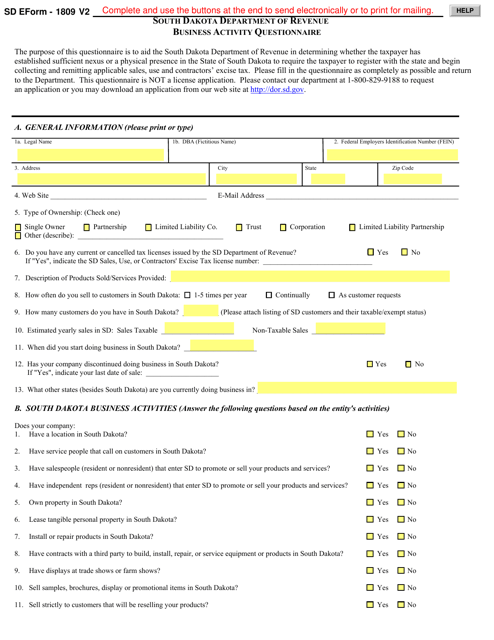

This Form is used for submitting the Business Activity Questionnaire in South Dakota.

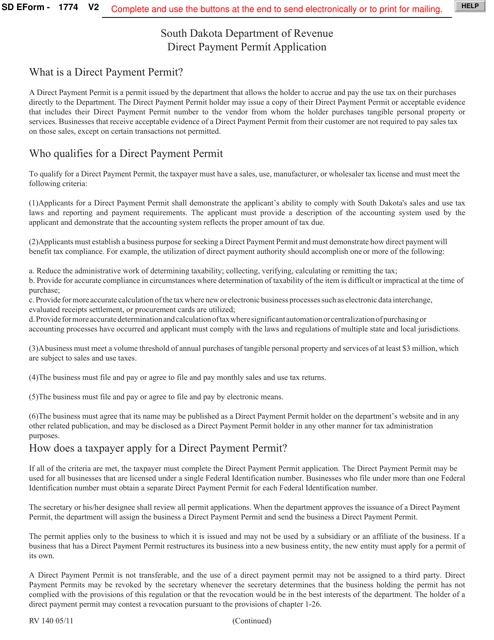

This form is used for applying for a direct payment permit in South Dakota.

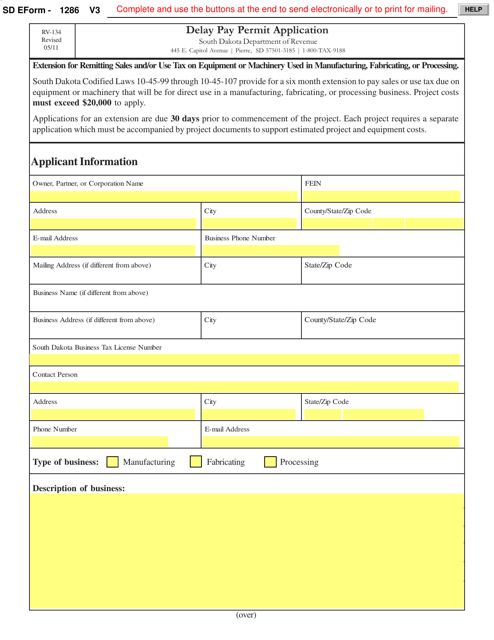

This Form is used for applying for a delay pay permit in South Dakota for recreational vehicles.

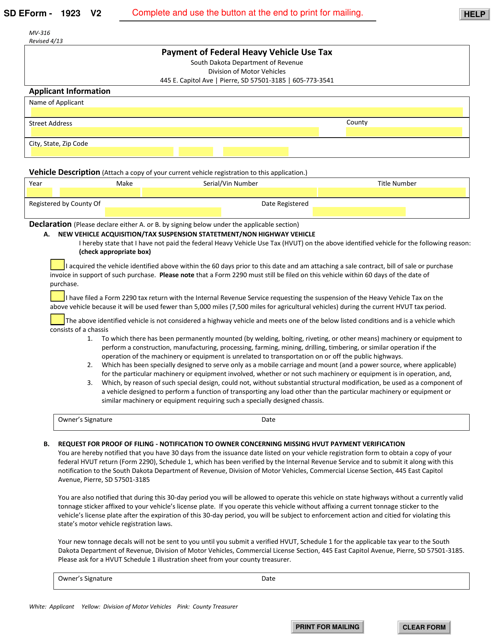

This form is used for paying the federal heavy vehicle use tax in South Dakota.

