Ohio Department of Taxation Forms

The Ohio Department of Taxation is responsible for administering the state's tax laws and collecting various taxes, such as income tax, sales tax, property tax, and corporate tax. Its primary purpose is to ensure that individuals and businesses in Ohio meet their tax obligations and to provide taxpayer assistance and support.

Documents:

402

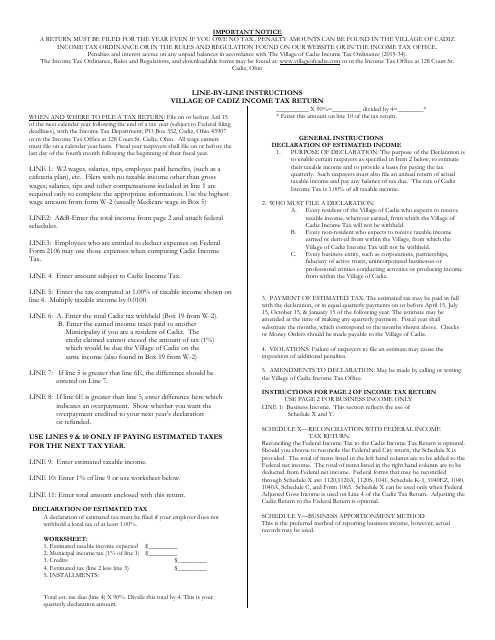

This document provides instructions for completing the Village of Cadiz Income Tax Return form in Cadiz, Ohio. It guides residents on how to accurately report their income and calculate their tax liabilities for the village.

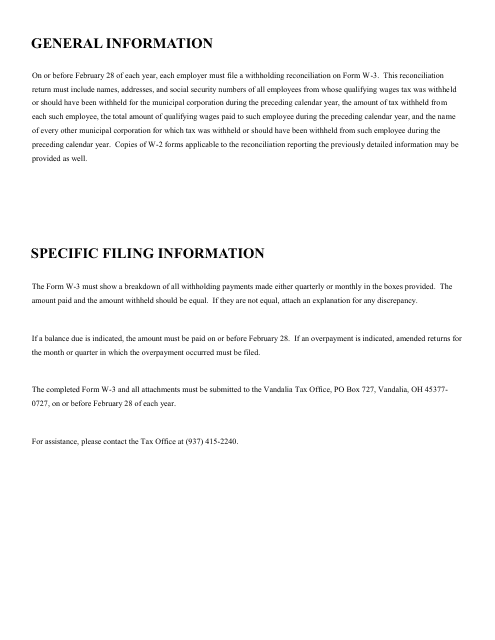

This Form is used for reconciling withholding taxes for the City of Vandalia, Ohio.

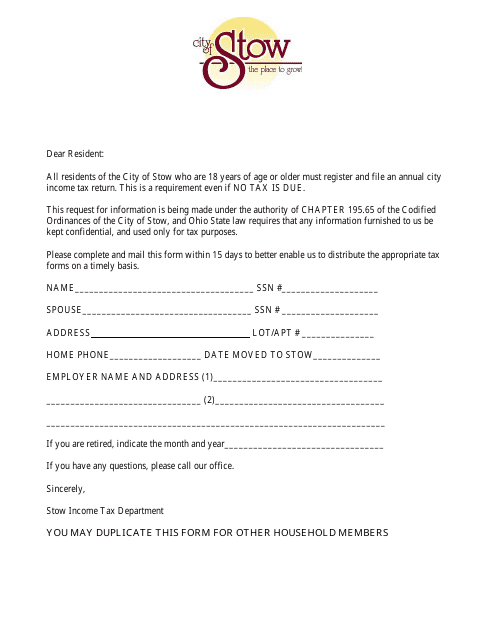

This Form is used for filing your income tax return in the City of Stow, Ohio.

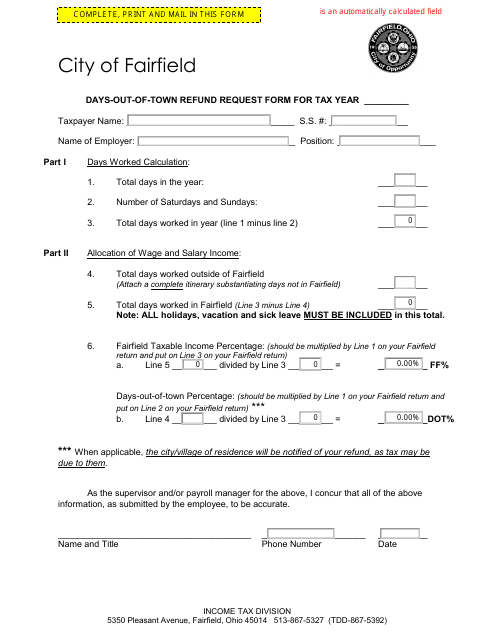

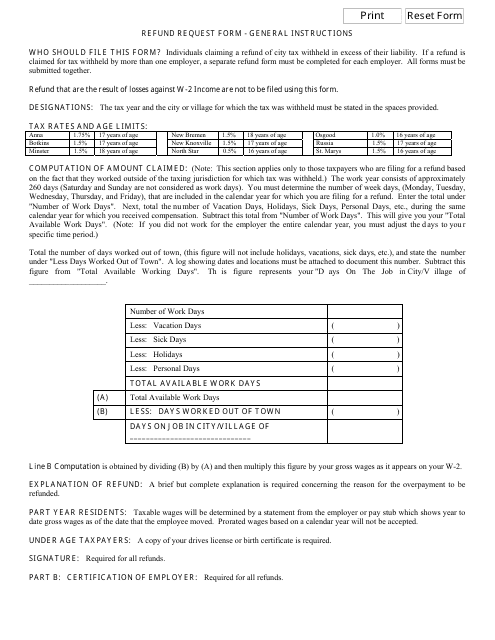

This Form is used for requesting a refund for days spent out of town in Fairfield, Ohio.

