South Carolina Department of Revenue Forms

The South Carolina Department of Revenue is responsible for administering and enforcing various tax laws and regulations within the state of South Carolina. Its main purpose is to collect taxes, including income tax, sales tax, property tax, and other taxes and fees. The department also provides taxpayer assistance, education, and enforcement of tax laws to ensure compliance by individuals and businesses in South Carolina.

Documents:

472

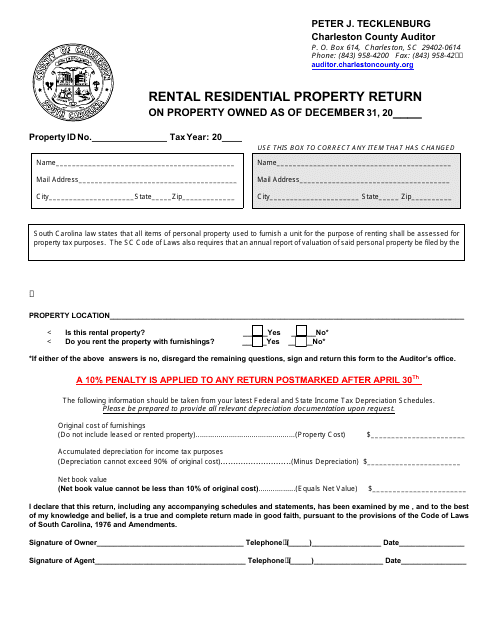

This Form is used for reporting rental residential property in Charleston, South Carolina.

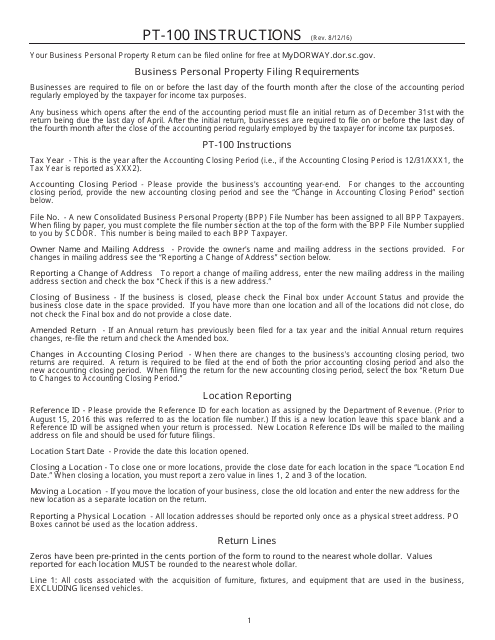

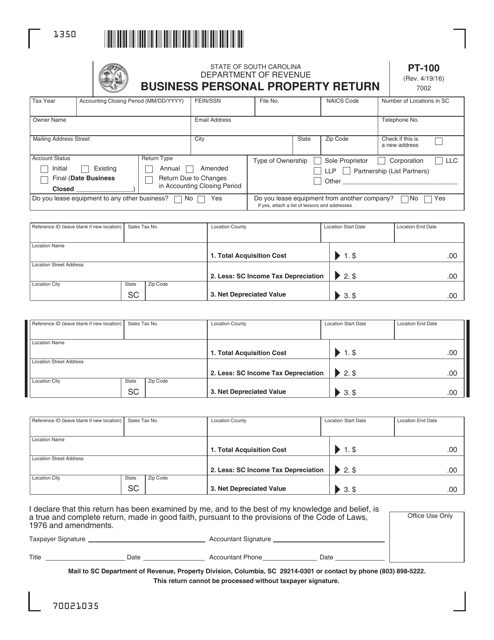

This Form is used for filing the Business Personal Property Return in South Carolina. It provides instructions on how to properly fill out and submit the form for reporting business personal property for taxation purposes.