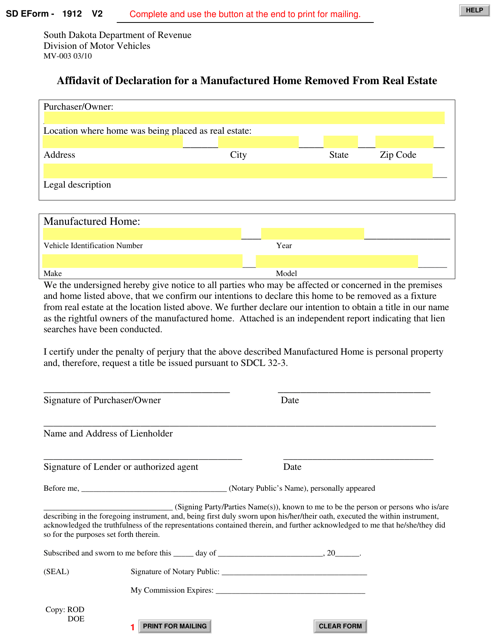

This form is used for declaring the removal of a manufactured home from real estate in South Dakota.

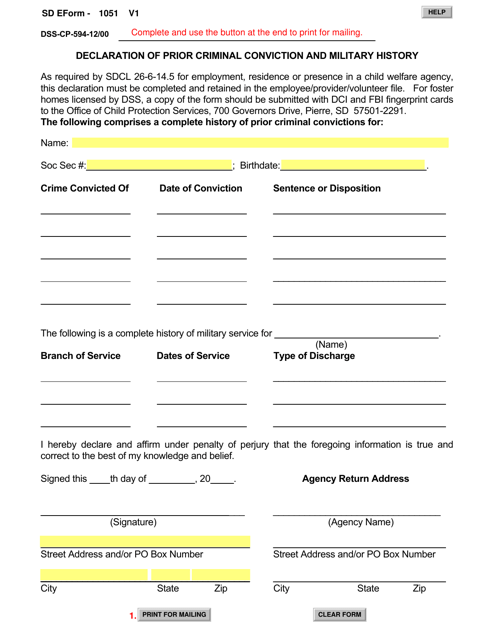

This Form is used for declaring prior criminal convictions and military history in South Dakota.

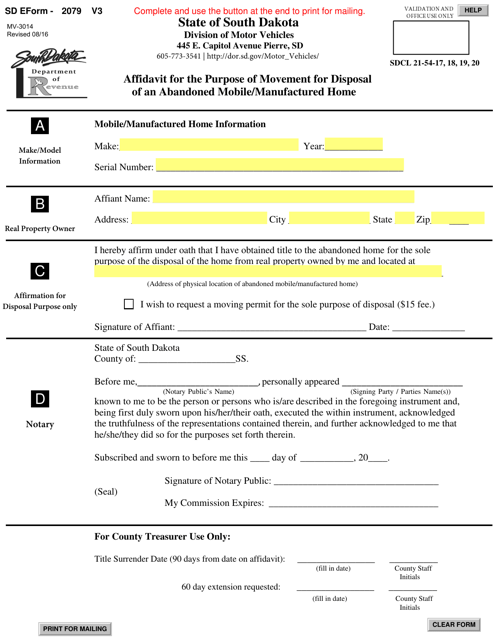

This document is used for submitting an affidavit to request permission to move and dispose of an abandoned mobile/manufactured home in South Dakota.

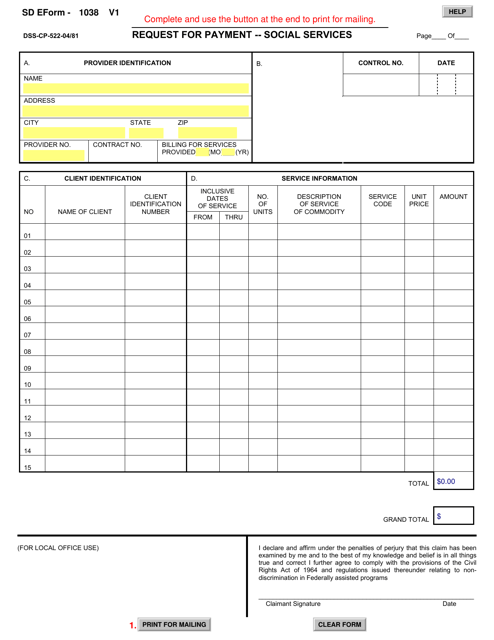

This Form is used for requesting payment for social services in South Dakota.

