New York City Department of Finance Forms

Documents:

716

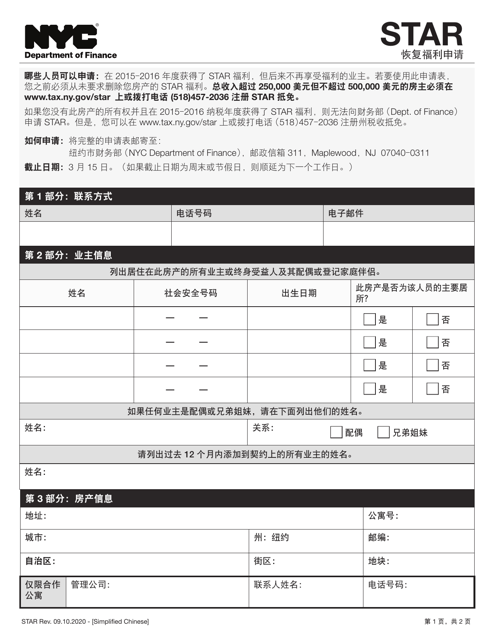

This Form is used for applying for a Star Benefit Restoration in New York City.

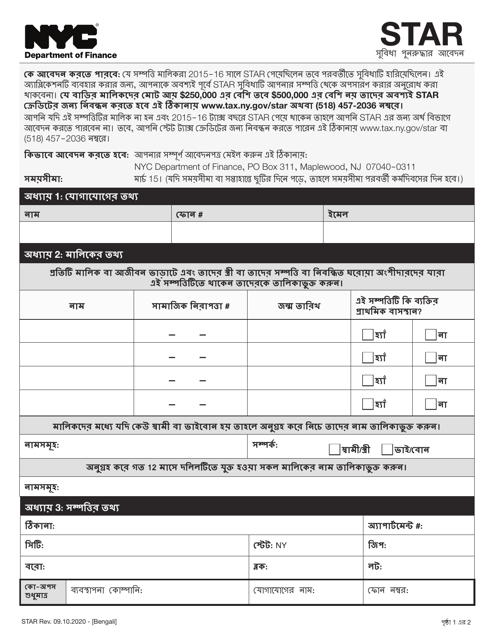

This document is for applying for the Star Benefit Restoration in New York City.

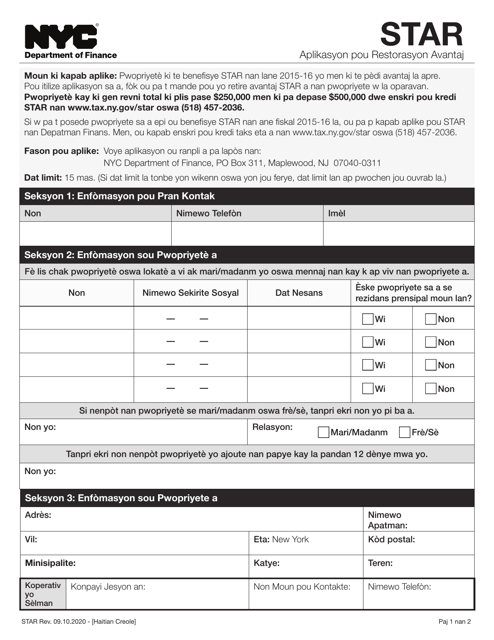

This document is used for filing a request to restore Star Benefits in New York City. It is available in Haitian Creole language.

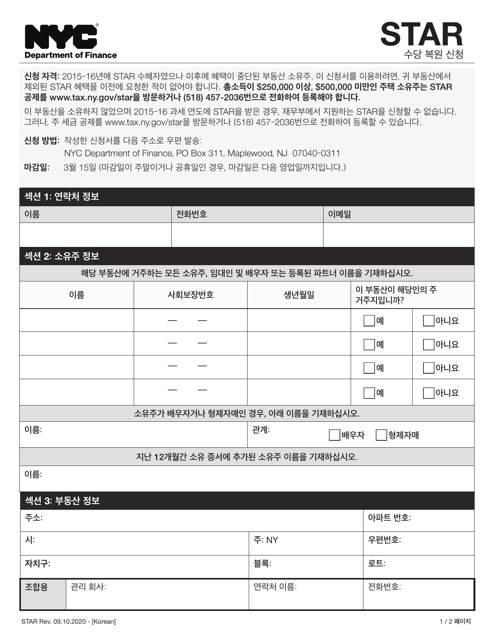

This document is for applying to restore star benefits in New York City. It is available in Korean language.

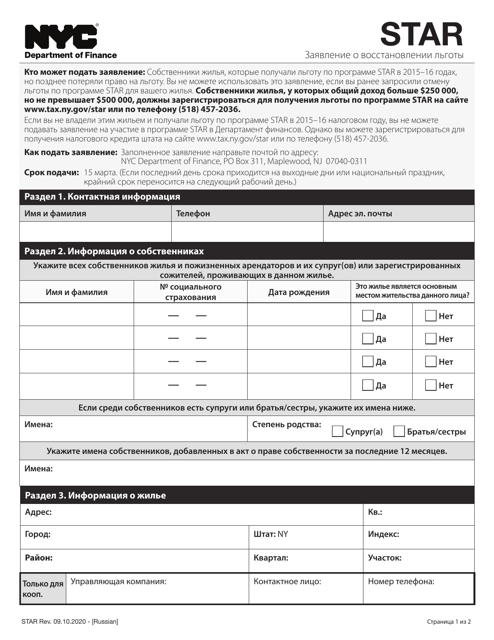

This type of document is used for applying for Star Benefit Restoration in New York City for Russian speakers.