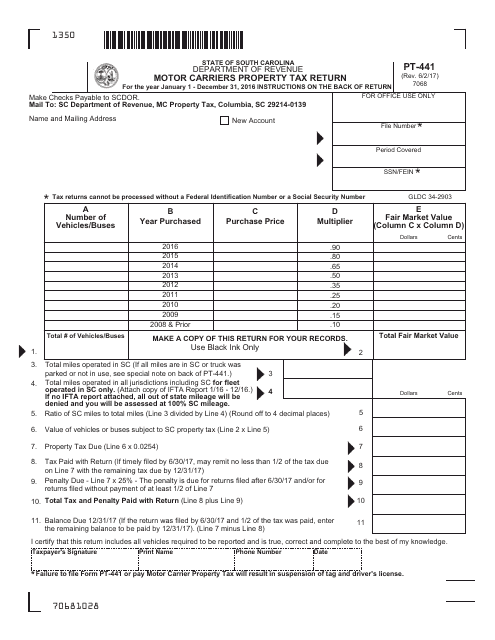

This form is used for South Carolina motor carriers to report and pay property taxes related to their operations.

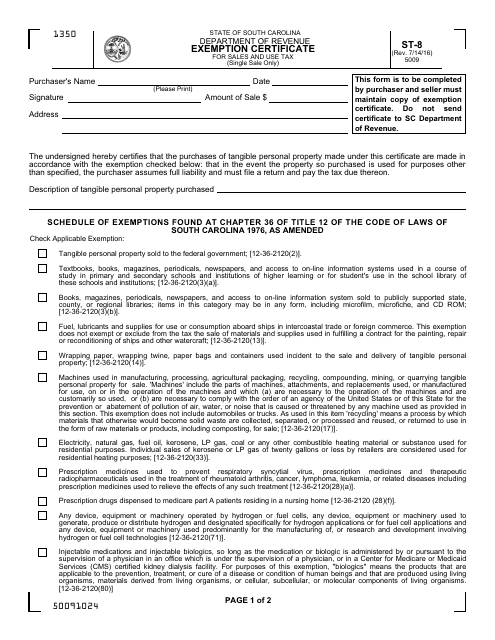

This form is used for requesting an exemption from sales and use tax in South Carolina. It is for individuals or businesses who qualify for certain exemptions.

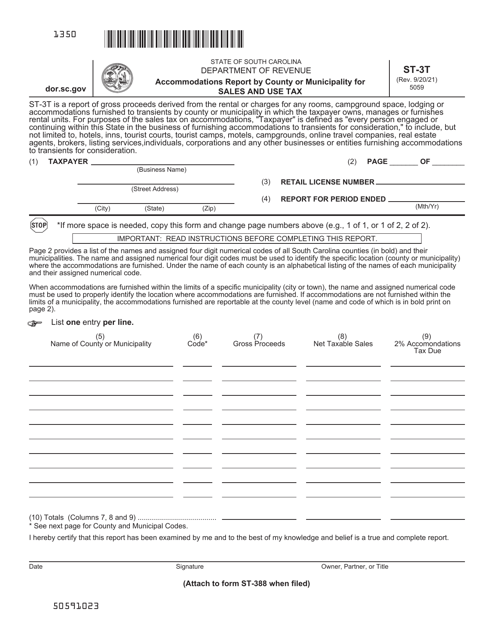

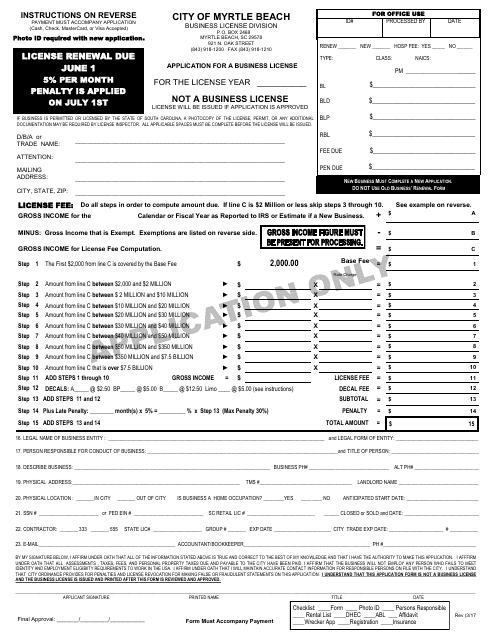

This form is used for applying for a business license in Myrtle Beach, South Carolina.