This Form is used for filing tax returns and declaring income to the City of Norton, Ohio.

This Form is used for requesting a refund from the City of St. Marys, Ohio.

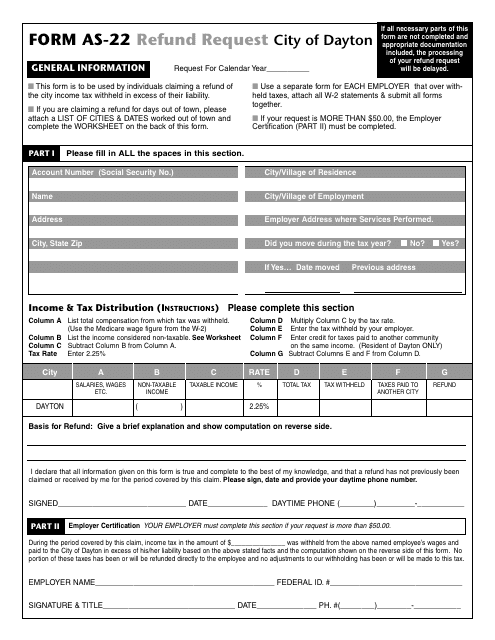

This form is used for requesting a refund from the City of Dayton, Ohio.

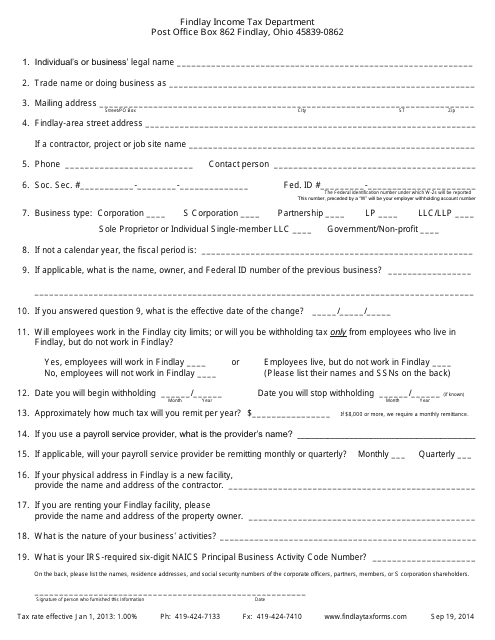

This type of document is a Business Questionnaire Form used by the City of Findlay, Ohio. It is used to collect information from businesses in the city for various purposes such as licensing, tax assessment, and community development.

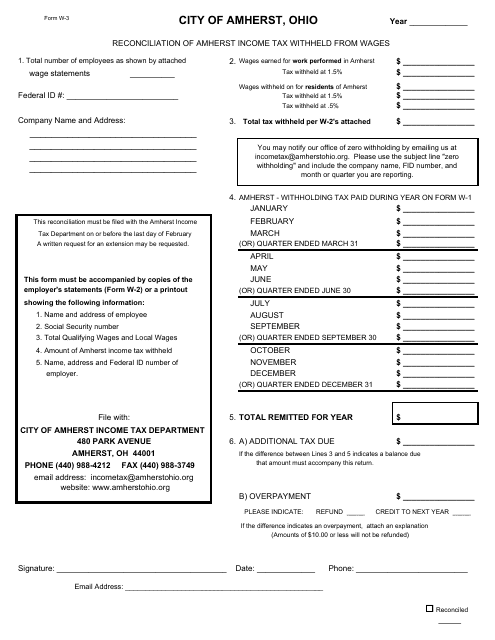

This type of document is used for reconciling the income tax withheld from wages in the city of Amherst, Ohio.