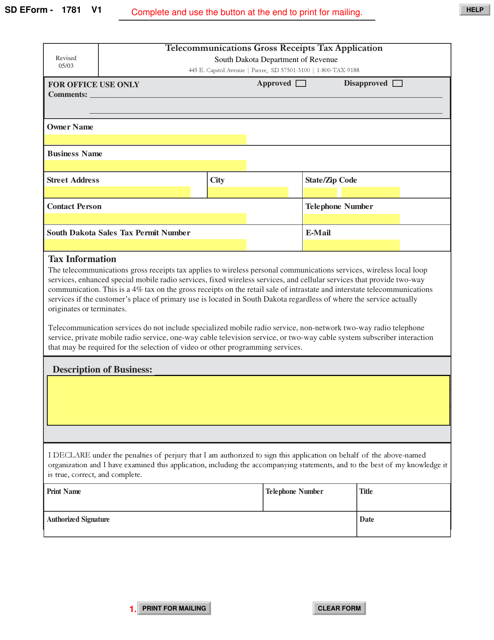

This Form is used for applying for the Telecommunications Gross Receipts Tax in South Dakota. It is a tax application form specific to the telecommunications industry in the state.

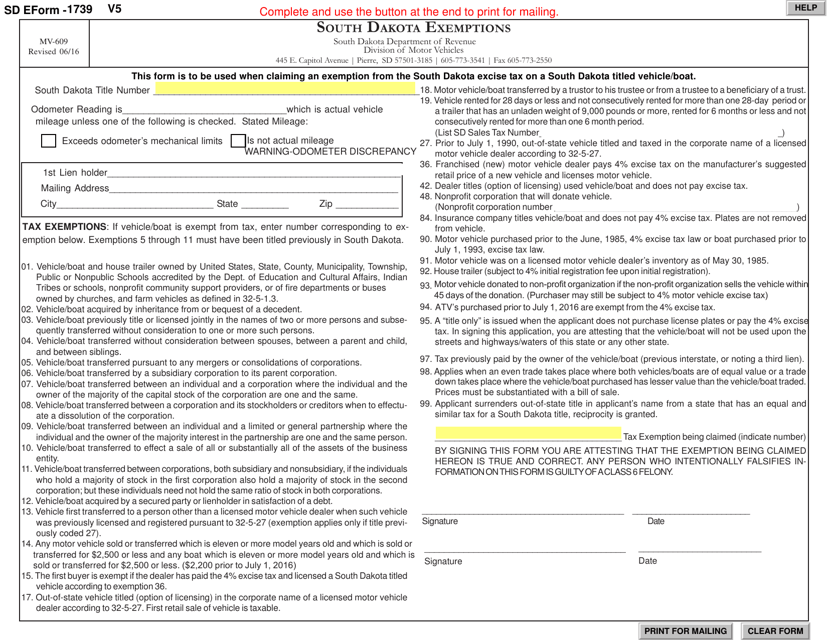

This form is used for claiming exemptions in South Dakota. It is specifically related to motor vehicles.

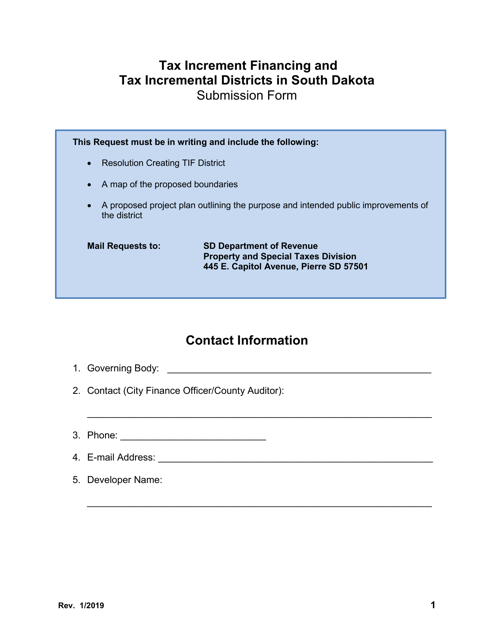

This Form is used for submitting information or applications related to South Dakota.