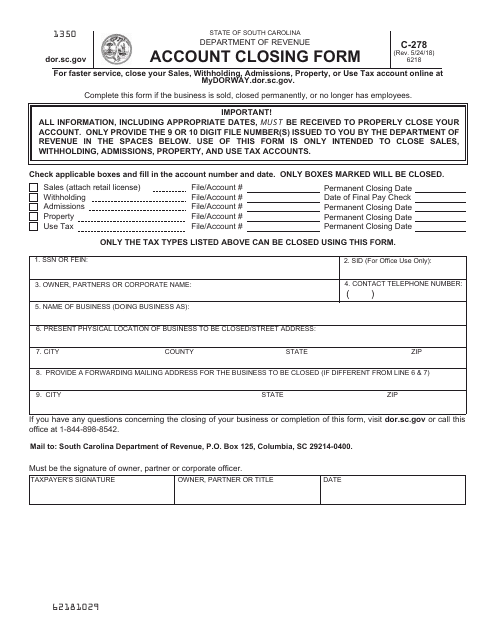

This Form is used for closing a financial account in South Carolina.

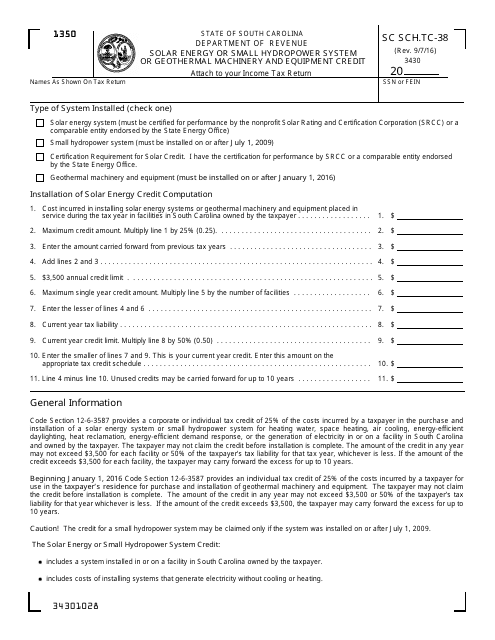

This Form is used for claiming the Solar Energy or Small Hydropower System or Geothermal Machinery and Equipment Credit in South Carolina.

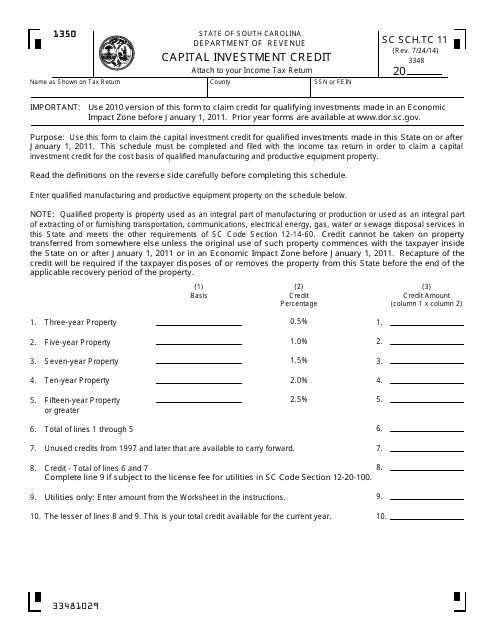

This Form is used for claiming the Capital Investment Credit in South Carolina.

This form is used for reporting business personal property in South Carolina. It is required for businesses to assess and declare the value of all tangible personal property they own, lease, or possess in order to calculate property taxes.

