New York City Department of Finance Forms

Documents:

716

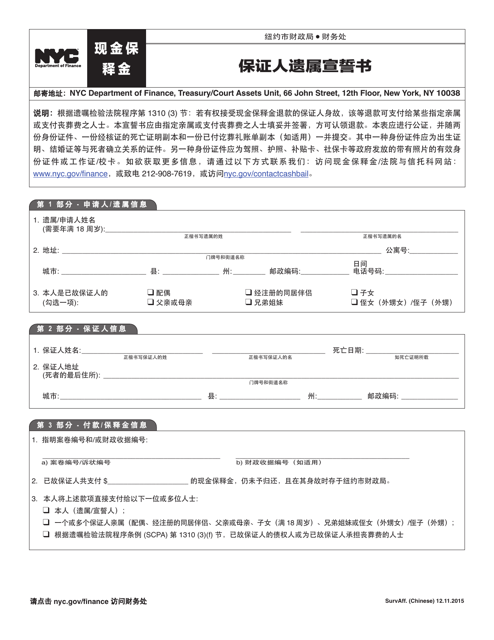

This document is used in New York City to provide a Chinese version of a Surety Survivor's Affidavit.

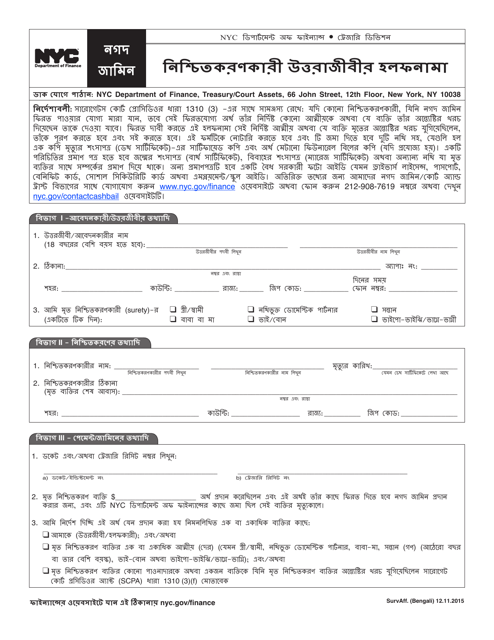

This document for the Surety Survivor's Affidavit in New York City, but it is written in Bengali language.

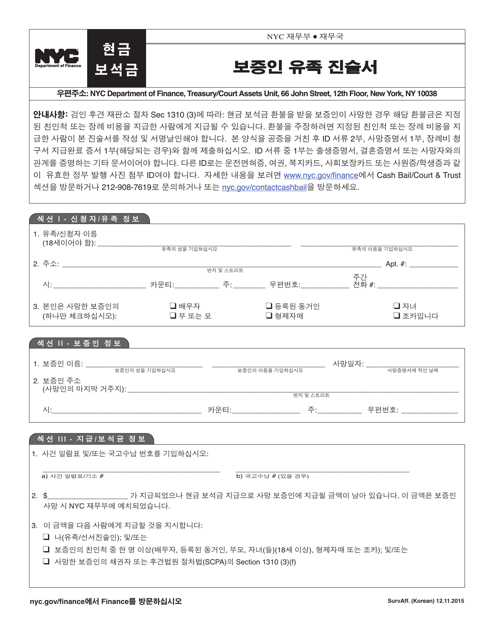

This document is used in New York City for a Korean-speaking person to declare their status as a survivor and provide information about the surety.