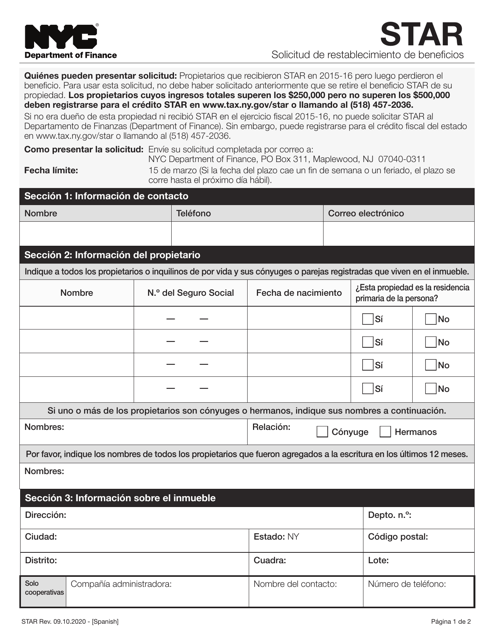

This document is used for requesting the restoration of benefits in New York City. It is written in Spanish.

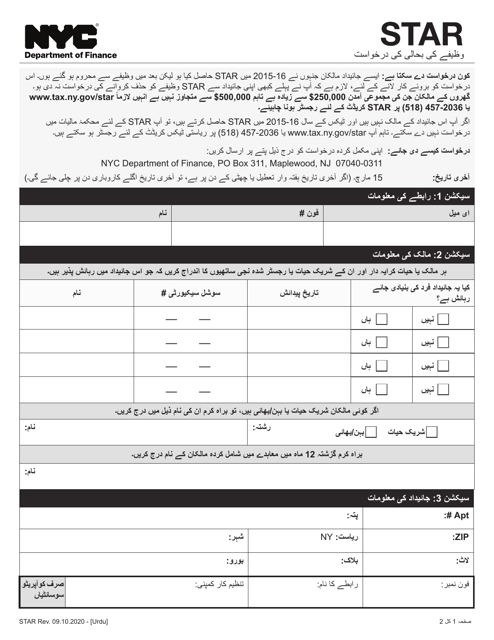

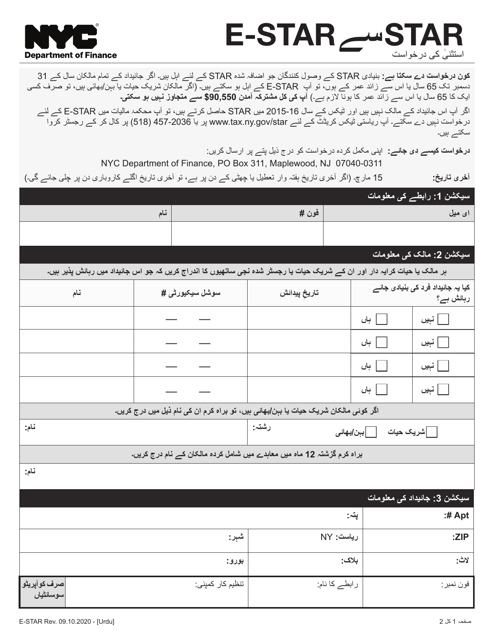

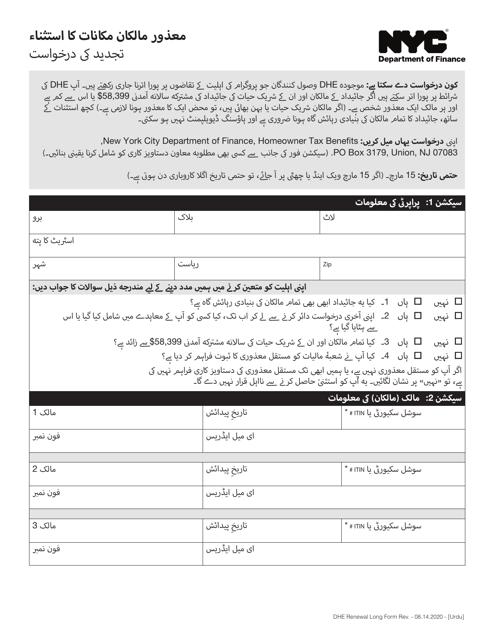

This Form is used for the Star Benefit Restoration Application in the Urdu language specifically for residents of New York City.

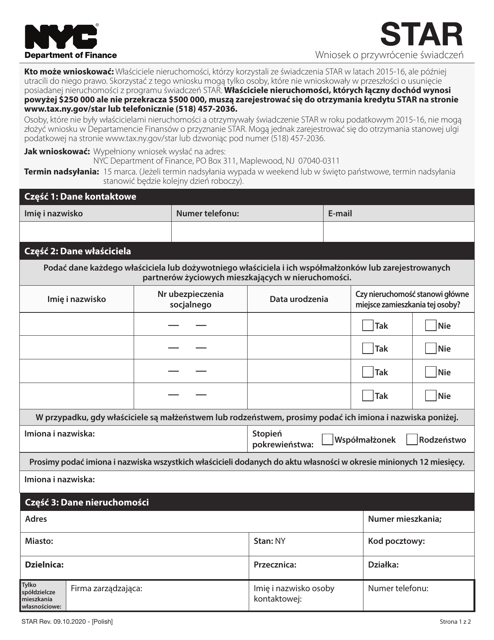

This form is used for applying for the Star Benefit Restoration in New York City for Polish-speaking residents.

