Oregon Department of Revenue Forms

The Oregon Department of Revenue is responsible for administering and enforcing tax laws in the state of Oregon. They collect various taxes, including income tax, property tax, and business taxes, and ensure compliance with tax regulations. The department also provides taxpayer assistance, processes tax returns, and conducts audits to verify accurate reporting of tax liabilities.

Documents:

1228

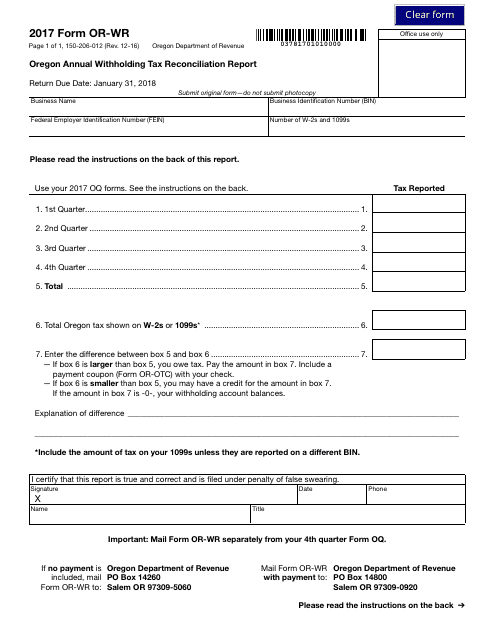

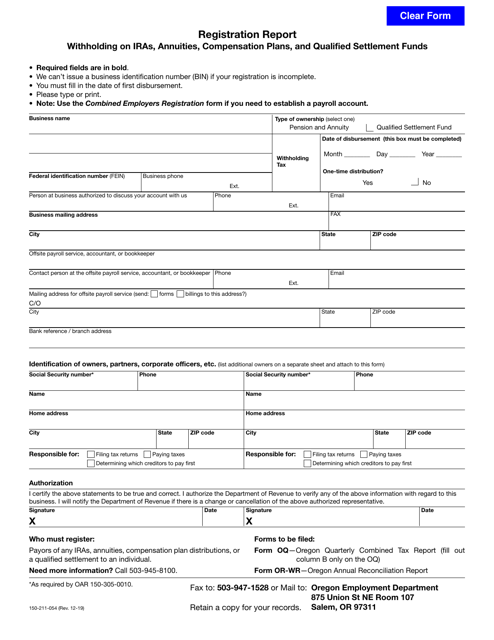

This Form is used for reporting annual withholding tax in Oregon.

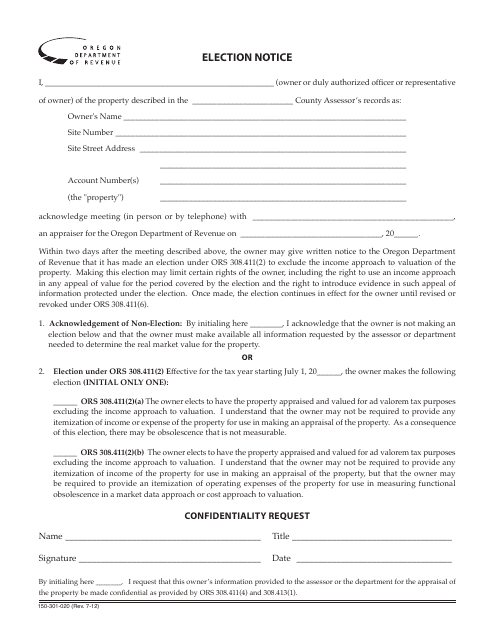

This form is used for providing an election notice in the state of Oregon.

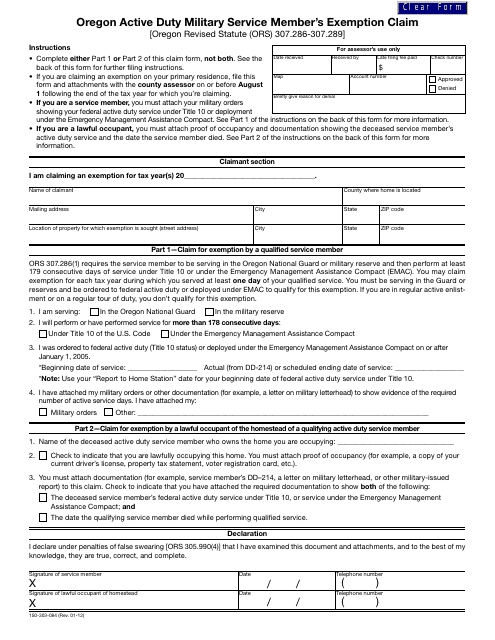

This form is used for Oregon residents who are active duty military service members to claim an exemption on their taxes.