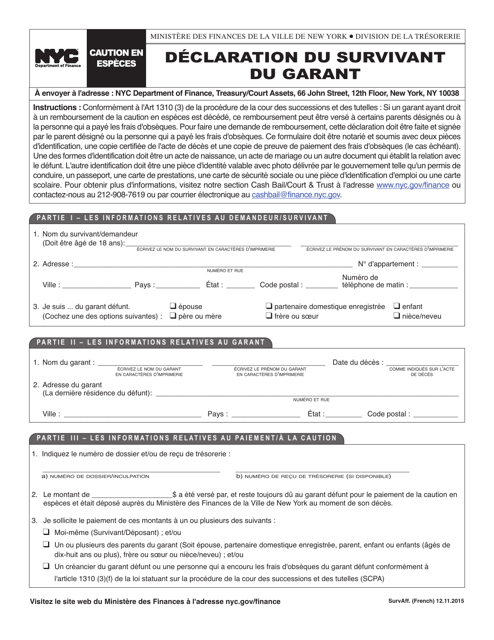

This document is used for a Surety Survivor's Affidavit in New York City. It specifically pertains to the French language.

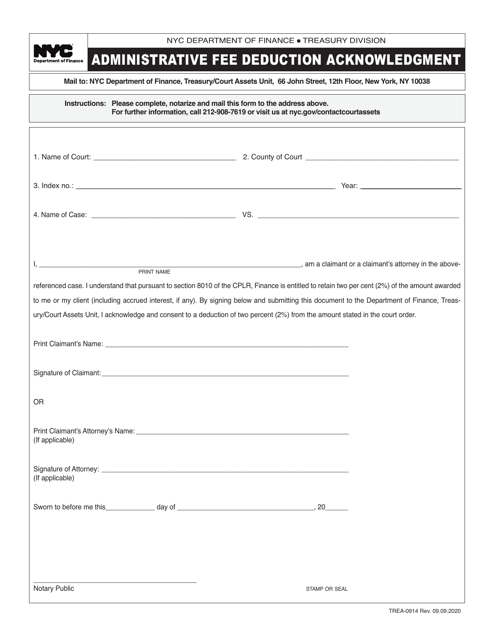

This form is used for acknowledging the deduction of administrative fees in New York City.

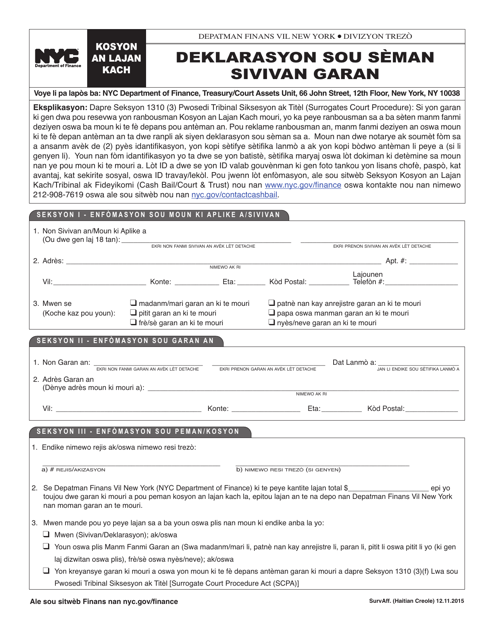

This document is used for providing a sworn statement in Haitian Creole by a surety survivor in New York City. It serves as a legal affirmation of the survivor's status and responsibilities.

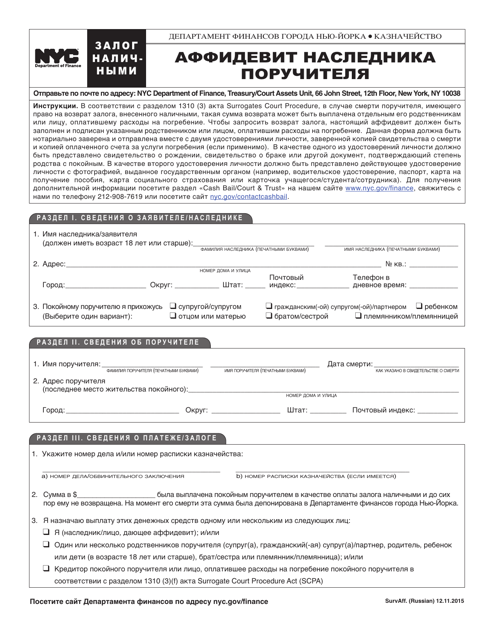

This document is a Russian version of a Surety Survivor's Affidavit used in New York City. It is used to verify the identity and relationship of the survivor of a surety in legal matters.

