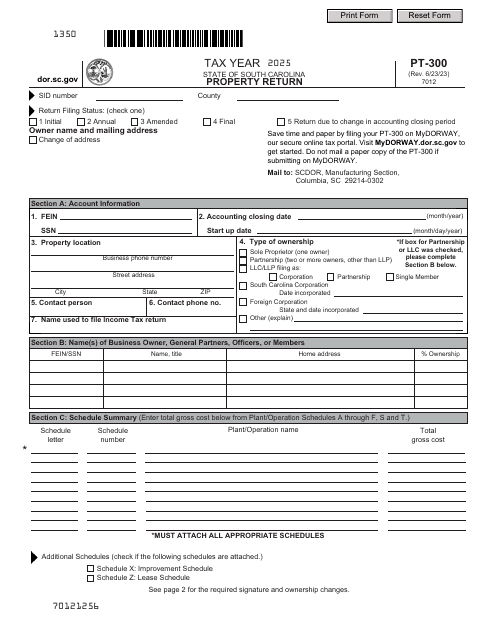

South Carolina Department of Revenue Forms

Documents:

472

This Form is used for claiming a credit for damaged, destroyed, returned, or short shipment beer in South Carolina.

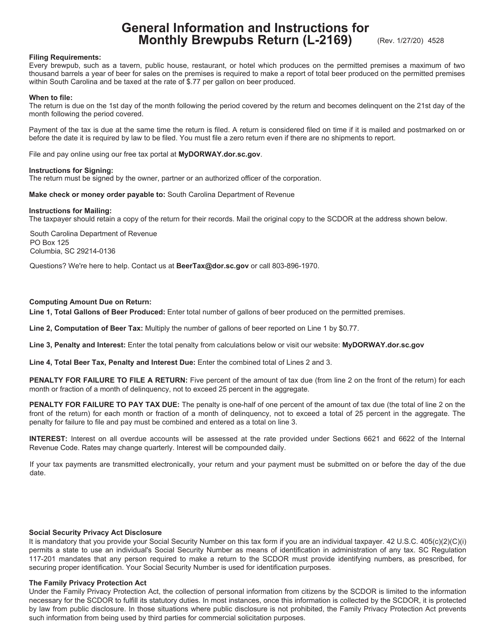

This document provides instructions for completing and filing the Monthly Brewpubs Return form in South Carolina. It includes guidelines on how to report income, expenses, and other necessary information for brewpub businesses on a monthly basis.

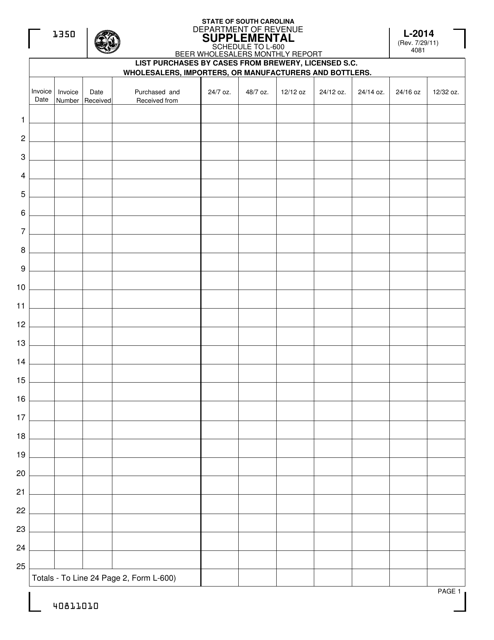

This form is used for beer wholesalers in South Carolina to provide a monthly report supplement to Form L-600. It is used to report specific information related to beer sales and inventory.

