Oregon Department of Revenue Forms

Documents:

1228

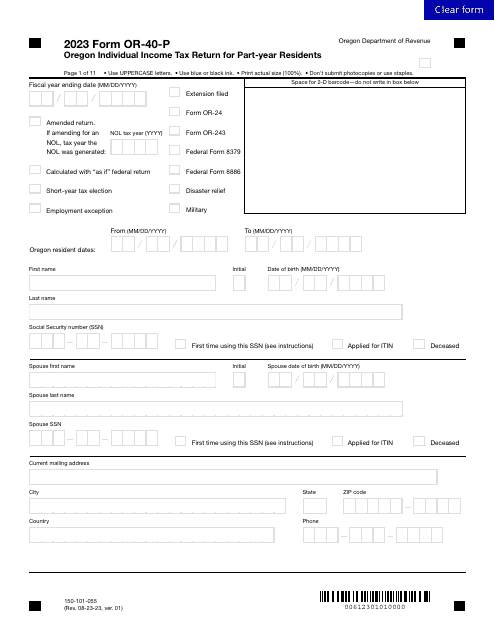

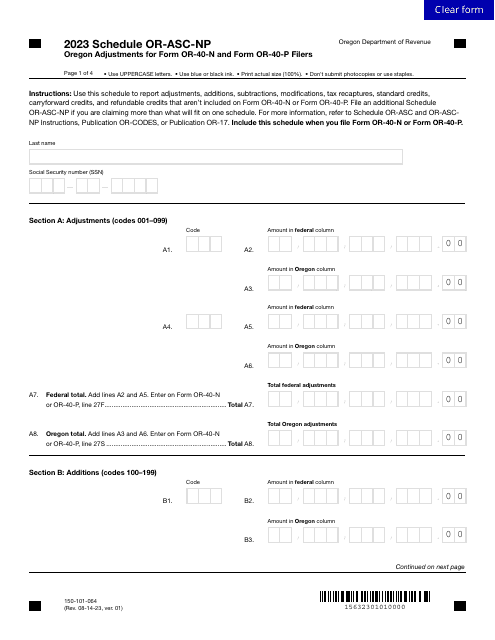

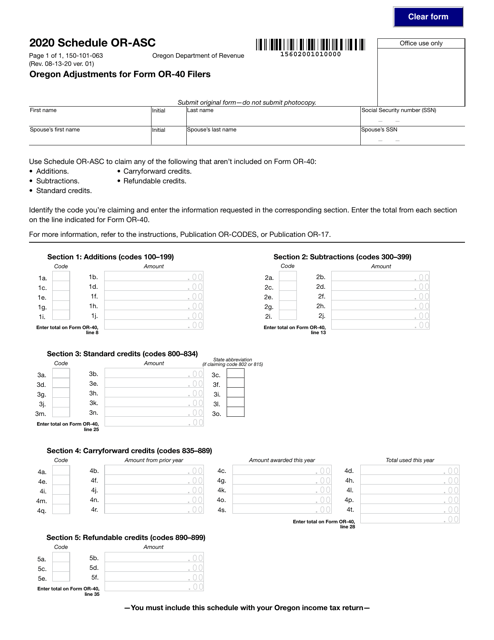

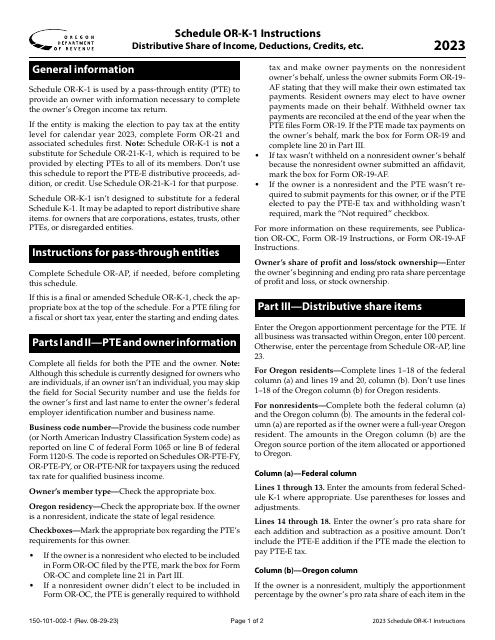

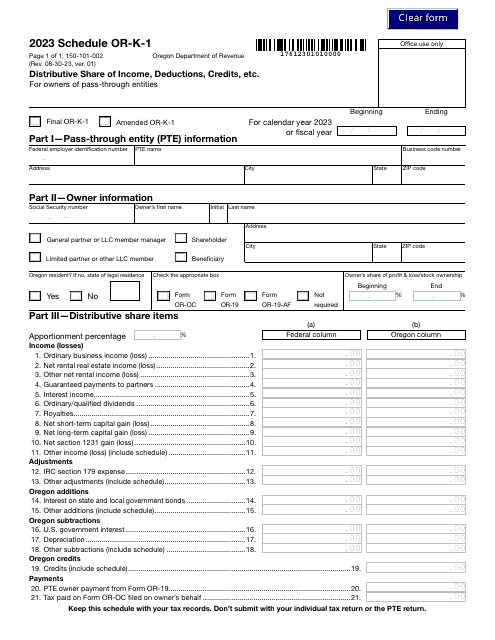

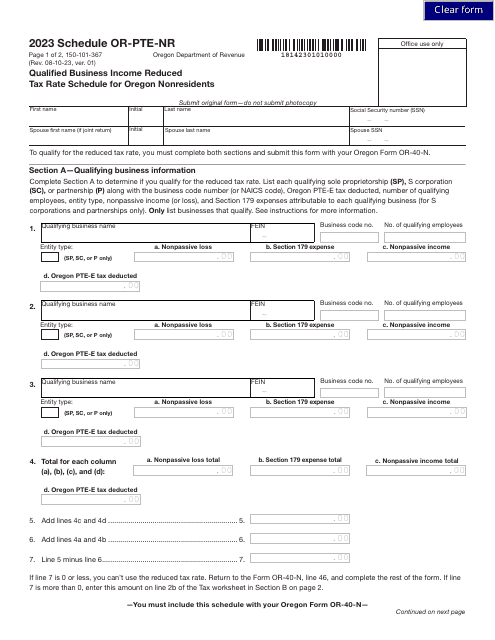

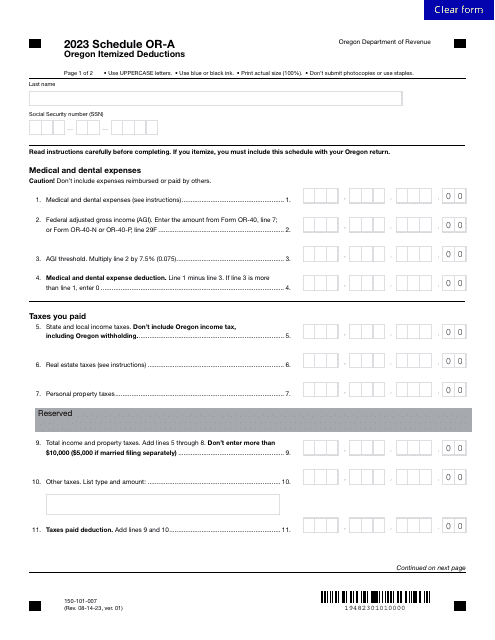

This form is used for making adjustments to the Oregon tax return (Form OR-40) filed by individuals in Oregon. It is specifically designed for Oregon residents and allows them to make corrections or additions to their original tax return. This form helps taxpayers in Oregon ensure that their tax returns are accurate and complete.