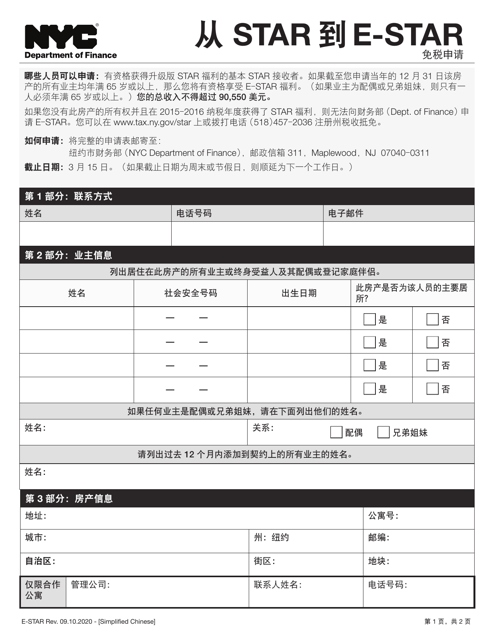

This document is used to apply for the Star to E-Star Exemption in New York City and is available in the Chinese Simplified language.

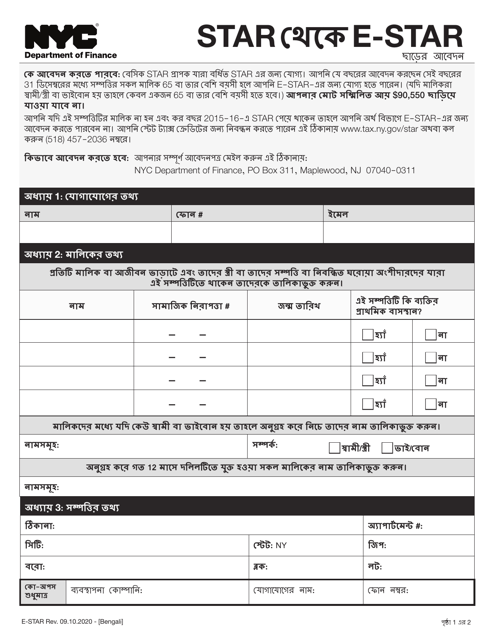

This document is for applying for the Star to E-Star Exemption in New York City. It is available in Bengali.

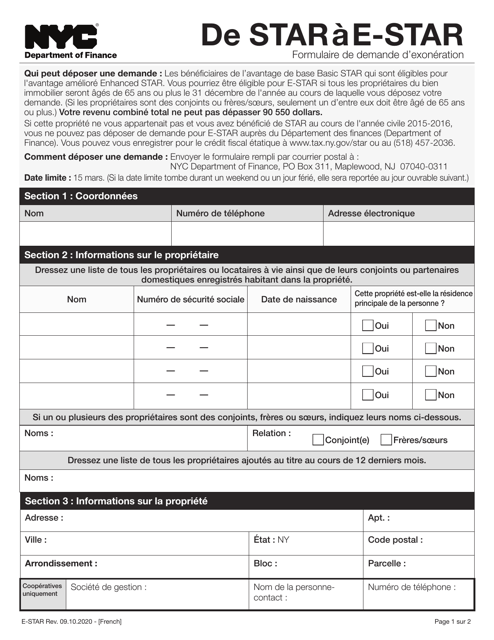

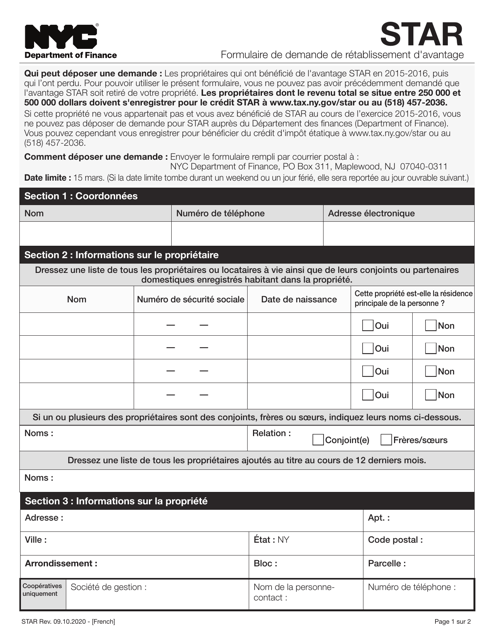

This document is for applying for the Star to E-Star exemption in New York City. It is available in French.

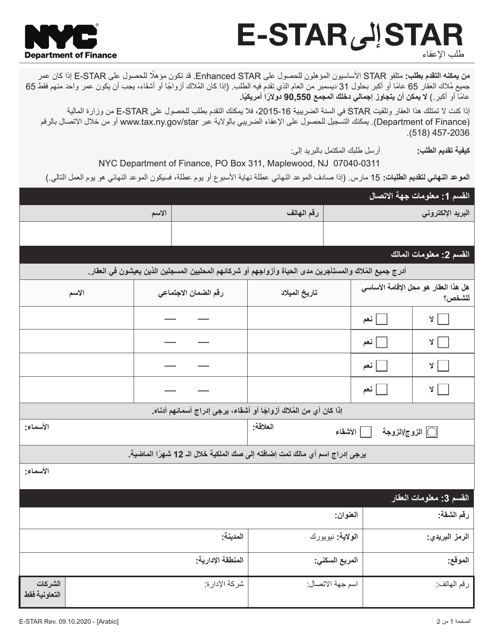

This document is for applying for the Star to E-Star Exemption in New York City. It is available in Arabic.

