Oregon Department of Revenue Forms

Documents:

1228

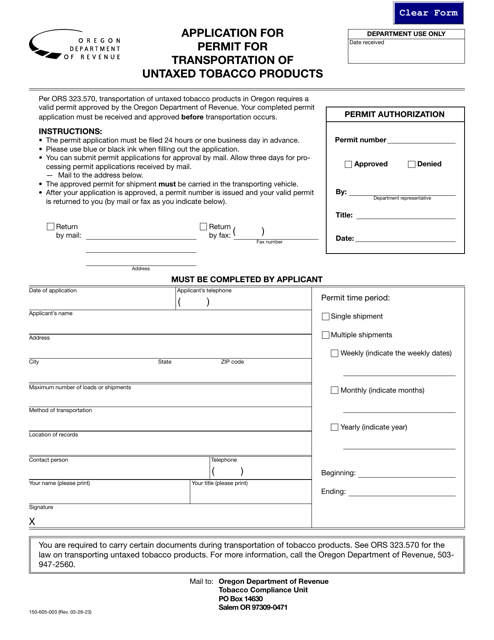

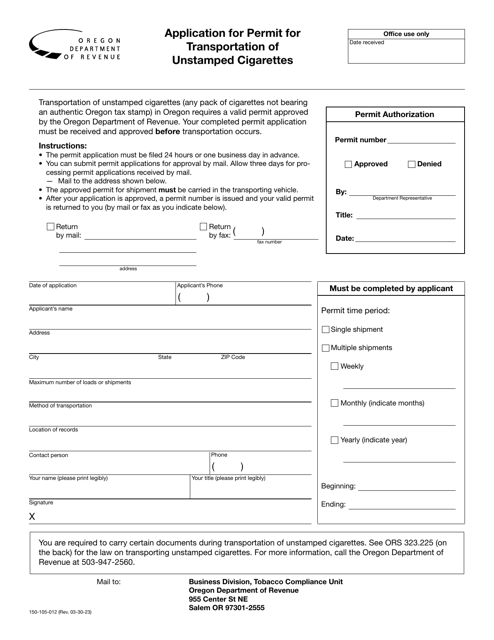

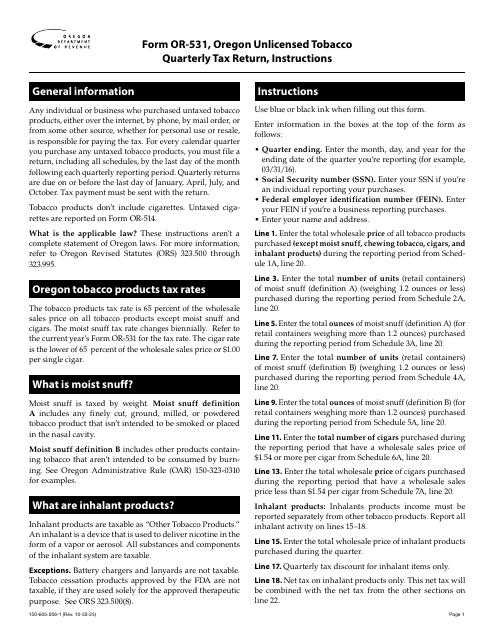

This form is used for applying for a permit to transport untaxed tobacco products in the state of Oregon.