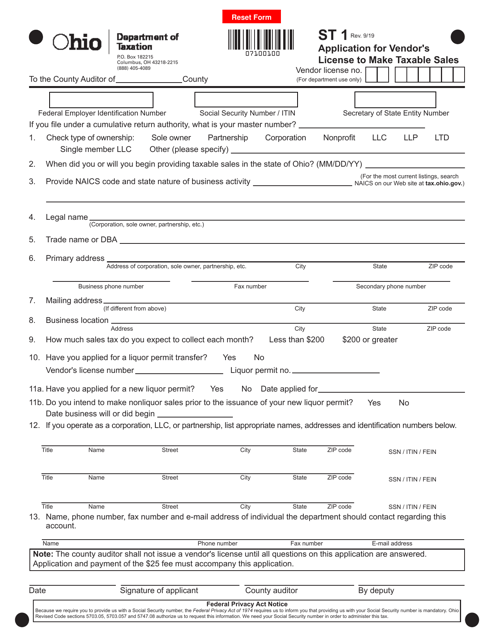

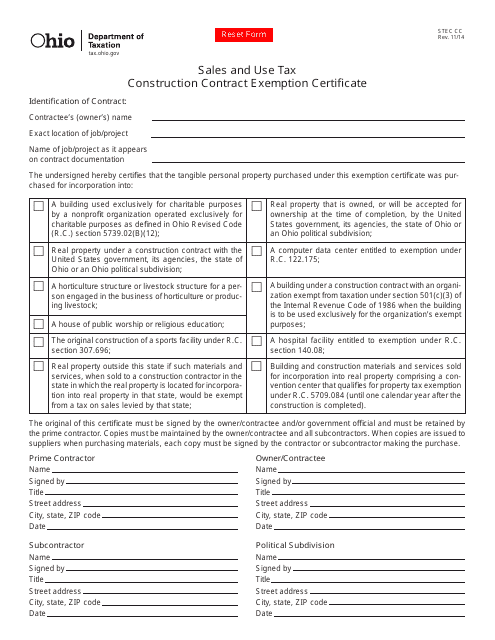

This form is used for claiming a sales and use tax exemption for construction contracts in Ohio. Contractors can use this certificate to exempt certain construction materials and services from sales tax.

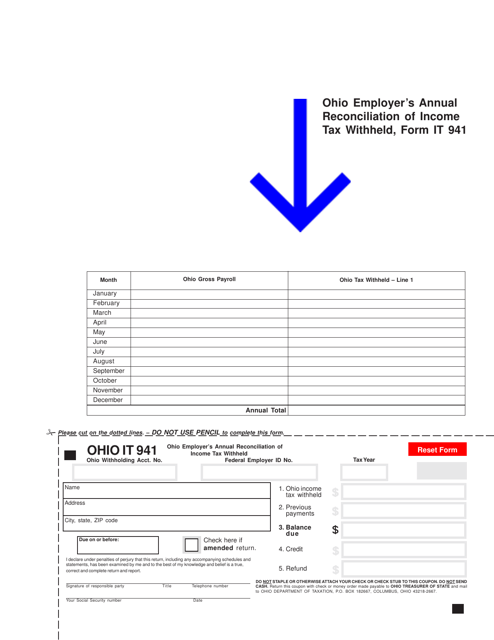

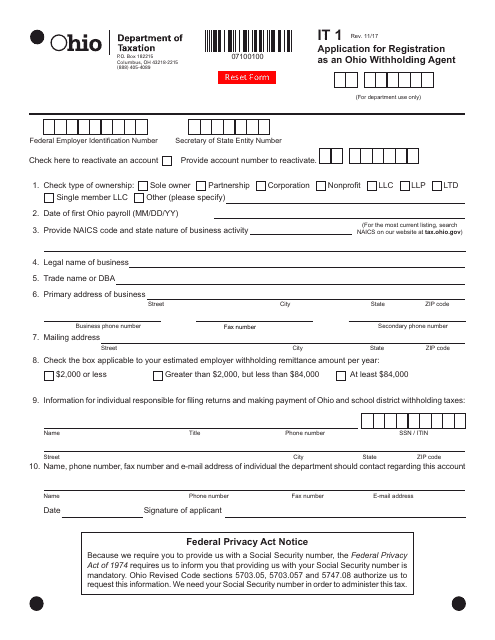

This form is used for applying to become a withholding agent in Ohio.

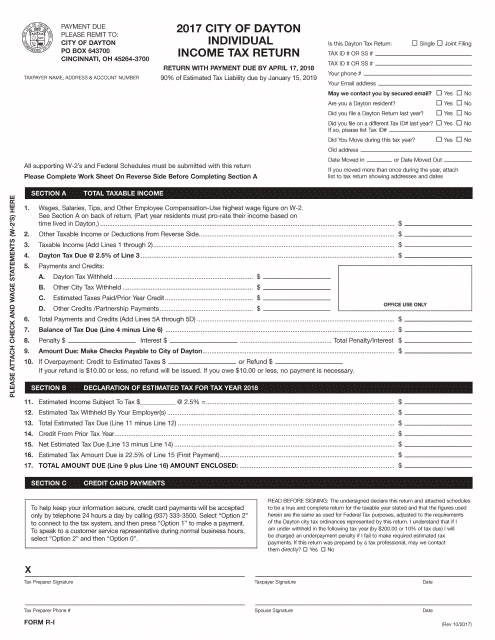

This form is used to report individual income tax return for residents of the City of Dayton, Ohio.

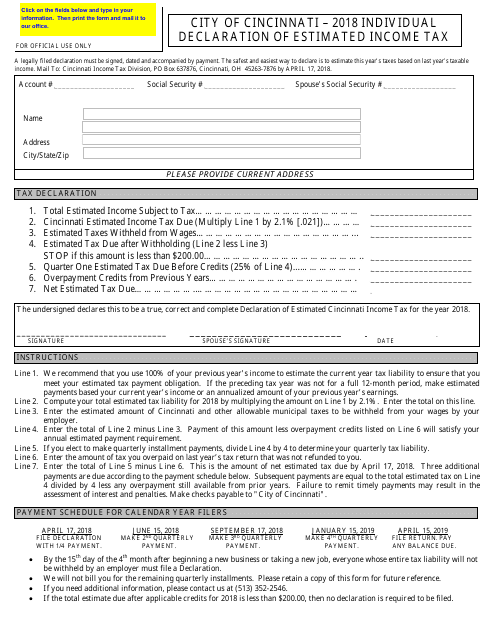

This document is used for individuals to declare their estimated income tax in the City of Cincinnati, Ohio. It is used to estimate and pay the amount of income tax owed to the city throughout the year.