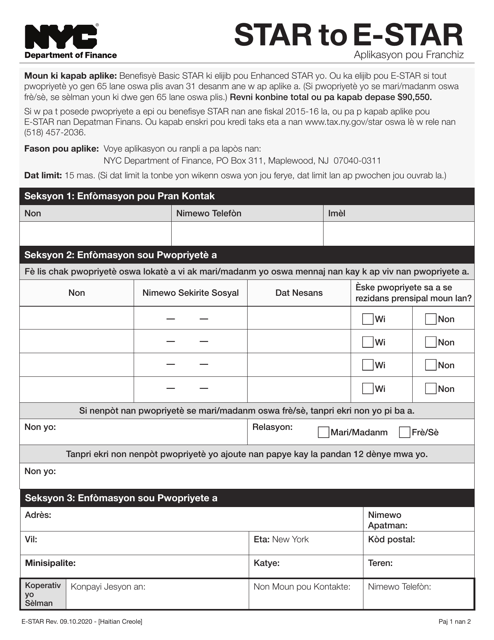

This document is used for applying for the Star to E-Star exemption in New York City. It is available in Haitian Creole language.

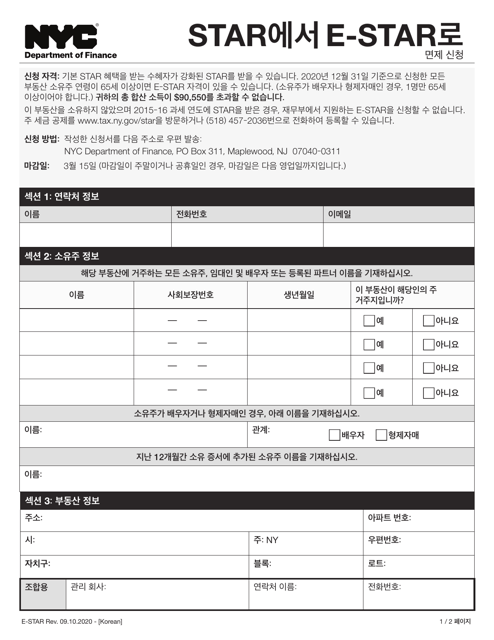

This document is an application form for the Star to E-Star Exemption in New York City, specifically for Korean speakers. The E-Star Exemption provides property tax relief for eligible homeowners.

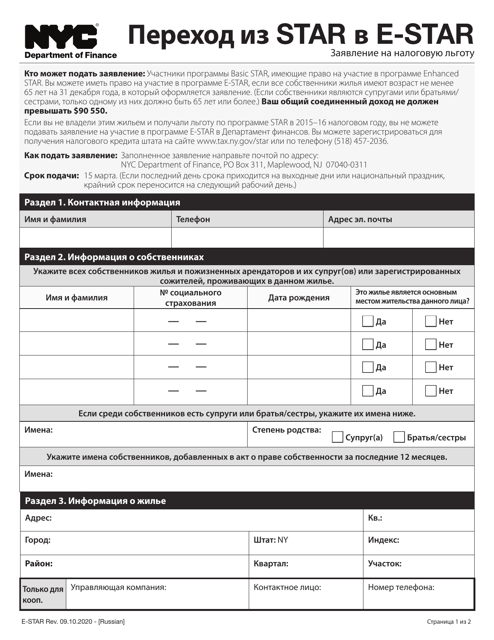

This document is an application for the Star to E-Star exemption in New York City, written in Russian.

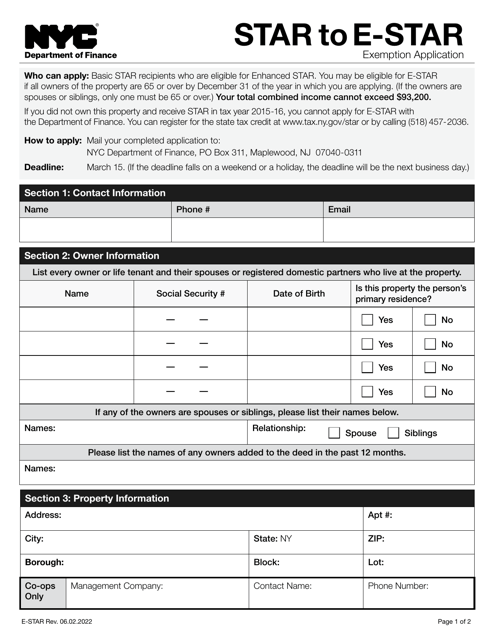

This document is used for applying for the Star to E-Star exemption in New York City.

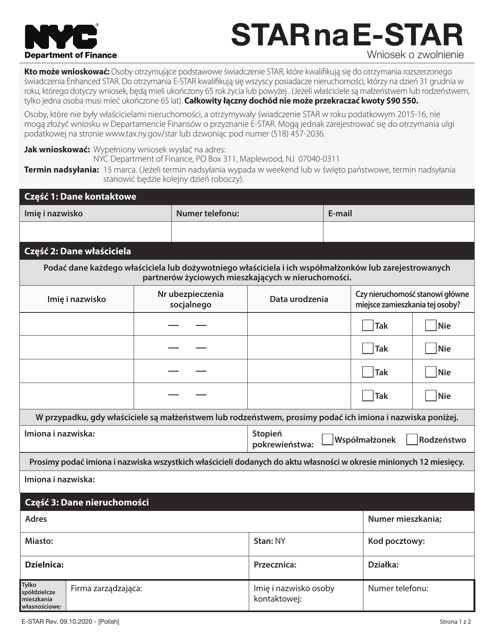

This Form is used for applying for the Star to E-Star Exemption in New York City for Polish-speaking residents.