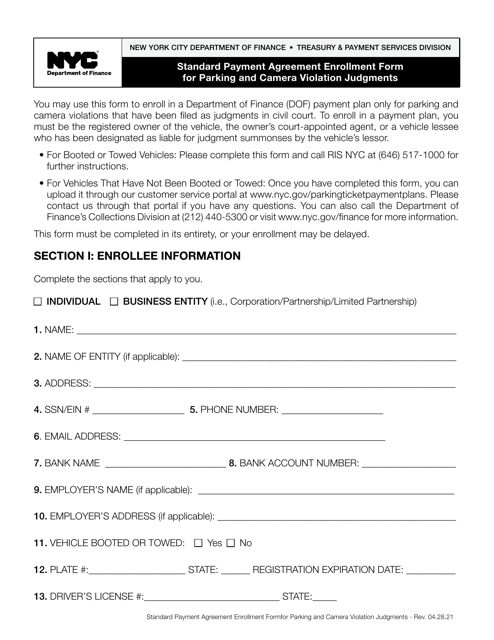

This document is used for enrolling in a standard payment agreement for parking and camera violation judgments in New York City.

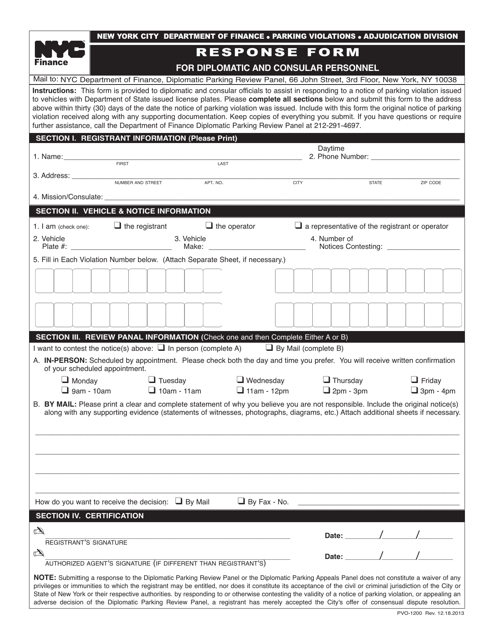

This form is used for diplomatic and consular personnel in New York City to submit their response.

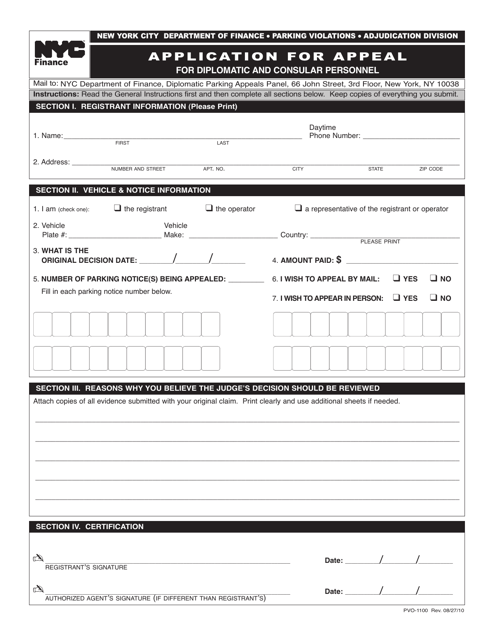

This Form is used for applying for an appeal for diplomatic and consular personnel in New York City.