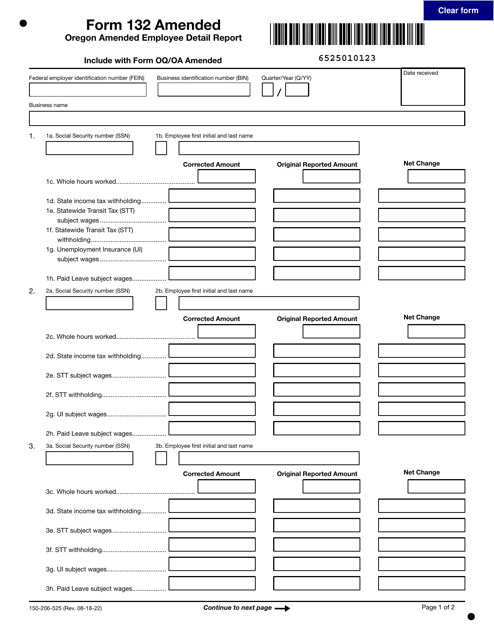

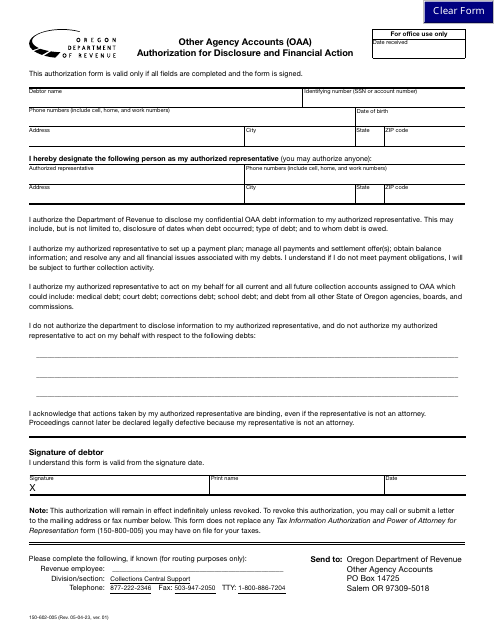

This form is used for reporting changes or corrections to an employee's details in the state of Oregon.

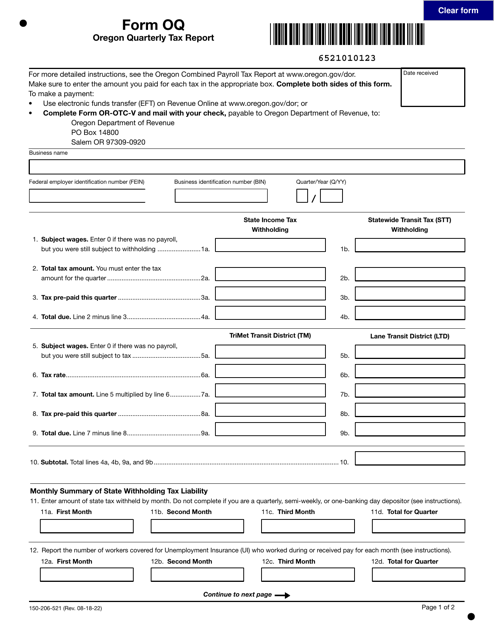

This form is used for filing quarterly tax reports in Oregon. It is known as Form OQ (150-206-521) and is used by individuals and businesses to report their earnings and pay the appropriate amount of taxes to the state of Oregon.