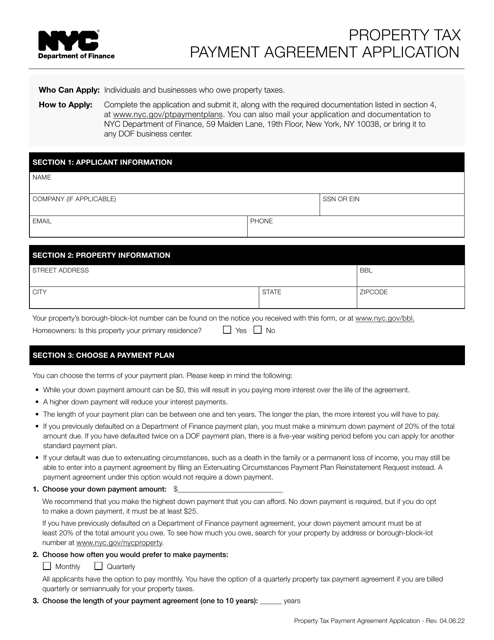

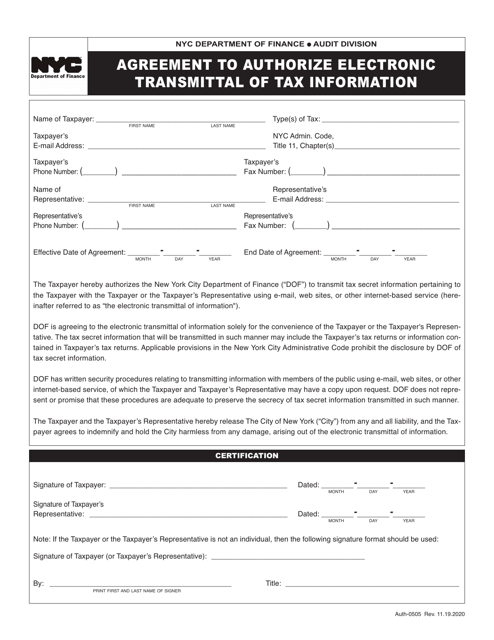

This form is used for authorizing the electronic transmittal of tax information in New York City.

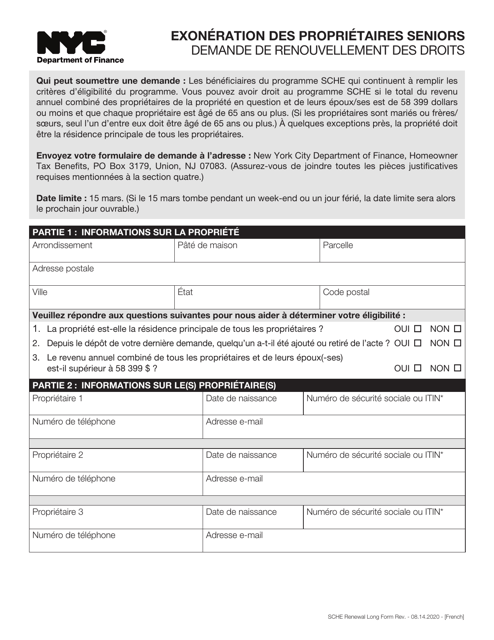

This document is for renewing the Senior Citizen Homeowners' Exemption in New York City. It is available in French.

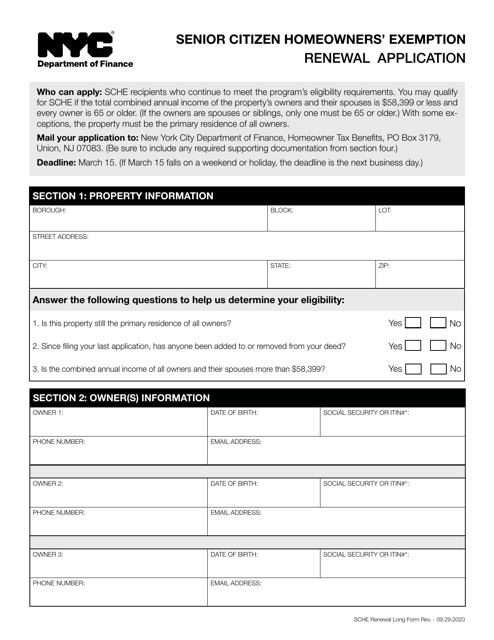

This form is used for renewing the Senior Citizen Homeowners' Exemption (SCHE) in New York City. The exemption provides property tax relief to senior citizens who own and live in their homes.