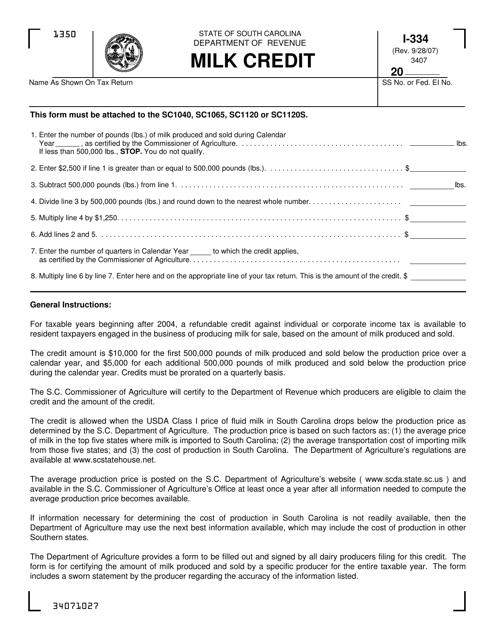

This Form is used for claiming the milk credit in South Carolina. It allows taxpayers to deduct the cost of milk products from their tax liability.

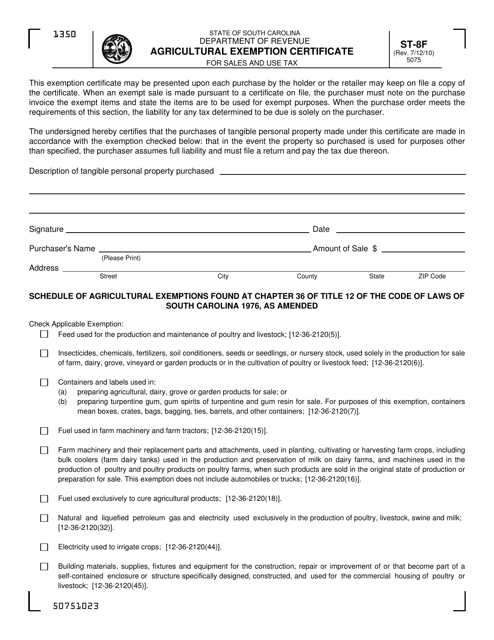

This form is used for claiming an exemption from sales and use tax on agricultural products in South Carolina. It provides instructions on how to properly fill out and submit the Form ST-8F Agricultural Exemption Certificate.

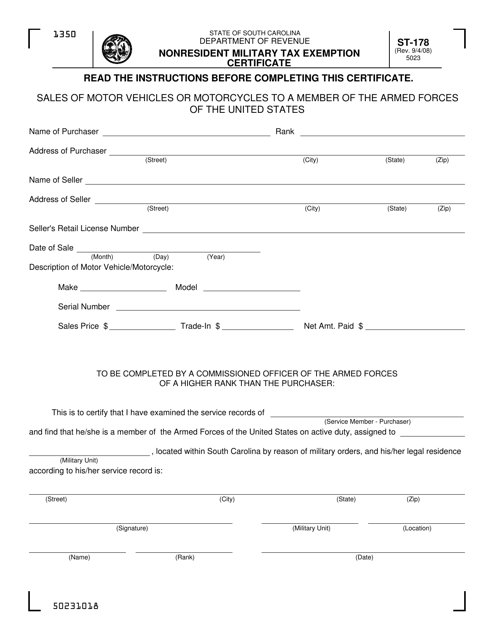

This form is used for nonresident military personnel to claim tax exemption in South Carolina.