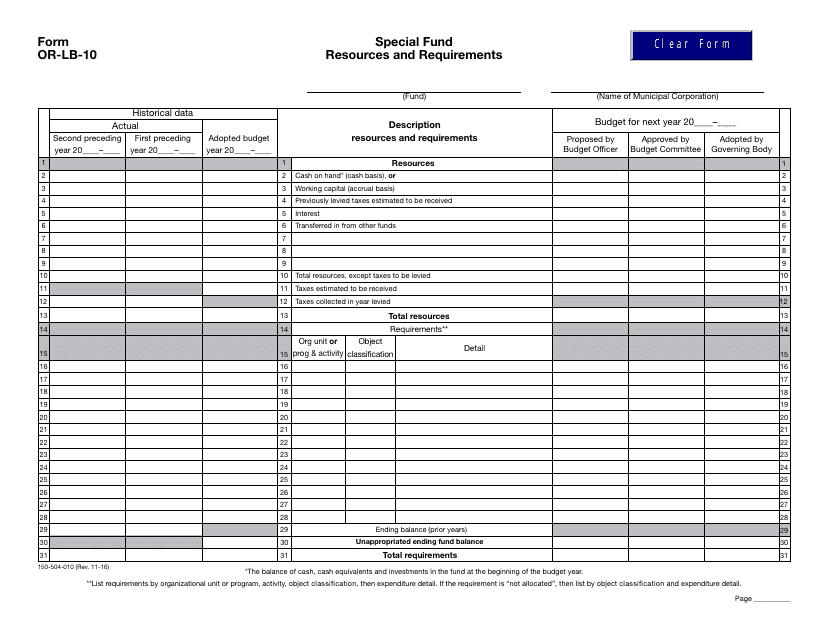

This form is used for reporting and managing special fund resources and requirements in the state of Oregon. It provides a detailed overview of the funds available and their specific requirements.

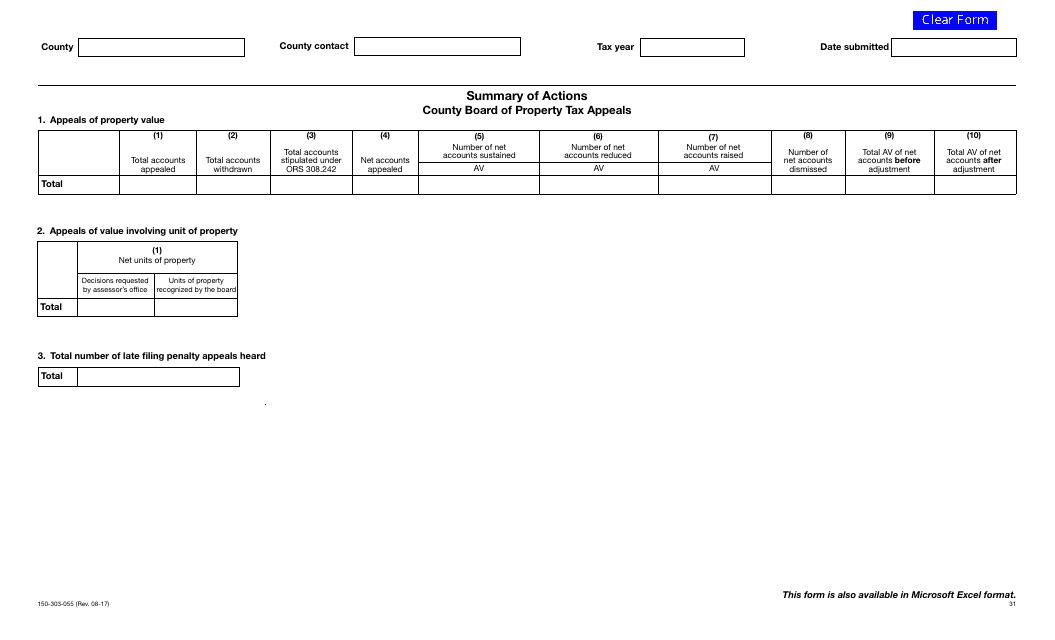

This form is used for submitting a summary of actions for the County Board of Property Tax Appeals in Oregon.

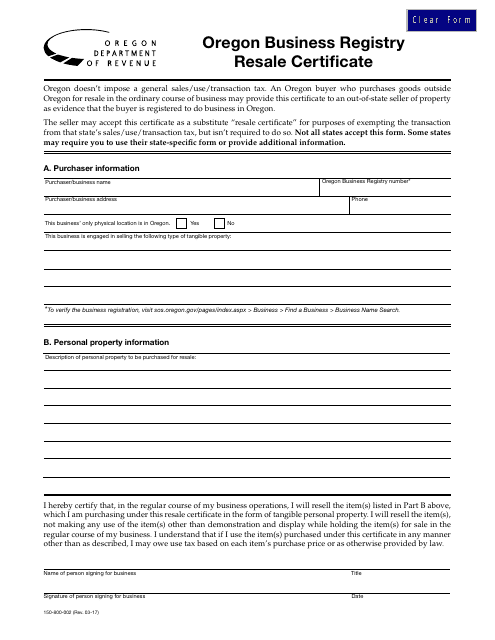

This Form is used for obtaining a Resale Certificate in Oregon for businesses registered in the state. It allows businesses to make purchases for resale without paying sales tax.

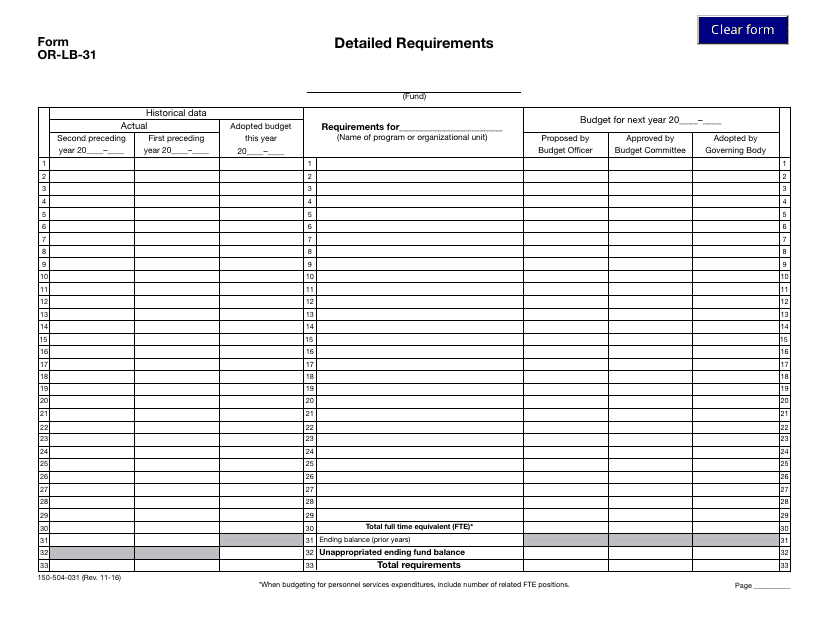

This document provides detailed requirements for Form 150-504-031 (OR-LB-31) in the state of Oregon.