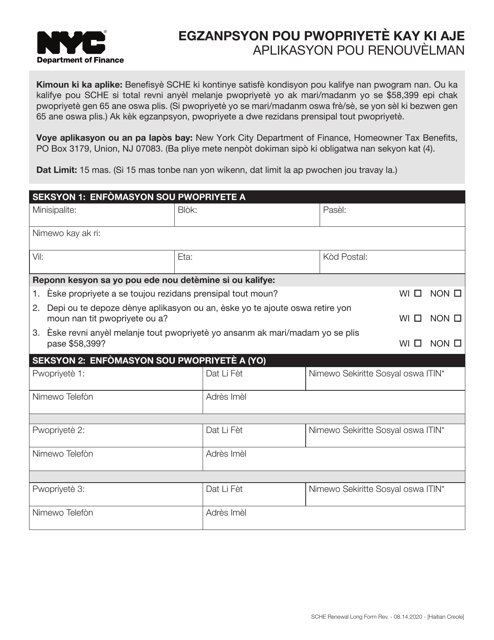

This Form is used for renewing the Senior Citizen Homeowners' Exemption in New York City. It is available in Haitian Creole language.

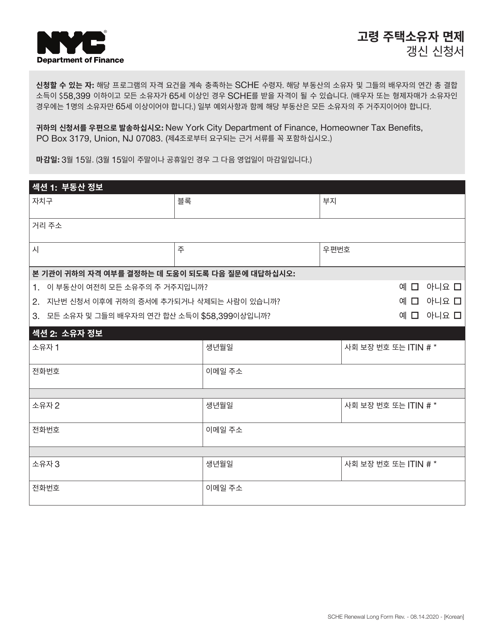

This document is for renewing the Senior Citizen Homeowners' Exemption in New York City for Korean-speaking residents.

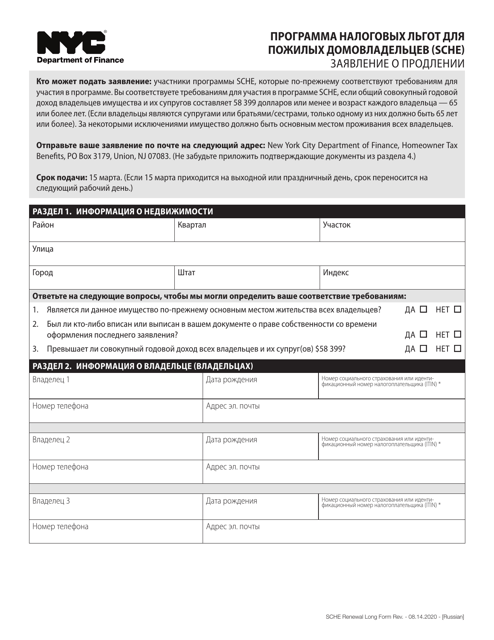

This document is for renewing the Senior Citizen Homeowners' Exemption in New York City. It is available in Russian.

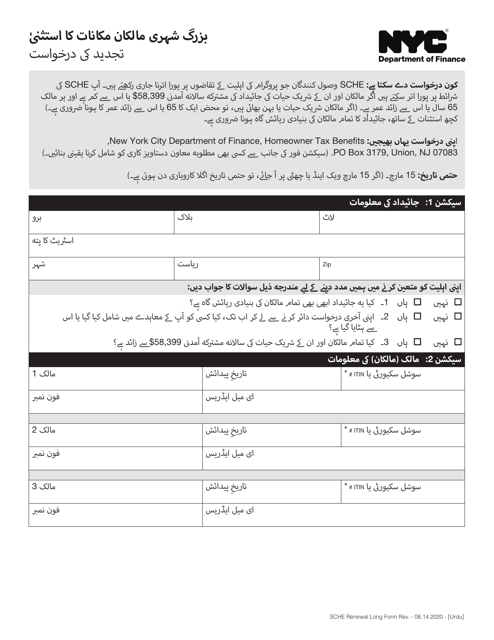

This document is for renewing the Senior Citizen Homeowners' Exemption in New York City. It is available in Urdu.

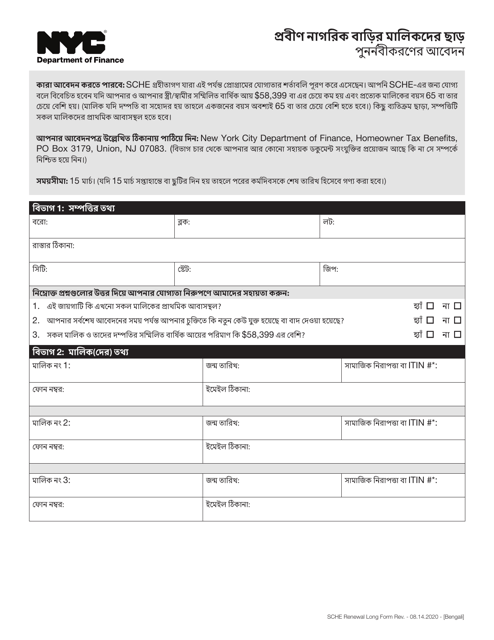

This document is for renewing the Senior Citizen Homeowners' Exemption in New York City.