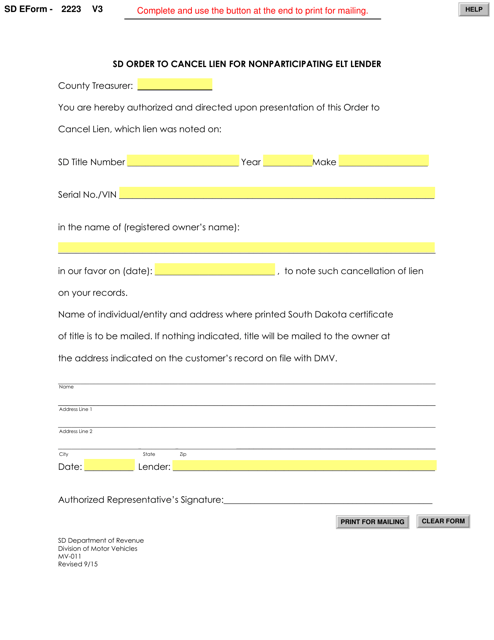

This form is used for ordering the cancellation of a lien for a nonparticipating electronic lender in South Dakota.

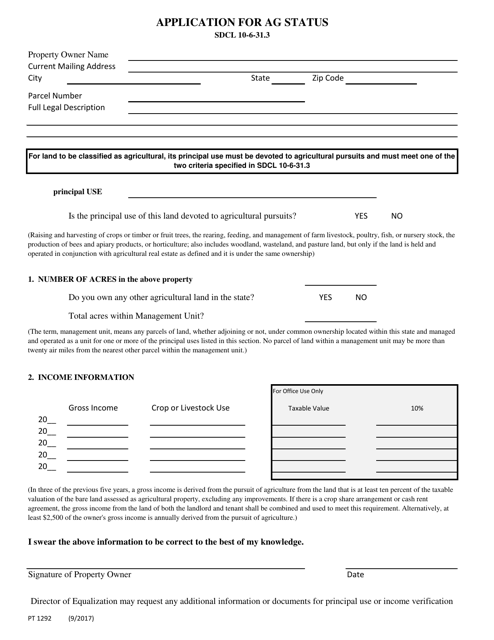

This form is used for applying for Agricultural Status in South Dakota. It is a document needed to qualify for property tax benefits for agricultural land.

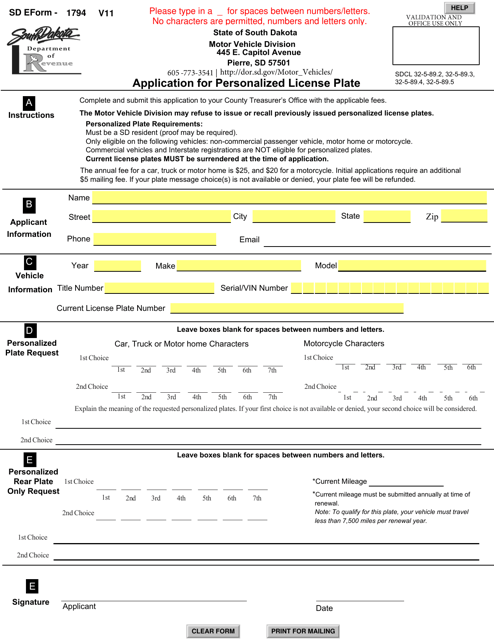

This form is used for applying for a personalized license plate in South Dakota.