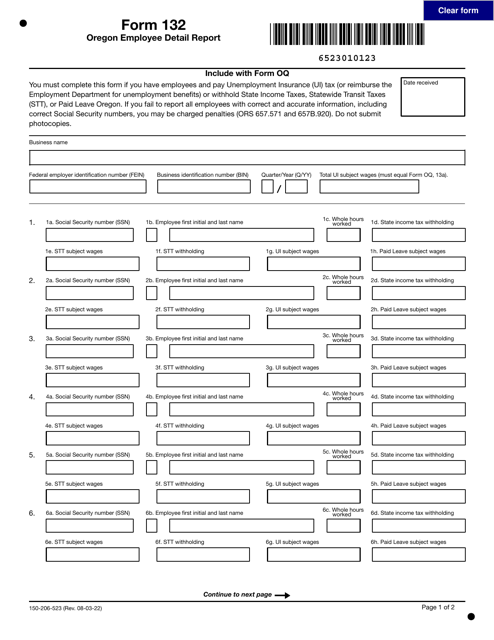

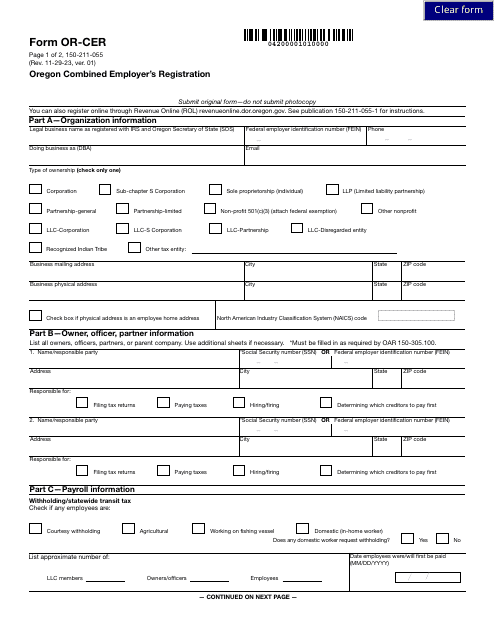

This document is used for reporting employee details in the state of Oregon.

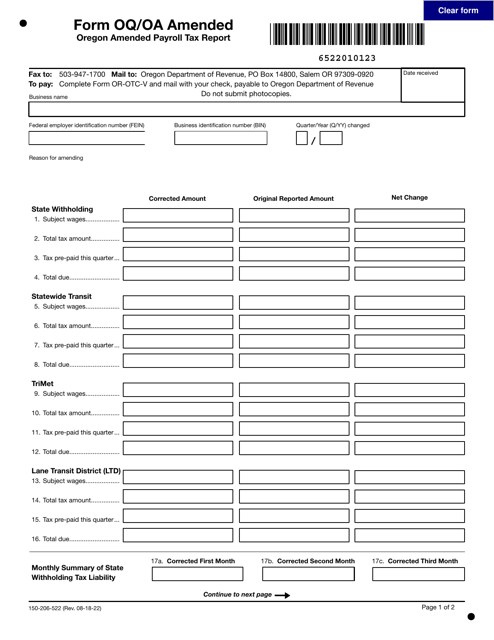

This form is used for filing an amended payroll tax report in Oregon. It is specifically for the OQ/OA AMENDED (150-206-522) form.

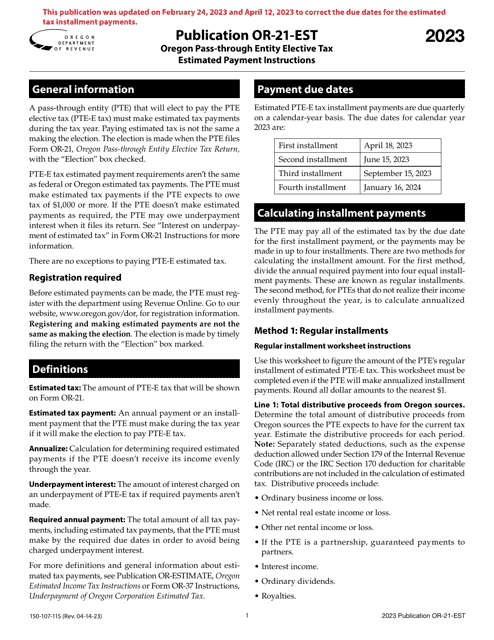

This Form is used for making estimated tax payments for pass-through entities in Oregon.