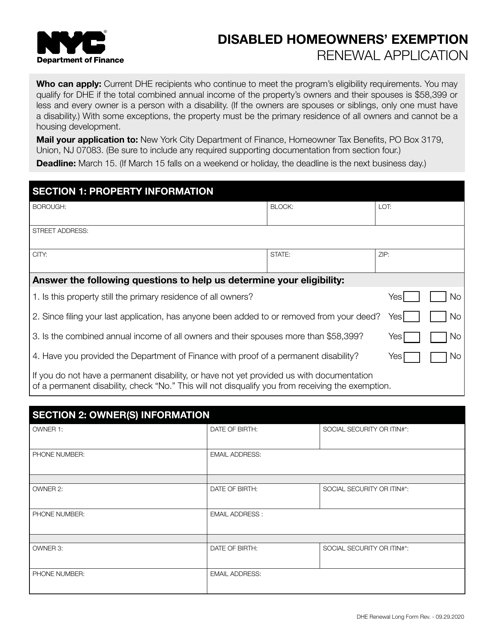

This Form is used for renewing the Disabled Homeowners' Exemption in New York City.

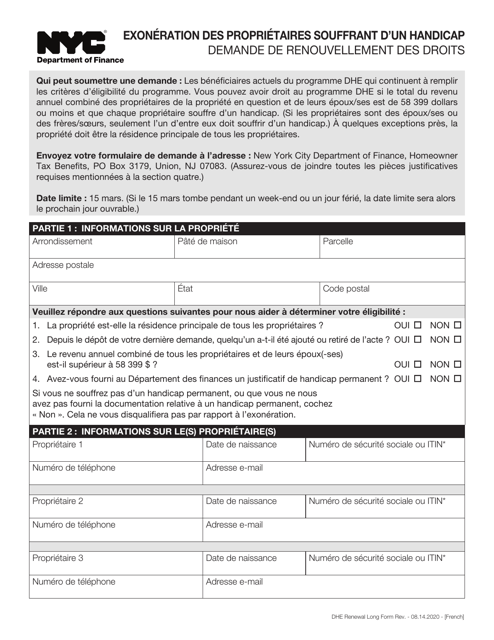

This Form is used for renewing the Disabled Homeowners' Exemption in New York City.

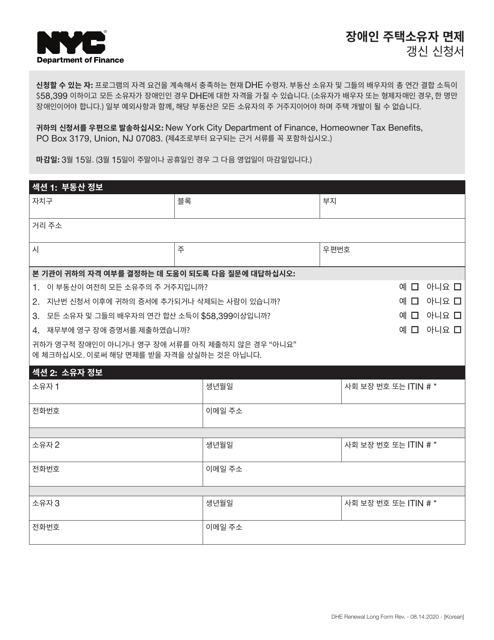

This document is for disabled homeowners in New York City who need to renew their exemption application. It is available in Korean.

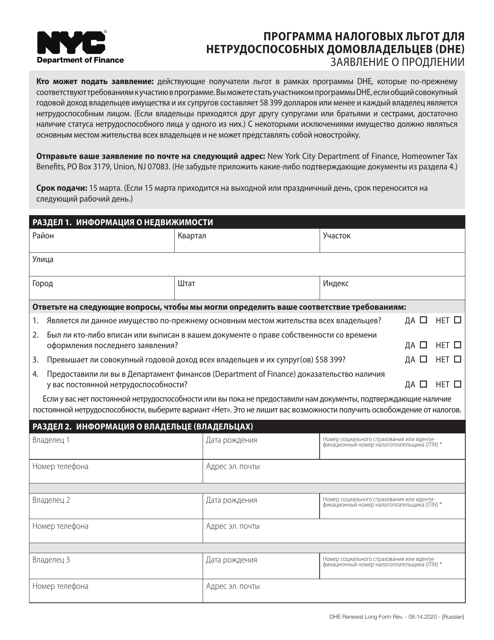

This document is for renewing the Disabled Homeowners' Exemption in New York City for residents who speak Russian.

This form is used for disabled homeowners in New York City who want to renew their exemption for property taxes.

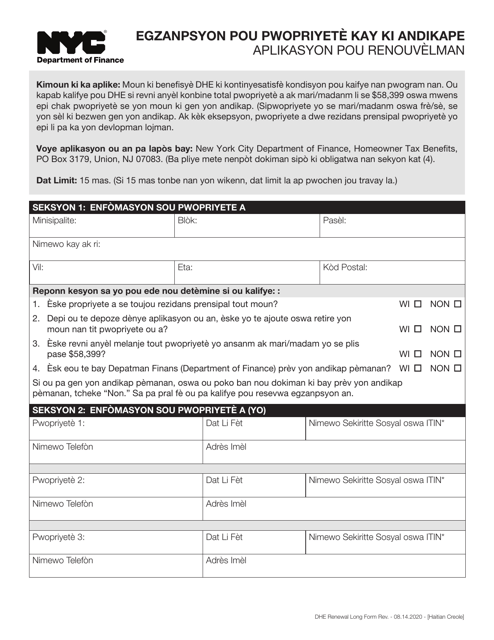

This form is used for renewing the Disabled Homeowners' Exemption in New York City. It is available in Haitian Creole language.