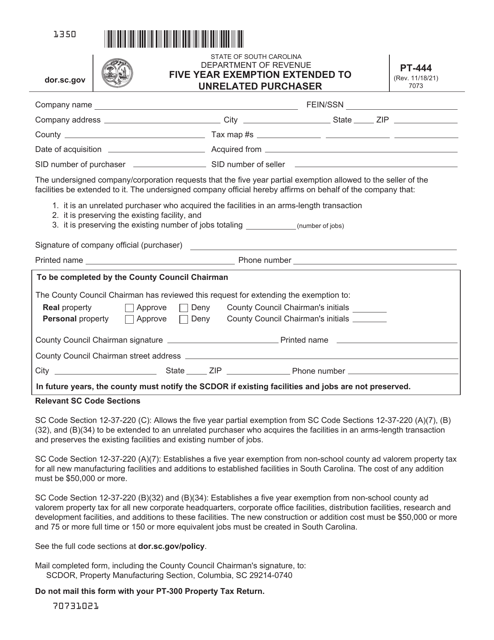

This form is used for extending the five-year exemption to an unrelated purchaser in South Carolina.

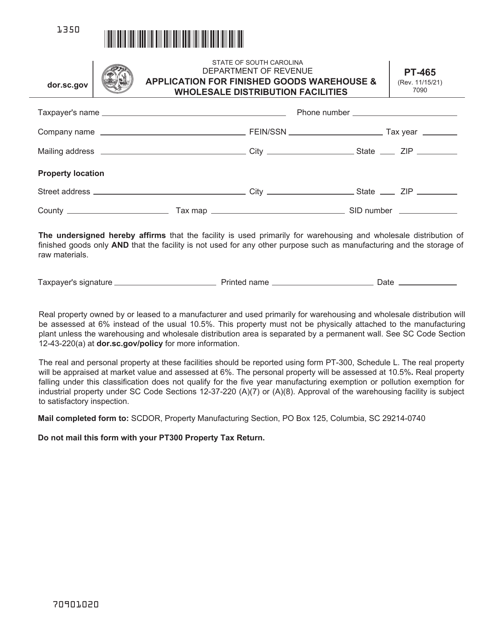

This form is used to apply for a finished goods warehouse and wholesale distribution facilities in South Carolina.

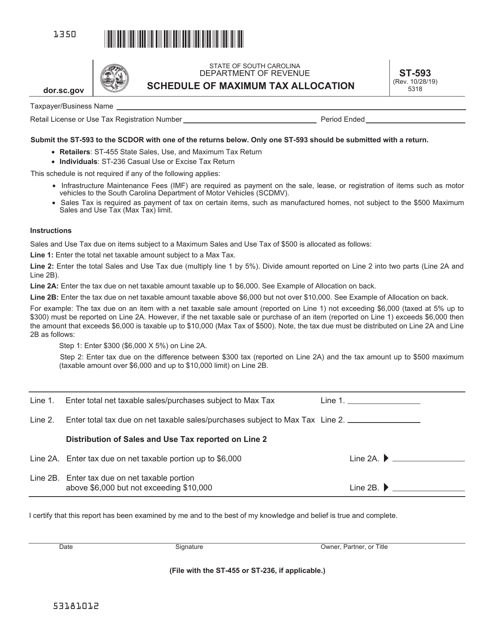

This Form is used for filing state sales, use, and maximum tax return for businesses in South Carolina. It provides instructions on how to report and pay the taxes owed.