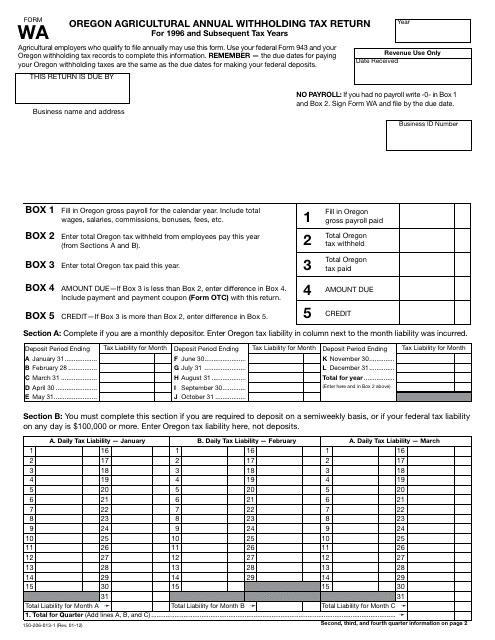

This document is used for reporting and paying the annual withholding tax for agricultural businesses in the state of Oregon.

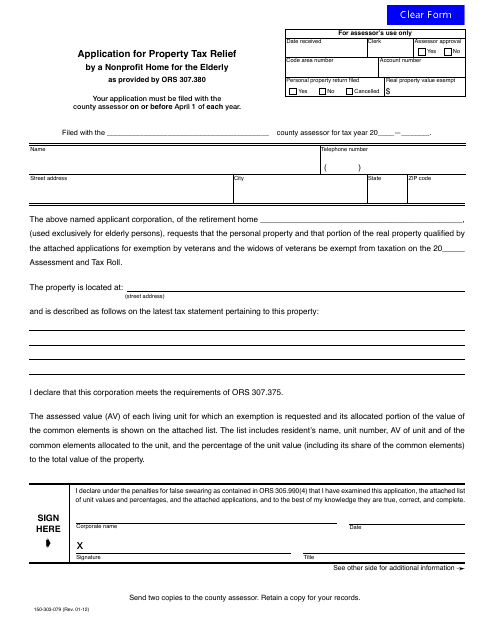

This form is used for nonprofit homes for the elderly in Oregon to apply for property tax relief. It helps them reduce their tax burden and continue providing essential services for the elderly population.

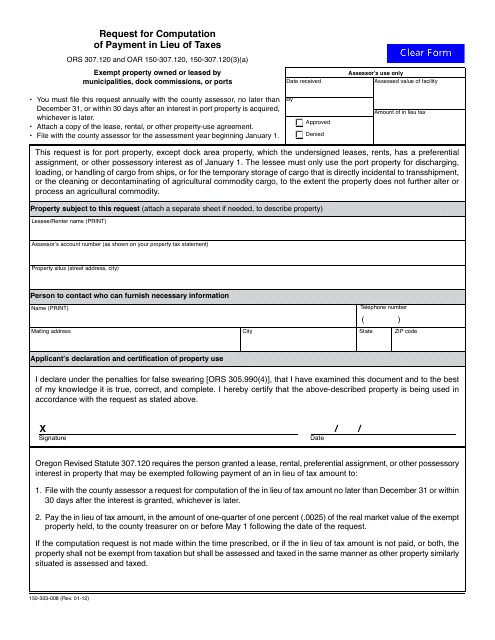

This form is used for requesting the computation of payment in lieu of taxes in the state of Oregon.

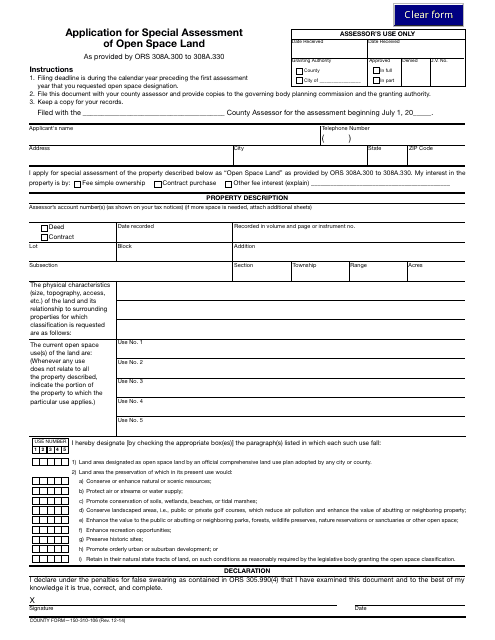

This Form is used for applying for special assessment of open space land in Oregon.

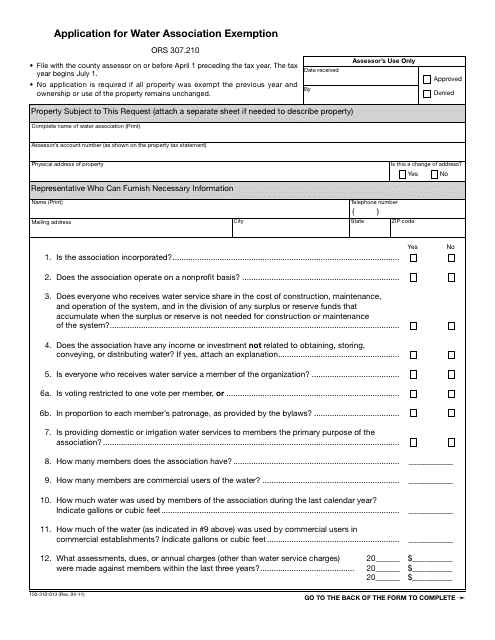

This Form is used for applying for a water association exemption in the state of Oregon.