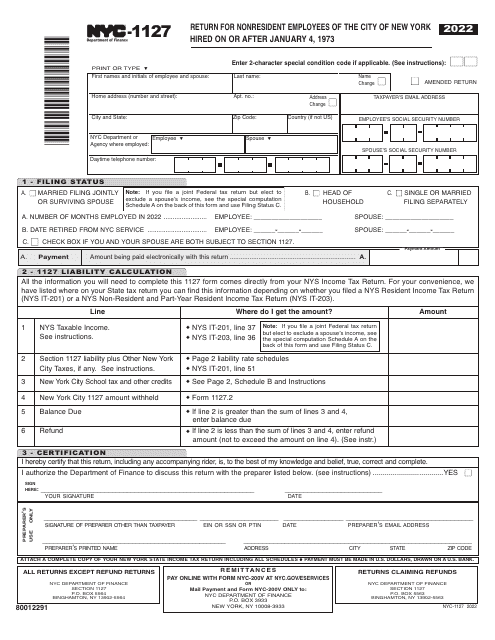

This is a personal income tax form that must be completed for New York City employees who reside outside of the 5 boroughs as if they resided in New York City and were hired on or after January 4th, 1973.

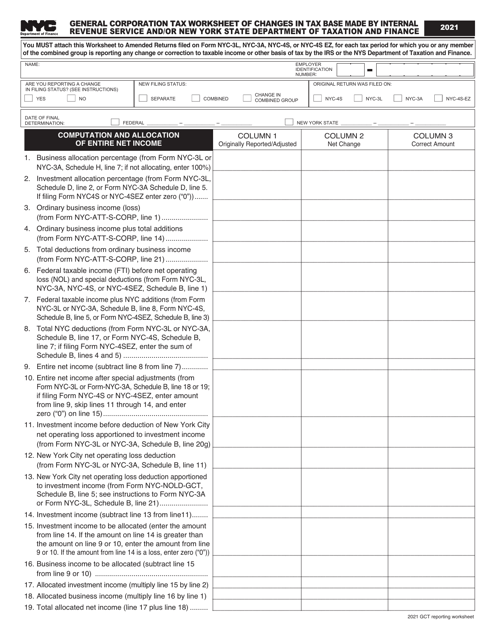

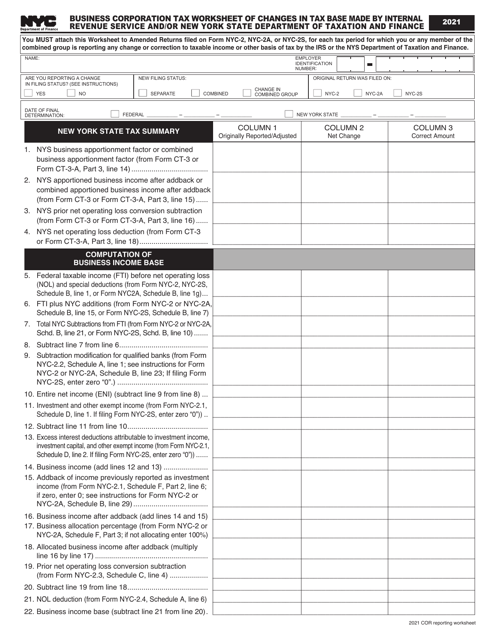

This document provides a worksheet for calculating changes in tax base made by the Internal Revenue Service (IRS) and/or the New York State Department of Taxation and Finance for general corporation tax in New York City.