This Form is used for filing income tax returns specifically for residents of the city of Brunswick, Ohio.

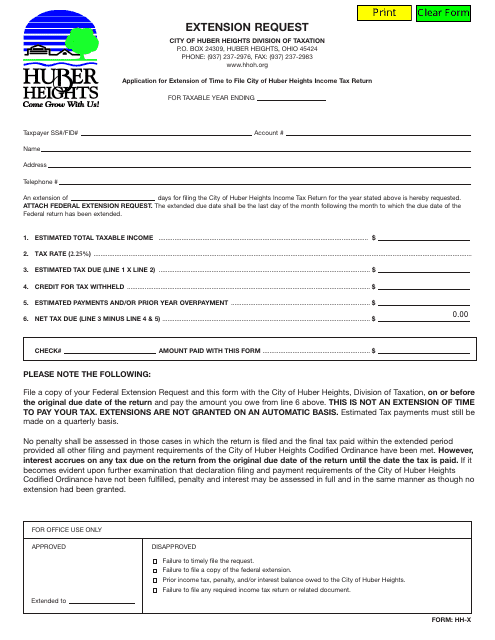

This form is used for requesting an extension of time for certain activities related to the City of Huber Heights, Ohio.

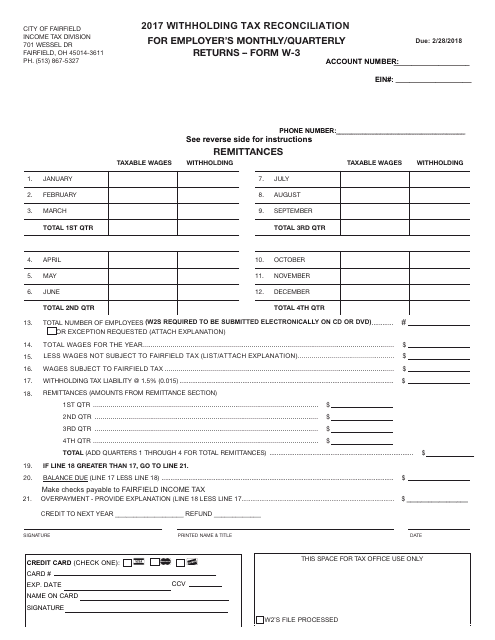

This form is used by employers in Fairfield, Ohio to reconcile withholding taxes from their monthly or quarterly returns. It helps ensure accurate reporting and payment of taxes to the city.

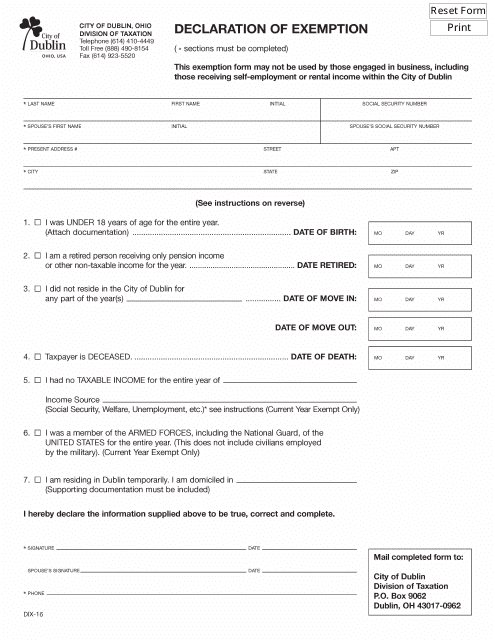

This form is used to declare exemption from certain taxes in the City of Dublin, Ohio.

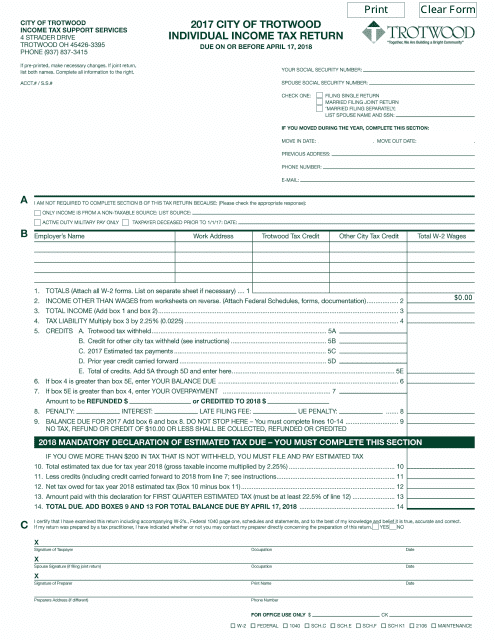

This form is used for filing individual income tax returns for residents of the City of Trotwood, Ohio.