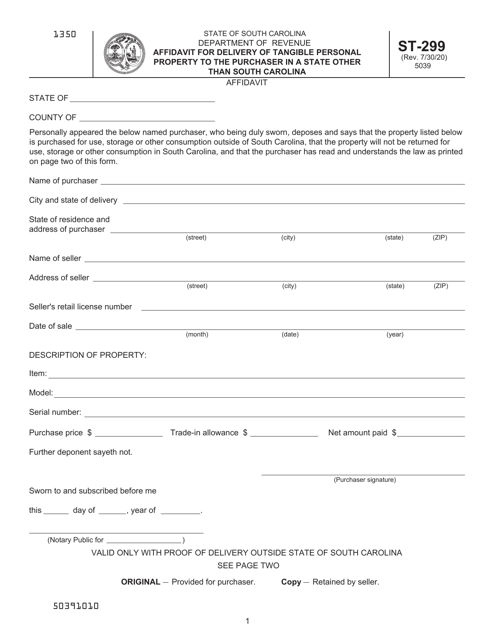

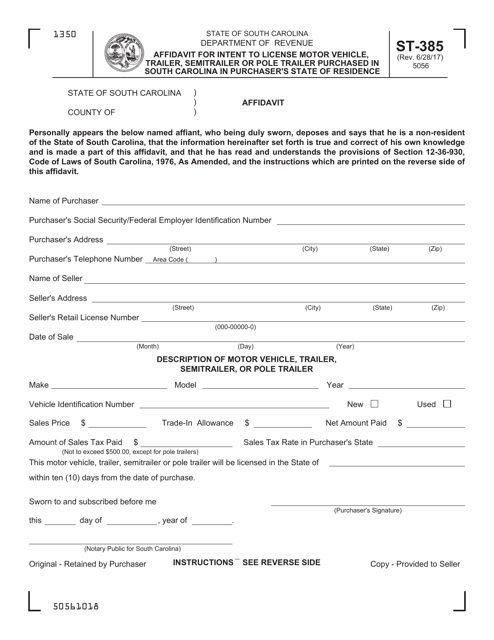

This form is used for South Carolina residents who purchased a motor vehicle, trailer, semitrailer, or pole trailer in another state and intend to license it in their state of residence. It is an affidavit that states the purchaser's intent and provides necessary information for licensing the vehicle.

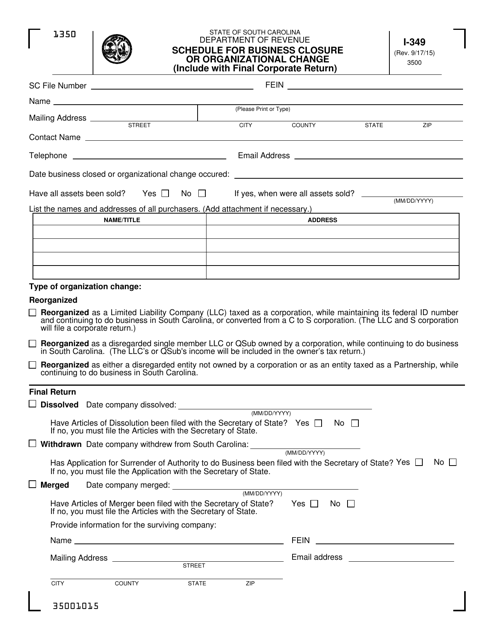

This form is used for announcing the schedule for business closure or organizational change in South Carolina.

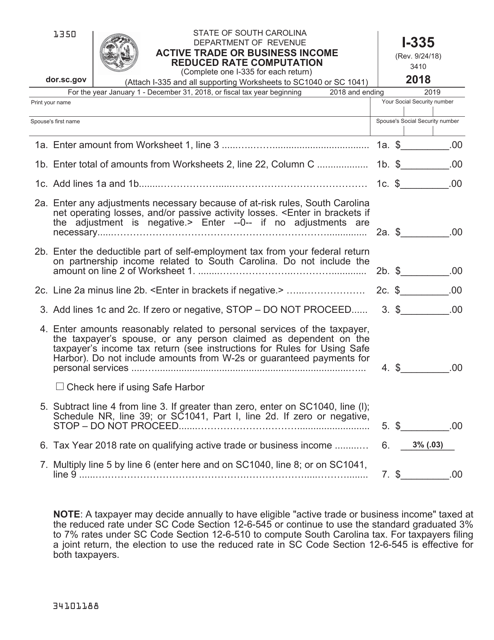

This form is used for computing the reduced rate of active trade or business income in South Carolina.