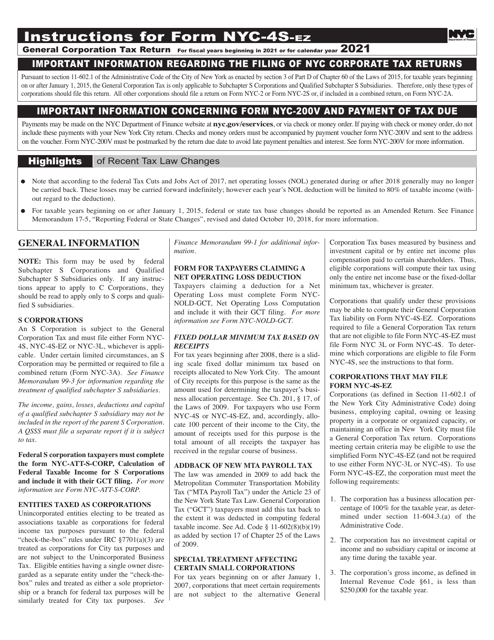

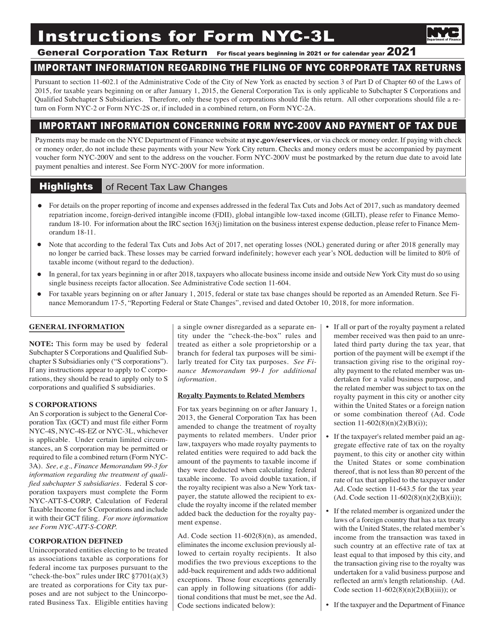

This form is used for filing the General Corporation Tax Return for businesses in New York City. It provides instructions on how to complete the form and pay the appropriate taxes.

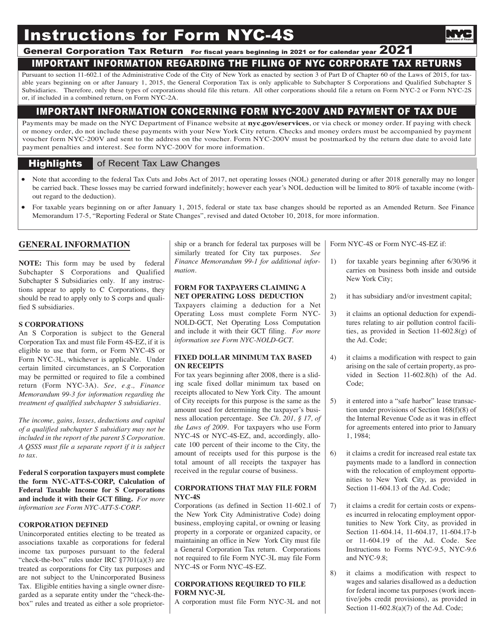

This Form is used for filing your General Corporation Tax Return for businesses in New York City. It provides instructions on how to complete and submit the NYC-4S form.

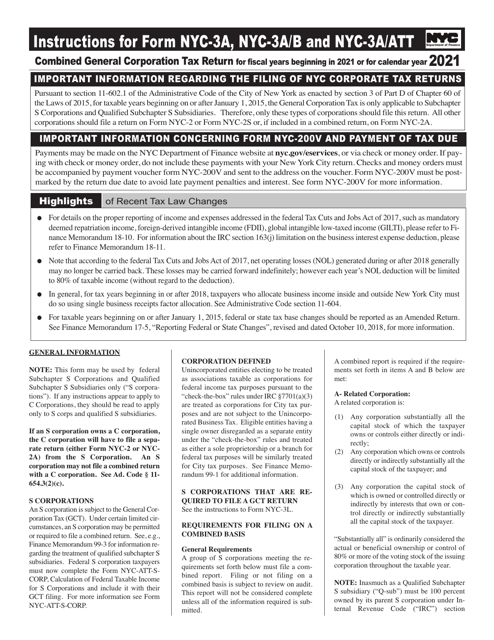

This Form is used for providing instructions on how to fill out forms NYC-3A, NYC-3A/B, and NYC-3A/ATT for New York City residents. It provides guidance on completing these tax forms correctly.