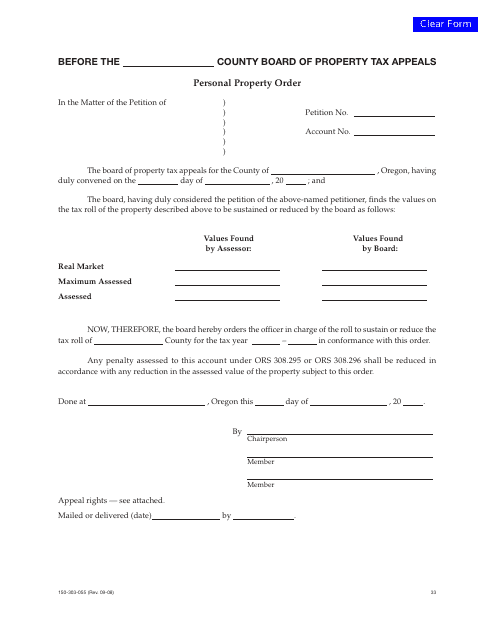

This form is used for placing an order for personal property in the state of Oregon.

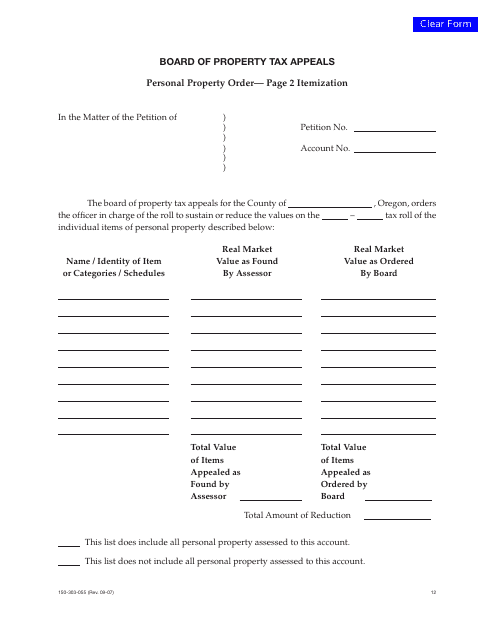

This form is used for itemizing personal property in Oregon.

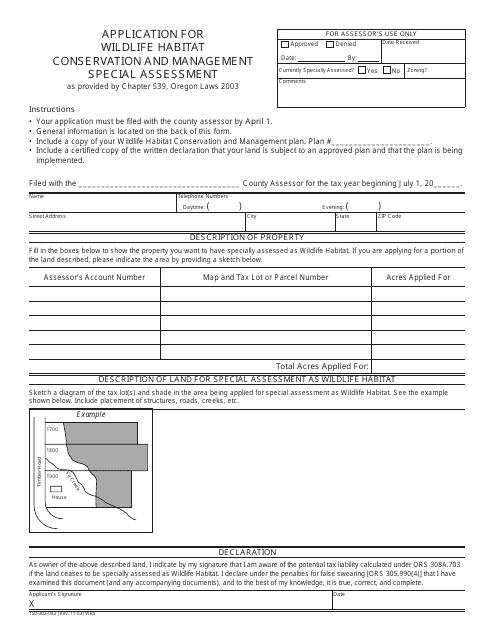

This form is used for applying for the Wildlife Habitat Conservation and Management Special Assessment in Oregon.

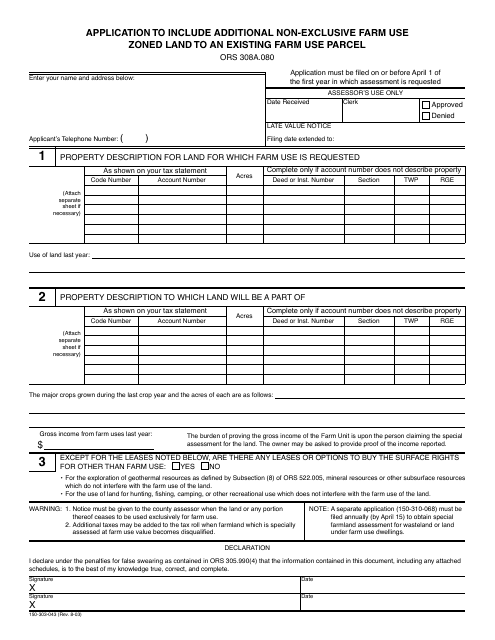

This form is used in Oregon to apply for including additional non-exclusive farm use zoned land to an existing farm use parcel.

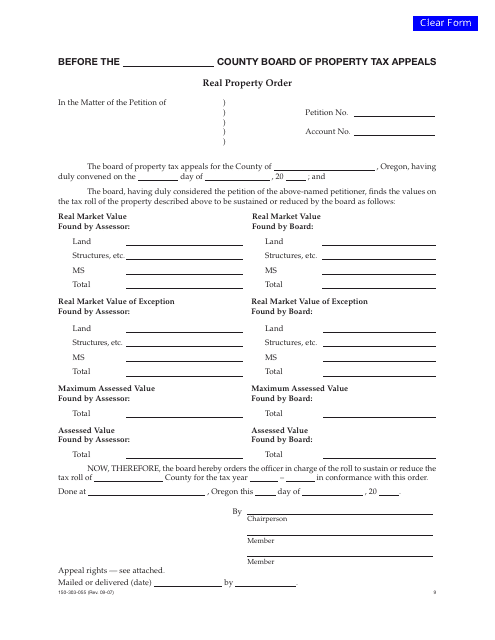

This form is used for creating a real property order in the state of Oregon.