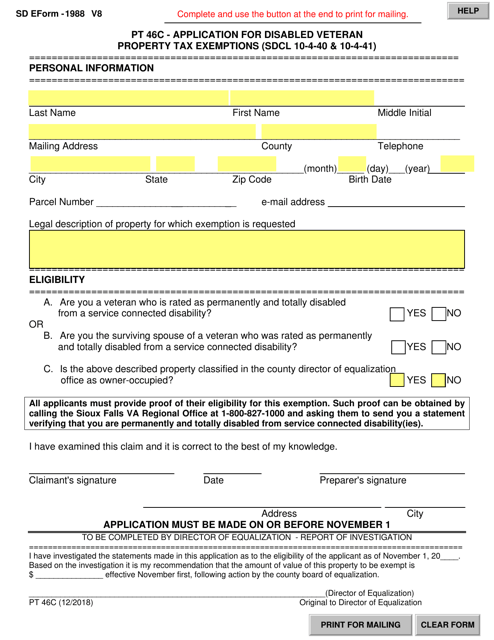

This Form is used for applying for property tax exemptions for disabled veterans in South Dakota.

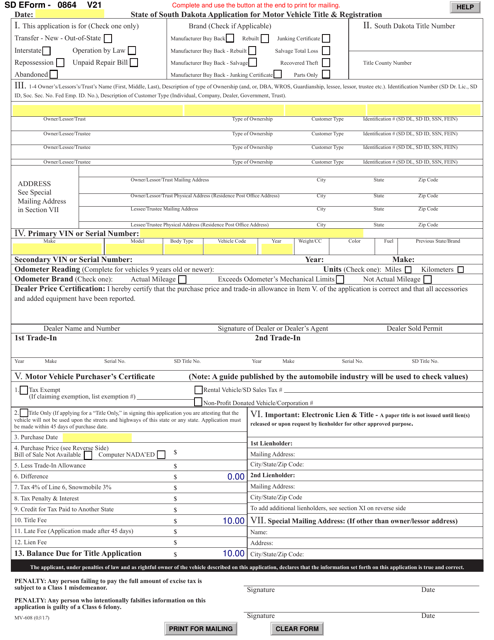

This form is used for applying for motor vehicle title and registration in South Dakota.

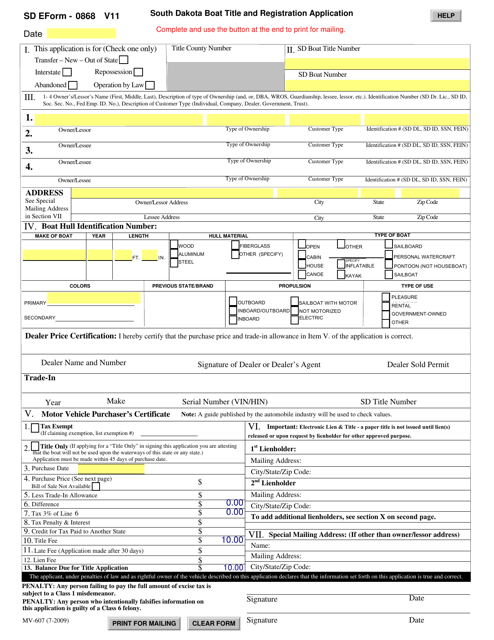

This document is used for applying for a boat title and registration in South Dakota.

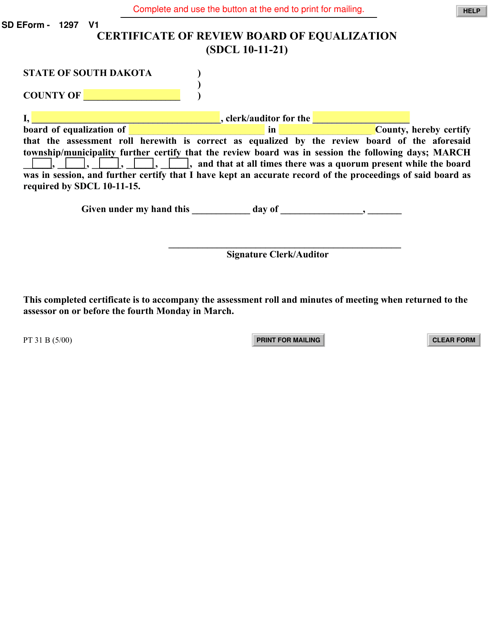

This Form is used for filing a Certificate of Review with the Board of Equalization in South Dakota.