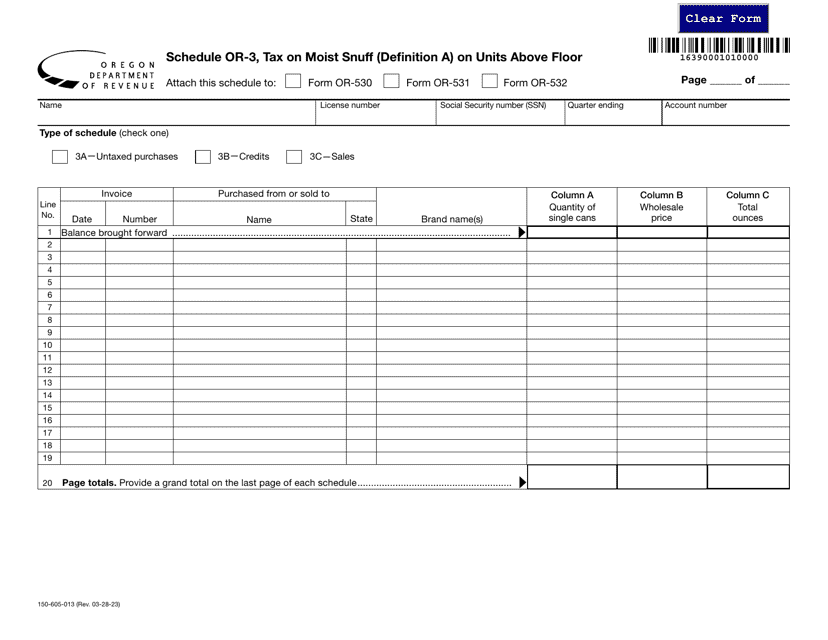

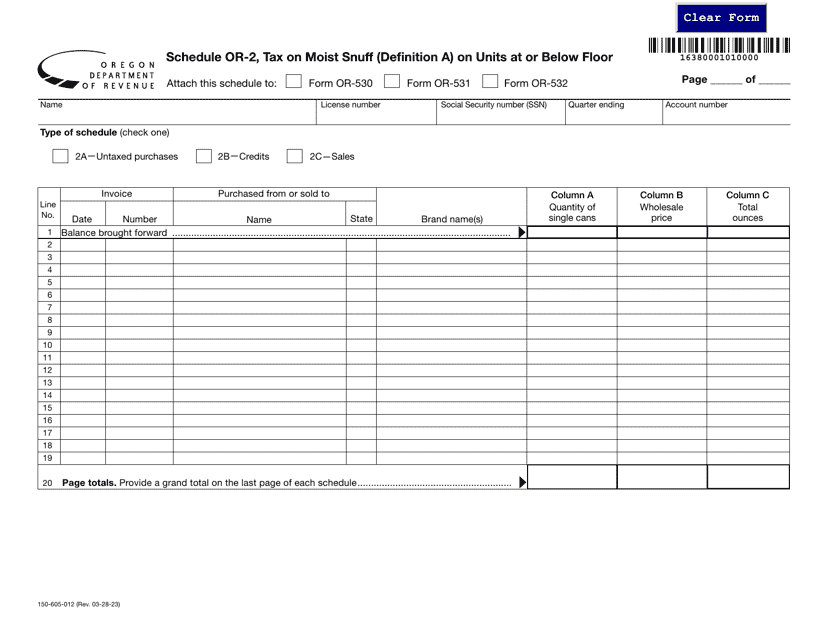

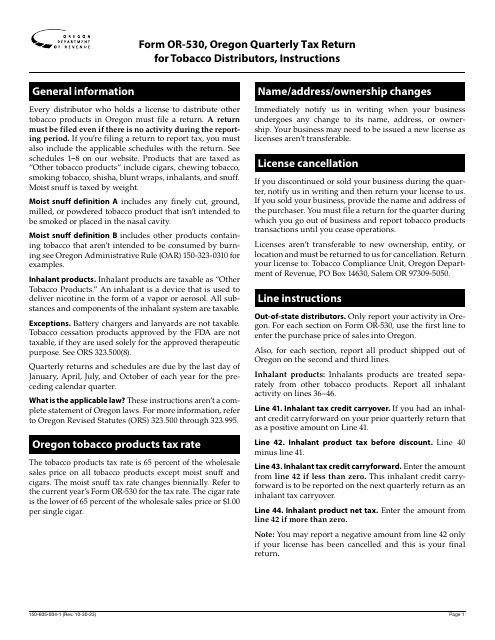

Form 150-605-012 Schedule OR-2 Tax on Moist Snuff (Definition a) on Units at or Below Floor - Oregon