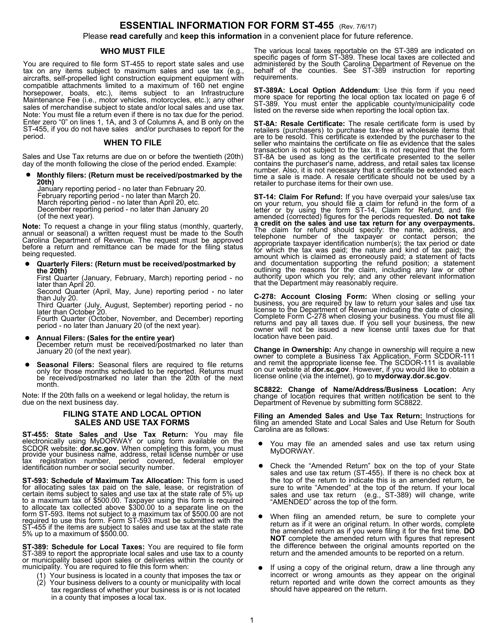

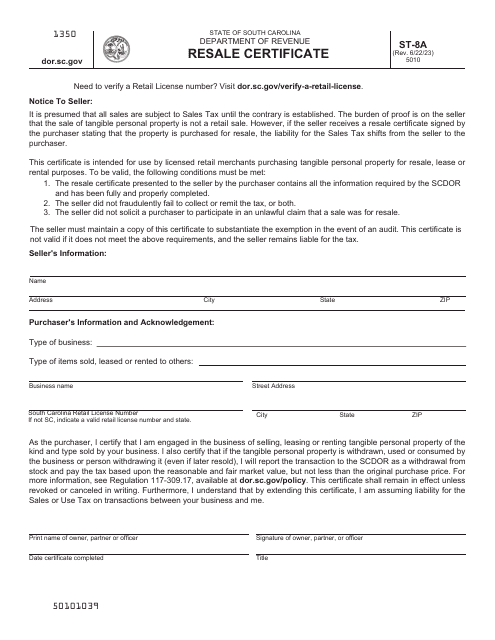

This form is used for reporting the maximum tax allocation details in South Carolina. It is used to allocate taxes based on specific criteria and guidelines.

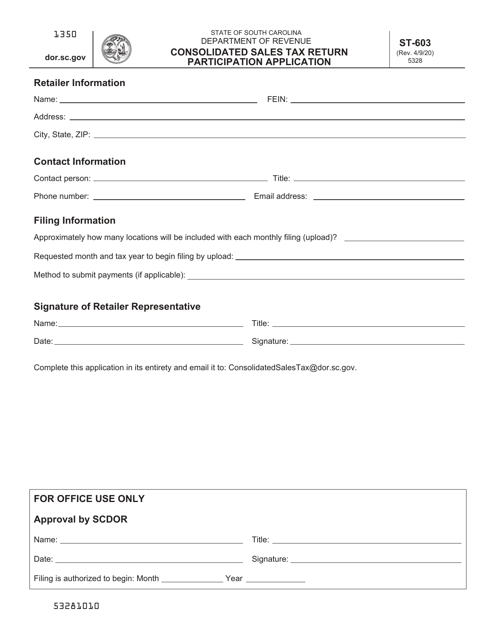

This form is used for applying to participate in the South Carolina Consolidated Sales Tax Return program.

This document provides an overview and details of a public incident response report in South Carolina. It outlines the response and actions taken during a specific incident.

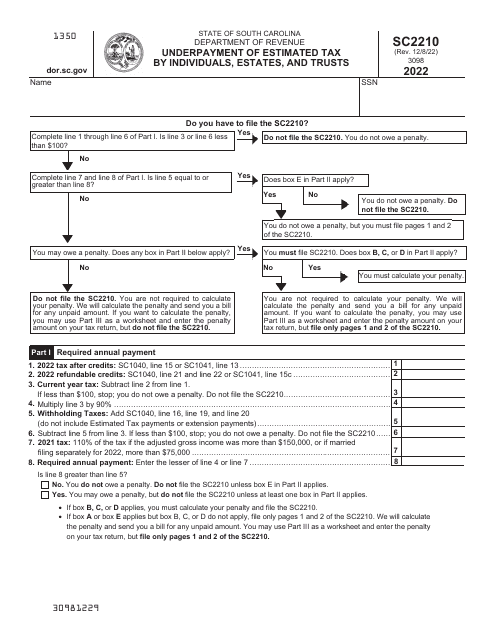

Form SC2210 Underpayment of Estimated Tax by Individuals, Estates, and Trusts - South Carolina, 2022