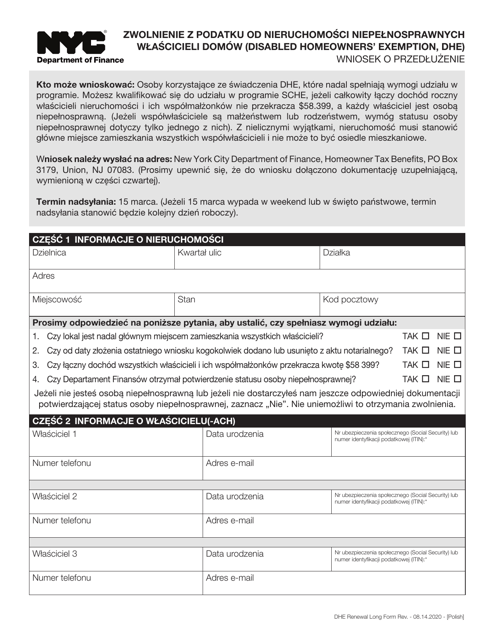

This document is for disabled homeowners in New York City who need to renew their exemption application. It is available in Polish.

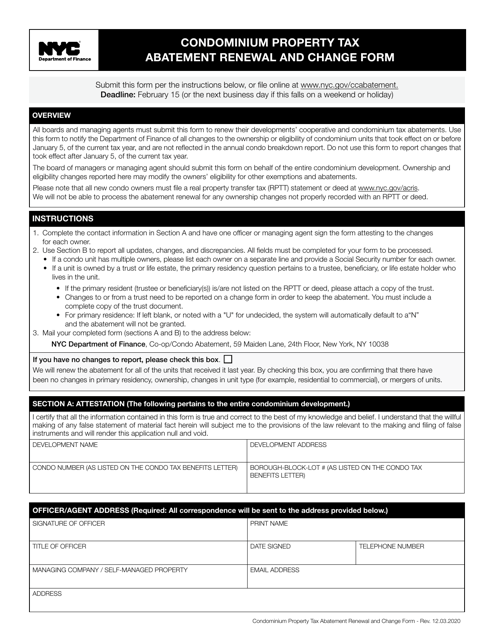

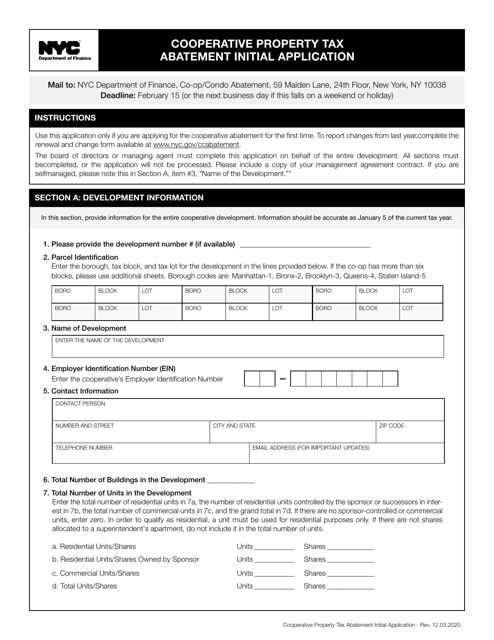

This form is used for renewing and making changes to the property tax abatement for condominiums in New York City.

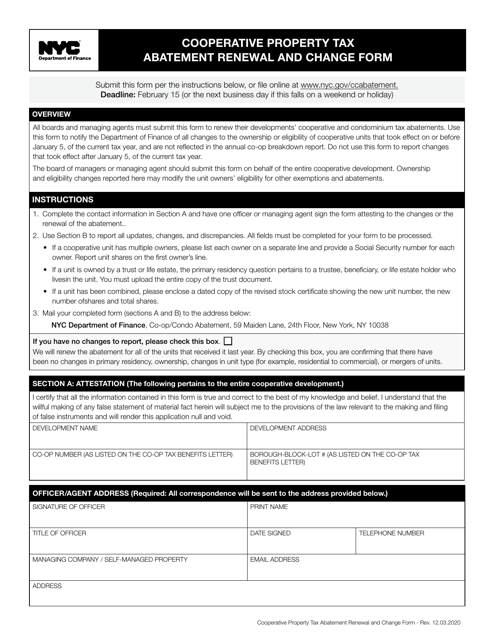

This document is used for renewing and making changes to the property tax abatement program for cooperative properties in New York City.

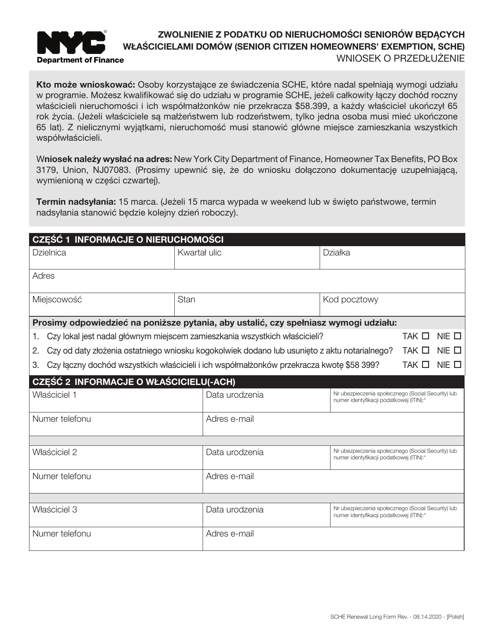

This form is used for senior citizens in New York City who own homes and need to renew their exemption for property taxes. The form is available in Polish.