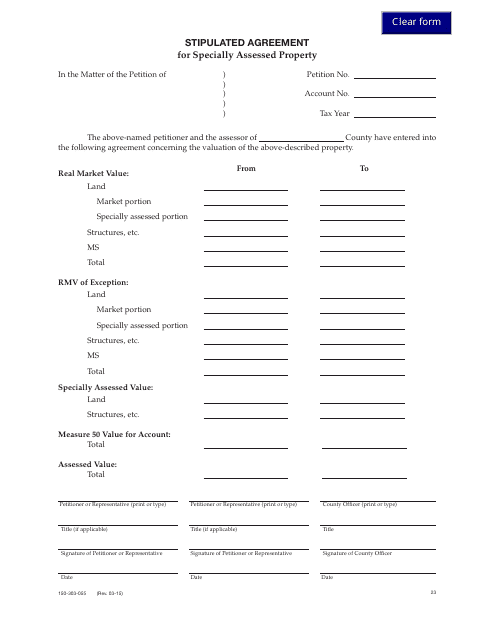

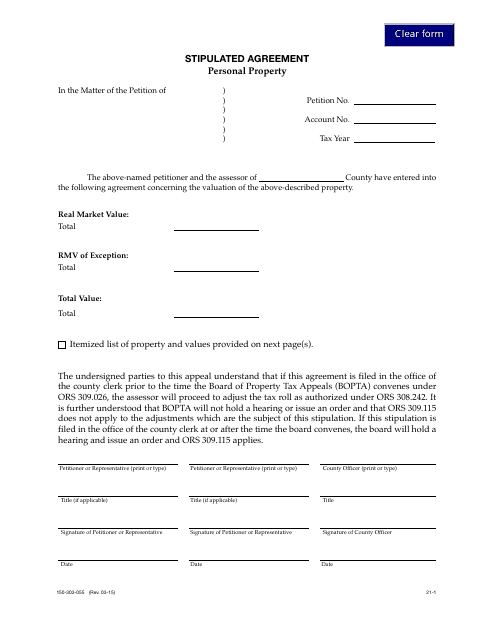

This form is used for entering into a stipulated agreement for specially assessed property in the state of Oregon.

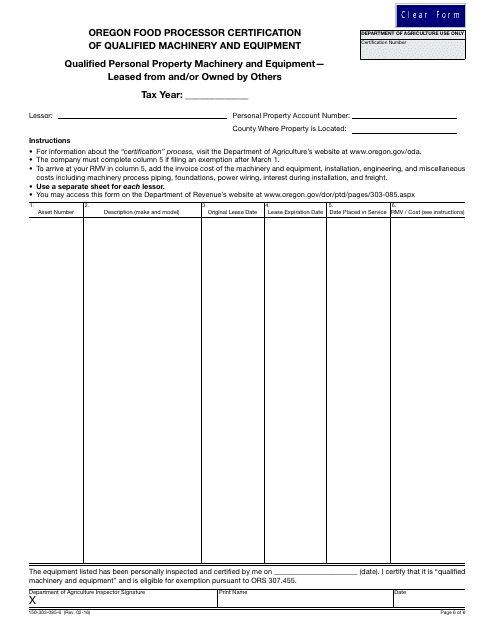

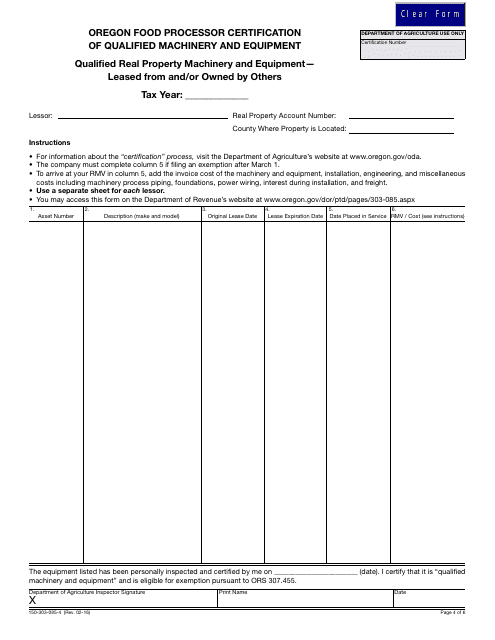

This Form is used for Oregon food processors to certify their qualified machinery and equipment that is leased or owned by others for tax purposes.

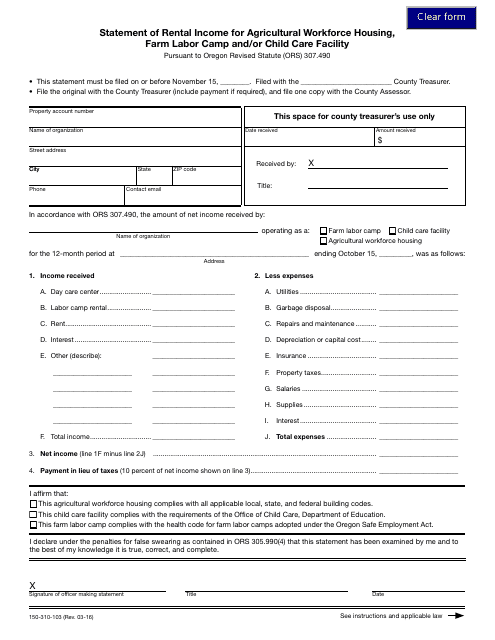

This form is used for reporting rental income for agricultural housing, farm labor camps, and child care facilities in Oregon.