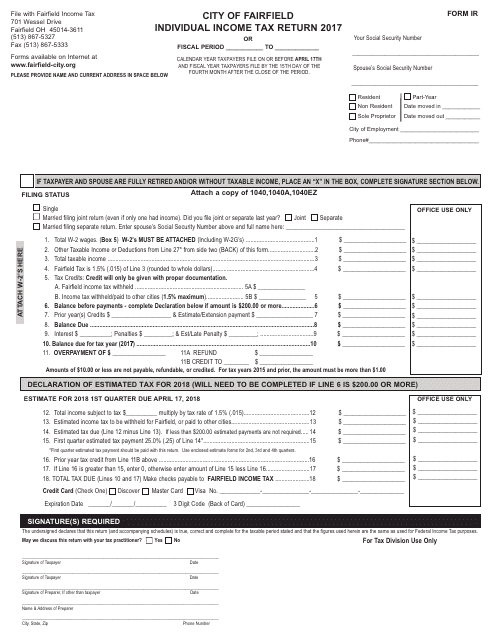

This form is used for filing an individual income tax return in the city of Fairfield, Ohio.

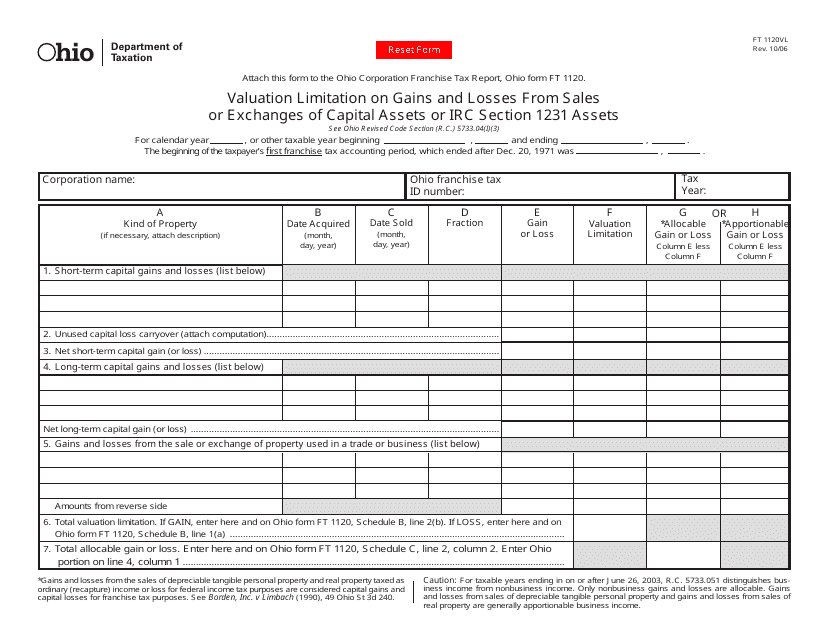

This form is used in Ohio to calculate the valuation limitation on gains and losses from sales or exchanges of capital assets or IRC Section 1231 assets.

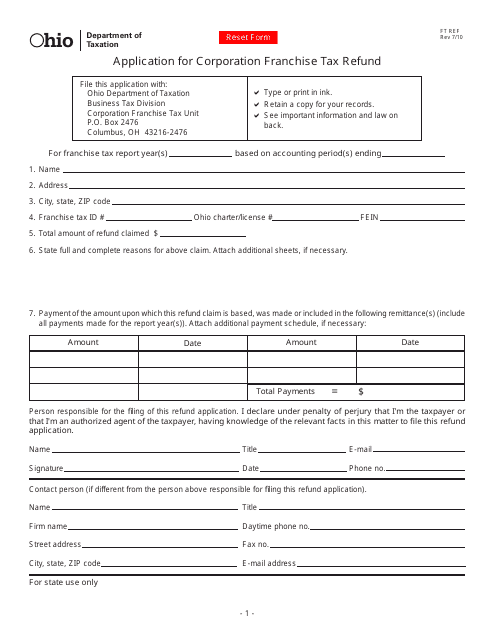

This Form is used for corporations in Ohio to apply for a refund of their franchise tax payments.

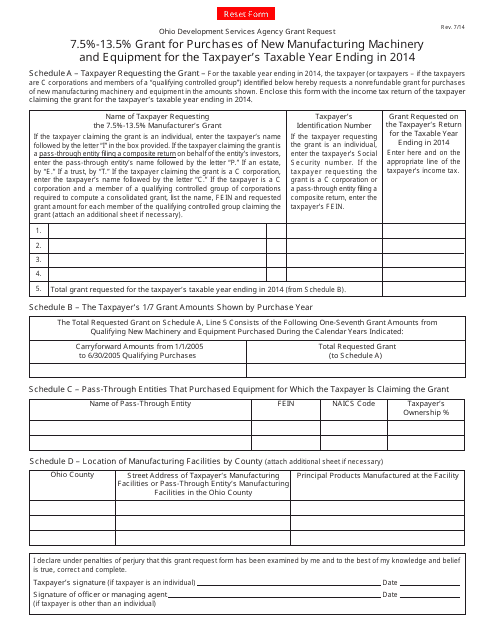

This form is used to apply for a grant of 7.5%-13.5% for the purchase of new manufacturing machinery and equipment in Ohio for the taxpayer's taxable year ending in 2014.