This Form is used for filing the General Corporation Tax Return for businesses in New York City. It provides instructions on how to complete the form and file taxes properly.

This document provides a worksheet to calculate changes in tax base made by the Internal Revenue Service and/or the New York State Department of Taxation and Finance for businesses in New York City. It helps businesses track and calculate any adjustments to their tax obligations.

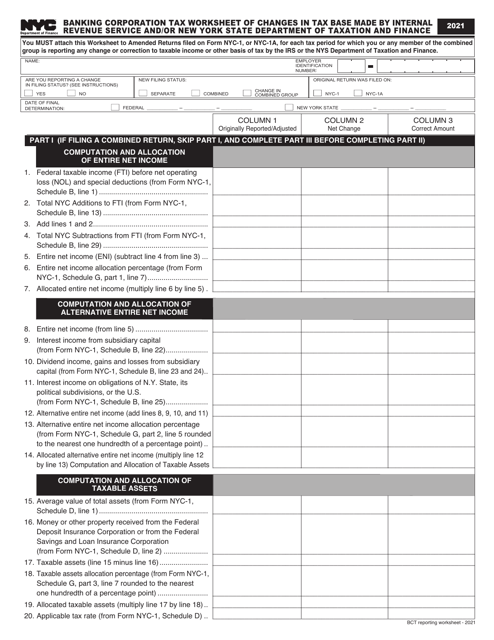

This document provides a worksheet for a banking corporation in New York City to track changes in their tax base made by the Internal Revenue Service and/or the New York State Department of Taxation and Finance.