This Form is used for creating a stipulated agreement regarding personal property in the state of Oregon. It outlines the terms and conditions agreed upon by both parties regarding the property in question.

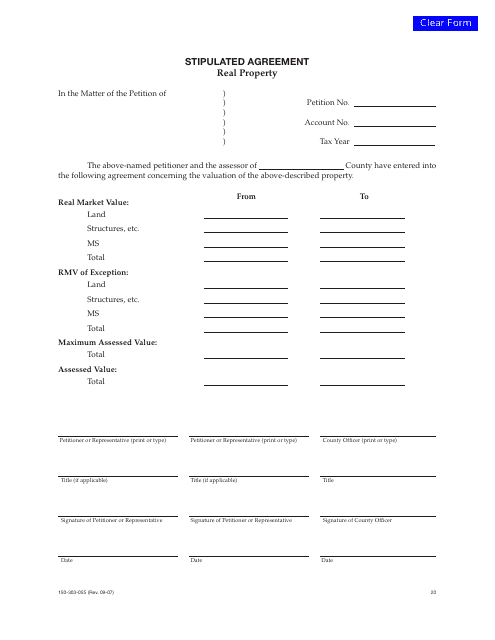

This Form is used for a stipulated agreement regarding real property in Oregon.

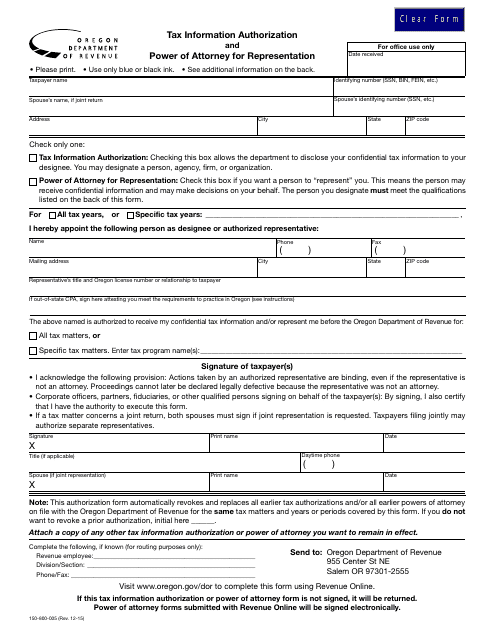

This form is used for authorizing someone to act on your behalf for tax matters in Oregon. It allows them to access your tax information and represent you before the Oregon Department of Revenue.

This Form is used for Oregon food processors to certify their leased or owned machinery and equipment.

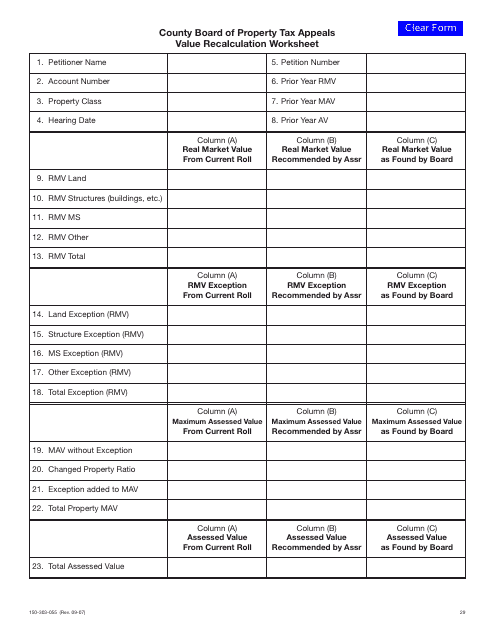

This form is used for property owners in Oregon to request a recalculation of their property's value for tax purposes.

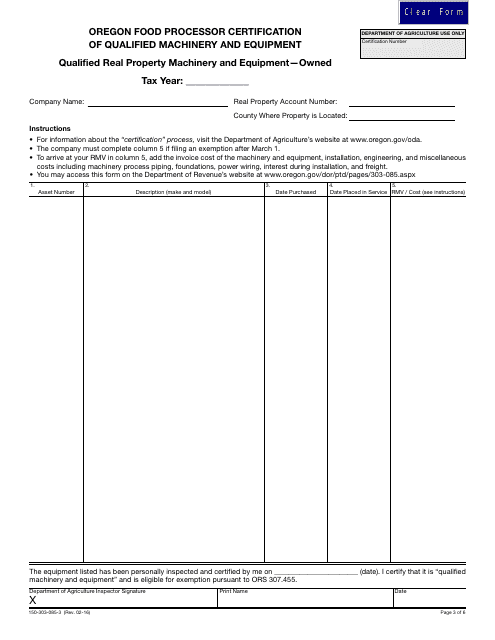

This Form is used for Oregon food processors to certify their qualified machinery and equipment that they own.

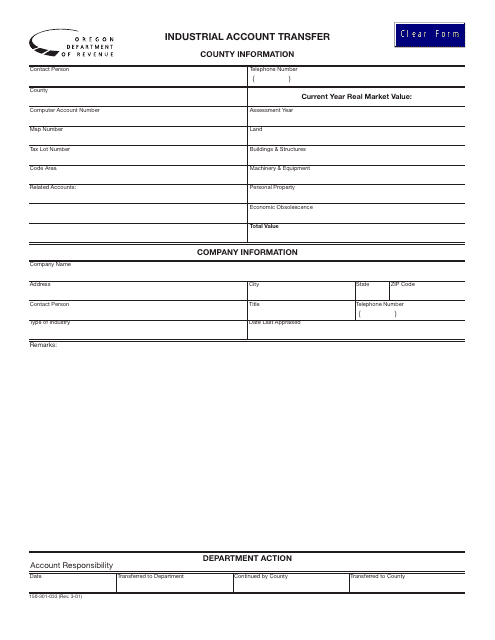

This form is used for transferring an industrial account in Oregon.