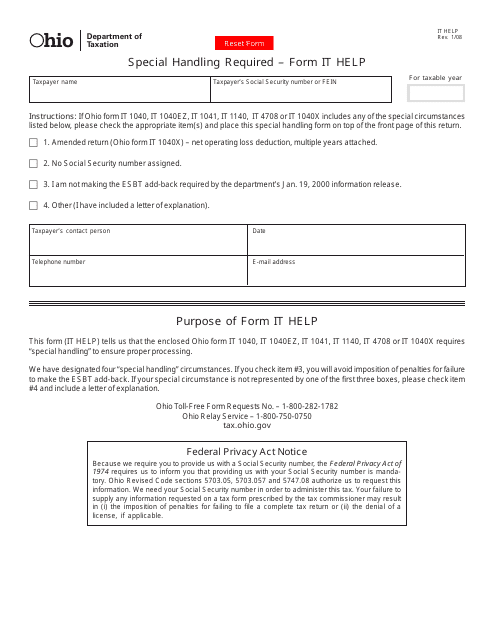

This Form is used for IT support requests from Ohio residents that require special handling.

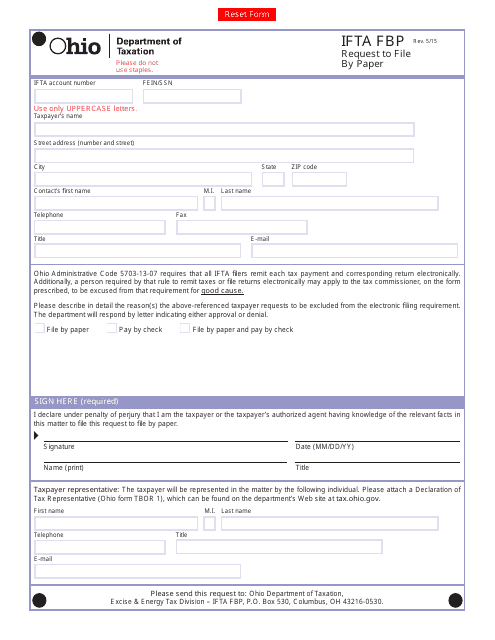

This form is used for requesting to file the International Fuel Tax Agreement (IFTA) Fuel Use Tax return by paper in the state of Ohio.

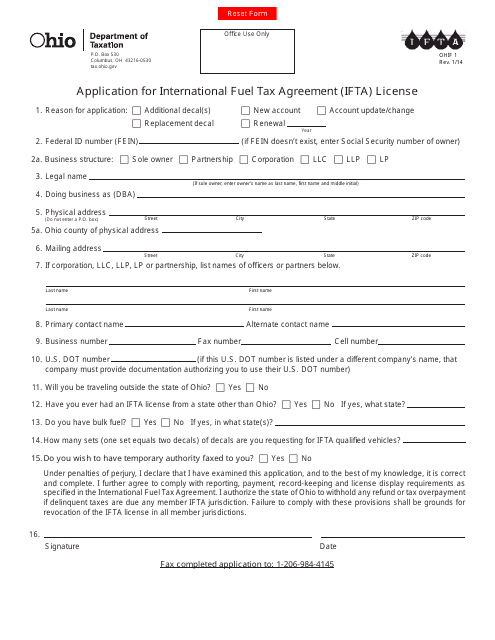

This Form is used for applying for an International Fuel Tax Agreement (IFTA) license in Ohio.

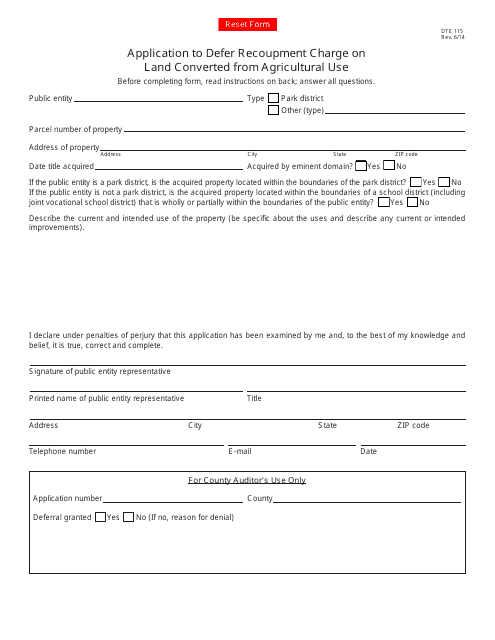

This form is used for applying to defer the recoupment charge on land that has been converted from agricultural use in Ohio.

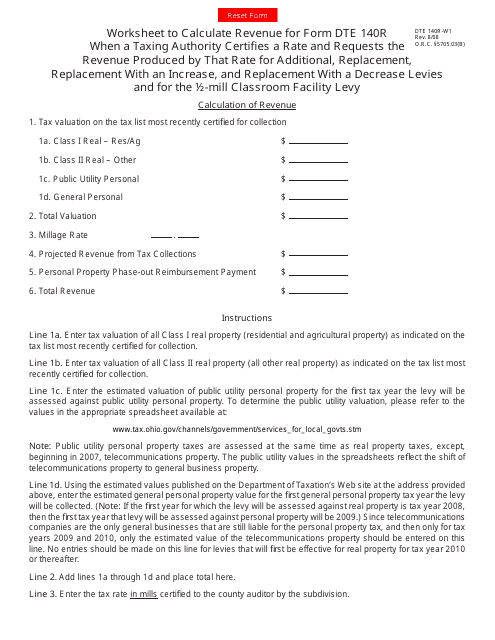

This form is used for calculating and reporting additional, replacement, increase, and decrease levies in Ohio, including the 1/2-mill classroom facility levy.