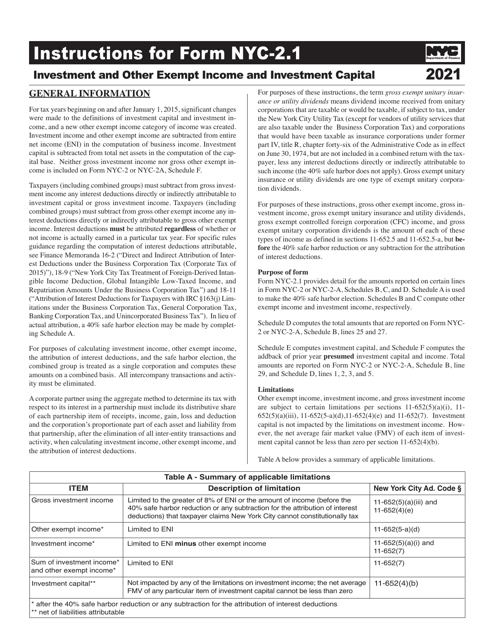

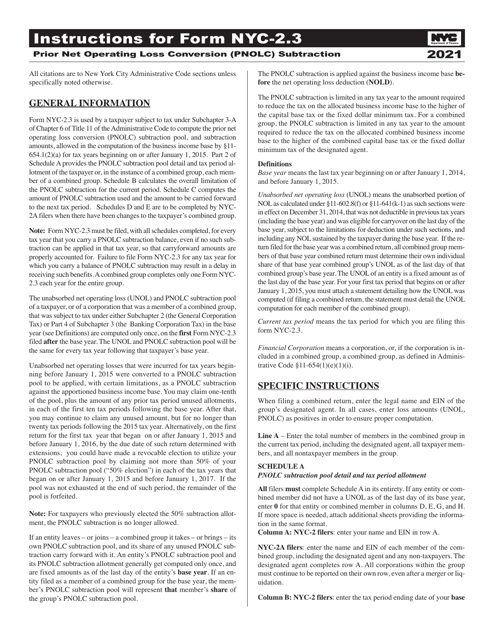

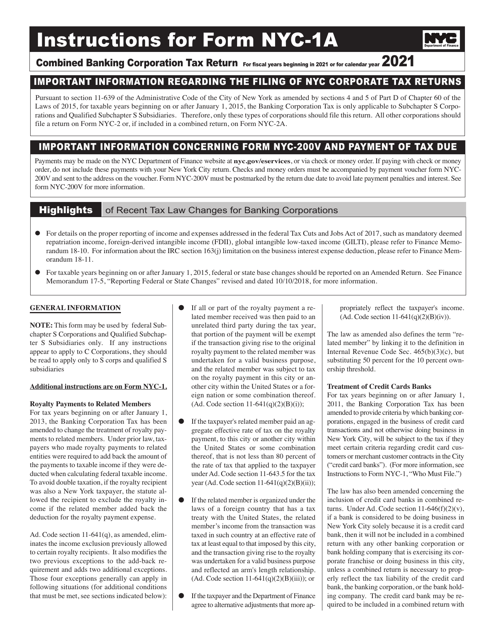

This Form is used for filing the combined tax return for banking corporations in New York City. It provides instructions on how to fill out and submit the form accurately.

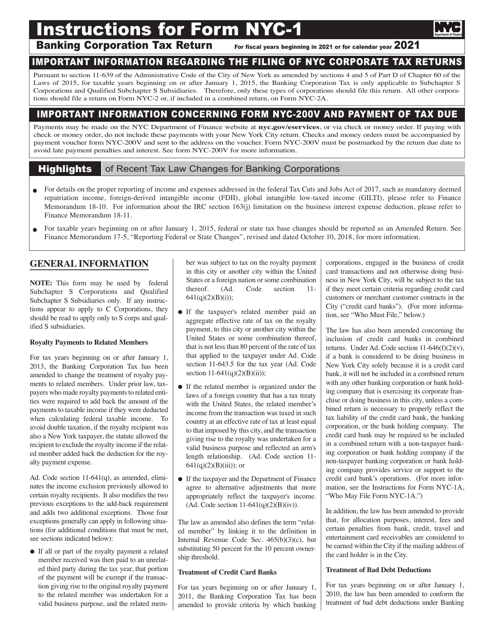

This form is used for filing tax returns by banking corporations in New York City. The instructions provide guidance on how to complete the form accurately and submit it to the relevant authorities.

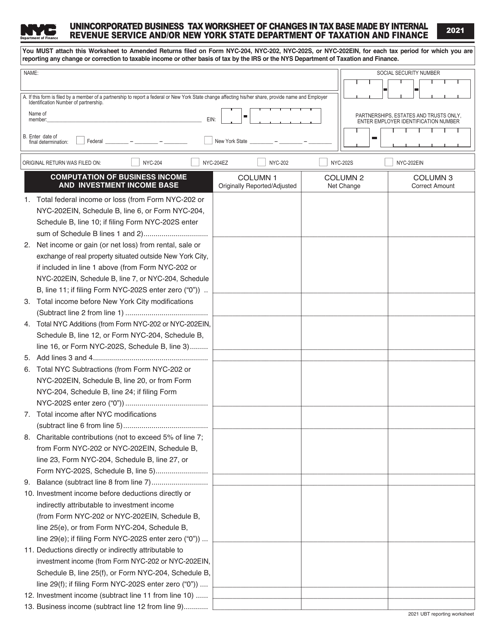

This document is used for calculating the changes in tax base for unincorporated businesses in New York City due to updates made by the Internal Revenue Service and/or the New York State Department of Taxation and Finance.

This Form is used for filing the Unincorporated Business Tax Return for Individuals in New York City. It provides instructions on how to accurately report your business income and calculate the tax owed.

This Form is used for filing the Unincorporated Business Tax Return for individuals and single-member LLCs in New York City. It provides instructions on how to report and calculate taxes on business income.

This Form is used for filing the Unincorporated Business Tax Return for Estates and Trusts in New York City. It provides instructions and guidelines for completing the form accurately.

This Form is used for filing the Unincorporated Business Tax Return for Partnerships (Including Limited Liability Companies) in New York City. It provides instructions on how to accurately complete and submit the form.