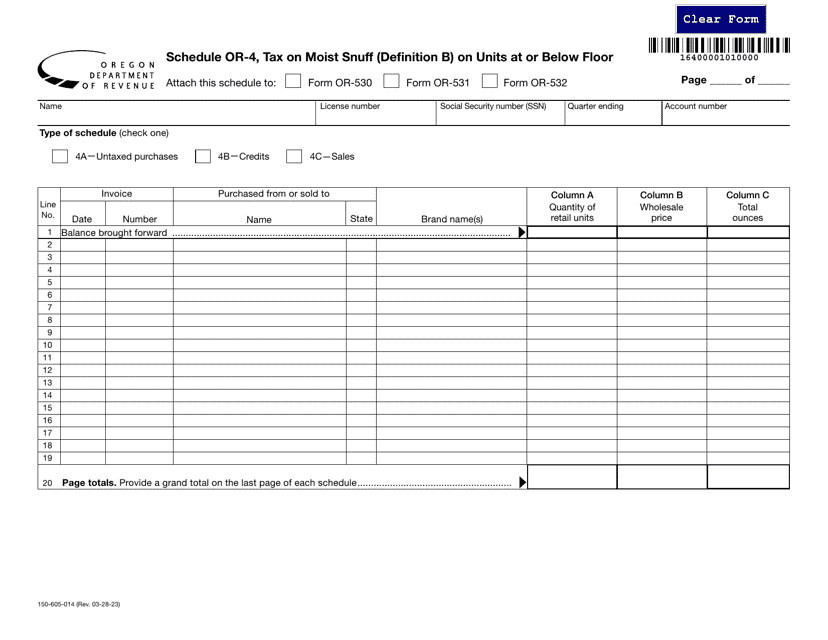

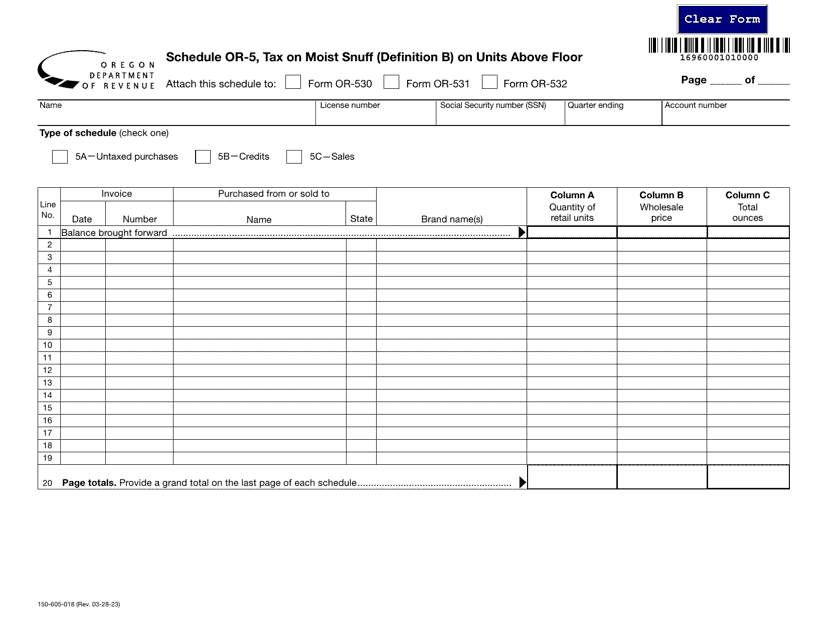

Form 150-605-014 Schedule OR-4 Tax on Moist Snuff (Definition B) on Units at or Below Floor - Oregon

This form is used for Oregon out-of-state cigarette distributors to reconcile their quarterly taxes.