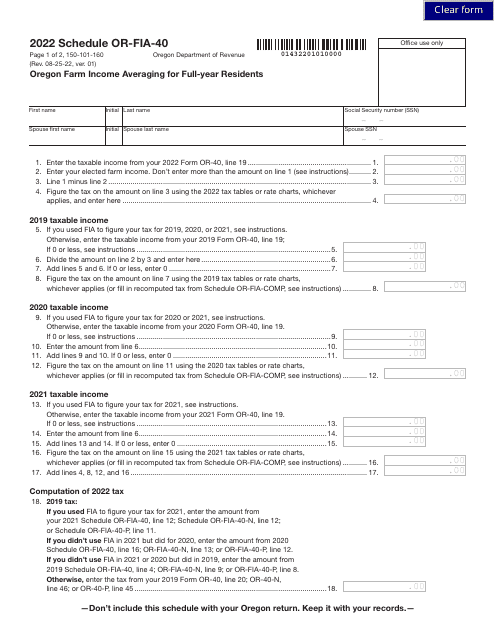

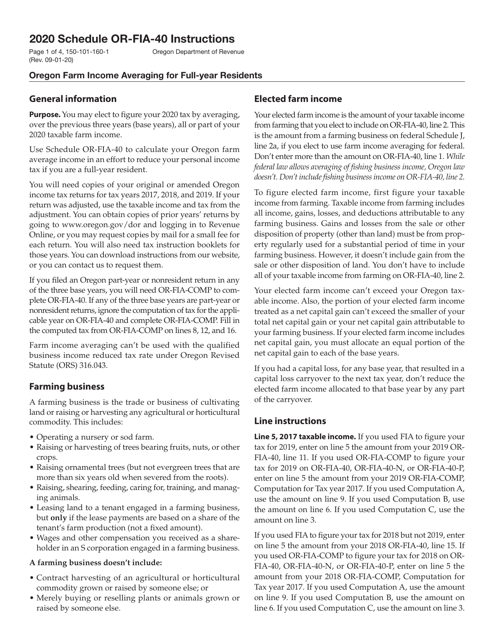

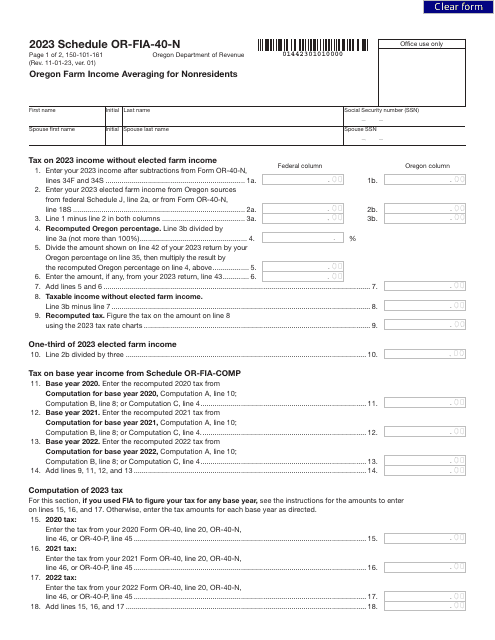

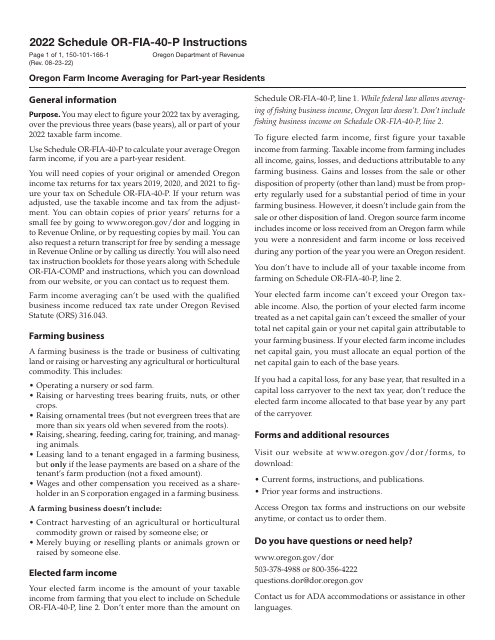

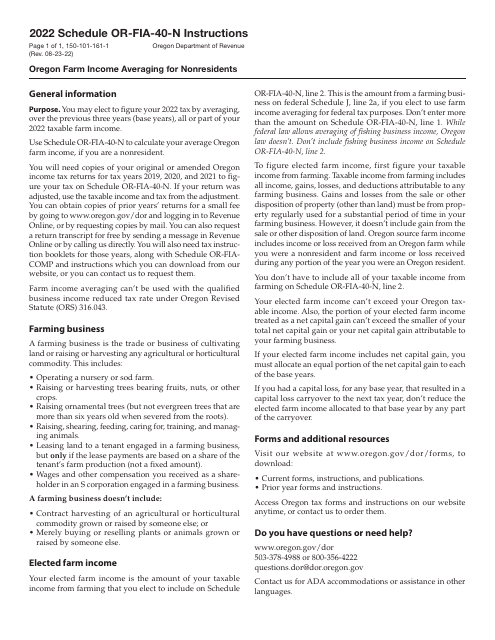

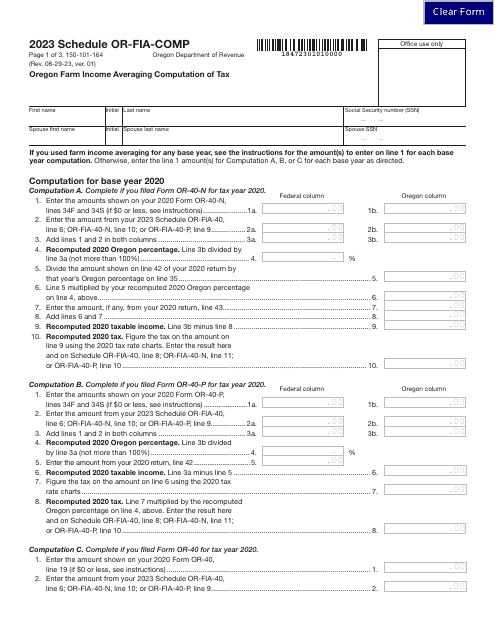

This Form is used for Oregon residents who are farmers to calculate their average income for tax purposes. It helps them determine if they qualify for income averaging and how to report their farm income.