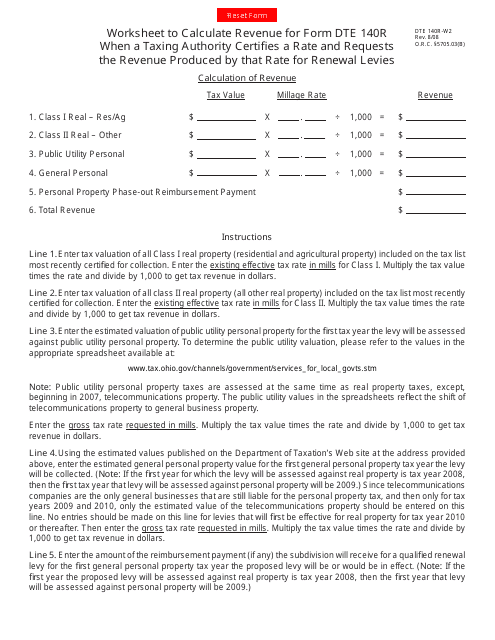

This form is used for completing the worksheet required for renewing levies in Ohio.

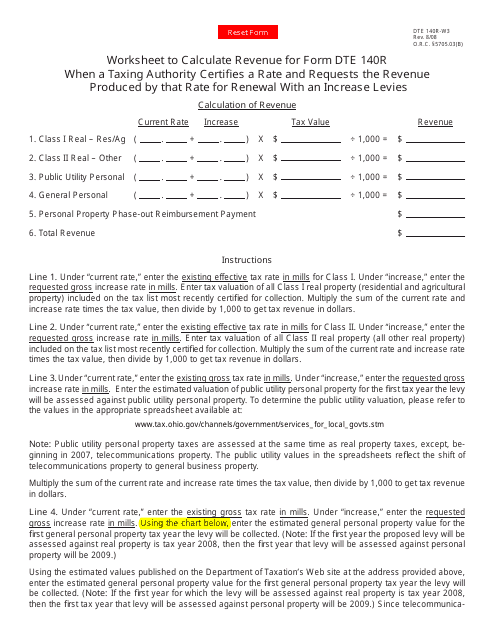

This form is used for completing the 140r Worksheet for Renewal With an Increase Levies in the state of Ohio. It is used by individuals or organizations to provide information about the increase in levies for renewal purposes.

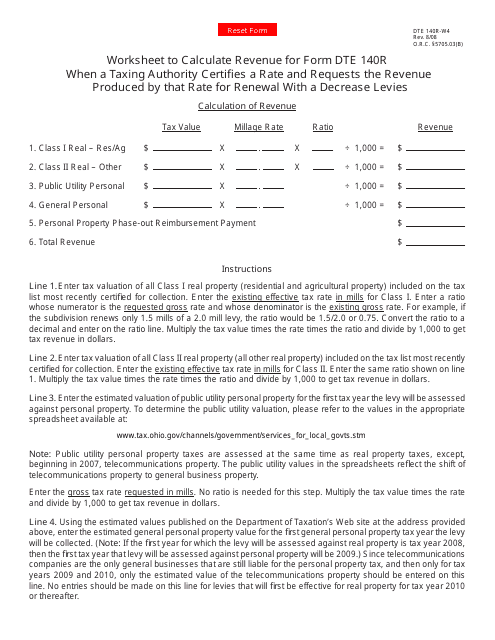

This form is used for calculating and reporting the renewal of levies with a decrease in Ohio. It is known as the DTE140R-W4 140r Worksheet.

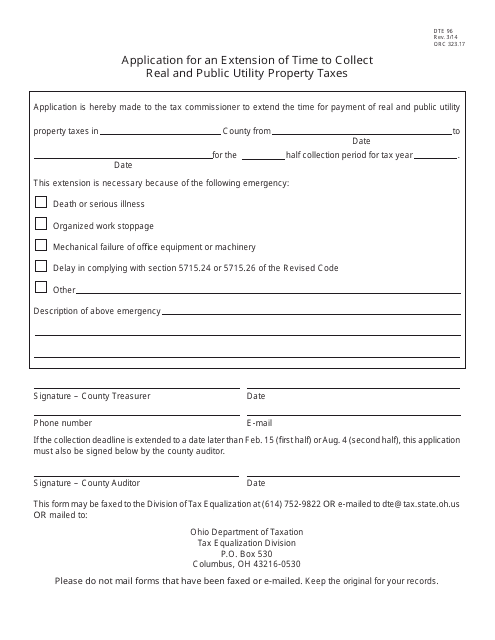

This form is used for applying for an extension of time to collect real and public utility property taxes in Ohio.