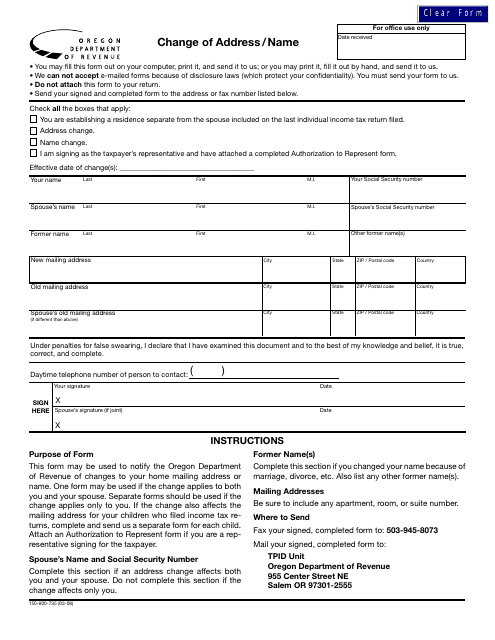

This form is used for changing your address or name in Oregon.

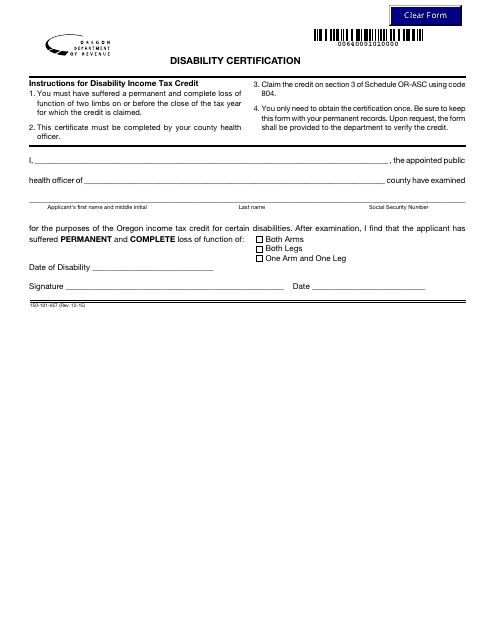

This Form is used for Disability Certification in the state of Oregon. It is used to determine if an individual qualifies for disability benefits in Oregon.

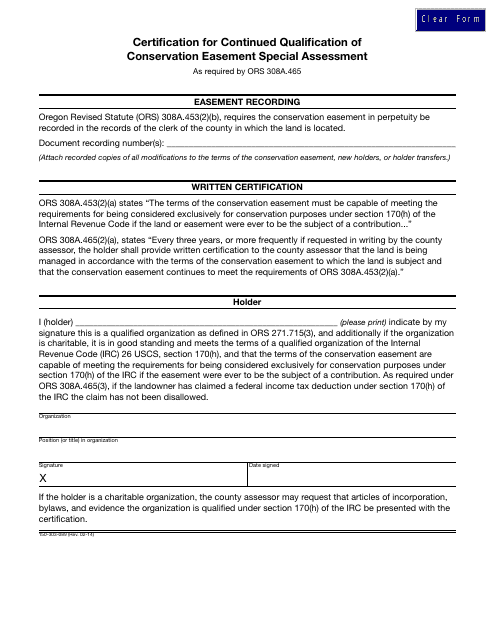

This form is used for the certification of continued qualification for the conservation easement special assessment in Oregon.

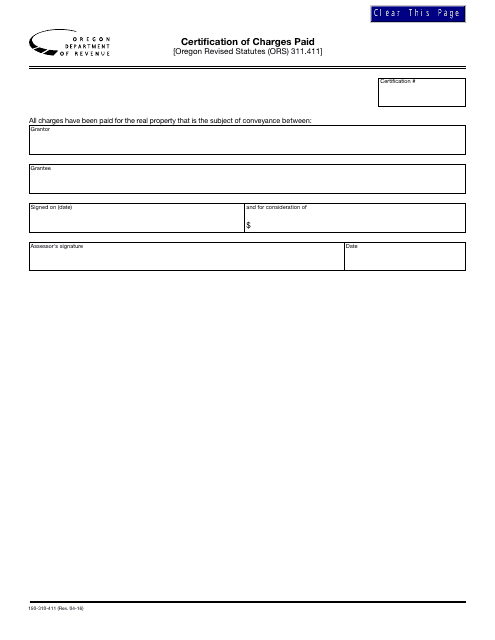

This form is used for certifying charges paid in the state of Oregon.

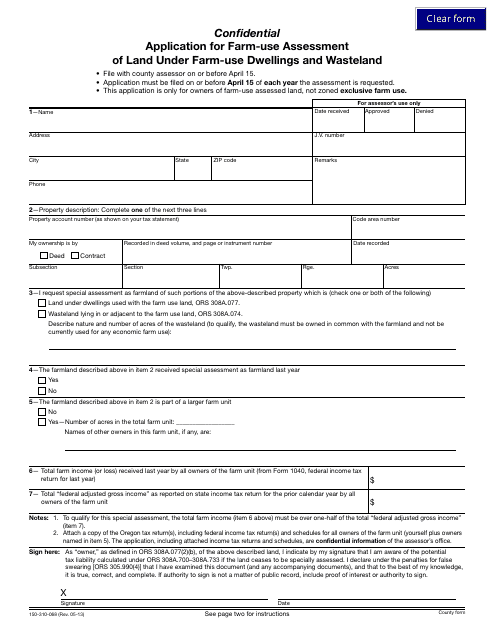

This form is used for confidentially applying for farm-use assessment of land under farm-use dwellings and wasteland in Oregon.