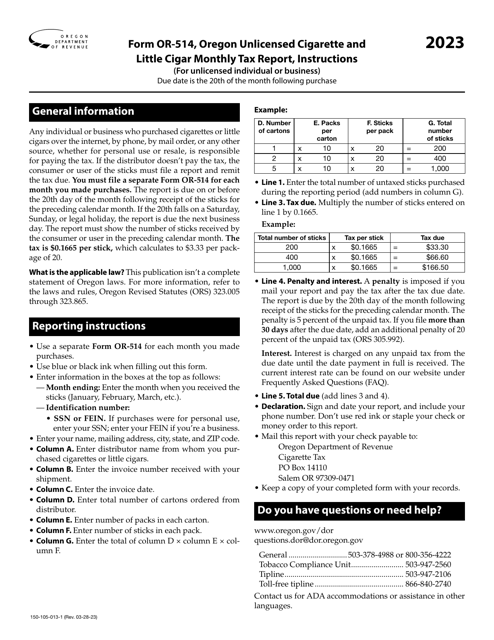

This Form is used for reporting monthly taxes on unlicensed cigarettes and little cigars in Oregon by unlicensed individuals or businesses.

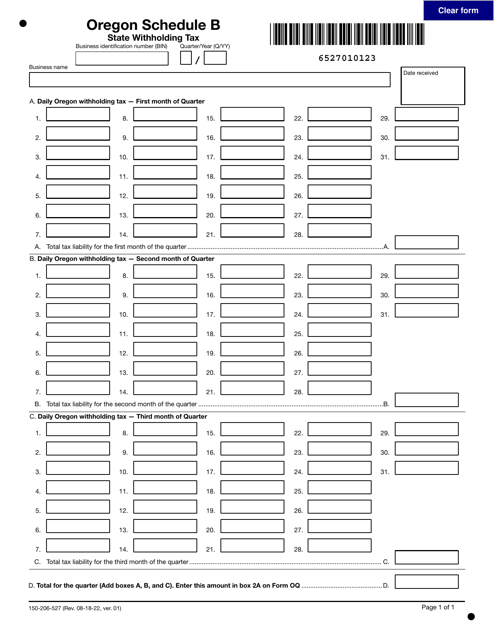

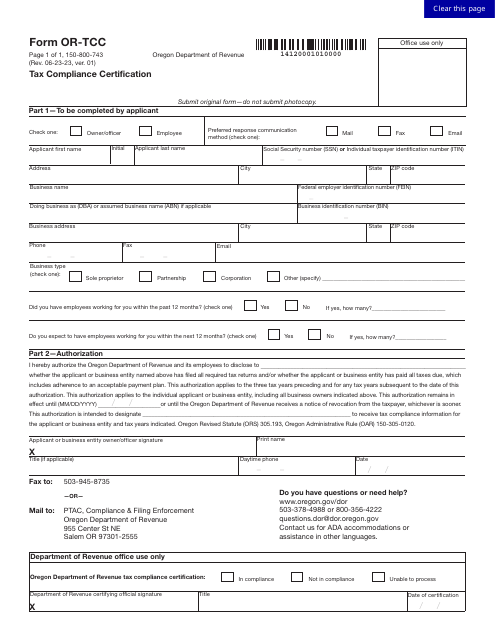

This form is used for reporting and calculating state withholding tax for individuals in the state of Oregon.

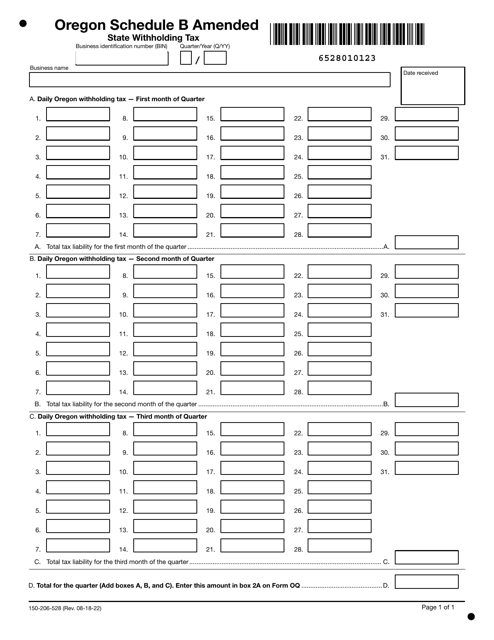

This form is used for reporting amended state withholding tax for Oregon.