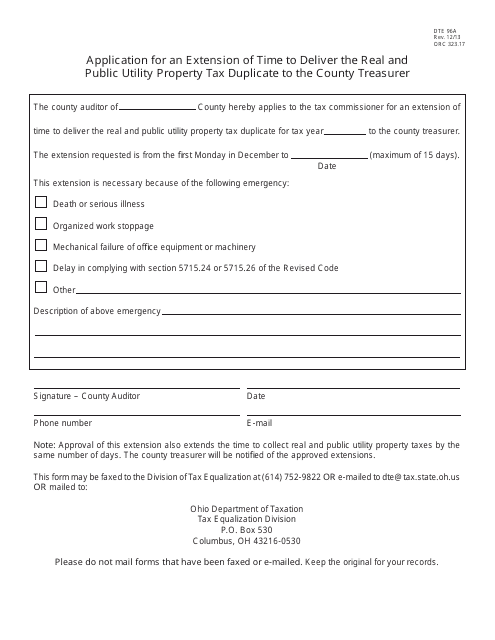

This form is used for applying for an extension of time to deliver the real and public utility property tax duplicate to the County Treasurer in Ohio.

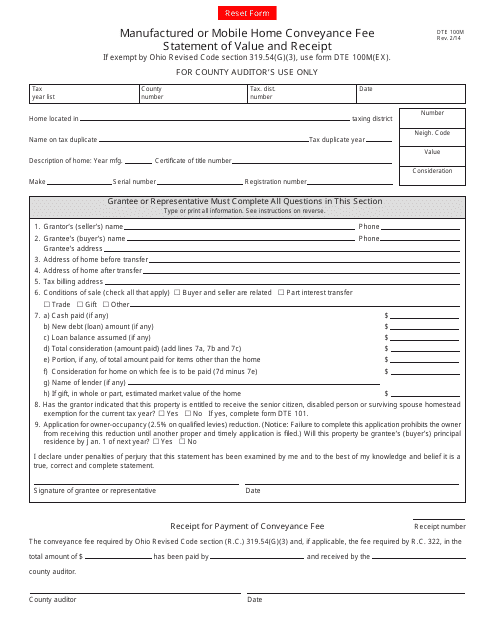

This form is used for reporting the value and payment of conveyance fees for the transfer of manufactured or mobile homes in Ohio.

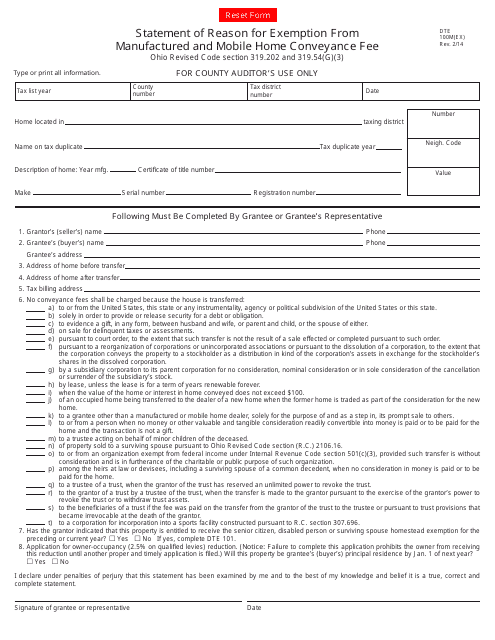

This Form is used for providing a statement of reason for exemption from the manufactured and mobile home conveyance fee in the state of Ohio.

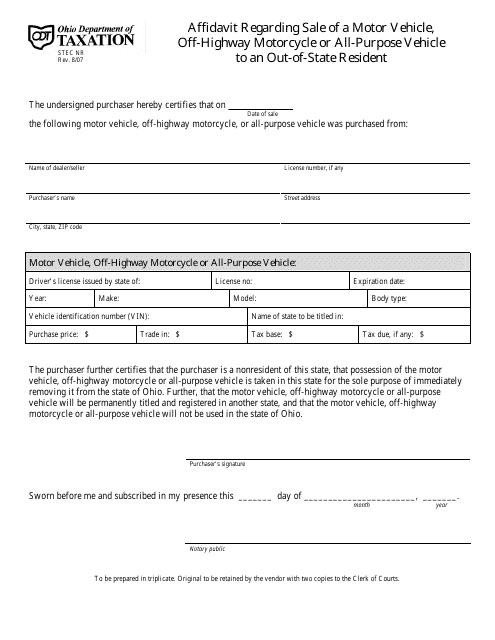

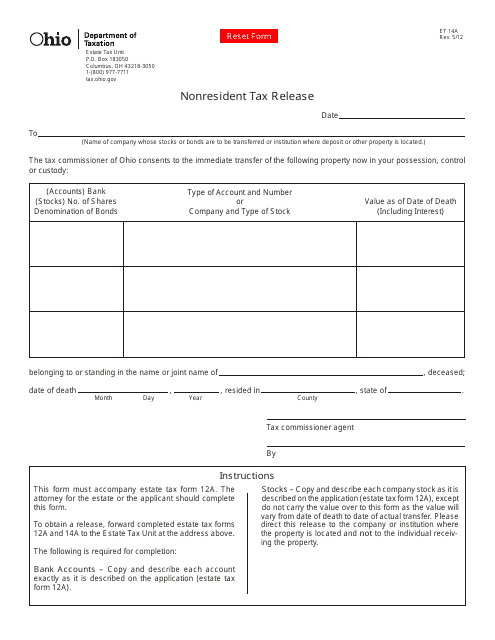

This form is used for nonresidents in Ohio to request a tax release.