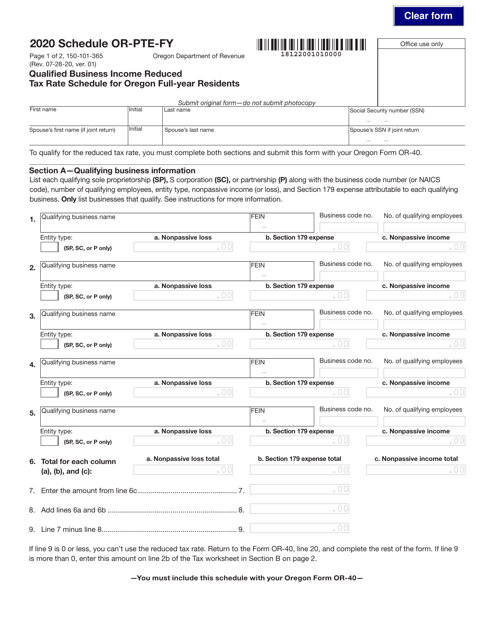

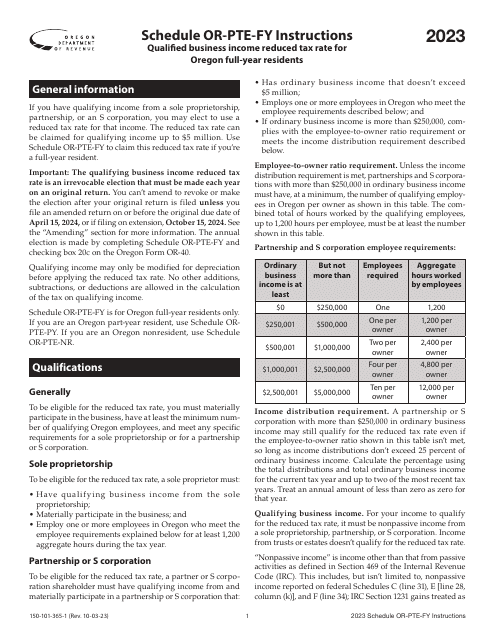

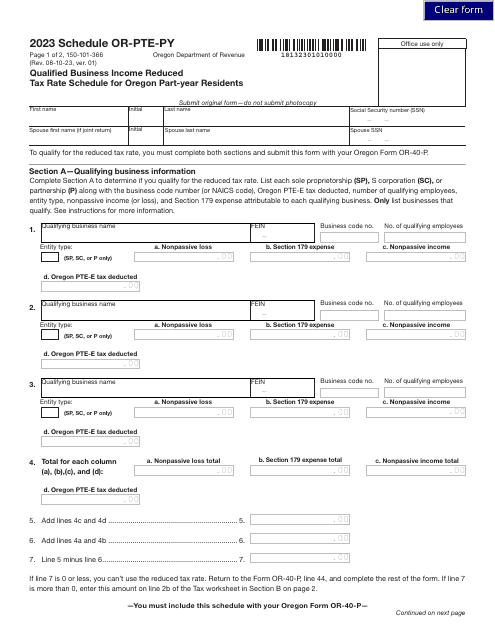

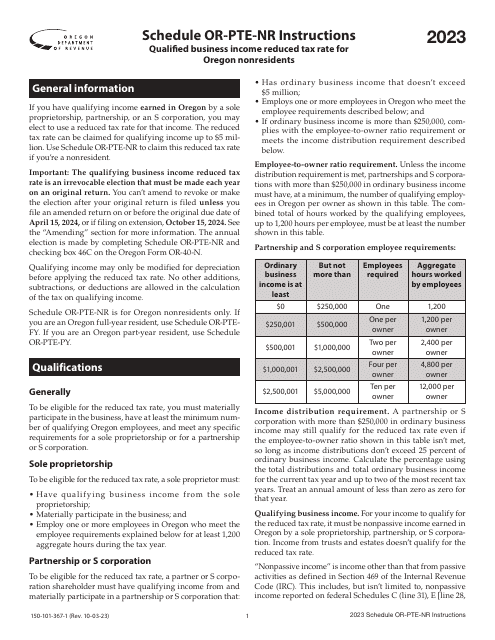

This form is used for Oregon full-year residents to calculate the reduced tax rate for qualified business income.

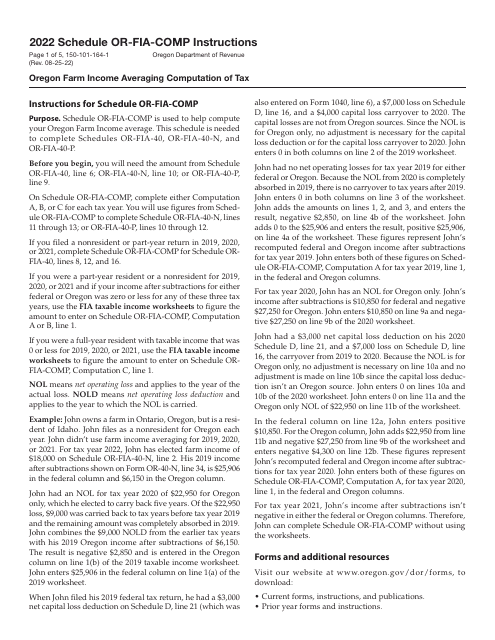

Form 150-101-164 Schedule OR-FIA-COMP Oregon Farm Income Averaging Computation of Tax - Oregon, 2023