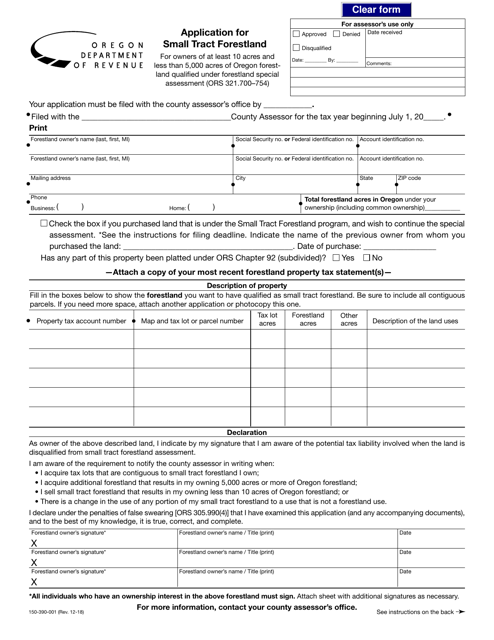

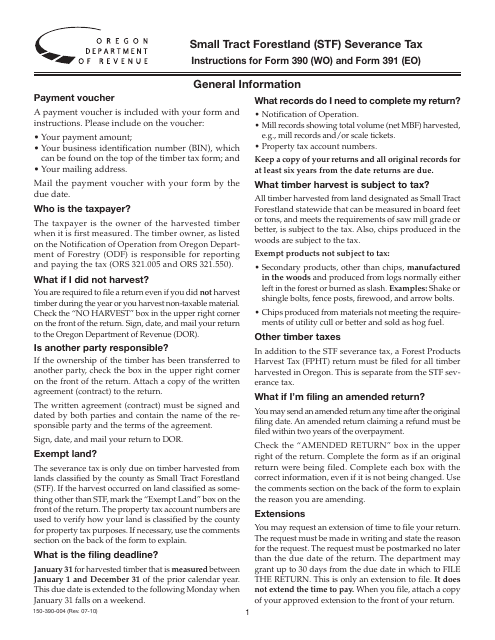

This form is used for reporting and paying the small tract forestland severance tax in Oregon. It provides instructions on how to fill out forms 390 (WO) and 391 (EO) for reporting the tax on forest product removals from small tracts of forestland.

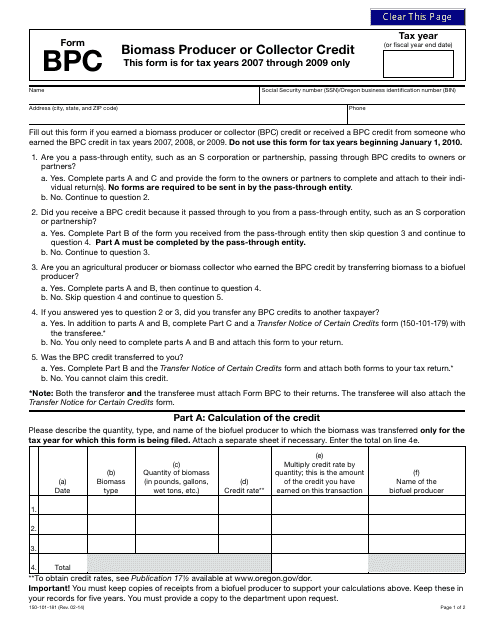

This form is used for claiming the Biomass Producer or Collector Credit in the state of Oregon.

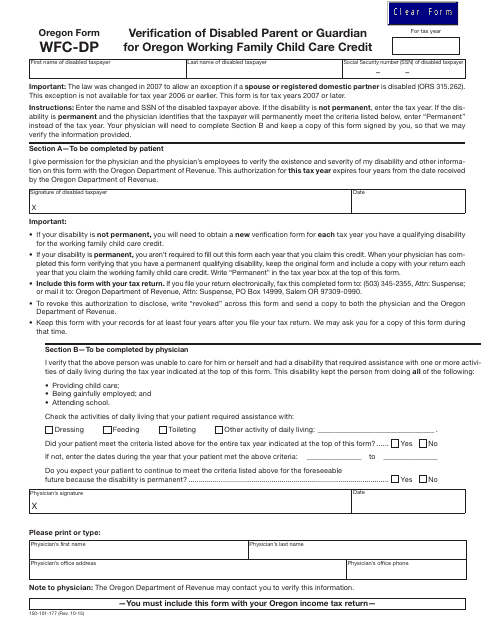

This form is used for verifying the disabled parent or guardian for the Oregon Working Family Child Care Credit in Oregon.

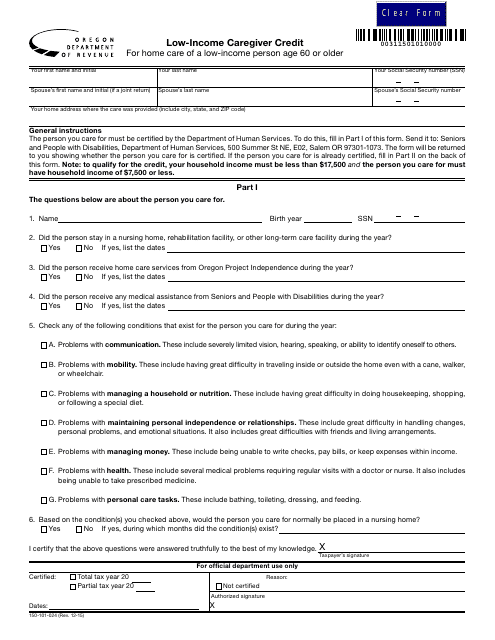

This form is used for claiming the Low-Income Caregiver Credit in the state of Oregon.