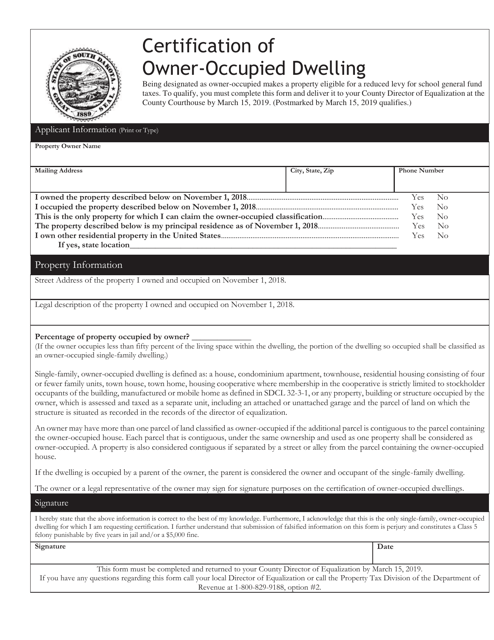

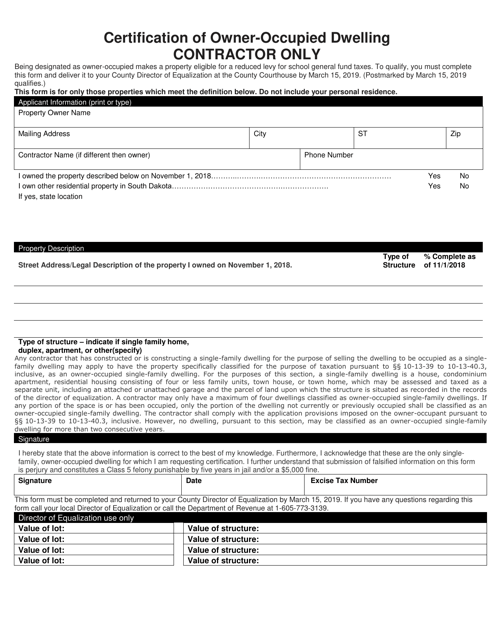

This document certifies that a dwelling is owner-occupied in the state of South Dakota. It is used to provide proof of ownership and occupancy for various purposes, such as taxation or eligibility for certain benefits.

This document is used by contractors in South Dakota for certifying owner-occupied dwellings.

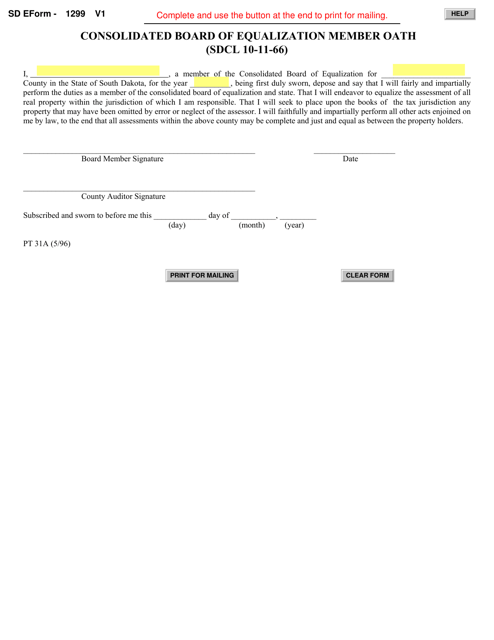

This Form is used for taking the Member Oath for the Consolidated Board of Equalization in South Dakota.

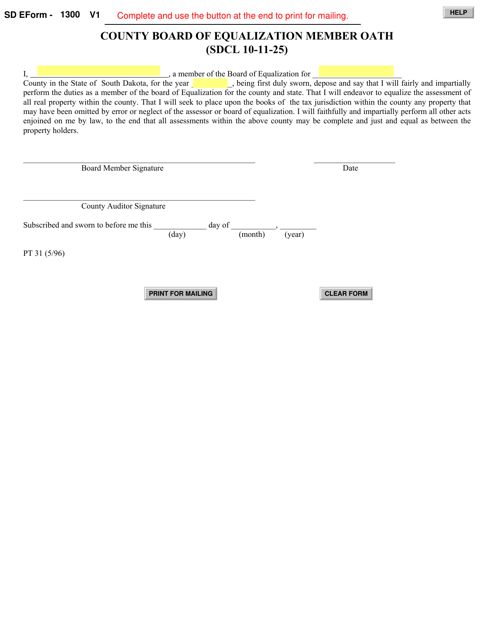

This document is for taking the oath of office for a member of the County Board of Equalization in South Dakota.